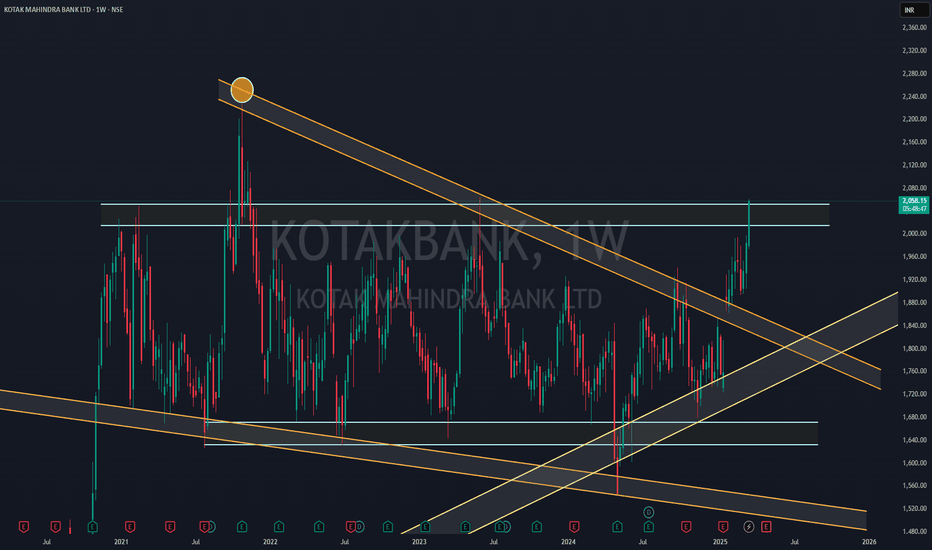

KOTAK BANK NEAR FLAG BReakoutKotakBank is nearly Flag Breakout on Monthly Candle (Wait more 7 days to Finish MOnthly Candle with Big Bull Breakout)

Wait for Proper Breakout beacuse its 4 time where Chart is going to test same Trendline.

Flag Pattern Start from 2020- After 5 years its will going to break

If we see fulll chart Stock taking support over 2013 Trendline before two months so there is more more possibility to give breakout

if we see RSI chart its also show Breakout over MOnthly RSI trendline..

## THis is my Just View, take position after all confromations and research by yourself##

also see weekly chart - weekly showing strong big bull canle ( 1more Weekly Candle Require for final conformations)

Kotakmahindrabank

Monthly Breakout On RSI & TrendlinePlease check Monthly Trendline over RSI - From 2018 to 2025 RSI Trendline Breakout done Last month & Sustain in crusial month also

Second thing if we check Trendlines over Chart - Stock is taking regular support from 2014 to till date

if we check from 2021 to till date consolidation zone - Stock is going to breakout this zone (final conformation above 2080, for Safest Entry)

But as per current scenario and situation i thing kotakbank will be a good choice if market start upward direction

Selling Dominates Nifty Bank: Technical Outlook for Key Stocks◉ Nifty Bank Technical Outlook NSE:BANKNIFTY

● The index has broken below its trendline support and is currently testing its immediate support zone between 48,300 and 48,600.

● If selling pressure persists, the index may plummet another 5% to find support around the 46,000 level.

◉ Key Constituents' Technical Standings

Let's dive into the technical analysis of the top Bank Nifty constituents to gauge their current standings and potential future movements.

1. HDFC Bank (Weightage - 28.11%) NSE:HDFCBANK

● As the leading component, HDFC Bank is poised to exert downward pressure on the overall index.

● The stock has broken below its trendline support and has been falling continuously for the last 6 trading sessions.

● Support level is expected somewhere between 1,600 - 1,610 level which is around 3.4% below from the current level.

2. ICICI Bank (Weightage - 24.98%) NSE:ICICIBANK

● The stock has also fallen below its trendline support and is currently hovering just above its immediate support zone.

● If this support is breached, a significant correction could drive the price down to around 1,150.

3. Kotak Mahindra Bank (Weightage - 8.80%) NSE:KOTAKBANK

● The stock has been consolidating within a range for almost 4 years.

● Recent chart patterns suggest the price may test its support zone again, around 7.7% below the current level.

4. Axis Bank (Weightage - 8.54%) NSE:AXISBANK

● Axis Bank's chart shows a bearish pattern, similar to HDFC Bank's, and is likely to experience a fall of around 6%.

5. State Bank of India (Weightage - 8.45%) NSE:SBIN

● The stock is currently positioned just above its immediate support level, suggesting a strong potential for a rebound from this point.

KOTAK MAHINDRA BANKKotak is consolidating from a very long period (2020 -2024), in 2024 we see a fake breakout as a liquidity sweep after this stock which is forming a support is acting as a support again. in this stock we may see a breakout of 2020 high which is 2253 and we see targets of 2345 in this stock.

you can ask your questions in comment section

Thanks

Ishu prajapati

Kotak Bank - SidewaysStock stuck between strong supply n demand zone now

1910-20 will act as current n strong resistance area

1870-80 will act as a strong support area as of now

Stock may remain in the zone for the time being before braking out

Excellent opportunity for straddle players at the moment as even time n premiums are in favour

break above 1930 or below 1960 will negate the trade

Kotak Mahindra BankAll important points are marked.

Do own studies before investing in equities.

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫: 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐢𝐧 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞 𝐬𝐮𝐛𝐣𝐞𝐜𝐭 𝐭𝐨 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐢𝐬𝐤𝐬, 𝐫𝐞𝐚𝐝 𝐚𝐥𝐥 𝐭𝐡𝐞 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐜𝐚𝐫𝐞𝐟𝐮𝐥𝐥𝐲 𝐛𝐞𝐟𝐨𝐫𝐞 𝐢𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠. 𝐒𝐭𝐨𝐜𝐤𝐬 𝐬𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐠𝐫𝐨𝐮𝐩 𝐚𝐫𝐞 𝐟𝐨𝐫 𝐞𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧 𝐩𝐮𝐫𝐩𝐨𝐬𝐞. 𝐖𝐞 𝐝𝐨𝐧𝐭 𝐦𝐚𝐤𝐞 𝐚𝐧𝐲 𝐩𝐫𝐨𝐟𝐢𝐭𝐬 𝐟𝐫𝐨𝐦 𝐭𝐡𝐢𝐬 𝐫𝐞𝐜𝐨𝐦𝐦𝐞𝐧𝐝𝐚𝐭𝐢𝐨𝐧𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠 𝐬𝐡𝐚𝐫𝐞𝐝 𝐡𝐞𝐫𝐞 𝐚𝐫𝐞 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐨𝐟 𝐟𝐫𝐞𝐞 𝐨𝐟 𝐜𝐨𝐬𝐭.

Corona Time AVWAP + Demand ZoneKey Highlights : 🔰

🔷 Script Name : KOTAK MAHINDRA BANK

🔷 Script Symbol : NSE:KOTAKBANK

🔶 Demand Zone : 🔥

🔶 Support Level : Corona Time AVWAP🔥

🔶 Holding Time : 9 - 12 Months 💚

👉🏻 Rule No.1 : When You Get 100% , Exit 50% !!

👉🏻 Rule No.2 : Always Remember Rule No. #1

👉🏻 Rule No.3 : Always Do Basket Of 9 - 10 Stocks, Never Buy Solo Stock. 😊

Disclaimer : This is NOT Investment Advice. This Post is Meant for Learning Purposes Only. Invest Your Capital at Your Own Risk.

Happy Learning. Cheers!!

Shyorawat Arun Singh ❤️

(@Shyorawat_ArunSingh)

Founder : Shyorawat Investing School

Bullish break out in the stocks for this week 08/07/2024..

ONGC is a government sector company is trading around the resistance zone. If there is a break out of the consolidation zone good returns can be captured in the stock.

The stock has taken a good support from 20 ema which also gives a confidence to hold the stock for a swing trading.

Even on the daily charts, the stock has test the 200 ema and chance of it clearing the resistance level is high.

A round number figure of 300 can be seen as the next resistance as the stock will be trading in an uncharted zone after the break out.

Kotak bank has been trading in a range and the upper resistance zone is around 2050 levels. The stock is currently trading around 1850 levels and has taken support from both the moving averages on the weekly charts.

If the stock sustain the break out there are chance of it hitting the resistance level soon. The target for trading are there on the chart.

Long term stock positions can also be created in the stock as it seems to show some bullishness.

Wait for the price action near the levels before entering the market.

Kotak: Short term reversal (6 May onwards)On this Daily Chart, we can see that Kotak has made a recent swing low of 1546 on Friday after losing support from its 1650 level. The results were out yesterday and Kotak has announced 26% increase in profits beating the market estimates. This should potentially cause a reversal in price going forward. In the short term, price is likely to touch the 200D SMA (purple line) which also coincides with a trend line (in blue) creating an upside of about 15% from current levels.

Indicators:

1. The EPS chart shows solid growth while the P/E is almost at a decadal low of 16.9

2. The RSI has bottomed out both in the Daily and Weekly

3. The price hit the lower threshold band of Fibonacci Bollinger Band (solid green line) indicating a possible bottoming out of price

4. The price is currently below both the 50D and 200D SMA, indicating short term bearish territory

Risks: The current downtrend can also continue in the next week and the next visible support is at 1450 implying a downside of 6%

Strategy: Given the growth drivers and a ridiculous valuation of the bank, the price is sure to make a reversal in coming days. Watch for the price action on Monday, and based on lower time frame price action, take entry. If the price comes down, towards 1450 levels, it should be used as an opportunity to build more positions instead of thinking about Stop loss and exiting.

Happy Trading!

Kotak Mahindra Bank HammeredNSE:KOTAKBANK shares have tumbled after RBI banned the private lender from taking on new clients digitally, due to IT-related deficiencies, raising concerns about the potential impact on the lender that relies heavily on online banking.

The current levels may act as a support but this firm stance by RBI is in line with the recent past actions on various other companies as well. This sector has the maximum headwinds currently and one should be careful of investing in these companies specially when opportunities elsewhere exist.

However, long term investors can start to accumulate this share if they want to have Kotak Mahindra Bank in their portfolio.

What's ahead for Kotak Mahindra Bank?Digital banking segment of Kotak Mahindra Bank is headed by Jay Kotak who recently made the headlines for his wedding recently. Similar ban happened with HDFC bank and price of the stock struggled to get back the momentum since then. The stock has been in this ₹1600-₹2000 zone since very long. Will it be able to sustain this or break this long time support? NSE:KOTAKBANK

24 Apr 2024– RBI bank on Kotak credit cards will create ruckus ?BankNifty Analysis - Stance Neutral ➡️

BankNifty also had a neutral day today, but the OTM options premium was so weak that I did not play expiry at all today. I frankly do not remember the last time I missed playing BN expiry day. The regular algos, which has the same logic for banknifty every day ran as usual and that is the only trade I did on BN today.

NiftyIT was totally against BankNifty today, the split showing its impact on Nifty50 (in a way helping its neutral case). But looking at the price action, BN was not able to generate any momentum to go for the next levels.

Even though the chart says there is further upside momentum left, the fundamentals may not really help BN this week. The news of RBI banning Kotak from issuing new credit cards broke after market hours (source). If the news came during trading hours, the BN would have expired at a different level altogether - but the news would have priced in and things would have settled. Now, we may have some push/pull for the price discovery tomorrow and it could really drive up some volatility. We would still prefer to maintain our neutral stance and go short only if 47465 is getting broken.

BN algos made 28600 today and I exited the trades by 13.15.

Bullish Potential: Kotak Mahindra Flag Pattern ConsolidationDetails:

Asset: Kotak Mahindra Bank (KOTAKBANK)

Pattern: Flag consolidation

Consolidation Range: From February 2021 at 1600 to 2050

Breakout Level: Above 2150

Potential Targets: Projection based on the height of the flagpole or next significant resistance levels

Stop Loss: Below breakout level or as per risk tolerance

Timeframe: Medium to long-term

Rationale: Kotak Mahindra Bank has been consolidating in a flag pattern since February 2021, with the price oscillating between 1600 and 2050. The flag pattern is characterized by a period of consolidation following a strong upward move (flagpole). A breakout above the upper boundary of the flag pattern, around 2150, could signal the continuation of the prior uptrend and potentially lead to a significant upmove.

Possibilities:

Continuation of Uptrend: A breakout above 2150 may indicate renewed buying interest and the continuation of the bullish trend seen prior to the consolidation phase.

Projection Targets: Traders often project the potential upside move by measuring the height of the flagpole and adding it to the breakout point. This gives an estimation of the potential target levels.

Increased Volume: Confirmation of the breakout with increased volume would add further validity to the bullish scenario.

Risk-Reward Ratio: Depends on individual risk appetite and stop-loss placement.

It's essential to monitor the price action closely for confirmation of the breakout and adjust trading strategies accordingly.

KOTAK BANK Double Bottom Bearish view for Intraday AnalysisThis stock in 30 and 15 min timeframe create a double Top Pattern.

Strong resistance at : 1918.55

Support at:1878

2nd January if price will be open above 1900 wait for break 1890 and make a short position based on your analysis. Max volume at 1918-1920

If price will be open below 1900 then make your entry on short side or wait for create an any bearish candle near 1900 or follow price will respect the 1900 as resistance . then make your position.

MACD indicator indicate bearish divergent.

KOTAK BANK: SYMMETRICAL TRIANGLEStock is under formation of a symmetrical triangle pattern. Stock is holding above it's 200 EMA on the weekly chart. A sustained closed above 2060 will be considered as a confirmed breakout of the pattern which shall take the prices towards 2800 zone in the coming months.

Kotak M Bank ( Looking good 💥) Add this to watchlist and wait for entry.👁️🗨️

For short term investment ;

Leave a " Like If you agree ".👍

.

Wait for small retracement & daily candle to close above - " 1805 ".

Trade carefully untill ENTRY level.

.

Entry: 1805

target: 1855 - 1950

sl: 1770 -1760

major stoploss/ support: 1758

.

.

Enter only if market Breaks

"Yellow box" mentioned.

.

.

Don't make complicated trade set-up.📈📉

Keep it " simple, focus on consistency "💹

Refer our old ideas for accuracy rate🧑💻

Follow for daily updates👍

.

Refer over old posted idea attached below.

kotak bank ranging inside wedge pattern on daily time frameNSE:KOTAKBANK seems to be trading in wedge pattern on daily timeframe if happens to break trendline of wedge in downside, may show a fall till second support,

first support (1670 zone) is at the bottom trendline of the wedge patterm from where kotak bank may move upside again if carries on the move inside wedge pattern