KPIT Technologies Downtrend Reversal with RSI ConfirmationKPIT Technologies Ltd is currently trading near ₹1271 on the daily chart. The stock has been in a downtrend, forming lower highs and lower lows, but is now attempting a trend reversal by breaking out of its downtrend line. Alongside this, the RSI indicator has moved above 50, signaling renewed buying strength. Let’s break down these concepts and understand the current opportunity.

🔹 Understanding the Downtrend Pattern

1. Downtrend Definition: A downtrend is characterized by a sequence of lower highs and lower lows, showing persistent selling pressure.

2. Trendline Role: Traders often draw a descending trendline connecting the highs. As long as price stays below this line, the downtrend remains intact.

3. Reversal Signal: When price breaks above the downtrend line, it suggests that sellers are losing control and buyers may be taking over.

4. KPIT Example: The breakout above its downtrend line indicates a potential shift from bearish to bullish sentiment.

🔹 RSI Indicator as Momentum Confirmation

Relative Strength Index (RSI): A momentum oscillator ranging from 0–100.

Key Levels:

Below 50 → bearish momentum

Above 50 → bullish momentum

Why It Matters: RSI crossing above 50 often confirms that buying activity is strengthening.

KPIT Example: RSI moving above 50 supports the breakout, adding conviction that the trend reversal is genuine.

🔹 Combining Downtrend Breakout with RSI

Dual Confirmation:

1. Breakout of the downtrend line → structural change in price action.

2. RSI above 50 → momentum shift toward buyers.

Why This Combination Works: It reduces false signals. A breakout alone may fail, but when supported by momentum indicators, the probability of success increases.

🔹 Current Trading Opportunity

Setup:

1. Entry: Near current levels (~₹1271), as price has broken the downtrend line.

2. Stop Loss: Below the most recent swing low, ensuring risk is defined if reversal fails.

3. Target: Traders often aim for the next resistance zone or use trailing stops to capture extended moves.

Risk Management:

1. Always define risk before entering.

2. Use the pullback low or recent swing low as a stop loss.

3. Adjust position size to maintain favorable reward-to-risk ratio.

📌 Key Takeaways

1. A downtrend reversal occurs when price breaks above its descending trendline.

2. RSI above 50 confirms momentum is shifting toward buyers.

3. Combining structural breakout with momentum confirmation creates a stronger trading signal.

4. Using the recent swing low as stop loss ensures disciplined risk management.

KPIT Technologies’ current setup is a textbook example of how traders can use trendline breakouts and RSI momentum together to identify potential reversals. It highlights the importance of combining price action with indicators to build a structured trading plan.

KPIT

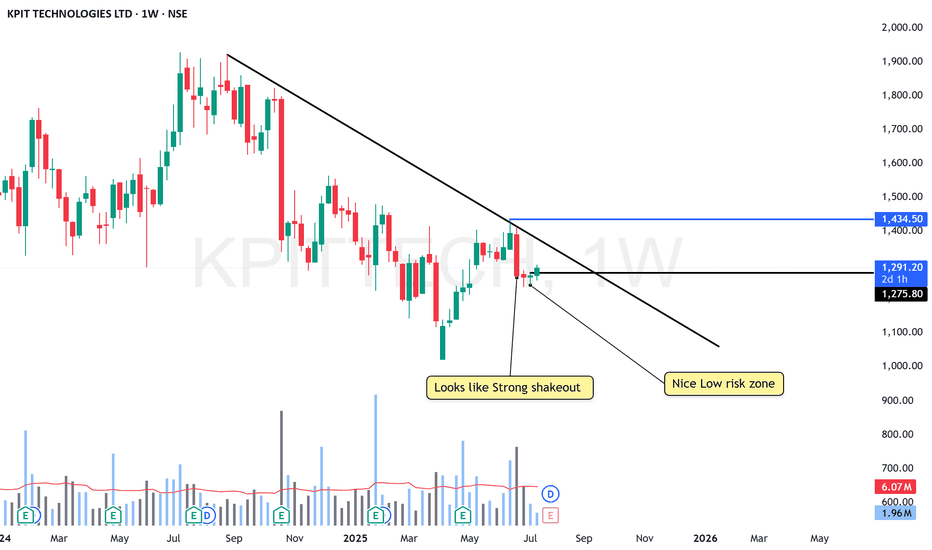

KPIT At low risk Zone - Getting ready to BlastNSE:KPITTECH

Its at Nice low risk Zone

KEEP IN MIND: The 6Rs Dividend Announced at QTR is on 28th JULY

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

NOT SEBI REGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

KPIT TECHNOLOGIES - Bullish Inverted H&S Breakout (Daily T/F)Trade Setup

📌 Stock: KPIT TECHNOLOGIES ( NSE:KPITTECH )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹1400.00 (Breakout Confirmation)

🛑 Stop Loss: ₹1247.00 (Daily Closing Basis) (-10 % Risk)

🎯 Target Levels:

₹1467.95

₹1539.15

₹1613.85

₹1692.20

₹1774.30

₹1851.00 (Final Target)

Technical Rationale

✅ Bullish Inverted Head and Shoulder Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily RSI > 65, Weekly RSI >64 & Monthly RSI >55

✅ Volume Confirmation - Breakout volume 2.8M vs previous day's 589.41K (Nearly 5x surge)

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:KPITTECH for this breakout opportunity? Share your views in the comments!

KPIT - at 1 YEAR SUPPORT LEVEL Can Enter at 1330

if again falls then you need to average at 1230 level

Target - 1800,1930

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍

KPIT Analysis! Ascending triangle!!KPIT Weekly Analysis

Ascending Triangle Pattern Formation in KPIT

KPIT has made Ascending Triangle Patern on Weekly Timeframe. KPIT has giver breakout at it's resistance level and trying to retest the level to establish the support over there. 805-829 is the support zone range. Price may take support at this zone and move further up towards our projected profit.

Trading Psychology - Aggresive investors can initiate buy at current price level and Conservative investers can initiate buy above 945 levels.

Entry - Current Level or Above 945

Taregt - 1992.35

Stop Loss- Below 737.25

If you like my analysis please do boost and share. I want support from you guys to help our trading community to achieve an edge in Technical Analysis

Disclaimer - All my analysis are for Educational Purpose only. Before entering into any trade - 1) Educate Yourself 2)Do your own research and analysis 3)Define your Risk to Reward ratio 3)Don't trade with full capital

KPIT - Strong consolidation breakout and Cup-handle pattern.Cup and handle pattern in KPIT and daily consolidation break with strong candle,

Higher Time frame candles (M/W)also looks strong.

we might see 800 levels very soon.

(there is Rally base Rally candles as per supply and demand method)

-Educational purpose.

KPITTECH Analysis & PredictionThis is the analysis of KPITTECH in the Daily Time Frame. Watch carefully. The chart explains itself.

If it breaks and sustains above the upcoming resistance level, it is good for the stock.

There are some prediction levels. These Levels act as Support and Resistance according to position of price. You have to trade according to level breakout or breakdown.

Always maintain your risk management.

Book your profit according to your “STOMACH”.

Disclaimer:

This is not investment advice. I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

Happy trading.

About KPITTECH :

KPIT Technologies Ltd. engages in the provision of software for the automobile and mobility industry. It operates through the following geographical segments: Americas, UK and Europe, and Rest of the World. The company was founded by Shashishekhar Pandit, Kishore Parshuram Patil, and Sachin Dattatraya Tikekar on January 1, 2018 and is headquartered in Pune, India.

Ride the Wave: KPITTECH- Breakout Signals Profitable OpportunityKPITTECH, has recently caught the attention of traders with its impressive momentum. stock experienced a breakout from the bullish trendline, marking a significant turning point. Currently, the stock is testing its breakout at trendline which was supply line before breakout, which has now transformed into a demand line.

📊 Key Analysis Points 📊

When examining the daily timeframe, it's clear that the stock is holding above its breakout level with minimal volume, confirming the bullish outlook at retest of breakout.

Zooming in to the 75-minute timeframe, we observe a bullish RSI divergence, providing additional confirmation for a buy entry at the retest of the trendline breakout.

Moreover, analysing the volume on the 75-minute timeframe, we notice that the majority of bullish candles exhibit higher volume, surpassing the 50-day moving average of volume. This indicates a significant buying interest and reinforces the bullish setup.

Based on this analysis, we can plan our buy trade if the price surpasses today's high at 1067. Once the breakout is confirmed, we can enter the trade at 1069. To manage risk, it is recommended to place the stop loss below the previous swing low, around 1044, it's prudent to keep a buffer and set the stop loss at 1041. it's crucial to trail stop losses to secure profits as the trade progresses.

🔍 Educational Insights 🔍

Before concluding this analysis, let's clarify some technical terms used:

1. Breakout : This refers to a price movement that surpasses a key resistance level or trendline, indicating a potential shift in market sentiment and often leading to further price appreciation.

2. Volume : It represents the number of shares or contracts traded during a given time period. Analysing volume can provide insights into the strength or weakness of price movements.

Curious about volume? Check out my educational article on volume analysis that made it to TradingView's prestigious Editor's Pick:

3. RSI (Relative Strength Index) Divergence : RSI is a popular momentum oscillator. Divergence occurs when the price and RSI indicator move in opposite directions, indicating a potential trend reversal.

curious about RSI Divergence? Learn more in my educational article on Divergence, chosen for TradingView's Editor's Pick:

Remember, this analysis is for educational purposes only and does not serve as financial advice. As a reminder, I am not a SEBI registered analyst.

If you found this analysis helpful, please like and share your observations in the comments section below. Your feedback keeps me motivated to consistently provide valuable content. Don't forget to follow me on TradingView for more articles and trade setups. Let's connect and grow together! 😊📈

Follow me on TradingView for more: in.tradingview.com

"The only way to do great work is to love what you do."

KPIT GOOD TO ADD IN WATCHLISTNSE:KPITTECH

Good to keep on the radar

Always respect SL & position sizing

======================

Trade Secrets By Pratik

======================

Disclaimer

SEBI UNREGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

A POTENTIAL UPFLAG PATTERN IN kpit

Only For Educational Purposes,

Invest at your own discretion

KPIT TECH after delivering a staggering quarter with updated Growth Guidance and Highest TCV for all time now looks to deliver in the Charts,

KPIT Closed around 681 a few weeks ago, and has tried to test the same levels a couple of times but has failed to do so clearly.

Now after respecting the FIB levels @647 the stock is looking to form a good base and forming a Potential Upflag pattern which may burst out in upcoming Months,

One can look to add it at the present levels as well with the potential target of Rs 750/- before Q4 23 ends.

Regards

KPIT looks goodChart -> KPIT Weekly

After an unbelievable uptrend, the stock needed some time to cool off. That's what happened with a down move. But this week it broke the previous high with a volume spark!

CMP -> 660

Good range: 600-640

Target: 801

SL: 570 weekly close

Disclaimer: This is for educational purposes only, not any recommendations to buy or sell. As I am not SEBI registered, please consult your financial advisor before taking any action.

KPIT Technologies... Is it ready to "tech" off?The stock price action in KPIT Technologies look good, given its move from around 450 levels to 569.

Breakout above 590 will add some momentum for it to go till 625 and 650 levels in the short to medium term.

Good support in the range between 540 and 525, below which it has strong support at 455.

Always trade with a stop loss.

Note: Not a buy/sell recommendation. Do consult your financial advisor.