BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

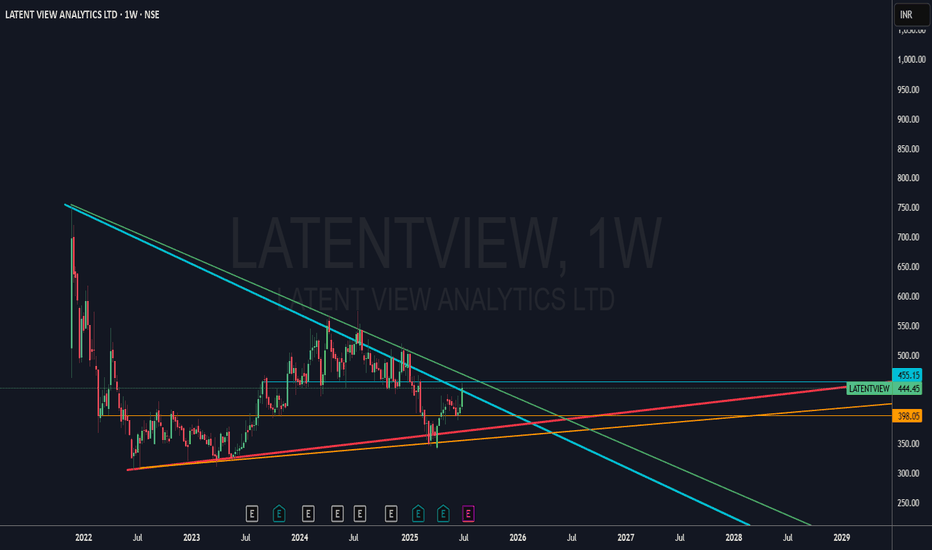

Trendline Breakout in LATENTVIEW

BUY TODAY SELL TOMORROW for 5%

LATENTVIEW

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in LATENTVIEW

BUY TODAY SELL TOMORROW for 5%

"(Re)Think Data. Think LatentView."Latent View Analytics Ltd

About

Latent View Analytics Ltd provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains.

LatentView has shown a strong weekly bullish candle backed by volume and trendline breakout after long consolidation. If it manages to close above ₹450, it may confirm a multi-timeframe breakout.

📌 Key technical positives:

Bullish structure on both weekly and monthly charts

Strong bounce from long-term support

Momentum indicators turning up

Volumes supporting price action

📈 Eyes on the ₹491–₹561 zone as potential next resistance range.

🔎 Fundamentally, the company shows solid revenue and profit growth (28% 3Y sales CAGR), high ROE, debt-free status, and consistent promoter holding above 65%.

🧠 Disclaimer: For educational and research purposes only. No buy/sell advice.

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

Latent view possible breakout after long consolidationLatent view might give a possible breakout as it is showing a long consolidation with flag and pole pattern, high volume was also seen a week back.

Also 55 Ema is below 8, 13, and 21 ema, which shows potential up movement

Buy around 415-420

Target - 508

Duration - 2-3 months

Double Moving Averages Crossover Swing Trade📊 Script: CHOLAFIN

📊 Sector: Finance

📊 Industry: Finance & Investments

⏱️ C.M.P 📑💰- 1337

🟢 Target 🎯🏆 - 1443

⚠️ Stoploss ☠️🚫 - 1295

📊 Script: PRAJIND

📊 Sector: Capital Goods-Non Electrical Equipment

📊 Industry: Engineering

⏱️ C.M.P 📑💰- 590

🟢 Target 🎯🏆 - 623

⚠️ Stoploss ☠️🚫 - 574

📊 Script: LATENTVIEW

📊 Sector: IT - Software

📊 Industry: Computers - Software - Medium / Small

⏱️ C.M.P 📑💰- 514

🟢 Target 🎯🏆 - 543

⚠️ Stoploss ☠️🚫 - 503

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

Latent View Analytics Ltd| Swing + long term investingLatent View Analytics Ltd provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains

Financial:

Market Cap₹ 11,158 Cr. Current Price ₹ 542 Stock P/E 75.6

ROCE 16.7 % ROE13.8 % Debt to equity 0.02

Promoter holding 65.4 % Quick ratio 15.8 Current ratio 22.9

Piotroski score 5.00 Profit Var 3Yrs 31.8 % Sales growth 3Years 20.2 %

Return on assets 13.0 %

This stock is recently published and you can see long downside cover with rounding bottom and clear cut straight away RSI in strong Momentum .keep close watch on this .Data and Analytics is the Future of India. so keep invest on India and make wealth.

Note: I am not SEBI registered financial Adviser. I solely present my views on chart .I do not charge any kind of service. This is not buy sell recommendation.

If you like my ideas than like boost and follow me for more ideas.

Thanks and feel free to comment .

LatentView looking good for target 750Latent View Analytics Ltd provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions.

IT sectors may've revenue shortage but margins are stable as per news.

LATENTVIEW : Breakout Stock#LATENTVIEW #breakoutstock #patterntrading #swingtrade #roundingbottom

LATENTVIEW : Weekly (1-3 months)

>> Breakout Stock

>> Rounding Bottom formation

>> Good Strength & Decent Volumes

>> Risk Reward Favorable

Swing Traders can lock 10% profit & keep trailing

Please give a Boost or comment if u r Liking the analysis & Learning from it. Keep showing ur Love by following

Pls Retweet if u like the Analysis

Disclaimer : This is not a Trade Recommendations & Charts/ stocks Mentioned are for Learning/Educational Purpose. Do your Own Analysis before Taking positions.

Breakout in Latent View Analytics Ltd...Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Latent view can be a potent multibagger!Latent view was one of the highest rated stock during its IPO listing which had got 300x subscription. The overhyped IPO market of 2021 has trapped many investors in multiple stocks including Latent view.

However, we can see some positive bounce in the stock from the demand zone of 310-320 after a major consolidation near the same.

A short term trendline breakout is also visible. The stock can be added on dips at 355, 344 with a SL of below 310 WCB for minimum target of 430.

My observation of the stock is that The consolidation structure is similar to Happiest minds which has given multibagger returns after consolidation breakout. Can we see the same in this stock? only time can tell!

Idea is shared for educational purposes only and should not be considered as a recommendation.

MULTIBAGGER ALEART Its the next multibagger, its already it buying zone and consolidating since long time, every stock has already shooten up but IT industry is left. Now its time for IT industry and LATENTVIEW ANALYTICS is one of the high margin constant profit maker of 25%+. its a constant profit making company since its established. promoter group is really strong. compounding on this stock will make you big chunk of money. BUY AND HOLD before is shoots.

LATENTVIEW DOUBLE BOTTOM @ WEEKLY CHARTLatentview on weekly chart is finally breaking the descending triangle trendline.

Enter in lower timeframes in the price range of 350-360 OR at current price.

STOP LOSS @ 345

Target at 400-420 after that trail using EMAs.

If price holds above 430 we can plan for 500-520 levels.

Latent View Analytics- Possible selling exhaustion

- Forming the accumulation schematic

- Strong fundamentals

- Potential multi-bagger

Seems like a good time to start accumulating with a long-term perspective. Thoughts?

Disclaimer: This is NOT investment advice. This post is meant for learning purposes only. Invest your capital at your own risk.

Latentview : Trendline Breakout + Retest done#latentview

>> Positional Call (1-3 months)

>> Enter above safe entry levels

>> Good Strength & Volumes in stock

>> Stock Ready to fly Upside.

Swing Traders book your Profits at 5-10% fully or partially and keep trailling

Keep Liking & sharing for more such Analysis

@moneyfesttrading

Latent view analytics Stock is trading below ipo price

It has produced good results

Expect for good upward movement

All levels mentioned in chart

Trade according to levels

Latent View Analytics reports Q2 earnings.

▶️Net profit up 71.7% at Rs 37.2 cr Vs Rs 21.7 cr (YoY)

▶️Revenue up 39.7% at Rs 132.4 cr Vs Rs 95.8 cr (YoY)

▶️EBITDA up 40.5% at Rs 37.2 cr Vs Rs 26.5 cr (YoY)

▶️EBITDA margin at 28.1% Vs 27.9% (YoY)

Latent View Analytics. A stock with good sentiments right now.Latent View can be bought at cmp for the given targets.

This stock currently has good sentiments behind it and can be traded for short term.

I personally will only trade and not sure about holding it for long term so decide your quantity accordingly.