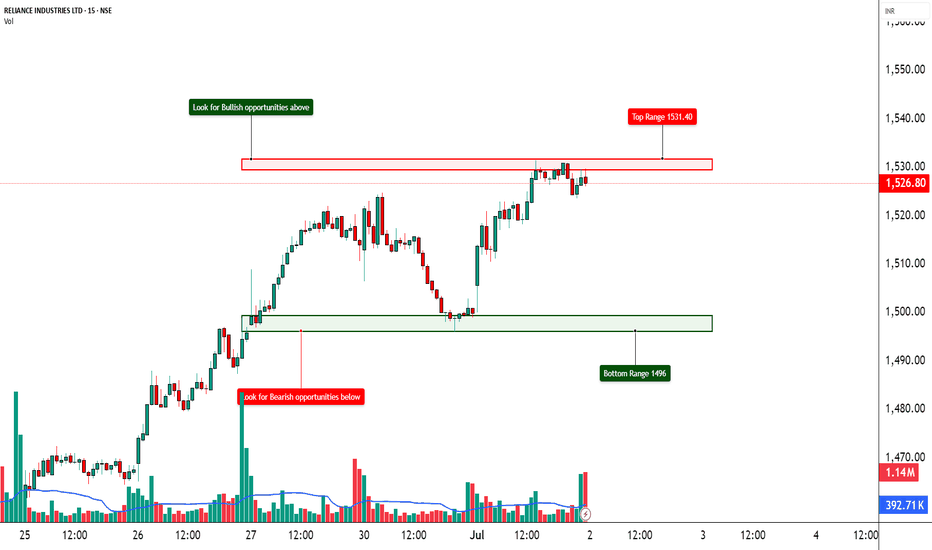

RELIANCE – Short Covering Fueling a Reversal?📈 RELIANCE – Short Covering Fueling a Reversal?

🔍 Heavy Action Across 1500–1570 CEs | Bullish Reversal on the Cards?

Chart Type: 15-min / 1H / Daily

Indicators: STWP Zones, Option Chain Activity, Volume Clusters, Demand-Supply

🔹 What’s Catching Our Eye?

✅ Aggressive Long Build-Up across multiple CEs (1550–1580)

✅ Massive Short Covering on 1500–1530 Calls – Bears exiting fast

✅ Huge OI Additions at 1550, 1560, 1570 CEs – Smart money positioning ahead?

✅ Put Writers Building Base at 1500–1520 PE → Strong support developing

✅ Spot Price at ₹1528.4 – Right at the heart of breakout zone

✅ IVs remain in control (~15.9–16.3%) = room for expansion

📊 What We’re Watching for:

📍 Breakout Zone: 1530–1540

📍 Targets: 1560 → 1580 → 1600

📍 Invalidation Below: 1490

📍 Momentum Confirmation: Price closing above 1540 with volume & OI spike

📍 Option Chain Support: 1500 PE (OI: 29.3L) + short build-up in multiple puts

📌 Trade Plan (Educational Purpose Only):

🔹 Bullish Idea: Buy above 1530–1540 with SL below 1490

🔹 Options Play: 1550 or 1560 CE suitable for short-term directional trades

🔹 Positional Angle: Momentum may sustain toward 1600 if 1540 holds

⚠️ Disclaimer:

This post is for educational and learning purposes only.

It does not constitute buy/sell advice or investment recommendation.

Always consult your financial advisor before taking any positions.

STWP is not liable for any financial decisions based on this content.

📚 “When bears cover in panic, bulls prepare their charge.”

💬 What’s your take on Reliance? Is 1600 on the radar, or is this just a squeeze?

Learntotrade

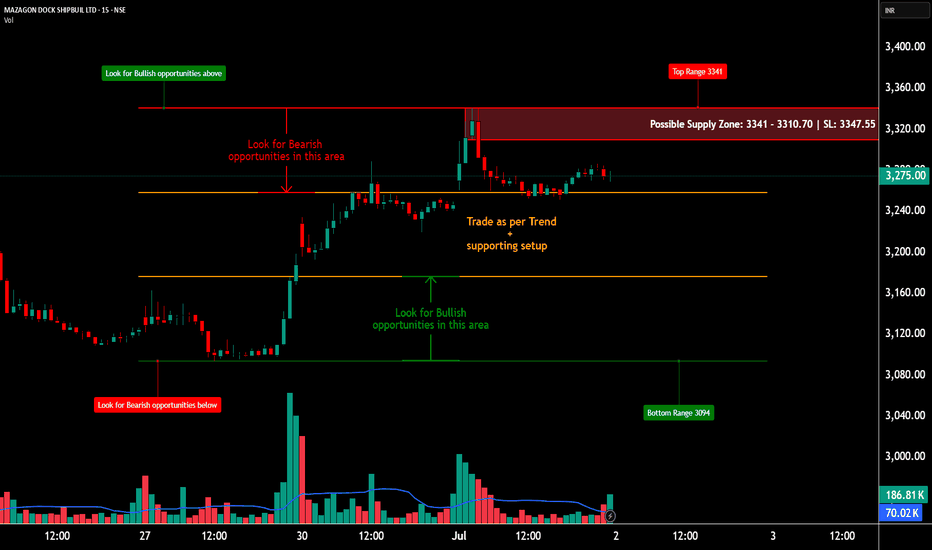

MAZDOCK - – INTRADAY ZONE ANALYSIS________________________________________________________________________________📈 MAZAGON DOCK SHIPBUILDERS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹3341

🟢 Bottom Range (Support): ₹3094

⚪ No Trade Zone: (Trade only with trend + confirmation in this zone)

________________________________________________________________________________

🧩 Chart Pattern: No visible chart pattern seen.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range:

✅ Multiple strong rejection candles near ₹3341 along with long upper wicks and volume drop — suggesting supply zone holding.

🟢 Bottom Range:

✅ Bullish Marubozu and wide-range green candles seen around ₹3094, confirming strong buyer interest and a potential reversal zone.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹3120–₹3094 demand zone with bullish confirmation (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹3090

Risk-Reward: 1:1 | 1:2+

Logic: Strong buyer reaction from demand zone previously suggests continued interest if tested again.

________________________________________________________________________________

🔽 Bearish Trade:

Idea: Short if price retests ₹3341–₹3310 and rejects with bearish candle formation (strong bearish candle, reversal candles, volume support, long wick).

Stop Loss: Above ₹3347.55

Risk-Reward: 1:1 | 1:2+

Logic: Supply zone confirmed with rejections earlier. Reversal here can lead to downside till mid or demand zone.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹3341 – ₹3310

SL: ₹3347.55

Plan: Enter short if price shows rejection with bearish confirmation at this zone.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹3120 – ₹3094

SL: ₹3090

Plan: Enter long on bullish reversal setup from this demand area.

Risk-Reward: 1:1 | 1:2+

________________________________________________________________________________

📌 Disclaimer

This analysis is for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before trading. Always use strict risk management and act only on confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on MAZDOCK?

Will it break the supply zone and rally higher, or revisit the demand zone before bouncing back?

Share your thoughts and chart setups below 👇

________________________________________________________________________________

BLUE STAR LTD. – TECHNICAL ANALYSIS📈 BLUE STAR LTD. – TECHNICAL ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Resistance): 2417

• 🟢 Bottom Range (Support): 1521

________________________________________________________________________________

🔹 Chart Pattern: ✅

Rectangle/Box Consolidation Breakout – Price was range-bound in a tight zone and has given a strong breakout on high volume, indicating bullish intent.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns

• Top Range (2417): ⛔ No recent candlestick activity visible at the top range.

• Bottom Range (1521): Todays Candle

✅ Bullish Engulfing + Strong Bullish Candle

✅ RSI Bounce + Volume Spike

✅ Confirmed by Price Action and Momentum Indicators

________________________________________________________________________________

📊 Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade Setup:

• Entry: 1715 (Breakout Candle Close)

• Stop Loss: 1614.45 (Below consolidation and bullish candle)

• Target 1: 1850

• Target 2: 1980

• Reason:

o Strong breakout with above-average volume

o Multiple confirmations (RSI, Bollinger Band, Supertrend)

o Box breakout with previous supply cleared

________________________________________________________________________________

🔽 Bearish Trade Setup:

• If price fails to sustain above 1715 and closes back below 1680 zone

• Entry: Below 1665 (Fakeout confirmation)

• SL: Above 1715

• Target: 1615 / 1550

• Reason: Potential failed breakout & liquidity trap

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Britannia?

Drop your thoughts and chart setups

________________________________________________________________________________

BRITANNIA INDUSTRIES LTD. – INTRADAY ZONE ANALYSIS📈 BRITANNIA INDUSTRIES LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹5869.50

🟢 Bottom Range (Support): ₹5721

⚪ Neutral Zone: Between ₹5732 – ₹5804 (No clear directional bias until breakout from either zone)

________________________________________

🧩 Chart Pattern: No

There’s no prominent chart pattern (e.g., flag, wedge, triangle) seen in the current snapshot. This is primarily a demand-supply structure with price action analysis.

________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No textbook reversal candle observed yet. However, the previous rejection from ₹5822–₹5804 still makes this zone valid for bearish observation.

🟢 Bottom Range: ✅ Morning Star pattern identified near ₹5721.

This is a strong bullish reversal pattern indicating potential buyer strength emerging from the demand zone.

________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹5732–₹5721 and holds with bullish confirmation (preferably another higher low or volume spike).

Stop Loss: Below ₹5715

Risk-Reward: 1:1 | 1:2+

Logic: Presence of a valid Morning Star reversal at demand zone suggests buyer strength and potential upside toward ₹5800+.

________________________________________

🔽 Bearish Trade:

Idea: Short if price rallies to ₹5822–₹5804 and shows rejection (bearish wick, reversal candle, volume drop).

Stop Loss: ₹5827.25

Risk-Reward: 1:1 | 1:2+

Logic: Previously reacted supply zone with strong rejection. If tested again without volume confirmation, short setup is valid.

________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹5822 – ₹5804

SL: ₹5827.25

Plan: Enter short only if price rejects the zone again with bearish confirmation.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹5732 – ₹5721

SL: ₹5715.60

Plan: Enter long if the zone holds, ideally using the Morning Star as confirmation.

Risk-Reward: 1:1 | 1:2+

________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________

💬 Comments

What’s your view on Britannia?

Will the Morning Star at the demand zone lead to a reversal, or will supply pressure dominate again?

Drop your thoughts and chart setups below 👇

________________________________________

BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS________________________________________________________________________________

📈 BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range(Resistance): 1324.50

🟢 Bottom Range(Support): ₹1270

⚪ No Trade Zone: Mid-range, no clear directional bias

________________________________________________________________________________

🧩 Chart Pattern: No

There is no visible or marked chart pattern (e.g., flag, triangle, head and shoulders) on the chart.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No visible reversal candle pattern at the supply zone on this chart snapshot, but the area has been marked for potential rejection.

🟢 Bottom Range: No textbook reversal candlestick (like pin bar, hammer, or engulfing) is clearly visible at ₹1270. However, the price bounced strongly from this level, indicating possible short-term support or buyer interest.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: If price retests ₹1270 and forms a bullish structure (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹1269

Risk-Reward: 1:1 | 1:2+

Logic: you need to give an actual logic to this

________________________________________________________________________________

🔽 Bearish Trade:

Idea: If price rejects 1324.50 and forms a bearish structure (strong bearish candle, reversal candles, volume support, long wick)

Stop Loss: ₹1325

Risk-Reward: 1:1 | 1:2+

Logic: Historically rejected area as marked on chart.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone Trade:

Zone: ₹1293.30 – ₹1299.90

SL: ₹1301.45

Plan: Trade the Supply Zone (only on rejection confirmation)

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: No defined demand zone.

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Bharat Forge?

Will it reject from the supply zone or hold the bottom range?

Share your charts or thoughts below 👇

________________________________________________________________________________

Top 5 Common Trading Mistakes and How to Avoid ThemHow to Avoid Common Trading Mistakes

1. Chasing Trades Due to FOMO

Here’s what happens:

• Fear of Missing Out (FOMO) often leads traders to jump into impulsive trades without proper analysis, resulting in poor entry points and unnecessary losses.

What does it mean?

• Jumping into trades without proper analysis increases risk and can cause emotional decisions.

Outcome:

• Stick to your trading plan.

• Wait for confirmation signals like moving averages or RSI before entering a trade.

2. Ignoring Risk Management

Here’s what happens:

• Traders focus too much on profits while neglecting risk controls, leading to major losses.

What does it mean?

• Without proper risk management, a single bad trade can wipe out your portfolio.

Outcome:

• Always set a stop-loss to protect your trades.

• Limit your risk to no more than 2% of your portfolio per trade.

3. Overtrading

Here’s what happens:

• Traders try to capture every market move, often leading to exhaustion and poor decision-making.

What does it mean?

• Overtrading reduces focus and increases emotional mistakes.

Outcome:

• Focus on high-probability setups that align with your strategy.

• Remember, quality over quantity always wins.

4. Trading Without a Clear Plan

Here’s what happens:

• Entering trades without a defined strategy is like gambling—it relies on luck, not skill.

What does it mean?

• A lack of planning results in inconsistent performance and increased risk.

Outcome:

• Develop a trading plan that includes your entry, exit, and risk management rules.

• Stick to your plan, even during volatile market conditions.

5. Letting Emotions Drive Decisions

Here’s what happens:

• Fear, greed, or frustration often leads to impulsive trading and poor outcomes.

What does it mean?

• Emotional decisions cloud judgment and lead to inconsistent performance.

Outcome:

• Journal your trades to identify emotional patterns.

• Focus on data-driven strategies to maintain objectivity.

Final Thoughts

Trading is not about avoiding losses entirely but managing them effectively. By addressing these common mistakes, you can build a strong foundation for long-term success.

What trading challenges have you faced? Share your experiences below—we can all learn and grow together!

TITAN - Triple Top Chart PatternTitan has formed a bearish chart pattern called Triple Top.

Triple top is a bearish chart pattern which is formed in an uptrend where three tops are lying on a flat horizontal resistance line and pattern will activate only when closing below the neckline or support. Pattern will activate only below the closing 3475 marks.

Triple top pattern is one the rarest chart pattern with high accuracy.

Thank You

Arvind Share Academy

Importance of time based stop lossNormally we see stop losses that are on the basis of price but i t is also important that we maintain a time based stop loss. Have a time period for stocks to see the performance, if it doesn't perform, sell and switch (you can always buy later!) to a better counter.

In this chart we can see NSE:KANSAINER has not given any returns since years. In fact on the date of posting, we are still at levels that were seen in June 2017. This share has been range-bound and has not triggered stop losses on longer time frames, however, the price correction (for whatever reason) has costed its investors (assuming they remained invested) a lot in terms of opportunity cost.

Hence, it is always advisable to have a time-based stop loss according to your system and appetite.

What you need to become a successful trader?here we have discussed what are the important things that you will need to become a successful trader.

1. Techinical Analysis Skill: Understanding the chart behaviour;

Price

Volume

Support and resistance

Trendlines

2. Risk Capability

How much money you can afford to lose on a single order, and on a single day.

3. Peace of Mind

Are you having a thought that might disturb your trade making decision. You must

have a calm and peaceful mind for being a successful trader.

4. Trade Managment

Trade management is the skill that gives you the power to make intelligent

decisions based on the analysis of which point is the best point to enter and

exit from the trade.

How To Trade with Neowave Trading IdeaHello Everyone,

Welcome to you all, this is an educational post in which you will learn how to trade with our neowave trading chart. For better understanding also watch the video which will be available soon.

See the below image

## This is how a Neowave structure looks in which a stock price goes up and down.

##These no 12345, I called them motive waves mean trending direction. As you can see these are in diffrent colors. Each color represent a trend cycle mean for how many days this particular stocks is going up or down.

See the below example

## As you can see in below examples , group of smaller cycles made bigger cycles and bigger cycles made more bigger cycles and so on

Example 1

Example 2

## But this hard to understand for ordinary eyes and neowave coding style is always differ between neowave analyst also. For one neowave analyst one trend is short and for other it can be intraday.it just there perspective. For every other person 12345 is create confusion, hard to tell how long this trend will go up. you just dont know this 12345 is short term cycle or longterm cycle.

To solve this i am changing coding style

##As name represent itself its cycles s for short cycles, m for medium cycles and l for longterm cycles.

see the below chart

Now see the below image for another part of neowave which is called correction

## As you know every trending cycles, there comes an consolidation period in which price gives some retracement but never retraced 100 percent of previous trend. This consolidation is represent as correction in neowave.

## This correction comes in same cycles in which the cycles was trend. As you can see short cycles trend in the image, after s5 there comes a flat pattern which is labbeld as SC1, this c stand for correction.same for ther cycles.

These are the list of the cycles which will be labbled in my chart.

See the below chart for complete list.

Now next part is important for you. These are the expected time frame for the repected cycles.

If you love the post than give it a boost and keep following us for more trading idea.

Thank You

Turbo Breakout Setup: High-Probability Trades with Precision.NSE:CNXFINANCE

Hello Traders,

In this video, I have explained a Breakout trading setup that will generate only high-probability breakout trades, that have high success rate than another breakout.

The setup is based on a pure price action structure and does not require any indicators just we are using volume as a confirmation tool.

Why does this setup work?

The logic is very simple

let's talk about the 1st variation of this setup:- Fake Breakout

as you can see in this setup most of the time the structure completes after a fake breakout.

So that fake breakout means the short sellers in the correction phase trying to defend there stop loss and make prices go down but what do you think for how long they will be able to defend that zone when buyers' strength is increasing? so after that when buyers push the price a little above-failed breakout zone the price hits short sellers stop losses and include new buying at that level to push prices toward the sky.

What about scenario 2nd:- NO failed breakout but horizontal range inside trend resistance line.

When the trend Resistance line and horizontal line break at the same price point it invites many traders to put a limit order above that horizontal line and most of the short sellers also have put their stop loss when that zone hit the price again and start moving towards the sky.

Other factors and detailed setup have been explained in the video.

Any setup is useless without a pre-defined stop loss cause you need to focus on capital protection first then you can aim for profits.

Always take calculated risks and use proper position sizing.

This is only for educational purposes only.

Always trade with stop-loss.

I hope you found this idea helpful.

Please like and comment.

Share with Your Friends.

Keep Learning,

Happy Trading!

How to Trade Camerilla Pivot Points with Live Trade exampleHow to Trade Camerilla Pivot Points with Live Trade example

Keep Eye on Stop loss levels they will either work as Support/Resistance breakout or breakdown can give Explosive moves which are good level for Options Buying

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my view.

Please consult your Financial Advisor before making any trading decision.

IGL stock to take long entryLong IGL above 435 levels for the target price of 455-460 . All important levels has been marked on the charts. 5 star Trading setup analysis:

1- Star- RSI taken well support at 40 levels sharp V turn.

2- Star- Resistance BO with very strong bullish candle & trading at support level.

3-Star-- After the second BO of marked resistance area well confirmation and can play trade.

4-Star-- Stock trading within channel & trading forming bullish sign from the lower channel.

5- Star-- Stock has been crossed the 50 as well as 200 EMA.

All above setup is good to go for high probability long entry with good risk to reward trade but not 100% full proof .Therefore, more important this setup can also be failed. So the stop loss need to be placed well in advance to avoid any fall in the stock market. This is for your education purpose only. Learn & trade only#.

JNJ at the best possible place to buyJNJ has recently been through a sharp correction in its price and currently, it is trading at $160.39, so when we check the charts on the weekly timeframe we can see that the price has previously taken support from this exact point and has shot up every time, additionally the price has also tested and bounced back from the 200 EMA on the weekly timeframe and there's more to it, the price has formed somewhat of a weakish hammer candle on the weekly timeframe, thus giving my bullish conviction a triple strength.

TLDR: If we check the weekly chart we will find the price taking support from an important zone, 200 EMA, and forming a hammer candle.

Coming to the hourly timeframe here you can see the price is following a trend line very meticulously and thus I will be waiting for a breakout and after that I will look for a retest as shown with the ghost candles after the price retests the important zone I will switch to the 15 minute timeframe and look for a long opportunity.

Hope it helps.

Happy Trading.

SUPPORT & RESISTANCE EXPLAINED IN NIFTYIn the Nifty chart, we can see that the Index was rejected multiple times along the trendline drawn and finally managed to give a breakthrough above the trendline.

Now, this resistance trendline is likely to act as a support trendline.

On Elliot wave analysis, the up move is currently at wave five, and we can expect a correction that will re-test the trendline.

The Index should test the support zone (17650 levels) and resume its upward rally.

Morning Mantra, 30th November 2022So, yesterday was another beautiful day in the Market, where Nifty had successfully made an all time new high of 18678, along with a fresh new closing of 18618.05

Well apart from this, there is another good news, as we can now shift our support level from 17800 to 18400.

Yes you've read it correctly! It's 18400.

So, yes with this new support level of 18400, be stock specific, start cherry picking and enjoy the Market's momentum, as of now.

Besides, at this New All Time High of Nifty, we can suggest you for reviewing your portfolio, as this is an ideal time for portfolio rebalancing as per your risk appetite.

Nifty Levels 15270-15400-15580-15800

-16200-16350-16700-17300 -17800

-18100-18350

Nifty’s Previous Day Closing - 18618.05 (+55.30)

Regards,

Alok Daiya

Expecting a Bullish Momentum in INTELLECTAs per the 2 Hour Chart of INTELLECT, we have witnessed the Formations of a “Bullish Harami” Pattern backed by a confirmation candle.

Therefore, we are expecting to witness a bullish momentum in the stock in the upcoming trading sessions. Wherein, the stock is being expected to face a resistance initially at around the levels of 808.85, 828.30, and 846.70. Whereas, on the other hand, on the downside levels, the stock may face a support at the level of 766.90, on closing basis.

Closing Price (as on 02.05.22) : 788

Disclaimer: No financial information whatsoever published here, should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for Educational and Information purposes only and under no circumstances should be used for making investment decisions. Viewers must consult their personal financial advisor before making any actual investment decisions, based on information published here. Any Investor or Trader taking decisions based on any information published here, does so entirely at its own risk. Investors and Traders should bear in mind that any investment in Stock Market is subject to unpredictable market-related risks.

How to be successful by following the foot prints of Big Banks.A Very simple way to identify the foot prints of Big banks / Institutions / Big players in trading.

Why to follow the big banks ?

Because they are the market leaders who decide the direction of a market, and also they never loose their position most of the

time.

So who will be successful ? following big players or the one who follow retailers?

So hope you can find the answer - the one following the big banks / or institutions.

This can be achieved by finding the Valid Supply and Demand Zones and taking trade at those Zones only.

More info is given in below comments

BREAK OUT TRADE'S.BREAK OUT TRADES ARE VERY FRUITFUL IF YOU CAN FIND PERFECT SUPPORT/RESISTANCE AREA'S. IN THE CHART, I SHOWN PROPER SUPPORT AND RESISTANCE AREA'S ON THE CHART OF MUTHOOT FINANCE OF DAILY TIME FRAME. IF YOU LEARN TO FIND THESE IMPORTANT AND MOST IMPORTANTLY, AFTER FINDING OUT THESE ARES YOU WILL HAVE TO ENTER INTO THAT TRADE ON BREAK OUT PRICE SO THAT YOU CAN ENJOY THE BENEFITS OF THESE HUGE BREAK OUT OF DAILY TIME FRAME.

THIS POST IS JUST FOR EDUCATIONAL PURPOSE.

BREAK OUT IS HAPPENDED LONG AGO, POST IS PURELY FOR EDUCATIONAL PURPOSE.

Ascending Triangle Chart Pattern (Continuation Pattern)An ascending triangle is a chart pattern used in technical analysis. It is created by price moves that allow for a horizontal line to be drawn along the swing highs, and a rising trendline to be drawn along the swing lows. The two lines form a triangle. Traders often watch for breakouts from triangle patterns. The breakout can occur to the upside or downside. Ascending triangles are often called continuation patterns since the price will typically breakout in the same direction as the trend that was in place just prior to the triangle forming.

Important Points to look at -

The trendlines of a triangle need to run along at least two swing highs and two swing lows.

Ascending triangles are considered a continuation pattern, as the price will typically breakout of the triangle in the price direction prevailing before the triangle. Although, this won't always occur. A breakout in any direction is noteworthy.

Increasing volume helps to confirm the breakout, as it shows rising interest as the price moves out of the pattern.

A minimum of two swing highs and two swing lows are required to form the ascending triangle's trendlines. But, a greater number of trendline touches tends to produce more reliable trading results. Since the trendlines are converging on one another, if the price continues to move within a triangle for multiple swings the price action becomes more coiled, likely leading to a stronger eventual breakout.

A triangle is a type of consolidation, and therefore volume tends to contract during an ascending triangle. As mentioned, traders look for volume to increase on a breakout, as this helps confirm the price is likely to keep heading in the breakout direction. If the price breaks out on low volume, that is a warning sign that the breakout lacks strength. This could mean the price will move back into the pattern. This is called a false breakout.

$ = Liquidity