DMART – A Clean Case Study in Patience & Price Action________________________________________

Ticker: NSE: DMART

Sector: Retail – Supermarkets & Hypermarkets

Market Cap: ≈ ₹2.78 lakh crore (approx as of July 30, 2025)

Current Price: ₹4,281.40 (up ~7% on July 30, 2025)

Technical Rating: ⭐⭐⭐⭐⭐

________________________________________

📢 DMart (Avenue Supermarts) Update – July 30, 2025:

If you’re a new investor tracking India’s retail space, DMart just gave us a masterclass in how market sentiment can flip fast — and why fundamentals still matter.

In its Q1 FY26 results, DMart reported a modest 2% profit growth (₹830 cr), despite a solid 16% jump in revenue. This raised concerns among analysts about tight margins and intensifying competition, especially from fast-moving consumer goods (FMCG) and quick-commerce players. Not surprisingly, the stock dipped around 2.6% post-results.

But fast-forward to late July, and the narrative flipped.

On July 30, DMart shares surged 7–8% intraday, marking their biggest rally since March, after announcing the opening of its 426th store and laying out a bold expansion plan. The market cheered the company’s strong growth visibility and confidence in its value-retail model. CEO Neville Noronha emphasized the importance of store additions, digital scaling via DMart Ready, and the company’s resilience in a competitive landscape.

On the digital front, online grocery sales grew 21% YoY to ₹3,502 cr in FY25 — a good sign of consumer shift — though losses widened as DMart expanded into new cities.

What’s the takeaway? For learners, this is a great example of how stocks don’t move just on earnings, but on future guidance, strategy, and investor confidence. DMart may not have wowed with profits this quarter, but its long-term vision still packs a punch.

________________________________________

📉 Technical Analysis | Chart Pattern: Potential Breakout Brewing:

DMART has been consolidating in a symmetrical triangle pattern on the daily chart since April 2025 — a classic setup that often signals a big move ahead. On July 30, the stock showed signs of life with a strong 7% gain and a 5× volume spike, which usually reflects institutional accumulation and rising trader interest.

🔍 But here’s the key insight:

Despite the surge in volume, the price has not yet convincingly broken above the triangle’s upper trendline. This means there’s no valid price breakout yet — only a volume-based alert. For newer traders, this is a great example of why volume alone isn't enough. A true breakout needs a strong candle closing above the pattern, preferably with follow-through buying.

________________________________________

🔼 Key Resistance Levels to Watch:

₹4,403 – Recent swing high and immediate target if breakout confirms

₹4,526 – April top and near-term bullish milestone

₹4,728 – Long-term resistance if momentum builds up post-breakout

🔽 Important Support Levels:

₹4,078 – Breakout support zone and first pullback entry area

₹3,876 – Base of the triangle, also a structural support

₹3,753 – Deeper support, invalidation point if breached

________________________________________

🧭 Strategy Insight for New Traders:

This is a textbook case of a "breakout watchlist" setup. With strong bullish indicators — RSI > 60, MACD crossover, Supertrend flip, and a BB Squeeze breakout setup — the chart is preparing for a move. But confirmation is key.

✅ Wait for a clear breakout above the trendline with sustained volume

✅ Avoid chasing the move too early — breakout traps are common

✅ If the breakout confirms, ₹4,403 and ₹4,526 become logical targets

✅ A retest toward ₹4,080 could offer a low-risk long entry if supported by volume

________________________________________

🧠 Pro Note for Beginners: A breakout isn’t just about price jumping — it’s about structure, confirmation, and follow-through. Think of volume spikes as the "whispers" before the market makes a bold statement.

________________________________________

🔍 Fundamental Analysis:

If you’re just starting out in stock market investing, DMART offers an interesting case study—a well-run retail company with strong fundamentals and a clear growth story. As of July 2025, DMART has shown solid performance, especially in revenue growth, while keeping debt levels incredibly low.

In Q1 FY26, the company posted standalone revenues of ₹15,932 crore—up 16.2% YoY—highlighting strong consumer demand and steady growth momentum. Over the full FY25, consolidated revenue rose nearly 17% YoY, reflecting DMART’s consistent top-line performance. However, while revenues are rising fast, margins have seen slight compression. PAT (net profit) for FY25 stood at ₹2,707 crore with a PAT margin of 4.6%, down from 5% a year earlier.

DMART’s earnings per share (EPS) is growing steadily too—₹41.61 in FY25, up ~7% from last year. But with a price-to-earnings (P/E) ratio of ~96x, the stock trades at a steep premium compared to peers, signaling that the market has high expectations for its future growth.

One of DMART’s biggest strengths is its minimal debt—the company operates with almost zero leverage, giving it exceptional financial flexibility. It also generates healthy free cash flows from its core retail operations, though its online grocery venture (DMart Ready) is still in the investment phase, posting losses as it expands.

From a valuation standpoint, DMART is expensive, no doubt. But investors are paying for its scalability, low-risk model, and disciplined management. With 415 stores across India and consistent quarterly additions, the company continues to grow organically while maintaining a lean balance sheet.

🔔 Bottom Line for Beginners: DMART is a financially strong and well-managed company with proven business fundamentals. But with a very high valuation and slowing profit growth, new investors should be cautious. It may be wise to watch for better entry points or wait for earnings to catch up with the price. For long-term investors with patience and a high-quality bias, it could still be a worthy contender—especially if margins and digital growth improve.

________________________________________

📈 DMART Chart Study – Educational Swing Trade Example:

Disclaimer: This is an educational post intended to help new traders understand breakout setups. This is not a recommendation to buy, sell, or hold any stock or security. Always consult your registered financial advisor before making any trading decisions.

If you're learning how swing trades work, this DMART daily chart setup from July 30, 2025, offers a great example of how price action, volume, and key levels can come together. It’s a practical case study to understand the breakout trading concept.

________________________________________

🛠️ Trade Structure (For Educational Purposes)

Reference Entry Price: ₹4,324.00

Reference Stop Loss: ₹3,925.85

Risk-Reward Scenario: Approx. 1:1, with potential extension to 1:2+ (based on hypothetical higher target)

________________________________________

🔍 Key Chart Observations:

✅ Breakout Candle Formation: A strong bullish candle closed near its high — a typical sign of price strength.

✅ Volume Confirmation: Volume surged to 3.39 million shares, which is over 4× the daily average — often seen in breakout moves.

✅ Price Range Context:

• Support/Base Zone: Around ₹3,340

• Initial Target Zone: ₹4,557.70

________________________________________

📘 Educational Insights:

🔴 Risk-Reward Perspective: At the observed entry level, the risk-to-reward ratio was near 1:1 — not ideal for most strategies. A more efficient trade setup might occur on a pullback or with a more distant target.

🔄 Retest Possibility: If the price retraces to ₹4,150–₹4,200 with lower volume, that zone could serve as a reference for learners exploring re-entry setups (purely for study).

🧠 Capital Risk Planning: Risk management is crucial. Avoid risking more than 2–3% of total trading capital on any single idea, no matter how strong the pattern looks.

________________________________________

📌 Beginner Learning Point:

Breakout trading is more than just chasing big candles. A proper breakout setup usually involves volume surge, clear consolidation range, and defined risk management. Learning to combine these elements is key to developing trading discipline.

________________________________________

🧾 Why I’m Watching DMART — A STWP Perspective for Beginner Investors:

One of the best lessons I’ve learned in my investing journey is this: It’s better to buy a great business at a fair price than a fair business at a great price. And when I look at DMART (Avenue Supermarts Ltd.), I see the foundation of a truly great business — even if the price isn’t quite right just yet.

________________________________________

🛒 A Business Anyone Can Understand:

DMART isn’t chasing trends or building flashy tech. It’s focused on something much simpler — and far more reliable: selling everyday essentials. Groceries, home goods, basics — the things people need no matter what. And they do it efficiently, consistently, and affordably. That simplicity, when executed well, is a major strength.

________________________________________

🧱 A Strong, Repeatable Model:

What really impresses me is their cost discipline. DMART owns many of its stores, keeping rental costs low. They avoid unnecessary frills and instead focus on efficiency and tight operations. The result? A cost advantage that’s tough for others to beat. Even though retail has thin margins, DMART’s model is scalable, profitable, and built for the long haul.

________________________________________

👨💼 Led by a Trusted Name:

The company is backed by Radhakishan Damani — a man known for his patience, clarity, and capital discipline. He’s not in a rush to make headlines. He’s building something durable. And when you find great leadership combined with a focused business model, that’s a rare combo worth watching.

________________________________________

📉 Why This Stock Is on My Watchlist?

In one word: Valuation.

DMART often trades at 80–100 times earnings — which is expensive, even for a wonderful business. As an investor, I’d rather wait for a better deal than rush in and overpay. Great businesses can still turn into poor investments if you don’t get the price right. So for now, I’m staying patient.

________________________________________

📈 If the Price Comes Down…

If the market turns pessimistic or earnings grow into the valuation, DMART will be high on my buy list. Here’s why:

✅ A clean, debt-light balance sheet

✅ A brand people trust

✅ A scalable, cost-efficient model

✅ A long growth runway in India’s retail sector

✅ And thoughtful, no-drama leadership

________________________________________

🪙 Final Thought for New Investors:

As Warren Buffett says, “Time is the friend of the wonderful company and the enemy of the mediocre.”

DMART, in my view, is a wonderful company. I’d love to own it — but only when the price is right. Until then, I’ll keep watching, learning, and staying patient.

(Of course, one could consider buying a small quantity now and adding more on dips — a strategy that balances quality with prudence.)

________________________________________

⚠️ Disclaimer (Please Read Carefully):

This content is shared strictly for educational and research purposes only.

I am not a SEBI-registered investment advisor, and no buy or sell recommendations are being made.

All views expressed are based on personal market analysis and experience. They are not intended as financial advice.

Trading — especially in derivatives like options — involves significant financial risk. Losses can exceed your initial investment.

👉 Always do your own research and consult a certified SEBI-registered advisor before making any investment or trading decisions.

👉 Use proper risk management and only trade with capital you can afford to lose.

The author assumes no responsibility or liability for any trading losses incurred from acting on this content.

By engaging with this material, you agree to these terms.

________________________________________

💬 Found this helpful?

Drop your thoughts, questions, or insights in the comments below ⬇️ — let’s learn together!

🔁 Share this post with your trading friends and community — help them discover clean charts, structured setups, and zone-based learning.

✅ Follow @simpletradewithpatience for clear setups, educational content, and a no-nonsense approach to price action, supply-demand zones, and risk-managed trades.

🚀 Trade with patience. Trust your charts. Stay clear-headed.

Because the goal is not just to trade — it's to trade better.

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

Learntrading

HDFCBANK – Bullish Potential Post Results, But OI Shows Bearish________________________________________________________________________________📈 HDFCBANK – Bullish Potential Post Results, But OI Shows Bearish Overhang

📅 Setup Date: 17.07.2025 | ⏱ Timeframe: Daily

📍 Strategy: Post-Earnings Reaction Play with Mixed Sentiment in Options

________________________________________________________________________________

🔍 Overall View

Spot Price: ₹1957.4

Trend: Mixed – Strong Q1 results (profit ↑12%, bonus/dividend declared), but price action weak

Volatility: High IVs — Calls ~23–25%, Puts ~29–32% → post-result event premium still elevated

Ideal Strategy Mix: Neutral-to-bullish spreads with defined risk or post-IV crush contrarian longs

________________________________________________________________________________

1️⃣ Bullish Trade (Contrarian Setup with Fundamental Trigger)

Best CE: Buy 1980 CE @ ₹24.2

Why:

• Strong earnings + corporate action (bonus/dividend) → triggers potential sentiment reversal

• CE 1980 saw Short Build-Up (+144% OI), premium ↓25% → ideal for short-covering setup

• Delta ~0.41 with high IV (~24.3%) → moderate leverage & gamma in case of price breakout

• Use only if price breaks and sustains above ₹1975 with strong candle + volume

________________________________________________________________________________

2️⃣ Bearish Trade (Trend Following)

Best PE: Sell 1900 PE @ ₹16.65

Why:

• PE 1900 saw massive Long Build-Up (+70%) but IV surged → may now face decay pressure

• Selling this deep OTM PE gives ~₹57 buffer from spot (≈3% downside cushion)

• Post-results, downside may be limited → good candidate to play post-IV crush

• Spot stability around 1950–1960 invalidates aggressive downside

________________________________________________________________________________

3️⃣ Strategy Trade (Defined Risk Based on Mixed Setup)

Strategy: Bull Call Spread → Buy 1980 CE / Sell 2020 CE

→ ₹24.2 / ₹10.7

Net Debit: ₹13.50

Max Profit: ₹40 (spread width) – ₹13.5 = ₹26.5

Max Loss: ₹13.50

Risk:Reward: ≈ 1 : 1.96 ✅

Lot Size: 550

Total Risk: ₹7,425

Max Profit: ₹14,575

📊 Breakeven Point: ₹1993.5

📉 Reversal Exit Level: Exit if Spot < ₹1940 (invalidates breakout + earnings move fade)

________________________________________________________________________________

Why:

• Bullish news (Q1 beat, bonus/dividend) could trigger CE short covering if price moves above 1980

• Limited risk strategy — works well if post-result rally is moderate

• High IVs favour spread over naked options (caps loss from premium crush)

• CE OI from 1960–2060 mostly short → if momentum picks up, rally could be fast

________________________________________________________________________________

📘 My Trading Setup Rules

Avoid Gap Plays

→ Check pre-open price action to avoid trades influenced by gap-ups/gap-downs.

Breakout Entry Only

→ Enter trades only if price breaks previous day’s High (for bullish trades) or Low (for bearish trades).

Watch Volume for Confirmation

→ Monitor volume closely. No volume = No trade.

Enter on Strong Candle + Volume

→ Execute the trade only if a strong candle appears with increasing volume in the direction of the trade.

Defined Risk:Reward Only

→ Take trades only if R:R is favourable (ideally ≥ 1:2).

Premium Disclaimer

→ Option premiums shown are based on EOD prices — real-time premiums may vary during execution.

Time Frame Preference

→ Trade with your preferred time frame — this strategy works across intraday or positional setups.

________________________________________________________________________________

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________________________________________________

UPL – Demand Zone Based Trade Setup________________________________________________________________________________📈 UPL – Demand Zone Based Trade Setup

🕒 Chart Type: 15-Min | 🗓 Date: 17th July 2025

🔍 Simple and Structured Setup for New Traders

________________________________________________________________________________

🚦 Key Zones to Watch

🔴 Top Range (Resistance) – 697.45

🟠 Mid-Level Zones – 685.60 | 673.75

🟢 Bottom Range (Support) – 661.95

📦 Possible Demand Zone – 671.95 to 669.70 (SL: 669 | Risk: 2.95)

________________________________________________________________________________

💡 What’s Happening on the Chart?

✅ Strong price rally from the demand area 📈

✅ Price is now consolidating just below major resistance (697.45)

✅ Volume spikes indicate strong participation

✅ Market respecting zones cleanly — ideal for zone learners 📚

________________________________________________________________________________

🎯 How to Plan Trades (For Educational Use Only):

🔼 Best Buy Setup:

• Entry: Near 671.95–669.70 (Demand Zone)

• Stoploss: 669

• Target: 685 / 697

• Why: Tested demand zone + strong uptrend + low-risk trade

🔽 Best Sell Setup:

• Entry: Near 697.45 (Resistance Zone)

• Stoploss: 699

• Target: 685.60 / 673.75

• Why: Top zone tested + price may reverse with exhaustion

________________________________________________________________________________

🧠 Learning Points for New Traders:

• ✅ Always trade with trend until you hit opposite zone

• 🧱 Focus on buying near support and selling near resistance

• 📊 Use volume and structure for entry confirmation

• 🧠 Risk should always be smaller than reward

________________________________________________________________________________

📦 Zone Summary for Quick Reference:

• 🔴 Resistance Zone: 697.45

• 🟢 Demand Zone: 671.95 – 669.70 (Risk only ₹2.95!)

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this helpful?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community – let them benefit from clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for charts, clean setups, and educational content based on price action, zones, and risk-managed trades.

🚀 Trade with patience, trust your charts, and stay clear-headed!

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

________________________________________________________________________________

PRESTIGE – Bullish Continuation with Aggressive Call Build-Up________________________________________________________________________________📈 PRESTIGE – Bullish Continuation with Aggressive Call Build-Up

📅 Setup Date: 18.07.2025 | ⏱ Timeframe: Daily

📍 Strategy: Options Trade Setup

________________________________________________________________________________

Overall Bias: Bullish

Spot Price: ₹1,783.2

Trend: Uptrend resumption with aggressive Call OI build-up

Volatility: IV slightly falling in puts, rising in calls → good for defined risk bullish setups

Ideal Strategy Mix: Bullish with defined reward → Bull Call Spread or Naked CE

________________________________________________________________________________

1. 🔼 Bullish Trade (Naked options as per trend)

Best CE: Buy 1800 CE @ ₹49.10

Why:

• Strong Long Build Up with OI up 225%

• Massive volume (1.78L contracts) and ₹33.2 Cr TTV → clear interest

• Decent delta (approx. 0.5–0.55) → good sensitivity to price movement

• Strike closest to spot + high liquidity = ideal for directional trade

________________________________________________________________________________

2. 🔽 Bearish Trade (Naked options as per trend)

Best PE: Sell 1740 PE @ ₹28.6

Why:

• Price down 46% with high volume (4.2L) = put writing

• OI dropped 6.94% → likely unwinding from short bias

• Deep OTM with stable delta (-0.25 approx)

• Favorable if bullish view sustains and price stays above ₹1,740

________________________________________________________________________________

3. ⚙️ Strategy Trade (As per trend + OI data)

Strategy: Call Debit Spread → Buy 1780 CE + Sell 1820 CE

Net Debit: ₹57.3 - ₹41.1 = ₹16.2

Max Profit: ₹40 (spread) - ₹16.2 = ₹23.8

Max Loss: ₹16.2

Risk:Reward ≈ 1 : 1.47

Lot Size: 450

Total Risk: ₹7,290

Max Profit: ₹10,710

Why:

• 1780 CE shows explosive Long Build Up (OI ↑1031%) → active strike for bulls

• 1820 CE also shows strong Long Build Up (OI ↑1000%) → defined bullish target

• Much better R:R than 1800–1840 while staying aligned with trend

• Defined risk with improved capital efficiency and lower theta burn

________________________________________________________________________________

📘 My Trading Setup Rules

Avoid Gap Plays

→ Check pre-open price action to avoid trades influenced by gap-ups/gap-downs.

Breakout Entry Only

→ Enter trades only if price breaks previous day’s High (for bullish trades) or Low (for bearish trades).

Watch Volume for Confirmation

→ Monitor volume closely. No volume = No trade.

Enter on Strong Candle + Volume

→ Execute the trade only if a strong candle appears with increasing volume in the direction of the trade.

Defined Risk:Reward Only

→ Take trades only if R:R is favorable (ideally ≥ 1:2).(Safe R:R – 1:1)

Premium Disclaimer

→ Option premiums shown are based on EOD prices — real-time premiums may vary during execution.

Time Frame Preference

→ Trade with your preferred time frame — this strategy works across intraday or positional setups.

________________________________________________________________________________

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this helpful?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community – let them benefit from clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for charts, clean setups, and educational content based on price action, zones, and risk-managed trades.

🚀 Trade with patience, trust your charts, and stay clear-headed!

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊________________________________________________________________________________

PATANJALI - OPTIONS TRADE SETUPPATANJALI OPTIONS TRADE SETUP – 17 JULY

Spot: ₹1859.6

Trend: Bullish

Volatility: Moderate IV rise (38–41%)

Lot Size: 300

________________________________________

1. Bullish Trade (Naked options as per trend)

Best CE: Buy 1860 CE @ ₹59.45

Why: Strong continuation signal with rising OI and price, heavy volume, and ideal gamma/vega mix for price moves.

________________________________________

2. Contrarian Trade (Naked options against trend)

Best PE: Buy 1800 PE @ ₹31.3

Why: Defensive Put play with unusually high activity and rising IV → could work as hedge if breakdown begins below ₹1840.

________________________________________

3. Strategy Trade (As per trend + OI data)

Strategy: Bull Call Spread → Buy 1860 CE / Sell 1920 CE

Net Debit: ₹59.45 - ₹35.5 = ₹23.95

Max Profit: ₹60 - ₹23.95 = ₹36.05

Max Loss: ₹23.95

Risk:Reward ≈ 1:1.5

Lot Size: 300

Total Risk: ₹7,185

Max Profit: ₹10,815

Why:

• Massive Long Buildup in CE chain (1820 to 1960), with 1860 CE leading in volume and OI surge

• 1860–1920 spread captures ideal move zone before resistance at 1960

• IVs rising moderately → favors debit spread entry

• PE chain showing Short Buildup, especially at 1800/1840/1880 → downside bets getting squeezed

• Balanced risk with great R:R (1:1.5) near breakout zone — clean bullish continuation setup

________________________________________

📘 My Trading Setup Rules

Avoid Gap Plays

→ Check pre-open price action to avoid trades influenced by gap-ups/gap-downs.

Breakout Entry Only

→ Enter trades only if price breaks previous day’s High (for bullish trades) or Low (for bearish trades).

Watch Volume for Confirmation

→ Monitor volume closely. No volume = No trade.

Enter on Strong Candle + Volume

→ Execute the trade only if a strong candle appears with increasing volume in the direction of the trade.

Defined Risk:Reward Only

→ Take trades only if R:R is favorable (ideally ≥ 1:2).

Premium Disclaimer

→ Option premiums shown are based on EOD prices — real-time premiums may vary during execution.

Time Frame Preference

→ Trade with your preferred time frame — this strategy works across intraday or positional setups.

________________________________________

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________

Options Strategy Breakdown – For Educational Purpose Only________________________________________

📈 Options Strategy Breakdown – For Educational Purpose Only

🧠 Learn to Structure a Bull Call Spread Strategically

________________________________________

🔹 Stock Name: BSE

🔹 Spot Price: ₹2546

🔹 Lot Size: 375

🔹 Number of Lots: 1

🔹 Expiry Date: 31-July-2025

🕒 DTE (Days to Expiry): 16 Days

💡 Strategy Type: Bull Call Spread – Limited Risk | Limited Reward Option Structure

________________________________________

📘 Strategy Construction (Illustrative Example):

1️⃣ Buy Call Option – Strike: ₹2500 | Premium Paid: ₹125

2️⃣ Sell Call Option – Strike: ₹2600 | Premium Received: ₹76

🧮 Net Premium Outflow: ₹49

(₹125 - ₹76 = ₹49 * 375 = ₹18,375)

________________________________________

📊 Payoff Metrics (Illustrative & Hypothetical):

• 🔹 Breakeven Point: ₹2549.00

• 📈 Maximum Profit: ₹19,125 (When Spot ≥ ₹2600)

• ⚠️ Maximum Loss (Capital Deployed): ₹18,375 (if Spot ≤ ₹2500)

• 🔄 Real-Time PnL: Subject to market movement

• 🎯 Suggested Profit Booking Threshold: ₹18,375 (illustrative target)

• 🛑 Reversal Exit Point (Invalidation): Spot < ₹2487.75 (Support Violation)

________________________________________

📌 Why Learn This Strategy?

The Bull Call Spread is a risk-defined options strategy designed for moderately bullish views. It reduces premium cost compared to naked options and has a clearly capped loss and reward, making it suitable for learning proper risk management in derivatives trading.

________________________________________

🔍 Key Educational Takeaways:

• Helps manage premium exposure in trending markets

• Builds awareness of breakeven levels and invalidation points

• Encourages use of defined-risk structures over naked positions

• Promotes discipline and technical level-based exits

________________________________________

⚠️ Educational Disclaimer:

📢 This post is intended purely for educational and informational purposes only and does not constitute investment advice, recommendation, or solicitation to trade.

I am not a SEBI-registered investment advisor. All data shared above is illustrative and should not be considered as buy/sell advice.

Trading in derivatives involves risk. Please consult a SEBI-registered advisor before taking any financial decisions.

📘 Past performance or setup structure does not guarantee future results.

Always do your own research and use strict risk management.

________________________________________

💬 Want more educational breakdowns like this?

Drop a comment or message!

🔁 Share this with fellow learners to help them build structured option strategies.

✅ Follow @simpletradewithpatience for charts, clean setups, and educational content based on price action, zones, and risk-managed trades.

________________________________________

HEROMOTOCO – Option Chain + Price Action Intraday Setup________________________________________

📊 HEROMOTOCO – Option Chain + Price Action Intraday Setup

🕒 Chart Type: 15-Min Timeframe

📅 Date: July 15, 2025

🎯 For Educational Purpose Only

________________________________________

🔍 Chart Observations:

• Clean rally supported by increasing volume.

• Price nearing the Top Range / Resistance at ₹4465.

• A visible Demand Zone formed between ₹4328.80–₹4310.70 with a strong bounce.

• Volume spike confirms strong buying interest near demand levels.

________________________________________

🔢 Option Chain Insights:

🔼 Call Side Activity:

• 4500 CE: Massive Long Build Up — OI +111.76%, premium ₹52.3 → Suggests strength.

• 4450 CE: Also saw strong Long Build Up with rising premium.

• 4400 CE: Witnessed aggressive Short Covering, adding fuel to bullish momentum.

📈 Interpretation: Option writers are unwinding shorts on 4400, and 4500 is seeing heavy buildup — bullish sentiment.

🔽 Put Side Activity:

• 4400 PE: Sharp Short Build Up, IV at 34.5 → Puts being sold aggressively = Bullish bias.

• 4300 PE: Also saw strong Short Build Up, with OI rising despite falling premiums.

📉 Interpretation: Put writers are confident on downside support holding.

________________________________________

✅ Trade Plan Breakdown:

🔼 1. Best Buy – "Buy on Dip to Demand"

• Entry: ₹4328 – ₹4310 (Demand Zone)

• SL: ₹4306

• Risk Reward: 1:1 | 1:2 +

• Logic: Re-entry near demand zone + strong put writing + bullish volume = trend continuation

________________________________________

🔽 2. Best Sell – "Fade the Supply"

• Entry: ₹4460 – ₹4465 (Supply Zone)

• SL: ₹4475

• Risk Reward: 1:1 | 1:2 +

• Logic: Price near resistance with possible exhaustion. CE premiums elevated → good short-risk area

________________________________________

🟢 3. Best CE – "Momentum Play Above ₹4465"

• Strike: 4500 CE

• Trigger: If price breaks above ₹4465 with volume

• Logic: LTP ₹52.3 with Long Build Up, high delta (0.47) → Ready for breakout rally

________________________________________

🔴 4. Best PE – "Rejection Trade Below ₹4430"

• Strike: 4400 PE

• Trigger: If spot breaks below ₹4430

• Logic: LTP ₹95.75, Short Build Up suggests hedge-unwinding or trap possibility on failure

________________________________________

📦 5. Applicable Demand and Supply Zones

• Demand Zone: ₹4328.80 – ₹4310.70 (SL: ₹4306.30)

• Supply Zone: ₹4460 – ₹4465

• Mid-level Zones:

o Watch for support at ₹4373.15

o Breakdown area at ₹4281.60

• Bottom Range Support: ₹4190.00

________________________________________

💬 STWP Summary View:

The sentiment is strongly bullish, backed by long buildup in calls and short buildup in puts. If price breaks above ₹4465, momentum CE trades can fly. But supply pressure could give quick fade setups for scalpers too.

________________________________________

⚠️ Disclaimer (Read Before Trading):

• This setup is shared for educational purposes only.

• No investment advice or trade recommendation is being made.

• Always use proper risk management.

• STWP is not a SEBI-registered advisor.

• Markets involve risk. Trade with a plan, not with emotions.

________________________________________

💬 Found this helpful?

Drop your thoughts or questions below ⬇️

🔁 Share with your trading circle to help them navigate zone-based trades.

✅ Follow @simpletradewithpatience for smart charts, clean setups & demand-supply backed analysis.

📊 Let the price guide you — trade with patience, charts, and clarity!

________________________________________

HERO MOTOCORP LTD – TECHNICAL ANALYSIS________________________________________

📈 HERO MOTOCORP LTD – TECHNICAL ANALYSIS

📆 Date: July 15, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Supply Zone / Resistance): ₹4,486.70

• 🟢 Bottom Range (Demand Zone / Support): ₹4,158.10

Price has recently broken out from a symmetrical triangle pattern, heading toward the marked supply zone. The demand zone at ₹4,158 has been tested multiple times and held firm, acting as the base for this breakout.

________________________________________

🔹 Chart Pattern: ✅

The stock formed a tight triangle consolidation, compressing between a rising support and horizontal resistance. Today’s breakout candle, backed by volume, confirms a bullish resolution of the pattern.

________________________________________

🔹 Reversal Candlestick Patterns

A large bullish engulfing candle has cleared recent highs with strength. Closing near the high, it signals conviction and opens the path for a continued up-move.

________________________________________

🔹 Technical Indicators

• RSI: Crossed above 60 — strength building

• MACD: Positive crossover confirming trend reversal

• VWAP: Price comfortably trading above — supports trend

• Bollinger Bands: Post-squeeze breakout with wide expansion

• Volume: Breakout supported by 20-day volume high — adds strong confirmation

________________________________________

📌 What’s Catching Our Eye:

The volume spike is significant — over 1.76M with breakout from both triangle resistance and VWAP. Add to that a BB Squeeze release, and the setup gets stronger technically.

________________________________________

👀 What We’re Watching For:

If price sustains above ₹4,454, it may move into the next resistance cluster: ₹4,525.97 → ₹4,599.93 → ₹4,730.87. On dips, ₹4,188 and ₹4,158 become important demand zones to monitor for re-entries.

________________________________________

⚠️ Risks to Watch:

A failed follow-up tomorrow or close below ₹4,405 could invalidate the momentum. Also, overbought conditions without volume expansion may lead to a false breakout near ₹4,486.

________________________________________

🔮 What to Expect Next:

If bullish momentum sustains, the stock may first target ₹4,599 and then ₹4,695. Resistance is expected near ₹4,525–₹4,599 range. A clean breakout above ₹4,486 could invite strong follow-up buying.

________________________________________

📊 Trade Plan (Based on Reason and Charts)

🔼 Bullish Trade Setup:

Entry Zone: ₹4,454 – ₹4,465

Stop-loss: ₹4,405.63

Risk–Reward: ~1:1 to 1:2

Reason: Triangle breakout + BB Squeeze + RSI/MACD confirmation + VWAP support

🔽 Bearish Trade Setup:

Only if the price rejects ₹4,486.7 and breaks below ₹4,405:

Entry: Below ₹4,405

SL: ₹4,465

Risk–Reward: ~1:1 to 1:2

Reason: Failed breakout + supply pressure at top range

________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Found this helpful?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community – let them benefit from clean charts, structured setups, and zone-based learning.

✅ Follow @simpletradewithpatience for chart-backed technical analysis that respects price action, demand & supply.

🚀 Trade with patience, trust your charts, and stay clear-headed!

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

________________________________________

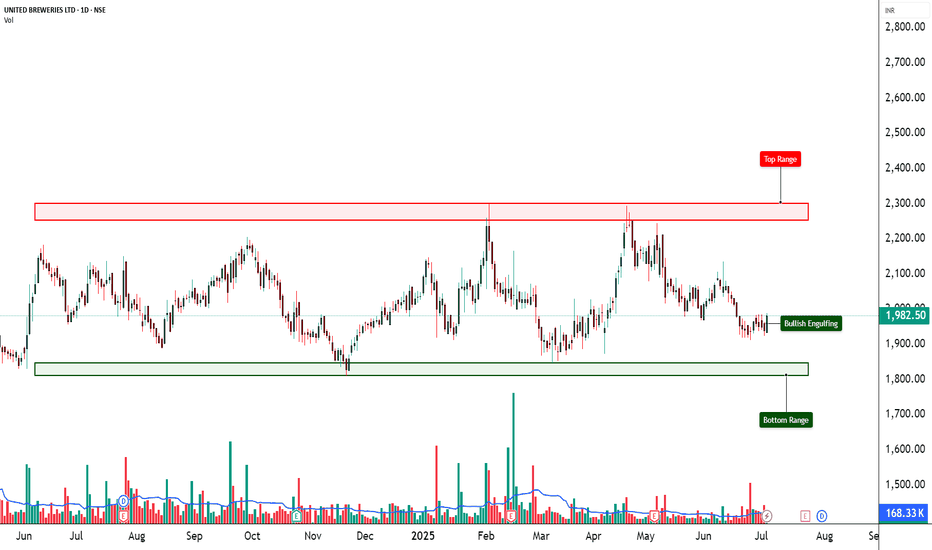

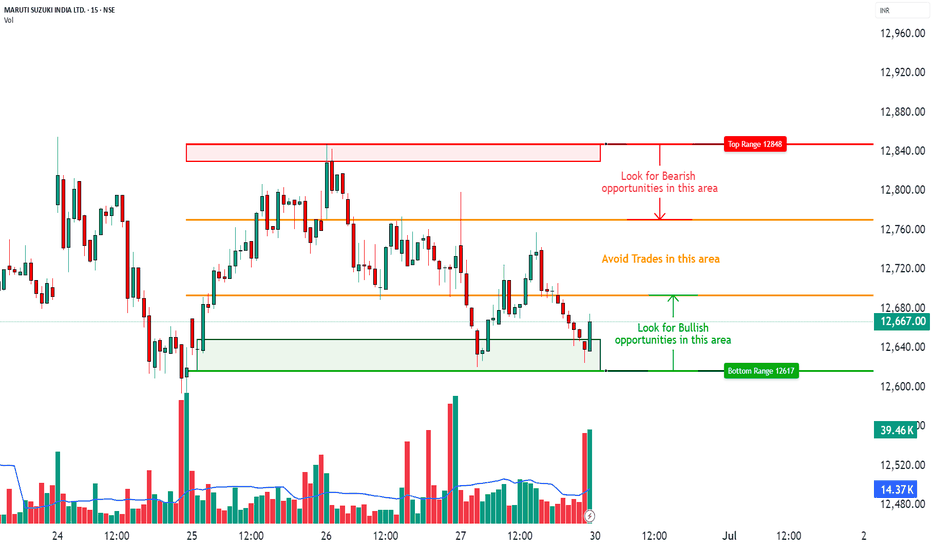

Maruti - Strong Option Chain Signals for Potential Trade Setups________________________________________________________________________________

MARUTI

Bias: Bullish Bias

Strong Long Build-Up across Call strikes (12700–13500)

Simultaneous Short Build-Up on Puts — classic bullish confirmation

________________________________________________________________________________

Best CE:

Strike: 12800

LTP: ₹138.3

OI: 5,14,100 (+78,350 | +17.98%)

Volume: 17,570

Build-Up: Long Build-Up

Interpretation: High OI addition + price rise = active bullish bets at 12800

________________________________________________________________________________

Best PE:

Strike: 12600

LTP: ₹159

OI: 1,05,700 (+76,600 | +263.23%)

Volume: 10,114

Build-Up: Short Build-Up

Interpretation: Strong put writing at 12600 suggests immediate support here

________________________________________________________________________________

Best Strategy:

Bull Call Spread or Naked Call Buy

(Buy 12800 CE, Sell 13200 or 13500 CE for risk-defined play)

- Directional bullish play

- Room to run till 13200–13500 zone based on fresh CE buildup

- Ideal if Spot sustains above 12600

________________________________________________________________________________

Why:

- Long Build-Up seen from 12700 CE to 13500 CE

- Spot = ₹12650, and 12600 PE has heavy Put writing → firm base

- Call Short Covering seen at 12500, 12600 → unwinding resistance

- IVs are rising on PEs, falling on CEs → supports bullish sentiment

- 12800 CE has highest Long Build-Up + Volume → key upside breakout strike

- Above 12800, next resistance zones visible around 13200–13500 based on CE action

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community.

✅ Follow simpletradewithpatience for price-action backed technical setups.

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

MANKIND PHARMA – Descending Triangle Breakout________________________________________________________________________________📈 MANKIND PHARMA – Falling Trendline Breakout | Strong Reversal Candle | Volume Spike

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

________________________________________________________________________________

📌 Price Action:

MANKIND PHARMA has executed a decisive breakout above a falling trendline on the daily chart, breaking out of a multi-week descending structure. The price action had been consolidating within a triangular pattern, and on July 9, it registered a powerful wide-range bullish candle, closing at 2526.60 — well above the recent consolidation highs. This move came from a structured base with two strong pivot lows and now places the stock back into a strong bullish trajectory. The breakout is not random; it’s backed by structure, momentum, and confirmation — suggesting potential for a trend continuation if sustained.

________________________________________________________________________________

📊 Chart Pattern:

The chart shows a descending triangle breakout with compression near the apex. This setup builds pressure and usually resolves in the direction of volume. The move out of this pattern has occurred with authority, marked by a clean range expansion and bullish follow-through above resistance. This is a momentum-confirming breakout, which opens up room toward testing higher resistance zones.

________________________________________________________________________________

🕯️ Candlestick Pattern:

Strong Bullish Candle

Open = Low (Intraday strength)

Buy Today, Sell Tomorrow-type price action

Aligned with Volume Spike and Trendline Breakout

________________________________________________________________________________

🔊 Volume Analysis:

The breakout is accompanied by more than 2x the 20-day average volume, signaling real participation — not just speculative noise. Delivery volumes are notably strong, and volume came after a phase of tight consolidation, which indicates a possible transition from quiet accumulation to active participation by stronger hands.

________________________________________________________________________________

📈 Technical Indicators:

RSI (Daily): 66 – strong, trending up

MACD: Bullish crossover, both on Daily and Weekly

CCI: 220 – highly bullish momentum territory

Stochastic: 94 – overbought but confirming momentum

SuperTrend & VWAP: Clearly bullish

Bollinger Band: Price is expanding beyond upper band — volatility expansion in motion

________________________________________________________________________________

🧱 Support & Resistance:

🔻 Supports:

2448.27 – Immediate support (previous breakout zone)

2369.93 – Structure base support

2322.27 – Last defense before breakout invalidation

Bottom Range / Demand Zone: 2115.1 – Long-term accumulation zone

🔺 Resistance Zones:

2574.27 – First supply zone; watch for price reaction

2621.93 – Medium-term resistance; previously rejected here

2700.27 – Higher timeframe swing resistance

Top Range: 2998.4 – Long-term resistance; breakout confirmation if crossed

________________________________________________________________________________

👀 What’s Catching Our Eye:

What stands out is the confluence breakout — trendline, structure, volume, and indicators are all pointing in the same direction. The BB squeeze, RSI breakout, and strong candle together make this a multi-signal setup — rarely do we get such alignment across tools.

________________________________________________________________________________

🔍 What We’re Watching For:

Will the price hold above 2448–2526 for the next couple of sessions? If yes, this breakout can see momentum continuation toward 2574+. Any low-volume pullback toward the trendline or support zone could be a low-risk re-entry. If it fails to hold above the breakout candle, momentum could fade.

________________________________________________________________________________

✅ Best Buy Level for Equity (Low Risk Idea):

Entry: Above 2543.60 (post-breakout confirmation or clean retest of 2448–2455 zone)

Stop Loss: 2404.95 (on a closing basis)

Risk Reward Strategy: 1:1 initially, trail for 1:2+ if volume expands

Avoid chasing: Let the price validate with sustained volume above breakout

________________________________________________________________________________

💼 Sector Tailwinds:

The pharmaceutical sector is seeing renewed investor interest post-COVID, with growing focus on specialty products, chronic therapy lines, and export-led growth. MANKIND is among the strongest consumer-pharma brands with consistent results and brand recall — adding fundamental strength to this technical breakout.

________________________________________________________________________________

⚠️ Risk to Watch:

A close below 2448 could invalidate this setup

The overbought Stochastic means minor pullbacks or shakeouts are possible

Don’t chase — always confirm the breakout with a retest or follow-through candle

Over-positioning during volatility can lead to poor R:R trades

________________________________________________________________________________

🔮 What to Expect Next:

If this breakout holds, we may see follow-through toward 2574.27 in the short term. Strong volume above 2540+ can unlock upside toward 2621+. However, if the price closes below 2448, we may be dealing with a failed breakout — a scenario to strictly avoid. Watch next 2–3 sessions for clarity.

________________________________________________________________________________

🧠 How to Trade MANKIND PHARMA (For Educational Use Only):

🔹 Breakout Trade Plan

Entry: Above 2543.60

Stop Loss: 2404.95 (Closing basis)

Pullback Entry: Into 2448 zone with bounce candle

Risk-Reward: Start with 1:1, then trail to 1:2+

Position Sizing: Risk-calibrated, never go all-in

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

What’s your ideal approach to this setup — breakout entry or pullback into zone?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

EMAMI LTD – Strong Bullish Breakout | Volume Spike________________________________________________________________________________

📈 EMAMI LTD – Strong Bullish Breakout | Volume Spike | Structure-Based Trade Idea

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

________________________________________________________________________________

📌 Price Action:

EMAMI LTD has delivered a decisive breakout from its recent compression phase after trading sideways between 570–585 for several sessions. On July 9, the stock posted a wide-range bullish candle, closing at 609.15, backed by high delivery and breakout volume. The candle formed with an open = low structure, a strong intraday move, and solid closing near the high, confirming buyer dominance. This marks a shift in control from range-bound consolidation to potential momentum continuation.

________________________________________________________________________________

📊 Chart Pattern:

This breakout is from a Box Compression Zone, where the stock had been moving within a tight band. This is a textbook bullish compression breakout, often seen before short-term trend expansions. The range contraction, followed by a sudden expansion with volume, signals that smart money may be entering. Though not a VCP, the narrowing of ranges followed by a strong candle reflects controlled buildup and release of bullish pressure.

________________________________________________________________________________

🕯️ Candlestick Pattern:

Bullish Engulfing

Open = Low Candle

Momentum Continuation Candle

The current candle also fits the "Buy Today, Sell Tomorrow" setup logic, especially useful for short-term intraday/momentum traders from an educational lens.

________________________________________________________________________________

🔊 Volume Analysis:

Volume on July 9 crossed 3x the 20-day average, showing an institutional-grade breakout. What's more important is that this move comes after multiple low-volume sessions, which indicates that the base was silent before this burst — classic sign of accumulation followed by breakout. The presence of a BB squeeze and volume compression breakout confirms the start of a volatility expansion phase.

________________________________________________________________________________

📈 Technical Indicators:

RSI (Daily): 65 – strong and rising

MACD: Bullish crossover on Daily, but flat on Weekly/Monthly

CCI: 319 – strong bullish momentum reading

Stochastic: 85 – in a bullish zone, showing follow-through possibility

SuperTrend & VWAP: Bullish bias confirmed

BB Squeeze: Compression off, likely start of expansion

These indicators align well to show a breakout backed by momentum and volume expansion.

________________________________________________________________________________

🧱 Support & Resistance:

🔺 Resistance Zones to Watch:

629.23 – First key level where supply may come in

649.32 – Major resistance from previous swing

678.63 – Long-term resistance zone

Top Range: 653.35 – Official top of the recent consolidation base

🔻 Support Levels:

579.83 – Immediate support post-breakout

550.52 – Minor swing base

530.43 – Deeper demand level from which recent trend started

Bottom Range (Demand Zone): 507.70 – Long-term structural support

________________________________________________________________________________

👀 What’s Catching Our Eye:

What stands out in this chart is the confluence of breakout signals — RSI breakout, engulfing candle, Bollinger squeeze off, and high delivery volume — all firing together. The open-low bullish bar is not just random price movement; it's a statement from buyers that they're ready to defend this zone.

________________________________________________________________________________

🔍 What We’re Watching For:

We’re watching if EMAMI can sustain above 609–620 for the next couple of sessions. A consolidation above this zone will indicate strength. On the flip side, any rejection and close back below 579.83 will raise flags. We're also watching for any mild retest toward 580–585 on low volume, which can offer a secondary low-risk entry opportunity.

________________________________________________________________________________

✅ Best Buy Level for Equity (Low Risk Idea):

Breakout Entry: Above 620 with follow-through or retest confirmation

Pullback Buy: Into the 579.83–585 support zone with a strong bounce candle

Stop Loss: 560.33 (structure-based, on closing basis)

Risk-Reward Lens: Start with a 1:1 target; trail for 1:2+ based on structure — avoid fixed upside projections

________________________________________________________________________________

💼 Sector Tailwinds:

The FMCG and personal care space is seeing renewed demand due to rising rural consumption, price stability in raw materials, and stronger brand-led companies gaining market share. EMAMI, with a wide product portfolio, is well-positioned to benefit. Fundamentally, the stock is also recovering from long-term price compression — aligning well with the recent breakout.

________________________________________________________________________________

⚠️ Risk to Watch:

A close below 579 will invalidate the breakout setup

Indicators are strong but slightly stretched, so chasing blindly can invite volatility

The price must confirm above 620+ for the trend to gain broader legs

Always wait for follow-through before committing fresh capital

________________________________________________________________________________

🔮 What to Expect Next:

If EMAMI sustains above 609–620, the stock could gradually move toward 629.23 and test higher levels like 649.32. But if it fails to hold above the breakout candle, we may see a pullback to 580–585. Either way, price and volume in the next 2–3 sessions will confirm whether this is a false breakout or the start of a real trend.

________________________________________________________________________________

🧠 How to Trade EMAMI LTD (For Educational Use Only):

Breakout Plan (Hypothetical Setup):

🔹 Entry: Above 620 only if follow-through confirmation candle appears

🔹 Stop Loss: 560.33 (on closing basis)

🔹 Pullback Buy: Into 580–585 with same SL, if bullish reversal shows

🔹 Risk-Reward: 1:1 minimum; trail for more

🔹 Position Sizing: Use capital allocation based on risk tolerance — never go all-in on breakout

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

What would be your ideal trade in EMAMI — breakout follow-through or support pullback?

Drop your thoughts in the comments below ⬇️

🔁 Share this with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

PG ELECTROPLAST – Volume Breakout from Tight Base________________________________________________________________________________

📈 PG ELECTROPLAST – Volume Breakout from Tight Base | Bullish Momentum Brewing

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

________________________________________________________________________________

📌 Price Action:

PG ELECTROPLAST LTD has shown an impressive breakout from a tight base, rising from the 735–755 congestion zone with a wide-range bullish candle on July 9. The candle had an open = low structure, closed near the high, and was backed by massive volume. This signals clear buying strength and suggests that bulls are stepping in after a period of low volatility and sideways movement. The stock had been trading in a narrow band and has now broken out with strong conviction, hinting at the beginning of a possible trend reversal or a short-term momentum rally.

________________________________________________________________________________

📊 Chart Pattern:

The chart displays a tight base breakout from a multi-week compression zone. While not a textbook wedge or flag, the narrowing range combined with flat moving averages suggested the stock was coiling up for a move. The breakout candle pierced the upper end of the range, with volume confirming that it wasn't a false push. This kind of price behaviour often leads to trend expansion — especially when confirmed by broader volume activity.

________________________________________________________________________________

🕯️ Candlestick Pattern:

Bullish Engulfing Candle

Open = Low Structure

Strong Bullish Range Candle

This combination, particularly when seen after a base, is a strong signal of fresh buying interest. It also fits the “Buy Today, Sell Tomorrow” short-term momentum logic, especially for educational model trades.

________________________________________________________________________________

🔊 Volume Analysis:

The breakout was supported by a 10-day volume breakout, with volumes spiking over 3x the average. This is not just intraday noise — it reflects strong delivery participation and genuine interest. Volume spike at breakout is a key sign of smart money involvement. Moreover, the spike occurred from a compressed base, which adds further weight to the strength of the breakout.

________________________________________________________________________________

📈 Technical Indicators:

RSI (Daily): 56 — rising from neutral territory, not yet overbought

MACD: Bullish crossover active on Daily & Monthly

Stochastic: 90 on Daily – indicates strong upward momentum

CCI: 155 – overbought but in a bullish continuation zone

Bollinger Bands: Price broke out of a tight squeeze zone — start of volatility expansion phase

BB Squeeze + Bullish VWAP: Adds confirmation that the trend is beginning to expand

________________________________________________________________________________

🧱 Support & Resistance:

🔺 Resistance Levels:

810.43 – First resistance to watch above current price

832.12 – Prior swing level; price may pause or consolidate here if momentum continues

867.33 – Longer-term resistance zone, marked as a level of interest

Top Range: 1054.2 – Long-term weak resistance zone that triggered the previous major selloff

🔻 Support Levels:

753.53 – Closest support below breakout

718.32 – Well-tested swing level; acted as floor in recent range

696.63 – Important structural support

Bottom Range (Demand Zone): 597.05 – Major long-term support, last zone from where price rallied strongly

________________________________________________________________________________

👀 What’s Catching Our Eye:

The combination of price compression, bullish engulfing breakout, and high volume participation makes this setup stand out. Volume is not just high — it’s clean and backed by structure. The candle formation, RSI breakout, and BB squeeze all come together, creating a powerful setup for momentum continuation. This kind of alignment is rare and usually signals smart money entry.

________________________________________________________________________________

🔍 What We’re Watching For:

The most critical zone is the 796.90 breakout level. If price sustains above it for the next couple of sessions, the structure remains intact. We’re also watching for a possible retest toward the 753–755 zone — if the stock pulls back there on low volume and bounces again, it may offer a low-risk entry setup. Continuation beyond 810 could build momentum, but we will rely on risk-reward and price behaviour — not predictions.

________________________________________________________________________________

✅ Best Buy Level for Equity (Low Risk Idea):

Breakout Entry: Above 796.90, only on follow-through or sustained closing above breakout zone

Pullback Entry: Into the 753.53–755 support zone if the price stabilizes and shows a bullish reversal

Stop Loss: Structure-based, below 736.95 (on closing basis)

Risk-Reward Thinking: Look for 1:1 initially, then trail the stop as the move develops; no fixed projections — price action will guide the outcome

________________________________________________________________________________

💼 Sector Tailwinds:

PG ELECTROPLAST operates in the electronics and contract manufacturing sector — two spaces getting a major boost from PLI schemes, China+1 shift, and rising domestic demand. India’s push toward import substitution, rising middle-class consumption, and government incentives are all helping businesses like PG scale up. This provides a strong macro tailwind to any technical strength seen on charts.

________________________________________________________________________________

⚠️ Risk to Watch:

If price slips back below 753, the breakout weakens

A close below 736.95 negates the breakout setup and could invite selling pressure

Indicators are showing strength, but slightly stretched — so expect volatility and avoid over positioning

Never trade based only on breakout excitement — always wait for confirmation and manage risk first

________________________________________________________________________________

🔮 What to Expect Next:

If the price holds above 796.90, the path toward 810.43 may open up quickly. Sustained volume and consolidation near highs would indicate strength, while sharp rejection could signal a trap. A minor pullback to support zones (753–755) could offer a second opportunity if structure holds. The next few candles will tell us whether this breakout becomes a trend or just a temporary spike.

________________________________________________________________________________

🧠 How to Trade PG ELECTROPLAST (For Educational Use Only):

Breakout Plan (Hypothetical):

🔹 Entry: Above 796.90 (only if price sustains)

🔹 Stop Loss: 736.95 (closing basis; risk-controlled)

🔹 Trade Logic: Use position sizing as per capital and SL distance

🔹 Risk-Reward: Look for 1:1 minimum, trail for 1:2+ if structure expands — don’t fix targets, let the chart lead

🔹 Pullback Buy: Into 753–755 zone with same SL (if structure supports)

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

Where would you look for a trade in PG — breakout follow-through or pullback into the support zone?

Share your thoughts or questions in the comments ⬇️

🔁 Share this with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

METROPOLIS – Big Volume Breakout + Price Action + Momentum___________________________________________________________________________

📈 METROPOLIS – Big Volume Breakout | Strong Momentum Building |

Price Action | Volume Structure

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

___________________________________________________________________________

Price Action: METROPOLIS HEALTHCARE LTD has delivered a strong breakout on the daily chart, moving out of a multi-week consolidation zone between 1880–1910 with a wide-range bullish candle on July 9. This breakout above the key resistance of 2110.9 comes with a clean structure, strong closing, and sharp momentum — now placing the stock near its 52-week high. The accumulation phase is likely over, and this price action suggests the beginning of a new trend. As a key player in the diagnostics sector, METROPOLIS is gaining renewed attention post-COVID, with the healthcare space showing strong tailwinds and fresh investor interest.

___________________________________________________________________________

Chart Pattern: The chart is showing a Flat Base Breakout following a multi-week consolidation, indicating the potential beginning of a new momentum leg within the broader structure. Notably, the base was tight and shallow, which is considered a strong bullish signal as it reflects controlled accumulation and limited profit-booking. This clean breakout hints at renewed strength and the possibility of sustained upside if volume and structure hold.

___________________________________________________________________________

Candlestick Pattern: NA

___________________________________________________________________________

Volume Analysis: The volume analysis strongly supports the breakout, with trading volume on the breakout day soaring to over 5 times the average of the past 20 sessions. This surge was not just in quantity but also in delivery volume, signaling that the move was backed by genuine long-term accumulation rather than intraday speculation. As the classic saying goes, “volume precedes price” — and this sharp spike clearly points to smart money entering the stock, lending credibility to the breakout and hinting at further upside potential.

___________________________________________________________________________

Technical Indicators: The technical indicators paint a strongly bullish picture. The RSI on the daily timeframe is at 84, which, while overbought, reflects strength and momentum rather than exhaustion. The MACD has triggered a bullish crossover, with a steadily rising histogram indicating a healthy momentum buildup. Both CCI and Stochastic oscillators are deep in bullish territory — CCI above 300 and Stochastic over 88 — highlighting the intensity of the current uptrend. Additionally, the price has expanded beyond the upper Bollinger Band, suggesting the start of a volatility expansion phase, which often accompanies strong directional moves.

___________________________________________________________________________

Support & Resistance: The stock has given a decisive breakout above ₹2110.9, which now acts as a strong reference point and the official top of its recent consolidation range. This level was pierced by a bullish candle backed by high volume, confirming strength and conviction in the move. Ahead, the stock faces its first hurdle at ₹2157, a short-term resistance just above the breakout zone where minor profit-booking may emerge. Beyond that, ₹2256.1 marks a key medium-term resistance aligned with a previous swing high — a level to watch closely if the rally continues on solid volume. For positional traders, ₹2401.3 stands as a distant resistance zone that, while weak, could be relevant if momentum accelerates. On the downside, ₹1912.7 offers immediate support, being the level that held firm during base formation. If deeper retracements occur, ₹1767.5 and ₹1668.4 are layered supports where the price previously showed strength. At the very base lies ₹1315, the major long-term demand zone — a structural support that triggered the prior trend and serves as the final defence in case of any broad weakness.

___________________________________________________________________________

What’s Catching Our Eye: The price has decisively broken above a multi-week resistance zone, and what makes this move stand out is the massive volume backing it. This isn't just a random spike — it's a structured breakout with all the internals lining up beautifully. Momentum indicators like RSI, MACD, CCI, and Stochastic are all in bullish alignment, confirming that the strength is real and not a one-off event. This kind of confluence often signals the start of a meaningful trend, not just a short-lived rally.

___________________________________________________________________________

What We’re Watching For: The key question now is whether the price can sustain above ₹2110.9, the breakout level, without slipping back into the previous range — a crucial sign of breakout validation. We're also keeping an eye out for a healthy pullback toward the ₹1880–₹1910 zone, which could offer a far better risk-reward entry if the uptrend remains intact. Most importantly, the bigger picture is in focus: Is this the beginning of a larger trend aiming for ₹2400+, or are we simply witnessing a short-term momentum burst? The next few sessions will be critical in answering that.

___________________________________________________________________________

Best Buy Level for Equity (Low Risk Idea): A low-risk buying opportunity opens above ₹2110.9, but only if the price sustains this breakout for a day or two — confirming strength and avoiding a false breakout scenario. Alternatively, a pullback to the ₹1880–₹1910 zone could offer an excellent risk-reward setup, especially if accompanied by a clear bullish reversal signal (like a strong candle or volume spike). In both cases, keep a strict stop loss at ₹1839 on a closing basis to protect against deeper downside.

___________________________________________________________________________

Sector Tailwinds: The diagnostic sector continues to build long-term strength in the post-COVID landscape, as healthcare awareness and preventive testing become mainstream. Investors are increasingly allocating capital toward healthcare services, recognizing their structural growth potential. Add to that the rising urban demand for quality diagnostics and the company's strong brand trust, and you get a solid layer of fundamental support fueling this rally — making the technical breakout even more meaningful.

___________________________________________________________________________

Risk to Watch: If the price fails to hold above ₹2110 and starts slipping below ₹1910, there’s a real risk of this breakout turning into a false move. While the current momentum is strong, indicators are overheated, which increases the chances of a short-term pullback or shakeout. Most importantly — no confirmation means no trade. Avoid chasing blindly; let the price action validate the move before committing capital.

___________________________________________________________________________

What to Expect Next: The stock may see a sideways move or a minor pullback toward the ₹1910 zone as it digests the breakout. However, if the price holds above the breakout level, we could see a continuation move toward ₹2157–₹2256 in the near term. The key to watch is volume — if the stock holds near highs with rising volume over the next 2–3 sessions, it could trigger a strong trending move, confirming that smart money is firmly in control.

___________________________________________________________________________

How to Trade METROPOLIS (For Educational Use Only):

Here’s a simple Breakout Trade Plan based on current structure and volume confirmation:

🔹 Entry: Above ₹2110.9 — either on a successful retest of the breakout level or a clean follow-through candle with strength

🔹 Stop Loss: ₹1839 (on closing basis) to protect capital in case of breakdown

🔹 Risk-Reward: Aim for 1:1 initially, then trail for 1:2+ if momentum holds

🔹 Position Sizing: Adjust based on your capital, risk appetite, and SL range — avoid going all-in; stay disciplined with allocation

📌 Always follow your trading plan. This setup is for educational and analysis purposes only.

___________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

___________________________________________________________________________

💬 Found this helpful?

What would be your ideal entry in this METROPOLIS setup — breakout follow-through or demand zone pullback?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

___________________________________________________________________________

NAUKRI - Demand Zone + Key Levels________________________________________________________________________________

📊 INFO EDGE (NSE: NAUKRI) – Beginner Chart Study | Demand Zone + Key Levels

🕒 Chart Timeframe: 15-Min | 📆 Updated: July 8, 2025

________________________________________________________________________________

🔍 What the Chart Shows:

NAUKRI recently bounced from a clearly defined demand zone and is now trading near a key mid-level. This educational post is meant to help understand how price behaves around such zones.

________________________________________________________________________________

✅ Zones to Observe for Strength (Upside):

• Above 1489.00: Price sustaining above this top range may indicate strength.

• Between 1432.35 and 1404.10: This broader zone has acted as support earlier. If revisited, watch how price behaves here.

________________________________________________________________________________

⚠️ Neutral / Observation Area:

• Around 1459.40 (near 1460.65): Price is consolidating near this level. It’s better to observe and wait for more clarity from price movement and volume.

________________________________________________________________________________

🔻 Zones to Observe for Weakness (Downside):

• Between 1460.65 – 1489.00: If price reacts negatively here (e.g., rejection candles or high supply volume), observe how it develops.

• Below 1402.85: This would invalidate the previous demand zone. Further weakness could be possible if price closes below.

________________________________________________________________________________

🧠 Learning Takeaways for Traders:

• Avoid trades in the middle zone without clear confirmation.

• Always wait for bullish or bearish patterns and supporting volume before considering action.

• Structure and levels help guide observation – not prediction.

________________________________________________________________________________

📌 Levels Recap:

• Top Range (Resistance): 1489.00

• Mid Resistance: 1460.65

• Mid Support: 1432.35

• Bottom Range: 1404.10

• Demand Zone Reference: 1414.20 – 1404.90 | SL Reference Level: 1402.85 (used for structure observation only)

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Join the Discussion (Comments):

✅ Was this chart structure easy to understand?

✅ How do you look at such supply and demand zones in your charting?

✅ Want more beginner-focused educational charts? Drop a 💬 below.