ETERNAL 1D Time frame📍 Today’s Expected Range (Intraday Approximation)

Expected High: ₹341–₹343

Expected Low: ₹336–₹335

These are approximate intraday levels. Actual prices may fluctuate slightly due to volatility.

🔍 Key Points

Current price: ₹337–₹338, trading near the middle of the day’s range.

If price breaks above ₹343 with strong volume → bullish momentum likely.

If price falls below ₹335 → short-term correction or pullback possible.

📊 Suggested Trading Strategy

Bullish Scenario

If Eternal breaks ₹341–₹343, you can buy, targeting ₹348–₹350.

Stop-loss: ₹335

Bearish Scenario

If Eternal drops below ₹335, you can sell/short, targeting ₹330–₹325.

Stop-loss: ₹338

Range-Bound / Sideways

If price trades between ₹335–₹343, it’s better to wait and avoid trading until a clear breakout occurs.

💡 Summary

Resistance Zone: ₹341–₹343

Support Zone: ₹335–₹336

Strategy: Trade in the direction of the breakout, and always use stop-loss to manage risk.

LICI

HDFCBANK 1D Time frame📊 Current Snapshot

Current Price: Around ₹967

Day Range: ₹962 – ₹976

52‑Week Range: High ~ ₹1,018, Low ~ ₹805

Volume: Slightly above recent average, showing decent trading interest

🔍 Support & Resistance

Immediate Resistance: ₹975 – ₹983

Higher Resistance: ₹989 – ₹990

Immediate Support: ₹960 – ₹954

Lower Support: ₹946

⚙️ Indicators & Trend

RSI / Stochastic: Neutral to slightly bearish, indicating mild selling pressure

Pivot Level: Around ₹968 – ₹969, meaning price is near equilibrium

Moving Averages: Mixed signals; short-term MAs under slight pressure, long-term trend still intact

🎯 Possible Scenarios

Bullish Case: Break and sustain above ₹980 → next target ₹990+

Bearish Case: Fail at resistance → pullback toward ₹960‑₹954; below ₹954 → possible drop to ₹946

⚠️ Key Points

Resistance zones are tight and need strong volume for a breakout

Price near pivot levels may lead to short-term sideways movement or volatility

Confirmation from trading volume is important for trend sustainability

DLF 1D Time frameCurrent Price: Around 780 – 790.

Current Trend: Stock is in a strong uptrend, consolidating after recent highs.

Support Zone: Strong support at 770 – 775. Buyers are likely to defend this level.

Resistance Zone: Key resistance at 800 – 810. A breakout above this can lead to fresh upside.

Indicators: Daily candles show higher lows forming, indicating strength; volumes are healthy.

Outlook:

Above 810 → bullish momentum may continue toward 830+.

Below 770 → weakness may drag it toward 750.

👉 In short:

Tone: Bullish with consolidation.

Range: 770 – 810.

Shall I also prepare a re

BANKNIFTY 1D Time frame✅ Current Facts

Current Level: ~ 55,400 – 55,480

Trend: Mildly bullish; trading above short-term moving averages (20-day & 50-day EMA).

Momentum Indicators:

RSI (14-day): ~61 → bullish but not overbought.

MACD: Positive → supporting the upward trend.

Price Action: Daily candles show small upper wicks → minor profit-taking near resistance.

⚙️ Outlook

Bullish Scenario:

Holding above 55,350 → retest 55,550–55,600 and possibly 55,700–55,750.

Range / Consolidation:

Price oscillates between 55,350 – 55,550 → sideways trading likely.

Bearish Scenario:

Close below 55,350 → downside risk toward 55,150–55,200 or lower.

⚠️ Key Facts

55,400 – 55,500 is acting as a short-term pivot: above it favors bulls, below it favors bears.

Resistance at 55,550–55,600 is the first hurdle; breakout here can lead to further upside.

Support at 55,300–55,350 is critical; failing to hold may lead to short-term correction.

HCLTECH 1D Time frameCurrent Picture

Share price is ~ ₹1,499-₹1,505.

Recent momentum has been upward; the stock is trading above most moving averages—short-, medium-, and long-term.

Indicators are generally favoring continuation of the uptrend.

⚙️ Indicators / Momentum

Many oscillators (RSI, MACD, CCI etc.) are in bullish territory.

Moving averages from 5-, 10-, 20-, 50-, 100- to 200‐day are all aligned bullish (price above them).

Volatility is moderate to high — good movement, but also risk of pullbacks.

📌 Key Support & Resistance Levels

Immediate Resistance: around ₹1,505-₹1,515.

Immediate Support: near ₹1,480-₹1,490.

Stronger support further down around ₹1,400-₹1,420 in case of sharper correction.

✅ Outlook & Risks

Short term bias is bullish as long as price holds above the immediate support (≈ ₹1,480).

If resistance around ₹1,510 breaks decisively, more upside is likely.

BAJAJ_AUTO 1D Time frameCurrent Snapshot

Price is trading around ₹9,080 – ₹9,100.

Stock is moving above both 50-day and 200-day moving averages, showing a steady uptrend.

It is still below its all-time high, so recovery space remains.

⚙️ Indicators / Momentum

RSI: Neutral, neither overbought nor oversold.

MFI (Money Flow Index): Balanced, showing moderate buying pressure.

Momentum: Stable with a slightly bullish bias.

📌 Key Levels

Immediate Resistance: ₹9,300 – ₹9,400.

Immediate Support: ₹8,800 – ₹9,000.

Stronger Support: Near ₹7,500 on longer-term charts.

✅ Outlook

Trend remains mildly bullish as long as price stays above ₹9,000.

Break above ₹9,400 could push price toward new highs.

Fall below ₹8,800 may lead to deeper correction.

SENSEX 1D Time frameCurrent Status

Sensex Level: 82,623

Change: +594.95 points (+0.73%)

Opening: 81,852

Day’s Range: 81,780 – 82,443

52-Week Range: 71,425 – 85,978

📈 Market Sentiment

Trend: Mildly bullish

Leading Sectors: Auto, Realty, Telecom

Investor Mood: Optimistic, but watching global cues

🔍 Key Levels to Watch

Immediate Support: 81,800 – 81,850

Resistance Zone: 82,400 – 82,500

Psychological Milestone: Breaking above 82,500 may push higher

🧭 Outlook

Sensex is showing positive momentum supported by strong sectors.

Bulls are slightly stronger, but resistance near 82,400–82,500 may cap upside.

A drop below 81,800 could bring downside pressure toward 81,500–81,400.

SBIN 1D Time frameCurrent Stock Price

Current Price: ₹842.25

Day’s Range: ₹831.00 – ₹845.80

52-Week Range: ₹680.00 – ₹875.45

Market Cap: ₹7.68 lakh crore

P/E Ratio: 9.77

EPS (TTM): ₹86.06

Dividend Yield: 1.91%

Book Value: ₹527.66

📈 Trend & Outlook

Short-Term Trend: Bullish; trading above key support levels and showing positive momentum.

Resistance Levels: ₹845.80 (day’s high), ₹875.45 (52-week high)

Support Levels: ₹831.00 (day’s low), ₹818.32 (weekly pivot)

Investor Sentiment: Positive, with institutional interest and favorable outlook.

🧭 Key Notes

Immediate support around ₹831–₹818; if it holds, price may rise toward resistance.

If it drops below ₹818, downside may extend toward ₹800 or lower.

Overall, bulls are slightly stronger, but watch resistance near ₹845–₹875.

“Your welfare is our responsibility”CMP 963

Life Insurance Corporation (LIC) is the largest insurance provider company in India. It has a market share of above 66.2% in new business premium. The company offers participating insurance products and non-participating products like unit-linked insurance products, saving insurance products, term insurance products, health insurance, and annuity & pension products.

This is just to boost my confidence. No Suggestions for buying. I will keep checking and updating my mistake if last post gone wrong...

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial Adviser before making any decisions.

LIC of India cmp 954.45 by Weekly Chart view since listedLIC of India cmp 954.45 by Weekly Chart view since listed

- Support Zone 865 to 900 Price Band

- Resistance Zone 1010 to 1055 Price Band

- Bullish Rounding Bottom under Resistance Zone

- Heavy Volume surge by demand based buying last week

- Rising Support Trendline respected and Falling Resistance Trendline Breakout, both seem well sustained

LICI: Breakout Above 800 Targeting 1200Details:

Asset: Life Insurance Corporation of India (LICI)

Breakout Level: ₹800

Potential Targets: ₹1000 (intermediate), ₹1200 (major)

Stop Loss: ₹750

Timeframe: Medium to Long Term

Rationale:

LICI has broken out of a long-term descending channel and is now sustaining above ₹800, signaling a shift in momentum. The stock is now eyeing a move towards ₹1000 with strong potential for ₹1200.

Market Analysis:

Technical Setup: Channel breakout with consistent higher lows forming.

Fundamental Backdrop: Improving investor sentiment around insurance and PSU stocks.

Volume: Above average, confirming breakout strength.

Risk Management:

Stop Loss: ₹750 to manage downside risk.

Capital Allocation: Moderate exposure recommended due to long-term setup.

Risk-Reward Ratio:

Attractive with ~50% upside potential from breakout level.

Conclusion: LICI sustaining above ₹800 is a strong technical signal. As long as it holds this level, it can target ₹1000 and possibly ₹1200 in the coming months.

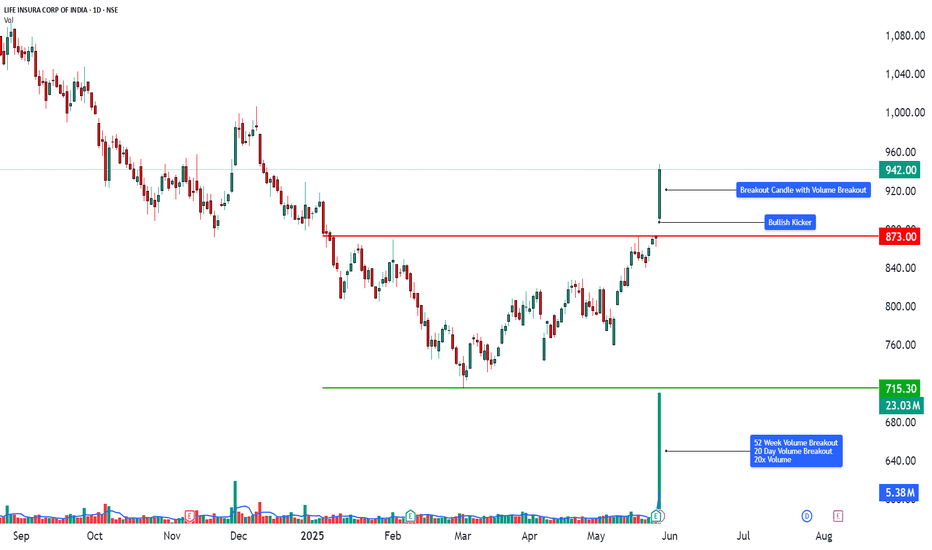

Technical Analysis | Powerful Price Action with Volume Breakout📈 LIFE INSURANCE CORPORATION OF INDIA (LICI) – TECHNICAL ANALYSIS

📆 Date: May 28, 2025

🔍 Timeframe: Daily

________________________________________

Price Action:

LICI surged over 8.12% in today’s session, registering a breakout after weeks of sideways consolidation. The breakout candle was wide-bodied, closing near the day’s high, and supported by a 20-day volume breakout – signaling fresh bullish momentum and accumulation at lower levels.

________________________________________

Chart Pattern / Candlestick Pattern:

• Sideways Consolidation Breakout

• Strong Bullish Candle (Buy Today, Sell Tomorrow setup)

• 52-Week Volume Breakout

• RSI Breakout

• BB Squeeze Exit – Volatility Expansion Phase

• Bollinger Band Expansion + Momentum Surge

• Multiple bullish candlestick patterns across all timeframes = multi-frame trend alignment.

• Gap-Up + Kicker + Long White Candle combo increases conviction of momentum breakout.

• Heikin Ashi continuity indicates a trend in motion without signs of reversal.

________________________________________

Technical Indicators:

• RSI (Daily): 79 – Bullish territory

• MACD: Bullish crossover active

• Stochastic: 97 – Overbought but confirms momentum

• CCI: 206 – Strong upside acceleration

• Volume: 23.03M – Very high vs. 2.24M average, confirms breakout

________________________________________

Support & Resistance Levels:

• Immediate Resistance: ₹964

• Next Resistance: ₹986

• Major Resistance: ₹1024

• Immediate Support: ₹904

• Secondary Support: ₹866

• Major Support: ₹844

• Weak Support Zone: ₹760–₹720

________________________________________

Chart Overview:

This visual representation highlights:

🔸 Clear resistance break with powerful volume

🔸 Bullish momentum confirmed by multiple indicators

🔸 20-day volume breakout indicating accumulation

🔸 Layered resistance levels between ₹964–₹1024

🔸 Tight squeeze breakout offering high R:R setups

________________________________________

Educational Breakdown:

This trade setup showcases:

• Breakout Confirmation: Price + Volume + Momentum Alignment

• Band Expansion: Beginning of volatility trend

• Momentum Shift: From sideways to bullish trend

• Volume Behavior: Institutional interest clearly visible

• Support Layering: Gives fallback levels for pullback traders

Such a chart is a perfect case study in breakout trading, especially post-consolidation and on high volume days.

________________________________________

How to Trade LICI (for learning purpose):

• Entry Example: ₹942.00

• Stop Loss: ₹844.00 (Risk: ₹98.00)

• Target 1: ₹964.00 (Reward: ₹22.00)

• Target 2: ₹986.00 (Reward: ₹44.00)

• Target 3: ₹1024.00 (Reward: ₹82.00)

• Sample Quantity: 50 shares

• RR Ratio: Short-term ~1:0.5; Swing ~1:1 or more

• Aggressive Traders: Can trail stop-loss as price approaches ₹986

• Conservative Traders: Wait for dip toward ₹904 or ₹866 zones

________________________________________

This breakout setup is ideal for swing trades, backed by strong volume and momentum indicators. However, since the RSI and Stochastic are in the overbought zone, traders should manage risk through stop-losses or wait for minor retracements for safer entries.

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

LIC Share Price Analysis – Key Support & Resistance Levels🕒 Timeframe: Daily | Symbol: NSE:LICI

LIC stock is currently showing a consolidation pattern after a decent rally from previous lows. Price action suggests that the stock is preparing for a directional move. Traders should keep an eye on the following critical levels:

🔹 Support Zone: ₹807 – ₹830

This range has held strong multiple times, indicating buying interest around this zone. A breakdown below ₹723 could lead to a deeper correction.

🔹 Resistance Zone: ₹866 & ₹1000

LIC has struggled to sustain above ₹826. A breakout with volume above ₹866 may lead to bullish momentum toward ₹1000+.

📌 Trading Viewpoint:

✅ Bullish Bias if price sustains above ₹866 & ₹1000 with volume

⚠️ Bearish Below ₹723 (watch for a breakdown retest)

🛑 Disclaimer: This is for educational purposes only. Not financial advice. Do your own research before investing.

#LIC #LICShareAnalysis #LICI #TradingView #StockMarketIndia #SupportAndResistance #NSE #LICBreakout #LICStock #TechnicalAnalysis #SwingTrading

LIC of India - Strong Bearish PossiblityStock reaching its RBD area

High possibility supply area 775 - 795

Trend line Rejection area too

Upside Sl strictly above 810

Supply zone areas in 125 as well as 75 Mins as well

Strong possibility of reversal from this area

LTF confirmation required

Downside target area near 735

LICI - Cooling OffStock coming down near its strongest support

862 - 880 (Area of strongest support)

It may go sideways before planning next direction

If cools off near 865 - 870 then a good buy opportunity with strict Sl of close below 860

Any close below 860 negates the view

Once below 860 then the same area (862-880) will start acting as strongest resistance

LICI Life Insurance Corporation of India buy trade with targetsHi! this is Kapil,

I made this graph of LICI by just using simple Fib extensions and reversals for getting to the desired target.

After seeing the closing of LICI in 2024 November month i have decided to Make this Chart.

Consult your financial advisor before investing.

Life Insurance Corporation of India - Breakout Setup, Move is ON#LICI trading above Resistance of 1159

Next Resistance is at 1548

Support is at 835

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Life Insurance Corporation of India - Long Setup, Move is ON...#LICI trading above Resistance of 918

Next Resistance is at 1159

Support is at 770

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.