XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Short-Term Sell Pressure as Liquidity Gets Cleared | Lana ✨

Gold is showing signs of short-term weakness after an aggressive upside expansion. Price action suggests the market may continue to move lower in the near term, not as a trend reversal, but as a liquidity-driven correction within a broader bullish structure.

At this stage, the focus shifts from continuation to how price behaves while liquidity is being taken below structure.

📈 Market Structure & Price Behavior

The recent vertical rally has left the market overextended, making a corrective phase technically healthy.

Price has broken below short-term support and is now trading under a descending corrective trendline, signaling short-term bearish pressure.

This type of structure often develops when the market needs to clean buy-side positions before rebuilding for the next leg.

While the higher-timeframe trend remains bullish, the intraday bias has shifted to corrective / bearish until liquidity objectives are met.

🔍 Key Liquidity Zones on the Chart

Short-term sell zone: the descending trendline near current price As long as price reacts below this trendline, rallies are more likely to be sold.

Scalping buy liquidity: around 5050–5070 This area may generate temporary bounces, but reactions here should be treated as short-term only.

Key bullish order block: 4825 – 4830 A critical zone where stronger buyer participation may appear if the sell-off extends.

Major swing liquidity zone: 4613 – 4625 This is a high-confidence liquidity pocket where the market could complete a deeper correction and reset the broader bullish structure.

🎯 Trading Scenarios

Primary scenario – Continuation of the pullback: As long as price remains below the descending trendline, gold may continue to move lower to sweep liquidity below recent lows. This favors sell-on-rallies rather than buying strength.

Secondary scenario – Temporary reaction: Short-term bounces may occur around the 5050–5070 area, but without structural reclaim, these moves are more likely corrective than trend-changing.

Structural defense scenario: If price reaches the 4825–4830 or 4613–4625 zones, watch closely for signs of stabilization and absorption, which would signal that the liquidity objective has been completed.

🧠 Lana’s View

This move lower is best seen as liquidity cleanup, not panic selling. Lana stays patient during corrective phases, avoiding early longs and waiting for price to reach clear liquidity zones before reassessing bullish continuation.

✨ Let the market take what it needs, then look for structure to rebuild.

Liquidity

Bitcoin at Demand: Where Most Traders Panic and Smart Money WaitWhen I look at this chart, I don’t see weakness.

I see price reacting exactly where it should .

Bitcoin is sitting above a clearly defined demand zone, and instead of collapsing, price is slowing down and compressing.

That usually tells me the market is absorbing liquidity, not distributing .

Key things I’m focusing on:

Price is holding above ascending demand , which shows buyers are still defending structure.

Reactions from the demand zone are clean , not impulsive, a sign of controlled participation.

Overhead supply is present , which explains the compression instead of an instant breakout.

RSI bullish divergence adds confidence that downside momentum is weakening near demand.

My mindset here:

I’m not chasing moves.

I’m not panicking into demand.

I’m simply watching how price behaves here , because this zone decides whether the next move expands or fails.

As long as structure holds, patience matters more than prediction.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage your risk.

BTC Compression Phase: Where Smart Money Builds Positions!Hey guy's, When I look at this chart, I’m not seeing fear or trend failure.

I’m seeing something far more important, controlled compression above demand .

Bitcoin has pulled back, swept liquidity, and is now holding above a clearly defined demand area while volatility keeps contracting.

This kind of behaviour rarely appears during panic.

It usually appears when the market is absorbing supply quietly .

What I’m seeing on the chart:

Price is still respecting the ascending demand structure , which tells me higher-timeframe buyers are active and defending key levels.

The recent move cleaned out weak hands below demand , but price did not accept lower, a classic liquidity sweep, not a breakdown.

Supply is visible above , which explains why price is compressing instead of expanding immediately. Sellers are present, but they are not overpowering buyers.

The range between ascending demand and overhead supply is tightening . This is where impatience builds, and where strong positioning usually happens.

The psychology part (this matters):

This phase feels uncomfortable.

Price isn’t doing much.

Both sides are frustrated.

And that’s usually a clue.

If Bitcoin wanted to break structure, it had a clean opportunity below demand.

It didn’t take it.

That tells me sellers are getting weaker, not stronger.

So my thinking stays simple:

I don’t want to chase upside after expansion.

I don’t want to panic into a sell-off that already swept liquidity.

I want to watch how price reacts around demand, because this is where real decisions are made.

As long as structure holds:

Pullbacks into the 88k–87k demand zone remain high-probability reaction areas.

Compression above demand keeps the door open for a mean-reversion move toward higher levels.

Only a clean breakdown and acceptance below ~84k would invalidate this structure.

Until then, I’m not trying to predict the next candle.

I’m trying to read behaviour .

Markets don’t move when everyone is excited.

They move when most people get bored, confused, or impatient.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage risk and trade according to your own plan.

XAUUSD (H4) – Trendline break confirmedXAUUSD (H4) – TRENDLINE BREAK CONFIRMED, NOW IT’S ALL ABOUT BUYING THE DIP.

Macro context

Safe-haven flows are still supporting precious metals as geopolitical uncertainty rises. Headlines around the US–Venezuela situation and political pushback can keep price action reactive, meaning sharp spikes and liquidity sweeps are very possible before the market commits to the next leg.

Technical view (H4)

The bullish structure remains intact: higher highs + higher lows.

Price has broken the trendline/resistance and is holding above the “buy resistance” area around 4550 → a positive sign for continuation.

The 1.618 Fibonacci extension above is a major liquidity magnet, but also a zone where short-term profit-taking can trigger a pullback.

Key levels

Pivot support: 4550–4545

Deeper support: 4475–4455 (balance area inside the rising channel)

Target resistance: 4760–4770 (Fibo 1.618 / “sell Fibonacci” zone)

Trading scenarios

Scenario 1: Trend-following BUY (preferred)

Entry: Buy pullback 4552–4560

SL: 4540

TP1: 4635–4660

TP2: 4720–4740

TP3: 4760–4770

Plan: wait for a clean reaction at the new support after the breakout, then ride the trend.

Scenario 2: Safer BUY after a deeper liquidity sweep

If price dumps hard on thin liquidity/news:

Entry: Buy 4475–4455

SL: 4435

TP: 4550 → 4635 → 4760

Scenario 3: Reaction SELL (short-term only)

Only if there’s a clear rejection at the highs:

Sell zone: 4760–4770

SL: 4785

TP: 4685 → 4635 → 4550

Conclusion

H4 bias stays bullish after the trendline break. The best approach is no chasing — wait for a dip into 4550 to buy with structure. SELL is only a tactical reaction if price rejects hard at the 1.618 extension.

👉 Follow LiamTradingFX to get my XAUUSD plans early every day.

XAUUSD H4 – Correction, then ExpansionXAUUSD H4 – Pullback Then Continuation Using Fibonacci and Key Levels

Gold remains in a strong bullish trend on H4, but the current structure suggests the market needs a pullback into liquidity before the next expansion leg.

Market View

The recent rally has pushed price into premium territory, which often triggers short-term profit-taking.

Fibonacci extensions are acting as liquidity magnets: 2.618 is a key reaction zone, while 3.618 is the next expansion target.

Main approach: wait for the pullback into support/buy zones, then follow the trend.

Key Levels to Watch

Near resistance: 4546–4550 (reaction zone / key resistance)

Sell reaction zone: 4632–4637 (Fibonacci 2.618, likely to cause volatility)

Expansion target: 4707 (Fibonacci 3.618)

Buy liquidity zone: 4445–4449 (best buy area in this structure)

Strong support: 4408 (critical defensive support)

Scenario 1 – Shallow Pullback, Then Push Higher

Idea: price pulls back lightly, holds structure, and resumes the uptrend quickly.

Preferred pullback zone: 4546–4550

Expectation: move back up toward 4632–4637, and if absorbed, extend toward 4707

Confirmation to watch: H4 candles hold above 4546–4550 with clear buying response (rejection wicks, strong closes, momentum return)

Scenario 2 – Deeper Pullback to Sweep Liquidity, Then Strong Rally

Idea: price sweeps deeper into the best demand zone before the next major leg.

Deep pullback zone: 4445–4449

Expectation: bounce back to 4546–4550 → then push to 4632–4637 → and potentially extend to 4707

Confirmation to watch: strong reaction at 4445–4449 (buyers absorb, structure holds, no clean breakdown)

Important Notes

4632–4637 is a sensitive zone where profit-taking and sharp swings can appear before continuation.

If price breaks and holds below 4445–4449, shift focus to 4408 to judge whether the bullish structure is still being defended.

Conclusion

The main trend is still bullish, but the best edge comes from waiting for a pullback and buying at key levels. Focus zones: 4546–4550 (shallow pullback) and 4445–4449 (deep pullback with better R:R). If Fibonacci expansion continues, the next upside target is 4707.

If you share the same view, follow me to get the next updates earlier.

XAUUSD (H3) – Liam StrategyTrendline break confirms the uptrend ✅ | Buy the discount, scalp-sell at ATH

Quick overview

On the H3 chart, the story is clean: price has broken the bearish trendline and held structure after a clear BOS, which keeps the bias bullish for continuation.

But the best execution is still the same: no FOMO. I’d rather buy from discount liquidity zones than chase mid-range candles.

Key Levels (from your chart)

✅ Buy Zone 1 (re-buy): 4434 – 4437

✅ Buy Zone 2 (liquidity imbalance): 4340 – 4343 (deep sweep zone)

✅ ATH Sell scalping: 4560 (main profit-taking / reaction sell)

Technical read (Liam style)

Breaking through the trend confirms uptrend: the trendline break signals buyers are back in control.

4434–4437 is the clean re-entry area: a logical pullback zone with better R:R.

If volatility spikes and price hunts liquidity, 4340–4343 is the “best value” area to look for a strong reaction.

Trading scenarios

✅ Scenario A (priority): BUY the pullback at 4434–4437

Entry: 4434 – 4437

SL: below 4426 (or below the most recent H1/H3 swing low)

TP1: 4485 – 4500

TP2: 4560 (ATH – main target)

Logic: Uptrend confirmation is in place — I only want the pullback entry, not a chase.

✅ Scenario B (deep buy): If price sweeps down into 4340–4343

Entry: 4340 – 4343

SL: below 4330

TP: 4434 → 4500 → 4560

Logic: This is the “sweet spot” if the market does a liquidity reset before pushing higher again.

⚠️ Scenario C (scalp only): SELL reaction at ATH 4560

Entry: 4560 (only if we see clear rejection / weakness)

SL: above the sweep high

TP: 4520 → 4500 (quick scalp)

Note: This is a scalp idea at ATH — not a long-term bearish call while the bullish structure is intact.

Key notes

Avoid entries mid-range. Only execute at 4434–4437 or 4340–4343.

Wait for confirmation on M15–H1 (rejection / engulf / MSS).

Risk management: 1–2% per idea, scale out into ATH.

Are you waiting for the 4434 pullback buy, or hoping for a deeper sweep into 4340 for the cleanest entry? 👀

Gbpjpy Projecting in sellside delivery till weekly imbExpecting GBPJPY short term sell delivery,pric rejected from monthly Order block after taking previous monthly highs, expecting liquidity to take till weekly imbalance, onwards based on confirmation bullish move probably expected (the fundamental idea promotes buy from weekly imb where as GBP interest rates are 3.75% (more strength fundamentally than yen ) and Jpy 0.75%

Why Gold Loves Trapping Both Buyers and Sellers!Hello Traders!

If you have traded Gold for some time, you’ve probably felt this frustration more than once. You take a clean buy, price stops you out and reverses. You flip to sell, and the same thing happens again. It starts feeling personal, like Gold is hunting you specifically.

The truth is, Gold doesn’t hate buyers or sellers.

Gold loves liquidity, and liquidity comes from trapped traders on both sides.

This is not manipulation in the emotional sense. This is how a highly liquid, institution-driven market functions.

Why Gold Rarely Moves in a Straight Line

Gold is one of the most actively traded instruments in the world. Because of this, it cannot afford to move cleanly for long. Straight moves don’t provide enough participation.

Clean trends attract late buyers at the worst possible prices

Obvious breakdowns invite emotional sellers too early

Both sides place stops at similar, predictable levels

Before Gold commits to direction, it usually clears both sides first.

How Buyers Get Trapped in Gold

Buy side traps often appear after a strong bullish candle or breakout. The structure looks convincing, momentum feels strong, and buyers feel safe.

Price breaks a visible resistance and attracts breakout buyers

Stops get placed just below the breakout level

Gold pulls back sharply to test liquidity below

Buyers aren’t wrong on direction.

They’re early, and early entries are expensive in Gold.

How Sellers Fall Into the Same Trap

Sell-side traps usually form after a sharp rejection or false breakdown. Fear builds quickly, and sellers assume the move is done.

Price dips below support and invites aggressive shorts

Stops cluster just above the rejected level

Gold spikes upward to clear those stops

Again, direction is not the issue.

Timing is.

Why Gold Needs Both Traps

Gold doesn’t choose a side until enough liquidity is collected. Buyers provide one side of liquidity. Sellers provide the other.

Trapped buyers fuel downside liquidity

Trapped sellers fuel upside liquidity

Only after both sides react does structure become clean

This is why Gold feels chaotic to emotional traders and logical to patient ones.

How This Changed My View on Gold

Once I understood that traps are part of the process, not mistakes, my trading became calmer.

I stopped reacting to the first breakout

I waited for both sides to show their hand

I focused more on reactions than predictions

Gold didn’t change.

My expectations did.

Rahul’s Tip

If Gold traps you once, learn from it.

If it traps you repeatedly, it’s not the market, it’s impatience. The real opportunity usually appears after frustration peaks on both sides.

Buyers get trapped.

Sellers get trapped.

Patient traders get paid.

If this post matches your Gold trading experience, drop a like or share your thoughts in the comments.

More real, experience-based lessons coming.

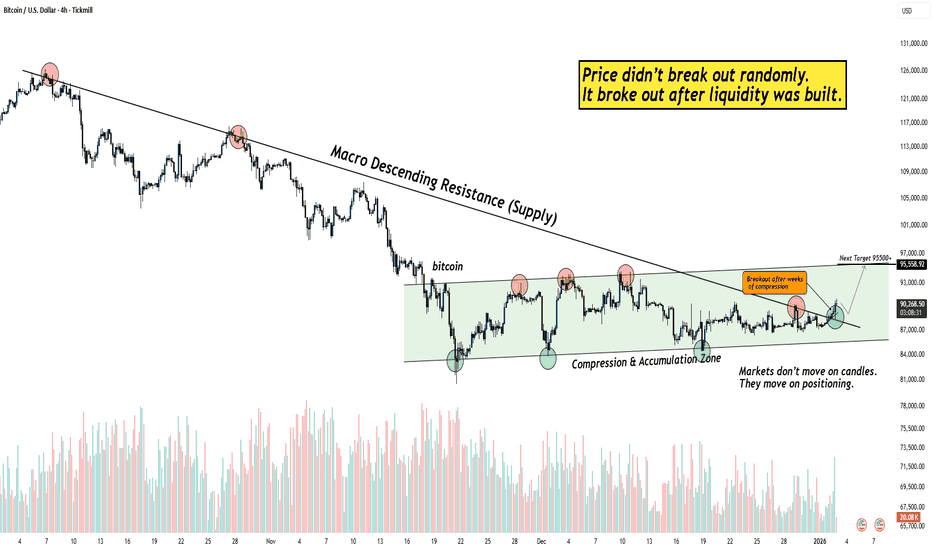

Why Bitcoin Broke Out After Weeks of Boring Price Action?Hello guy's let's analyse Bitcoin because for weeks, Bitcoin stayed inside a tight compression range while most traders lost interest. Price looked slow, directionless, and boring, exactly the phase where liquidity gets built quietly.

This breakout matters because it didn’t come after a spike.

It came after patience.

What the chart is really showing

A macro descending resistance was respected for months, keeping sellers confident.

Price compressed inside a clear accumulation zone, forming higher lows while absorbing supply.

Multiple rejections failed to push price lower, a classic sign of seller exhaustion.

Once liquidity was built and weak hands were positioned wrong, price expanded cleanly

Why this breakout is different from random moves

Most breakouts fail because they happen too early.

This one happened after time did the hard work.

No emotional spike before the move.

No vertical candles inside the range.

Compression + absorption first, expansion later.

That’s how sustainable moves begin.

When everyone gets bored, structure is usually being prepared.

And when structure completes, the move looks “sudden” only to those who weren’t watching.

Final thought

As long as price holds above the broken structure, this breakout remains valid.

Failure only comes if price accepts back inside the range, until then, momentum favors continuation.

If this helped you see the market differently, like, follow, or share your view below.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

XAUUSD (D1) – Elliott ABC pattern activeLana sells the pullback, waits to buy at major liquidity 💛

Quick summary

Timeframe: Daily (D1)

Elliott view: Price is likely developing an ABC corrective structure after a strong rally

Strategy: Sell the B-wave pullback into supply, buy only when price returns to strong liquidity

Context: Precious metals started 2026 strong, but short-term volatility and re-accumulation swings are still expected

Fundamental backdrop (supports the bigger trend)

Gold and silver opened 2026 with strong momentum, extending the best run since the late 1970s. Goldman Sachs remains bullish on precious metals and continues to highlight an aggressive long-term target (around $4,900 for gold).

Lana’s key point: the long-term bull cycle can remain intact, but the market still needs healthy corrections to reset liquidity and build new structure.

Technical view (D1) – Elliott ABC structure

On the Daily chart, after the powerful top, gold dropped sharply, forming a clean Wave A. The current structure suggests:

Wave B: a corrective rebound into resistance/supply

Wave C: a potential move back down into liquidity zones before the next major direction is confirmed

This ABC lens helps avoid getting trapped when the news looks bullish, but price is still in a corrective phase.

Key levels from the chart

1) Sell zone (B-wave supply)

Sell: 4435 – 4440

This zone aligns with marked resistance and a Fibonacci pullback cluster (0.236 / 0.382). If price retraces here and shows rejection, it’s a strong area to look for B-wave selling pressure.

2) Buy zone (major liquidity – potential C-wave completion)

Buy Liquidity: 4196 – 4200

This is the strongest liquidity area on the chart. If Wave C plays out, Lana will look for buying opportunities here with clearer risk control.

3) Deeper accumulation liquidity

Accumulate liquidity: the lower accumulation area highlighted on the chart

If the market sweeps deeper than expected, this is the region where longer-term buyers may step in.

Trading plan (Lana’s approach)

Primary idea: Sell rallies into 4435–4440 if price shows weakness (B-wave rejection).

Primary buy plan: Wait for price to revisit 4196–4200 and confirm support (liquidity absorption).

If price breaks and holds above the sell zone, Lana stops selling and waits for a new structure to form.

Note on early-year behavior

The first weeks of the year often bring “messy” moves as liquidity returns and positioning resets. Lana will only trade at planned zones and avoid entries in the middle of the range.

This is Lana’s personal market view and not financial advice.

Coiled Spring Bitcoin is holding structure on the high time frames, currently reclaiming the $90k level after testing the lows. I’ve got my weighted average bands on the chart and price is respecting them so far. You can see on the daily chart how we’ve just poked back above the latest FOMC anchor (the blue line) and are squeezing between that and the breakdown AVWAP overhead. I try not to preempt levels though, I only really care about them once price actually reacts there.

Macro wise, things look decent. Yield curves like the 5y-03m and 10y-03m are positive. We’re seeing a bull steepening, not the textbook version since the 2y is still lower than the 3m, but not a cause for concern.

Other signals I’m tracking:

VIX is stable.

USDJPY is trending up but getting close to resistance, so that’s one to watch.

MOVE index is chilling, down at 63% which is historically a good zone for us.

DXY is high at 98 but trending down.

Credit spreads are super low at 2.84, so no stress there.

TGA is pivoting down now too.

Real yields aren’t doing much since nominals and breakevens are falling together.

Current pricing suggests no cut at the next FOMC, which is fine. But if a cut comes as a surprise that would be very interesting to say the least.

The Second Move Strategy in Gold – Why the First Spike Is a TrapHello Traders!

There is a moment in Gold trading that has trapped more traders than bad analysis ever did. It’s that sudden spike, fast, aggressive, and convincing, where everything on the chart screams this is the move. Your instincts tell you not to miss it. Your emotions tell you to act now. And that’s exactly why most traders lose money there.

Gold is not a market that rewards excitement. It rewards restraint. The first spike is rarely the opportunity, it is usually the test.

Why the First Spike Feels Impossible to Ignore

The first move in Gold often arrives with speed and confidence. Candles expand, momentum increases, and breakouts appear clean. This creates urgency, not clarity.

Fast candles trigger fear of missing out

Indicators flip direction almost instantly

Breakout traders pile in without confirmation

The move looks strong because it is designed to look strong.

Strength attracts participation, and participation creates liquidity.

What That First Spike Is Really Doing

In many cases, the first spike is not commitment, It is information gathering. Actually market is checking who is chasing, where stops are sitting, and how much emotional money is willing to enter without patience.

Early entries get trapped during shallow pullbacks

Stops cluster around obvious support or resistance

Traders confuse volatility with direction

This is where most losses begin, not from bad direction, but from bad timing.

Why the Second Move Is Where Professionals Act

After the initial spike, Gold usually pauses. It retraces, consolidates, or retests key levels. This is not weakness, this is clarity forming.

Liquidity from the first move gets absorbed

Weak hands exit under pressure

Structure becomes visible instead of emotional

The second move lacks drama, But it carries intent.

How This Changed My Gold Trading

Once I stopped chasing the first candle, my trading changed quietly but completely. I started letting price reveal itself instead of reacting to it.

I stopped entering during emotional expansion

I waited for retests and structural confirmation

I reduced position size until direction proved itself

Nothing fancy changed, Just patience, and patience did the heavy lifting.

Rahul’s Tip

If a Gold move makes you feel rushed, excited, or pressured, step back. That feeling is not intuition. It’s emotion. The best Gold trades usually feel boring at entry and obvious only in hindsight.

Final Thought

Gold doesn’t trap traders with complexity. It traps them with urgency. The first spike grabs attention. The second move offers opportunity. Learn to wait, and you stop trading reactions. You start trading structure.

If this post made you rethink how you enter Gold trades, drop a like or share your experience in the comments. More real trading lessons coming.

XAUUSD (H1) – Monday Trading StrategyLana prioritizes selling setups until a new high is broken.

Quick summary

Technical context: Price has pulled back strongly from the All-Time High, showing short-term weakness.

Daily bias: Sell on rallies, until price breaks and holds above a new high.

Key events: Speech from U.S. President Trump and updates related to U.S.–China trade may increase volatility.

News impact – what to watch

Trump’s speech: Often drives short-term USD sentiment through comments on growth, tariffs, and inflation. Gold may react sharply to headline risk.

U.S.–China trade activity (CCPIT): Any improvement in trade sentiment can support USD in the short term, adding pressure to gold. Rising tensions would favor gold as a safe haven.

Because of this, Lana will focus on price reaction at key zones rather than predicting the news outcome.

Technical analysis (H1)

Gold printed a new All-Time High and then sold off aggressively, signaling profit-taking near the top.

Price is now consolidating within a corrective structure, where selling rallies remains the higher-probability play.

Key zones identified on the chart:

Sell zone: 4529 – 4531

Buy reaction zone: 4498 – 4500 (support)

Trading plan for Monday

Primary scenario – Sell rallies

Sell: 4529 – 4531

This zone is expected to act as resistance during the current correction.

Bias change condition:

Only shift to a bullish continuation if price breaks above the previous high and holds.

Secondary scenario – Short-term buy reaction

Buy: 4498 – 4500

This is considered a scalp-only setup, as the overall intraday bias remains bearish.

Session notes

Asian session may remain slow, while volatility is likely to increase around the scheduled events.

Best trades are expected when price returns to planned zones rather than trading in the middle of the range.

This analysis reflects Lana’s personal market view and is not financial advice.

XAUUSD: Buy the dip or break to 4,587? MMF strategyXAUUSD (2H) – MMF Intraday Outlook

Market Context

Gold remains in a bullish continuation phase after breaking out of the prior accumulation range. Current price action shows a healthy pullback / rebalancing inside an ascending channel — a typical behavior before the next expansion leg, not a reversal signal.

Structure & SMC

Strong bullish impulse → range formation for liquidity reset.

4,485.981 acts as a key Demand / Bullish OB, where buyers previously stepped in.

Liquidity and upside objective are resting near 4,587.447.

Key Levels

BUY Zone (Demand / OB): 4,486

Mid-range / Pivot: ~4,533

Upside Liquidity Target: 4,587

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY (Preferred)

If price pulls back into 4,486 and shows acceptance (wick rejection / bullish close),

Then look for BUY continuation:

TP1: range high / intraday resistance

TP2: 4,587

Invalidation: clean 2H close below 4,486 → stand aside and reassess structure.

Alternative Scenario – Break & Retest BUY

If price holds above balance and breaks higher with strong displacement,

Then wait for a break–retest to join continuation toward 4,587.

Avoid chasing price in the middle of the range.

Macro Backdrop

Ongoing dovish Fed expectations and softer yields continue to support gold.

End-of-month liquidity can cause sharp swings → patience and level-based execution are key.

Summary

Short-term bias remains bullish as long as 4,486 holds.

MMF focus today: buy pullbacks into demand, target 4,587 liquidity.

XAUUSD (H4) – Trading Rising ChannelLana focuses on pullback buys for the week ahead 💛

Weekly overview

Primary trend (H4): Strong bullish structure, price is respecting a clean ascending channel

Current state: Price is trading near ATH and Fibonacci extensions → short-term reactions are possible

Weekly strategy: No FOMO. Lana prefers buying pullbacks at value zones, not chasing highs

Market context

Recent comments from the U.S. highlight strong economic growth and confidence in trade policies. While such statements can influence USD sentiment, gold at year-end is often driven more by liquidity conditions and technical structure than headlines.

With holiday liquidity thinning out, price movements can become sharper and less predictable. That’s why this week Lana stays disciplined and trades strictly based on structure and key levels.

Technical view based on the chart (H4)

On the H4 timeframe, gold is moving smoothly within a rising channel, consistently forming higher lows. The strong impulse leg has already completed its psychological breakout phase, and price is now hovering near the upper area of the channel.

Key points:

Fibonacci extension zones near the top act as psychological resistance, where temporary pullbacks are normal.

The best opportunities remain inside the channel, around value and liquidity zones.

Key levels Lana is watching this week Primary buy zone – Value Area (VL)

Buy: 4482 – 4485

This is a value zone within the rising channel. If price pulls back here and holds structure, continuation to the upside becomes more likely.

Safer buy zone – POC (Volume Profile)

Buy: 4419 – 4422

This POC zone shows heavy prior accumulation. If volatility increases or price corrects deeper, this area offers a more conservative buy opportunity.

Psychological resistance to respect

4603 – 4607: Fibonacci extension & psychological barrier At this zone, a short-term rejection or liquidity grab is possible before the next directional move.

Weekly trading plan (Lana’s approach)

Buy only on pullbacks into planned zones, with confirmation on lower timeframes.

Avoid chasing price near ATH or psychological resistance.

Reduce position size and manage risk carefully during low-liquidity holiday sessions.

Lana’s note 🌿

The trend is strong, but discipline at the entry is everything. If price doesn’t return to my zones, I’m happy to stay patient and wait.

This is Lana’s personal market view, not financial advice. Always manage your own risk. 💛

EUR/USD – Accumulation After Sell-Off, Structure-Based Long IdeaEUR/USD has seen a strong sell-off, followed by a sharp reaction from a well-defined support zone. This area has already proven its strength by absorbing selling pressure and pushing price higher.

After the bounce, price is now consolidating near support instead of breaking down further, indicating potential accumulation at these levels.

What Price Is Telling Us: Price is holding above the support zone with multiple rejections and overlapping candles, showing a clear loss of bearish momentum. Sellers are failing to push price lower despite earlier strength.

This type of behavior often appears before a corrective move or continuation higher, especially after an impulsive decline.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Why Gold Behaves Differently During Christmas Week – A Lesson!Hello Traders!

If you have traded gold for a few years, you might have noticed something strange around Christmas week.

Your usual setups feel different. Levels don’t react the same way. Moves look random, slow, or suddenly sharp without logic. This is not because your analysis stopped working.

Gold behaves differently during Christmas week because liquidity behaves differently.

Understanding this one concept can save you from unnecessary losses.

What Changes in the Market During Christmas Week

During Christmas week, a large part of institutional traders, banks, and big market participants are either inactive or trading with very light exposure. Volumes drop significantly, and participation becomes uneven.

When fewer large players are active, the market structure changes. Gold still moves, but the quality of moves changes.

I’ve learned to treat this week very differently from normal trading weeks.

Why Low Liquidity Changes Gold’s Behavior

Gold is a highly liquid instrument most of the year, but during holiday weeks, especially Christmas, liquidity becomes thin.

With thin liquidity:

Small orders can move price more than usual

False breakouts become more frequent

Clean follow-through after breakouts reduces

Price starts reacting more to random flows than to strong conviction.

The Common Trap Retail Traders Fall Into

Most retail traders trade Christmas week exactly like any other week. They expect normal volatility, normal reactions, and normal continuation.

What actually happens is different.

Price spikes suddenly, hits stops easily, and then goes quiet again. This creates frustration and confusion, especially for intraday and scalping traders.

I’ve personally learned this the hard way earlier in my trading journey.

Why Gold Can Look “Manipulated” During Holidays

When liquidity is low, price movements feel exaggerated. Stops get hit easily, wicks become longer, and reversals appear sudden.

This makes traders feel like gold is being manipulated.

In reality, it is not manipulation, it is absence of depth. When the market lacks depth, price becomes sensitive.

How I Personally Trade Gold During Christmas Week

Over time, I changed my approach completely for holiday periods.

I reduce position size significantly, even if my analysis is strong.

I avoid aggressive intraday trades and prefer higher timeframe context.

I accept that missing trades is better than forcing trades during low liquidity.

Sometimes, the best trade during Christmas week is no trade.

Why Patience Matters More Than Prediction Here

During Christmas week, prediction matters less than protection. Even correct analysis can fail due to lack of participation.

Gold may move, but moves are often unreliable and short lived. This is where discipline protects capital.

I remind myself every year, markets will still be there next week.

Rahul’s Tip

If gold starts behaving strangely during Christmas week, don’t doubt yourself immediately.

Check liquidity first. Reduce size, reduce expectations, or step aside completely.

Preserving capital during low-quality conditions is also a skill.

Conclusion

Gold does not change its nature during Christmas week. Liquidity changes, and gold simply reacts to that.

When you understand how liquidity affects behavior, you stop forcing trades and start respecting the environment.

If this post helped you understand holiday trading better, like it, share your experience in the comments, and follow for more practical gold trading insights. Happy Merry Christmas to all from @TraderRahulPal :))

USD/CAD – Liquidity & Structure Based Short IdeaUSD/CAD has been trading inside a well-defined rising channel for a while. Price is now approaching the upper boundary of this channel, a zone where sellers have previously stepped in with strength.

This area is not just resistance, it’s also a liquidity zone, where stop-losses of late buyers are resting above recent highs. Such zones often attract smart money activity before a directional move.

What Price Is Telling Us: Price is currently stalling near resistance instead of expanding higher. We can observe Multiple rejections near the channel top, Overlapping candles showing loss of bullish momentum and Lack of strong follow-through despite previous volume spike.

This behavior often appears before distribution or a corrective move, especially when price is trading at premium levels.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Why Gold Spikes Right When Everyone Gives Up!Hello Traders!

Over the years, one thing I’ve noticed again and again is this, gold rarely moves when everyone is confident about it.

In fact, the strongest gold spikes I’ve seen came at moments when traders were tired, bored, and emotionally done with gold.

No excitement, no news, no hype. just silence and frustration. That is usually when gold decides to move. This post is about that exact moment most people miss.

1. The Phase Where Traders Emotionally Disconnect

After a long consolidation or slow decline, gold starts testing patience more than levels.

Daily candles become small, nothing seems to work, and traders slowly stop caring.

People say things like “gold is not moving” or “nothing is happening here” and shift their attention elsewhere.

I’ve personally learned to be very alert during this phase.

When traders disconnect emotionally, the market often prepares its next move.

2. Giving Up Is Not Random, It Is a Signal

When traders finally give up, they close positions without a plan, just to feel relief.

This creates a wave of selling from weak hands.

That selling provides clean liquidity for stronger participants to step in quietly.

Gold does not spike because something suddenly improves.

It spikes because selling pressure gets exhausted.

3. Why Gold Loves Emotional Extremes

Gold is not driven only by fundamentals, it is heavily driven by emotion and sentiment.

Fear pushes people into gold, boredom pushes them out.

When boredom and frustration peak, price often stops falling even though sentiment stays negative.

Whenever I see gold refusing to go lower despite bad sentiment,

I know the story is changing under the surface.

4. What Retail Traders Usually Do at This Point

Most retail traders stop watching gold charts completely.

They move to faster markets or trending assets.

They tell themselves they will come back “once gold starts moving again”.

Ironically, by the time gold starts moving, it is already far from the level where patience was required.

5. How I Personally Read These Gold Spikes

I focus more on behavior than prediction.

I look for long periods where price goes nowhere but also refuses to break down.

I pay close attention when volatility compresses and volume dries up.

When price holds steady while emotions collapse,

I don’t rush, I observe.

That calm observation has helped me catch moves that looked sudden to everyone else.

6. The Spike Feels Sudden Only If You Were Not Prepared

By the time gold spikes, accumulation is usually already complete.

To emotional traders, the move feels random and unfair.

To prepared traders, it feels logical and almost expected.

Big moves never announce themselves loudly.

They quietly prepare while most people lose interest.

Rahul’s Tip

Whenever I feel bored or frustrated watching gold, I pause instead of walking away.

That emotional discomfort is often a signal, not a problem.

If you can stay present when others disconnect, you automatically gain an edge.

Conclusion

Gold rarely spikes when belief is strong. It spikes when patience is gone and hope feels weak.

If you understand this emotional timing, you stop chasing gold and start positioning before it moves.

If this post felt relatable, like it, share your experience in the comments, and follow for more market psychology insights.

How Market Makers Trap Retail Traders & How to Avoid It?Hello Traders!

Have you ever taken a perfect-looking trade, only to see price hit your stop loss and then move exactly in your direction?

You felt unlucky.

You blamed manipulation.

You thought the market was against you.

But here’s the uncomfortable truth.

Most retail traders don’t lose because their setup is bad.

They lose because they don’t understand how market makers operate.

Once you understand how traps are created, your entire way of reading charts changes.

Who Are Market Makers (In Simple Words)?

Market makers are not sitting there to hunt you personally.

Their job is to provide liquidity and execute large orders.

To do that, they need one thing from the market.

Orders.

Stop losses, breakout entries, panic exits, all of these are liquidity.

Common Ways Retail Traders Get Trapped

False Breakouts

Price breaks an obvious high or low.

Retail traders jump in expecting a strong move.

Within a few candles, price reverses sharply and traps them.

Stop-Loss Hunts

Price suddenly spikes just enough to take out stop losses placed below support or above resistance.

Once liquidity is collected, price moves in the opposite direction.

Emotional Candles

Big red or green candles appear after news or during high volatility.

Retail reacts emotionally.

Market makers use this emotion to fill positions.

Choppy Ranges

Price keeps moving up and down inside a range, stopping out both buyers and sellers.

Retail overtrades.

Smart money accumulates quietly.

If this feels familiar, don’t worry.

Almost every trader learns this the hard way.

Why Retail Traders Fall Into These Traps

They chase obvious levels that everyone can see.

They place predictable stop losses at exact highs and lows.

They trade based on excitement instead of structure.

They react instead of waiting for confirmation.

Market makers don’t need to predict the future.

They simply exploit predictable behavior.

How I Avoid Market Maker Traps

This part changed my trading completely.

I Stop Chasing Breakouts

If a level looks too obvious, I wait.

Real moves usually come after trapping traders, not before.

I Wait for Confirmation

I look for price to break a level and then fail.

False moves often reveal real direction.

I Respect Liquidity Zones

Highs, lows, equal highs, equal lows, these are liquidity pools.

I expect reactions there, not blind continuation.

I Trade With Calm, Not Urgency

When I feel FOMO, I know I’m late.

Good trades never force you emotionally.

Trading became much easier once I stopped trying to be right and started trying to be patient.

The Biggest Mindset Shift

The market’s job is not to be fair.

Your job is not to be emotional.

Once you accept this, traps stop hurting you.

Sometimes you even start using them to your advantage.

Rahul’s Tip

If price does something that feels “too obvious,” pause.

Ask yourself one question

“Who benefits if retail enters here?”

That single question has saved me from many bad trades.

Conclusion

Market maker traps are not a conspiracy.

They are a result of human psychology and predictable behavior.

When you stop reacting and start observing,

the market stops feeling random and starts making sense.

If this post helped you see traps differently, like it, share your thoughts in the comments, and follow for more real-world trading psychology content.

BTC: Liquidity Sweep SetupBTC: Liquidity Sweep Setup

Bitcoin continues to operate inside a broad equilibrium zone after completing a prolonged downward phase earlier in the month. The decline lost momentum as price entered a high-participation area, where trading activity became increasingly balanced and rotational. Since then, the market has developed a wide consolidation band, signaling a temporary standoff between directional conviction and liquidity accumulation.

Recent sessions show price repeatedly rotating through the center of this zone, forming alternating impulses that lack continuation. This pattern reflects a market focused on collecting orders rather than trending. Each short-lived push quickly transitions back into the range, indicating absorption on both sides and limited willingness from participants to sustain directional movement.

The lower portion of the range has begun attracting more activity, suggesting interest from larger players seeking efficient fill zones before any expansion. Price behaviour here is characterized by controlled sweeps, shallow recoveries, and frequent re-tests of the mid-band — signs of liquidity harvesting rather than aggressive distribution.

Forward behaviour on the chart implies that the market may first dip into the lower liquidity pocket to finalize order collection. Once this pocket is satisfied, conditions become favourable for a transition into an expansion phase targeting the upper boundary of the current equilibrium. This type of structure is common before major repricing, as it reflects the buildup of untriggered positions awaiting execution.

Overall, Bitcoin is in a preparation phase where energy is being stored, volatility is compressing, and liquidity is reorganizing. The next significant development is likely to emerge once the market completes its sweep of inefficient areas inside the range and finds a stable base for expansion.

ETH/USDT Bullish Reversal SetupETH/USDT Bullish Reversal Setup

The chart shows a clear transition in ETH as price moves from a prolonged distribution-driven decline into a developing accumulation range. After weeks of consistent bearish structure, the market finally printed multiple upside shifts, signaling that sell-side pressure is weakening and liquidity behavior is changing.

The recent impulsive rally out of the discounted range confirms that buyers are actively defending lower levels. Price is now pulling back toward a short-term demand pocket formed during the breakout. This area represents the first meaningful accumulation zone after the market broke a series of internal swing points.

As long as price maintains stability within this demand block, the structure favors continuation toward the next major liquidity cluster above. The next upside draw is positioned around the 3,440–3,500 region, where previous inefficiencies and unmitigated zones converge. That region also holds resting buy-side liquidity, making it the logical target for a future expansion move.

The current market behavior suggests that ETH is in the early phase of a bullish repricing cycle. A controlled pullback into the highlighted zone—followed by a reaction—would confirm continuation and attract momentum buyers aiming for the higher liquidity magnet.

Overall, this chart reflects a shift in narrative: sellers are losing dominance, the market is building a fresh bullish structure, and the path of least resistance is gradually tilting upward as long as the demand zone remains protected.

Why Gold Hits Your SL🌟 Why Gold Hits Your SL 😭💛📈

Gold is one of the most aggressive and volatile assets in the market — and if you’ve ever wondered “Why does gold ALWAYS hit my stop-loss before moving in my direction?”, this post explains the real reason.

Let’s break it down clearly 👇

🔶 1. Gold Loves Liquidity — Not Levels 💦💰

Gold doesn’t move based on your support/resistance lines.

It moves based on liquidity, meaning:

Where traders place stop-losses ❌

Where pending orders sit 🎯

Where large institutions want to fill positions 🏦

Your SL is simply sitting where everyone else puts theirs, which makes it prime liquidity.

🔶 2. XAUUSD Spikes Are Designed to Collect Orders ⚡💥

Gold often creates sudden:

Wicks

Fake breakouts

Quick pumps or dumps

Sharp candle spikes

These moves are NOT random — they’re engineered to:

🔸 Trigger stop-losses

🔸 Activate pending buy/sell orders

🔸 Grab liquidity before the real move

This is why your SL gets hit by $1–$3 before price completely reverses.

🔶 3. Gold Moves Session-by-Session 🕒🌍

Gold behaves differently depending on the time of day:

Asia session → Slow, tight range

London session → First big manipulation

New York session → Volatility explosion + real direction

Most SL hunts take place when London opens or when NY session begins ⚠️🔥

🔶 4. Clean Highs & Lows = SL Magnets 🧲📌

Gold LOVES attacking:

Previous day’s high/low

Asian range high/low

London session extremes

Double tops & bottoms

Round numbers (like 4000 / 4050 / 4100)

These areas hold thousands of stop-losses.

So before gold takes a real direction — it sweeps them first. 🏹😈

🔶 5. The Classic Gold Pattern: Trap → Reversal → Expansion 🔁🚀

Most XAUUSD moves follow this sequence:

1️⃣ Sweep liquidity 😭

2️⃣ Fake breakout 😈

3️⃣ Sharp rejection 👋

4️⃣ Real trend begins 🚀

If you’ve ever seen price:

Break a level

Wick hard

Then reverse the entire move

That’s gold performing a liquidity grab.

🔶 6. How To Avoid Getting Stopped Out ✔️

Here’s what actually helps:

🌟 A. Don’t put SL exactly at obvious levels

Move it beyond common liquidity zones.

🌟 B. Wait for the sweep before entering

Let gold perform the trap first.

🌟 C. Trade reaction — not prediction

Look for re-entry after the wick forms.

🌟 D. Use sessions to your advantage

Avoid placing SL right before London/NY opens.

🌟 Final Words

Gold isn’t hunting you —

it’s hunting liquidity.

Your job is simple:

👉 Stop placing stops where everyone else does

👉 Let gold sweep liquidity first

👉 Then catch the real move

Trade smarter, not tighter. 💛⚡