When Gold ETFs Crash, Psychology Crashes Faster Than Price!Hello Traders!

When Gold ETFs start falling sharply, the damage doesn’t begin on the chart. It begins in the mind. Prices may drop in percentages, but psychology collapses much faster. Confidence disappears, patience breaks, and long-term thinking gets replaced by fear-driven decisions.

Right now, we are in one of those phases. Headlines are loud. Charts look heavy. And emotions are running far ahead of logic. This is where most investors don’t lose money because Gold failed, they lose because their mindset did.

Why Gold ETF Falls Feel More Painful Than Spot Moves

ETF investors experience drawdowns differently. Unlike intraday traders, they are mentally invested for the long term. When price drops suddenly, it shakes belief, not just positions.

Long-term conviction starts feeling shaky

Every red candle feels like a warning sign

Investors start questioning decisions made months or years ago

The fall itself may be normal.

The emotional reaction is usually not.

What Panic Really Looks Like in Gold ETFs

Panic rarely shows up as one big decision. It shows up in small mental cracks.

Checking prices more frequently than usual

Reading every negative headline as confirmation

Comparing current drawdowns with worst-case scenarios

This is how psychology collapses quietly, long before price finds stability.

Why Markets Create This Psychological Pressure

Sharp corrections are not just price adjustments. They are tests of belief. Markets use volatility to separate conviction from convenience.

Weak conviction exits during uncertainty

Strong conviction pauses and reassesses

Impatient money provides liquidity for stability

Gold doesn’t need everyone to believe at the same time.

It needs disagreement to function.

What Smart Investors Focus On During This Phase

Experienced investors don’t react immediately. They zoom out and slow down decision-making.

They separate short-term noise from long-term intent

They revisit why Gold was added to the portfolio

They avoid making decisions during emotional peaks

This phase is not about predicting the bottom.

It’s about protecting mindset.

How I Personally Handle These Phases

When Gold ETFs correct sharply, I don’t rush to act. I observe behaviour, both market behaviour and my own.

I reduce information intake instead of increasing it

I avoid reacting to one-day or one-week moves

I remind myself that volatility is part of long-term assets

Markets recover before confidence does.

And that gap is where mistakes usually happen.

Rahul’s Tip

If a Gold ETF fall is disturbing your peace more than your portfolio balance, step back. Good investments don’t require constant emotional attention. If fear is forcing urgency, the decision is probably premature.

Final Thought

When Gold ETFs crash, price moves fast.

Psychology moves faster.

Those who survive this phase are not the ones who predict perfectly, but the ones who stay emotionally stable while others panic.

If this post reflects what you’re feeling right now, drop a like or share your thoughts in the comments.

More real, market-relevant lessons coming.

Community ideas

Nifty - Budget Day Analysis...During budget day, the price can give a volatile and big move. This volatility is risky to trade. People who like the thrilling effect trade on such days without any plan or analysis.

Usually, during volatile time what emotions make a trader do impulsive trading?

Fear of missing out, greed trading, confirmation bias and revenge trading.

Premium will be high during opening and decay fast during the budget time.

Important support levels are 24900 and 25000. If broken, the next support is around 24500.

Important resistance levels are 25300 and 25600. If broken, the next resistance is at 25900.

Always do your analysis before taking any trade.

Nifty - Weekly review Feb 2 to Feb 6The price has broken the ascending channel and fall towards the important support 24500 today during the budget. This volatile movement range, 24580 to 25300, will attract both buyers and sellers in the coming days.

As per the daily chart, we can see a clear rejection from the 25300 zone.

24460 - 24500 is the next important support level.

The important levels to look for trading opportunities are 24500, 24700, 24900, 25000 and 25300.

At these levels, how the price reacts will decide the trend direction.

If the price opens flat, buy above 24860 with the stop loss of 24780 for the targets 24900, 24960, 25000, 25060, 25120 and 25200.

Sell below 24680 with the stop loss of 24740 for the targets 24640, 24600, 24540, 24500, 24460, 24400 and 24320.

Expecting audcad sell delivery for buy setupsBetween these two red lines inside weekly+daily imb, the set-up could be find for buys

Why? Price already taken the liquidity above and it possible scenario

shows the probability

of retracement ( where structure shift indicates sellside delivery,

however buys will be

more safer approach fundamentally

and technically both .

Fundamental reason : aud have strong

intrest rate i.e (3.6%)

whereas CAD indicates 2.25%

And Technically it's bullish orderflow .🤝

KAYNES above 3427 – Breakout or Pullback?KAYNES Technology India has strong long-term earnings growth and good profit and revenue growth over recent years, supported by expanding electronics & EMS market trends.

The stock trades with a relatively high P/E but is backed by a firm order book and industry relevance.

Despite recent volatility and technical sell signals, some brokerages maintain positive long-term growth outlooks, and key quarterly results are due soon.

The stock has bounced off the recent low near 3300 after forming a double bottom, and is now approaching a historically important resistance zone at 3517–3568. Price action around this area will likely define the next directional move.

Bearish Scenario:

If KAYNES gets rejected at 3517–3568 and fails to hold, we could see a pullback toward 3427 — an important psychological and short-term support level, and the closest invalidation point for the bulls. If trades further down below 3427 then next target 3335

Bullish Scenario:

If price breaks above and sustains above 3568, that could unlock further upside with a target around 3690.

3427 will be a major pivot, bulls are likely to defend it strongly, and a clean break below with follow through selling would confirm bearish strength.

I am not sebi registered financial advisor.

NIFTY trapped between two magnets - A flat Kijun & flat Senkou BNIFTY's daily chart price action is stuck between two magnetic levels that tend to attract price towards them - A flat Kijun & a flat Senkou B. Which magnet is more powerful? With union budget round the corner, expecting one of the level to play out very soon

This analysis is for educational purposes only

Part 2 Technical Vs. Institutional Option Trading Types of Option Trading: Calls and Puts- Call Option:

- Gives buyer the right to BUY the underlying asset.

- Buyer expects price to RISE.

- Example: Buy Nifty Call at 22,000 strike, profit if Nifty goes above 22,000 + premium paid.

- Put Option:

- Gives buyer the right to SELL the underlying asset.

- Buyer expects price to FALL.

- Example: Buy Nifty Put at 22,000 strike, profit if Nifty goes below 22,000 - premium paid

NIFTY KEY LEVELS FOR 01.02.2026 BUDJET DAY SPLNIFTY KEY LEVELS FOR 01.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Budget day Nifty Strategy for Feb 01, 2026Wrap up:-

After hitting of Trailing Sl in wave 3 counts have been changed and internal wave 2 of major wave 2 is still pending because Nifty has made 1-2 and internal 1-2 for a impulsive move of wave c of b of y of 4. Now, wave 3 is about to start and also, breakout will be confirmed once nifty breaks 25475.

What I’m Watching for Feb 01, 2026 🔍

Sell Nifty @25315 sl 25458 for a target of 25131-25075.

Buy Nifty @25131-25075 sl 24919 for a target of 25613-25710.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

[SeoVereign] BITCOIN BULLISH Outlook – January 31, 2025Bitcoin is currently deciding its next move around the recent daily low of 80,700 USDT.

At this point, there are three main scenarios that could unfold for Bitcoin. First, it does not break below 80,700 USDT and continues to rise. Second, it breaks below 80,700 USDT but forms a whipsaw movement, fully recovers the decline, and reverses upward. Third, it breaks below 80,700 USDT and leads to a major decline.

Since we are traders, we must determine which of these three scenarios will prove to be correct.

It would be ideal if we could clearly choose one of the three options above. However, a market perspective is rarely something that can be decisively concluded in a black-or-white manner.

Therefore, rather than selecting one of the three scenarios, I will describe my subjective view in a narrative form.

First, I believe that in the short term, Bitcoin could rise without breaking below 80,700 USDT. However, if that happens, I do not expect the upward trend to last very long.

The reason is that historically, when Bitcoin transitions from a major downtrend to an uptrend, it has often broken below the previous low through a whipsaw to stop out long positions before reversing.

This may differ in smaller trends, but in larger timeframes, a double bottom without a whipsaw (where the right bottom is higher than the left) has, in my experience and research, rarely resulted in a meaningful major trend reversal.

Therefore, if the price rises immediately from the current level, I plan to take profits relatively quickly, as indicated on the chart.

On the other hand, if Bitcoin breaks below 80,700 USDT, two possibilities emerge. It could form a whipsaw and then transition into a major bull trend, or it could enter what many would call a “season-ending” level of significant decline. Which of these becomes reality can only be determined by observing the chart structure after some time has passed following the actual breakdown below 80,700 USDT.

Predicting the distant future in advance may be possible for some, but I consider it nearly impossible.

That is why, even though I predicted a rise in my previous idea and currently hold a long position, I did not allocate a large size. Compared to my usual trades, the position is very small, because my level of conviction was not high before placing the bet.

Although it is still early 2026, this moment could turn out to be the most difficult trading environment to predict this year. As I always say, everything is hardest at the beginning. Investing is the same. Capturing the initial turning point from decline to rise is extremely difficult and painful. However, once this phase passes and the next trend forms, reading the market becomes much easier.

The reason I maintain a high win rate is that I do not rashly predict the distant future. If you wait, there are often moments when the chart provides clues about the next move. I simply wait until then. The longer you wait, the more evidence accumulates, and predicting the next move becomes significantly easier.

If Bitcoin breaks below 80,700 USDT, I will update my view in this idea or share a new post.

Another point I would like to mention is that significant movements are occurring across the broader market.

If a book is ever written about the history of silver, January 31 may be recorded as one of its historic days. As of now, silver is showing a drop of over 20% in a single day. Alongside the U.S. market, the commodities market is experiencing enormous volatility. While the exact cause requires further research, what is certain is that asset “rebalancing” is taking place.

For some time, crypto has been thoroughly neglected by the market. While other assets continued their rallies, crypto alone remained in decline. The reason is simple. The crypto market lacked attractiveness, and capital did not flow into it. However, crypto is now at relatively low price levels, while other assets are forming price ranges near their highs.

I believe there is a high probability that funds liquidated from assets positioned at high levels will eventually flow into the crypto market. If crypto continues to decline, it may mean that investors are temporarily holding that capital on the sidelines. In other words, commodities are likely to show weakness or move sideways, while crypto is likely to show strength or move sideways.

Even I am currently holding a substantial amount of cash while waiting for opportunities to increase my spot crypto allocation.

As mentioned in this post, crypto’s direction will soon be determined. When that moment comes, I will decide whether to purchase spot or wait a little longer.

In summary, in the short term, I plan to accumulate long exposure based on this idea. The size of the position will be adjusted over time as the market becomes clearer. For now, since information is limited and multiple directions remain open, I am buying only a small amount. Technically, I am basing this on the Shark Pattern, and from a macro perspective, on the market rebalancing discussed above.

Accordingly, I have set a short-term target around 89,308 USDT.

If the movement becomes clearer or the analysis requires updating, I will add to this post or return with a new one.

Thank you for reading.

Part 1 Intraday Institutional Trading Who Should Trade Options?

People who:

- Understand options and risks.

- Have experience trading stocks/derivatives.

- Want to hedge existing positions.

- Are comfortable with potential losses.

Not suitable for:

- Beginners without knowledge.

- Risk-averse investors.

PAGEIND M PATTREN BREAKDOWN 31 01 2026📈 1) Pageind Pattern Structure: M-Pattern / Double Top

An M-Pattern (Double Top) is a bearish reversal pattern with the following components:

Left Top → Right Top ≈ equal highs

Neckline → horizontal support connecting the swing lows between tops

Breakdown → close below the neckline confirms the pattern

CHART LINES :

🔴 Double Top Peak (Both Tops): ~50500

🟢 Neckline / Base Low: ~34000

Support Line : ~17600

👉 This creates a classic M-Pattern.

2) Price Projection (Measured Move)

Calculation: Percentage Move from Neckline to Bottom Target

Top: 50,500

Neckline: 34,000

The distance from Top to Neckline is: 50,500 − 34,000 = 16,500

Measured from the neckline downward, the target projection is:

34,000−16,500=17,500

Your next major support is ~17,600, which is almost exactly the measured move target.

Now, calculate the % move from Neckline (34,000) to Target in downside (17,600):

34,000−17,600

So:

✅ Projected target from neckline to support ~17,600 ⇒ ~48% decline

📊 3) Daily Breakdown Confirmation

I noted that the last two days have broken down below the neckline:

A close below neckline signals a confirmed breakdown

USDCHF 1W T/F ANALYSIS---

USDCHF 1w t/f analysis----

📊 Market Structure Explanation (usdchf – 1w):-

Centeral structure are a vibrancy (Explanation of Vibrancy structure > this structure are first volume contraction and bended both side also then empulsive move and break it`s self ) \

now this condition breakdown it`s self so we can measure structure of previous marked supply and past on breakdown of top candle so now we have a clear down side direction and we have a buyesh for sell side now we can go with sell side on lower t/f on every retesting :-

Updated Nifty Analysis for Feb 01, 2026Wrap up:-

Trailing Sl in wave 3 has been hit and now, Nifty has made wave 1 at 25435 and in wave 2 nifty has been making abc correction of which a is completed at 24932, b at 25458 and now, wave c is in progress.

What I’m Watching for Feb 01, 2026 🔍

Buy Nifty only above 25386 for a target of 25613-25710 -25818-25937.

Sell Nifty below 25270 sl 25370 for a target of 24954-24920.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

Hindustan Copper Limited - Breakout Setup, Move is ON...#HINDCOPPER trading above Resistance of 602

Next Resistance is at 896

Support is at 458

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

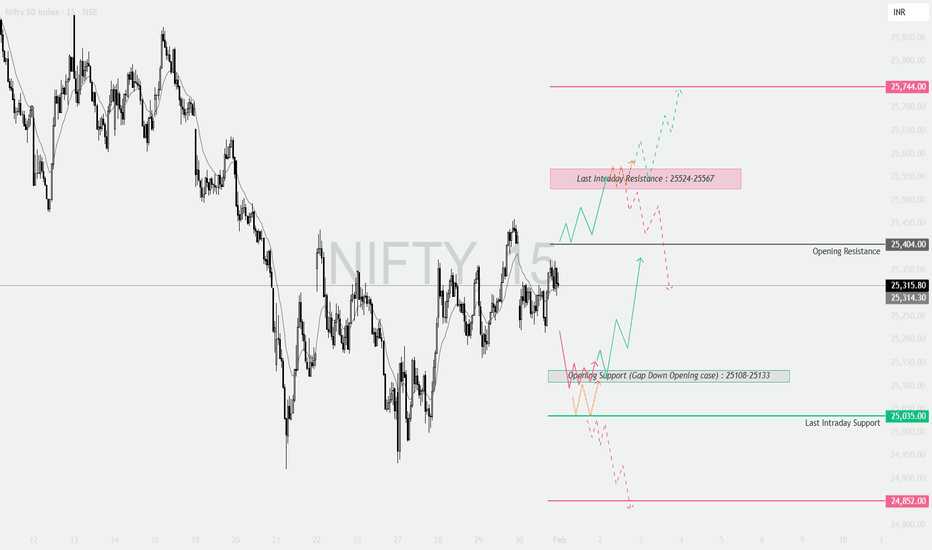

NIFTY : Detailed trading plan for 01-Feb-2026📘 NIFTY Trading Plan – 1 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | For Educational Purpose)

🔑 Key Levels to Track

🔹 25,744 – Higher Timeframe Resistance

🔹 25,524 – 25,567 – Last Intraday Resistance Zone

🔹 25,404 – Opening Resistance

🔹 25,108 – 25,133 – Opening Support (Gap-Down Case)

🔹 25,035 – Last Intraday Support

🔹 24,852 – Major Breakdown Support

🧠 Market Structure & Psychology

NIFTY is currently in a short-term recovery phase after a sharp sell-off, forming a base near lower supports.

However, price is now approaching important supply zones, where sellers may again become active.

👉 Direction for the day will depend on how price reacts near opening levels, not on predictions.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,420)

🧠 Psychology

A big gap up usually reflects short covering + overnight optimism, but higher zones still hold unfilled selling pressure.

🟢 Bullish Plan

🔵 If price sustains above 25,404 on a 15-min close

🔵 Expect move towards 25,524 – 25,567

🔵 Further strength can extend towards 25,744

🔴 Caution Zone

🔴 Rejection near 25,524 – 25,567

🔴 Indicates supply → Expect pullback or consolidation

📌 Why this works

Institutions sell into resistance. Acceptance above resistance confirms real demand, not emotional buying.

➖ Scenario 2: FLAT Opening

(Opening between 25,280 – 25,380)

🧠 Psychology

Flat opens show indecision. Market usually expands after liquidity grab on either side.

🟢 Upside Plan

🔵 Hold above 25,404 → Bias turns bullish

🔵 Targets: 25,524 → 25,567

🔴 Downside Plan

🔴 Breakdown below 25,315 – 25,300

🔴 Weakness towards 25,133 → 25,035

📌 Why this works

Flat opens reward patience. Direction becomes clear only after range expansion.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,133)

🧠 Psychology

Gap down creates panic selling, but strong supports attract smart money buyers.

🟢 Bounce Setup

🔵 If 25,108 – 25,133 zone holds

🔵 Expect pullback towards 25,315 → 25,404

🔴 Breakdown Setup

🔴 Clean break below 25,035

🔴 Downside opens till 24,852

📌 Why this works

Supports fail only when demand dries up. Breakdown confirms sellers are in full control.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer option spreads near resistance/support

🟢 Avoid aggressive buying in high IV zones

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next logical level

🟢 No revenge trades ❌ Discipline first

🧾 Summary & Conclusion

📌 Market is at a decision-making zone

📌 25,404 & 25,133 are the most important intraday levels

📌 Trade reaction at levels, not assumptions

📌 Confirmation + Risk control = consistency 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trade.

Market investments are subject to risk.

Advanced Technical Analysis: A Comprehensive Guide1. Principles of Advanced Technical Analysis

At its core, technical analysis is based on three main principles:

Price Discounts Everything: All information — news, fundamentals, market sentiment — is reflected in the price. Advanced TA accepts this as a foundation, emphasizing price action over external factors.

Price Moves in Trends: Markets trend in three ways — uptrend, downtrend, and sideways. Advanced analysis focuses on identifying the start and end of these trends with precision using sophisticated tools.

History Repeats Itself: Patterns, behaviors, and psychology tend to repeat due to human nature. Advanced TA uses pattern recognition and statistical methods to capitalize on these repetitive behaviors.

Advanced TA combines these principles with quantitative methods and behavioral insights to increase accuracy.

2. Advanced Chart Patterns

While basic patterns include head and shoulders, double tops, and triangles, advanced patterns are more nuanced:

Harmonic Patterns: These patterns, like the Gartley, Butterfly, Bat, and Crab, use Fibonacci ratios to identify precise reversal zones. Unlike basic patterns, harmonic patterns offer a mathematically-defined framework for entry and exit.

Elliott Wave Theory: Developed by Ralph Nelson Elliott, this theory identifies recurring waves in price movement — impulsive (trend-following) and corrective (counter-trend) waves. Advanced traders use Elliott Wave to forecast multi-timeframe trends and market cycles.

Market Profile: This tool analyzes the distribution of traded volume at different price levels to identify value areas, points of control, and price acceptance zones. Market Profile is highly useful for intraday and institutional trading strategies.

3. Advanced Technical Indicators

Beyond moving averages and RSI, advanced traders rely on more sophisticated indicators:

Ichimoku Kinko Hyo: Often called the “one-glance indicator,” it provides support, resistance, trend direction, and momentum in one chart. The Kumo (cloud) identifies trend strength and potential reversals.

Fibonacci Extensions & Retracements: Advanced traders use Fibonacci levels not just for retracements, but for projecting price targets and stop-loss levels. Confluences with other indicators improve accuracy.

MACD with Histogram Divergence: While the basic MACD identifies trend and momentum, analyzing divergences between MACD and price uncovers early reversal signals.

Volume-based Indicators: Tools like On-Balance Volume (OBV), Chaikin Money Flow (CMF), and Volume Price Trend (VPT) help identify accumulation or distribution phases, indicating potential breakouts or breakdowns.

Adaptive Indicators: Indicators like Adaptive Moving Average (AMA) and Kaufman’s Efficiency Ratio adjust to market volatility, providing a more responsive approach than static indicators.

4. Multi-Timeframe Analysis

Advanced traders rarely rely on a single timeframe. Multi-timeframe analysis involves examining multiple chart intervals — from monthly to intraday — to identify trends and align trades with higher-probability setups. Key principles include:

Top-Down Approach: Start with a higher timeframe to identify the major trend, then use lower timeframes to refine entries and exits.

Timeframe Confluence: Trades are stronger when multiple timeframes agree on trend direction, support/resistance, and momentum.

Fractal Patterns: Price movements repeat across timeframes, allowing traders to anticipate behavior in smaller or larger scales using fractal analysis.

5. Advanced Price Action Techniques

Price action analysis is the study of raw price behavior without relying heavily on indicators. Advanced techniques include:

Order Flow Analysis: Examining the flow of buy and sell orders in real-time markets to understand institutional activity and anticipate price moves.

Candlestick Confluence: Combining multiple candlestick patterns across higher and lower timeframes to validate reversals or continuation signals.

Support/Resistance with Precision: Using historical highs/lows, pivot points, Fibonacci levels, and volume clusters to identify high-probability zones for entries and exits.

Trend Exhaustion Signals: Recognizing signs of overextension, like long wicks, shrinking volume, or divergence in oscillators, to anticipate reversals.

6. Quantitative and Statistical Methods

Professional technical analysis increasingly incorporates quantitative methods:

Statistical Indicators: Bollinger Bands, Standard Deviation Channels, and Keltner Channels help identify volatility, mean reversion, and breakout points.

Correlation Analysis: Examining how assets or indices move in relation to each other to hedge or amplify trades.

Backtesting and Algorithmic Validation: Advanced traders validate strategies using historical data, Monte Carlo simulations, and statistical models to measure risk and probability of success.

7. Risk Management and Trade Psychology

Advanced technical analysis is incomplete without rigorous risk management:

Position Sizing: Using volatility, ATR, or percentage-based methods to determine trade size.

Stop-Loss Placement: Placing stops beyond key support/resistance, volatility levels, or pattern invalidation points.

Reward-to-Risk Optimization: Targeting trades with at least a 2:1 or 3:1 reward-to-risk ratio ensures long-term profitability.

Psychological Discipline: Advanced traders maintain emotional control, avoid overtrading, and adhere strictly to plan-based trading.

8. Integration with Fundamental and Sentiment Analysis

Though TA focuses on price, advanced practitioners often combine it with fundamental and sentiment insights:

Macro Events: Interest rates, earnings, or geopolitical developments can amplify technical setups.

Market Sentiment Indicators: Commitment of Traders (COT) reports, VIX index, and news sentiment can provide context to technical signals.

Confluence Approach: Trades with alignment between technical setups, fundamental catalysts, and market sentiment tend to have the highest probability.

9. Algorithmic and Machine Learning Approaches

Modern advanced technical analysis increasingly incorporates algorithmic trading and AI:

Pattern Recognition AI: Machine learning models can detect complex chart patterns faster and more accurately than humans.

Predictive Analytics: Using historical price, volume, and alternative data to predict probabilities of trend continuation or reversal.

Automated Execution: Advanced traders often use bots and automated scripts to execute trades when conditions are met, reducing emotional bias and ensuring precision.

10. Key Takeaways

Advanced technical analysis is more than chart reading; it is an integrated science of price, volume, momentum, and psychology. Key principles for mastery include:

Understanding multi-timeframe trends.

Combining advanced indicators, harmonic patterns, and Elliott Wave.

Using quantitative validation and backtesting for strategy reliability.

Integrating price action with institutional order flow and sentiment data.

Implementing strict risk management and psychological discipline.

By combining these tools, techniques, and analytical frameworks, traders can increase the probability of success, adapt to changing market conditions, and make informed decisions beyond simple guesswork. Advanced technical analysis is not about finding “guaranteed” trades but about stacking probabilities in your favor.

Ashok Leyland Ltd - Breakout Setup, Move is ON...#ASHOKLEY trading above Resistance of 192

Next Resistance is at 289

Support is at 141

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Nifty Metal - Breakout Setup, Move is ON...#CNXMETAL trading above Resistance of 11523

Next Resistance is at 15060

Support is at 9968

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where index may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

NIFTY- Intraday Levels - 1st Feb 2026 special trading sessionspecial trading session for budget day.

If NIFTY sustain above 25437/67 then above this bullish then 25527/42 then 25584/95 or 25617 above this more bullish then 25650/71/77/92 or 25716 above this wait more levels marked on chart

If NIFTY sustain below 25256/26 below this bearish then around 25166/51 then 25076/16/11/01 or 24987 below this more bearish below this wait more levels marked on chart

My view :-

"My viewpoint, offered purely for analytical consideration, The trading thesis is: expect both side movements.

This analysis is highly speculative and is not guaranteed to be accurate; therefore, the implementation of stringent risk controls is non-negotiable for mitigating trade risk."

Consider some buffer points in above levels.

Please do your due diligence before trading or investment.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.