HDFCBANK 1d investment levelKey Support (Buy-on-Dip) Levels

(Where buyers tend to show up)

₹1,985 – ₹1,986 (S1 – Classic Pivot)

First support zone based on classic pivot calculations

₹1,973 – ₹1,974 (S2 – Fibonacci Pivot)

Stronger cushion in case of deeper pullbacks

₹1,954 – ₹1,955 (S3 – Classic Pivot)

Final buffer zone—breaking it may signal deeper weakness

🚧 Key Resistance (Profit-Taking) Levels

(Where selling might appear)

₹2,015 – ₹2,016 (R1 – Classic/Fibonacci Pivot)

Immediate resistance and possible profit-booking zone

₹2,033 – ₹2,034 (R2 – Classic/Fibonacci Pivot)

Next hurdle; be prepared to take partial profits

₹2,045 (R3 – Classic Pivot)

A stronger resistance zone; breaking it could signal fresh upside

🎯 Action Tips

Buying: Enter around ₹1,985, and add at ₹1,973 if dip deepens. Use ₹1,954 as a stop-loss trigger.

Selling (Profit Booking): Trim part of your position near ₹2,015, and more near ₹2,033–₹2,045 if momentum slows.

Breakout Strategy: A clean daily close above ₹2,045 with volume may trigger fresh upside moves.

Risk Control: If price dives below ₹1,954, re-evaluate—broader market risk may be rising.

🧠 Why These Levels Matter

Pivot levels are watched closely by traders and algorithms, making them natural turning points in daily price action

HDFC Bank’s technical signals are currently neutral to slightly bearish, making dip-buying near supports more advantageous than chasing highs .

✅ Final Word (Plain Language)

Look to buy dips in the ₹1,985–1,974 range with a tight stop below ₹1,954.

Take profits around ₹2,015 and ₹2,033–₹2,045 based on your risk appetite.

Watch closely above ₹2,045—that’s your breakout level for potential new highs

M-forex

BANKNIFTY 1D TimeframeCurrent Context

The index is trading near 56,900 – 57,000. Overbought signals have appeared but the overall trend remains bullish to neutral

🔄 Classic Pivot Points for Bank Nifty (Today)

Level Value Description

R1 57,323.5 First resistance—sell/reduce on strength

Pivot 57,180.7 Central bias: above = bullish, below = cautious

S1 57,070.75 First support—gentle dip-buy zone

S2 56,927.95 Deeper support—stronger buy zone

S3 56,818 Last buffer before bearish risk increases

🛡️ Support Zones (Where Buyers Typically Step In)

₹57,070 – ₹57,080 (S1): Good for light entries on dips

₹56,930 – ₹56,940 (S2): Solid zone to add more

₹56,818 (S3): Final defense—watch carefully for breakdown risk

🚧 Resistance Levels (Where Profit Booking May Kick In)

₹57,323 (R1): Near-term ceiling—consider booking profit

Above ₹57,323 with follow-through: Momentum may push toward R2 (~57,600–57,700)

🎯 Simple Strategy Guide

✅ If You’re Holding:

Stay invested while above 57,070.

Consider trimming near 57,320–57,400, especially if signs of overbought persist.

🟢 Looking to Buy the Dip?

Start buying at dips to 57,070–57,080 (S1).

Add more near 56,930–56,940 (S2) if momentum stays healthy.

🔵 Breakout Play:

A clean close above 57,323 with volume could open momentum to 57,600–57,700.

You can add post-breakout with confidence.

🛑 Risk Control:

If Bank Nifty closes below 56,818 (S3), reel in exposure—market direction may turn uncertain.

🧭 Quick Snapshot

Support: 57,070 → 56,930 → 56,818

Resistance: 57,323 → 57,600+ on breakout

Action Zones:

Buy zones: 57,070 / 56,930

Book profits: ~57,323

Add on breakout: above 57,323

🧠 Why Use These Levels?

Pivot-based zones are widely used by traders and algos, acting as natural turning points in daily price action

. Combining them with observed overbought conditions gives you a structured approach: buy smart, book gains, and manage risk effectively.

NIFTY 1D TimeframeToday’s Pivot Levels & Zones

(Data sourced from Moneycontrol – based on previous day’s trading range)

Level Type Price (₹)

Pivot Point 25,196

Resistance 1 (R1) 25,271

Resistance 2 (R2) 25,330

Resistance 3 (R3) 25,405

Support 1 (S1) 25,137

Support 2 (S2) 25,062

Support 3 (S3) 25,003

🛡️ Support Levels (Potential Buy Zones)

₹25,137 (S1) – The first support level where buying interest usually emerges during mild pullbacks.

₹25,062 (S2) – A deeper support and safer buying zone if the dip extends.

₹25,003 (S3) – Significant support; break below this may signal deeper correction.

🚧 Resistance Levels (Exit or Caution Zones)

₹25,271 (R1) – Immediate ceiling where profit-taking could occur.

₹25,330 (R2) – Next hurdle; a daily close above this could spark a bullish breakout.

₹25,405 (R3) – Major resistance; a strong move past this would pave the way for higher targets.

✅ How to Trade or Invest Based on These Levels

🔹 If You’re Already Holding

Stay invested while Nifty trades above ₹25,062 (S2).

Consider trimming positions around ₹25,271–25,330 on strength.

🟢 Looking to Buy on Dips?

Enter in tranches at S1 ₹25,137, and add more at S2 ₹25,062.

If Nifty drops toward S3 ₹25,003, you can accumulate more conservatively.

🔵 Planning for a Breakout?

A clean daily close above R2 (₹25,330) can be a signal to add strongly.

Post-breakout, the next target is R3 at ₹25,405.

🛑 Risk Management

If Nifty falls below ₹25,003 (S3), consider reducing exposure—trend bias may shift downward.

🎯 Quick Strategy Summary

Buy Zones: ₹25,137 → ₹25,062

Profit Zones: ₹25,271 → ₹25,330

Breakout Target: Clear above ₹25,330 → aim for ₹25,405

Watch-Out Level: Break below ₹25,003 → trend at risk

SENSEX 1D TimeframeCalculated Pivot Levels for Today

Classic Pivots:

Resistance 1 (R1): 82,831.8

Resistance 2 (R2): 83,029.2

Resistance 3 (R3): 83,273.7

Pivot Point (PP): 82,587.4

Support 1 (S1): 82,390.0

Support 2 (S2): 82,145.6

Support 3 (S3): 81,948.2

Fibonacci Pivots:

R1: 82,756.2

R2: 82,860.4

R3: 83,029.2

PP: 82,587.4

S1: 82,418.6

S2: 82,314.4

S3: 82,145.6

Camarilla Pivots:

R1: 82,675.0

R2: 82,715.5

R3: 82,756.0

PP: 82,587.4

S1: 82,594.0

S2: 82,553.5

S3: 82,513.0

📊 Why These Levels Matter

Pivot Point (PP) is the central reference — if Sensex trades above it, bias is bullish; below → bearish

Support Levels (S1–S3): potential zones to buy on dips.

Resistance Levels (R1–R3): profit-booking zones or areas where upside may pause.

🧭 How to Use This Today

✅ Trade Ideas

If Sensex stays above 82,587, the trend is positive — look to hold or buy dips.

Ideal dip buys:

Around 82,390–82,400 (S1) for gentle pullbacks.

82,145–82,150 (S2) for deeper retracement buyers.

🚀 Upside Strategy

Consider booking partial gains near 82,831–83,029 (R1–R2).

On breakout above 83,029, next target is 83,273–83,300 (R3).

🛑 Risk Control

If Sensex closes below 81,948 (S3), broader market risk rises — consider reducing exposure

Key Takeaway (Simple Terms)

Above 82,587? Trend remains upbeat — look for dip-buying opportunities.

Between S1 and PP (82,390–82,587)? Good entry zone for cautious buying.

Between R1 and R2 (82,831–83,029)? A likely profit-taking region—watch closely.

Breakouts above 83,029? Potential for new highs (up to R3).

Drop below S3 (81,948)? Consider tightening risk—market may shift downward

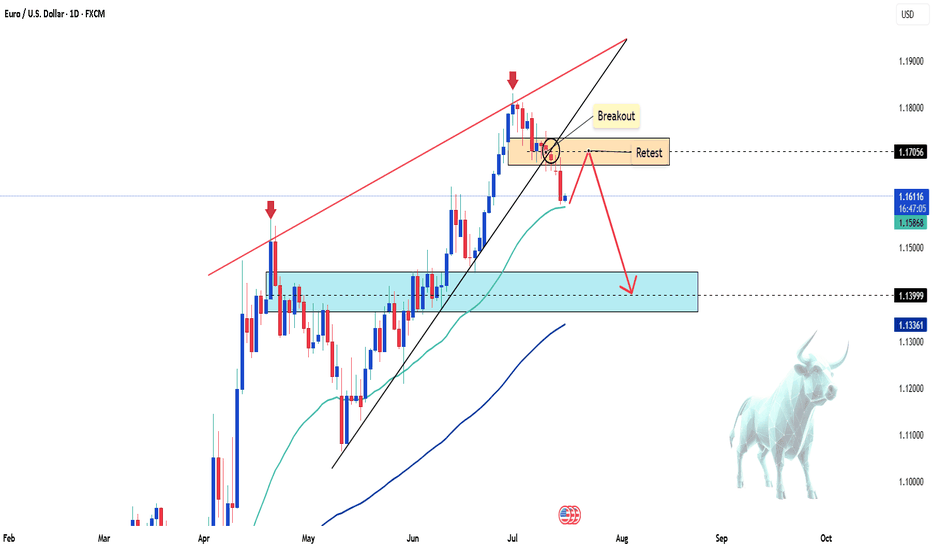

Euro Slips Further as Safe-Haven Demand for USD GrowsThe EUR/USD pair is facing strong selling pressure as global financial markets continue to reel from geopolitical and trade-related tensions. The Euro is weakening as investors increasingly turn to the U.S. Dollar as a safe haven, following a series of aggressive tariff policies announced by the United States.

Adding to the Euro’s struggles is the lack of positive economic data from the Eurozone, which has further diminished hopes for a meaningful recovery. Traders are now closely watching for monetary policy signals from both the ECB and the Federal Reserve, but so far, the bearish trend remains firmly in place.

On the technical front, EUR/USD continues to move within a descending channel, while the bearish crossover of the EMA 34 and 89 keeps sellers in control. With risk sentiment leaning defensive and capital flowing toward safe-haven assets, the pair may see further downside unless surprise bullish catalysts emerge from upcoming data or central bank remarks.

BTCUSDT – Breakout confirmed, bullish momentum continuesBTCUSDT has officially broken above a long-standing resistance channel, confirming a breakout and establishing a base around the nearest Fair Value Gap. The price action maintains a clear uptrend structure with consecutive higher lows and higher highs, supported by consistent buying pressure after minor pullbacks.

In terms of news, the U.S. decision to temporarily delay stricter regulations on spot Bitcoin ETFs, along with stable interest rate signals from the Fed, has boosted market sentiment. Capital continues to flow into crypto, especially as altcoins show limited recovery, making BTC the preferred asset.

As long as BTCUSDT holds above the nearest support zone, the pair is likely to advance toward the next psychological resistance. Any pullbacks could offer a buy-on-dip opportunity in line with the current trend.

EUR/USD Under Pressure: Will the Downtrend Continue?The EUR/USD exchange rate remains under pressure today, fluctuating below the 1.1700 level as the U.S. dollar gains strength following President Trump's announcement of new tariff letters directed at his two largest trade partners, boosting demand for safe-haven assets.

The downtrend may be further reinforced in the near term, if not in the short run. On the chart, a wedge pattern is forming, and breaking this pattern could add fresh momentum to EUR/USD.

Do you agree with my view?

Leave your comments below and don’t forget to like the post for extra luck!

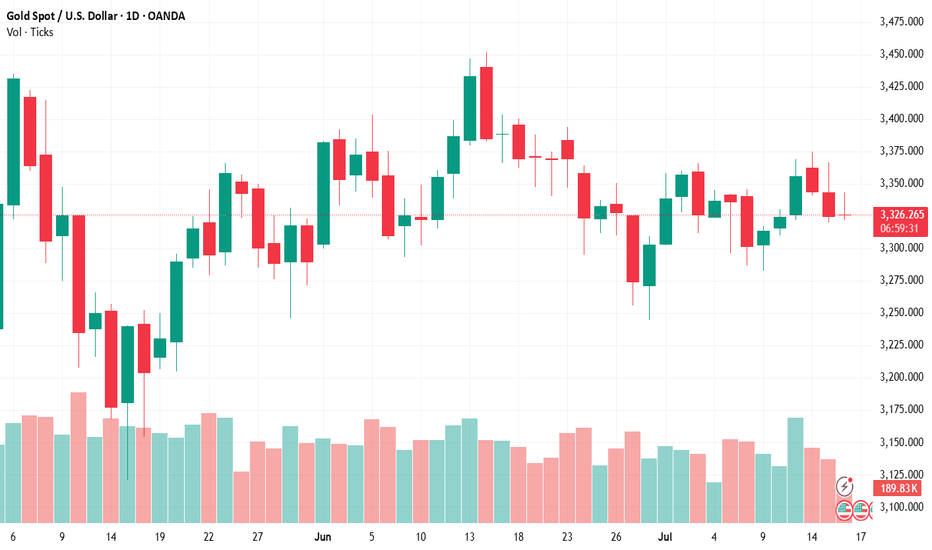

Gold XAUUSD Trading Strategy on July 16, 2025Gold XAUUSD Trading Strategy on July 16, 2025:

Yesterday's trading session was in line with our prediction, the gold price corrected strongly after meeting the resistance zone of 336x. However, the support zone of 333x did not help the gold price continue to maintain the sideway range.

Basic news: The US CPI reached 2.7%, higher than the forecast of 0.1% and higher than the previous 0.3%; positively affecting the USD, helping the gold price to decrease sharply.

Technical analysis: Currently, the gold price has broken the sideway range of 3335 - 3375 and is likely to compress in the 3300 area. RSI of the H1, H4 and D1 time frames are moving towards the buying zone. This could be a good long-term trading opportunity for us.

Important price zones today: 3338 - 3343, 3350 - 3355 and 3300 - 3305.

Today's trading trend: SELL (BUY hold).

Recommended orders:

Plan 1: SELL XAUUSD zone 3341 - 3343

SL 3346

TP 3338 - 3328 - 3318 - 3308.

Plan 2: SELL XAUUSD zone 3353 - 3355

SL 3358

TP 3350 - 3340 - 3330 - 3300.

Plan 3: BUY XAUUSD zone 3300 - 3302

SL 3297

TP 3305 - 3315 - 3335 - 3350 - Open (small volume).

Wish you a safe, favorable and profitable trading day.🌟🌟🌟🌟🌟

Tech & Digital Transformation (AI, Automation, EV)Introduction

We live in a time where machines can think, cars can drive themselves, and businesses are run by algorithms and automation. This isn’t a sci-fi movie — it’s happening now.

In 2025, the technology and digital transformation wave is in full swing in India. From Artificial Intelligence (AI) to robotic automation, and from electric vehicles (EVs) to cloud-based services, industries across the board are being reshaped.

This isn’t just about fancy tech buzzwords. It’s about:

Creating new businesses

Changing how old industries operate

Giving rise to new investment and trading opportunities

Let’s break down this major trend in a way that’s simple, clear, and real — so whether you’re a trader, investor, student, or entrepreneur, you’ll understand exactly what’s going on and how you can benefit.

🔍 What Is Digital Transformation?

Digital Transformation means using technology to make businesses smarter, faster, and more efficient.

For example:

A factory installs sensors and AI software to reduce waste

A hospital uses AI to detect diseases faster

A cab company replaces petrol cars with electric vehicles and uses an app to manage rides

It’s not just about using computers — it’s about rethinking how we do things using modern technology.

🚀 What’s Driving the Tech Transformation in 2025?

Let’s look at what’s fueling this massive shift:

✅ 1. Government Support & Policies

India’s government is pushing hard for:

AI adoption in governance, education, and healthcare

EV ecosystem with PLI schemes, subsidies, and charging infra

Digital India 2.0 for internet access, 5G, and digital services

This strong policy backing is giving tech companies the freedom to scale quickly.

✅ 2. Rise of Young Tech-Savvy Population

India has over 700 million internet users and a median age of 29. That means:

More digital consumption

More startups building tech products

More users adopting AI, EVs, and online services

✅ 3. Global Tech Trends Are Local Now

AI models like ChatGPT, MidJourney, and Copilot are being used in:

Schools

Small businesses

Customer service

Indian firms are localizing this tech — using it for regional languages, agriculture, finance, etc.

✅ 4. Corporate India Is Adopting Automation

From TCS to Tata Steel, companies are:

Automating HR, finance, supply chains

Using AI for predictive maintenance and demand forecasting

Adopting cloud computing for scale and security

This saves time, reduces cost, and improves profits — which markets love.

🧠 Let’s Dive Into 3 Key Areas

1️⃣ Artificial Intelligence (AI)

💡 What is AI?

AI is when machines are programmed to “think” like humans — they learn from data and make smart decisions.

Examples:

Google Maps finding fastest routes

YouTube recommending videos

Chatbots answering your bank queries

Indian AI Stocks to Watch

Tata Elxsi – AI in automotive, healthcare, media

Persistent Systems – AI in BFSI and digital transformation

Happiest Minds – AI-powered automation, analytics

LTTS (L&T Tech) – AI in industrial automation

Cyient DLM – Smart systems for defence and manufacturing

📈 Why AI Is a Hot Investment Theme

AI is not just a cost-saver — it creates entirely new business models

Global demand is exploding (even SMEs are adopting it)

India has rich data + cheap talent = AI leadership potential

2️⃣ Automation & Robotics

🤖 What is Automation?

Automation is when machines or software handle repetitive tasks without human help.

From factory robots to chatbots, automation is everywhere.

🏭 Where India Is Using Automation in 2025

Smart Factories: Robots assembling products, AI managing inventory

Warehousing: Amazon-style automated fulfillment

Banks: Robotic Process Automation (RPA) for account management, KYC

Transportation: Drones for delivery, automated traffic systems

🧑💼 Impact on Jobs & Skills

While some repetitive jobs may reduce, automation is creating new roles in:

Robotics management

AI training and supervision

Tech repair and integration

Data analytics

In short: Humans + Machines = Powerful combo

📊 Indian Automation Stocks to Watch

ABB India – Robotics & factory automation

Honeywell Automation – Process control tech

KPIT Tech – Automotive software automation

LTTS – Industrial and smart city automation

Tata Elxsi – Automation in EVs, healthcare, and rail

3️⃣ Electric Vehicles (EVs)

⚡ What are EVs?

EVs are vehicles powered by electric batteries instead of petrol/diesel.

They are:

Cleaner (no tailpipe emissions)

Cheaper to run (₹1/km vs ₹6/km for petrol)

Quieter and more efficient

🚗 Why India Is Going Electric in 2025

High petrol/diesel prices

Pollution control targets

Government incentives (FAME II, state subsidies)

Massive charging infra expansion

🏭 Companies Driving the EV Revolution

EV Manufacturers:

Tata Motors – India’s EV leader (Nexon EV, Tiago EV)

Mahindra & Mahindra – Born-EV architecture

Ola Electric – Two-wheelers and upcoming EV cars

Battery & Charging:

Exide Industries

Amara Raja Energy

Servotech Power

HBL Power Systems

Ancillary (parts, controllers, software):

Sona Comstar

Samvardhana Motherson

Electra EV (private)

📈 EV Investment Trend

Investors are eyeing battery tech, charging infra, and lightweight materials

Many EV stocks are already multi-baggers

PLI Scheme for battery storage and EV parts = big boost

📊 Performance Snapshot: Tech & Digital Leaders (Jan 2023 – July 2025)

Stock Jan 2023 Price July 2025 Price Approx. Gain

Tata Elxsi ₹6,500 ₹10,200 57%+

LTTS ₹3,800 ₹6,200 63%+

KPIT Tech ₹750 ₹1,560 108%+

Persistent Systems ₹4,000 ₹6,850 71%+

Servotech Power ₹45 ₹210+ 360%+

Tata Motors ₹400 ₹950+ 130%+

🧭 The Bigger Picture: Digital India 2.0

The Indian government is pushing:

5G/6G rollout

Smart city automation

AI in governance

Digital healthcare

Universal EV adoption by 2030

All of this means huge tailwinds for technology companies, startups, and R&D investments.

✅ Final Thoughts

The Tech & Digital Transformation theme in 2025 is not a bubble — it’s a fundamental shift in how India works, moves, learns, and grows.

AI is no longer future tech — it’s today’s business driver.

Automation is making Indian industries globally competitive.

EVs are no longer a dream — they’re on every city road.

This megatrend is not going away anytime soon. Whether you’re an investor, trader, or entrepreneur, now is the time to understand, explore, and ride the digital wave

Power & Utilities in 2025 Introduction: Why Power & Utilities Are Buzzing in 2025

Imagine running a growing city — there are electric buses on the roads, factories running 24/7, smart homes everywhere, and electric cars being charged in every neighborhood. Behind all of this is one invisible but powerful engine: electricity.

In 2025, India's power and utility sector is not just surviving — it is booming, evolving, and attracting massive investor interest. Whether it’s traditional power giants like NTPC or new-age energy plays like Tata Power and Servotech, this space is heating up because:

Power demand is at an all-time high

Government support is stronger than ever

Clean energy goals are transforming old players

The PLI scheme (Production Linked Incentive) is pushing domestic manufacturing

This is not just another sectoral rally — it's a structural shift. Let’s explore what’s driving this change and what it means for traders and investors in simple language.

🔌 What Is the Power & Utilities Sector?

The power and utilities sector includes companies that:

Generate electricity (thermal, hydro, solar, wind, nuclear)

Transmit and distribute it to homes, businesses, and factories

Make components like transformers, wires, batteries, solar modules

Operate infrastructure like smart grids, substations, power lines

These are the companies that light up India, literally.

Traditionally, this sector was slow-moving and PSU-dominated. But now, with renewables, EV charging, energy storage, and smart grids, it’s become a major growth story.

🌟 What’s Driving the Power Sector Boom in 2025?

Let’s break this into 6 easy-to-understand points:

✅ 1. Exploding Electricity Demand

India’s electricity demand is growing at 8–10% annually, faster than any major economy. Why?

Urbanization

More factories and data centers

EV charging needs

Heatwaves and air conditioners

Rural electrification

In short: More people + more machines = more electricity needed

✅ 2. Government Push for Renewable Energy

India is aiming for 500 GW of non-fossil fuel energy by 2030. This means huge support for:

Solar

Wind

Hydropower

Green hydrogen

Big players like NTPC, Adani Green, Tata Power, and ReNew Power are investing billions in clean energy. The budget also offers tax breaks, low-interest loans, and faster clearances.

✅ 3. PLI Scheme: Game-Changer for Power Equipment

PLI (Production Linked Incentive) is a government scheme that gives incentives to manufacturers based on their output.

In the power sector, PLI is being used for:

Solar panel/module manufacturing

Advanced battery storage

EV charging infrastructure

Smart meters and grid tech

This means companies making power equipment within India get rewarded — boosting domestic manufacturing and exports.

Examples of PLI Winners:

Tata Power Solar

Waaree Energies

Servotech Power

Amara Raja Energy

Exide Industries (battery PLI)

✅ 4. Modernization of Grid & Infrastructure

India’s power infrastructure is being upgraded and digitized.

Smart meters replacing old meters

Smart grids to manage load more efficiently

Underground cables, better transmission

PSUs like Power Grid Corporation, REC Ltd, and NHPC are leading this transformation. These upgrades improve efficiency, reduce loss, and bring more reliability.

✅ 5. EV Revolution = New Opportunity

Electric vehicles are the future. Every EV needs:

A charging station

Stable power supply

Smart grid support

So companies setting up EV charging infra (like Servotech, Tata Power, NTPC) are seeing new business models emerge. This link between mobility and energy is a major opportunity.

✅ 6. Private + PSU Partnership Model

Unlike the past, today’s power ecosystem sees collaboration between private players and PSUs. For example:

NTPC and Indian Oil working on hydrogen

Tata Power partnering with states for solar rooftops

Servotech tying up with PSUs for EV charging

This reduces risk, increases scale, and boosts trust for investors.How to Understand Different Power Stocks

🔌 Generation Stocks:

These companies produce electricity.

NTPC (thermal + renewable)

NHPC (hydropower)

SJVN (solar, hydro)

Adani Green (solar, wind)

⚡ Transmission & Distribution Stocks:

They carry electricity from plants to homes/factories.

Power Grid Corporation

Torrent Power

Tata Power

🔋 Equipment & Infra Stocks:

They make batteries, inverters, smart meters, charging stations

Servotech Power

Amara Raja Energy

Exide Industries

Hitachi Energy India

📈 Trading Strategies for Power Stocks

🛠️ For Swing Traders:

Watch for breakouts from consolidation patterns

Use indicators like volume + RSI divergence for entry

Example: Servotech consolidates for 3–5 days → breakout candle + high volume = entry

💼 For Long-Term Investors:

Pick companies with:

Consistent revenue/profit growth

Low debt

Green energy roadmap

SIP into leaders like NTPC, Tata Power, Power Grid

🔁 For Momentum Traders:

Use sector rotation charts (Nifty Energy Index)

Trade around policy news, budget updates, energy shortages, or global oil price moves

Outlook for 2025–2030

India’s power sector is not just about keeping lights on anymore. It’s about:

Powering a digital, electric, and green economy

Becoming a global energy exporter

Creating jobs and wealth through Make in India

Here’s what we can expect in coming years:

Massive growth in battery storage capacity

Rooftop solar + net metering in most cities

Hydrogen-based vehicles and fuel stations

India becoming a solar module export hub

In simple words: The power sector of tomorrow is smart, clean, connected — and investable.

✅ Final Thoughts

The Power & Utilities sector in 2025 is at a tipping point — supported by government policy, modern tech, global ESG demand, and rising consumption. It’s no longer “boring” or “slow.”

Whether it’s green energy leaders like Tata Power, efficient PSUs like NTPC, or disruptors like Servotech — this space is full of opportunity

IPO & SME Buzz📈 Why Are IPOs Booming in 2025?

Let’s understand what’s fuelling this mega wave:

✅ 1. Strong Market Sentiment

Both Nifty and Sensex are near all-time highs

Retail, FII, and mutual fund participation is rising

This bullishness is driving interest in new listings

✅ 2. Favorable Regulatory Environment

SEBI has streamlined IPO processes

Faster listing timelines (T+3 now), better SME disclosures

Attracting more genuine companies to go public

✅ 3. Retail Investor Explosion

Retail investors have grown from 4 crore to 12 crore+ in 3 years

Most IPOs are oversubscribed in the retail segment

Apps like Zerodha, Groww, Upstox have made IPO investing super easy

✅ 4. SMEs Want Capital + Visibility

SMEs are looking to raise capital for expansion, not just survival

Going public builds brand trust, creditworthiness, and long-term valuation

Also helps in professionalizing business operations

✅ 5. High Listing Gains = FOMO

Many IPOs (especially SME) are opening with 100%–500% premiums

This creates a rush — people apply hoping for quick profits

🚀 SME IPOs: The Real Game Changer

What is an SME IPO?

SME IPOs are for smaller companies (typically with ₹10–250 crore market cap), listed on:

NSE Emerge

BSE SME

These platforms are designed for high-growth businesses in manufacturing, IT, textiles, agriculture, infra, and other emerging sectors.

Why are SME IPOs buzzing?

Low valuation entries (IPO price ₹10–₹150 range)

Limited retail quota (35%) = quick oversubscription

Thin float (less available shares) = strong price movement

High retail interest, often driven by buzz on social media and brokers

Pros of SME IPOs:

Multibagger potential

Early entry into high-growth businesses

Often undervalued compared to mainboard peers

Cons of SME IPOs:

Low liquidity post-listing

Price volatility is high

Promoter quality needs deeper due diligence

Some may be “pump and dump” type plays

🧠 Should You Apply for IPOs?

Here’s how to decide whether an IPO is worth applying to:

🔍 Key Factors to Consider

Company Fundamentals

Revenue, profit trend, debt levels, ROE, margins

Business model — is it scalable?

Promoter Background

Are promoters credible? Any fraud history?

Prior experience and educational background

Valuation

Is it overvalued compared to listed peers?

Use P/E, P/B, EV/EBITDA ratios

IPO Objectives

Is the money being used for business growth?

Or just for promoter exit?

Grey Market Premium (GMP)

While unofficial, GMP shows listing expectations

Be cautious though — GMPs can be manipulated

🧾 How to Apply for an IPO (Step-by-Step)

🛠️ Through UPI-enabled Broker Apps (Zerodha, Groww, etc.)

Go to IPO section

Select IPO > Enter lot size (1 lot = 100 shares typically)

Enter UPI ID > Submit

Accept mandate in UPI app (PhonePe/Google Pay)

Wait for allotment (T+3 now, earlier T+6)

💡 Pro Tip:

Use multiple demat accounts (self, spouse, family) to increase allotment chances in oversubscribed issues.

🧾 What if You Don’t Get Allotment?

Don’t worry! You can:

Buy from listing day (at open or on dips)

Track stocks for post-IPO corrections (good entries happen 1–3 months later)

Use SME listing trends to plan swing trades

📊 Technical Strategy for IPO Traders

Gap Up Listings: Wait 5–15 mins post open → enter on pullback or breakout

F&O stocks: Use option straddle/strangle around listing day for volatility

SME IPOs: Watch for delivery volume, UC/LC hits, and media chatter

🧭 What’s Next for IPOs in 2025?

The pipeline remains very strong.

Upcoming Big IPOs:

PharmEasy (health tech)

Ola Electric (EV leader)

MobiKwik (fintech)

Navi Finserv (Sachin Bansal-backed)

Snapdeal (retail comeback)

Also, dozens of SMEs across states like Gujarat, Maharashtra, Rajasthan are planning listings in Q3–Q4 2025.

SEBI is also working to merge SME IPOs to mainboard faster, which could give early investors big rewards.

✍️ Final Thoughts

The IPO and SME buzz in 2025 is not just hype — it’s a real wealth-building opportunity for informed investors.

Yes, some IPOs are risky.

Yes, some are overhyped.

But the ones with good businesses, honest promoters, and solid demand are delivering massive returns.

This trend is part of a larger India story — where startups, manufacturers, tech firms, and SMEs are finally getting the capital and visibility they deserve

Sensex 1D Timeframe✅ On Dips: Consider buying near ₹82,280–₹82,310 (S1) or deeper at ₹81,990–₹82,020 (S2) if broader markets soften.

🔼 On Rallies: Think about partial profit-taking near ₹82,800–₹82,830 (R1).

🚀 Breakout Strategy: A daily close above ₹83,030–₹83,060 (R2) could lead to a move toward ₹83,325–₹83,360 (R3), and potentially retest the all-time highs (~₹85,978)

🚫 If Breakdown Occurs: A drop below ₹81,758–₹81,800 (S3) may shift the trend to bearish—time to consider reducing exposure.

Simple Action Plan

Buy-on-Dip Zones: ₹82,280–₹82,310; deeper: ₹81,990–₹82,020

Take Profits / Caution: ₹82,800–₹82,830

Breakout Trigger: ₹83,030–₹83,060 close → target ~₹83,325–₹83,360

Trend Alert (Bearish): Below ₹81,758

BankNifty 1D TimeframeLatest Index Level: ~57,178

Recent Range: 56,940 – 57,276

Trend: Bullish overall, but momentarily facing consolidation/overbought signals

🛡️ Key Support Levels

Support 1 (S1): 56,765 – 56,807

First cushion on pullbacks; intraday dips often find buyers here

Support 2 (S2): 56,522 – 56,666

Deeper support; a solid safety zone in case of broader market weakness

Support 3 (S3): 56,494 – 56,494 (approx)

Critical pivot pad—crossing below may trigger deeper correction

Lower Buffer: 56,100 – 56,000

Strong area noted by multiple reports as base zone for deeper dip

KOTAKBANK 1D TimeframeHow You Can Use These Levels

On Dips

Buy first around ₹2,168–₹2,170

If market softens, look to ₹2,149–₹2,150

For long-term entries, accumulate near ₹2,117–₹2,120

On Rallies

Consider partial portfolio blackening near ₹2,220–₹2,225

If it clears ₹2,252, additional gains may follow → consider selling gains near ₹2,272

Breakout/Bearish Triggers

A close below ₹2,117 signals potential short-term downtrend

A breakout above ₹2,272 with strong volume opens the path to higher highs

✅ Bottom Line (in simple terms)

Buy dips around ₹2,168, with stronger buying near ₹2,149 and ₹2,117.

Take profits roughly between ₹2,220–₹2,252.

If resistance breaks with conviction, expect more upside.

Conversely, if it drops below ₹2,117, be cautious.

Gold rebounds – Is the next bullish wave starting? XAUUSD is holding firmly above its ascending trendline, with each pullback quickly absorbed around the support zone near 3,333. The current price structure suggests a continued move higher, as long as the trendline remains intact.

On the news front, U.S. PPI data came in at 0.2% — exactly in line with expectations — offering no major surprises. With the dollar failing to gain strength, gold remains supported. In this context, XAUUSD is likely to continue its climb toward the next resistance zone near 3,447, which has previously triggered strong price reactions.

Institutional Objectives in Options TradingWhy Do Institutions Trade Options?

Institutions such as hedge funds, banks, mutual funds, and insurance companies trade options not to “hit it big,” but to:

Protect capital

Generate consistent income

Reduce portfolio risk

Hedge exposure

Speculate with calculated risk

They use options as a tool, not a shortcut.

🎯 Key Institutional Objectives in Options Trading

1. Portfolio Hedging

Institutions use put options to hedge large equity portfolios. If the market drops, the puts increase in value, helping offset losses in their stock holdings. This is like buying insurance — they sacrifice a small premium to avoid larger losses.

Example:

A mutual fund holding ₹100 crores in Nifty stocks might buy at-the-money puts on Nifty to protect against market crashes.

2. Risk Management & Exposure Control

Institutions manage their exposure to volatility, direction, and time decay using the Greeks (Delta, Gamma, Theta, Vega). They dynamically adjust their positions to stay delta-neutral or reduce gamma risk, maintaining stable portfolios under different market conditions.

They don’t just bet — they engineer their risk.

3. Premium Collection Strategies

Big players often sell options — not buy them — to earn steady income. Strategies like:

Covered Calls

Iron Condors

Credit Spreads

Calendar Spreads

allow them to profit from time decay (Theta) and implied volatility drops, especially in range-bound markets.

Example:

An institution expecting low volatility might sell both calls and puts (straddle or strangle) and pocket the premium as long as the market stays quiet.

4. Arbitrage and Market-Making

Institutions engage in option arbitrage, exploiting price inefficiencies between spot, futures, and options. They also act as market makers, providing liquidity and earning from bid-ask spreads while balancing risk using delta hedging.

This is a low-risk, high-volume business built on speed, data, and precision.

5. Speculation with Defined Risk

When institutions do speculate, they often use options to limit downside risk. For example, they may buy calls to play an upside breakout — knowing their maximum loss is limited to the premium paid.

They might also take advantage of event-driven trades like earnings, elections, or economic reports using option straddles or strangles — managing risk while targeting large moves.

✅ Why It Matters for Retail Traders

By understanding institutional objectives, you can:

Avoid emotional trades

Learn how to trade like professionals

Focus on capital preservation and risk-adjusted returns

Develop long-term strategies based on logic, not luck

📈 Final Thought

Institutions don’t gamble — they plan, hedge, and execute with precision. Learning their objectives in options trading will help you shift your mindset, adopt safer strategies, and build consistent, professional-level performance in the market.

RIDE THE BIG MOVESWhat Does “Ride the Big Moves” Mean?

It means:

✅ Spotting a strong directional move early

✅ Entering with confirmation and confidence

✅ Managing your risk while maximizing reward

✅ Staying in the trade through minor pullbacks

✅ Exiting smartly at a major trend exhaustion point

Most traders cut winners early and let losers run. This approach flips that pattern — teaching you how to stay in profitable trades and compound gains.

🧠 Core Concepts You’ll Learn

1. Trend Identification

Learn how to identify:

Primary trends (uptrend/downtrend)

Pullbacks vs. reversals

Trend strength using price action and volume

Higher-timeframe confirmation

2. Entry Techniques for Big Moves

Breakout from consolidation

Trendline and moving average support

SMC-based entries: Order blocks & market structure shifts

Avoiding fakeouts with volume and time confirmation

3. Stay in the Move

How to manage fear during winning trades

Trailing stop techniques: MA trail, swing low method, ATR

Adding to positions safely in trending markets

Avoiding premature exits caused by emotions

4. Exit Like a Pro

Identifying exhaustion signals

Divergences, volume drops, or climax candles

Scaling out profits strategically

Avoiding full exit too early — ride until structure breaks

📊 Why Big Moves Matter

Let’s say your risk is ₹1,000 per trade.

In a scalp, you might make ₹1,500.

In a small swing, maybe ₹3,000.

But if you ride a big move, your reward could be ₹10,000 or more — with the same risk.

That’s the power of risk-reward optimization — where one big move can cover multiple small losses and lift your win ratio significantly.

👨🏫 Who Should Learn This?

Intraday and swing traders

Option buyers looking for momentum moves

Long-term investors who want better timing

Anyone tired of small profits and early exits

✅ What You’ll Achieve:

Learn to identify market momentum early

Improve patience and discipline

Build strategies that favor 1:5 or even 1:10 risk-reward setups

Confidence to hold winners without panic

Eliminate noise and trade with clarity

⚡ Start Riding Waves, Not Ripples

“Ride the Big Moves” is more than a strategy — it's a mindset shift. It teaches you how to think like professionals who don’t chase trades, but wait for the market to offer big, clean opportunities — then ride them with focus and control

Institution Option Trading🔍 What Are Options?

Options are financial contracts that give you the right, but not the obligation, to buy or sell an asset at a specific price within a set time. There are two types:

Call Options – Right to buy

Put Options – Right to sell

Institutions use these tools not for speculation but for hedging, portfolio insurance, income strategies, and market positioning.

🧠 How Institutions Trade Options Differently

1. Multi-Leg Strategies

Institutions use advanced strategies like:

Covered Calls

Iron Condors

Vertical Spreads

Calendar Spreads

These strategies allow them to generate income and control risk, unlike directional bets most retail traders make.

2. Risk Management Focus

Institutions never “go all in.” They manage risk using:

Delta-neutral positioning

Hedging with opposite positions

Dynamic rebalancing

Volatility-based exposure control

They measure every trade based on risk-reward, not hope or prediction.

3. Understanding Option Greeks

Institutions actively monitor:

Delta (directional exposure)

Gamma (sensitivity to price change)

Theta (time decay)

Vega (volatility impact)

They use this to manage trades like professionals and adjust positions based on market conditions.

4. Implied Volatility & Volume Triggers

They don’t chase options with hype — they analyze:

Open interest spikes

Volatility crush or expansion

Skew analysis

These help detect big moves before they happen.

5. Smart Money Flow Tracking

Institutional traders leave footprints. You can learn to track:

Block trades

Unusual options activity

Dark pool activity

This reveals where big money is being placed — giving you a serious trading edge.

🎯 What You’ll Learn in Institutional Option Trading

Institutional mindset and objective-driven trading

How to trade options with structure and clarity

How to use Greeks for trade management

Institutional strategies vs. retail mistakes

Real-world case studies from option chain data

👨🏫 Who Is This For?

Traders who want to learn professional-grade options trading

Retail traders looking to stop losses and build consistency

Intermediate traders who want to move beyond basic buying

Investors looking to hedge or enhance returns with options

✅ Final Thoughts

Institutional Option Trading is not about quick profits — it's about risk-managed, high-probability trading with purpose. By learning how institutions trade options, you can elevate your trading game, improve consistency, and avoid emotional mistakes.

Technical Class📘 What is Technical Analysis?

Technical analysis is the study of past market data — mainly price and volume — to forecast future price movement. Unlike fundamental analysis (which looks at company financials), technical analysis focuses entirely on what is happening on the chart right now.

It’s based on three core principles:

Price Discounts Everything

Price Moves in Trends

History Repeats Itself

By mastering this, you can trade like a professional — with logic, structure, and discipline.

🔧 What You’ll Learn in the Technical Class

This class covers all the essential tools, techniques, and strategies used by full-time traders and institutions. Key topics include:

🔹 1. Charting Basics

Types of charts: Candlestick, Line, Bar

Timeframes: 1-min to monthly charts

How to set up charts for analysis

🔹 2. Candlestick Patterns

Bullish and bearish candlesticks

Reversal vs. continuation patterns

Psychology behind candlestick formations (e.g., Doji, Engulfing, Hammer)

🔹 3. Support & Resistance

How to identify key price levels

Role of horizontal zones and trendlines

Breakout and retest strategies

🔹 4. Chart Patterns

Double Top & Bottom

Head and Shoulders

Flags, Pennants, Triangles

Price action and pattern recognition techniques

🔹 5. Technical Indicators

Moving Averages (SMA, EMA)

RSI, MACD, Bollinger Bands

Volume Profile, VWAP

When to use and when to avoid indicators

🔹 6. Trend Analysis

Identifying uptrends, downtrends, sideways movement

Using higher timeframes for confirmation

Entry and exit based on trend strength

🔹 7. Volume Analysis

Importance of volume in confirming moves

Volume spikes and trap zones

Institutional activity detection

🧠 Why Technical Analysis Matters

Most professional traders rely heavily on technicals for:

Short-term and intraday trading

Identifying breakout and breakdown zones

Predicting reversals and continuation setups

Aligning with smart money and institutional behavior

It is one of the most practical skillsets you can learn in trading.

🎯 Who Should Join This Class?

Beginners in the stock market

Aspiring intraday/swing traders

Investors who want better timing

Crypto, forex, or index traders

📈 Conclusion: Read the Market Like a Pro

The Technical Class will give you the confidence to read charts, spot opportunities, and manage trades with structure — no more relying on tips or guesswork.

You’ll walk away with real, practical skills that you can apply in any market, any timeframe, any strategy

Trading Master Class 1. Understanding Financial Markets

The course starts with a strong foundation in how financial markets work. You’ll learn the difference between investing and trading, the role of exchanges (like NSE, BSE, NYSE), and how different participants — including retail traders, institutions, brokers, and market makers — influence the market.

You’ll also understand key trading instruments such as:

Stocks (Equities)

Indices (Nifty, Sensex, Dow Jones)

Options & Futures

Commodities and Currencies

This foundation helps in selecting the right markets and strategies for your trading style.

2. Technical Analysis & Chart Reading

Technical analysis is the core tool used by traders to make entry and exit decisions. In this section, you’ll master:

Candlestick Patterns (Doji, Hammer, Engulfing)

Support & Resistance Levels

Chart Patterns (Head & Shoulders, Triangles, Flags)

Volume Analysis

Trend Identification

You’ll also get hands-on experience with popular indicators like Moving Averages, RSI, MACD, and Bollinger Bands — learning when and how to use them effectively.

3. Institutional Trading Concepts

This section reveals how big institutions (smart money) operate and how they trap retail traders. You’ll learn advanced concepts like:

Market Structure

Order Blocks

Liquidity Grabs

Break of Structure (BoS)

Supply and Demand Zones

These concepts help you align your trades with institutional movements, giving you a powerful edge.

4. Strategy Development

You’ll be guided through the process of developing your own trading strategy based on market conditions and personal risk appetite. This includes:

Identifying setups

Entry and exit rules

Risk-reward calculations

Journaling and performance tracking

Backtesting strategies with real data

The focus is on clarity, simplicity, and consistency.

5. Options Trading Simplified

Options are a powerful tool for both hedging and profit. This module covers:

Basics of Calls and Puts

Options Buying vs. Selling

Option Greeks (Delta, Theta, Vega)

Strategies like Covered Calls, Iron Condors, Spreads

Intraday and expiry-day strategies

6. Risk Management & Trading Psychology

No trading system works without discipline and emotional control. This part of the course trains your mindset to handle:

Fear of loss

Greed during profits

Revenge trading

Overtrading

Proper position sizing and capital allocation

You’ll build habits to stay consistent — the key to long-term success.

Summary:

The Trading Master Class is not just about charts or indicators — it’s about learning the right way to trade, with a focus on:

Market knowledge

Strategy building

Institutional concepts

Risk control

Trading psychology

It’s the complete path to becoming a smart, confident, and consistently profitable trader.

EUR/USD Faces Strong Sell-off, Is a Deeper Correction Coming?The FX:EURUSD pair continued its sharp decline this morning, currently trading around 1.161, after breaking through the bullish wedge pattern on the daily chart. This key technical signal suggests that the previous uptrend has ended, opening the possibility for a deeper correction in the short term. The inability to hold the 1.171 resistance after two attempts further confirms the ongoing downtrend.

The selling pressure is driven by the strong recovery of the USD, as investors seek refuge in safe-haven assets amid concerns about global growth and geopolitical instability. Additionally, U.S. bond yields have rebounded following strong economic data, reducing the appeal of the euro. The expectation that the Fed will maintain high interest rates for a longer period also contributes to the downward pressure on EUR/USD.

In the short term, if EUR/USD fails to hold the 1.158 support, there is a high likelihood of a drop towards 1.140, a level that acted as strong support in the past. Traders should closely monitor signals from the Fed and the upcoming PMI data for the Eurozone to assess the next trend direction.

Gold Faces Pressure as USD Strengthens – A Buying Opportunity?Gold prices have seen a slight decline today compared to yesterday’s trading session, fluctuating around 3,328 USD after losing over 43 USD in just one session.

The main factors contributing to this drop are:

-USD Strength: The USD Index rose by 0.56%, making gold more expensive for investors holding other currencies.

-Rising U.S. Bond Yields: U.S. Treasury yields surged to nearly 4.5%, drawing money away from the gold market.

-U.S. CPI for June: The CPI met expectations, easing inflation fears and reducing the demand for gold as a safe-haven asset.

Despite the short-term pressure, investors remain hopeful that the Fed will cut interest rates in September, potentially providing a boost for gold.

Personal assessment: While gold is currently in a correction phase, its long-term trend remains intact. This could be a buying opportunity if you believe in the upcoming monetary easing cycle.

What do you think about gold’s price today? Let us know in the comments!

XAUUSD – Facing Strong Resistance, Pullback Risk IncreasesGold is approaching a major resistance zone that previously halted its upward momentum. Bullish momentum is fading, while the RSI shows signs of mild divergence. Market expectations around Federal Reserve policy, along with key data like CPI, unemployment rates, and geopolitical developments, are putting pressure on the precious metals market.

Without a strong catalyst from upcoming news, gold may enter a short-term pullback phase before establishing its next major trend.