XAUUSD – Breaks Support Line, Risk of Deeper CorrectionOn the H4 timeframe, gold has officially broken below the ascending trendline formed since mid-May, after several successful retests. This is a clear sign that the short-term uptrend is losing momentum.

Following the trendline breakdown, price is currently making a mild pullback, retesting the confluence zone of EMA34–EMA89 around 3,323 to 3,336 USD. However, if this zone continues to act as resistance, the pullback pattern will complete and open up the possibility of further decline toward the next support area around 3,264 USD – which previously held price well.

Moreover, gold remains under pressure due to the US dollar’s strong rebound amid expectations that the Fed will maintain high interest rates. Hot CPI and PPI forecasts are delaying rate cut hopes, further weighing on gold prices.

M-forex

Learn Institutional options trading Part-4SEBI Regulations & Reforms

SEBI has made multiple reforms to ensure safe and transparent options trading:

Peak Margin Requirements – Traders must maintain full upfront margin.

Ban List – Illiquid stock options are periodically banned.

Lot Size Revisions – To control leverage and speculation.

Options Chain Transparency – Exchanges provide real-time data.

Investor Education Initiatives – Workshops, certifications, and sandbox testing.

Risks in Options Trading'

Options can generate high rewards, but they carry significant risks, especially if misused without understanding.

Key Risks:

Premium decay

Volatility risk

Leverage risk

Liquidity issues in stock options

Wrong position sizing

SEBI has introduced risk-mitigation measures, such as margin rules and banning of certain contracts for illiquid stocks.

Learn Institutional options trading Part-5Future of Options Trading in India

What Lies Ahead:

More weekly expiries (e.g., MIDCPNIFTY)

Improved retail education

Stricter compliance and reporting

Rise in algo trading and automation

Integration with global exchanges (GIFT City)

With platforms like NSE IFSC, Indian traders may soon get access to international stock derivatives from Indian soil.

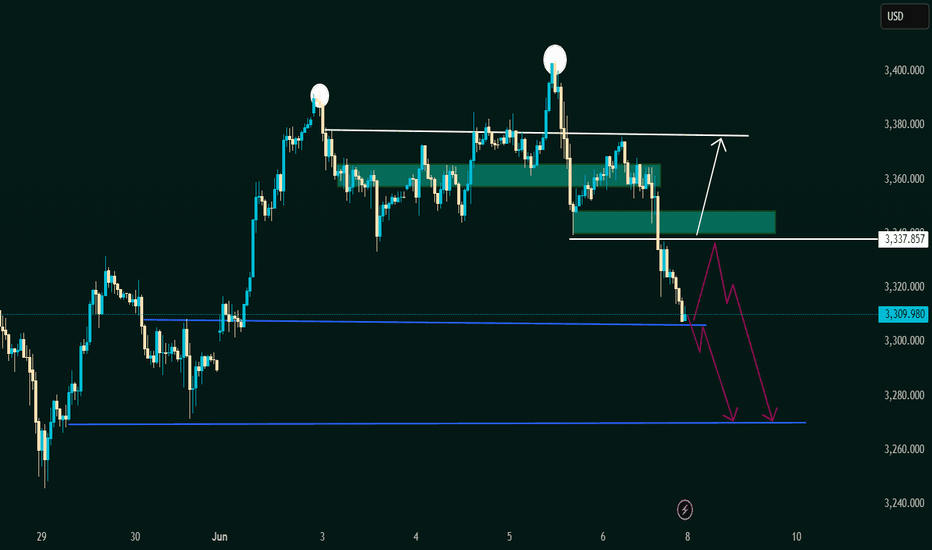

Potential Breakdown with Retest or Reversal Zone This chart represents a classic Double Top pattern, a bearish reversal signal indicating strong resistance around the 3,380 - 3,390 USD zone (marked with two white circles).

🔍 Key Zones and Levels:

1. Resistance Zone (~3,380 - 3,390 USD):

Price was rejected twice here.

Suggests strong selling pressure and buyer exhaustion.

2. Mid Support/Retest Zone (~3,337.857 USD):

Marked with a horizontal white line.

Could act as a short-term resistance if price retraces.

3. Demand Zone (~3,330 - 3,337 USD):

Highlighted green box: potential reversal/retest zone.

Bullish scenario: price bounces from here and heads back to retest resistance.

4. Current Price (~3,309.980 USD):

Price has broken below the demand zone and is approaching strong horizontal support.

5. Lower Support (~3,265 - 3,270 USD):

Highlighted with blue horizontal lines and purple arrows.

Could be the next bearish target if breakdown is confirmed.

🔄 Two Possible Scenarios:

📉 Bearish Continuation:

Price retests the broken demand zone (now resistance).

Rejects and forms a lower high.

Falls toward the lower support around 3,265–3,270 USD.

📈 Bullish Reversal:

Price reclaims the green demand zone.

Pushes above 3,337.857 USD level.

Heads back to retest the double top area (~3,380

✅ Conclusion:

The bias is currently bearish, supported by:

Double top formation.

Breakdown below key demand zone.

Momentum favoring further downside

However, a bullish reversal is possible if price reclaims the 3,337 USD zone and shows strong bullish structure.

Reliance levels for swing tradingAccording to a recent analysis, the important levels are:

Current Price & Context

-- CMP: ₹1,449.4 (up ~0.4%)

-- Technical outlook: Rated a Strong Buy with RSI ≈ 63 and positive MACD signals

Pivot & CPR Levels

Daily (Classic) Pivot Points

Pivot (P): ₹1,444.00

Support: S1 = 1,436.50; S2 = 1,429.50; S3 = 1,422.00

Resistance: R1 = 1,451.00; R2 = 1,458.50; R3 = 1,465.50

Daily CPR:

Bottom Central (BC) = 1,444.25

Central = 1,444.00

Top Central (TC) = 1,443.75

Weekly Pivot Points

Pivot: ₹1,431.27

Support: S1 = 1,407.83; S2 = 1,372.17

Resistance: R1 = 1,466.93; R2 = 1,490.37

Nifty-50 levels for swing tradingAccording to a recent analysis, the important levels are:

Trend‑deciding pivot: 25,064

Resistance (R): 25,142 → 25,221 → 25,299 → 25,343 → 25,416

Support (S): 24,985 → 24,907 → 24,828 → 24,750 → 24,671

Weekly Pivot: ~24,844

R1: ~25,187, R2: ~25,372; S1: ~24,661, S2: ~24,317

Waiting for the Breakout: Consolidation or Trend Continuation?XAUUSD – Waiting for the Breakout: Consolidation or Trend Continuation?

Gold (XAUUSD) is trading within a narrowing range, building momentum after rebounding from the 3.276 support area. Despite short-term uncertainties, the overall macroeconomic landscape continues to favor bullish scenarios — though key resistance levels must be cleared to confirm continuation.

🌍 MACRO & MARKET SENTIMENT

USD Weakness: The DXY continues to trade under pressure, increasing the appeal of non-yielding assets like gold.

US–China Trade Talks: Ongoing high-level negotiations in London could either ease geopolitical tensions or fuel safe-haven demand, depending on outcomes.

Global Risk Appetite: With US debt ceiling concerns still looming and the Fed showing hesitancy to cut rates soon, gold remains in focus as a hedge.

📈 TECHNICAL OUTLOOK (30M–H1)

The price has formed a descending wedge structure and is hovering near key EMAs (13–34–89–200).

A breakout above 3,334 could trigger a short-term bullish wave, while failure at this zone would likely lead to deeper correction toward 3,276 or lower.

📍 STRATEGIC KEY LEVELS

Resistance: 3,334 – 3,336 – 3,362 – 3,390

Support: 3,300 – 3,276 – 3,250

🧭 TRADING SCENARIOS

🔵 BUY ZONE: 3,276 – 3,274

SL: 3,270

TP: 3,280 → 3,284 → 3,288 → 3,292 → 3,296 → 3,300

🔻 SELL SCALP: 3,334 – 3,336

SL: 3,340

TP: 3,330 → 3,326 → 3,322 → 3,318 → 3,314 → 3,310

🔻 SELL ZONE: 3,362 – 3,364

SL: 3,368

TP: 3,358 → 3,354 → 3,350 → 3,346 → 3,340 → 3,335 → 3,330 → 3,320

✅ SUMMARY

Gold remains in a critical range, and traders should focus on well-defined zones to capitalize on volatility. Use confirmation-based entries and respect risk parameters — especially as macro headlines and technical patterns align for a potential breakout.

XAUUSD – Shaky below resistance, clear bearish signal formingGold is showing signs of weakness after retesting the resistance area around 3,394 USD. The current price structure indicates a failed minor rebound – most likely a false breakout, suggesting the potential for another leg down.

On the H4 chart, price has slipped below the EMA34 and is heading toward the EMA89 zone. If selling pressure continues, the next target will be the strong support around 3,167 USD. A break below this level could trigger a deeper decline toward the 3,114 USD zone.

Notably, price action is forming a short-term “lower high” – a classic characteristic of a downtrend. The strategy now is to closely monitor the retracement zone around 3,320–3,330 USD for reversal signals, rather than trying to catch a bottom too early.

Sideways Gold, Stronger Dollar: A Pause Before the BreakGold attempted a bullish breakout recently but failed to sustain momentum and is now back within a consolidation zone between 3,250–3,350. The repeated failure to break above descending trendline resistance suggests weakening buyer strength. It is currently forming lower highs, indicating distribution or sideways movement rather than a clear rally.

On the other hand, DXY has bounced from a key demand zone near 99.00, showing signs of short-term strength. It is now targeting the 102.60–104. resistance zone, which aligns with a Fibonacci retracement. If DXY continues higher, it could put pressure on gold prices in the near term.

Given this context, it is wise to remain on the sidelines for the next 2–3 weeks and wait for one of two scenarios:

1. DXY rejection from the 102.60–104 area – This would support a bullish case for gold.

2. Gold breakout above 3,400 with strong volume or need another bounce from lower support area as marked on chart which can provide confirmation of bullish continuation.

Until then, gold is likely to stay in a range or face minor downside due to DXY strength.

XAUUSD – Reaccumulating below key resistanceGold is following the textbook pattern of a strong uptrend on the D1 chart. After bouncing from the support zone around EMA34 and EMA89, the price is continuing to consolidate just below the major resistance around 3,397.500 USD.

What’s notable is that this level previously rejected price, so the current pause in momentum is understandable. However, as long as the price holds above the support zone around 3,171.600 USD – which aligns with EMA89 and the prior demand zone – the bullish structure remains intact.

The most reasonable scenario now is to wait for a clear bounce from the EMA region or a confirmed breakout above resistance. If a breakout occurs, the next target will likely be the previous high around 3,434.500 USD.

On the news front, U.S. jobless claims have slightly increased this week, reinforcing expectations that the Fed will keep interest rates unchanged – an indirect boost for gold.

Open Interest & Option Chain Analysis Topic: Open Interest & Option Chain Analysis

1: What is Open Interest (OI)?

Simple Meaning:

Open Interest means the total number of active option or futures contracts in the market that haven’t been closed yet.

Easy Example:

If you and your friend enter into a new option trade, the open interest is 1. If someone else joins with a new trade, it becomes 2. But if you close your trade, it becomes 1 again.

What It Tells You:

If OI is increasing, more people are joining the market.

If OI is decreasing, traders are exiting their trades.

Combine OI with Price Movement:

Price going up + OI going up = New buying → Bullish

Price going down + OI going up = New selling → Bearish

Price going up + OI going down = Traders exiting shorts → Short covering

Price going down + OI going down = Traders exiting longs → Profit booking

2: What is an Option Chain?

Simple Meaning:

Option Chain is a table that shows all the call and put options for a stock at different strike prices.

What You’ll See in an Option Chain:

Strike Price: The price you agree to buy/sell.

Calls (CE): Right to buy.

Puts (PE): Right to sell.

Open Interest (OI): How many contracts are active.

Volume: How many were traded today.

LTP: Latest price of that option.

3: How to Read Option Chain Like a Pro

1. Spot the Support Levels:

Look for the highest OI on the put (PE) side → Big money sees this as support.

2. Spot the Resistance Levels:

Look for the highest OI on the call (CE) side → Traders think price won't go above this.

3. Track Market Mood:

If more puts are being written (PE OI going up) → Traders are bullish.

If more calls are being written (CE OI going up) → Traders are bearish.

4. PCR (Put Call Ratio):

PCR > 1 → More puts than calls = Bullish

PCR < 1 → More calls than puts = Bearish

Advance Institutions Option Trading - Lecture 4If you're looking for a simple options trading definition, it goes something like this: Options trading gives you the right or obligation to buy or sell a specific security on or by a specific date at a specific price. An option is a contract that's linked to an underlying asset, such as a stock or another security.

Options trading also involves two parties: the holder (buyer) and the writer (sometimes called the seller). Holders are investors who purchase contracts, while writers create them. The holder pays the writer a premium for the right to sell or buy a stock by a certain date.

USDJPY – Buying momentum builds, uptrend in sightUSDJPY has just bounced strongly from the key support zone around 142.510 – a level that has acted as a “fortress” over the past two weeks. Price action is gradually regaining momentum, forming a potential double bottom and heading toward a retest of the long-term descending trendline.

Currently, the 144.800–145.000 area is the nearest resistance, aligning with both the EMA and the descending trendline. If buyers maintain control, a breakout above this zone could pave the way for the next leg up toward 145.750 and beyond.

In terms of news, the latest U.S. ISM Services data came in weaker than expected, reducing rate hike expectations. While this puts mild pressure on the USD, the reaction from USDJPY suggests the market is leaning toward a rebound rather than a breakdown.

NFP STORM BREWING: WILL GOLD BREAK HIGHER OR DIVE LOWER?XAUUSD – NFP STORM BREWING: WILL GOLD BREAK HIGHER OR DIVE LOWER?

Gold enters a highly sensitive phase ahead of tonight’s Non-Farm Payrolls (NFP) release – one of the most influential data points for global financial markets. With US-China trade tensions rekindling and sovereign debt concerns mounting in the US, the yellow metal could experience a major breakout or a sharp reversal during the New York session.

🌍 MACRO & FUNDAMENTAL OUTLOOK

US-China trade talks have resurfaced, with concerns around tariffs and strategic metals dominating headlines. China's recent stance signals it may take stronger defensive actions.

The US national debt is projected to hit $55 trillion by 2034, prompting global central banks to ramp up gold purchases as a strategic hedge.

Fed Chair Powell reiterated a “no rush to cut” stance, yet political pressure is mounting – especially with Donald Trump urging immediate rate cuts following the weakest ADP job growth in two years.

Unemployment Claims released today came in slightly better than expected (236K vs. 240K), adding fuel to speculations around a softer NFP print – potentially bullish for gold.

🔍 TECHNICAL ANALYSIS (H1 – EMA 13/34/89/200)

The chart shows a clean impulsive wave structure. After hitting the resistance zone at 3408–3410, gold entered a consolidation range.

Price is currently hovering around EMA 89–200, suggesting trend divergence and uncertainty ahead of NFP.

A breakdown below the 3344–3332 support zone could push price down to the FVG (Fair Value Gap) at 3320, which may act as a strong liquidity pool for buyers.

⚠️ KEY LEVELS TO WATCH

Resistance: 3380 – 3392 – 3408 – 3436

Support: 3365 – 3350 – 3344 – 3332 – 3320

🧭 TRADE SETUPS

🔻 SELL ZONE: 3408 – 3410

Stop Loss: 3415

Take Profit: 3404 → 3400 → 3395 → 3390 → 3380 → 3370 → 3360 → 3350

🔵 BUY ZONE: 3318 – 3316

Stop Loss: 3310

Take Profit: 3322 → 3326 → 3330 → 3335 → 3340 → 3350 → 3360 → ???

✅ CONCLUSION

Gold is poised for a volatile breakout with NFP acting as the key catalyst. A soft jobs report may trigger a breakout above 3410, while stronger-than-expected numbers could fuel a bearish reversal. In this sensitive phase, traders should stick to defined zones and wait for confirmed liquidity reactions rather than chasing price impulsively.

Option Chain AnalysisTo read an options chart effectively, consider the following steps:

Identify the strike price associated with each line on the chart.

Observe the direction and steepness of the lines to gauge the options' delta values. ...

Assess the options' positions concerning the current market price of the underlying asset.

Basic to Advance in Trading Understand market trends and patterns.

Use risk management strategies, like setting stop-loss orders.

Focus on liquid assets with high volume.

Keep emotions in check and stick to a trading plan.

Limit the number of trades to manage risk.

Constantly educate yourself on market dynamics and trading strategies.

Class for Advanced Trader part 2To understand how to become a trader, follow these seven steps:

Complete your education. ...

Learning the basics of trading. ...

Determine the product in which you want to trade. ...

Develop trading techniques. ...

Gain trading experience. ...

Understand risk management. ...

Review your trades.

Put Call Ratio (PCR) Trading The Put Call Ratio (PCR) is a tool in the stock market to understand how investors feel about a stock or the market's future. It compares the number of put options to call options traded. More puts traded mean investors expect prices to fall (bearish). More calls traded mean investors expect prices to rise (bullish).

EURUSD – Strong uptrend, Non-farm could trigger breakoutEURUSD continues to maintain a steady uptrend within a well-defined ascending channel. Each pullback has been well absorbed around the EMA 34–89 and the dynamic support zone near 1.13650, signaling that buyers remain in control.

Currently, price is approaching the key resistance area around 1.14840 – a level that previously triggered a rejection. If it fails to break through again, a minor pullback toward the support zone followed by a bounce, as shown in the chart, is a likely scenario.

What’s worth noting is that the Non-Farm Payroll report is due later today – a potential catalyst that could either fuel a breakout or break the current channel. If U.S. job data comes in weaker than expected, the USD may face selling pressure, providing a strong boost for the euro.