M-forex

XAUUSD PLAN END-OF-MONTH CASHOUT OR TREND REVERSAL? XAUUSD PLAN – MAY 30 | GOLD DROPS SHARPLY IN ASIAN SESSION | END-OF-MONTH CASHOUT OR TREND REVERSAL?

Gold surprised the market this morning with a sharp drop of nearly $30/oz, despite closing yesterday with a strong bullish daily candle. Profit-taking pressure near month-end and uncertainty surrounding US–China trade negotiations have returned gold to a bearish technical structure in the short term.

🌍 MACRO OVERVIEW:

US–China trade talks show no clear progress, with both sides signaling a cautious and non-committal stance.

Hedge funds and large players may be exiting ahead of monthly/weekly candle closes, causing increased volatility.

Meanwhile, investors are waiting for key US PCE inflation data and more Fed speeches, keeping risk sentiment fragile.

➡️ The market remains technically weak and highly reactive. Price is vulnerable to quick liquidity sweeps and false breakouts — best to stay reactive and trade confirmed zones.

📈 TECHNICAL ANALYSIS (H1 – EMA 13/34/89/200):

Gold has broken below EMA89 and is now trading beneath all major EMAs, indicating a strong short-term downtrend.

The resistance zone at 3,322–3,324 aligns with the EMA200 and a descending trendline, making it a prime area for short entries on rejection.

Key support sits at 3,266–3,264. A break below could send price to test deeper levels at 3,235 or even 3,210, following the broader descending channel.

The 3,274–3,276 zone (EMA13 crossing below EMA34) may offer minor reactions for scalpers in the London session.

🔍 TRADE SETUPS FOR TODAY:

🔵 BUY ZONE: 3,266 – 3,264

Stop Loss: 3,260

Take Profits:

3,270 – 3,274 – 3,278 – 3,282 – 3,286 – 3,290 – 3,300

🔻 SELL ZONE: 3,322 – 3,324

Stop Loss: 3,328

Take Profits:

3,318 – 3,314 – 3,310 – 3,306 – 3,300 – 3,295 – 3,290 – 3,280

🎯 INTRADAY SCALPING IDEAS:

BUY SCALP: 3,274 – 3,276 | SL: 3,270 | TP: 1R (50 pips max)

SELL SCALP: 3,302 – 3,304 and 3,310 zone | SL: 50–60 pips | Flexible TP

📌 SUMMARY:

The current momentum is bearish. Focus on short setups unless price clearly reclaims key EMAs. Scalping opportunities exist around reaction zones. With month-end volatility at play, avoid FOMO and stick to strict SL discipline.

💬 Found this plan helpful? LIKE – COMMENT – FOLLOW for daily GOLD strategies from the MMF Team, crafted for serious traders in India and beyond!

PCR Trading part 1PCR trading refers to using the Put-Call Ratio (PCR) indicator to assess market sentiment and potentially predict future price movements. It's a contrarian indicator, meaning it suggests trading against the prevailing market sentiment. For example, a high PCR (suggesting a bearish market) might signal an opportunity to buy, as the market might be over-sold.

What is Technical Trading ?Technical trading, also known as technical analysis, involves studying historical price charts and market statistics to identify patterns and trends in order to make informed trading decisions. It focuses on the belief that market prices reflect all available information, and past patterns can help predict future price movements.

NIFTY FINANCIAL SERVICES LIMITED#FINNIFTY : INSTITUTIONAL LEVELS FOR 30/05/2025

• Overview

A simple yet powerful trading system for active 5-minute timeframe traders, built for quick, confident decisions in fast markets.

• Key Guidelines

Retest Entries: Prefer retests over breakouts.

Multiple Confirmations: Validate trades with 2+ signals.

ATM Options: Stick to at-the-money (ATM) or above for better liquidity and risk control.

• System Logic

Uses volume, historical price action, and ranges to find high-probability entries and exits, reducing guesswork and keeping trading consistent.

• Entry & Exit Signals

Blue Line: Possible long entry.

Red Line: Possible short entry.

Always align with extra confirmations for best results.

• Stop Loss & Target

Long SL: Below the nearest red line.

Short SL: Above the nearest blue line.

Long Target: Next red line above.

Short Target: Next blue line below.

Timeframe

Best for the 5-minute chart.

• Risk Note

▲ Trade responsibly. Use only capital you can afford to lose.

• Community

#Join discussions, share ideas, and grow with like-minded traders!

• Original System

* 100% original, tested in real markets for a true trading edge.

Gold stuck inside range : No clear direction as of now Yesterday, we have seen a strong bounce from the major support zone around 3260–3280 (marked as major support on chart), reclaiming the lost ground after the initial breakdown from the trendline (green line on chart). On daily time frame price seems to be stuck in a tight consolidation range and reflects a choppy environment where neither bulls nor bears have taken decisive control.

It's worth noting that we're right at the dynamic resistance zone ( the red trendline),which continues to cap any upside attempts. On the flip side, the major support area seems to be doing a decent job of holding the floor, at least for now.

With monthly and weekly closing candles coming up today, I’m still in "wait and watch" approach, just like yesterday. The price action around this consolidation zone isn’t giving any clear, high conviction directional clues.

RBL BANK LTD#RBLBANK

STOCK NAME: RBL BANK LTD (NSE)

CHART ANALYSIS: Rounding Bottom breakout with bullish volume. Trend reversal confirmed.

Trading above resistance - next move can be explosive!

TREND: Bullish

SUPPORT: 208 / 188

RESISTANCE: 217 / 245/260

TRADE SETUP:

BUY above 217 | SL 208 | Targets 230 / *245 / *260

X SELL below *205 (if fails) | SL 215 | Target *190

▲ I AM NOT SEBI REGISTERED. THIS IS ONLY FOR EDUCATIONAL PURPOSE.

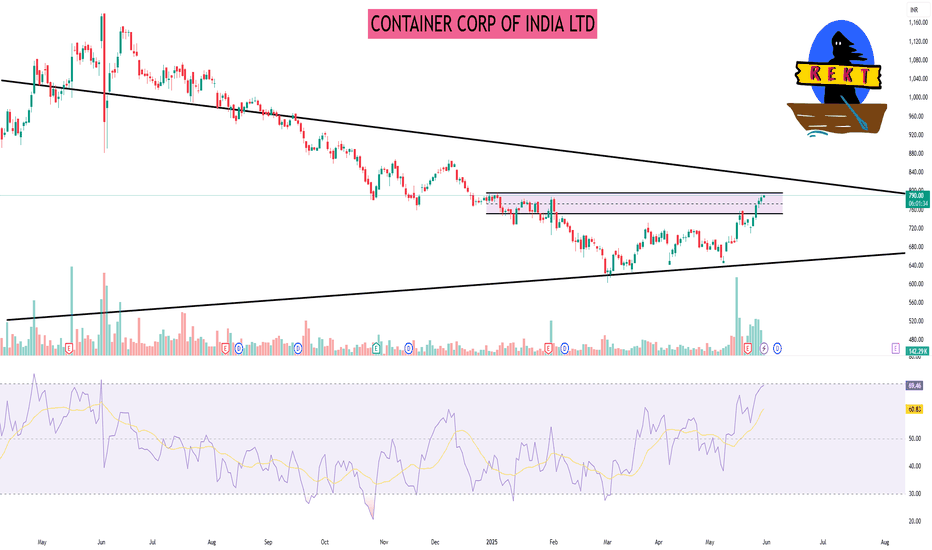

CONTAINER CORP OF INDIA LTDAs of May 30, 2025, Container Corporation of India Ltd. (NSE: CONCOR) is trading around ₹778.10. Based on daily technical analysis, here are the key support and resistance levels:

📊 Daily Support & Resistance Levels

Pivot Type Support Levels (S) Resistance Levels (R) Pivot Point (P)

Classic S1: ₹773.70S2: ₹761.45S3: ₹752.80 R1: ₹794.60R2: ₹803.25R3: ₹815.50 ₹782.35

Fibonacci S1: ₹774.37S2: ₹769.43S3: ₹761.45 R1: ₹790.33R2: ₹795.27R3: ₹803.25 ₹782.35

Camarilla S1: ₹784.03S2: ₹782.12S3: ₹780.20 R1: ₹787.87R2: ₹789.78R3: ₹791.70 ₹782.35

Note: These levels are derived from pivot point calculations and can vary based on market conditions.

🔍 Technical Overview

Trend Outlook: The stock is exhibiting a neutral to slightly bullish trend.

Key Observations:

The price is hovering around the pivot point, indicating potential consolidation.

A breakout above R1 (₹794.60) may signal bullish momentum, while a drop below S1 (₹773.70) could indicate bearish pressure.

JASH ENGINEERING LTDAs of May 30, 2025, Jash Engineering Ltd. (NSE: JASH) is trading at approximately ₹559.40. Based on recent technical analyses, here are the 15-minute intraday support and resistance levels:

🔹 Intraday Support & Resistance Levels (15-Minute Interval)

Classic Pivot Points:

Support Levels:

S1: ₹567.54

S2: ₹554.87

S3: ₹544.94

Resistance Levels:

R1: ₹590.14

R2: ₹600.07

R3: ₹612.74

Fibonacci Pivot Points:

Support Levels:

S1: ₹568.84

S2: ₹563.50

S3: ₹554.87

Resistance Levels:

R1: ₹586.10

R2: ₹591.44

R3: ₹600.07

Camarilla Pivot Points:

Support Levels:

S1: ₹578.13

S2: ₹576.06

S3: ₹573.99

Resistance Levels:

R1: ₹582.27

R2: ₹584.34

R3: ₹586.42

Note: These levels are derived from pivot point calculations and can vary based on market conditions.

📊 Technical Indicators

Moving Averages: The stock is currently below both short-term and long-term moving averages, indicating a bearish trend.

MACD: A bullish crossover has been observed, suggesting potential upward momentum.

RSI: The Relative Strength Index is in the neutral zone, indicating neither overbought nor oversold conditions.

🔍 Observations

The stock has recently tested the support level around ₹539.50, which may act as a strong base.

Resistance is observed near ₹554.05, and a breakout above this level could signal further upside.

The stock's volatility is moderate, with a daily average movement of approximately 4.39%.

RELIANCE INDUSTRIES LIMITEDReliance Industries Ltd view for Intraday 29th May #RELIANCE

Resistance 1430 Watching above 1432 for upside momentum.

Support area 1400 Below 1410 ignoring upside momentum for intraday

Watching below 1397 for downside movement...

Above 1410 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks....

CRUDE OIL FUTURESAs of May 30, 2025, here are the latest 15-minute support and resistance levels for Crude Oil Futures:

🛢️ WTI Crude Oil Futures (NYMEX: CL1!)

Current Price: ~$60.62 per barrel

Support Levels:

S1: $59.97

S2: $59.00

S3: $57.45

Resistance Levels:

R1: $62.49

R2: $64.04

R3: $65.01

🇮🇳 MCX Crude Oil Futures (INR)

Current Price: ~₹5,191 per barrel

Support Levels:

S1: ₹5,153.33

S2: ₹5,092.67

S3: ₹5,031.33

Resistance Levels:

R1: ₹5,231.67

R2: ₹5,292.33

R3: ₹5,353.67

📊 Technical Outlook

Trend: Neutral to slightly bearish

Indicators: The 15-minute chart shows a potential for a bullish reversal, but confirmation is needed.

Strategy: Traders may consider watching for a breakout above resistance levels for potential long positions, or a breakdown below support levels for short positions.

TRIVENI TURBINE LTDAs of May 30, 2025, Triveni Turbine Ltd. (NSE: TRITURBINE) is trading at approximately ₹595.40 . Based on the latest technical data, here are the intraday support and resistance levels:

🔹 Intraday Support & Resistance Levels

Standard Pivot Points:

Support Levels:

S1: ₹597.12

S2: ₹584.98

S3: ₹577.87

Resistance Levels:

R1: ₹616.37

R2: ₹623.48

Fibonacci Pivot Points:

Support Levels:

S1: ₹597.12

S2: ₹589.76

S3: ₹585.22

Resistance Levels:

R1: ₹604.47

R2: ₹609.01

R3: ₹616.37

Camarilla Pivot Points:

Support Levels:

S1: ₹590.34

S2: ₹588.57

S3: ₹586.81

Resistance Levels:

R1: ₹593.86

R2: ₹595.63

R3: ₹597.39

Note: These levels are derived from pivot point calculations and can vary based on market conditions.

🔹 Technical Indicators

Relative Strength Index (RSI): The RSI is currently between 45 and 55, indicating a neutral condition.

Stochastic Oscillator: The Stochastic Oscillator is in the bullish range, suggesting potential upward momentum.

🔹 Recent Price Action

Triveni Turbine's stock has experienced significant volatility recently. After reaching a high of ₹885.00 on November 26, 2024, the stock declined to a low of ₹460.30 on March 3, 2025. Since then, it has rebounded, trading around ₹595.40 as of May 30, 2025.

Divergence SecretsDivergence trading identifies potential trend reversals or continuations by comparing price action with technical indicators. When an asset's price moves in one direction, but a related indicator moves in the opposite direction, it suggests a possible shift in momentum. Traders can use this information to spot potential entry points for trades.

Support and Resistance part 2ASupport is a price point below the current market price that indicate buying interest. Resistance is a price point above the current market price that indicate selling interest. S&R can be used to identify targets for the trade. For a long trade, look for the immediate resistance level as the target.

Advanced Trading part 2The first step should be to approach trading as a business: draft a business plan, create a budget, determine the necessary tools, and determine the markets and strategies you'll trade. Organize and keep on file all important documents: trading plans, brokerage statements, trading journals, and other resources.

GOLD RETESTING KEY ZONES AHEAD OF INFLATION DATA XAUUSD PLAN – MAY 29 | GOLD RETESTING KEY ZONES AHEAD OF INFLATION DATA | HOLDING OR BREAKING?

After yesterday’s sharp decline, GOLD is showing signs of stabilization around the 3,270 region. This appears to be a consolidation phase before the market reacts to key macro events — particularly the upcoming Core PCE inflation report and a string of Fed speeches this week.

🌍 MACRO LANDSCAPE:

US 10-year yields are holding steady near 4.5%, continuing to pressure gold in the short term.

Fed officials remain cautious about rate cuts, pushing back against dovish expectations.

However, concerns over structural fiscal pressure (including Fed losses and budget cuts) support the long-term bullish case for gold.

➡️ In the short term, the market remains range-bound, and tactical entries near key zones offer the best opportunities.

📈 TECHNICAL OUTLOOK (H1):

Gold is consolidating below a major resistance zone at 3,308–3,310, which aligns with the descending trendline and 200 EMA.

Fibonacci retracement zones (0.5–0.618) also highlight strong resistance around 3,297–3,309.

On the downside, support at 3,263 is key; a break below may expose the broader demand zone near 3,246.

🔍 TRADE SETUPS – MAY 29:

🔵 BUY ZONE: 3,247 – 3,245

Stop Loss: 3,241

Take Profit Targets:

3,251 – 3,255 – 3,260 – 3,264 – 3,270 – 3,275 – 3,280

🔵 BUY SCALP: 3,263 – 3,261

Stop Loss: 3,257

Take Profit Targets:

3,266 – 3,270 – 3,275 – 3,280 – 3,290 – 3,300

🔻 SELL SCALP: 3,294 – 3,296

Stop Loss: 3,300

Take Profit Targets:

3,290 – 3,286 – 3,282 – 3,278 – 3,274 – 3,270 – 3,260

🔻 SELL ZONE: 3,308 – 3,310

Stop Loss: 3,314

Take Profit Targets:

3,304 – 3,300 – 3,296 – 3,292 – 3,288 – 3,280

📌 STRATEGY TIP:

Price is range-bound ahead of key data. Avoid entering mid-range. Wait for price to reach the edges (BUY/SELL zones) and look for clear rejection or confirmation candles. Stick to strict risk management.

Advanced Trading part 1Advanced trading encompasses sophisticated strategies, tools, and techniques used by experienced traders to navigate complex market dynamics and potentially maximize profits. It involves utilizing a range of analytical tools, including technical indicators, chart patterns, and quantitative analysis, as well as employing instruments like options and futures.

Technical Trading Technical trading is a broader style that is not necessarily limited to trading. Generally, a technician uses historical patterns of trading data to predict what might happen to stocks in the future. This is the same method practiced by economists and meteorologists: looking to the past for insight into the future.

Database Trading **Database trading**, often referred to as **algorithmic trading** or **quantitative trading**, involves using large sets of structured data to make trading decisions and execute trades automatically. It relies heavily on databases to store, process, and analyze market data (historical prices, volumes, order books, etc.) and other relevant information (like economic indicators, news, etc.). The goal is to identify patterns, trends, or anomalies that can be leveraged for profitable trading strategies.