M-forex

NESTLE INDIA LTDAs of May 26, 2025, Nestle India Ltd. (NSE: NESTLEIND) closed at ₹2,451.00, marking a 1.52% increase from the previous day. The stock's intraday range was between ₹2,405.40 and ₹2,464.90.

📊 Daily Support & Resistance Levels

Based on various pivot point calculations, the following are the key support and resistance levels for Nestle India:

Standard Pivot Points

Support Levels:

S1: ₹2,396.83

S2: ₹2,369.67

S3: ₹2,324.93

Resistance Levels:

R1: ₹2,468.73

R2: ₹2,513.47

R3: ₹2,540.63

Fibonacci Pivot Points

Support Levels:

S1: ₹2,396.83

S2: ₹2,369.37

S3: ₹2,352.40

Resistance Levels:

R1: ₹2,424.30

R2: ₹2,441.27

R3: ₹2,468.73

Camarilla Pivot Points

Support Levels:

S1: ₹2,407.81

S2: ₹2,401.22

S3: ₹2,394.63

Resistance Levels:

R1: ₹2,420.99

R2: ₹2,427.58

R3: ₹2,434.17

📈 Technical Indicators Overview

Relative Strength Index (RSI): 70.998 — approaching overbought territory.

MACD (12,26): 17.89 — bullish crossover.

Stochastic Oscillator (9,6): 85.134 — overbought.

Average Directional Index (ADX): 56.86 — indicating a strong trend.

Moving Averages: The stock is trading above its 5-day (₹2,454.78), 10-day (₹2,436.91), 20-day (₹2,405.42), 50-day (₹2,397.91), 100-day (₹2,374.14), and 200-day (₹2,381.37) simple moving averages, suggesting a strong upward momentum.

🔍 Summary

Nestle India Ltd. is exhibiting strong bullish momentum, trading above key support levels and moving averages. However, technical indicators like RSI and Stochastic Oscillator suggest that the stock is nearing overbought conditions. Investors should monitor these levels closely for potential pullbacks or consolidations.

BANKNIFTY Bank Nifty - Intraday Levels

Current Level: 55,571.95 (as of May 26, 2025)

Support Levels:

S1: 55,300

S2: 54,800

S3: 54,500

Resistance Levels:

R1: 55,800

R2: 56,200

R3: 56,500

Intraday Strategy:

Bullish Scenario: If Bank Nifty sustains above 55,800, consider long positions targeting 56,200-56,500.

Bearish Scenario: If Bank Nifty breaks below 55,300, consider short positions targeting 54,800-54,500.

Stop-Loss:

For Long Positions: Below 55,300

For Short Positions: Above 55,800 #NIFTYBANK

MIDCPNIFTY MIDCPNIFTY- Intraday Levels

Pivot Level: 12,673.53

Support Levels:

S1: 12,640.97

S2: 12,621.26

S3: 12,586.12

Resistance Levels:

R1: 12,706.10

R2: 12,725.81

R3: 12,760.95

Intraday Strategy:

Bullish Scenario:

If MIDCPNIFTY sustains above 12,687.25, consider long positions targeting 12,706.10-12,725.81-12,760.95.

Stop-Loss: 12,682.10

Bearish Scenario:

If MIDCPNIFTY breaks below 12,659.82, consider short positions targeting 12,640.97-12,621.26-12,586.12.

Stop-Loss: 12,682.10

#MIDCPNIFTY

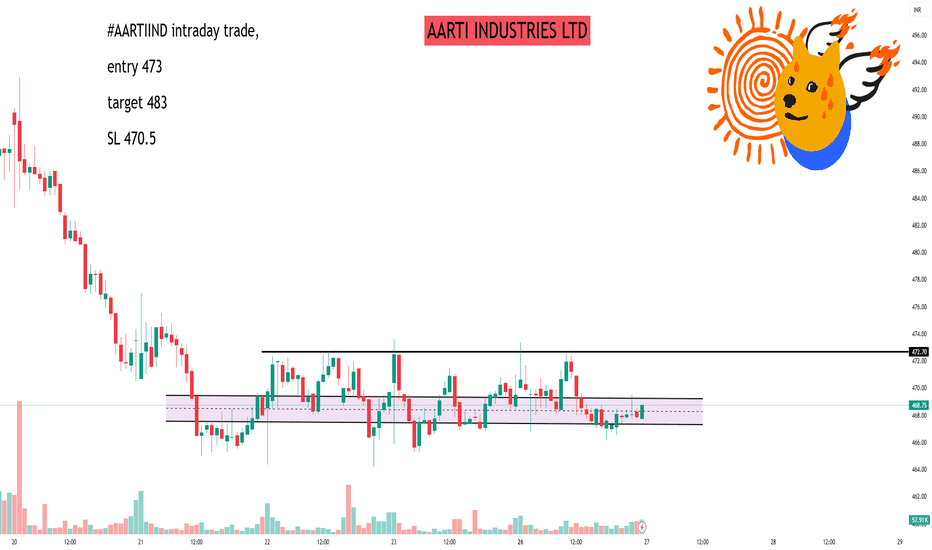

AARTI INDUSTRIES LTD📊 Intraday Support & Resistance Levels (15-Minute Interval)

Based on recent technical data, the following are the key support and resistance levels for AARTIIND:

Support Levels:

S1: ₹466.67

S2: ₹464.97

S3: ₹462.22

Resistance Levels:

R1: ₹472.17

R2: ₹473.87

R3: ₹476.62

These levels are derived from Fibonacci pivot point calculations and are pertinent for intraday trading decisions.

📈 Technical Indicators Overview

Trend Analysis: The stock exhibits a bullish trend in the short to mid-term, with resistance noted around ₹486.90 and support near ₹420.40.

Moving Averages: AARTIIND is trading above its 50-day moving average, indicating upward momentum.

Relative Strength Index (RSI): The RSI is approaching overbought territory, suggesting caution for new long positions.

✅ Trading Strategy Suggestions

Long Positions: Consider entering if the price sustains above ₹472.17 (R1) with strong volume, targeting ₹476.62 (R3).

Short Positions: If the price falls below ₹466.67 (S1), it may test lower supports at ₹464.97 (S2) and ₹462.22 (S3).

Stop-Loss Recommendations:

For Long Trades: Place a stop-loss below ₹466.67.

For Short Trades: Place a stop-loss above ₹472.17.

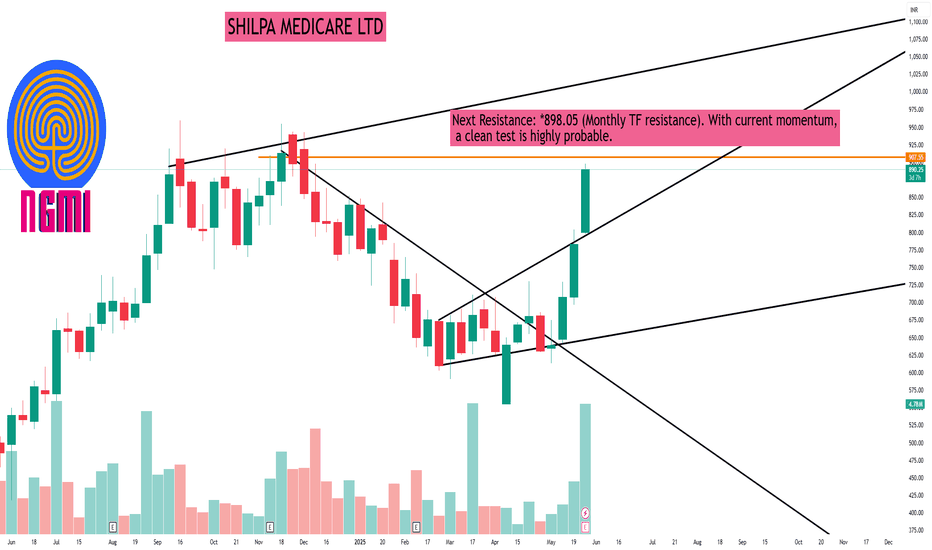

SHILPA MEDICARE LTDSHILPA MEDICARE LTD

Hidden Channel SHATTERED - Explosive Breakout on SHILPA MEDICARE

Breakout from a well-defined Weekly Counter Trendline (white thick line) with strong bullish candle.

Hidden Broadening Channel Formation (dotted white lines) was also broken in the same move-double breakout confirmation!

* Volume spike-first major surge in weeks, indicating institutional participation.

✰ Consolidation just below major resistance (MTF orange line) played out perfectly. Price broke above previous swing highs.

Next Resistance: *898.05 (Monthly TF resistance). With current momentum, a clean test is highly probable.

Will Gold Break Through 3366 or Pull Back Before NFP Week?XAUUSD PLAN – 26/05 | Will Gold Break Through 3366 or Pull Back Before NFP Week?

Gold is currently trading near a major resistance zone after a sharp rebound last week. With Fed policies still hawkish and trade tensions between the US and EU on hold, the market is entering a wait-and-see phase — ideal for structured trades.

🌍 MACRO CONTEXT:

Trump Delays 50% Tariffs on EU Until July 9: This cooled market tension temporarily but doesn’t eliminate the risk long term.

US 10-Year Yields Surge Back Above 4.55% right after, showing bond markets are still pricing in tighter conditions.

The Fed Faces Strategic Losses: As rate hikes increase reserve interest payments, the Fed is trimming 10% of its workforce — a rare signal of operational pressure.

➡️ Investors should brace for volatility ahead of NFP and watch closely for central bank reactions.

🔍 TECHNICAL OUTLOOK – H1/H4 View:

Gold is respecting a rising channel while consolidating near the 3360–3366 region — a key sell zone with potential for reversal.

The chart also shows clear Fair Value Gaps (FVGs) above and below current price, signaling pending liquidity sweeps.

🔑 KEY TECHNICAL LEVELS

🔺 Resistance Zones:

3364 – 3366 → Local top and key reversal zone

3406 – 3408 → FVG upper bound, potential blow-off target if breakout occurs

🔻 Support Zones:

3324 – 3326 → 20 EMA retest, potential bullish bounce

3310 – 3308 → Trendline + EMA89 confluence

3304 → Break below this area could invalidate short-term bull bias

🎯 TRADE SETUPS

🟢 BUY SCALP:

Entry: 3326 – 3324

Stop-Loss: 3320

Take-Profit: 3330 → 3334 → 3338 → 3342 → 3346 → 3350

🟢 BUY ZONE:

Entry: 3310 – 3308

Stop-Loss: 3304

Take-Profit: 3314 → 3318 → 3322 → 3326 → 3330 → 3340

🔴 SELL SCALP:

Entry: 3364 – 3366

Stop-Loss: 3370

Take-Profit: 3360 → 3356 → 3352 → 3348 → 3344 → 3340

🔴 SELL ZONE:

Entry: 3406 – 3408

Stop-Loss: 3412

Take-Profit: 3400 → 3396 → 3392 → 3388 → 3385 → 3380

⚠️ STRATEGY RECOMMENDATION:

If price breaks above 3366 with momentum, expect a run to 3408 and possibly 3450.

If price rejects 3366 or fails to hold above 3320, scalpers can look for quick shorts with tight stops.

📌 Avoid chasing price in the middle of the range. Wait for strong rejection or breakout confirmation to enter.

Management and PsychologyTrading psychology is the emotional component of an investor's decision-making process, which may help explain why some decisions appear more rational than others. Trading psychology is characterized primarily by the influence of both greed and fear. Greed drives decisions that might be too risky.

Advanced Trading part 1Advanced trading encompasses sophisticated strategies, tools, and techniques used by experienced traders to gain an edge in the market, often involving complex instruments like options and futures, and multiple technical indicators. It's about developing a trading system, testing and refining strategies, and understanding market micro-structure.

RSI (Relative Strength Index)In trading, RSI stands for Relative Strength Index. It's a momentum indicator used in technical analysis to measure the speed and change of price movements of an asset. RSI helps traders identify potential overbought or oversold conditions, providing signals that can guide their trading decisions.

VA TECH WABAG LTDBREAKOUT STOCK

Stock: VA TECH WABAG

Chart: weekly

View: bullish

Resistance Levels:

R1: ₹1,644.17

R2: ₹1,736.33

R3: ₹1,875.87

Support Levels:

S1: ₹1,412.47

S2: ₹1,272.93

S3: ₹1,180.77

▸ Va Tech Wabag is trading 1.78% upper at Rs 1,552.10 as compared to its last closing price.

Va Tech Wabag has been trading in the price range of 1,595.10 & 1,532.80.

Va Tech Wabag has given -5.54% in this year & 8.77% in the last 5 days.

There are 2 analysts who have initiated coverage on Va Tech Wabag.

There are 1 analysts who have given it a strong buy rating & 1 analysts have given it a buy rating. 0.00 analysts have given the stock a sell rating.

The company posted a net profit of 99.50 Crores in its last quarter.Listed peers of Va Tech Wabag include Va Tech Wabag (1.78%), Jitf Infralogistics (-0.70%), Captain Polyplast (0.06%). The Mutual Fund held in Va Tech Wabag was at 2.29% in 31 Mar 2025.

►The Fll holding in Va Tech Wabag was at 18.58% in 31 Mar 2025. The FIl holding has decreased from the last quarter

TATA INVESTMENT CORP LTDAs of May 26, 2025, Tata Investment Corporation Ltd. (NSE: TATAINVEST) closed at ₹6,269.00. Here's an overview of its 15-minute intraday support and resistance levels based on technical analysis:

📊 15-Minute Intraday Support & Resistance Levels

While specific 15-minute pivot points are not readily available, we can refer to the daily pivot levels as a proxy for intraday analysis:

Classic Pivot Points:

Pivot Point (P): ₹6,257.33

Resistance Levels:

R1: ₹6,374.66

R2: ₹6,480.33

R3: ₹6,597.66

Support Levels:

S1: ₹6,151.66

S2: ₹6,034.33

S3: ₹5,928.66

These levels can serve as reference points for intraday trading decisions.

🔍 Technical Indicators Overview

RSI (14-day): 57.56 — indicating neutral momentum.

MACD: 27.09 — suggesting bullish momentum.

Stochastic Oscillator: 72.08 — approaching overbought territory.

Supertrend Support: ₹5,861.93 — acting as a dynamic support level.

Parabolic SAR: ₹5,842.13 — indicating an upward trend.

These indicators suggest a cautiously bullish outlook for the short term.

📈 Trading Strategy Insights

Bullish Scenario: A breakout above ₹6,374.66 (R1) with strong volume could signal further upward momentum.

Bearish Scenario: A drop below ₹6,151.66 (S1) may indicate potential downside risk.

Traders should monitor these levels closely and consider additional technical indicators for confirmation.

ICICI PRU LIFE INS CO LTDAs of May 26, 2025, ICICI Prudential Life Insurance Co. Ltd. (NSE: ICICIPRULI) closed at ₹642.20, marking a 3.62% increase from the previous session. Here's a detailed analysis of its weekly support and resistance levels based on various pivot point methodologies:

📊 Weekly Pivot Point Levels

Classic Pivot Points

Pivot Point (P): ₹632.07

Resistance Levels:

R1: ₹654.08

R2: ₹665.97

R3: ₹687.98

Support Levels:

S1: ₹620.18

S2: ₹598.17

S3: ₹586.28

Fibonacci Pivot Points

Pivot Point (P): ₹632.07

Resistance Levels:

R1: ₹645.02

R2: ₹653.02

R3: ₹665.97

Support Levels:

S1: ₹619.12

S2: ₹611.12

S3: ₹598.17

Camarilla Pivot Points

Pivot Point (P): ₹632.07

Resistance Levels:

R1: ₹645.31

R2: ₹648.42

R3: ₹651.52

Support Levels:

S1: ₹639.09

S2: ₹635.99

S3: ₹632.88

🔍 Technical Outlook

Trend Analysis: The stock is currently trading above its central pivot point (₹632.07), indicating a bullish bias.

Key Resistance: A breakout above ₹654.08 (R1) could signal further upward momentum.

Key Support: A decline below ₹620.18 (S1) may suggest a potential bearish reversal.

ABB INDIA LTDAs of May 26, 2025, ABB India Ltd. (NSE: ABB) closed at ₹5,961.00. Here's a comprehensive overview of its weekly support and resistance levels based on technical analysis:

📊 Weekly Support & Resistance Levels

Classic Pivot Points:

Resistance Levels:

R1: ₹6,063.67

R2: ₹6,166.33

R3: ₹6,343.17

Support Levels:

S1: ₹5,784.17

S2: ₹5,607.33

S3: ₹5,504.67

Pivot Point: ₹5,941.83

Fibonacci Pivot Points:

Resistance Levels:

R1: ₹5,985.57

R2: ₹6,012.59

R3: ₹6,056.33

Support Levels:

S1: ₹5,898.09

S2: ₹5,871.07

S3: ₹5,827.33

Pivot Point: ₹5,941.83

Camarilla Pivot Points:

Resistance Levels:

R1: ₹5,971.50

R2: ₹5,981.99

R3: ₹5,992.49

Support Levels:

S1: ₹5,950.50

S2: ₹5,940.01

S3: ₹5,929.51

Pivot Point: ₹5,941.83

🔍 Technical Outlook

Trend: ABB India is exhibiting a neutral to mildly bullish trend.

Key Observations:

The stock is trading near its central pivot point, suggesting potential for either a breakout or a pullback.

A decisive move above R1 levels could indicate bullish momentum, while a drop below S1 may suggest bearish tendencies.

Technical indicators such as RSI are indicating buying momentum, suggesting the stock might rise.

NIFTY 50 INDEXMarket View:

On Friday, we saw sellers suddenly exit from the 25,000 CE level. So be cautious today.

Avoid first 15-minute trades early in the day.

Watch the 24,950-24,970 zone:

If price goes up from the current market price look again if any selling starts around this level, and a candle closes below this level (24,950) we may see a 130+ point fall.

But if 24,950 holds and the 30-minute chart shows higher highs, the market could move up towards 25,120-25,200.

INDO STAR CAPTIAL LTDBREAKOUT STOCK

Stock: #INDOSTAR

Chart: daily

View: bullish

Key points:

Indostar Capital Finance is trading 7.63% upper at Rs 336.40 as compared to its last closing price.

Indostar Capital Finance has been trading in the price range of 345.20 & 308.60.

Indostar Capital Finance has given 24.58% in this year & 6.28% in the last 5 days.

Indostar Capital Finance has TTM P/E ratio 79.27 as compared to the sector P/E of 33.60.

(7.63%).

The Mutual Fund holding in Indostar Capital Finance was at 0.01% in 31 Mar 2025.

The MF holding has decreased from the last quarter.

The FIl holding in Indostar Capital Finance was at 2.68% in 31 Mar 2025.

The FIl holding has increased from the last quarter

NMDC LTDNMDC Limited (National Mineral Development Corporation) is a leading Indian public sector enterprise under the Ministry of Steel, Government of India. Established in 1958, NMDC is India's largest producer of iron ore, with operations spanning mining, mineral exploration, and value-added production.

🏢 Company Overview

Headquarters: Hyderabad, Telangana

Chairman & Managing Director: Amitava Mukherjee

Ownership: Government of India holds approximately 60.79% stake

Employees: Approximately 5,887 (as of March 2019)

🛠️ Core Operations

Iron Ore Mining: NMDC operates highly mechanized iron ore mines in Chhattisgarh (Bailadila) and Karnataka (Donimalai), producing over 45 million tonnes annually.

Diamond Mining: Operates India's only mechanized diamond mine at Panna, Madhya Pradesh, with a capacity of 84,000 carats per year.

Other Minerals: Engaged in the exploration and extraction of copper, rock phosphate, limestone, dolomite, gypsum, bentonite, and beach sands.

🌍 Global Presence & Diversification

International Ventures: Through its subsidiary, Legacy Iron Ore Limited, NMDC holds exploration tenements in Western Australia for iron ore, gold, tungsten, and base metals.

Strategic Investments: Holds a 26% stake in International Coal Ventures Pvt. Ltd. (ICVL), which owns coking coal deposits in Mozambique.

🏗️ Nagarnar Steel Plant

NMDC established a 3 million tonnes per annum (MTPA) integrated steel plant at Nagarnar, Chhattisgarh, to diversify into steel production. In 2022, the steel business was demerged to form NMDC Steel Limited, which was listed on Indian stock exchanges in February 2023.

📈 Financial Highlights

Stock Listings: Listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) under the ticker symbol 'NMDC'.

Shareholding Pattern (as of February 2020):

Government of India: 69.65%

Life Insurance Corporation of India: 13.699%

Other Institutional Investors: Approximately 24%

🏆 Awards & Recognition

SCOPE Eminence Award 2019-20 for CSR Excellence

Most Sustainable & Innovative Manufacturing Practices at World HRD Congress & Awards 2024

CEO of the Year Award at the Business Leader of Year 2024

Best PSU for CSR in Mining and Minerals at the Global CSR Excellence and Leadership Awards 2024

Will Gold Surge with a Gap Up as US-China Trade War Heats Up?XAU/USD Analysis: Will Gold Surge with a Gap Up? (26/5 - 30/5)

Fundamental Outlook

US-China Trade War: China's halt on US goods imports weakens the USD, boosting gold (inverse USD correlation).

Trump’s 50% EU Tariff Threat: Potential EU retaliation could spike global uncertainty, driving investors to gold as a safe haven.

Gold Demand: Rising trade tensions and inflation fears are pushing capital into gold, especially in India and China with upcoming festivals.

Macro Drivers

Monetary Policy:

US Fed: Trade war fallout may pressure rate cuts, reducing USD appeal and supporting gold.

China’s PBOC: Possible Yuan devaluation could lift gold prices in USD terms.

Market Sentiment:

Expect VIX spikes from trade uncertainties, favoring gold.

Strong physical gold demand in Asia supports prices.

Key Events:

US PCE inflation and consumer confidence data (watch for high inflation boosting gold).

Monitor EU/China trade retaliation statements.

Technical Analysis (H4 Chart)

Trend: Gold is in a strong ascending channel with support (3,325) and resistance (3,407 - 3,444).

Current Price: 3,407.554, testing key resistance (3,407 - 3,444).

Support Levels: 3,361.648 (mid-channel), 3,325.347 (channel support).

Resistance: 3,444.436 (all-time high).

Price Action: Recent Doji candle at resistance suggests possible pullback before continuation.

Fair Value Gaps (FVG):

3,325 - 3,340

3,361 - 3,407

Scenarios:

Bullish: Break above 3,444 with momentum could trigger a gap up, targeting 3,500

Bearish: Failure at 3,444 may lead to a pullback to 3,361 or 3,325.

Gap Up Probability: 60% chance at market open (26/5), driven by bullish sentiment.

Trading Plan

Buy Strategy

Entry: 3,361 - 3,370 (pullback to FVG or mid-channel).

Take Profit: 3,444 (resistance), 3,500 (breakout target).

Stop Loss: Below 3,325 (channel support).

Sell Strategy

Entry: Sell on rejection at 3,444 with bearish confirmation (e.g., strong bearish candle or head-and-shoulders).

Take Profit: 3,361 (FVG zone).

Stop Loss: Above 3,444.

Best Trading Times

Monitor market open (26/5) for gap-up confirmation.

Trade during London/New York sessions for optimal liquidity.

Key Takeaways

Gold is poised for potential upside due to trade war escalation and USD weakness. Watch for a breakout above 3,444 for a possible gap up or a pullback to 3,361 for buying opportunities. Stay updated on US inflation data and trade policy news.

Institutional Trading part 4Institutional trading involves buying and selling securities by organizations on behalf of other investors, typically in large volumes. These traders, often working for entities like mutual funds, pension funds, and hedge funds, manage significant capital and can influence market prices. Institutional trading differs from retail trading, which involves individual investors making smaller trades for their own accounts.