Manappuram Finance LtdThe stock is currently moving within an ascending broadening wedge, a pattern that usually indicates a bearish reversal. However, it is forming higher highs and higher lows. The support line has been well respected, with multiple touches and no breakdowns.

Consider buying above 285, aiming for targets of 315 and 350.

MANAPPURAM

MANAPPURAM: Soaring High with a 15% Growth Potential

Strong Resistance Breakout

Trading above all EMAs

Gap Filled

RSI Above 60

Next Resistance Level and Breakout Indicated on the Chart

Disclaimer: This analysis is provided solely for informational and educational purposes and should not be interpreted as financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions.

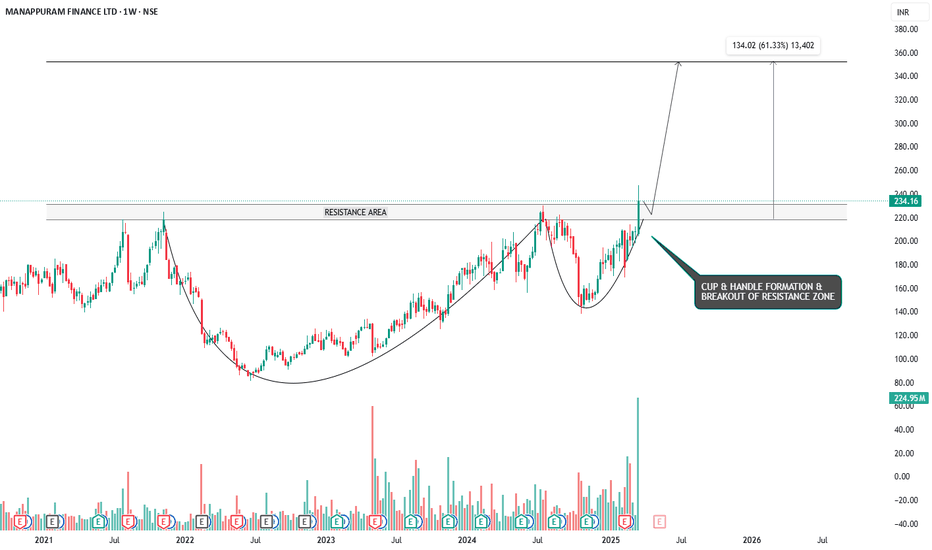

RIDING THE WAVE - CUP & HANDLE BREAKOUT IN MANAPPURAM FINANCESymbol - MANAPPURAM

CMP - 234.16

Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC.

Manappuram Finance Ltd. has recently demonstrated a significant bullish breakout, having formed a classic cup and handle pattern on a larger time frame and breaking out with strong volume. The cup and handle pattern is a well-regarded bullish breakout formation, and when it occurs on weekly or larger time frames, it tends to be highly reliable, indicating a robust upward momentum.

Currently, the stock price may retest the breakout zone, which coincides with the previous resistance area; now turned support - around the 230 to 217 range. This retest is a natural price action behavior and offers an attractive entry point for long positions before the stock continues its upward trajectory.

The target for this breakout, based on technical projections, is around 350, representing a 60% upside from the current market price. Given the strength of the breakout and the established pattern, this target appears achievable over the medium term.

For risk management, a stop loss can be placed around the 197 level, providing a reasonable cushion in case of a price reversal.

From a broader perspective, the formation of a cup and handle pattern coupled with a successful breakout on higher time frames adds a significant bullish bias to the stock. Investors looking for a favorable risk-to-reward setup may find this an opportune time to initiate or add to their positions in Manappuram Finance.

Disclaimer: The information provided here should not be construed as a buy or sell recommendation. It reflects my personal analysis and my trading position. Please consider this trading idea for educational purposes only. Thank you!

MANAPPURAM FINANCE LTD - APPROACHING RESISTANCE AREASymbol - MANAPPURAM

Manappuram Finance Ltd. has been experiencing a recovery from lower levels in recent weeks. The stock has bounced back from support zones and is now testing key resistance areas. However, it faces considerable challenges at higher levels, showing signs of consolidation as it approaches its resistance zones.

The overall trend appears to be in recovery, following a significant dip. However, the stock is facing resistance at higher levels, indicating a potential pause or consolidation before any significant movement.

Short-term trend looks slightly bearish, as the stock has encountered selling pressure at resistance levels and is currently consolidating. Long-term trend remains positive, driven by the company’s strong fundamentals in the gold loan market.

The stock is currently trading within an ascending triangle pattern and is consolidating near key resistance levels. My personal bias is towards the downside, and we could potentially see a sell-off from the resistance zone towards the triangle support trendline, with the possibility of a move below it.

The trade strategy could involve looking for short opportunities near the resistance zone, especially if the stock fails to break out and begins to reverse. However, if the stock manages to break above the resistance trendline of the ascending triangle, the bias would shift to the upside.

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

Manappuram Finance ( Reverse or Good Breakout )Stock Analysis: NSE:MANAPPURAM ( Reverse or Breakout )

Overview:

Current Price: ₹224.23

Timeframe: Monthly Chart

Key Levels:

Resistance Levels:** ₹225 (significant), ₹233.04 (major), ₹315.42 (potential target if breakout occurs)

Support Levels:** ₹190.00 (recent low), ₹160.00 (significant support)

Price Action:

The stock is currently approaching a major resistance level at ₹233.04.

A breakout above ₹233.04, accompanied by strong volume, could signal a continuation of the uptrend towards ₹315.42.

Conversely, failure to break above ₹233.04 may result in a potential reversal towards support levels like ₹190.00 and ₹160.00.

Volume Analysis:

- Increasing volume could support a breakout above ₹225.

Conclusion:

- Watch for a closing price above ₹225 as an indication of potential bullish momentum in Manappuram Finance.

- Confirmation with strong volume is advisable for assessing sustainability of any breakout

- Be mindful of support levels at ₹190.00 and ₹160.00 in case of a reversal scenario.

MANAPPURAM - SWING TRADE - 23rd December #stocks#MANAPPURAM (1W TF)

Swing Trade Analysis given on 23rd December, 2023

Pattern: ASCENDING CHANNEL BREAKOUT

- Breakout of Channel Resistance - Done ✓

- Volume Spike Buildup - Done ✓

- Retracement & Consolidation - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte

MANAPPURAM - Bullish Swing ReversalNSE: MANAPPURAM is closing with a bullish swing reversal candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Breakout In Manappuram Finance !Manappuram Finance has just demonstrated a noteworthy breakout from an Ascending Channel pattern, which has helped it hit 52-week high levels. A general bullish biasness towards the stock is indicated by this upturn.

After carefully examining the daily charts, it is apparent that a Change in Polarity (CIP) pattern has developed near the Rs 131 price level. The stock's upward trajectory is thereby strengthened.

Along with this, the stock price managed to sustain above crucial moving averages i.e. 50,100, and 200 SMA. Hence, strong bullish momentum can be expected in upcoming few weeks.

CMP: 146

Buy above 154.

Target: 185-190

Stoploss: 138.

Please do your own research before initiating any trade. Always keep stoploss in order to protect your capital.

#Follow us for more such information and educational ideas. Give it a like if you appreciate the idea. Queries will be answered in comment section.

INTRADAY TRADE FOR TOMORROW If Stock opens Gap up or Gap down from the buy price please Avoid trade

DISCLAIMER:- I'm not SEBI registered research analyst or investment adviser. All stocks & information given is for educational purpose only. Consult with your financial advisor before taking the trade on my views given here.

Manappuram chart studyManappuram spot cmp 104

weekly time frame

chart pattern study

Head and shoulder pattern

Pole and Flag pattern,

Counter have neck line support around 90 levels

and demand zone as per previous swing low around 70-80 levels

at the moment counter is on verge to give a weekly close below support line of penant, if that happen counter can give fall till levels of 90-80-70 levels.

Keep watch..

MANAPPURAMMANAPPURAM:- Ascending triangle pattern is formed, breakout is found and if it comes out above 132 then you can plan something, till then keep your eye on the stock.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

MANAPUPURAM ---MULTIBAGGER 2023MANAPPURAM -- Monthly chart setup - GOLDEN YEAR 2023

1. stock trading at Monthly upper channel , channel lower level support seen around 100-105 level from then continuation to upward channel

2. Gold price appreciation this year gold price hit all time high, that boost fundamentally.

3 . Normalized smooth MACD shown at positive crossover point

4. Double bottom support seen at trend reversal around 80-85 level

5. potential upside 50-80% from current level 115-118 target 150-180-200 n 1 year, stop loss bellow channel and trendline support at 75

** THIS IDEA IS FOR EDUCATIONAL PURPOSE .. Trade at own risk !!

** HAPPY TRADING. !!