Manappuram Finance LtdThe stock is currently moving within an ascending broadening wedge, a pattern that usually indicates a bearish reversal. However, it is forming higher highs and higher lows. The support line has been well respected, with multiple touches and no breakdowns.

Consider buying above 285, aiming for targets of 315 and 350.

Manappuramlong

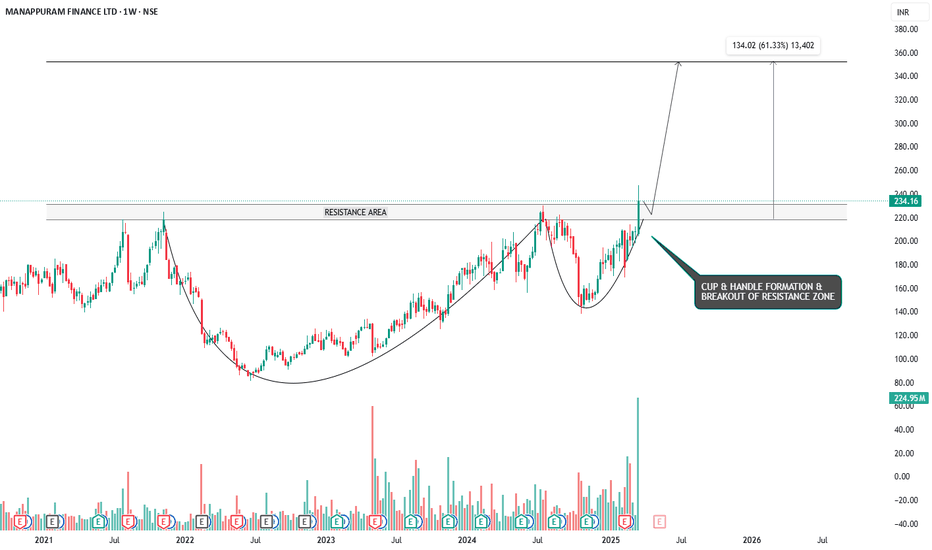

RIDING THE WAVE - CUP & HANDLE BREAKOUT IN MANAPPURAM FINANCESymbol - MANAPPURAM

CMP - 234.16

Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC.

Manappuram Finance Ltd. has recently demonstrated a significant bullish breakout, having formed a classic cup and handle pattern on a larger time frame and breaking out with strong volume. The cup and handle pattern is a well-regarded bullish breakout formation, and when it occurs on weekly or larger time frames, it tends to be highly reliable, indicating a robust upward momentum.

Currently, the stock price may retest the breakout zone, which coincides with the previous resistance area; now turned support - around the 230 to 217 range. This retest is a natural price action behavior and offers an attractive entry point for long positions before the stock continues its upward trajectory.

The target for this breakout, based on technical projections, is around 350, representing a 60% upside from the current market price. Given the strength of the breakout and the established pattern, this target appears achievable over the medium term.

For risk management, a stop loss can be placed around the 197 level, providing a reasonable cushion in case of a price reversal.

From a broader perspective, the formation of a cup and handle pattern coupled with a successful breakout on higher time frames adds a significant bullish bias to the stock. Investors looking for a favorable risk-to-reward setup may find this an opportune time to initiate or add to their positions in Manappuram Finance.

Disclaimer: The information provided here should not be construed as a buy or sell recommendation. It reflects my personal analysis and my trading position. Please consider this trading idea for educational purposes only. Thank you!

Breakout In Manappuram Finance !Manappuram Finance has just demonstrated a noteworthy breakout from an Ascending Channel pattern, which has helped it hit 52-week high levels. A general bullish biasness towards the stock is indicated by this upturn.

After carefully examining the daily charts, it is apparent that a Change in Polarity (CIP) pattern has developed near the Rs 131 price level. The stock's upward trajectory is thereby strengthened.

Along with this, the stock price managed to sustain above crucial moving averages i.e. 50,100, and 200 SMA. Hence, strong bullish momentum can be expected in upcoming few weeks.

CMP: 146

Buy above 154.

Target: 185-190

Stoploss: 138.

Please do your own research before initiating any trade. Always keep stoploss in order to protect your capital.

#Follow us for more such information and educational ideas. Give it a like if you appreciate the idea. Queries will be answered in comment section.

MANAPPURAM FIN LONGBuy MANAPPURAM FIN for Target 1= 114 Target 2= 124

with SL below 89

Note : Trading in any financial market is very risky. I post ideas for educational purpose only. It is not financial advice. Do not hold us responsible for any potential loss you may incur. Please consult your financial adviser before trading.

MANAPPURAM Bouncing off long-term trendlineMANAPPURAM has successfully taken support at its long-term trendline for the last 6 years. The stock has touched this trendline and bounced off of it every two years since December 2016 (as shown in the chart). Another bounce happened in May 2022 and the price is still in a buy range.

This looks like a good place for accumulation. Price targets can be 126, 145, with 218 as the final target. Stop loss below 80. This is a medium to long-term buy opportunity in Manappuram Finance.

Manappuram Finance - Can it become 3X again?Manappuram Fin is trading near a key trendline support. Stock has always become 2.5X to 3X after taking support on this trendline. Positive on the stock. Any further downside will be a good opportunity to add. SL below the trendline support (only on a close below the trendline on monthly candle)

#manappuramFinance support NSE:MANAPPURAM

📌 To Trade on This Chart, You Should Have Reversal Trading Knowledge. As Harmonic is One Of The Best Reversal Trading Strategy, But Always Remember That Harmonic Patterns Also Can Fail (there is no holly grail In Stock Market). That's Why One Should Must Have Knowledge Of Reversal Trading To Trade On Harmonic Patterns.

📌 That Dash Line Is Called PRZ, From That Dash Line To that Horizontal Simple Line Area Is Whole PRZ(Price Reversal Zone).

📌 As One can see, This Pattern has Been Made on Extended levels, that's why stop loss quite big as per this pattern. So wait for perfect reversal first then only go for long and ones enter in trade then strictly follow stop loss and here as per my own experience one should keep Stop Loss as closing basis.

(PRZ :- Potential Reversal Zone, SL :- Stop Loss, TF :- Time Frame)

PRZ 1 :- 139.55

SL :- 122 (Closing Basis)

Target 1:- 148

Target 2:- 154

Target 3:- 161 and more Trailing basis

Note:- As Per this harmonic pattern , stop loss is quite big, so Trade on reversal only if you don’t know what is reversal, Kindly note that and ask in live session so next time you could be able to identify reversal by your self. Even ask doubts in comments, below.

******whatever charts or levels sharing here or on any other platforms are just for educational purpose only, Not A Recommendation To Buy Or Sell. Please do your own analysis before taking any trade on them. We are not SEBI registered.

03/12/2021 Research Report For ManappuramDisclaimer:

I am not SEBI registered person and this is not an investment advice and also please note this is only for education purpose. Also note we can use this research in my own portfolios. So don't influence yourself by this research. Please note before investing according to this educational research, please do own research and also do take advice from your financial adviser. Your any profits and loss are totally your liability. No one is liable for that. Also, please note we will not never compensate your any loss. So before investing any single rupee, please do your own research according to your risk taking capacity and after that do invest and book profits on right time.

Buy at C.M.P (Current Market Price) to Maximum 175

Target 1:- 200

Target 2:- 203

Target 3:- 206

Target 4:- 216

09/11/2021 Research Report ManappuramDisclaimer:

I am not SEBI registered person and this is not an investment advice and also please note this is only for education purpose. Also note we can use this research in my own portfolios. So don't influence yourself by this research. Please note before investing according to this educational research, please do own research and also do take advice from your financial adviser. Your any profits and loss are totally your liability. No one is liable for that. Also, please note we will not never compensate your any loss. So before investing any single rupee, please do your own research according to your risk taking capacity and after that do invest and book profits on right time.

Buy at C.M.P (Current Market Price) to Maximum 225

Target 1:- 236

MANAPPURAM FINANCE TRADE SETUP FOR TOMORROWMANAPPURAM FINANCE share is near to breakout, stock is consolidating between 170-175.

.

Previously we also gave the trade when MANAPPURAM is at 168. Now again it a time to BREAKOUT.

.

169-170 is strong support zone, you can buy this trade once it cross 175 for the target of 180-185

.

What's your view on this comment below in the box.

MANAPPURAM FINANCE TRADE SETUP FOR TOMORROWAs we already told you in the previous charts, once it break 170 level.

.

We can see the upward momentum, so the stock has given breakout.

.

You can make a position in MANAPPURAM FINANCE above 174.

.

Our short term target is 185-190.

.

What's your view on this comment below in the box.

MANAPPURAM FINANCE TRADE SETUP MANAPPURAM FINANCE share given the closing above 163,

.

So I think this is the time to enter in this trade, but still I recommend.

.

Safe Trader can enter in this trade once it cross 170, because from that stock can give some correction.

.

Once it goes above 170, we can see in the chart, there is strong rally of around of 40-50.

.

You can book your profit as per you comfort.

.

What's your view on this comment below in the box.