MANINFRA

Man Infra cmp 222.90 by Daily Chart views*Man Infra cmp 222.90 by Daily Chart views*

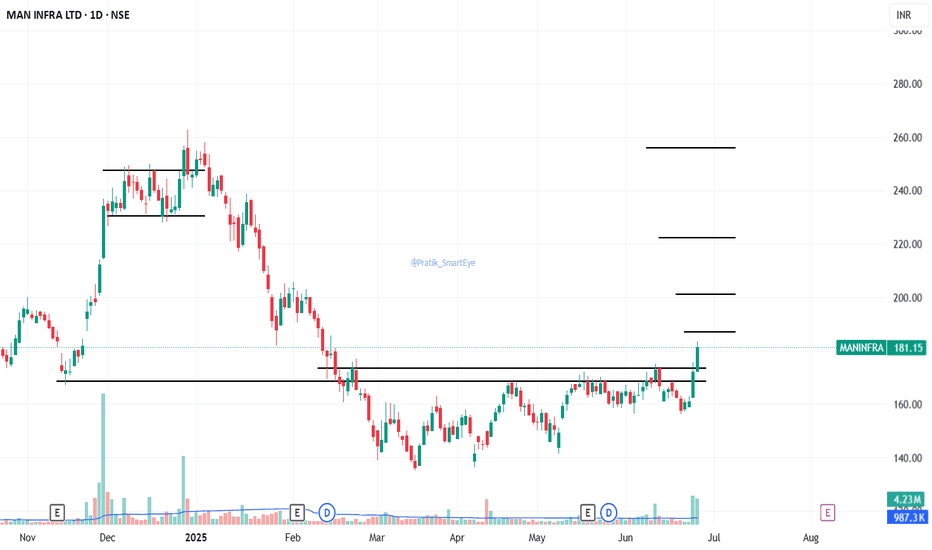

- Price Band 194 to 200 Strong Support Zone

- Double Bottom formed at 168 to 170.50 Price Band

- Strong Resistance Zone at 219 to 223 Price Band to be Support Zone

- Daily basis Support at 206 > 188 >168 with Resistance at 231 > ATH 249.30

- Volumes had spiked over past few days but Resistance Zone is acting as a good hurdle

- Price Breakout above Falling Resistance Trendline and well sustained above Support Zone

MANINFRA - Long Setup, Move is ON..NSE:MANINFRA

✅ #MANINFRA trading near Resistance of 215

✅ Next Resistance is at 266

Related charts:

Charts are self-explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Man Infraconstruction#MANINFRA

CMP :₹. 201.40/-

DATE : 02/12/2023

Company engaged in civil construction business in India. A low debt company with zero promoter pledge and improving financials. Sales and operating profit are increasing YoY .Eventhough debtor days have increased from previous year Cash conversion cycle and working capital days improved remarkably. Net casflow is dreadfully negative which is a menace. Recently board of directors company announced the allotment of preferential shares. Promoters and FIIS increased their stake. Stock is now at its 52 week high . Stock gained more than 20% in one month. Technically looking good. A slight dip due to profit booking can be expected in coming days. A 50% movement can be expected within 6 months time. Stoploss @ ₹.180/-

Disclaimer : Post only for educational purpose. Not a buying / selling recommendation. This is only my personal view. I am not a SEBI registered analyst . Do your own analysis and act accordingly .

MANINFRA - Long Setup, Move is ON..NSE:MANINFRA

✅ #MANINFRA trading near Resistance of 160

✅ Next Resistance is at 215

Related charts:

Charts are self-explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

MANINFRA - Weekly Chart AnalysisAfter almost a ~50% move from the low cheat trigger point the stock broke the ATH levels (116-131)and managed to sustain above it for 3 weeks and 15% range which was taken out this week on good volumes.

I shall wait for further confirmation of at least 1 close above 155.50 on daily timeframe.

Stock is showing good strength and so is its index. It is trading above all the key moving averages.

View gets invalid if it manages to close below the ATH Zone which now shall act as a support.

Trend based fib targets comes out to 220-260 levels.

Disclaimer: This is just an analysis and not a buy/sell recommendation. If you intend to trade this counter then do your own due diligence and trade at your own risk.

MANINFRA - Long Setup, Move is ON..NSE:MANINFRA

✅ #MANINFRA trading above Resistance of 127

✅ Next Resistance is at 160

Related charts:

Charts are self-explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Man Infra Construction Ltd. EMA cross, Resistance B/O and retestMan Infra Construction has taken good support at fib 0.5 ( from March 202 lows to the all time high) and consolidated and reversed.

the levels are placed and described.

targets are from upcoming resistance and Fibonacci reversal from ATH to reversal level.

Place your stoploss accordingly.

Financial results were good and it has goo dividend payout.

Note. Research ideas are for educational purpose and to learn technical analysis.

Always be patient and do not fall in love with stocks and pull down your stop losses,

Exit at your targets if you are a swing trader or add on good opportunities for long term.

Raakhi Gift!This Raakhi gift your sister a wonderful chart!

Chart -> MANINFRA Daily

The stock has given a breakout of an important support-resistance trendline, with a volume pop-up.

CMP: 88

Targets: 92, 102, 110

SL: 83 on a closing basis

Disclaimer: This is for educational purposes only, not any recommendations to buy or sell. As I am not SEBI registered, please consult your financial advisor before taking any action.

Man Infra - Breakout & Volatality contraction My analysis is based on the Monthly chart. The monthly chart is considered ideal for long term investors and gives a directional perspective of the stock price.

The stock is forming a double bottom pattern. Typically, a double bottom is formed after a single rounding bottom pattern is formed and is often an early sign of a potential reversal. According to Investopedia "Rounding bottom patterns will typically occur at the end of an extended bearish trend. The double bottom formation constructed from two consecutive rounding bottoms can also infer that investors are following the security to capitalize on its last push lower toward a support level. A double bottom will typically indicate a bullish reversal which provides an opportunity for investors to obtain profits from a bullish rally. After a double bottom, common trading strategies include long positions that will profit from a rising security price."

Volume expansion can also be clearly seen as the candles are coming close to ATH (All time high). The ATH was in year 2010 and the stock has broken with a strong body candle and volumes after eleven years. If the period from January 2018 to July 2021 is observed carefully, there is volume contraction- this is a good sign.

Relative Strength against CNX Infra index is outperforming since April 2021. This is another positive.

Data from Screener.in shows that promoter has been increasing shareholding since September 2018 -from 63.13% to 66.10% in June 2021. Promoter buying is again considered a positive move.

Entry strategy - now that the longer timeframe looks positive, we should move to the lower timeframe to get an entry. Here I will move to the Weekly timeframe and follow the Stan Weinstein framework. The stock has to be above the 30 Weekly MA, volume expansion must be clearly seen, range and body of weekly closing candle must be strong. Stock must be in HH HL structure. The stock fulfils the Stan Weinstein framework. If stock retraces and takes support within the 75-81 zone, that would be a good entry point to add from risk reward standpoint. Ensure volume does NOT expand when stock retraces.

If you move to the Weekly timeframe, between the candles of 19 July 2021 to 30 August 2021 you will see a high tight flag (HTF) formation. The stock had run up approx. 86% between 19 April to 19 July 2021. HTF is a very rare pattern and forms in bull cycles and according to William O'Neil, HTF begins with a stock moving 100% to 120% in a very short time, usually four to eight weeks. It then corrects sideways no more than 10% to 25% usually in three to five weeks. It may not be HTF strictly by William O'Neil's definition, but the flag can be seen very clearly.

Risk management is key in both investment or trading. If we see the current market cycle, NIFTY50 is forming newer highs. The rise has been unprecedented. This is fuelled by supply of money in the markets. What if in the near future money supply is chocked by tapering by FED or hawkish stance by MPC of RBI? In that case we will see a retracement even if the broader economy is doing well, structurally speaking. No one knows the future and hence a safer approach is to invest using a pyramid model i.e. take an entry when stock is just above the 50 Day MA with volumes above average and scale up. This could be an equal split, for example, 34-33-33 or 50-25-25. There is no hard and fast rule. There is a possibility that stock may shoot up after the first tranche and not give another opportunity to enter at retracement, but what is market turns against us? In that case our loss will be limited to the first tranche only.

Disclaimer: I am not a registered investment advisor or analyst. This is not a recommendation to buy or sell. The purpose is to share with peer community and learn from the experts. For any investment or trading calls, please consult your authorised investment advisor.