Bitcoin Is Reacting, Not Breaking, Patience Before the Next MoveWhen I look at this chart, I don’t see panic or trend failure. I see price pulling back into a clearly defined demand area within a rising structure and responding from it. That matters. If sellers were truly in control, price wouldn’t pause here, it would slice through demand without hesitation. Instead, Bitcoin is holding above structure, absorbing selling pressure, and stabilising.

The repeated rejections from the upper supply zone show that resistance exists, but the key point is this: sellers are unable to push price into a breakdown. Momentum has cooled, volatility has compressed, and RSI has reset without price collapsing, all signs of balance, not weakness.

This phase feels slow and uncomfortable, especially for traders who expect constant movement, but historically this is where the market builds the base for its next decision. I’m not interested in chasing price near resistance, and I’m not interested in panic selling into demand. I want to observe how price behaves here, because reactions at structure tell the real story. As long as Bitcoin continues to respect this rising demand and doesn’t accept below it, the broader structure remains intact and upside expansion stays on the table. A clean break below structure would force me to rethink, until then, patience is the position. Sometimes the best trades don’t come from predicting the next candle. They come from waiting while price proves who is actually in control.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and trade according to your own plan.

Marketstructure

Bitcoin at Demand: Where Most Traders Panic and Smart Money WaitWhen I look at this chart, I don’t see weakness.

I see price reacting exactly where it should .

Bitcoin is sitting above a clearly defined demand zone, and instead of collapsing, price is slowing down and compressing.

That usually tells me the market is absorbing liquidity, not distributing .

Key things I’m focusing on:

Price is holding above ascending demand , which shows buyers are still defending structure.

Reactions from the demand zone are clean , not impulsive, a sign of controlled participation.

Overhead supply is present , which explains the compression instead of an instant breakout.

RSI bullish divergence adds confidence that downside momentum is weakening near demand.

My mindset here:

I’m not chasing moves.

I’m not panicking into demand.

I’m simply watching how price behaves here , because this zone decides whether the next move expands or fails.

As long as structure holds, patience matters more than prediction.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage your risk.

USDJPY Pullback Explained: Trend Support in Focus!For me, USDJPY is still behaving like a healthy uptrend, not a market that is rolling over. Price has been respecting a clear rising channel structure, with buyers consistently defending higher lows.

The recent move lower looks more like a pullback into major trend support rather than a sign of weakness. This is exactly how strong trends usually behave, they pause, retrace, and then decide the next leg based on support reaction.

From a broader perspective:

On the fundamental side, currencies are currently adjusting to shifting rate expectations and global risk sentiment. In such phases, trends rarely reverse immediately. Instead, price often retraces into key levels before continuing or changing structure.

What I’m watching now:

As long as the rising channel and demand zone hold, the overall structure remains intact. The next move will largely depend on how price reacts at this support, not on short-term volatility.

This is not a trade call, it’s an observation of market behavior and structure.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk.

GBPUSD – Support Holding, Watching Reaction From RangeGBP/USD has reacted from a well-defined support zone, an area where buyers have stepped in multiple times before. Price is currently trading between clear support and resistance, indicating a short-term range environment.

As long as this support holds, upside reactions toward the resistance zone remain possible. A clean break below support, however, would weaken this structure and change the short-term bias.

This is a reaction-based zone, not a prediction. Let price confirm the next move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk. Please manage risk responsibly.

USDJPY – A Global Repricing Phase, Not a Random MoveWhen I look at USDJPY, this move doesn’t feel random to me. It looks like part of a broader global adjustment phase rather than something driven by this pair alone.

Price Context:

Price spent a long time reacting from a major supply zone before showing a clear structure shift. Since then, the market has been respecting an ascending channel, with higher highs and higher lows.

Why this move makes sense:

As global risk sentiment shifts and interest rate expectations change, currencies often move together. That’s why similar moves are visible across multiple FX pairs, this is a broad-based repricing, not a pair-specific reaction.

Current Structure:

The recent pullback into demand and trend support looks like a healthy retracement, not a breakdown. As long as this structure holds, the broader trend remains intact.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk.

Gold Investors: What to Do When Your Investment Has Multiplied?Hello Traders!

There comes a phase in every Gold investor’s journey that feels like success. You bought Gold much earlier, prices moved in your favour, and today your investment has multiplied. On paper, everything looks perfect. Profits are healthy, confidence is high, and holding feels easy.

But this phase is more dangerous than buying at the bottom.

Not because Gold is weak, but because emotions quietly change once profits become large. Decisions are no longer based on logic alone. They start revolving around fear of losing what you’ve already gained.

Why This Phase Is Emotionally Tricky

When your Gold investment multiplies, the mindset shifts from growth to protection. And protection, if unmanaged, turns into hesitation.

You start watching prices more frequently than before

Small pullbacks feel bigger because profits are involved

The fear of “giving back gains” becomes stronger than logic

This is where many investors either exit too early or hold blindly without a plan.

The Two Common Mistakes Gold Investors Make

Most investors fall into one of these extremes.

Booking full profits too early due to fear

Holding everything without re-evaluating structure

Both decisions come from emotion, not process. Gold doesn’t require extreme actions. It requires balance.

What Smart Investors Actually Do

Instead of reacting, experienced investors reassess. They treat this phase as a new decision point, not a continuation of the past.

They review why they invested in Gold in the first place

They secure partial profits instead of exiting fully

They align remaining holdings with long-term structure

This keeps emotions controlled while allowing participation if the trend continues.

How I Personally Handle This Situation

When Gold gives strong returns, I stop thinking in terms of “profit” and start thinking in terms of position management.

I remove emotional attachment to the entry price

I trail decisions based on structure, not headlines

I respect that trends don’t move forever in one direction

The goal is not to catch the top.

The goal is to avoid emotional mistakes near it.

Rahul’s Tip

When your Gold investment multiplies, don’t ask, “Should I sell or hold?”

Ask, “How do I reduce regret on both sides?” Partial exits and planned holding do that better than emotional all-or-nothing decisions.

Final Thought

Profits don’t end careers.

Poor decisions around profits do.

Gold rewards patience on the way up, and discipline after success.

If this post helped you think clearly about managing profitable Gold investments, drop a like or share your thoughts in the comments.

More real, experience-based lessons coming.

BTC Compression Phase: Where Smart Money Builds Positions!Hey guy's, When I look at this chart, I’m not seeing fear or trend failure.

I’m seeing something far more important, controlled compression above demand .

Bitcoin has pulled back, swept liquidity, and is now holding above a clearly defined demand area while volatility keeps contracting.

This kind of behaviour rarely appears during panic.

It usually appears when the market is absorbing supply quietly .

What I’m seeing on the chart:

Price is still respecting the ascending demand structure , which tells me higher-timeframe buyers are active and defending key levels.

The recent move cleaned out weak hands below demand , but price did not accept lower, a classic liquidity sweep, not a breakdown.

Supply is visible above , which explains why price is compressing instead of expanding immediately. Sellers are present, but they are not overpowering buyers.

The range between ascending demand and overhead supply is tightening . This is where impatience builds, and where strong positioning usually happens.

The psychology part (this matters):

This phase feels uncomfortable.

Price isn’t doing much.

Both sides are frustrated.

And that’s usually a clue.

If Bitcoin wanted to break structure, it had a clean opportunity below demand.

It didn’t take it.

That tells me sellers are getting weaker, not stronger.

So my thinking stays simple:

I don’t want to chase upside after expansion.

I don’t want to panic into a sell-off that already swept liquidity.

I want to watch how price reacts around demand, because this is where real decisions are made.

As long as structure holds:

Pullbacks into the 88k–87k demand zone remain high-probability reaction areas.

Compression above demand keeps the door open for a mean-reversion move toward higher levels.

Only a clean breakdown and acceptance below ~84k would invalidate this structure.

Until then, I’m not trying to predict the next candle.

I’m trying to read behaviour .

Markets don’t move when everyone is excited.

They move when most people get bored, confused, or impatient.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage risk and trade according to your own plan.

EURUSD – Breakout From Falling Resistance, Retest Holding WellEUR/USD was trading under a falling resistance trendline for a long time, with sellers consistently stepping in at higher levels. Recently, price managed to break above this trendline, which was the first sign that bearish pressure was easing.

After the breakout, price came back for a retest of the broken structure and previous resistance area. This retest is holding well so far, showing that buyers are defending the level and not allowing price to slip back below the structure.

What stands out here is how price respected the retest and then pushed higher, leaving behind a small imbalance. This often indicates acceptance above the breakout level rather than a false move.

As long as price holds above the retest zone and structure support, the path of least resistance remains to the upside, with higher resistance levels marked on the chart. A clean breakdown below this area would invalidate the bullish view.

This is a structure-based idea, not a prediction. Let price continue to confirm.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk. Please manage risk responsibly.

GBPUSD – Breakout Retest Looks Healthy, Bulls in ControlGBP/USD has been trading below a falling resistance trendline for quite some time. Recently, price managed to break above this trendline, which is the first sign that selling pressure is weakening.

After the breakout, price did not continue straight up. Instead, it came back for a retest, and that retest is holding well so far. This is usually a healthy sign, showing that buyers are willing to step in at higher levels instead of letting price fall back below structure.

What Price Is Telling Us:

Price is respecting the previous resistance as support and forming higher lows. Sellers are trying, but they are unable to push price back below the trendline. This behavior often appears when the market is preparing for continuation rather than reversal.

As long as price holds above this zone, the bullish bias remains intact, with upside levels marked on the chart. A clean breakdown below the structure would invalidate this view.

This is a structure-based idea, not a prediction. Let price do the work.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

USDCHF – Gap Down From Resistance, Price Testing Key Support!USD/CHF was trading near a well-defined resistance zone where price has faced repeated rejection in the past. This clearly showed that sellers were active at higher levels and the market was struggling to sustain upside momentum.

From this resistance, the market opened with a gap down, which often signals aggressive selling and position unwinding rather than a slow intraday move. The gap was also supported by short-term U.S. dollar weakness, as the market adjusted expectations around risk sentiment and interest rates. When dollar weakness aligns with technical resistance, price usually reacts sharply.

After the gap down, price moved lower toward a major support zone, an area where buyers have previously stepped in. This makes the current zone a key decision point, either buyers defend again, or further downside continuation opens up.

This move is a result of both technical rejection and fundamental pressure, not random price action.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Gold Price Action Update-Clean Breakout with Clear Targets AheadGold has finally broken above the falling trendline, confirming a short-term shift in momentum. The breakout is clean, and price is now holding above the breakout area, which keeps the bullish continuation scenario active.

As long as price respects the highlighted support zone, pullbacks can be used for long opportunities toward the marked upside targets. A break below the invalidation level would cancel this setup, so risk management remains key.

This is a structure-based trade, not a chase.

KEY LEVELS

Entry Zone: 4671 – 4668

1st Target: 4678

2nd Target: 4684

Final Target: 4690

Stop Loss: 4660

Disclaimer

This analysis is for educational purposes only and should not be considered financial advice. Trading involves risk. Please do your own research and use proper risk management.

ASIANPAINT - STWP Equity Snapshot________________________________________

STWP Equity Snapshot – Asian Paints Ltd (ASIANPAINT)

(Educational | Chart-Based Interpretation)

________________________________________

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: ~2,890–2,910

Risk Reference (If price weakens below structure): ~2,755

Observed Upside Areas: ~3,075 → ~3,195

________________________________________

📌 Swing Reference Levels (Hybrid Model | 2–5 days | Observational)

Reference Price Zone: ~2,890–2,910

Risk Reference (If structure breaks): ~2,685

Higher Range Area (If strength continues): ~3,325 → ~3,645

________________________________________

🔑 Key Levels – Daily Timeframe

Support Areas: 2,836 | 2,776 | 2,744

Resistance Areas: 2,928 | 2,960 | 3,020

________________________________________

🔍 STWP Market Read

Asian Paints remains in a clear upward trend. After a strong move, the stock faced selling near earlier highs and then moved into a short sideways phase. Price has now found support near the highlighted zone, showing that buyers are still active.

The structure remains positive as long as price holds above this support area. Momentum is healthy but controlled, suggesting the stock may move gradually rather than sharply in the near term.

________________________________________

📊 Chart Structure & Indicator Summary

Structure: Higher highs and higher lows

Trend: Up

Momentum: Strong but not stretched

RSI: Healthy zone (~62)

Volume: Above average, indicating participation

________________________________________

📈 Final Outlook (Condition-Based)

Momentum: Strong

Trend: Up

Risk: High (stock is near important resistance)

Volume: High

________________________________________

💡 STWP Learning Note

Strong stocks often pause before moving further. These pauses help price cool down and allow the trend to continue in a healthier way. Focus on structure, not predictions.

________________________________________

⚠️ Disclaimer

This post is shared only for educational and informational purposes. It is not a recommendation, advice, or solicitation. Equity markets involve risk. Please consult a SEBI-registered financial advisor before making any trading or investment decision.

________________________________________

📘 STWP Approach

Observe price behaviour. Respect risk. Let structure guide decisions.

________________________________________

💬 Did this snapshot help you read the chart better?

🔼 Boost to support structured learning

✍️ Share your views in comments

🔁 Forward to someone learning price action

👉 Follow for clean, beginner-friendly STWP insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

________________________________________

INDUSINDBK - STWP Equity Snapshot________________________________________

STWP Equity Snapshot – IndusInd Bank Ltd (INDUSINDBK)

(Educational | Chart-Based Interpretation)

________________________________________

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: ~906–908

Risk Reference (If price slips below structure): ~872

Observed Upside Areas: ~951 → ~980

________________________________________

📌 Swing Reference Levels (Hybrid Model | 2–5 days | Observational)

Reference Price Zone: ~906–908

Risk Reference (If weakness appears): ~871

Higher Range Area (If strength continues): ~981 → ~1,035

________________________________________

🔑 Key Levels – Daily Timeframe

Support Areas: 887 | 869 | 858

Resistance Areas: 916 | 926 | 945

________________________________________

🔍 STWP Market Read

IndusInd Bank has shown steady upward movement after a period of sideways trading. The price moved higher, pulled back briefly, and is now holding above an important support area. This suggests that buyers are still active and the structure remains positive.

Momentum is healthy but not aggressive. The recent move happened with normal to slightly higher trading activity, which supports the price but also indicates that the stock may move in a controlled manner rather than sharply. As long as price stays above the current support zone, the broader trend remains upward.

________________________________________

📊 Chart Structure Summary

Price Structure: Gradual rise with pauses

Trend Direction: Up

Price Strength: Stable

Momentum: Moderate

Trading Activity: Normal to slightly above average

________________________________________

📈 Final Outlook (Condition-Based)

Momentum: Moderate

Trend: Up

Risk: High (banking stocks can move quickly)

Volume: Moderate

________________________________________

💡 STWP Learning Note

Strong trends do not move in straight lines. Pullbacks and pauses are normal. Focus on how price behaves near support areas instead of trying to predict the next move.

________________________________________

⚠️ Disclaimer

This post is shared only for educational and informational purposes. It is not a recommendation or advice. Stock market investments involve risk. Please consult a SEBI-registered financial advisor before making any trading or investment decision.

________________________________________

📘 STWP Approach

Observe price behaviour. Respect risk. Let structure guide decisions.

________________________________________

💬 Did this help you understand the chart better?

🔼 Boost to support learning

✍️ Share your views or questions

🔁 Forward to someone learning chart reading

👉 Follow for clean, beginner-friendly STWP insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

________________________________________

The Silent Trap of Overconfidence in Gold Trading!Hello Traders!

There is a trap in Gold trading that doesn’t look dangerous at all. It doesn’t come with panic, fear, or frustration. In fact, it often feels good. Calm. Confident. Almost comfortable. And that’s why it’s so deadly.

That trap is overconfidence.

It usually appears after a few good trades. You start reading Gold better. Entries feel smoother. Drawdowns feel smaller. Somewhere quietly, the market stops being respected and starts being assumed. That’s when Gold prepares its lesson.

How Overconfidence Slowly Enters Gold Trading

Overconfidence doesn’t arrive suddenly. It builds quietly, trade by trade.

A few winning trades make setups feel obvious

You start trusting instinct more than structure

Risk rules feel flexible because “this one looks sure”

Nothing looks wrong on the surface.

But discipline starts loosening, silently.

Why Gold Punishes Confidence So Hard

Gold is not a market that rewards certainty. It thrives on uncertainty, liquidity, and reaction. The moment a trader becomes sure, Gold usually does the opposite.

Entries get taken earlier than planned

Stop losses get tighter or ignored

Position size increases without logic

Gold doesn’t need you to be wrong on direction.

It only needs you to be careless with timing and risk.

The Difference Between Confidence and Overconfidence

Healthy confidence comes from following rules.

Overconfidence comes from recent results.

Confidence respects invalidation

Overconfidence ignores warning signs

Confidence waits for confirmation

Gold can sense when traders stop waiting.

How This Trap Affected My Gold Trading

I’ve experienced this phase myself. After a good run, trades started feeling easy. I trusted my read a little too much. I pushed entries, adjusted stops emotionally, and expected Gold to behave.

Losses came faster than expected

Good setups failed without warning

Emotional frustration returned suddenly

Gold didn’t change.

My discipline did.

Rahul’s Tip

The moment you feel too comfortable trading Gold, reduce size and slow down. Comfort is not mastery. In Gold, discomfort keeps you alert, and alert traders survive longer.

Final Thought

Gold doesn’t trap traders with fear alone.

It traps them with confidence.

When you feel unstoppable, pause.

When trades feel easy, question them.

The market respects humility far more than belief.

If this post reflects a phase you’ve experienced in Gold trading, drop a like or share your thoughts in the comments.

More real lessons coming.

MTARTECH - STWP Equity SnapshotPrice moved up strongly earlier, pulled back and found support.

Now it is testing the same selling area again, showing strength.

Watching how price behaves near this level is important.

STWP Equity Snapshot – MTARTECH(Educational | Chart-Based Interpretation)

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: 2,742

Risk Reference (If structure fails): 2,351.84

Observed Upside Zones: 3,210.19 → 3,522.32

📌 Swing Reference Levels (Hybrid Model | 2–5 days | Observational)

Reference Price Zone: 2,742

Risk Reference (If price weakens): 2,156.76

Higher Range Area (If strength continues): 3,912.48 → 4,790.34

Key Levels – Daily Timeframe

Support Areas: 2,548 | 2,407 | 2,310

Resistance Areas: 2,786 | 2,883 | 3,024

🔍 STWP Market Read

MTAR Technologies Ltd has moved up strongly after spending time in a sideways range. The rise happened with very high trading activity, which shows strong interest from bigger market participants. The stock also stayed strong even when the overall market was weak, which is a positive sign.

The price strength is steady and not overdone. Buying interest is clearly visible, and the move does not look rushed. As long as the price stays above the earlier breakout area, the overall price structure remains positive.

🧭 News-Linked Price Behaviour (Simple Scenarios | Educational)

Recently, a large global institution bought a stake in the company. This news has already had a positive impact on the stock price. Based on how markets usually behave after such news, a few outcomes are commonly seen:

Scenario 1: Strong and Stable Start

The stock may open slightly higher or stable and continue to trade above recent levels. This shows buyers are comfortable at higher prices.

Scenario 2: Sideways Movement

The stock may open flat and move in a narrow range. This means the market is taking time to adjust after the recent rise. This is normal and healthy.

Scenario 3: Early Rise, Then Pause

The stock may rise early in the day and then slow down or move sideways. This usually happens when short-term traders book profits and does not mean the trend has turned weak.

A sharp fall only because of this news is unlikely unless the overall market turns very negative.

📊 Chart Structure Summary

Price Structure: Strong move after a long pause

Trend Direction: Up

Price Strength: Strong

Momentum: Positive

Trading Activity: Very high, supporting the move

📈 Final Outlook (Condition-Based)

Momentum: Strong

Trend: Up

Risk: High (price can move fast both ways)

Volume: High

💡 STWP Learning Note

News can bring attention, but price behaviour after the news matters more. When price stays strong after a rise, it shows confidence. Focus on how price holds important levels instead of guessing what will happen next.

⚠️ Disclaimer

This post is for educational purposes only. It is not a recommendation or advice. Stock market investments involve risk. Please consult a SEBI-registered financial advisor before making any trading or investment decision.

📘 STWP Approach

Watch price behaviour. Control risk. Let the chart guide you.

💬 Did this help you understand the market better?

🔼 Boost to support learning

✍️ Share your thoughts or questions

🔁 Forward to someone who is learning trading

👉 Follow for simple, structured STWP insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

Why Gold Loves Trapping Both Buyers and Sellers!Hello Traders!

If you have traded Gold for some time, you’ve probably felt this frustration more than once. You take a clean buy, price stops you out and reverses. You flip to sell, and the same thing happens again. It starts feeling personal, like Gold is hunting you specifically.

The truth is, Gold doesn’t hate buyers or sellers.

Gold loves liquidity, and liquidity comes from trapped traders on both sides.

This is not manipulation in the emotional sense. This is how a highly liquid, institution-driven market functions.

Why Gold Rarely Moves in a Straight Line

Gold is one of the most actively traded instruments in the world. Because of this, it cannot afford to move cleanly for long. Straight moves don’t provide enough participation.

Clean trends attract late buyers at the worst possible prices

Obvious breakdowns invite emotional sellers too early

Both sides place stops at similar, predictable levels

Before Gold commits to direction, it usually clears both sides first.

How Buyers Get Trapped in Gold

Buy side traps often appear after a strong bullish candle or breakout. The structure looks convincing, momentum feels strong, and buyers feel safe.

Price breaks a visible resistance and attracts breakout buyers

Stops get placed just below the breakout level

Gold pulls back sharply to test liquidity below

Buyers aren’t wrong on direction.

They’re early, and early entries are expensive in Gold.

How Sellers Fall Into the Same Trap

Sell-side traps usually form after a sharp rejection or false breakdown. Fear builds quickly, and sellers assume the move is done.

Price dips below support and invites aggressive shorts

Stops cluster just above the rejected level

Gold spikes upward to clear those stops

Again, direction is not the issue.

Timing is.

Why Gold Needs Both Traps

Gold doesn’t choose a side until enough liquidity is collected. Buyers provide one side of liquidity. Sellers provide the other.

Trapped buyers fuel downside liquidity

Trapped sellers fuel upside liquidity

Only after both sides react does structure become clean

This is why Gold feels chaotic to emotional traders and logical to patient ones.

How This Changed My View on Gold

Once I understood that traps are part of the process, not mistakes, my trading became calmer.

I stopped reacting to the first breakout

I waited for both sides to show their hand

I focused more on reactions than predictions

Gold didn’t change.

My expectations did.

Rahul’s Tip

If Gold traps you once, learn from it.

If it traps you repeatedly, it’s not the market, it’s impatience. The real opportunity usually appears after frustration peaks on both sides.

Buyers get trapped.

Sellers get trapped.

Patient traders get paid.

If this post matches your Gold trading experience, drop a like or share your thoughts in the comments.

More real, experience-based lessons coming.

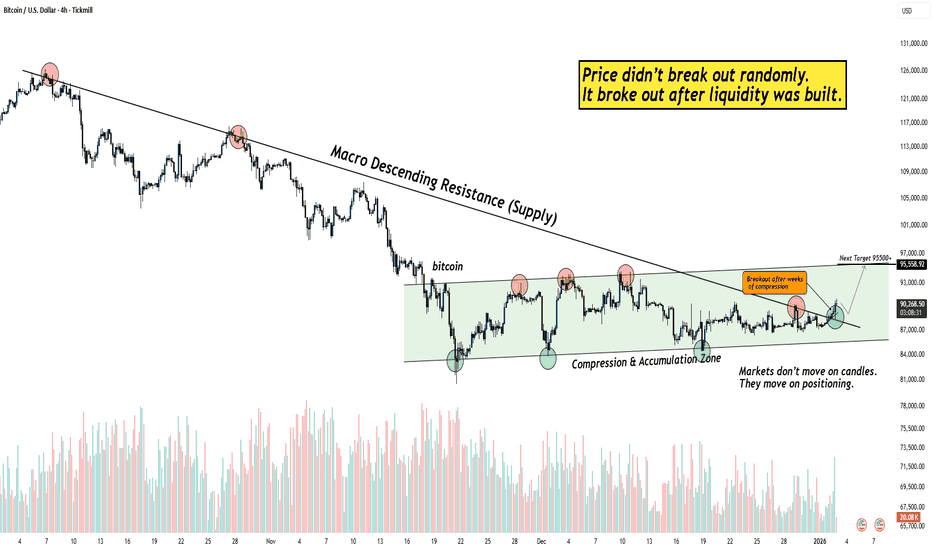

Why Bitcoin Broke Out After Weeks of Boring Price Action?Hello guy's let's analyse Bitcoin because for weeks, Bitcoin stayed inside a tight compression range while most traders lost interest. Price looked slow, directionless, and boring, exactly the phase where liquidity gets built quietly.

This breakout matters because it didn’t come after a spike.

It came after patience.

What the chart is really showing

A macro descending resistance was respected for months, keeping sellers confident.

Price compressed inside a clear accumulation zone, forming higher lows while absorbing supply.

Multiple rejections failed to push price lower, a classic sign of seller exhaustion.

Once liquidity was built and weak hands were positioned wrong, price expanded cleanly

Why this breakout is different from random moves

Most breakouts fail because they happen too early.

This one happened after time did the hard work.

No emotional spike before the move.

No vertical candles inside the range.

Compression + absorption first, expansion later.

That’s how sustainable moves begin.

When everyone gets bored, structure is usually being prepared.

And when structure completes, the move looks “sudden” only to those who weren’t watching.

Final thought

As long as price holds above the broken structure, this breakout remains valid.

Failure only comes if price accepts back inside the range, until then, momentum favors continuation.

If this helped you see the market differently, like, follow, or share your view below.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

Coiled Spring Bitcoin is holding structure on the high time frames, currently reclaiming the $90k level after testing the lows. I’ve got my weighted average bands on the chart and price is respecting them so far. You can see on the daily chart how we’ve just poked back above the latest FOMC anchor (the blue line) and are squeezing between that and the breakdown AVWAP overhead. I try not to preempt levels though, I only really care about them once price actually reacts there.

Macro wise, things look decent. Yield curves like the 5y-03m and 10y-03m are positive. We’re seeing a bull steepening, not the textbook version since the 2y is still lower than the 3m, but not a cause for concern.

Other signals I’m tracking:

VIX is stable.

USDJPY is trending up but getting close to resistance, so that’s one to watch.

MOVE index is chilling, down at 63% which is historically a good zone for us.

DXY is high at 98 but trending down.

Credit spreads are super low at 2.84, so no stress there.

TGA is pivoting down now too.

Real yields aren’t doing much since nominals and breakevens are falling together.

Current pricing suggests no cut at the next FOMC, which is fine. But if a cut comes as a surprise that would be very interesting to say the least.

Gold Update: Watching Channel Support for ContinuationGuys last trade of the year haha, let's see if we got something in this trade. Gold is trading inside a rising channel, and the overall structure remains positive. After the recent move up, price has pulled back toward the lower side of the channel, which is a normal and healthy behavior in an uptrend.

This pullback is bringing price closer to a key support area, where buyers have previously stepped in. As long as price holds above this support, the probability favors upside continuation rather than a breakdown.

This is not a breakout trade. It is a buy-on-pullback setup, where patience matters more than speed. A clear hold near support is what keeps this setup valid.

Disclaimer: This analysis is for educational purposes only and should not be taken as financial advice. Please do your own research or consult your financial advisor before investing.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

If this update helped, like and follow for regular updates.

The Second Move Strategy in Gold – Why the First Spike Is a TrapHello Traders!

There is a moment in Gold trading that has trapped more traders than bad analysis ever did. It’s that sudden spike, fast, aggressive, and convincing, where everything on the chart screams this is the move. Your instincts tell you not to miss it. Your emotions tell you to act now. And that’s exactly why most traders lose money there.

Gold is not a market that rewards excitement. It rewards restraint. The first spike is rarely the opportunity, it is usually the test.

Why the First Spike Feels Impossible to Ignore

The first move in Gold often arrives with speed and confidence. Candles expand, momentum increases, and breakouts appear clean. This creates urgency, not clarity.

Fast candles trigger fear of missing out

Indicators flip direction almost instantly

Breakout traders pile in without confirmation

The move looks strong because it is designed to look strong.

Strength attracts participation, and participation creates liquidity.

What That First Spike Is Really Doing

In many cases, the first spike is not commitment, It is information gathering. Actually market is checking who is chasing, where stops are sitting, and how much emotional money is willing to enter without patience.

Early entries get trapped during shallow pullbacks

Stops cluster around obvious support or resistance

Traders confuse volatility with direction

This is where most losses begin, not from bad direction, but from bad timing.

Why the Second Move Is Where Professionals Act

After the initial spike, Gold usually pauses. It retraces, consolidates, or retests key levels. This is not weakness, this is clarity forming.

Liquidity from the first move gets absorbed

Weak hands exit under pressure

Structure becomes visible instead of emotional

The second move lacks drama, But it carries intent.

How This Changed My Gold Trading

Once I stopped chasing the first candle, my trading changed quietly but completely. I started letting price reveal itself instead of reacting to it.

I stopped entering during emotional expansion

I waited for retests and structural confirmation

I reduced position size until direction proved itself

Nothing fancy changed, Just patience, and patience did the heavy lifting.

Rahul’s Tip

If a Gold move makes you feel rushed, excited, or pressured, step back. That feeling is not intuition. It’s emotion. The best Gold trades usually feel boring at entry and obvious only in hindsight.

Final Thought

Gold doesn’t trap traders with complexity. It traps them with urgency. The first spike grabs attention. The second move offers opportunity. Learn to wait, and you stop trading reactions. You start trading structure.

If this post made you rethink how you enter Gold trades, drop a like or share your experience in the comments. More real trading lessons coming.

Gold (XAUUSD) – 4H Chart Update | Breakout → Pullback Phase!Hello Everyone,, i hope you all will be doing good, let's check the updates of Gold as it has already done the hard part, the breakout above the previous resistance is in place. After the breakout, price pushed higher and is now doing what strong markets usually do: a pullback.

This pullback is not a sign of weakness yet. In fact, it is a healthy reaction, where the market is testing whether the old resistance can act as new support. This phase decides continuation or failure.

As long as Gold holds above the marked support zone, the structure remains positive, and continuation toward higher levels stays open. What we want to see here is price stabilizing, not panic selling.

If support fails and price starts accepting below it, then the breakout thesis weakens. Until that happens, this move should be treated as a normal post-breakout retest.

Key Levels to Watch

Breakout Level / New Support: Around 4330–4340

Immediate Support Zone: Pullback base area

Upside Continuation: Possible if support holds

Bias: Neutral-to-Bullish above support

Well Guys Most traders get confused during pullbacks. Strong moves rarely go straight up, continuation usually comes after patience, not after chasing candles.

Disclaimer: This analysis is for educational purposes only and should not be taken as financial advice. Please do your own research or consult your financial advisor before investing.

Give likes and comment your thought on my analysis, thankyou everyone!

Gold Holds Rising Channel – Upside Targets Still OpenGold is trading inside a clean rising channel, forming clear higher highs and higher lows, which confirms that the overall trend remains bullish. Instead of chasing breakouts, price is now doing what strong trends usually do, pause and consolidate before the next move.

The marked buying zone sits perfectly inside the rising channel and has already acted as a strong demand area. As long as Gold holds above this zone, buyers remain in control and upside continuation remains the higher probability scenario.

Upside targets are aligned with the channel resistance, which adds further confidence to this setup. These types of structures often reward traders who wait for pullbacks rather than reacting emotionally to fast candles.

A breakdown below the marked invalidation level would weaken this bullish view, but until then, the structure favors patience and trend-following.

Key Levels to Watch

Best Buying Range: 4519–4515

1st Target: 4535

2nd Target: 4553

Final Target: 4570

Structure Invalidation: Below 4497

Trend Bias: Bullish above support

Disclaimer: This analysis is for educational purposes only and should not be taken as financial advice. Please do your own research or consult your financial advisor before investing.

XAUUSD (H1) – Monday Trading StrategyLana prioritizes selling setups until a new high is broken.

Quick summary

Technical context: Price has pulled back strongly from the All-Time High, showing short-term weakness.

Daily bias: Sell on rallies, until price breaks and holds above a new high.

Key events: Speech from U.S. President Trump and updates related to U.S.–China trade may increase volatility.

News impact – what to watch

Trump’s speech: Often drives short-term USD sentiment through comments on growth, tariffs, and inflation. Gold may react sharply to headline risk.

U.S.–China trade activity (CCPIT): Any improvement in trade sentiment can support USD in the short term, adding pressure to gold. Rising tensions would favor gold as a safe haven.

Because of this, Lana will focus on price reaction at key zones rather than predicting the news outcome.

Technical analysis (H1)

Gold printed a new All-Time High and then sold off aggressively, signaling profit-taking near the top.

Price is now consolidating within a corrective structure, where selling rallies remains the higher-probability play.

Key zones identified on the chart:

Sell zone: 4529 – 4531

Buy reaction zone: 4498 – 4500 (support)

Trading plan for Monday

Primary scenario – Sell rallies

Sell: 4529 – 4531

This zone is expected to act as resistance during the current correction.

Bias change condition:

Only shift to a bullish continuation if price breaks above the previous high and holds.

Secondary scenario – Short-term buy reaction

Buy: 4498 – 4500

This is considered a scalp-only setup, as the overall intraday bias remains bearish.

Session notes

Asian session may remain slow, while volatility is likely to increase around the scheduled events.

Best trades are expected when price returns to planned zones rather than trading in the middle of the range.

This analysis reflects Lana’s personal market view and is not financial advice.