Mazdock Long - Technical AnalysisMAZDOCK Technical Analysis Summary

Current Price : 2,985.00

Technical Reasons to Pick MAZDOCK

1 - Dow Theory Confirmation

- Higher Highs (HH) - Higher Lows (HL)

- Clear uptrend structure maintained

2 - EMA Support Structure - Took support from 100 EMA on a weekly Timeframe

- Trading above sorted EMA 100/200

- Strong momentum indication

- Bullish reversal from key moving average

4 - A clear Hidden RSI Divergence

- Indicates continuation of uptrend

- Target 1 : 3,240.00

- Target 2 : 3,502.30

- Target 3 : 3,774.00

- Grand Target : 4,094.00

Risk Management

Watch for sustained break below 100 EMA for trend reversal

Overall Bias : BULLISH

Strategy : Buy on dips near EMA support levels.

Mazdockanalysis

MAZDOCK – TECHNICAL ANALYSIS - W PATTERN________________________________________________________________________________

📈 MAZDOCK – TECHNICAL ANALYSIS

📆 Date: July 4, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range: 3775

• Resistance: 3362 – 3396 – 3423

• 🟢 Bottom Range: 3077.7

• Support: 3241 – 3274 – 3301

________________________________________________________________________________

🔹 Chart Pattern: ✅ W-Bottom Formation

A clean W-shaped reversal pattern is forming. Price is respecting demand zones and gradually forming higher lows. Neckline lies around 3369 — breakout above this may fuel further upside.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns:

⛔ No major reversal candle on 4th July 2025.

________________________________________________________________________________

🔹 Volume Footprint:

✅ Gradual volume pickup

🚨 Watch for breakout above 3362–3396 with volume >3.5M

🔼 A successful breakout may trigger a swift move toward 3425–3520.

________________________________________________________________________________

🔹 Trend Bias: ✅ Bullish

Short-term momentum favors the bulls with sectoral tailwinds from PSU + Defense themes.

________________________________________________________________________________

📌 What’s Catching Our Eye:

• W-Bottom Pattern nearing breakout

• Price reclaimed key demand zone and consolidating just below resistance

• PSU + Defense theme rally adds sector momentum

________________________________________________________________________________

👀 What We’re Watching For:

• Breakout Confirmation: Daily close above 3396 with 3.5M+ volume

• Pullback Re-entry: Ideal zone 3300–3310 for fresh entries

• Volume Spike: Key trigger for breakout validation

________________________________________________________________________________

⚠️ Risks to Watch:

• Low volume breakout = Bull trap risk

• Sector rotation or sudden weakness in PSU/Defense

• Breakdown below 3240 = pattern failure & shift in bias

________________________________________________________________________________

🔮 What to Expect Next:

• ⚡ Retest of 3362–3396 range likely

• 🔄 Minor consolidation / handle formation possible

• 🔄 Watch for volatility near resistance (intraday fakeouts)

________________________________________________________________________________

📊 Trade Plan (Based on Logic + Volume Confirmation)

🔼 Breakout Long Setup:

• Entry: Above 3369

• Stop Loss: 3300

• Risk–Reward: ~1:1 to 1:2

📌 Why:

• W-bottom breakout

• Sector strength + price structure alignment

• Volume >3.5M is the key trigger

________________________________________________________________________________

🔁 Pullback Long Setup:

• Entry Zone: 3305–3310

• Stop Loss: 3240 (Support 3)

• Risk–Reward: ~1:1 to 1:2

📌 Why:

• Tight SL near structure

• Good risk-reward for early entry

________________________________________________________________________________

🔽 Bearish Setup (Rejection from Resistance):

• Entry: Below 3300

• Stop Loss: Above 3365

• Risk–Reward: ~Flexible — as per individual trader's strategy and risk appetite

📌 Why:

• Rejection from neckline

• Low-volume breakout = trap

• Breakdown below support shifts structure to bearish

________________________________________________________________________________

❌ Invalidation Triggers:

• Daily Close below 3240

• Bearish Marubozu with volume = shift to supply pressure

________________________________________________________________________________

📌 Intraday Supply Zones Noted (15-Min Chart):

The 15-minute chart reveals the presence of multiple intraday supply zones, indicating short-term selling pressure.

🟥 Tested Supply Zone: 3337.30 – 3346.30 | SL: 3352.20

🟥 Strong Supply Zone: 3349.40 – 3358.60 | SL: 3364.50

These zones may act as resistance levels for intraday traders. Watch for price rejection or confirmation candles in these areas before planning any breakout trades.

________________________________________________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this helpful?

Have you caught this W-pattern early?

Share your thoughts in the comments ⬇️

🔁 Spread the insight with fellow traders

✅ Follow STWP for smart technical setups backed by volume and price action

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

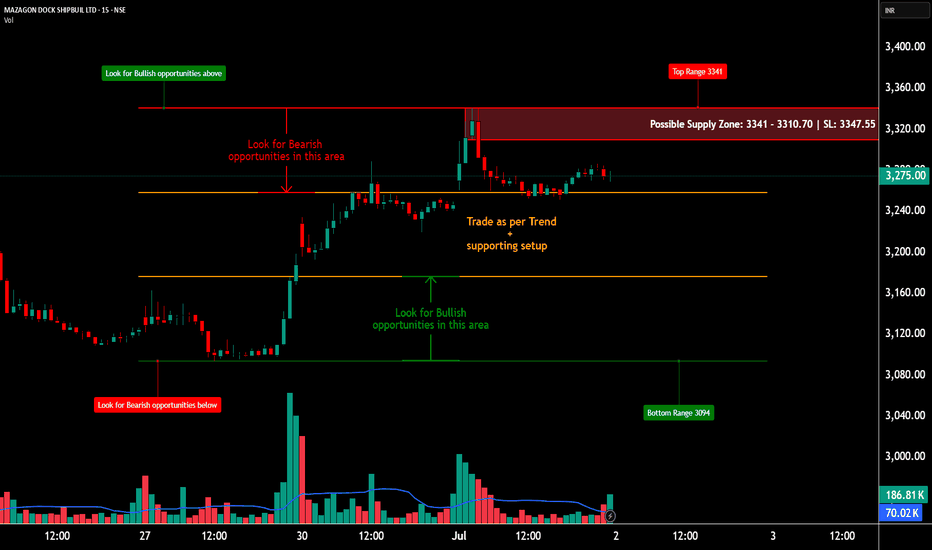

MAZDOCK - – INTRADAY ZONE ANALYSIS________________________________________________________________________________📈 MAZAGON DOCK SHIPBUILDERS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹3341

🟢 Bottom Range (Support): ₹3094

⚪ No Trade Zone: (Trade only with trend + confirmation in this zone)

________________________________________________________________________________

🧩 Chart Pattern: No visible chart pattern seen.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range:

✅ Multiple strong rejection candles near ₹3341 along with long upper wicks and volume drop — suggesting supply zone holding.

🟢 Bottom Range:

✅ Bullish Marubozu and wide-range green candles seen around ₹3094, confirming strong buyer interest and a potential reversal zone.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹3120–₹3094 demand zone with bullish confirmation (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹3090

Risk-Reward: 1:1 | 1:2+

Logic: Strong buyer reaction from demand zone previously suggests continued interest if tested again.

________________________________________________________________________________

🔽 Bearish Trade:

Idea: Short if price retests ₹3341–₹3310 and rejects with bearish candle formation (strong bearish candle, reversal candles, volume support, long wick).

Stop Loss: Above ₹3347.55

Risk-Reward: 1:1 | 1:2+

Logic: Supply zone confirmed with rejections earlier. Reversal here can lead to downside till mid or demand zone.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹3341 – ₹3310

SL: ₹3347.55

Plan: Enter short if price shows rejection with bearish confirmation at this zone.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹3120 – ₹3094

SL: ₹3090

Plan: Enter long on bullish reversal setup from this demand area.

Risk-Reward: 1:1 | 1:2+

________________________________________________________________________________

📌 Disclaimer

This analysis is for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before trading. Always use strict risk management and act only on confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on MAZDOCK?

Will it break the supply zone and rally higher, or revisit the demand zone before bouncing back?

Share your thoughts and chart setups below 👇

________________________________________________________________________________