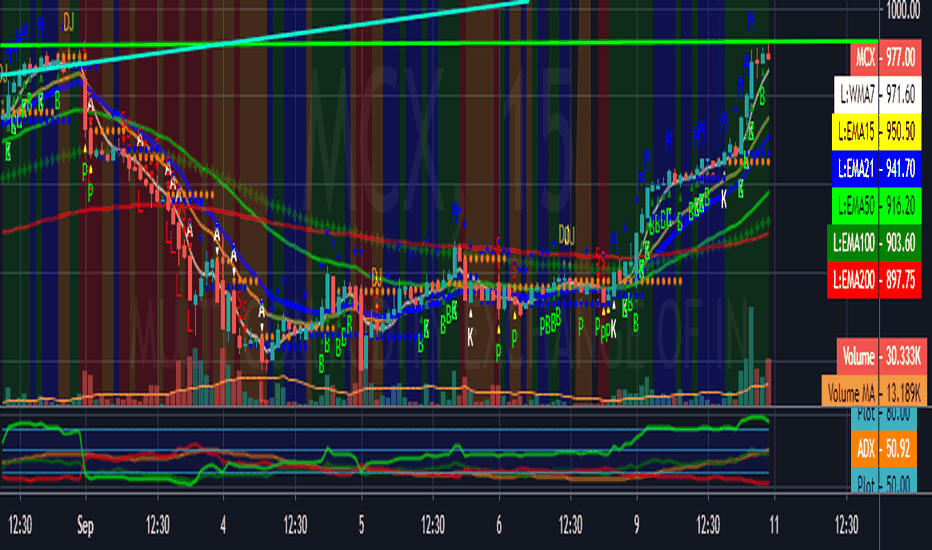

MCX

Gold is showing resistance on weekly charts, 1645 is importantGold or xauusd is moving in a bullish channel on weekly charts.

Friday's top has touched this very line and closed a couple of dollars lower.

Breakouts on weekly channels are not seen very often, a cautious approach is a must at these levels.

I would wait for more SELL signals on other indicators before going short, 4-5 $ above the trendline will be the stop loss for this trade.

on certain momentum based indicators, some weakness can be noticed on hourly charts, this can be due to some profit booking ahead of weekend or initial signs or some sort of reversal or pullback in a overbought market.

Nifty/Comex Gold -Solving Explosive puzzle with Golden ShineDisclaimer

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Comex Gold

Trading above 1490$ - There is room for gold to move 80-100$ upside in 1580-1625$

Later below 1490$ - It can slip to 1410/1265/1050$ as per long term strategy.

Nifty Index

Holding below 11310-11325 – Bias remains negative & whole explosive rally of last trading day could fizzle out & Index could slip back to

Target 1-

11140-11150

Target 2-

Below 11140 – target is 11080-11090

Target 3-

Below 11080- Expect 10950

Target 4-

Below 10890– Expect 10750

Target 5-

Below 10740– Expect 10580-10615

Note – Above 11325 – This idea gets invalidated

MCX Trade setup which comes once in a blue moon. #mcxMcx have made a beautiful bullish breakout on monthly chart (chart attached), which in simple language means that it will be soon making a new All time high.

Ideal trade strategy would be to buy the dips and hold this stock for good part of 2020.

Feel free to share your opinion and do join our trading.shiksha family on telegram.

I will keep on updating about this setup in my absolutely free telegram channel www.t.me