Mcxgold

Gold $ International Chart (Bird View)Analysis On 14th December 2022

This is a Bird View so Possible Movement of Gold in a Daily TF for a Medium-term view.

>Wave Counts - Recently, Gold has just reached to Depth of Correction point in Minute Cycle of Wave Count , while in an Intermediate Cycle, it seems like Wave C is still on.

Furthermore, Last month's upward journey is still not break 50% (Healthy Retracement) of retracement compared to top of B wave (Intermediate Cycle). (Bearish)

Divergences - There is multiple divergences, we can see in above chart,

1. Bearish Continuous Divergence between 2nd wave and C wave within the C wave (Intermediate Cycle). (Bearish)

2. Bearish Reversal Divergence in Wave C (Minute Cycle), Where some sort of Upward Triangle Chart Pattern Has Formed. (Bearish)

After all, I expect one more downside leg which is 5th wave in Minor Cycle, till Depth of Correction in Intermediate cycle of 4th Wave (1451.41 $)

Have a Good Day!!

#GOLD $XAUUSD primed to shoot upGOLD and SILVER have been in a downtrend after a surge in Mar of this year which was a reaction to the Ukraine invasion. A lot of "GOLD is a safe haven " traders may have entered in post the invasion and have been stuck for over 6 months as the metal moved down over 21%. Of course the continuous downmove since then may have forced a lot of exits.

We can now see that GOLD is trying to break upwards of the downward sloping trendline. A divergence on the MACD can also be noted.

If GOLD can sustain above the trendline , then we look to catch a sharp upmove reversing the pent-up buying pressure.

Keep stops below recent lows and stay long above the 1650 levels. SILVER should shadow the upmove if this resolves upwards

MCX Gold Elliott Wave Projection For July 2022Gold has accomplished the final correction wave (Y) of wave ((B)) and has begun to form sub-waves of the corrective wave ((C)).

Currently, the price is at 100 EMA & the lower band of the parallel channel. It appears that the movement of gold is being dominated by bears, as it is making lower lows and lower highs.

If the price breaks down the parallel channel, traders can initiate a short position for the following targets: 50153 – 49600 – 48560 . It should be noted that the breakdown of the parallel channel is also the breakdown of the 100 EMA.

49600 is a pivot zone for gold. If the price sustains below 49600 , traders can expect rapid bearish momentum.

Gold Price Predictions for 2022In the previous trading session, MCX Gold made a high of 51538 and closed at 51343 ( +444 ). A question is, is it moving upward?

To identify uptrend:

There are two hurdles to continuing the uptrend. It should break out the 5th May high or settle above the control line.

According to the above chart, Gold is forming a bullish flag pattern. And we're waiting for a breakout of the flag pattern. This breakout will skyrocket the gold price, and we can see 6400+ points of bullish movement here. Long-term target for gold 58000 - 60000 .

Gold downtrend confirmation:

But if gold breaks the support trendline (invalidation), then a downtrend may start. And if it happens, I will update you asap.

At present, intraday traders can keep buying for targets of 51500 - 51800+ levels.

Watch significant releases or events that may affect the movement of gold, silver, and crude oil.

Monday, May 09, 2022

04:30 FOMC Member Bostic Speaks - Medium Impact

11:00 Investing.com Gold Index - Medium Impact

18:15 FOMC Member Bostic Speaks - Medium Impact

Tuesday, May 10, 2022

17:10 FOMC Member Williams Speaks - Medium Impact

18:00 FOMC Member Bostic Speaks - Medium Impact

21:30 EIA Short-Term Energy Outlook - High Impact

Wednesday, May 11, 2022

00:30 FOMC Member Mester Speaks - Medium Impact

02:00 API Weekly Crude Oil Stock - Medium Impact

04:30 FOMC Member Bostic Speaks - Medium Impact

18:00 Core CPI (MoM) (Apr) - Medium Impact

20:00 Crude Oil Inventories - High Impact

22:31 10-Year Note Auction - Low Impact

23:30 Federal Budget Balance (Apr) - Low Impact

Thursday, May 12, 2022

10:30 Natural Gas Storage - Low Impact

13:30 IEA Monthly Report - Medium Impact

Friday, May 13, 2022

08:30 Import/Export Price Index (MoM) - Low Impact

11:00 FOMC Member Kashkari - Medium Impact

12:00 FOMC Member Mester Speaks - Medium Impact

13:00 U.S. Baker Hughes Oil Rig Count - Medium Impact

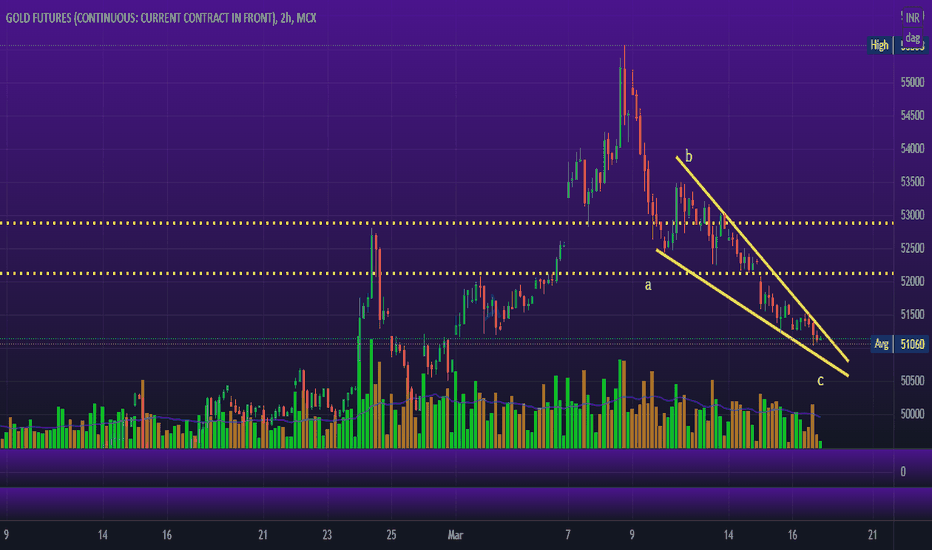

GOLD FUTURES ANALYSIS Hello, gold futures analysis on 2hr chart buy: 52,000 target: 53,200 stoploss: 51,750.

LOGIC BEHIND TRADE : Gold futures has formed W pattern on 2hr chart & given breakout of resistance, buying on pull back is strategy RR is good in trade (target identified from harmonic xabcd pattern level 0.886) stoploss is taken low of resistance candle. MCX:GOLD1!

MCX Gold's Bullish Mode ActivatedDid you read the 26 Jan 2021 article on Gold?

Article: Don't Get Yourself Into a Bull Trap With MCX Gold

Wherein I have highlighted a strong resistance (SR) which is 49280 . It has broken down on 14 Feb 2022. That indicates the MCX gold uptrend is unfolding here. If it consecutively remains above the SR, we will see the gold price above 51160 - 51740 .

The following indicators have been indicating impending advance:

ADX, DMI, and MA

Watch significant releases or events that may affect the movement of gold, silver, and crude oil.

Tuesday, Feb 22, 2022

19:30 S&P/CS HPI Composite - 20 n.s.a. (YoY) (Dec) - Medium Impact

20:15 Manufacturing, Markit Composite, & Services PMI (Feb) - Medium Impact

20:30 CB Consumer Confidence (Feb) - High Impact

Thursday, Feb 24, 2022

03:00 API Weekly Crude Oil Stock - Medium Impact

19:00 GDP (QoQ) (Q4), and Initial Jobless Claims - High Impact

21:00 Natural Gas Storage - Low Impact

21:30 Crude Oil Inventories - High Impact

22:30 FOMC Member Mester Speaks - Medium Impact

GOLD the Rising Giant !!!!Gold has finally given the breakout of ascending triangle pattern with RSI breaching above 60 and MACD crossover,

and the target coming for that pattern is of 52000.

I've given this call 1 week earlier, those who have trade my idea have surely

made profit you could check that idea in the related link.

sell gold cmp 49100 sl 49400 tgt 48700 / 48500 /48300 / 48100sell gold cmp 49100 sl 49400 tgt 48700 / 48500 /48300 / 48100

Sell Gold At CMP 1856 tgt 1842 / 1835 / 1825 sl 1870

in last few day gold has seen tremendous rally from 1760-1868

Now 4h chart is showing tired sign

being contrarian i think it should fall for further upmove