NSE: HINDCOPPERCompany Overview

NSE:HINDCOPPER Hindustan Copper is India’s only vertically integrated copper producer, operating across mining, beneficiation, smelting, refining, and casting. It plays a strategic role in India’s infrastructure, power, renewable energy, and electrification ecosystem.

Fundamental Summary (High Level)

The company has gone through a long period of operational stagnation and underperformance, but the structural backdrop has shifted. Rising domestic demand, electrification, renewable energy expansion, and tighter global copper supply create a favourable long-term setup. While near-term fundamentals remain cyclical, copper itself is a strategic metal aligned with India’s capex and energy transition themes.

Technical Analysis (Monthly Chart)

On the monthly timeframe, HINDCOPPER shows a clean long-term breakout after spending several years in a broad consolidation range. Price has moved decisively above prior resistance with strong follow-through.

RSI has entered a sustained bullish zone, confirming strength rather than a short-lived spike. The stock is holding well above its long-term moving averages, indicating a transition from accumulation to trend continuation.

Trade Setup (Technical View)

Entry: ₹480–₹530 zone on pullbacks or continuation

Stop Loss: Below ₹420 on a monthly closing basis

Potential Upside: ₹650–₹750 over the medium term

Rationale: Monthly range breakout + strong momentum + structural copper theme aligned with India’s capex cycle

Monthlychart

PEL | Triangle breakout after 7 years consolidationPEL | Triangle breakout after 7 years consolidation

CMP : 1293 (Dip : 1150)

SL : 1000

5000 Days vs 500 Days of Data : Which is better ?Most traders jump straight into attractive chart patterns and impulsively take trades, ignoring the bigger picture. Here’s a powerful case study

Left Side: Full Monthly Chart with Hidden Resistance

On the left, the chart captures over a decade of price action, immediately drawing attention to a long-standing downward-sloping resistance stretching from all-time highs. This hidden resistance line is not visible on the usual zoomed-in view, yet it presents a formidable barrier that traders often neglect.

(Pro Insight: Always extend trendlines and resistance zones till the inception of the instrument for real swing perspective)

(Risk Reminder: What looks like a clear breakout on a recent timeframe may actually be approaching a multi-year resistance trap)

Right Side: Symmetrical Triangle – The Pattern Focus

The right segment restricts focus to the last few years, zooming in on a visually perfect symmetrical triangle. While the setup looks neat and promising—indicating contraction and likely expansion ahead—this trimmed view risks obscuring the bigger, hidden resistance directly overhead.

Disclaimer: This post reflects technical views for educational purposes only, not investment advice. Always perform your own due diligence before trading.

Monthly Descending Triangle & False BreakdownA descending triangle on the monthly chart shows lower highs converging toward a flat support, reflecting mounting seller pressure and key institutional interest at the horizontal base

The red counter trendline highlights corrective rallies within the broader down-sloping resistance.

The red demand zone marks where significant buying absorbed prior declines, offering a structural support area.

The white box illustrates a false breakdown below support—a liquidity-grab that shook out weak hands before a swift recovery—demonstrating how professional traders engineer stop-hunts to secure favorable entry levels.

This interplay of pattern, trendlines, demand zone, and false breakdown underscores how market structure and institutional tactics shape price action—key for informed, risk-defined decisions.

Disclaimer: For educational purposes only. Not investment advice. Risk management and independent research are vital.

GODREJ AGROVATE RETEST ON MONTHLY CHARTChart looks good on the bigger time frame. Support is at 700 on a monthly closing basis.

CMP: 752

Support: 700

This is for educational purposes only. Please seek advice from your financial advisor before making any trade decisions. This is not a recommendation.

Samvardhana Motherson BreakoutMOTHERSON Stock Analysis

MOTHERSON stock is breaking out again on the monthly chart after previously reaching a new all-time high and then declining. It recently broke the trend-line with good buying pressure. The target could be the all-time high or lower, but it may take a few months to reach if things go well. Stop-loss should be set based on individual risk appetite.

Index Inclusion : Part of NIFTY NEXT 50 and NIFTY 100 indices, indicating significant market presence.

Financial Highlights:

- Revenue Growth : Consistent increase over recent quarters, reaching Rs 113,662 crore in Mar 2025.

- Net Profit : Also rising, with Rs 3,618 crore in Mar 2025.

- EPS : Improved to Rs 5.50 in Mar 2025.

- Annual Revenue & Profit : Steady growth over the past five years, with revenue surpassing Rs 113,662 crore and net profit over Rs 3,618 crore in 2025.

Financial Performance:

- Profit Margins : Net profit margin around 3.18% in Mar 2025.

- Valuations : P/E ratio at approximately 23.81, indicating moderate valuation.

- Debt Levels : Debt-to-equity ratio at 0.42, reflecting manageable debt.

- Cash Flow & Balance Sheet : Operating cash flow remains strong; assets and liabilities Show growth aligned with revenue expansion.

These financial insights are sourced from Moneycontrol.

Conclusion :

Motherson International shows a consistent growth in revenue and profits, with stable financial ratios and manageable debt levels. Its inclusion in major indices and recent financial performance suggest it remains a significant player in its sector. However, the recent stock decline indicates market caution, so investors should monitor market sentiment closely.

This is for educational purposes only and not a buy or sell recommendation.

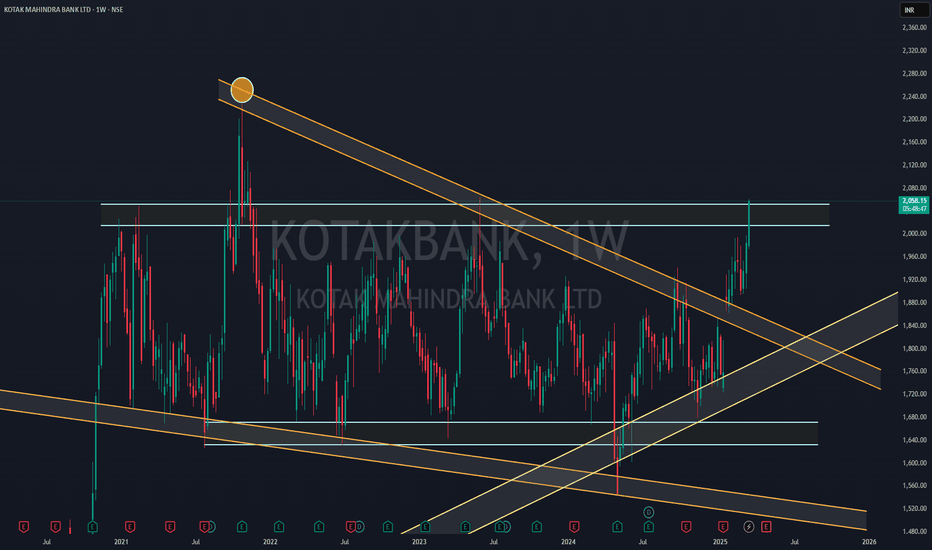

KOTAK BANK NEAR FLAG BReakoutKotakBank is nearly Flag Breakout on Monthly Candle (Wait more 7 days to Finish MOnthly Candle with Big Bull Breakout)

Wait for Proper Breakout beacuse its 4 time where Chart is going to test same Trendline.

Flag Pattern Start from 2020- After 5 years its will going to break

If we see fulll chart Stock taking support over 2013 Trendline before two months so there is more more possibility to give breakout

if we see RSI chart its also show Breakout over MOnthly RSI trendline..

## THis is my Just View, take position after all confromations and research by yourself##

also see weekly chart - weekly showing strong big bull canle ( 1more Weekly Candle Require for final conformations)

NIFTY Breaking 2020 Trendline with Monthly Big Bear CandleNifty Breakdown 2020 Trendline on Monthly Chart with Big Bear Candle - (Currently Now its show almost Full Bear power Candle near at 10:30am)

If You See the Monthly RSI Is also going to break almost Five years Low 53.30

3rd thing if you comapre RSI low 2016-2020 breakdown its Go more 39% Down in just 2 months.

Chart & Indicator both Saw Very bad Sentiments & Pattern on chart.

my prediction as below as per fibo chart shown in chart

Target as per Fibolevel

T1- 21848.50 (23.8%)

T2- 19108.65 (38.3%)

T3- 16894.25 (50%)

T4- 14679.80(61.8%)

Target as per Chart (Zones)

T1 Zone- 22081- 21588

T2 Zone- 18912-18515.50

T3 Zone- 15645-15177

Cords Cables-Can it continue to be a multibagger?Cords Cables is a small cap company which is available at a perfect position technically.

Zone of 140-150 was a supply zone earlier which now should become a demand zone.

If stock manages to bounce from here with good volumes, it can continue its multibagger journey towards big targets.

However, if this zone is breached, stock can fall rapidly so it sis make or break level for stock technically.

Very risky. Keep in watchlist to study and learn.

Not a recommendation.

SAMKRG Pistons & Rings - Monthly - Long Term Channel - BullishSAMKRG Pistons & Rings Ltd. (BSE: 520075) has been trading within a well-defined ascending channel, showcasing a consistent long-term uptrend. The chart highlights key support levels at the bottom of the channel, from where the price has always bounced.

The recent price action and technical indicators suggest a potential for further gains.

Key Points:

1. Ascending Channel: The stock has been moving within a clear ascending channel since 2006. The price recently rebounded from the lower boundary of the channel, indicating strong support and a continuation of the upward trend.

2. Key Support Levels: The chart shows multiple instances where the stock has found strong support at the bottom of the channel. Each bounce from this support level has led to significant upward movements, affirming the reliability of this trend.

3. Relative Strength Index (RSI): The RSI has made higher lows and higher highs in the preceding months and looks to be on an upward trajectory.

Disclosure: Invested at ₹179

Disclaimer: This analysis is for educational purposes and should not be considered financial advice. Always conduct your own research before making any investment decisions.

GTPL - Symmetrical Triangle Breakout with Retest - Bullish LongGTPL Hathway Ltd. (NSE: GTPL) has recently broken out of a symmetrical triangle pattern on the daily chart. The breakout has been followed by a successful retest, indicating a strong bullish signal.

A Symmetrical Triangle Breakout would indicate a continuation of prior trend, which is bullish in the long-term, as shown by the Monthly Chart below.

I have also given a possible long-term channel for GTPL. The support at the bottom of the channel has been tested multiple times, as shown. We'll have to see if the top also holds but that is a long time away.

On the Monthly time-frame, the RSI is also on an upward trajectory, as shown.

Please comment with your views on the set-up.

Disclaimer: This analysis is for educational purposes and should not be considered financial advice. Always conduct your own research before making any investment decisions.

Everest Organics - Monthly - Ascending Channel - Bullish - LongEVEREST ORGANICS LTD. is exhibiting strong bullish signals on the monthly chart. Here is a detailed analysis of the key technical indicators and potential future movements:

Ascending Channel:

The stock has been trading within a well-defined ascending channel since early 2016.

Support: The lower channel line has provided consistent support, marked by multiple bounces.

Resistance: The upper channel line acts as resistance, tested multiple times.

Recent Price Action:

The stock recently bounced off the lower channel support around 120 INR and is showing signs of upward movement.

This bounce indicates a potential continuation towards the mid-channel and upper-channel resistance levels.

RSI Analysis:

The Relative Strength Index (RSI) is currently at 57.59, indicating bullish momentum.

The RSI has been trending upwards, suggesting increasing buying pressure and potential for further gains.

Disclosure: Invested at 149

Disclaimer: This analysis is for educational purposes and should not be considered financial advice. Always conduct your own research before making any investment decisions.

Please leave a Comment with your thoughts and analysis

Boost the idea if you found it useful

Follow me for more analyses!

Biocon - Monthly - Ascending Channel - Rebound & Breakout - LongBiocon Ltd. (NSE: BIOCON) has been consistently trading within a long-term ascending channel, with the channel Top and Bottom being tested multiple times over the years, as shown in the chart.

The Price has again bounced after touching the bottom of the channel and made a breakout from a descending trendline followed by a successful retest. The RSI trajectory is also bullish.

Key Points:

1. Ascending Channel: The stock has been moving within a well-defined ascending channel since 2013. The recent price action saw a strong bounce off the lower boundary of the channel, suggesting robust support at this level.

2. Key Support and Resistance Levels: The chart highlights multiple instances where the stock has found support at the bottom of the channel and faced resistance at the top. These levels have been tested several times, reinforcing the reliability of this trend.

3. Relative Strength Index (RSI): The RSI is currently at 64.77, trending upwards. This indicates bullish momentum and suggests that the stock could continue its upward movement. The RSI has consistently made higher lows and higher highs, which further supports the bullish outlook.

Breakout on Weekly Timeframe

The weekly chart shows a breakout from a descending trendline followed by a successful retest, confirming the bullish momentum. The RSI on the weekly timeframe is also in an upward trend, indicating strong momentum.

Disclosure: Invested at 338

Disclaimer: This analysis is for educational purposes and should not be considered financial advice. Always conduct your own research before making any investment decisions.

Please do leave a comment with your views or any additional insights you might have. If you found this analysis helpful, give it a boost and follow me for more in-depth analyses and updates on promising stocks.

Rane Brake Lining - Monthly Chart - Ascending Channel - LongRane Brake Lining Ltd. (NSE: RBL) moving in a clear Ascending Channel with support at the bottom of the channel retested multiple times as shown in the chart.

The Price has again bounced after touching the bottom of the channel and RSI has a strong upward trajectory.

Key Points:

Ascending Channel: The stock has been trading within a well-defined ascending channel for several years. The price recently bounced off the lower boundary, affirming strong support at this level.

Key Support Levels: The chart highlights multiple instances where the stock has found strong support at the bottom of the channel, reinforcing the robustness of this upward trend. Each bounce off the lower boundary has led to significant upward movements.

Relative Strength Index (RSI): The RSI is trending upwards and currently stands at 63.9, indicating bullish momentum.

The price has also broken above the trendline on Weekly timeframe as shown above.

Disclosure: Invested at 960.15

Disclaimer: This analysis is for educational purposes and should not be considered financial advice. Always conduct your own research before making any investment decisions.

BEPL-An ATH breakout for multibagger returns!BEPL has been consolidating in a cup and handle pattern in monthly timeframe

130-150 has been a strong supply zone for the stock which has been successfully crossed.

Now, we might see a big strong move as gates are open for stock.

Long term investors should not miss this stock.

Swing traders should wait for pull back of 135 levels for entry.

We can expect multibagger returns from stock in future.