Nasdaqshort

NASDAQ Potential Bearish Reversal Analysis NASDAQ Potential Bearish Reversal Analysis 🧠🔻

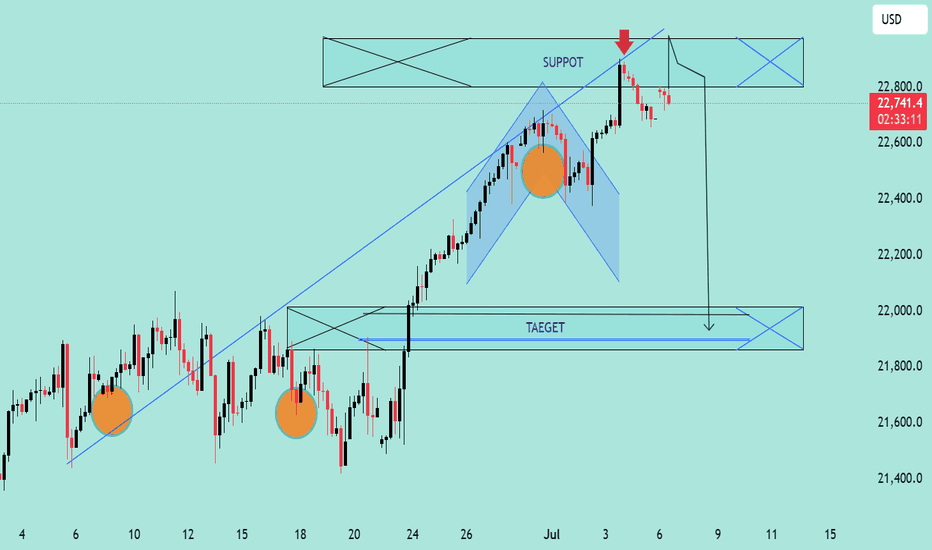

The chart illustrates a potential bearish setup forming after a recent uptrend in NASDAQ. Let's break it down professionally:

🔍 Technical Overview:

Ascending Trendline Break ✅

Price had been respecting a steady ascending trendline.

A break below this trendline indicates a possible momentum shift from bullish to bearish.

Bearish Pattern Formation 🔷

A bearish flag/pennant-like formation can be observed after the sharp rise.

This consolidation followed by a breakdown could be a continuation pattern, hinting at further downside.

Resistance Rejection 🔴

A red arrow marks a clear rejection from the resistance zone near 22,800 USD.

Strong wick rejections and bearish candles suggest selling pressure at that level.

Support Turned Resistance (SUPPOT 🛑)

The previously broken support zone is now acting as resistance (note: "SUPPOT" appears misspelled—should be "SUPPORT").

Bearish Target Zone 🎯

The chart marks a "TAEGET" zone (should be "TARGET") near the 21,900 – 22,000 USD range.

This aligns with prior consolidation and demand zones, making it a likely area for price to retrace.

📌 Key Zones:

Resistance (Rejection Area): 22,800 USD

Current Price: 22,739.7 USD

Bearish Target Zone: 21,900 – 22,000 USD

⚠️ Conclusion:

The market shows signs of a bearish reversal with a confirmed trendline break, resistance rejection, and bearish pattern formation. If the price fails to reclaim the 22,800 level, there’s a high probability of downward continuation toward the 22,000 target.

🧠🔻

The chart illustrates a potential bearish setup forming after a recent uptrend in NASDAQ. Let's break it down professionally:

🔍 Technical Overview:

Ascending Trendline Break ✅

Price had been respecting a steady ascending trendline.

A break below this trendline indicates a possible momentum shift from bullish to bearish.

Bearish Pattern Formation 🔷

A bearish flag/pennant-like formation can be observed after the sharp rise.

This consolidation followed by a breakdown could be a continuation pattern, hinting at further downside.

Resistance Rejection 🔴

A red arrow marks a clear rejection from the resistance zone near 22,800 USD.

Strong wick rejections and bearish candles suggest selling pressure at that level.

Support Turned Resistance (SUPPOT 🛑)

The previously broken support zone is now acting as resistance (note: "SUPPOT" appears misspelled—should be "SUPPORT").

Bearish Target Zone 🎯

The chart marks a "TAEGET" zone (should be "TARGET") near the 21,900 – 22,000 USD range.

This aligns with prior consolidation and demand zones, making it a likely area for price to retrace.

📌 Key Zones:

Resistance (Rejection Area): 22,800 USD

Current Price: 22,739.7 USD

Bearish Target Zone: 21,900 – 22,000 USD

⚠️ Conclusion:

The market shows signs of a bearish reversal with a confirmed trendline break, resistance rejection, and bearish pattern formation. If the price fails to reclaim the 22,800 level, there’s a high probability of downward continuation toward the 22,000 target.

NAS100 Technical Analysis – Bearish Rejection at Resistance NAS100 Technical Analysis – Bearish Rejection at Resistance 🚨

📅 Date: June 6, 2025

📈 Instrument: NAS100 (US Tech 100 Index)

🔍 Chart Overview:

The price action shows a clear rejection from the 21,800 USD resistance zone, marked by two strong bearish wicks (indicated by red arrows 🔴). This level has proven to be a strong supply zone, as sellers repeatedly step in to push prices lower.

🔵 Key Zones:

🔺 Resistance Zone: 21,750 – 21,800 USD

✅ Multiple rejections and bearish pressure.

🔻 Support Zone 1: 21,100 – 21,200 USD

📍 Acts as a mid-range demand zone and a potential take-profit level for short positions.

📉 Support Zone 2 (Major): 20,700 – 20,850 USD

📦 High-probability bounce area due to historical demand.

🔄 Price Action Insight:

The chart outlines a bearish double rejection pattern at the resistance level.

The current candlestick setup suggests bearish momentum, with a potential drop toward the mid-support zone.

If the price breaks below the mid-support, it could cascade down toward the major support near 20,800 USD.

📌 Projected Move:

🔻 From current levels (~21,750), expect:

Pullback from resistance,

Target 1️⃣: 21,100 USD zone,

Target 2️⃣: 20,800 USD major support.

🚫 A clean break and close above 21,800 invalidates the bearish outlook and may trigger a bullish continuation.

✅ Conclusion:

The chart favors a short bias below the resistance zone. Patience is key—wait for confirmation (like a bearish engulfing or break of structure 📉) before entering positions.

📊 Always use risk management. Set stop-loss above resistance in case of reversal

NASDAQ100 Analysis – Key S/R Zones & Price Reaction Incoming NASDAQ100 Analysis – Key S/R Zones & Price Reaction Incoming! 🚨

🔍 Chart Breakdown:

This is a technical chart analysis of NASDAQ100 (NAS100) with defined Support and Resistance zones. The price is currently at 21,314.50, sitting below a critical decision area.

🧱 Key Zones:

🔵 Resistance Zone:

‣ 21,640 – 21,800

‣ Strong supply area where price sharply reversed previously.

‣ If price breaks above the mid resistance zone, a bullish move towards this level is likely.

🟩 Support + Resistance Flip Zone:

‣ 21,280 – 21,420

‣ Former support, now acting as resistance.

‣ Price is struggling to reclaim this zone.

‣ Acts as a key decision level.

🟢 Support Zone:

‣ 20,630 – 20,750

‣ Strong demand zone from which previous rallies initiated.

‣ Target if bearish rejection continues.

🔄 Price Action Insight:

Price is currently rejecting the Support-turned-Resistance zone.

There’s a clear bearish rejection at the mid-zone (S/R flip), forming a lower high structure.

📉 A breakdown from current levels could lead to a retest of the support zone at 20,700 area.

🟢 However, a successful reclaim and bullish confirmation above 21,420 could see price target the upper resistance at 21,800.

📌 Outlook:

🔽 Bearish Bias if price fails to break above 21,420 – possible drop to 20,700.

🔼 Bullish Reversal above 21,420 could drive price to 21,800.

📅 Date: June 1, 2025

🕒 Timeframe: Likely 1H or 4H chart

💬 “Respect the levels, not the noise.”

Trade safe! ✅

Huge selling in NASDAQ after Big upsideNasdaq may face resistance around 20100-20500

Nasdaq is up almost 100% from 2023 lows

And there are 3 channels are working in Nasdaq

One medium term channel is working from 2020 and other 2 channels are short term

With the price action there is Weekly RSI that also around the resistance levels.

So be caution around these levels.

Thank you !!

Disclaimer : We are not SEBI registered analyst. Do your own research before taking any investment decision.

NASDAQThe NASDAQ appears to be following Elliott Wave Theory, where it's currently situated in what's projected to be Wave 5 of Primary Degree. Within this wave, it's believed to be in Wave 3, which typically signifies a strong upward movement in prices we are seeing now.

This suggests that we may see a bit more upward momentum in the NASDAQ before a correction phase begins. The expected correction is anticipated to be quite substantial, potentially leading to a range of 13,000 to 12,500. This correction would encompass the entire Primary Degree, marking a significant and extended market trend reversal.

Bearish Harmonics In NasdaqBearish Shark

Sell PRZ - 14625/14791

SL - 15275

Target - 13125/12600

If Breaks 15275

Bearish Alt Shark

Sell PRZ - 15765/15826

SL - 16400

Target - 13765/13100

IXIC (June 15, 2021) SignalsCould be an end of Bull Run?

Indicators are Recommending the Price Action to move Down.

IXIC is getting extreme momentum which is too dangerous for Nasdaq at this level.

Sudden Increase in Volume, Volatility, Momentum, Liquidity is dangerous for NASAQ health.

RSI is Almost at an Overbought level.

Stochastic RSI is at Overbought Level.

CCI is on its way ahead to crack the overbought level.

Extremely Bearish Strength for June 15, 2021. NASDAQ:IXIC

Expecting a 53 Points Down from the Opening.

Thanks for using your Valuable time. Leave a like which helps me to do better. Follow me for Daily Signals,

Get updates on, FOREX, Stocks, INDICES, Crypto, #--CFD's to be expected soon. (Share to your Market Friends)

NASDAQ COMPOSITE (Signals) [June 14]IXIC to the Ground

IXIC is making a Momentum to maintain the Volatility

Candle Stick patterns shows that there are more buyers in the market. Large Body Candles.

There are some levels marked in the chart.

These levels are considered as Pivot Points and S&R.

14,072 and 14,009 and 14,016 and 14,048. The Crucial Levels for June 14 mark it on your chart.

The Overall Strength is Bearish.

Expecting a +17 Points Up from the Opening and -39 Points Down from +17 Points.

Thanks for using your Valuable time. Leave a like which helps me to do better. Follow me for Daily Signals,

Get updates on, FOREX, Stocks, INDICES, Crypto, #--CFD's to be expected soon. (Share to your Market Friends)