Nasdaqsignals

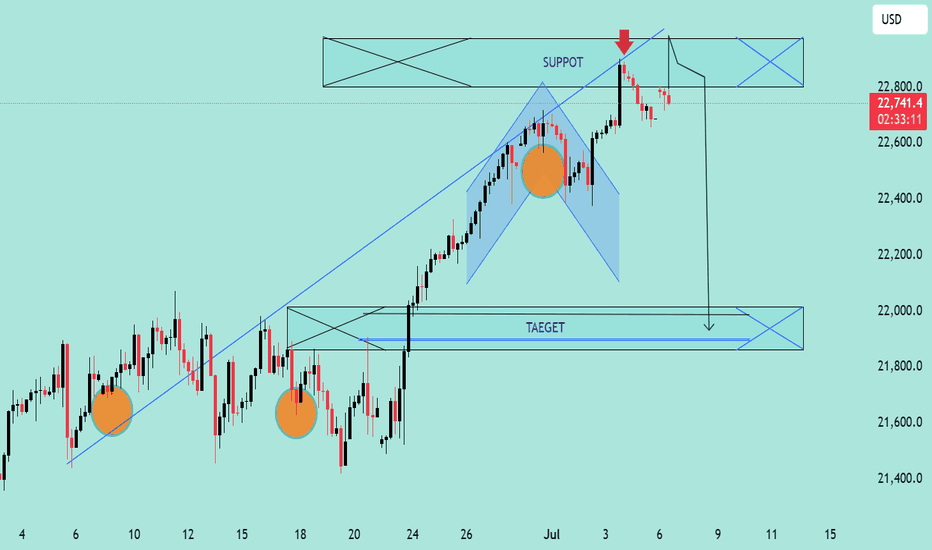

NASDAQ Potential Bearish Reversal Analysis NASDAQ Potential Bearish Reversal Analysis 🧠🔻

The chart illustrates a potential bearish setup forming after a recent uptrend in NASDAQ. Let's break it down professionally:

🔍 Technical Overview:

Ascending Trendline Break ✅

Price had been respecting a steady ascending trendline.

A break below this trendline indicates a possible momentum shift from bullish to bearish.

Bearish Pattern Formation 🔷

A bearish flag/pennant-like formation can be observed after the sharp rise.

This consolidation followed by a breakdown could be a continuation pattern, hinting at further downside.

Resistance Rejection 🔴

A red arrow marks a clear rejection from the resistance zone near 22,800 USD.

Strong wick rejections and bearish candles suggest selling pressure at that level.

Support Turned Resistance (SUPPOT 🛑)

The previously broken support zone is now acting as resistance (note: "SUPPOT" appears misspelled—should be "SUPPORT").

Bearish Target Zone 🎯

The chart marks a "TAEGET" zone (should be "TARGET") near the 21,900 – 22,000 USD range.

This aligns with prior consolidation and demand zones, making it a likely area for price to retrace.

📌 Key Zones:

Resistance (Rejection Area): 22,800 USD

Current Price: 22,739.7 USD

Bearish Target Zone: 21,900 – 22,000 USD

⚠️ Conclusion:

The market shows signs of a bearish reversal with a confirmed trendline break, resistance rejection, and bearish pattern formation. If the price fails to reclaim the 22,800 level, there’s a high probability of downward continuation toward the 22,000 target.

🧠🔻

The chart illustrates a potential bearish setup forming after a recent uptrend in NASDAQ. Let's break it down professionally:

🔍 Technical Overview:

Ascending Trendline Break ✅

Price had been respecting a steady ascending trendline.

A break below this trendline indicates a possible momentum shift from bullish to bearish.

Bearish Pattern Formation 🔷

A bearish flag/pennant-like formation can be observed after the sharp rise.

This consolidation followed by a breakdown could be a continuation pattern, hinting at further downside.

Resistance Rejection 🔴

A red arrow marks a clear rejection from the resistance zone near 22,800 USD.

Strong wick rejections and bearish candles suggest selling pressure at that level.

Support Turned Resistance (SUPPOT 🛑)

The previously broken support zone is now acting as resistance (note: "SUPPOT" appears misspelled—should be "SUPPORT").

Bearish Target Zone 🎯

The chart marks a "TAEGET" zone (should be "TARGET") near the 21,900 – 22,000 USD range.

This aligns with prior consolidation and demand zones, making it a likely area for price to retrace.

📌 Key Zones:

Resistance (Rejection Area): 22,800 USD

Current Price: 22,739.7 USD

Bearish Target Zone: 21,900 – 22,000 USD

⚠️ Conclusion:

The market shows signs of a bearish reversal with a confirmed trendline break, resistance rejection, and bearish pattern formation. If the price fails to reclaim the 22,800 level, there’s a high probability of downward continuation toward the 22,000 target.

NAS100 Bullish Breakout SetupNAS100 Bullish Breakout Setup 🚀

🧠 Chart Analysis (H4 timeframe)

🔹 Ascending Channel:

Price has been trending inside a clear ascending channel (blue zone), supported by higher highs and higher lows.

🔹 Support & Resistance:

Support: Around 21,635.32 – tested multiple times (highlighted by 🔵 arrows).

Resistance: Around 22,265.19 – recent highs and psychological barrier.

🔹 Double Bottom Formation 👣:

Near support zone, a potential double bottom (bullish reversal pattern) is visible. The neckline has been challenged.

🔹 Breakout Confirmation 🟢:

Price has broken above the descending neckline of the double bottom and is hovering near 21,644, indicating potential bullish continuation if sustained.

🔹 Target 🎯:

Projected breakout target lies at 22,265.19, aligning with the previous resistance zone.

🔹 Volume & Momentum 📊:

While not shown, a breakout above the neckline generally needs strong volume confirmation to validate the move.

📌 Conclusion:

If price sustains above the 21,635 – 21,644 area and gains momentum, the path to 22,265 looks likely ✅. However, a false breakout could drag the price back into the channel.

NAS100 Technical Analysis – Bearish Rejection at Resistance NAS100 Technical Analysis – Bearish Rejection at Resistance 🚨

📅 Date: June 6, 2025

📈 Instrument: NAS100 (US Tech 100 Index)

🔍 Chart Overview:

The price action shows a clear rejection from the 21,800 USD resistance zone, marked by two strong bearish wicks (indicated by red arrows 🔴). This level has proven to be a strong supply zone, as sellers repeatedly step in to push prices lower.

🔵 Key Zones:

🔺 Resistance Zone: 21,750 – 21,800 USD

✅ Multiple rejections and bearish pressure.

🔻 Support Zone 1: 21,100 – 21,200 USD

📍 Acts as a mid-range demand zone and a potential take-profit level for short positions.

📉 Support Zone 2 (Major): 20,700 – 20,850 USD

📦 High-probability bounce area due to historical demand.

🔄 Price Action Insight:

The chart outlines a bearish double rejection pattern at the resistance level.

The current candlestick setup suggests bearish momentum, with a potential drop toward the mid-support zone.

If the price breaks below the mid-support, it could cascade down toward the major support near 20,800 USD.

📌 Projected Move:

🔻 From current levels (~21,750), expect:

Pullback from resistance,

Target 1️⃣: 21,100 USD zone,

Target 2️⃣: 20,800 USD major support.

🚫 A clean break and close above 21,800 invalidates the bearish outlook and may trigger a bullish continuation.

✅ Conclusion:

The chart favors a short bias below the resistance zone. Patience is key—wait for confirmation (like a bearish engulfing or break of structure 📉) before entering positions.

📊 Always use risk management. Set stop-loss above resistance in case of reversal

NASDAQ100 Analysis – Key S/R Zones & Price Reaction Incoming NASDAQ100 Analysis – Key S/R Zones & Price Reaction Incoming! 🚨

🔍 Chart Breakdown:

This is a technical chart analysis of NASDAQ100 (NAS100) with defined Support and Resistance zones. The price is currently at 21,314.50, sitting below a critical decision area.

🧱 Key Zones:

🔵 Resistance Zone:

‣ 21,640 – 21,800

‣ Strong supply area where price sharply reversed previously.

‣ If price breaks above the mid resistance zone, a bullish move towards this level is likely.

🟩 Support + Resistance Flip Zone:

‣ 21,280 – 21,420

‣ Former support, now acting as resistance.

‣ Price is struggling to reclaim this zone.

‣ Acts as a key decision level.

🟢 Support Zone:

‣ 20,630 – 20,750

‣ Strong demand zone from which previous rallies initiated.

‣ Target if bearish rejection continues.

🔄 Price Action Insight:

Price is currently rejecting the Support-turned-Resistance zone.

There’s a clear bearish rejection at the mid-zone (S/R flip), forming a lower high structure.

📉 A breakdown from current levels could lead to a retest of the support zone at 20,700 area.

🟢 However, a successful reclaim and bullish confirmation above 21,420 could see price target the upper resistance at 21,800.

📌 Outlook:

🔽 Bearish Bias if price fails to break above 21,420 – possible drop to 20,700.

🔼 Bullish Reversal above 21,420 could drive price to 21,800.

📅 Date: June 1, 2025

🕒 Timeframe: Likely 1H or 4H chart

💬 “Respect the levels, not the noise.”

Trade safe! ✅

Dow Futures Trading Levels and Strategy for 09th December 2024Dow Futures Trading Levels and Strategy

Market Context

Dow Futures is showing potential for a breakout, and this strategy focuses on confirmation by waiting for candle closures to minimize false signals. Adjust position sizing according to your risk tolerance.

Buy Setup

Entry:

Wait for a 15-minute candle to close above 44,900.

Place a buy order above the high of that candle.

Targets:

45,050

45,150

45,300

Stop Loss: Place a stop loss below the low of the breakout candle.

Sell Setup

Entry:

Wait for a 15-minute candle to close below 44,600.

Place a sell order below the low of that candle.

Targets:

44,450

44,300

44,100

Stop Loss: Place a stop loss above the high of the breakdown candle.

Market Context

Dow Futures is showing potential for a breakout, and this strategy focuses on confirmation by waiting for candle closures to minimize false signals. Adjust position sizing according to your risk tolerance.

Disclaimer

The above analysis is provided for educational purposes only and does not constitute financial or investment advice.

Trading in futures involves significant risks, including the loss of capital.

Always conduct your own research or consult with a certified financial professional before making trading decisions.

Use proper risk management, including stop-loss and position sizing, to safeguard your investments.

Dow Futures Trading Strategy 05th December 2024Trading Strategy for Dow Futures:

Buy Strategy:

Entry Point: Enter a long position (buy) above the high of the candle that closes above 45230 on a one-hour timeframe. This means if a one-hour candle closes above 45230, you will buy once the price exceeds the high of that candle.

Stop Loss: Set a stop loss slightly below the low of the breakout candle to manage risk. For instance, if the breakout candle has a low of 45100, you might set your stop loss at 45090 to protect your capital.

Target: Determine your target based on historical resistance levels or a risk-reward ratio. For example, if you're risking 140 points (45230 to 45090), aim for a reward of at least 280 points (e.g., a target of 45510).

Sell Strategy:

Entry Point: Enter a short position (sell) below the low of the candle that closes below 44870 on a one-hour timeframe. This means if a one-hour candle closes below 44870, you will sell once the price drops below the low of that candle.

Stop Loss: Set a stop loss slightly above the high of the breakdown candle. For example, if the breakdown candle has a high of 45000, you might set your stop loss at 45010 to mitigate risk.

Target: Determine your target based on historical support levels or a risk-reward ratio. For example, if you're risking 140 points (44870 to 45010), aim for a reward of at least 280 points (e.g., a target of 44600).

Risk Management:

Use Stop Losses: Always use stop losses to protect your capital and limit potential losses.

Position Sizing: Never risk more than a small percentage (e.g., 1-2%) of your trading capital on a single trade.

Regular Review: Continuously monitor the market and adjust your strategy based on evolving conditions and new information.

Market Context:

Economic Indicators: Pay attention to key economic indicators such as employment data, GDP figures, and interest rate announcements that can impact Dow futures.

Geopolitical Events: Be aware of geopolitical events and developments that can cause significant market volatility.

Disclaimer:

Trading in financial markets involves substantial risk of loss and is not suitable for every investor. The strategies and opinions expressed are those of the author and do not necessarily reflect the views of Microsoft. Users should perform their own research and consult with a financial advisor before making trading decisions. Past performance is not indicative of future results.

Dow Future Trading Strategy for 04th December 2024Trading Strategy:

Buy Strategy:

Entry Point: Enter a long position (buy) above the high of the candle that closes above 44980 on a one-hour timeframe. This means if a candle on the one-hour chart closes above 44980, you will buy once the price exceeds the high of that candle.

Stop Loss: Set a stop loss below the low of the breakout candle or a significant support level to manage risk. For instance, if the breakout candle has a low of 44850, you might set your stop loss slightly below this level to protect your capital.

Target: Determine your target based on historical resistance levels or a specific risk-reward ratio. For example, if you risk 100 points (from 44980 to 44880), aim for a reward of at least 200 points (e.g., a target of 45180).

Sell Strategy:

Entry Point: Enter a short position (sell) below the low of the candle that closes below 44670 on a one-hour timeframe. This means if a candle on the one-hour chart closes below 44670, you will sell once the price drops below the low of that candle.

Stop Loss: Set a stop loss above the high of the breakdown candle or a significant resistance level. For example, if the breakdown candle has a high of 44800, you might set your stop loss slightly above this level to mitigate risk.

Target: Determine your target based on historical support levels or a specific risk-reward ratio. For example, if you risk 100 points (from 44670 to 44770), aim for a reward of at least 200 points (e.g., a target of 44470).

Risk Management:

Use Stop Losses: Always use stop losses to protect your capital and limit potential losses.

Position Sizing: Never risk more than a small percentage (e.g., 1-2%) of your trading capital on a single trade.

Regularly Review: Continuously monitor the market and adjust your strategy based on evolving conditions and new information.

Market Context:

Economic Indicators: Keep an eye on key economic indicators such as employment data, GDP figures, and interest rate announcements that can impact Dow futures.

Geopolitical Events: Be aware of geopolitical events and developments that can cause significant market volatility.

Disclaimer:

Trading in financial markets involves substantial risk of loss and is not suitable for every investor. The strategies and opinions expressed are those of the author. Users should perform their own research and consult with a financial advisor before making trading decisions. Past performance is not indicative of future results.

Trade wisely and stay informed! 📈💼

Dow Futures Trading Strategy for 03rd December 2024Dow Futures Trading Strategy

Buy Strategy:

Condition: Look for the price of Dow futures to close above 45050 on a one-hour candle.

Entry Point: Identify the high of the candle that closes above 45050.

Action: Place a buy order above this high once the one-hour candle has closed above 45050. This confirms that the market is trending upward and you’re looking to ride the momentum.

Sell Strategy:

Condition: Look for the price of Dow futures to close below 44800 on a one-hour candle.

Entry Point: Identify the low of the candle that closes below 44800.

Action: Place a sell order below this low once the one-hour candle has closed below 44800. This confirms a downward trend, signaling a bearish market.

Current Price: The current price of Dow futures is 44880.

Disclaimer: This strategy is for informational purposes only and should not be considered financial advice. Trading involves risk, and you should do your own research or consult with a financial advisor before making any investment decisions.

Dow Futures Trading Strategy 29th November 2024Dow Futures Trading Strategy

Buy above the high of the one-hour candle which breaks and closes above 44980: Consider entering a buy position if the price breaks and sustains above the high of the one-hour candle and closes above 44980, indicating potential bullish momentum.

Sell below the low of the one-hour candle which breaks and closes below 44840: Consider entering a sell position if the price drops and closes below the low of the one-hour candle and breaks below 44840, indicating potential bearish momentum.

Example Analysis

Given the current price of 44930:

Buying above the high of the one-hour candle which breaks and closes above 44980: If the price breaks the high of the one-hour candle and closes above 44980, it suggests a potential upward trend.

Selling below the low of the one-hour candle which breaks and closes below 44840: If the price breaks the low of the one-hour candle and closes below 44840, it indicates a potential downward trend.

Disclaimer

Trading in financial markets involves significant risk and can result in the loss of your invested capital. It is crucial to conduct thorough research and consult with a financial advisor to understand the risks and develop a sound strategy.

Dow Trading Strategy for 28th November 2024Trade Strategy for Dow Futures

Buy: Enter a long position when the price moves above 45000 on a one-hour candle close.

Sell: Enter a short position when the price drops below 44780 on a one-hour candle close.

Current Price: 44879

Support and Resistance Levels

Support Levels:

44780: This is the first line of defense where the price might find support and potentially reverse upwards.

44500: If the price falls below 44780, 44500 acts as the next significant support level.

44000: This is a major psychological level that could provide strong support.

Resistance Levels:

45000: The initial barrier where the price might encounter resistance and potentially reverse downwards.

45200: If the price breaks above 45000, 45200 becomes the next key resistance level.

45500: This is a significant resistance level that could pose a challenge for further upward movement.

Disclaimer

Trading involves significant risk and it's important to do your own thorough research or consult with a professional financial advisor before making any investment decisions. The information provided here is for educational purposes only and should not be considered as financial advice. Always consider your risk tolerance and investment goals before engaging in trading activities.

Dow Futures Trading Strategy for 22nd November 2024Dow Futures Trading Strategy

Current Price: 43953

Trading Levels:

Buy Above 44150

Action: Wait for a one-hour candle to close above 44150 before entering a long position.

Target 1: 44280

Target 2: 44400

Stop Loss: 44000

Rationale: A breakout above 44150 indicates bullish momentum and the potential for an upward move.

Sell Below 43750

Action: Wait for a one-hour candle to close below 43750 before entering a short position.

Target 1: 43620

Target 2: 43500

Stop Loss: 43900

Rationale: A breakdown below 43750 signals bearish sentiment and potential for further downside.

Support and Resistance Levels:

Resistance Levels:

44150 (Immediate resistance and breakout level)

44280 (First target)

44400 (Major resistance)

Support Levels:

43750 (Immediate support and breakdown level)

43620 (First target)

43500 (Strong support level)

Important Notes for Traders

Candle Confirmation: Always wait for a confirmed one-hour candle close above or below the defined levels to avoid false breakouts.

Risk Management: Ensure your position size aligns with your risk tolerance. Use stop-loss orders to protect your capital.

Market Volatility: Monitor economic news, earnings announcements, and geopolitical events as they can significantly impact Dow Futures prices.

Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice. Futures trading involves significant risk and is not suitable for every investor. You may incur losses greater than your initial investment. Always consult a licensed financial advisor or perform your own due diligence before making trading decisions. The author assumes no responsibility for any trading outcomes based on this information.

Dow Futures Analysis FOR 21st November 2024Dow Futures Analysis (1-Hour Candle Close Strategy)

Current Level: 43,572

Buy Setup

Condition: Buy only if the price closes above 43,620 on a 1-hour candle.

Entry: Enter a buy trade when the next 1-hour candle breaks the high of the breakout candle.

Targets:

T1: 43,700 (short-term target).

T2: 43,820 (extended target).

Stop-Loss: Below the low of the breakout candle (depending on risk tolerance).

Sell Setup

Condition: Sell only if the price closes below 43,175 on a 1-hour candle.

Entry: Enter a sell trade when the next 1-hour candle breaks the low of the breakdown candle.

Targets:

T1: 43,050 (short-term target).

T2: 42,900 (extended target).

Stop-Loss: Above the high of the breakdown candle.

Risk Management

Risk only 1-2% of your trading capital per trade.

Position size should be adjusted based on the distance between entry and stop-loss.

Disclaimer:

This analysis is for educational and informational purposes only and should not be considered as financial advice. Trading in futures markets involves significant risk and is not suitable for all investors. There is no guarantee of profit, and losses can exceed your initial investment. Always perform your own research or consult a professional financial advisor before making trading decisions.

Dow Futures Trading Strategy 20th November 2024Dow Futures Trading Signal

Current Value: 43,409

Trading Levels:

Buy Above: 43,600

Trigger a long position when the price closes above 43,600 on a 1-hour candle.

Resistance Levels:

R1: 43,750

R2: 43,900

Sell Below: 43,250

Trigger a short position when the price closes below 43,250 on a 1-hour candle.

Support Levels:

S1: 43,100

S2: 42,900

Key Notes:

Always wait for confirmation of a 1-hour candle close above or below the specified levels before initiating trades.

Use proper risk management techniques, including stop-loss orders placed slightly outside key support and resistance zones.

Additional indicators like moving averages or MACD can provide further confirmation.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice. Trading futures involves significant risk and may not be suitable for all investors. Ensure you fully understand the risks involved and consult a licensed financial advisor before trading. Past performance does not guarantee future results. Trade responsibly.

Dow Futures Trading Levels for 19th November 2024. Dow Futures Trading Levels (Based on 1-Hour Candle Chart):

Buy Above: 43,670 (Consider entering a buy position if the price breaks and sustains above this level on the 1-hour candle, signaling potential bullish momentum.)

Sell Below: 43,375 (Consider entering a sell position if the price drops and sustains below this level on the 1-hour candle, signaling potential bearish momentum.)

Current Value: 43,520

Key Levels to Watch:

Resistance Levels:

43,750 – 43,800

43,900 – 44,000

Support Levels:

43,450 ,43,300 , 43,200

Trading Tips:

Book Profits Regularly: Take partial profits near key resistance levels or major price zones to secure gains.

Use Trailing Stop-Loss: Set a trailing stop-loss to protect your profits while allowing the trade to follow the trend.

Watch for Confirmations: Ensure price action sustains above or below the given levels on the 1-hour candle before entering trades.

Disclaimer:

This analysis is based on technical indicators and the 1-hour candle chart. The information provided is for educational and informational purposes only and should not be considered as financial or trading advice.

Risk Management Guidelines:

Always confirm price action (e.g., breakouts, breakdowns, or reversals) at the specified support and resistance levels before making decisions.

Use stop-loss orders and proper position sizing to minimize risk.

Stay updated on economic news and market events that may influence Dow Futures.

Risk Disclosure:

Trading futures involves substantial financial risk and may not be suitable for all investors. Prices can be highly volatile, and there is no guarantee of profit or protection against losses. Consult with a licensed financial advisor before making any investment or trading decisions. Trade only with funds you can afford to lose.

Dow Futures Trading Strategy for 18th November 2024DOW FUTURES TRADING STRATEGY

Buy Above: 43,675

If the Dow Futures price closes above 43,675 on a one-hour timeframe, it could signal a potential upward momentum. Consider entering a long (buy) position above this level, with appropriate stop-loss and profit-target levels.

Sell Below: 43,470

If the Dow Futures price closes below 43,470 on a one-hour timeframe, it might indicate bearish momentum. A short (sell) position could be considered below this level, ensuring proper risk management.

Current Value: 43,581

This strategy is based on key technical levels and requires confirmation with a one-hour close above or below the specified levels. Traders should employ proper stop-losses, position-sizing strategies, and trailing stops to manage risk effectively.

Disclaimer:

The information provided is for educational and informational purposes only and does not constitute financial advice or a recommendation to trade. Trading in financial instruments, including Dow Futures, involves significant risk of loss and is not suitable for all investors. Financial markets are inherently volatile and subject to unpredictable changes influenced by global economic, political, and market factors.

The price levels mentioned are based on technical analysis and are subject to change as market conditions evolve. There is no guarantee that the specified levels will result in successful trades. Before executing any trades, it is essential to perform thorough analysis and consult with a qualified financial advisor or professional.

You are solely responsible for your trading and investment decisions. Neither the author nor the publisher of this information assumes any liability for losses incurred. Ensure that you are trading with risk capital you can afford to lose and that your trading practices align with your financial goals and risk tolerance.

Past performance is not indicative of future results, and no strategy can guarantee profitability. Always practice disciplined risk management.

Dow Futures Trading Strategy for 14th November 2024Dow Futures Trading Strategy: Buy Above 44,300 / Sell Below 43,930

Current Price: 44,120.00 USD

Key Levels:

Buy Signal: If the price closes above 44,300 on the one-hour candle, it indicates a potential upward trend, suggesting a good time to consider buying.

Sell Signal: If the price closes below 43,930 on the one-hour candle, it suggests a potential downward trend, indicating it might be a good time to consider selling.

Market Analysis:

The current price is hovering around 44,120.00 USD, just below the buy signal level.

The market is showing signs of bullish momentum, but it's important to monitor the price closely, especially around the 44,100 to 44,200 levels, which could act as support or resistance.

Recommendations:

Buy: If the price sustains above 44,300 on the one-hour candle close, consider entering long positions. Book profit at regular intervals or use a trailing stop loss to protect your profit, with targets at 44,500 and 44,600.

Sell: If the price breaks below 43,930 on the one-hour candle close, consider short positions. Book profit at regular intervals or use a trailing stop loss to protect your profit, with targets at 43,800 and 43,700.

Disclaimer: This is only for educational purposes. You may do your own analysis before taking any trading decisions.

Dow Trading Strategy for 13th November 2024Dow Trading Strategy: Buy Above 44,300 / Sell Below 44,030

Current Price: 44,025.00 USD

Key Levels:

Buy Signal: If the price closes above 44,300 on the one-hour candle, it indicates a potential upward trend, suggesting a good time to consider buying.

Sell Signal: If the price closes below 44,030 on the one-hour candle, it suggests a potential downward trend, indicating it might be a good time to consider selling.

Market Analysis:

The current price is hovering around 44,025.00 USD, just below the sell signal level.

The market is showing signs of bearish momentum, but it's important to monitor the price closely, especially around the 44,000 to 44,100 levels, which could act as support or resistance.

Recommendations:

Buy: If the price sustains above 44,300 on the one-hour candle close, consider entering long positions. Book profit at regular intervals or use a trailing stop loss to protect your profit, with targets at 44,500 and 44,600.

Sell: If the price breaks below 44,030 on the one-hour candle close, consider short positions. Book profit at regular intervals or use a trailing stop loss to protect your profit, with targets at 43,900 and 43,800.

Disclaimer: This is only for educational purposes. You may do your own analysis before taking any trading decisions.

Dow Jones Futures Trading Strategy for 11th November 2024Dow Jones Futures Trading Strategy: Buy Above 44,250 / Sell Below 43,920

Current Price: 44,148.00 USD

Key Levels:

Buy Signal: If the price closes above 44,250 on the one-hour candle, it indicates a potential upward trend, suggesting a good time to consider buying.

Sell Signal: If the price closes below 43,920 on the one-hour candle, it suggests a potential downward trend, indicating it might be a good time to consider selling.

Market Analysis:

The current price is hovering around 44,148.00 USD, just below the buy signal level.

The market is showing signs of bullish momentum, but it's important to monitor the price closely, especially around the 44,100 to 44,200 levels, which could act as support or resistance.

Recommendations:

Buy: If the price sustains above 44,250 on the one-hour candle close, consider entering long positions with targets at 44,500 and 44,600.

Sell: If the price breaks below 43,920 on the one-hour candle close, consider short positions with targets at 43,800 and 43,700.

Disclaimer: This is only for educational purposes. You may do your own analysis before taking any trading decisions.

A comparison of US Economy under Trump Vs Joe Biden PresidencyIt is debatable whether any sitting US President can exert much control over an economy that is as large and as complex as that of the U.S. But Stock Markets are a fair indicator of the overall state of the US economy based on investor sentiment in the markets.

So let's have a look at the various factors that affected how the Dow Jones (as an illustrative example) and the US economy in general fared under Trump Vs Biden-Harris.

1. The DJI gained an impressive approx +12337 points (+67.22%) during the Presidency of Donald Trump, whereas it gained an equally impressive +11,868 points (+38.70%) under Biden-Harris.

2. Yet, the markets stumbled in the Second year of each Presidency - due to COVID lock downs, rising interest rates, Government shutdowns, Trade friction with China (under Trump), and rise in Inflation and interest rates (under Biden).

3. Year-3 was best under each Presidency, with impressive returns and dividends partly driven by reduction in interest rates (under Trump), Billions of Dollars in Stimulus packages, and reopening of economy post COVID and burgeoning AI driven boom (under Biden) and also lowering of interest rates (late into Biden Presidency).

4. Americans enjoyed relatively low Inflation under Trump, whereas resurgence of Inflation has been the biggest problem of Biden-Harris administration. The COVID induced supply chain snarls, geopolitical pressures, unleashing of pent-up demand, all pushed prices sharply higher under Biden-Harris.

5. Inflation has since cooled, most supply chains have normalised, Aggressive Fed rates have helped bring down price growth, still Inflation has increased by +20% during Biden-Harris Presidency and Americans are grappling under it's debilitating effects.

6. The US economy added 6.8 million jobs in the first three years under Trump, it then lost 9.8 million jobs in 2020 producing a Net Loss in employment under Trump. The US added 16.4 million jobs under Biden-Harris.

7. Americans ability to spend is usually their view of the economy. It is no surprise that most Americans feel they did better under Trump, when although wages were lower, but so was Inflation, with average hourly earnings rising +6.4% under Trump. While a tight labour market brought significant wage growth for most Americans under Biden-Harris, high Inflation has restricted purchasing power. The REAL Inflation adjusted wage growth under Biden-Harris is only +1.4%.

8. Notwithstanding a strong job market and economy under Biden-Harris, consumers aren't pleased with economic the conditions. But the Biden-Harris administration inherited a country suffering from the COVID pandemic fallout and soon Inflation added to the woes. Considering these factors Biden-Harris has done a fair job of keeping it together despite the added presuure of global geopolitical challenges.

Even as the US markets are at All Time High levels, confidence in the trajectory of the economy is very low. The Gallup's Global Life Evaluation Index for US is registering low levels of confidence typically seen during recession.

So, which Presidential candidate Trump or Harris, do you think will be better for the US economy in General and US and global markets in particular?

Please let us know in the comments below.

And we will have to wait and see who wins the elections this time and how the markets react.

NAS100 SHOWING A GOOD UP MOVE WITH 1:5 RISK REWARD NAS100 SHOWING A GOOD UP MOVE WITH 1:5 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

NASDAQ Bank AnalysisNasdaq Bank experienced a Breakout after 7 months of Sideways movement and reached the top of the Trendline. The market has now returned to the Breakout point, retesting the Sideways range or the 0.6 Fibonacci Retracement level. A Triangle Pattern is forming, and if the Uptrend continues, the target is R1. If the market closes above R1, it is likely to move toward the top of the Trendline.