NIFTY

BANK OF INDIAHere are the intraday (1-day) support and resistance levels for Bank of India (NSE: BANKINDIA) as of the latest available data:

📊 Price Snapshot (as of May 30, 2025)

Last Traded Price: ₹121.94

Day’s Range: ₹117.80 – ₹122.61

52-Week Range: ₹90.05 – ₹137.45

Volume: 17,477,465 shares

VWAP: ₹121.03

Market Capitalization: ₹55,515 crore

Beta: 1.21

Dividend Yield: 2.30%

Book Value per Share: ₹162.55

Upper Circuit Limit: ₹131.13

Lower Circuit Limit: ₹107.28

🔧 Intraday Support & Resistance Levels

Classic Pivot Points

Pivot Point: ₹122.00

Resistance Levels:

R1: ₹122.69

R2: ₹123.28

R3: ₹123.97

Support Levels:

S1: ₹121.41

S2: ₹120.72

S3: ₹120.13

Fibonacci Pivot Points

Pivot Point: ₹122.00

Resistance Levels:

R1: ₹122.49

R2: ₹122.79

R3: ₹123.28

Support Levels:

S1: ₹121.51

S2: ₹121.21

S3: ₹120.72

Camarilla Pivot Points

Pivot Point: ₹122.00

Resistance Levels:

R1: ₹122.22

R2: ₹122.33

R3: ₹122.45

Support Levels:

S1: ₹121.98

S2: ₹121.87

S3: ₹121.75

📈 Technical Indicators Summary

Relative Strength Index (RSI): 70.99 (Buy)

MACD (12,26): 0.93 (Buy)

ADX (14): 32.69 (Buy)

Stochastic RSI (14): 92.60 (Overbought)

CCI (14): 191.58 (Buy)

ATR (14): 1.05 (High Volatility)

Williams %R: -13.78 (Overbought)

🧭 Trading Outlook

Trend: Strong Bullish

Recommendation: The stock exhibits a strong bullish trend with multiple technical indicators signaling a 'Buy'. However, the Stochastic RSI and Williams %R indicate overbought conditions, suggesting caution for new entries. Traders should monitor for potential pullbacks or consolidation before initiating new positions.

TRENT LTDAs of the latest available data, here are the intraday (1-day) support and resistance levels for Trent Ltd (NSE: TRENT), based on various technical analysis methods:

📊 Current Price Snapshot

Last Traded Price: ₹5,643.50

Day’s High: ₹5,728.00

Day’s Low: ₹5,625.00

Volume Weighted Average Price (VWAP): ₹5,652.07

52-Week Range: ₹4,196.00 – ₹8,345.00

Market Capitalization: ₹2.01 trillion

Beta: 1.35

Volatility: 1.83%

20-Day Average Volume: 1,297,570 shares

20-Day Average Delivery Percentage: 27.80%

Book Value Per Share: ₹131.64

Dividend Yield: 0.09%

Face Value: ₹1.00

Upper Circuit Limit: ₹6,222.50

Lower Circuit Limit: ₹5,091.50

All-Time High: ₹8,345.00

All-Time Low: ₹5.13

Previous Close: ₹5,657.00

Open Price: ₹5,656.00

Volume: 1,440,608 shares

Trade Value: ₹81,300.71 lakhs

Closing Price: ₹5,643.50

Price Change: -₹13.50 (-0.24%)

Date: May 30, 2025

🔧 Intraday Support & Resistance Levels

Classic Pivot Points

Pivot Point: ₹5,665.50

Resistance Levels:

R1: ₹5,706.00

R2: ₹5,768.50

R3: ₹5,809.00

Support Levels:

S1: ₹5,603.00

S2: ₹5,562.50

S3: ₹5,500.00

Fibonacci Pivot Points

Pivot Point: ₹5,665.50

Resistance Levels:

R1: ₹5,704.85

R2: ₹5,729.15

R3: ₹5,768.50

Support Levels:

S1: ₹5,626.15

S2: ₹5,601.85

S3: ₹5,562.50

Camarilla Pivot Points

Pivot Point: ₹5,665.50

Resistance Levels:

R1: ₹5,652.94

R2: ₹5,662.38

R3: ₹5,671.82

Support Levels:

S1: ₹5,634.06

S2: ₹5,624.62

S3: ₹5,615.18

📈 Additional Technical Insights

Short-Term Support & Resistance:

Support: ₹5,603 – ₹5,563 – ₹5,500

Resistance: ₹5,706 – ₹5,769 – ₹5,809

Volume-Based Levels:

Support: ₹5,172.50

Resistance: ₹5,576.75

🧭 Trading Outlook

Trend: Positive

Recommendation: If holding long positions, continue to hold with a daily closing stop-loss of ₹5,528. Fresh short positions can be considered if TRENT closes below ₹5,528.

HOME FIRST FIN CO IND LTD#HOMEFIRST

This is not a buy or sell recommendation only for educational purposes and I am not a SEBI registered.

Entry above :1315 on closing monthly candle

SLL: 1227

SWING TRADING TARGET: 1385-1679-1777

Based on a comprehensive analysis of Home First Finance Company India Ltd. (NSE: HOMEFIRST), here is an in-depth evaluation encompassing its fundamental performance, institutional investment trends, and suitability for long-term investment or swing trading strategies.

Fundamental Analysis

Financial Performance

Revenue & Profitability: The company has demonstrated robust financial growth, with annual revenue increasing from *242 million in FY2016 to *11.57 billion in FY2024. The net profit margin stood at 23.9% in Q3 FY25, indicating efficient operations and profitability.

Asset Quality: As of December 31, 2024, the total asset value was ₹11,309 crore, reflecting a strong asset base. The company maintains a healthy capital adequacy ratio (CRAR) of 36.2%, showcasing financial stability.

Return Metrics: The Return on Equity (ROE) improved to 14.41% in FY2024, up from 12.56% in FY2023, indicating enhanced shareholder value creation.

Institutional Investment Trends

Promoter Holdings: There has been a notable reduction in promoter holdings, decreasing from 23.38% to 14.31% in the quarter ending December 2024. Institutional Investors: Institutional investors have significantly increased their stake, rising from 37.98% to 56.19% in the same period, indicating growing confidence among large investors.

Technical Indicators

Moving Averages: The stock is trading close to its 50-day Simple Moving Average (SMA) of *996.03 and 200-day SMA of ₹1,051.20, suggesting a neutral trend. Momentum Indicators: The Relative Strength Index (RSI) is at 54.75, indicating a neutral momentum. The Money Flow Index (MFI) at 74.85 suggests strong buying pressure.

Investment Considerations

Long-Term Investment

Home First Finance exhibits strong fundamentals, consistent growth, and increasing institutional interest, making it a viable option for long-term investment. Analysts have set a 12-month average target price of ₹1,239.81, representing an upside potential of approximately 24.86% from the current price.

Swing Trading

For swing trading, the stock's current technical indicators suggest a neutral trend. Traders should monitor key support and resistance levels and consider market volatility before initiating short-term positions.

* Conclusion

Home First Finance Company India Ltd. presents a compelling investment opportunity, backed by strong financial performance and growing institutional interest. While the stock shows potential for long-term growth, swing traders should exercise caution and rely on technical analysis for entry and exit points. If you have specific queries regarding the monthly chart or require further analysis, please provide the chart details, and I will be glad to assist you further.

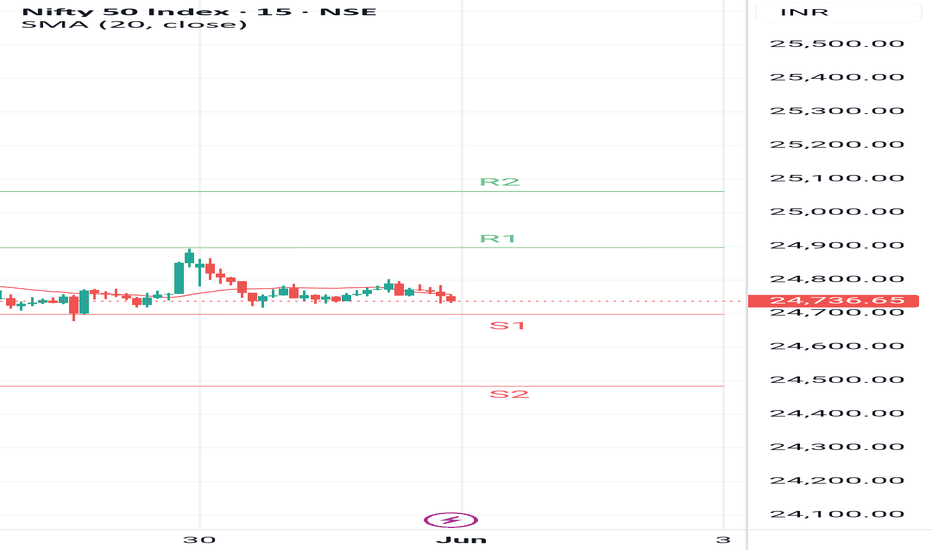

Nifty range for make or break for momentum trade. Nifty 50 index shows a moderately bullish structure, trading near the 24800 level after breaking out from consolidation earlier this week. Momentum remains strong, supported by gains in banking, IT, and FMCG sectors. Immediate support is seen Nifty 50 is trading near the 24700 mark 📈, reflecting bullish sentiment after breaking out from a consolidation phase. The index has been supported by strong performance in Banking 🏦, IT 💻, and FMCG 🍫 sectors.

The index has immediate support at 24700, while resistance is seen near 24900 and 25080

The broader trend remains positive, but some profit-booking is possible at higher levels.

🔵 Strategy (Bullish):

If Nifty trade and sustain above 24900, buy CE (Call Option) with limited quantity 🟢 and full quantity above 25080.

🔴 Strategy (Bearish):

If Nifty breaks below 24700, buy PE (Put Option) 🔻

💡 Tip: Trade with levels, maintain discipline, and manage risk smartly — the market rewards patience and planning.

Support and Resistance part 1In trading, support and resistance levels are significant price points where a price tends to stop and reverse direction. Support acts as a price floor, indicating strong buying interest that prevents further declines. Resistance, on the other hand, is a ceiling, where selling pressure halts upward movement.

PCR Trading part 2In the context of trading, PCR stands for Put-Call Ratio. It's a technical indicator used to assess market sentiment, specifically in the options market. The PCR is calculated by dividing the volume (or open interest) of put options by the volume (or open interest) of call options over a specific period.

PCR Trading part 1PCR trading refers to using the Put-Call Ratio (PCR) indicator to assess market sentiment and potentially predict future price movements. It's a contrarian indicator, meaning it suggests trading against the prevailing market sentiment. For example, a high PCR (suggesting a bearish market) might signal an opportunity to buy, as the market might be over-sold.

What is Technical Trading ?Technical trading, also known as technical analysis, involves studying historical price charts and market statistics to identify patterns and trends in order to make informed trading decisions. It focuses on the belief that market prices reflect all available information, and past patterns can help predict future price movements.

NIFTY FINANCIAL SERVICES LIMITED#FINNIFTY : INSTITUTIONAL LEVELS FOR 30/05/2025

• Overview

A simple yet powerful trading system for active 5-minute timeframe traders, built for quick, confident decisions in fast markets.

• Key Guidelines

Retest Entries: Prefer retests over breakouts.

Multiple Confirmations: Validate trades with 2+ signals.

ATM Options: Stick to at-the-money (ATM) or above for better liquidity and risk control.

• System Logic

Uses volume, historical price action, and ranges to find high-probability entries and exits, reducing guesswork and keeping trading consistent.

• Entry & Exit Signals

Blue Line: Possible long entry.

Red Line: Possible short entry.

Always align with extra confirmations for best results.

• Stop Loss & Target

Long SL: Below the nearest red line.

Short SL: Above the nearest blue line.

Long Target: Next red line above.

Short Target: Next blue line below.

Timeframe

Best for the 5-minute chart.

• Risk Note

▲ Trade responsibly. Use only capital you can afford to lose.

• Community

#Join discussions, share ideas, and grow with like-minded traders!

• Original System

* 100% original, tested in real markets for a true trading edge.

RBL BANK LTD#RBLBANK

STOCK NAME: RBL BANK LTD (NSE)

CHART ANALYSIS: Rounding Bottom breakout with bullish volume. Trend reversal confirmed.

Trading above resistance - next move can be explosive!

TREND: Bullish

SUPPORT: 208 / 188

RESISTANCE: 217 / 245/260

TRADE SETUP:

BUY above 217 | SL 208 | Targets 230 / *245 / *260

X SELL below *205 (if fails) | SL 215 | Target *190

▲ I AM NOT SEBI REGISTERED. THIS IS ONLY FOR EDUCATIONAL PURPOSE.

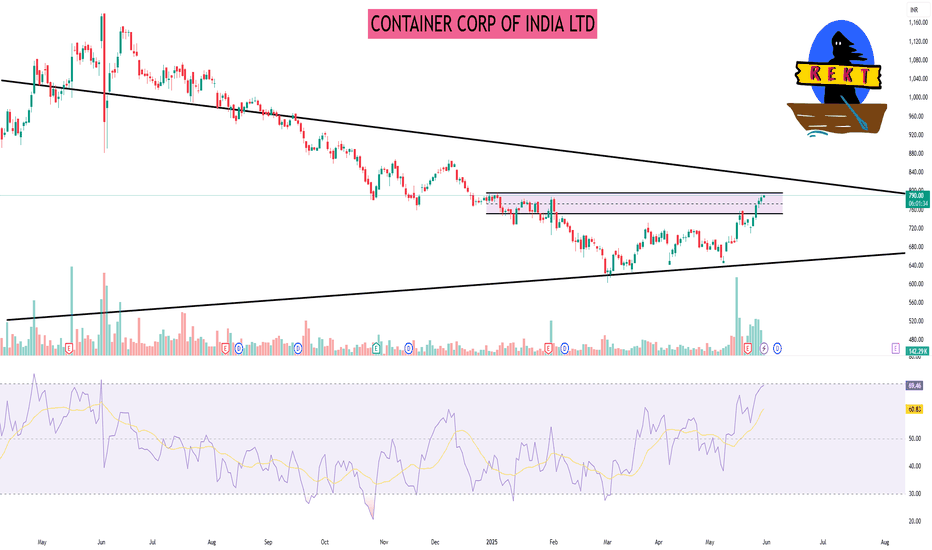

CONTAINER CORP OF INDIA LTDAs of May 30, 2025, Container Corporation of India Ltd. (NSE: CONCOR) is trading around ₹778.10. Based on daily technical analysis, here are the key support and resistance levels:

📊 Daily Support & Resistance Levels

Pivot Type Support Levels (S) Resistance Levels (R) Pivot Point (P)

Classic S1: ₹773.70S2: ₹761.45S3: ₹752.80 R1: ₹794.60R2: ₹803.25R3: ₹815.50 ₹782.35

Fibonacci S1: ₹774.37S2: ₹769.43S3: ₹761.45 R1: ₹790.33R2: ₹795.27R3: ₹803.25 ₹782.35

Camarilla S1: ₹784.03S2: ₹782.12S3: ₹780.20 R1: ₹787.87R2: ₹789.78R3: ₹791.70 ₹782.35

Note: These levels are derived from pivot point calculations and can vary based on market conditions.

🔍 Technical Overview

Trend Outlook: The stock is exhibiting a neutral to slightly bullish trend.

Key Observations:

The price is hovering around the pivot point, indicating potential consolidation.

A breakout above R1 (₹794.60) may signal bullish momentum, while a drop below S1 (₹773.70) could indicate bearish pressure.

JASH ENGINEERING LTDAs of May 30, 2025, Jash Engineering Ltd. (NSE: JASH) is trading at approximately ₹559.40. Based on recent technical analyses, here are the 15-minute intraday support and resistance levels:

🔹 Intraday Support & Resistance Levels (15-Minute Interval)

Classic Pivot Points:

Support Levels:

S1: ₹567.54

S2: ₹554.87

S3: ₹544.94

Resistance Levels:

R1: ₹590.14

R2: ₹600.07

R3: ₹612.74

Fibonacci Pivot Points:

Support Levels:

S1: ₹568.84

S2: ₹563.50

S3: ₹554.87

Resistance Levels:

R1: ₹586.10

R2: ₹591.44

R3: ₹600.07

Camarilla Pivot Points:

Support Levels:

S1: ₹578.13

S2: ₹576.06

S3: ₹573.99

Resistance Levels:

R1: ₹582.27

R2: ₹584.34

R3: ₹586.42

Note: These levels are derived from pivot point calculations and can vary based on market conditions.

📊 Technical Indicators

Moving Averages: The stock is currently below both short-term and long-term moving averages, indicating a bearish trend.

MACD: A bullish crossover has been observed, suggesting potential upward momentum.

RSI: The Relative Strength Index is in the neutral zone, indicating neither overbought nor oversold conditions.

🔍 Observations

The stock has recently tested the support level around ₹539.50, which may act as a strong base.

Resistance is observed near ₹554.05, and a breakout above this level could signal further upside.

The stock's volatility is moderate, with a daily average movement of approximately 4.39%.

RELIANCE INDUSTRIES LIMITEDReliance Industries Ltd view for Intraday 29th May #RELIANCE

Resistance 1430 Watching above 1432 for upside momentum.

Support area 1400 Below 1410 ignoring upside momentum for intraday

Watching below 1397 for downside movement...

Above 1410 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks....

CRUDE OIL FUTURESAs of May 30, 2025, here are the latest 15-minute support and resistance levels for Crude Oil Futures:

🛢️ WTI Crude Oil Futures (NYMEX: CL1!)

Current Price: ~$60.62 per barrel

Support Levels:

S1: $59.97

S2: $59.00

S3: $57.45

Resistance Levels:

R1: $62.49

R2: $64.04

R3: $65.01

🇮🇳 MCX Crude Oil Futures (INR)

Current Price: ~₹5,191 per barrel

Support Levels:

S1: ₹5,153.33

S2: ₹5,092.67

S3: ₹5,031.33

Resistance Levels:

R1: ₹5,231.67

R2: ₹5,292.33

R3: ₹5,353.67

📊 Technical Outlook

Trend: Neutral to slightly bearish

Indicators: The 15-minute chart shows a potential for a bullish reversal, but confirmation is needed.

Strategy: Traders may consider watching for a breakout above resistance levels for potential long positions, or a breakdown below support levels for short positions.

TRIVENI TURBINE LTDAs of May 30, 2025, Triveni Turbine Ltd. (NSE: TRITURBINE) is trading at approximately ₹595.40 . Based on the latest technical data, here are the intraday support and resistance levels:

🔹 Intraday Support & Resistance Levels

Standard Pivot Points:

Support Levels:

S1: ₹597.12

S2: ₹584.98

S3: ₹577.87

Resistance Levels:

R1: ₹616.37

R2: ₹623.48

Fibonacci Pivot Points:

Support Levels:

S1: ₹597.12

S2: ₹589.76

S3: ₹585.22

Resistance Levels:

R1: ₹604.47

R2: ₹609.01

R3: ₹616.37

Camarilla Pivot Points:

Support Levels:

S1: ₹590.34

S2: ₹588.57

S3: ₹586.81

Resistance Levels:

R1: ₹593.86

R2: ₹595.63

R3: ₹597.39

Note: These levels are derived from pivot point calculations and can vary based on market conditions.

🔹 Technical Indicators

Relative Strength Index (RSI): The RSI is currently between 45 and 55, indicating a neutral condition.

Stochastic Oscillator: The Stochastic Oscillator is in the bullish range, suggesting potential upward momentum.

🔹 Recent Price Action

Triveni Turbine's stock has experienced significant volatility recently. After reaching a high of ₹885.00 on November 26, 2024, the stock declined to a low of ₹460.30 on March 3, 2025. Since then, it has rebounded, trading around ₹595.40 as of May 30, 2025.