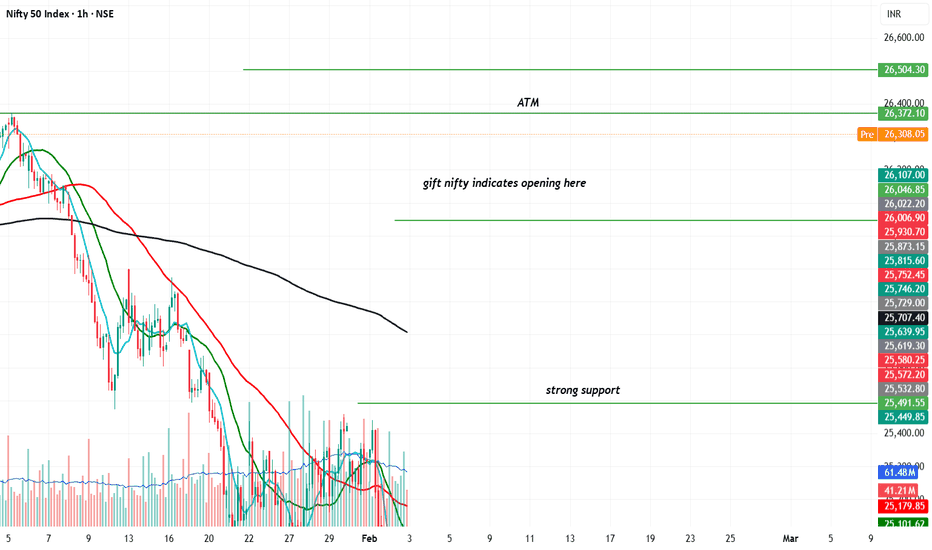

Nifty50 analysis(13/2/2026).CPR: NARROW +descending cpr: trending.

FII: 108.42 bought.

DII: 276.85

Highest OI:

CALL OI: 26000

PUT OI: 25900

Resistance: - 25800 to 26000

Support : - weak support only

conclusion:.

My pov:

1.market gapped down about 200 points . if it closed and crossed below 25600 then down trend continues.

2. 25800 will be the resistance , market continued to down trend if it touch.

3.next support will be 25350 if trend continues.

What IF:

if it breaks 25800 then retest

there is possible the trend continues or retest and continues .

psychology fact:

traders often underestimate how painful losing the money actually feels, which can make them take more risks

notes:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

I'm not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50analysis

Nifty50 analysis(12/2/2026).CPR: NARROW +ascending cpr: trending.

FII: 943.81 bought.

DII: -125.36 sold.

Highest OI:

CALL OI: 26000

PUT OI: 25900

Resistance: - 26000

Support : - 25800 and 25650

conclusion:.

My pov: highly possible today a trend day

1.26000 has huge resistance so its hard to break. market have to retest support at some point, after only 26000 can be broken.

2. for three days cpr shows narrow candle so either uptrend (possibly) or down trend can occur today.

3.25800 has supports, unless it close and cross in a day candle.

4.we can possibly see some v shape recovery, lets wait and watch

What IF:

retest possibilities 26000 on the upside

25650 or 25500 on the down side .

psychology fact:

Many traders make the mistake of trading aimlessly every day without trying to achieve specific goals.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

I'm not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

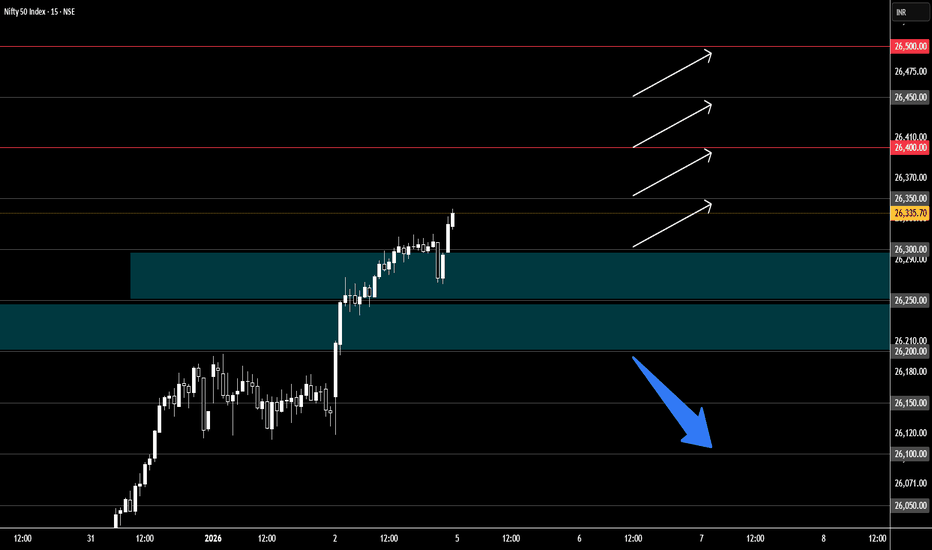

Nifty50 analysis(11/2/2026).CPR: narrow + ascending cpr: trending

FII: 69.45 bought

DII: 1,174.21 bought

Highest OI: too soon to tell

CALL OI: 26000

PUT OI: 26000

Resistance: - 26000

Support : - 25950

conclusion:.

My pov

1.market is in buy on dip mode any fall or support can rise the market to 26000 to atm.

2. Yesterday forms a virgin cpr so today highly possible to touch cpr and rise . 25930 also today narrow cpr.

3. If it breaks 26000 then all time high is the target. Only if it close in day candle.

4. Fii and dii continusly buying this show the bullishness in market. Clearly market in trend and a trend rise from a sharp fall. Expect the anything can happen.

What IF:

1.market can fall upto 25900 there one hour candle 50ma support that gives a good support.

2. If market breaks 26000 then all time high is the resistance.

Psycology:

Make a trade with high possibilities. Dont hope one factor make multiple factor on your side.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you

Support Holds, Volatility Fades — Fresh Rally Ahead for Nifty?Indian markets were volatile last week. Initial uncertainty after the Union Budget was followed by a strong positive reaction to the India–US trade deal.

Nifty moved in a wide range during the week but ended higher.

India VIX fell by around 12%, showing that volatility has reduced after major events.

◉ Key Levels

Immediate Support: 25,400–25,500

Immediate Resistance: 26,000

Strong Resistance: 26,200–26,300

The sharp sell-off after the gap-up opening found a base near 25,500, establishing it as a strong demand zone.

◉ Technical View

The overall trend remains positive above 25,400. A sustained move above 26,000 is needed for further upside, and a clear breakout above 26,300 could lead to the next rally.

◉ Key Triggers for the Week

India–US Trade Deal: Lower US tariffs (18%) improve visibility for exporters and foreign investors, supporting sentiment.

Inflation Data: Domestic CPI/WPI and global inflation prints will influence interest rate expectations and risk appetite.

Q3 FY26 Earnings: Results from banks, financials, IT, and other index heavyweights will drive sector leadership and Nifty direction.

◉ Trading Strategy

Traders should follow a buy-on-dips strategy near support levels and avoid taking aggressive positions until Nifty decisively moves above the 26,000–26,300 zone.

Nifty50 analysis(6/2/2026).CPR: narrow + decending cpr: trending

FII: 2,150.51 sold.

DII: 1,129.82 bought.

Highest OI:

CALL OI: 25700 to 26000

PUT OI: 25500

Resistance: - 26000

Support : - 25500

conclusion:.

My pov:

1.market gap down and continue with trend because of narrow cpr.

2.still support at 25400 and above first resistance is 25650.

3. Price must find a clear support until then bearish

What IF:

resistance 25650 on the upside

And support 25400 on the down side .

psychology:

Confidence. Discipline . Proper focus gives consistence result

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you

Nifty50 analysis(5/2/2026).CPR: wide + decending cpr: bearish consolidtion

FII: 29.79 bought.

DII: 249.54 bought.

Highest OI:

CALL OI: 25800, 26000

PUT OI: 25700

Resistance: - 26000

Support : - 25500

conclusion:. bearish

My pov:

1.still my view price should take support at 25650 then bullish

2.For 200ma line the price must break many time to get support ,so there is highly possible to go down to find support .

3.in 4hour candle has support of 200ma line at 25650 that itself give support or make market consolidate itself there 25650.

4.the price have to take retest and go long until then its a trap. so do not trade until the clear signal.

What IF:

retest possibilities 26000 on the upside

25650 or 25500 on the down side .

psychology fact:

You cant learn every possible way market behaves. If you cant accept uncertanity then you cant take trade without hesitation

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(4/2/2026).CPR: wide + ascending cpr: consolidtion

FII: 5,236.28 bought.

DII: 1,014.24 bought.

Highest OI:

CALL OI: 25800, 26000

PUT OI: 25700

Resistance: - 26000

Support : - 25500

conclusion:.

My pov:

1.today price consolidate towards 25250. because it is the place were huge support is seen.

2.in one hour candle the 200ma line is broken for first time , for 200ma line the price must break many time to get support ,so there is highly possible to go down to find support .

3.in 4hour candle has support of 200ma line at 25650 that itself give support or make market consolidate itself there 25650.

4.keep in mind that market is in bullish the price suddenly gapped up so most active player wait for the right place to entry long .

What IF:

market can go down to 25250 max.

if it 26000 is the high max.

psychology fact:

Trust the process, objectify the market, accept uncertainty.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(3/2/2026)Expiry day.CPR: wide + overlapping cpr: slightly bullish and consolidtion

FII: -1,832.46 sold

DII: 2,446.33 sold.

Highest OI:

cant say whats oi because of hugeeeeeeeeee gap up.

Resistance: -

Support : -

conclusion:.

My pov:

1.price has crossed the range 25500, this will be the strong support for today.

2.there is a huge gap up so market makes another rally because of short covering wait for first one and trade.

3. today is expiry that also has volatality, mind that.

What IF:

1.today market can break ATH.

2.can retest from high because most of the smart money try to entry at low .

psychology fact:

Trading fails not because of lack of opportunity,

but because most minds can’t handle unlimited freedom.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(2/2/2026).CPR: wide + descending cpr: consolidation.

FII: -588.34 sold

DII: -682.73 sold.

Highest OI:

25000 put oi.

24800 to 24600call oi.

Resistance: strong 25000.

Support :rising support 24800,24700,24600

conclusion: wide cpr shows high volatility.

My pov:

1.today price will not act accoding to indicators, if support is taken from the above level market will sustain if not it will move down side.it just breaks every resistance and move above.and breaks if and go down.

2.wait for the clear signal and trade responsibly.

What IF:

1.if market close above 24900 then retest.(possibily) and continuation.

2.if closed below 24800 then 24500 is then next support .

Note:

find what happened on this days:

1.20/9/2019.

2.07/04/2025.

3.09/03/2023.

psychology fact:

People are attracted to trading because it offers total freedom

but most people are not psychologically prepared to handle that freedom.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty Slides on Budget Shockwave: What’s Ahead for Markets?Indian equity markets faced sharp volatility following the Union Budget 2026, as the increase in Securities Transaction Tax (STT) on F&O trading weighed heavily on market sentiment.

In the special Sunday session, Nifty declined 495 points (-1.96%), closing at 24,825. Market uncertainty rose sharply, with India VIX climbing to 15.10, marking an 8-month high.

◉ Technical Setup

Nifty has broken below its rising channel, confirming that this isn’t just a healthy correction.

The structure now points toward a positional downtrend, with sellers firmly in control.

◉ Key Levels to Watch

Support Levels

24,500 – 24,400: Immediate support zone

24,000 – 23,900: Strong demand area with significant put writer positioning

Resistance Levels

25,000 – 25,100: Near-term resistance

25,500 – 25,600: Major supply zone

◉ Key Triggers for the Week

RBI Monetary Policy Meeting (Feb 4–6)

The RBI is widely expected to pause rates, after cutting 125 bps since Feb 2025, bringing the repo rate to 5.25%.

Q3 FY26 Corporate Earnings

A busy earnings calendar may influence index movement. Key companies reporting include State Bank of India NSE:SBIN , Bharti Airtel NSE:BHARTIARTL , LIC NSE:LICI , Adani Enterprises NSE:ADANIENT , and RVNL $NSE:RVNL.

Institutional Flows

After turning net sellers on Budget day, FII-DII activity will be closely watched.

◉ Weekly Outlook

The near-term outlook remains cautiously bearish with elevated volatility.

Nifty is expected to consolidate in the 24,500–25,100 range.

A sustained move above 25,200 is required to improve the technical outlook. Until then, upside attempts may face selling pressure.

◉ Trading Perspective

The market currently favours a sell-on-rise approach.

Aggressive long positions should be avoided unless Nifty closes above 25,200 on a daily basis.

Nifty50 analysis(1/2/2026)CPR: narrow + overlapping lower cpr: trending(slight bearish).

FII: 2,251.37 bought

DII: -601.03 sold.

Highest OI:

25300 and 25500 put oi.

25300 and 25200 call oi.

Resistance: strong 25500.

Support :weak 25200

Event:

Exchanges are conducting a special live trading session on Sunday, 01-Feb-26, on account of the presentation of the Union Budget.

conclusion: market shows weaknesses.

My pov:

1.when we look at the overall view market tightly consolidate range 25500-25200, if it breaks either a good trend can form. highly down side possible for now.

2.today Sunday market can be choppy too because how many will know today is a trading day.

3.overall market gives bearishness volume, MA lines, cpr in day candle any resistance or negative news can affect the market severe.

4.this bearishness is for the short term until huge support given .

What IF:

1.25500-25250 this must be broken for clear confirmation.

2.if range broken above then 26000, if broken below 24900 as the target.

3.if any shows strongness today or good news highly possible a good trend in day candle.

Note:

watch the volume in day candle something is fishy we gonna ride a huge trend sooner.

psychology fact:

never trade news or events. wait till uncertainty becomes certain.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(30/1/2026).CPR: wide + overlapping cpr: range day.

FII: -393.97 sold

DII: 2,638.76 bought.

Highest OI: 25500 put oi. and 25300 and 25200 call oi.

P.C.R: 1 bearish.

Resistance:25500.

Support : 25200

Event: Budget on Feb. 1

conclusion: bullish but retest is highly possible.

My pov:

1.market opens with gap down almost 100 points.

2.until 25200 is crossed below down only bullish pov.

3.IN one hour candle if it takes support at 50ma (red line ) from there the bullish trend continues.

4. budget is highly a anticipated event so uncertanity highly present trade accodingly. anything can happen on monday. wait until event is closed.

What IF:

1.if price breaks 25200 and 25450 closed in day candle then overall trend bearish

psychology fact:

Fight like you deserve to win, but don’t focus on the outcome.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(29/1/2026).CPR: narrow + ascending cpr: trending day.

FII: 480.26 bought

DII: 3,360.59 bought.

Highest OI: 25500and25300 put oi and 25300 and 25200 call oi.

P.C.R: 0.8 mild bullish.

Resistance:25500.

Support : 25150

conclusion:

My pov:

1.the first price resistance is 25450 if it crossed then bulish.

2.until 24900 is crossed below down only bullish pov.

3.today trending day so plan accordingly.

What IF:

1.if price breaks 24900 and closed in day candle then overall trend continues.

2.bullishness continues if it crossed 25450.

psychology fact:

embrace uncertainty, become skilled don't wait, go for it.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(28/1/2026).CPR: overlapping + descending cpr: consolidation day.

FII: -3,068.49 Sold

DII: 8,999.71 bought.

Highest OI: too soon to tell

Resistance:25500.

Support : 24900.

conclusion:

My pov:

1.yesterday clearly DII support with 9000cr. today a positive almost 300 point gap. this gap will not sustain.

2.price will drift towards yesterdays high or today cpr only then price goes upward.

3.wait for the price come to your range so you can buy at bottom.

What IF:

1.if price breaks 24900 and closed in day candle then overall trend continues.

2.if the gap sustained from openning then 25600 will be the resistance .

psychology fact:

A setbacks as the result of minor, controllable, situations that have nothing to do with them personally.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Nifty50 analysis(27/1/2026)Expiry.CPR: wide + descending cpr: consolidation day.

FII: -4,113.38 Sold

DII: 4,102.56 bought.

Highest OI: 25000 both PE and CE

Resistance: In 4hour candle the resistance lies 20ma and 200ma.

Support : recent low 24900.

conclusion:

My pov:

1.market can be choppy today because of high oi on both side and cpr indicates wide cpr. check both 4hour and daily candle for 200ma line.

2.any timeframe once the 200ma is crossed price can retest 200ma or can be fake breakout. also take support from there. bigger timeframe it hard to break 200ma line support.

3.today if price broke below 24900 in a day candle trend continues.

psychology fact:

A lazy mind creates a miserable future; a hardworking mind creates destiny.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Dalal Street Shaken Ahead of Monthly Expiry — What’s Next?Indian equity markets witnessed a sharp corrective move last week, with the Nifty sliding nearly 2.5% to close around 25,050. The sell-off came at a sensitive juncture—just ahead of monthly expiry.

Adding to the nervousness, India VIX jumped sharply by 24.8% to 14.19, signaling a sudden rise in uncertainty and trader caution.

A combination of geopolitical tensions, pre-Union Budget 2026 jitters, and mixed Q3 earnings weighed heavily on market sentiment, prompting profit booking across sectors.

◉ Technical Setup

Nifty is currently testing the lower end of its rising channel, a technically important area. A mild relief bounce is possible from these levels.

However, a decisive breakdown below the channel support could trigger another leg of sharp selling in the coming sessions, making this zone extremely crucial for near-term direction.

◉ Key Levels to Watch

Support Zones

25,000 – 24,900: Immediate psychological and technical support

24,500 – 24,400: Strong base with heavy put writer concentration

Resistance Zones

25,400 – 25,500: Immediate hurdle with significant call writing

26,000 – 26,100: Major supply zone and strong resistance

◉ Near-Term View

Volatility is likely to remain elevated in the coming week. While the broader structure has weakened, a short-term bounce from the 25,000 zone cannot be ruled out, given oversold conditions and strong psychological support.

That said, any recovery should be viewed with caution and may face stiff resistance at higher levels.

◉ Suggested Strategy

A cautious, stock-specific strategy is preferred for the week ahead. Short-term oversold signals may support a bounce, but the broader trend has weakened. Avoid aggressive longs and focus on protecting gains.

Indian Markets on Hold: Nifty Awaits the Next Big TriggerIndian markets remained range-bound last week, with the Nifty ending on a flat note. Participants stayed cautious as volatility showed early signs of revival, with India VIX inching up to 11.37.

◉ Technical Setup

From a technical standpoint, the index briefly slipped below the rising wedge support, but the move failed to attract strong selling pressure. Nifty continues to consolidate in a narrow band, suggesting indecision rather than a trend reversal.

This phase of consolidation is likely to extend into the coming week unless key levels are breached.

◉ Key Levels to Watch

The broader structure remains unchanged from last week.

Resistance: 26,000–26,100

Strong call writing in this zone makes it a tough hurdle.

Support: 25,500–25,400

A solid put base is visible here, offering near-term support.

A decisive break below 25,400 could open the door for a sharp downside move, pulling the index closer to 25,000.

◉ Key Triggers for the Week

Q3 Earnings Season – Results from large and mid-cap companies across sectors will guide stock-specific action and influence overall market sentiment.

India–US Trade Deal – Comments or policy moves around trade negotiations, especially related to agricultural tariffs, could impact sentiment and sectoral stocks.

◉ Weekly Outlook

The near-term outlook remains neutral, with Nifty expected to trade within a defined range until a decisive breakout or breakdown occurs.

◉ Trader’s Insight

Until Nifty decisively holds above 26,000, aggressive long positions across the board should be avoided. A selective, stock-specific approach, backed by strict risk management, is better suited to the current market environment.

Dalal Street Bleeds: Where Is NIFTY Headed Next?Indian markets witnessed a sharp sell-off last week, with the benchmark NIFTY closing 2.45% lower, as weak global cues and rising uncertainty dragged investor sentiment.

Adding to the caution, India VIX NSE:INDIAVIX jumped nearly 16%, settling at 10.92 after hitting multi-month lows earlier. This sudden spike in volatility clearly signals growing nervousness among market participants.

◉ Technical Picture Turns Weak

For the past few weeks, we consistently highlighted the formation of a Rising Wedge pattern on the daily chart—typically a bearish setup.

With Friday’s close below the wedge support, NIFTY has now confirmed a downside breakout, indicating that further pressure may persist in the near term.

To add to the concern, a Double Top pattern has also emerged on the charts, strengthening the bearish undertone for the coming sessions.

◉ Key Levels to Watch

Resistance Zone: 26,000 – 26,100

This area has now turned into a strong resistance, backed by heavy call writing, making it difficult for NIFTY to move higher in the short term.

Support Zone: 25,500 – 25,400

This is the immediate support area to watch closely.

A decisive break below this zone could open the door for a sharp 500-point fall, pulling the index closer to the 25,000 level.

◉ Key Triggers for the Upcoming Week

Q3 Earnings Season Kicks Off

Market focus will be on IT majors—TCS NSE:TCS , Infosys NSE:INFY , HCL Tech NSE:HCLTECH , Wipro NSE:WIPRO , and Tech Mahindra NSE:TECHM —along with heavyweights like Reliance Industries NSE:RELIANCE and HDFC Bank NSE:HDFCBANK . Earnings numbers and management commentary will play a crucial role in shaping near-term sentiment.

US Tariff Verdict

The US Supreme Court’s ruling on January 14 regarding Trump’s tariffs remains a major overhang. This decision could act as a key directional trigger, not just for India but for global and emerging markets as well.

◉ Outlook for the Coming Week

With weak global cues, rising volatility, and clear technical breakdowns, the market is likely to remain highly volatile, with a negative bias in the near term.

◉ What Traders Should Do

With volatility on the rise and technicals weakening, aggressive long positions can quickly turn risky. Until NIFTY shows stability above key support levels, traders are better off staying cautious, protecting existing profits, and focusing only on selective stocks that continue to show relative strength rather than chasing broad market moves.

Nifty 50 Price Structure Analysis [05/01/2026: Monday]Top-Down Nifty 50 Price Structure Analysis for 05th of January 2026. The day is Monday.

(1) Monthly Time Frame:

The candle is so far bullish. Price set a new all-time high (ATH). The moment the price starts to trade above level 26350, last month's candle will be engulfed. Strong support is 26200. Weak resistance is 26400. The view is bullish.

(2) Weekly Time Frame:

This week's candle shows a volatile session. Bears are badly trapped at level 25900. This week's market made a new ATH. The candle is a strong bullish candle with features similar to a bullish hammer. Additionally, the candle engulfed last week's candles. Weak resistance is 26350. Major resistance is 26400. Strong support zone is (26250 - 26200). Doubt every down move. The view is bullish.

(3) Daily Time Frame:

A strong bullish candle. Though there are wicks but the candle can be featured as an imperfect bullish marubozu. A very strong support zone is (26250 - 26200). Doubt every down move. Weak resistance is 26350. Strong resistance is 26400. However, there is a higher probability of the price to start trading above the level 26400. The view is bullish.

(4) 30-Minute Time Frame:

The session shows strong bullish dominance. The last 1-hour activity confirms that bears will be bullied every time there is a dip. The higher highs structure is intact. Strong support at the levels - 26300, 26250, and 26200. Doubt every down move. Weak resistance is 26350. Strong resistance is 26400. The view is bullish.

Bullish Scenario Set-Up:

(i) Price sustains above the opening price.

(ii) Price stays above level 26300.

(iii) Possible bullish targets after the price breaks out level 26350 are - 26400, 26450, and 26500.

Bearish Scenario Set-Up:

(i) Price sustains below the opening price.

(ii) Price starts to trade below the level 26200.

No Trading Zone (NTZ): (26300 - 26200).

Events: No expiry on Monday. No high-impact event on Monday.

Summary of the Trading Plan (Hypothesis and Insights):

(i) The monthly TF bias is bullish.

(ii) The weekly TF bias is bullish.

(iii) The daily TF bias is bullish.

(iv) The 30-minute TF bias is bullish.

(v) Establish intraday bias with respect to the opening price.

(vi) No trading zone (NTZ): (26300 - 26200).

(vii) There is a higher probability of a bullish move. There is a negligible chance of a bearish move. Doubt every down move as there is a strong support area till 26200.

(viii) After price breaks out above the level 26350, the probable targets would be - 26400, 26450, and 26500.

(ix) Trade only if there is either a bullish/ bearish scenario. Otherwise, don't trade. Remember, not trading is an extension of trading activity. BE RESPONSIBLE.

NOTE:

"Mark your points. Trade your points. Price is God. Anything can happen in the markets. Therefore, trade what you see, not what you believe."

Happy Trading!

Nifty Hits a New Peak: Is the Next Leg Up Around the Corner?Indian equities kicked off the New Year with confidence, gaining nearly 1% and finally breaking out of a five-week consolidation phase. After a slow and mixed start, a strong rebound in the latter half of the week pushed the Nifty to a fresh all-time high of 26,329.

Volatility ticked up slightly, with India VIX rising 3.28% to 9.45, but it continues to remain at comfortable, historically low levels.

◉ Technical Outlook

As highlighted earlier, the Cup & Handle pattern has now taken a clearer shape. A decisive breakout and sustained move above the neckline could trigger the next leg of the rally.

◉ Key Levels to Watch

● Resistance: 26,500 – 26,600 (heavy call writing zone)

● Immediate Support: 26,100 – 26,200

● Strong Support: 25,900 – 26,000 (heavy put writing zone)

◉ Near-Term View

Nifty is likely to consolidate within a 300-point range, broadly between 26,200 and 26,500, as the market digests recent gains.

◉ Key Trigger to Watch

Global cues remain important. Markets will closely monitor developments after reports of US military strikes on Venezuela, which could influence sentiment in the coming sessions.

◉ Trading Strategy

Expect mild profit-taking at higher levels. Avoid aggressive fresh buying, protect existing gains, and stay selective by focusing on stocks showing relative strength.

Nifty 50 Price Structure Analysis [02/12/2025: Friday]Top-Down Nifty 50 Price Structure Analysis for 02nd of December 2026. The day is Friday.

(1) Monthly Time Frame:

It is the first day of the month. The candle has so far no body formation. The candle is inside the previous month's black paper umbrella or hanging man. The market is flat. There's no price action clarity. Major resistance is 26200. Major support is 26000. The view is indecision.

(2) Weekly Time Frame:

Price is in the same choppy and sideways range. The present week's candle is bullish with a longer lower wick and a smaller upper wick. The previous week's candle is engulfed by this week's candle so far. Major resistance is 26200. Weak support is 26100. Major support is 26000. The view is indecision to bullish.

(3) Daily Time Frame:

Today's candle is a perfect black spinning top. It means today's intraday session was indecisive and choppy. Bulls are trapped near 26200, and bears are trapped near 26100. Price gave a closing above the previous day's closing price. Bullishness is still intact. Major resistance is 26200. First support is 26100. Final bullish support is 26000. The view is indecision to bullish.

(4) 30-Minute Time Frame:

The intraday session is choppy and sideways. Considering the price structure of 2 days, the price has formed a pole and flag pattern. If the price gives a breakout above the level 26200, then bullish continuation will be confirmed. The potential supports are - 26100, 26050, and 26000. The view is indecision to bullish.

Bullish Scenario Set-Up:

(i) Price sustains above the opening price.

(ii) Price must show sustainability above level 26150 for a longer duration (more than 1-2 hours) and show a sign of breaking out level 26200.

(iii) Price starts to trade above the level 26200. In this case, previous ATH (26277.35) and level 26300 are possible targets.

Bearish Scenario Set-Up:

(i) Price sustains below the opening price.

(ii) If the price breaks down level 26100, then execute a sharp short trade till level 26050.

(iii) If price breaks below the level 26050, then execute a sharp short trade til the level 26000.

(iv) In case level 26000 is decisively breached, then execute a confident short trade. In this case, the bearish phase will activate.

No Trading Zone (NTZ): (26200 - 26100)

Event: No expiry on Friday. No high-impact event. However, the day is Friday (the last day of the week).

Summary of the Trading Plan (Hypothesis and Insights):

(i) The monthly TF bias is indecision.

(ii) The weekly TF bias is indecision to bullish.

(iii) The daily TF bias is indecision to bullish.

(iv) The 30-Minute TF bias is indecision to bullish.

(v) Establish intraday bias with respect to the opening price.

(vi) No Trading Zone (NTZ): (26200 - 26100). Bulls are trapped at 26200, and bears are trapped at 26100.

(vii) There is a higher probability of a bullish move. The bullish bias is intact. So, wait for bullish confirmation.

(viii) Execute bullish trade when price sustains above level 26150 for a long time (1-2 hours) and shows promise of breaking out above level 26200. Confident bullish trades are possible when the price decisively starts to trade above the level 26200.

(ix) In case, price starts to trade below the level 26100, then short trades can be executed with the first target of 26050. Furthermore, if the price starts to trade below the level 26100, then short trades can be executed with the target of 26000. Remember, these trades should be sharp and short-lived as bullishness will be intact till level 26000.

(x) Confident bearish trades are only possible when the price decisively breaks below level 26000.

(xi) Trade only when either a bullish/ bearish scenario is activated. Otherwise, don't trade. Remember, not trading is an extension of the trading activity. Be Responsible.

NOTE:

"Mark your points. Trade your points. Price is God. Anything can happen in the markets. Therefore, trade what you see, not what you believe."

Happy Trading!

Nifty 50 Price Structure Analysis [01/01/2026: Thursday]Top-Down Nifty 50 Price Structure Analysis for 01st of January 2026. The day is Thursday.

(1) Monthly Time Frame:

The candle is a red paper umbrella plus an inside candle. The lower wick of the candle is longer as compared to the red body. It means the bears tried to push down the price, but the bulls are defending hard for their existence. Major resistance is 26200. Major support is 26000. The view is indecision.

(2) Weekly Time Frame:

This week's candle is kind of a green dragonfly doji with a body of a green spinning top. Candle structures are imperfect but sufficient enough to offer psychological insights. Most importantly, this week's candle engulfed last week's bearish gravestone doji formation. For the past 4 weeks, the price has been within the range (26200 - 25900). Bears are badly trapped at the level 25900. Price gave a close above the level 26100 (which was previously a major resistance). Major resistance is 26200 while major support is 26000. Since it is the season of consecutive dojis (indecision candles) in Nifty 50, we still cannot build conviction of the trend. It is a sideways market for 10 weeks. However, this week's lower wick is long, showing signs of bullish emergence. The view is indecision to bullish.

(3) Daily Time Frame:

The daily candle is an imperfect bullish marubozu. There is no lower wick, but there is an upper wick that formed due to sharp selling below the level 26200. However, the green candle structure engulfed the previous 3 red days. Very strong support is now at level 26000. Level 26100 is presently a weak support, but as the price spends more time above level 26100, it will become a strong support. The view is indecision to bullish.

(4) 30-Minute Time Frame:

Price has been in a zig-zag price structure since mid-November. For bullish sustenance, it is necessary for the price to trade above the level 26200 for a longer time with a promise of breaking out the previous all-time high (ATH: 26277.35). Major resistance is 26200. Weak support is 26100. Major support is 26000. In the present market condition, every downward move should be doubted. The view is bullish.

Bullish Scenario Set-Up:

(i) Price sustains above the opening price.

(ii) Price stays above the level 26100 for a long time.

(iii) Price shows promise of breaking out above the level 26200.

Bearish Scenario Set-Up:

(i) Price sustains below the opening price.

(ii) Price starts to trade below the level 26050, with a sign of breaking down the level 26000.

No Trading Zone (NTZ): (26100 - 26050)

Events: SENSEX weekly expiry. No other high-impact event.

Summary of the Trading Plan (Hypothesis and Insights):

(i) The monthly TF bias is indecision.

(ii) The weekly TF bias is indecision to bullish.

(iii) The daily TF bias is indecision to bullish.

(iv) The 30-minute TF bias is bullish.

(v) Establish intraday bias with respect to the opening price.

(vi) Weekly SENSEX expiry. No other high-impact event. Expecting a choppy market in the first half. Price will probably remain below the level of 26200 in the first half.

(vii) Major resistance is 26200.

(viii) Weak support is 26100.

(ix) Major support is 26000.

(x) No Trading Zone (NTZ): (26100 - 26050).

(xi) Execute bullish trade when price sustains above 26100 for a long time with a promise of breaking out level 26200.

(xii) Execute bearish trade when price starts to trade below level 26050 with a promise of breaking down level 26000.

(xiii) Take trades only if either a bullish/bearish scenario appears. Otherwise, do not trade. Remember, not trading is an extension of trading activity. Be responsible.

NOTE:

"Mark your points. Trade your points. Price is God. Anything can happen in the markets. Therefore, trade what you see, not what you believe."

Happy Trading!