BANKNIFTY at a Make-or-Break ZoneNIFTYBANK is currently trading at a critical confluence zone where a downward-sloping resistance trendline is meeting a well-defined rising support area on the 1-hour timeframe. This price compression indicates indecision and typically precedes a sharp directional move. The index has repeatedly respected both these levels, confirming their importance in the current structure.

On the upside, the falling resistance zone near 59,300–59,500 remains the key hurdle. A sustained breakout and close above this trendline would signal a shift in short-term momentum, opening the door for a recovery move toward 59,800 initially, followed by a potential extension toward the 60,400–60,600 zone. Such a breakout would also indicate that buyers are regaining control after the recent corrective phase.

On the downside, the green support zone around 58,700–58,850 is the immediate demand area to watch. This zone has acted as a base multiple times, and as long as Bank Nifty holds above it, pullbacks may continue to attract buyers. However, a decisive breakdown below this support would invalidate the bullish bounce scenario and could accelerate selling pressure toward 58,300 first, with a deeper downside extension possible toward the 57,200 region.

Overall, BANKNIFTY is trading inside a tightening range, signaling an imminent volatility expansion. Directional clarity will emerge only after a confirmed breakout or breakdown. Traders should remain cautious at current levels and wait for confirmation, as this is a classic decision zone where false moves are also common.

Niftybank

AXISBANK at ₹1115: Breakout or Rejection?Scrip: Axis Bank | Exchange: NSE | Timeframe: Daily

Summary:

Price is approaching a significant resistance level at ₹1115, which was the high of the July 18th gap-down session. A high-volume breakout above this level could trigger a move to fill the gap up to ₹1154. Conversely, a rejection at this resistance could lead to a decline.

Price Action Analysis:

Key Resistance: ₹1115 (The high of the massive gap-down day on July 18). This is the key level to watch.

Gap Analysis: The gap exists between the July 17 low (₹1154) and the July 18 open (₹1090). The first major hurdle to filling it is overcoming the ₹1115 high from that same day.

Key Support: ₹1050 (Recent Swing Low).

Scenario 1: Bullish Breakout (Gap Fill Play)

This scenario requires a true breakout, confirmed by a strong volume surge.

Trigger: A daily candle closing decisively above ₹1115.

Volume Confirmation: The breakout must be supported by significantly higher-than-average volume. This is essential for a "true" breakout and confirms real buying pressure.

Entry: High of the breakout candle (on closing basis).

Stop Loss: Low of the breakout candle.

Target: ₹1154 (To fill the July gap).

Scenario 2: Bearish Rejection (Resistance Hold)

This scenario plays out if the ₹1115 level holds as strong resistance.

Trigger: A clear bearish reversal candlestick at the ₹1115 resistance (e.g., a Shooting Star or Bearish Engulfing pattern on the daily timeframe).

Entry: Low of the reversal candle.

Stop Loss: High of the reversal candle.

Target: ₹1050.

Disclaimer: This is a technical analysis idea and not financial advice. Trading carries a risk of loss. Past performance is not indicative of future results. Always conduct your own research and manage your risk appropriately.

Bank nifty Futures- Consolidation ankNifty Futures (Index) daily

Technical analysis + sector (banking industry) fundamental overview + a learning summary for students.

Technical Analysis (Daily Chart) Candlestick & Chart Pattern👉

Recent candles show selling pressure after the peak near 57,800 (upper trendline rejection).

Current candles look like lower highs + lower lows = possible descending channel formation.

The long wicks at support zones indicate buyers are defending near 52,800- 53,000.

Swing Analysis

Major swing high: 57,850

Swing low: 47,750

Retracement happening between 0.382 (53,992) and 0.236 (55,466) Fibonacci levels.

Pattern in Progress

Falling Wedge / Descending Channel forming- often bullish if breakout happens above resistance trendline.

👉If price breaks below 52,800, then deeper correction possible.

Key Levels

-Support

52,800 - 53,000 (critical Fib support)

50,400 - 50,500 (strong demand zone)

48,500 (swing support)

-Resistance

55,000 - 55,500 (Fib cluster + recent rejection)

57,800 (swing high, big breakout point)

60,000 psychological level

Entry Points-

For Long (Investors/Positional)

-Enter near 52,800- 53,000 with SL below 52,500.

Add more if it breaks and sustains above 55,500.

-For Short (Traders):

Below 52,800, short with target 50,400 - 48,500.

Keep SL near 53,600.

Industry Analysis (Banking Sector)

Indian banks are in a strong credit growth cycle (loan demand high, NPA ratios declining).

-RBI’s monetary policy easing in future may improve margins further.

-PSU Banks are gaining strength, but private banks (HDFC, ICICI, Kotak) still dominate.

-Key Fundamental Ratios (Peer Banks)

-ICICI Bank: RoE - 16%, NIM - 4.5%, GNPA <2%

-HDFC Bank: RoE - 15%, NIM - 4.1%, GNPA - 1.5%

-SBI: RoE - 14%, NIM - 3.6%, GNPA - 2.5%

👉 Overall, sector health is positive, but valuation of large banks is already at premium.

-Student Learnings

1. Chart Patterns:

Descending channel/falling wedge = watch for breakouts.

2. Candlestick Wicks:

Long lower shadows = hidden buying.

3. Swing + Fibonacci:

Key tool to identify retracement zones.

4. Support & Resistance:

Always mark levels - entry becomes safer.

5. Fundamentals in Sector Indices:

Index = basket - study sector & top-weight banks, not single balance sheet.

⚠️ Disclaimer

This analysis is for educational purposes only. It is not financial advice. Trading in derivatives (like BankNifty Futures) is highly risky and may lead to capital loss. Please consult your financial advisor before investing.

Follow👣 for more🚩

#BankNifty #StockMarketIndia #TechnicalAnalysis #CandlestickPatterns #SwingTrading #SupportAndResistance #InvestingBasics #BankingSector #StockMarketEducation #FinanceStudents #MarketAnalysis

renderwithme | Bank Nifty Prediction for July 14–18, 2025

~~ Bank Nifty Current StatusClosing Price (July 11, 2025): ~~

The Bank Nifty index closed at 56,754.7, down 0.35% (201.3 points), reflecting selling pressure in key constituents like HDFC Bank (-1.16%), Canara Bank (-0.64%), and Bank of Baroda (-0.79%).

#Recent Trend:

The index has shown a bearish tilt, breaching the 20-day Exponential Moving Average (EMA) support, with a cautious market sentiment.

# Historical Context:

Despite the recent dip, Bank Nifty has a positive seasonality trend, with 11 out of 17 years showing positive returns in July.

~~ Technical Analysis ~~

# Support Levels:

Immediate support: 56,400–56,000 (key psychological and technical level).

Additional supports: 55,736 and 55,438.

Critical support: 55,000, a level noted as a potential rebound point if held.

# Resistance Levels:

Immediate resistance: 57,000–57,500 (significant open interest in call options at these strikes).

Higher resistance: 57,300–57,500, with a breakout above 57,200 potentially signaling a move toward 57,600–58,000.

Bank Nifty Prediction for July 14–18, 2025Bullish Scenario:A breakout above 57,200–57,300 could push the index toward 57,600–58,000, especially if banking heavyweights like ICICI Bank or SBI show strength.

Sustained trading above 57,000, supported by positive earnings or global cues, could reinforce the bullish trend.

Bearish Scenario:A break below 56,500 could trigger selling toward 56,000 or lower (55,540–55,000).

Negative earnings or renewed global uncertainties (e.g., trade tensions) could exacerbate declines.

Likely Range: The index is expected to trade between 56,500–57,500, with consolidation likely unless a clear breakout or breakdown occurs.

~~ Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

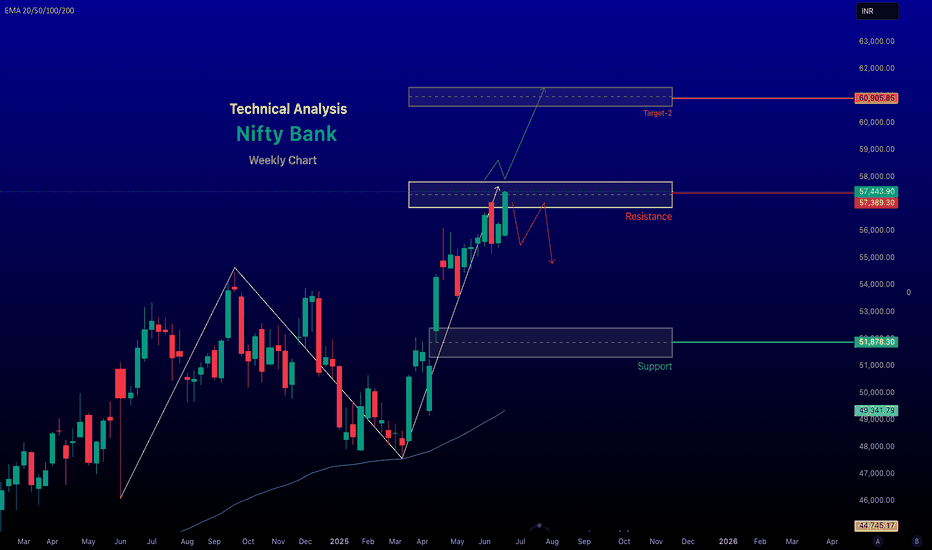

Bank Nifty Weekly Analysis for June 30, - 04, July - 2025The Bank Nifty index, as of June 28, 2025, shows a bullish outlook based on recent market data and technical analysis, though traders should remain cautious due to potential volatility and resistance levels. Here's a detailed analysis for today:

Market Performance and Sentiment

Recent Performance: The Nifty Bank index closed at 57,443.90 on June 27, 2025, with a gain of 237.20 points (+0.41%), indicating continued bullish momentum. The index has been trading near its 52-week high of 57,475.40, reflecting strong sectoral leadership. Posts on X suggest that Bank Nifty has outperformed the Nifty 50, which is 2.5% below its all-time high, with a target of 59,000.

Market Sentiment: Positive global cues, including a ceasefire between Israel and Iran, falling crude oil prices, and dovish signals from the U.S. Federal Reserve, have boosted risk appetite, supporting the banking sector's rally. Foreign Institutional Investors (FIIs) have been net buyers for four consecutive months, further fueling bullish sentiment. However, significant open interest (OI) buildup in the last two days suggests potential for abnormal volatility in the near term.

~~~ Technical Analysis ~~~

Current Levels and Trends: The index is closing at around 57,443.90, with a gain of 0.41%. The advance/decline ratio is positive at 8:4, indicating broader participation in the uptrend. The index is trading above key exponential moving averages (20-day, 50-day, and 200-day EMAs), confirming a strong upward trend on the weekly timeframe.

# Support and Resistance:

Support: Strong support is noted around 57,000, which has held well in recent sessions. A break below this could drag the index to 56,400–56,000. Additional support lies at 55,500, a critical level for maintaining bullish bias.

Resistance: Immediate resistance is at 57,500–57,800. A decisive break above 57,800 could push the index toward 58,000–58,400. Call options at 56,500 and 57,000 show significant open interest, reinforcing these as key resistance levels.

Technical Indicators: The Relative Strength Index (RSI) on the weekly timeframe is at 67.31, showing a reversal toward the upside, indicating strengthening momentum. However, a bearish divergence on the 4-hour chart remains unresolved, suggesting a potential correction toward 52,000 if the bullish structure weakens.

-- Bullish trend, next target 61,000 if we break and close above 57,800 on weekly timeframe --

Chart for reference.

- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

BANK NIFTY Levels for Intraday (Educational Purpose) 23/05/2025 📈 BankNifty Intraday Trade Setup – 23/06/2025 (Monday)

🕒 Timeframe: 1-Min Chart

📊 Market Sentiment: Cautiously Bullish | High Volatility Expected

🔼 Buy Above: 56,320 (sustained breakout)

🎯 Target 1: 56,420

🎯 Target 2: 56,550

🛑 Stop Loss: 56,180

⚠️ Confirm with strong volume and EMA crossover

🔽 Sell Below: 56,050 (breakdown below demand zone)

🎯 Target 1: 55,920

🎯 Target 2: 55,780

🛑 Stop Loss: 56,200

⚠️ Entry valid only after 5-min candle closes below 56,050

📍 Key Levels to Watch:

🔹 Resistance: 56,300 – 56,400

🔹 Support: 56,050 – 55,900

🔹 Demand Zone: 55,700 – 55,600

🔹 Supply Zone: 56,400 – 56,550

📌 Pro Tips for Monday:

✅ Track global cues (esp. geopolitical tensions)

✅ Use VWAP and RSI for extra confirmation

✅ No overtrading on breakout traps

Bank Nifty Weekly Analysis for June 24 –June 28 June , 2025~~ Technical Outlook ~~

Current Trend: The Nifty Bank Index is in a positive trend, with a closing value of 56,252.85 on June 20, 2025, reflecting a 1.22% gain. The index has entered a bullish phase in the last trading session, supported by strong buying in key constituents like HDFC Bank (+1.44%), ICICI Bank (+1.07%), Canara Bank (+2.25%), and Federal Bank (+1.62%).

#Support and Resistance Levels:

Support: Immediate support lies at 55,781, followed by 55,308 and 54,726. A critical long-term support is around 51,500; a break below 51,000 could signal weakness.

Resistance: Resistance is seen at 56,900, with potential upside targets at 56,600, 57,000, and a new all-time high around 57,267–57,500 if momentum sustains. the Long-term Target is around 60,500

!! Market Sentiment

Domestic and Institutional Activity: Domestic Institutional Investors (DIIs) have been strong buyers, purchasing ₹8,207 crore on June 18, while Foreign Institutional Investors (FIIs) were net buyers with ₹1,482 crore, indicating robust domestic support.

Sectoral Performance: The banking sector led gains, with 11 of 12 constituents in the green on June 20. Private banks like HDFC and ICICI Bank limited downside pressure, while public sector banks (PSU Banks) showed relative weakness, with the Nifty PSU Bank Index down 0.9% on June 16.

# Due to geopolitical tension, the market may be sideways or volatile.

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

IDFC BANK LONG TERM VIEWPrice seen taking support from the key demand area of 52-58 zone

Points To Note

- EMA 10-20 Bullish Cross At Weekly TF

- Downward Trendline Breakout

- Price Is Consolidating After T-line Breakout

- Once It Gives Break Above 70.80 Then We Can See Further Upsides

Lets See What It Follows Next

Till Then , Keep Following Markets

Banknifty Intraday Levels : 27-May-25BankNifty break the resistance level and closed above the resistance zone may seen downside if resistance broken else above resistance seen upside Banknifty

Bearish < 55250

Bullish > 55625

Wait for Proper Rejection/Pattern :

@Support : Bullish

@Resistance : Bearish

Use Sl Trailing to reduce Risk

*All views for educational purpose only

Banknifty Intraday Levels for 26-May-26

Banknifty closed above resistance level of Trendline and immediate support may seen upside if support not broken else pull back in bank Banknifty

Bearish < 55150

Bullish > 55500

Wait for Proper Rejection/Pattern :

@Support : Bullish

@Resistance : Bearish

*All views for educational purpose only

SBIN (NSE:SBIN) Breakout Alert: Inverse H&S Targets 835/875

Timeframe: Daily

Key Levels: Resistance: 786 (neckline of Inverse H&S).

Pattern & Context:

-Inverse Head & Shoulders nearing breakout confirmation.

-Price stabilizing post-gap-down, signaling potential bullish reversal.

Confirmation Needed:

-Breakout Candle: Strong close above 786 with elevated volume.

Trade Setup (Post-Breakout):

Entry: Retest/close above 786 with volume support.

Targets: 835 (pattern-derived), 875 (next key resistance).

Broader Market Check:

-Ensure bullish alignment in indices (Nifty/Bank Nifty).

Risk: Failure to sustain above 786 negates the setup.

Wait for volume-backed breakout before trading.

This idea is for educational purposes only, not financial advice. Trading carries risk—only trade with capital you can afford to lose. Past performance doesn’t guarantee future results. Always conduct your own analysis or consult a SEBI-registered advisor before acting. The author assumes no liability for losses incurred.

BANKNIFTY! Can it give a big move? Weekly zones!As per the trend BANKNIFTY is trying to sustain above 49000, which is a strong RESISTANCE.

If you want to follow up the trend UPSIDE then one should wait for HLs for a confirmation. Also, the trend changes if any of the big strikes gets eliminated. In this current scenario we are probably waiting for a confirmation.

I have marked the important Support & Resistances to help you in a better way.

INDIA VIX is down right now which is giving a good support to option buyers and Sellers.

As per the study let it close above today's high and give a HL confirmation for a trend change on a 15 mins time frame.

IMPORTANT ZONES TO WATCH : 49000-49100

NOTE: I'm not a SEBI reg. Study before investing.

NIFTYBANK FRIDAY TRADE PLAN Friday trade plan based on hourly chart.

Banknifty in Impulse diagonal abcde, with e in progress.

Making Higher High

Higher Low

Bullish Structure

Gap up Sustained

RBI Meet repo rate announcement 7 Feb 10 am. Can be volatile keep, trade cautiously.

Disclaimer: I am not SEBI registered analyst. These are not buy/sell recommendations. Trading/investing can be very risky, reach out to a authorised consultant before making any decisions. I do not claim/promise any profits.

Macd divergenceThe indicator is calculated by subtracting a 26-period Exponential Moving Average from the 12-period moving average. There is also a histogram available on the indicator which can also be used as a divergence indicator. As a result, you will then see the MACD line, which shows as an indicator below the price chart.

For daily charts, many traders find the default MACD settings (12, 26, 9) to be very effective. This timeframe captures the broader market trends and helps filter out market noise. Combine MACD with other indicators like RSI or Bollinger Bands when analyzing a 1-day chart for a more comprehensive market view

Bank Nifty Levels for Today 22nd-Jan-2025: Key Zones to WatchGood morning guy's i hope you all will be doing good. Let's start analysis of Banknifty:

Bank Nifty is currently trading around 48,626, offering a well-defined trading setup for both buyers and sellers. A breakout above 48,752 could indicate bullish momentum, with potential targets at 48,973, 49,195, and 49,608, while keeping a stop loss at 48,453. On the other hand, if the price breaks below 48,453, it may lead to a bearish move, targeting 48,252 and 47,972, with a stop loss at 48,752. The important support zone between 47,972 and 48,090 remains a key area to watch for price reversals or further breakdowns.

Looking at the indicators, the RSI suggests bearish divergence but hints at a possible recovery from oversold conditions, while the MACD continues to reflect bearish momentum. Traders should focus on price action around these levels to identify potential opportunities.

Disclaimer: This analysis is purely for educational purposes and does not constitute financial advice. Always do your own research or consult a professional advisor before trading.

If you found this analysis helpful, make sure to follow for regular market insights and share your thoughts in the comments below. Let’s grow together as traders!

Selling Dominates Nifty Bank: Technical Outlook for Key Stocks◉ Nifty Bank Technical Outlook NSE:BANKNIFTY

● The index has broken below its trendline support and is currently testing its immediate support zone between 48,300 and 48,600.

● If selling pressure persists, the index may plummet another 5% to find support around the 46,000 level.

◉ Key Constituents' Technical Standings

Let's dive into the technical analysis of the top Bank Nifty constituents to gauge their current standings and potential future movements.

1. HDFC Bank (Weightage - 28.11%) NSE:HDFCBANK

● As the leading component, HDFC Bank is poised to exert downward pressure on the overall index.

● The stock has broken below its trendline support and has been falling continuously for the last 6 trading sessions.

● Support level is expected somewhere between 1,600 - 1,610 level which is around 3.4% below from the current level.

2. ICICI Bank (Weightage - 24.98%) NSE:ICICIBANK

● The stock has also fallen below its trendline support and is currently hovering just above its immediate support zone.

● If this support is breached, a significant correction could drive the price down to around 1,150.

3. Kotak Mahindra Bank (Weightage - 8.80%) NSE:KOTAKBANK

● The stock has been consolidating within a range for almost 4 years.

● Recent chart patterns suggest the price may test its support zone again, around 7.7% below the current level.

4. Axis Bank (Weightage - 8.54%) NSE:AXISBANK

● Axis Bank's chart shows a bearish pattern, similar to HDFC Bank's, and is likely to experience a fall of around 6%.

5. State Bank of India (Weightage - 8.45%) NSE:SBIN

● The stock is currently positioned just above its immediate support level, suggesting a strong potential for a rebound from this point.

NIFTY BANK: Will It Bounce Back or Continue Falling? NIFTY BANK remains trapped in a falling channel, with key support and resistance levels coming into play. As the price consolidates, traders are watching closely for signs of a breakout or further downside movement.

Key Points:

1. Resistance Zones:

- 50,926.75

- 50,689.45

- 50,444.40

- 50,204.15

2. Support Levels:

- 49,957.80

- 49,721.60

- 49,473.10

- 49,259.55

3. Current Setup:

- NIFTY BANK is trading within a falling channel, indicating bearish momentum.

- The recent bounce from the lower support zone suggests possible short-term recovery, but resistance levels overhead could limit upside moves.

- Key Fibonacci retracement levels align with the channel's resistance, adding weight to the potential breakout or rejection.

How to Trade This:

- Bullish Strategy:

- Look for a breakout above 50,204.15 with strong volume.

- Targets: 50,444.40 and 50,689.45.

- Stop Loss: Below 49,957.80.

- Bearish Strategy:

- If the price fails to sustain above 49,957.80, consider short positions.

- Targets: 49,721.60 and 49,473.10.

- Stop Loss: Above 50,204.15.

Bottom Line:

NIFTY BANK is at a critical juncture, with the potential for either a breakout to the upside or a continuation of the downtrend. Keep an eye on key levels and trade with caution, as the next move could be decisive!

NSE:BANKNIFTY

Only for educational purposes.

This content is not a recommendation to buy and sell.

Not SEBI REGISTRAR.

BankNifty NR7 on Monthly charts + Covid low Trendline ##BankNifty making NR7 on monthly charts of 4000 points 49500-53500 levels also it trading near Trend line of Covid Lows this time BankNifty may give breakdown of this TrendLine. BankNifty Components like HDFC BANK & ICICI BANK made a Shooting Star on Monthly Charts so we have to watch these two how they move with Q3 Results onboards in coming days. Q3 Results will be more important for BankNifty to give Range Breakout.

I am waiting for breakdown of Trend line & 50055-49555 levels then only I will make short position.

Target for Downtrend will be T1- 48555, T2- 46077, T3- 44144, T4- 41855, T5- 39444, T6- 37711, T7- 35655, T8- 33933, T9- 32622 with StopLoss 53355 & trailing with target achieving.

Thank You & Happy Trading

#banknifty -11th December!NSE:BANKNIFTY1! NSE:BANKNIFTY

Understand the chart, observe the analysis, implement while trading:

Key Observations:

1. Trendlines:

- Resistance Trendline: A descending trendline (sloping down) marks the area where the price faces selling pressure. This indicates a pattern of lower highs.

- Support Trendline: An upward-sloping trendline beneath the price indicates where the price finds buying interest. This suggests a slight upward momentum at the support level.

2. Consolidation Zone:

- The price is moving within a tightening range between these two trendlines, forming a wedge or triangle pattern. This indicates consolidation, where the market is waiting for a breakout or breakdown.

3. Support Levels:

- Key support levels are highlighted at 53,407.75, 53,229.05, 53,057.45, and 52,784.15. These levels represent zones where buyers are likely to step in and prevent further price decline.

4. Resistance Levels:

- Resistance levels are marked at 53,679.35, 53,956.65, 54,128.90, and 54,304.25. These are zones where the price may face selling pressure.

5. Current Price Action:

- The price is currently at 53,577.70, approaching the descending resistance trendline. This is a critical point because it suggests a decision zone for the next move.

Scenarios:

1. Bullish Breakout:

- If the price breaks above the descending resistance trendline, it could signal bullish momentum.

- Potential targets are the next resistance levels at 53,956.65, 54,128.90, and 54,304.25.

2. Bearish Breakdown:

- If the price breaks below the support trendline, it may indicate a bearish trend.

- Possible downside targets are the lower support levels at 53,229.05, 53,057.45, and 52,784.15.

3. Neutral Consolidation:

- If the price continues to move within the wedge, traders may need to wait for a clear breakout or breakdown before acting.

What This Chart Suggests:

- The chart highlights decision points for the market, with the wedge pattern indicating an imminent breakout or breakdown.

- A breakout above resistance would suggest strength, while a breakdown below support would indicate weakness.

Trading Plan:

- For Buyers: Wait for a breakout above the resistance trendline and aim for higher resistance levels.

- For Sellers: Look for a breakdown below the support trendline and target the lower support zones.

Not SEBI Registere.