Havells at multi TF support 1. Price is at monthly 50 EMA, could prove to be a good supply point.

2. In weekly, Price at 200 SMA. Also, the RSI is at support level of 40.

3. Daily RSI showing bullish divergence & Price is at support trendline.

All these supports from multiple timeframes could constitute a reversal for long-tern in Havells. Trade is risk-reward favorable. SL to planned as per own analysis.

P. S. - Not a SEBI registered analyst & definitely not a buy recommendation. Please do your due diligence before planning to buy.

Niftyconsumption

Pivot Low Formed, Follow-Up Buying Crucial – Nifty and BankniftyYesterday, i mentioned that sellers’ volume was 40 million higher than buyers, and for a new trend to emerge, today’s candle needed to absorb that supply.

And look what happened — today, buyers’ volume surpassed sellers’ by 82 million.

All the setups I traded today blasted exactly as expected:

NSE:SWARAJENG (Earnings Pivot) – +10%

NSE:SPORTKING – +5.92%

NSE:MOBIKWIK – +4.16%

For the short term, I am still holding NSE:CUPID , which has already given a 22% move in the last 3 sessions since my entry!

Now, coming to today’s market action:

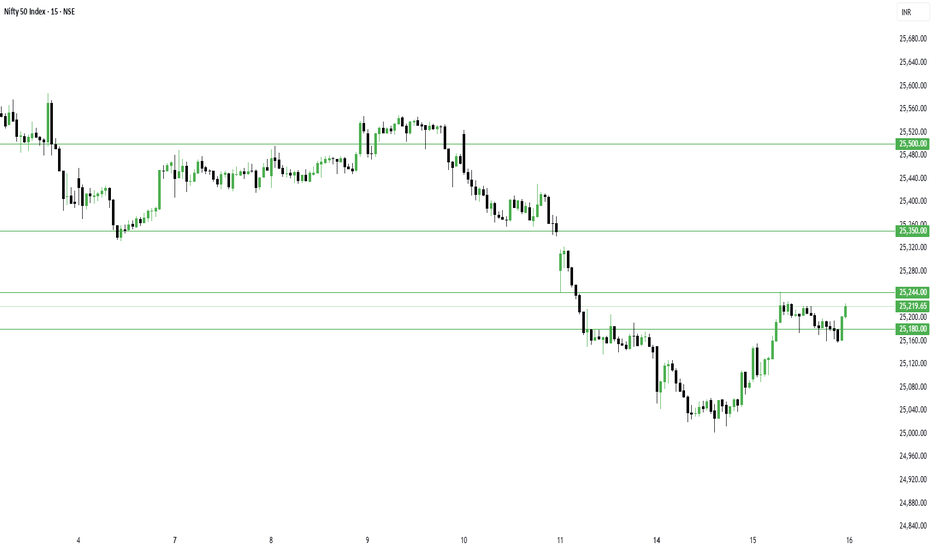

NSE:NIFTY formed a Demand Candle today, and along with that, a Pivot Low has also been created.

The only missing piece is that the index hasn’t yet closed above 25200.

The message is clear — if we get follow-up buying tomorrow, the index could be ready for a fresh high.

For tomorrow:

Resistance: 25244 — once crossed, short covering can push it directly to 25350/25500.

Support: will be at 25180.

NSE:BANKNIFTY looks more positive, and this time, NSE:CNXPSUBANK could be the key driver.

For BankNifty:

- Support: 56965

- Resistance: 57260 — a close above this could trigger a move towards a new high.

Talking about sector rotation — in the short-term timeframe, a new sector has emerged: NSE:NIFTY_CONSR_DURBL

NSE:NIFTY_IPO stocks remain strong, and for intraday trades, NSE:CNXAUTO and NSE:NIFTY_EV stocks are at the top of the list. So if you’re planning tomorrow’s intraday trades, focus on these sectors.

That’s all for today.

Take care.

Have a profitable tomorrow.

Consumption Boom: Tax Cuts Fuel India's Consumer Stock SurgeRecent trends in the Indian stock market indicate a significant shift from industrials to consumer-oriented stocks, particularly in sectors such as consumer goods, consumer discretionary, and automobiles. This change has been catalysed by the government's recent budget announcement, which included income tax cuts aimed at boosting consumer spending.

◉ Key Insights

● Increased Consumer Spending: The reduction in income tax is expected to enhance disposable income for individuals, thereby accelerating the shift towards consumption stocks. This trend is already visible, with the Nifty India Consumption Index NSE:CNXCONSUMPTION rising over 3% following the budget announcement.

● Impact on Industrial Stocks: Conversely, industrials faced a downturn post-budget, with the BSE Capital Goods Index dropping by 3% and the Infrastructure and Industrials indices falling over 2.5%. This indicates a market sentiment that favours consumer spending over capital expenditure in the short term.

● Bullish Outlook on Specific Sectors: Analysts are optimistic about sectors such as paints, consumer durables (including electric goods), and two-wheeler manufacturers like Bajaj Auto. These stocks are seen as underperformers that stand to benefit significantly from increased consumption.

◉ Government's Strategy

The government's strategy to stimulate consumption rather than focusing solely on capital expenditure marks a notable shift in fiscal policy. The intent is clear: by putting more money in consumers' hands, the government aims to invigorate spending and support economic growth.

◉ Market Predictions

Market participants predict that consumption stocks will lead market rallies in the near to medium term. The expected increase in spending from the middle class could help alleviate slow growth numbers in sectors like automotive and FMCG.

◉ Conclusion

As investors navigate these changes on Dalal Street, it is crucial to consider the implications of government policies on market dynamics. The current environment presents opportunities for those looking to invest in consumer-focused sectors while remaining cautious about industrial stocks in the near future.

Tataconsum breaking outThe stock seems to be breaking out from the support levels of 885 that we have identified with the following points

1. Rising volumes.

2. Rising relative strength as compared to the Nifty consumer Index which has not happened in the past

3. Fundamental view: Almost all counters have worked well in this index except for tataconsum, this is now time for this stock to give a nice upmove.

Potential upmove till 975 and then 1027

#DABUR... Looking good 22.05.23 frm now#DABUR... ✅▶️

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a huge movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

CNX Consumption looks good in short termStocks like Voltas, Havells, Marico, Bharti Airtel, Nestle, UBL, Asian Paints, ITC, Dabur, Titan United Spirits, Zeel, HUL, Colpal, Apollo Hospital etc are part of CNX Consumtion. CNX Consumption can give 5% upmove.

Views are for educational purpose only.

Please do your own research before entering any stock.