NIFTY : Detailed Trading plan for 09-Feb-2026📘 NIFTY Trading Plan – 9 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,161 – Higher Timeframe Resistance

🟢 25,858 – 25,906 – Last Resistance Zone

🟠 25,616 – 25,694 – Opening Support / Resistance (No-Trade Zone)

🟢 25,747 – Opening Resistance

🟢 25,616 – 25,747 – Immediate Decision Band

🟢 25,533 – Last Intraday Support

🧠 Market Structure & Price Psychology

NIFTY has shown a recovery bounce after recent weakness, but price is currently trapped near a decision supply zone.

This indicates balance between short covering & fresh selling.

👉 Direction on 9 Feb will depend on acceptance above resistance or breakdown below support, not prediction.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,780)

🧠 Psychology

Gap up reflects overnight bullish sentiment, but sellers often defend prior resistance zones.

🟢 Bullish Plan

🔵 Sustaining above 25,747 (15-min close)

🔵 Upside opens towards 25,858 – 25,906

🔵 Break & hold above zone → Expansion towards 26,161

🔴 Rejection Plan

🔴 Failure near 25,858 – 25,906

🔴 Pullback towards 25,747 → 25,694

📌 Why this works

Breakouts succeed only when price is accepted above supply, not just gap-driven spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,620 – 25,720)

🧠 Psychology

Flat opening inside consolidation shows indecision & liquidity absorption.

🟠 No-Trade Zone

🔸 25,616 – 25,694

🔸 Expect whipsaws & fake breakouts

🟢 Upside Plan

🔵 Break & hold above 25,747

🔵 Targets: 25,858 → 26,161

🔴 Downside Plan

🔴 Breakdown below 25,616

🔴 Weakness towards 25,533

📌 Why this works

Ranges expand after consolidation — patience gives better entries.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,616)

🧠 Psychology

Gap down indicates profit booking or fear-based selling, but demand zones can trigger relief rallies.

🟢 Bounce Setup

🔵 If 25,616 holds on 15-min basis

🔵 Expect bounce towards 25,694 → 25,747

🔴 Breakdown Setup

🔴 Clean break below 25,533

🔴 Downside momentum may accelerate

📌 Why this works

Strong supports either create sharp reversals or fast continuation moves.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk spreads in volatile markets

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in decision consolidation near resistance

📌 25,747 & 25,616 are key intraday triggers

📌 Break above 25,906 confirms bullish continuation

📌 Trade price reaction, not bias 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Niftylevels

NIFTY KEY LEVELS FOR 09.02.2026NIFTY KEY LEVELS FOR 09.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Detailed Trading Plan for 10-Feb-2026📘 NIFTY Trading Plan – 10 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,154 – Higher Timeframe Resistance

🟢 25,858 – 25,906 – No-Trade / Supply Zone

🟠 25,782 – 25,763 – Opening Support Zone

🟢 25,676 – Last Intraday Support

🟢 25,583 – Lower Breakdown Support

🟢 25,516 – 25,747 – Broader Demand Zone

🧠 Market Structure & Price Psychology

NIFTY has shown a strong recovery from lower demand, followed by consolidation near a falling trendline & supply zone.

This indicates buyers regaining strength, but confirmation is still pending near resistance.

👉 Tomorrow’s direction will depend on acceptance above the no-trade zone or rejection back into support.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,900)

🧠 Psychology

A gap-up near resistance shows overnight optimism, but sellers often defend prior supply aggressively.

🟢 Bullish Plan

🔵 If price sustains above 25,906 on a 15-min closing basis

🔵 Upside opens towards 26,154

🔵 Strong momentum continuation only if price accepts above supply

🔴 Rejection Plan

🔴 Rejection near 25,906 – 25,858

🔴 Expect pullback towards 25,782 – 25,763

📌 Why this works

True breakouts happen with price acceptance, not just gap-driven spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,780 – 25,850)

🧠 Psychology

Flat opening inside supply shows indecision & liquidity absorption.

🟠 No-Trade Zone

🔸 25,858 – 25,906

🔸 Expect whipsaws & fake moves

🟢 Upside Plan

🔵 Break & hold above 25,906

🔵 Targets: 26,154

🔴 Downside Plan

🔴 Breakdown below 25,763

🔴 Drift towards 25,676

📌 Why this works

Markets expand after consolidation, patience gives better risk-reward.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,676)

🧠 Psychology

Gap down reflects profit booking or fear selling, but demand zones attract smart money.

🟢 Bounce Setup

🔵 If 25,676 holds on 15-min basis

🔵 Expect bounce towards 25,763 → 25,782

🔴 Breakdown Setup

🔴 Clean break below 25,583

🔴 Downside opens till 25,516 – 25,547

📌 Why this works

Strong supports either give sharp bounces or fast continuation breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is consolidating below major supply

📌 25,906 & 25,676 are key intraday triggers

📌 Break above 25,906 confirms bullish continuation

📌 Trade price reaction, not assumptions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Nifty50 analysis(7/2/2026)CPR: wide + decending cpr: consolidtion

FII: 1,950.77 bought

DII: 1,265.06 sold

Highest OI:

CALL OI: 25500 and 25600

PUT OI: 25700 to 26000

Resistance: - 26000

Support : - 25500

conclusion:.

My pov:

1.today market consolidate and take support from 25600 or 25500 then bullish trend is possible

2.25500 and 25600 has more support and 25700 to 25900 has most resisting oi so possibly those gap will fade and take support .

3. If today price breaks 25850 then bullishness continues.

What IF:

1.If it breaks 25500 then 25400 great support

2. If it breaks 25900 then all time high is the target. Only if it close in day candle.

Psycology:

Find a good setup, retest same setup again and again all this 20 percent and 80 percent are mindset.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Support Holds, Volatility Fades — Fresh Rally Ahead for Nifty?Indian markets were volatile last week. Initial uncertainty after the Union Budget was followed by a strong positive reaction to the India–US trade deal.

Nifty moved in a wide range during the week but ended higher.

India VIX fell by around 12%, showing that volatility has reduced after major events.

◉ Key Levels

Immediate Support: 25,400–25,500

Immediate Resistance: 26,000

Strong Resistance: 26,200–26,300

The sharp sell-off after the gap-up opening found a base near 25,500, establishing it as a strong demand zone.

◉ Technical View

The overall trend remains positive above 25,400. A sustained move above 26,000 is needed for further upside, and a clear breakout above 26,300 could lead to the next rally.

◉ Key Triggers for the Week

India–US Trade Deal: Lower US tariffs (18%) improve visibility for exporters and foreign investors, supporting sentiment.

Inflation Data: Domestic CPI/WPI and global inflation prints will influence interest rate expectations and risk appetite.

Q3 FY26 Earnings: Results from banks, financials, IT, and other index heavyweights will drive sector leadership and Nifty direction.

◉ Trading Strategy

Traders should follow a buy-on-dips strategy near support levels and avoid taking aggressive positions until Nifty decisively moves above the 26,000–26,300 zone.

NIFTY KEY LEVELS FOR 06.02.2026NIFTY KEY LEVELS FOR 06.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

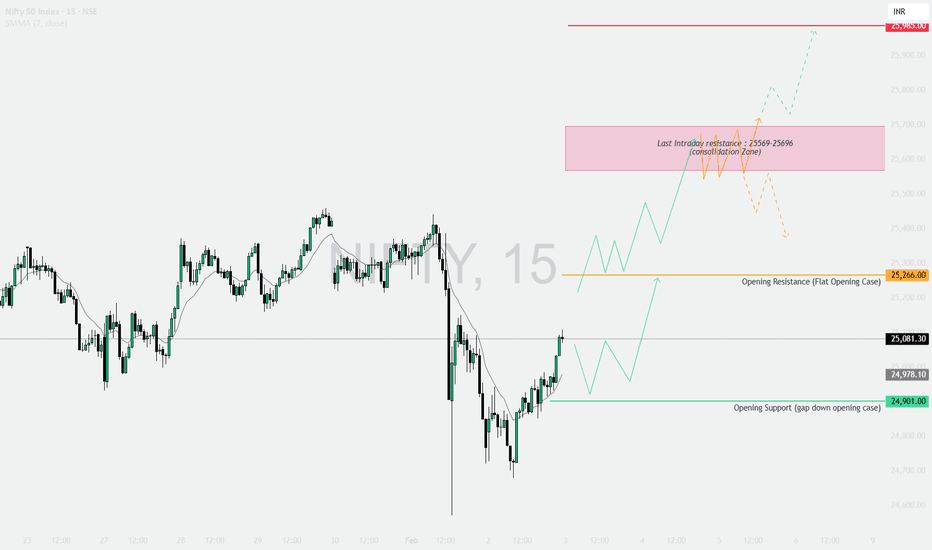

NIFTY : Trading levels and Plan for 06-Feb-2026📘 NIFTY Trading Plan – 6 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,171 – Higher Timeframe Resistance

🟢 25,985 – 25,950 – Last Intraday Resistance Zone

🟠 25,569 – 25,696 – Opening Support / Resistance (Consolidation Zone)

🟢 25,452 – 25,309 – Last Intraday Support Zone

🟢 25,021 – 24,948 – Lower Demand / Breakdown Zone

🧠 Market Structure & Price Psychology

NIFTY has shifted from a sharp recovery phase into consolidation, indicating exhaustion of short-covering and absence of aggressive fresh buying.

Price is currently oscillating inside a wide decision zone, where acceptance or rejection will define the next trending move.

👉 For 6 Feb, opening behavior around the consolidation zone will be the key trigger.

🚀 Scenario 1: GAP UP Opening (200+ Points)

(Opening near / above 25,850)

🧠 Psychology

A big gap up after consolidation often reflects overnight optimism, but higher supply zones attract institutional profit booking.

🟢 Bullish Plan

🔵 If price sustains above 25,985 on a 15-min closing basis

🔵 Upside opens towards 26,171

🔵 Momentum continuation only after clear acceptance above resistance

🔴 Rejection Plan

🔴 Failure to hold above 25,985 – 25,950

🔴 Expect pullback towards 25,696 – 25,569

📌 Why this works

Breakouts succeed only when price is accepted at higher value, not when driven by emotional gap-up buying.

➖ Scenario 2: FLAT Opening

(Opening between 25,550 – 25,700)

🧠 Psychology

Flat opening inside consolidation shows balance between buyers and sellers. Market usually expands after liquidity is absorbed.

🟢 Upside Plan

🔵 Sustaining above 25,696

🔵 Gradual move towards 25,985

🔴 Downside Plan

🔴 Failure to hold 25,569

🔴 Drift towards 25,452 – 25,309

📌 Important Note

🟠 25,569 – 25,696 is a high-chop consolidation zone

🟠 Avoid over-trading until a clean breakout or breakdown

🔻 Scenario 3: GAP DOWN Opening (200+ Points)

(Opening near / below 25,309)

🧠 Psychology

Gap down after consolidation indicates profit booking or fresh short initiation.

🟢 Bounce Setup

🔵 If 25,452 – 25,309 holds on a 15-min basis

🔵 Expect technical bounce towards 25,569 – 25,696

🔴 Breakdown Setup

🔴 Clean break below 25,309

🔴 Downside opens till 25,021 – 24,948

📌 Why this works

Strong demand zones either produce sharp relief rallies or fast breakdown continuation.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads in gap markets

🟢 Avoid aggressive buying near resistance ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next support/resistance

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in post-recovery consolidation

📌 25,696 & 25,309 are the most important intraday decision levels

📌 Break above 25,985 needed for bullish continuation

📌 Trade price reaction, not expectations 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 05.02.2026NIFTY KEY LEVELS FOR 05.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Understanding the Down Trend Line Breakout : Base chart GALLANTTUnderstanding the Down Trend Line Breakout : Base chart GALLANTT ISPAT Ltd

Introduction

Gallantt Ispat Limited, currently trading around 580.00 on its daily chart, has been moving below a persistent down trend line since August 2025. Recently, the stock has shown signs of strength by forming a double bottom pattern, a classic reversal signal, and is now attempting to break above this long-standing resistance. This setup provides an interesting case study for traders and investors on how to interpret down trend line breakouts, manage risks, and identify potential entry points.

What is a Down Trend Line?

A down trend line is drawn by connecting successive lower highs on a chart.

It acts as a resistance line, showing the prevailing bearish sentiment.

As long as price remains below this line, sellers dominate.

A breakout above the line often signals a shift in market psychology from bearish to bullish.

Importance of the Down Trend Line Breakout

Psychological Shift: A breakout indicates buyers are gaining control.

Volume Confirmation: Strong volume during breakout adds credibility.

Trend Reversal Potential: Especially when supported by reversal patterns like the double bottom.

Opportunity Zone: Traders often look for such setups to capture early stages of a new uptrend.

Risk Management in Breakout Trading

Trading breakouts can be rewarding but also risky if false signals occur. Key principles:

Wait for Confirmation: Avoid jumping in on the first candle above the line; look for sustained price action.

Use Stop Losses: Place stops below recent swing lows or the breakout level to limit downside.

Position Sizing: Never risk more than a small percentage of capital on a single trade.

Avoid Emotional Trading: Stick to a plan rather than chasing moves.

How to Enter Down Trend Line Breakouts

Aggressive Entry: Buy immediately on breakout with tight stop loss.

Conservative Entry: Wait for a retest of the trend line (now support) before entering.

Volume-Based Entry: Enter only if breakout is accompanied by above-average volume.

Pattern Confirmation: In Gallantt Ispat’s case, the double bottom adds conviction to the breakout attempt.

Key Takeaways for Investors & Traders

Trend lines matter: They reflect collective market psychology.

Breakouts need confirmation: Volume and sustained price action are crucial.

Risk management is non-negotiable: Protect capital with stops and sizing discipline.

Gallantt Ispat’s setup: The double bottom plus breakout attempt makes this chart worth monitoring closely.

Patience pays: Waiting for confirmation often saves traders from false breakouts.

Conclusion

Gallantt Ispat Limited’s daily chart is at a critical juncture. After months of trading under a down trend line, the stock is now attempting to break free, supported by a double bottom formation. For traders, this is a textbook scenario to study the dynamics of breakout trading. The lesson here is clear: respect the trend line, manage risk diligently, and enter with discipline when the breakout is confirmed.

#BANKNIFTY📊 BankNifty Wave Analysis – Is the Weekly Bull Run Ending?

BankNifty began its 5-wave impulsive structure on 10th March 2025 (weekly chart). Breaking it down into daily subwaves:

• 🚀 Wave 1: Started on 10th March, completed on 1st July 2025

• 🔄 Wave 2: A complex correction followed, retracing ~38.2%

• 📈 Wave 3: Continued the rally, forming a high on 1st December 2025

• 📉 Wave 4: A flat correction completed around Budget Day, again retracing ~38.2%

• ⚡ Wave 5: Post the US–India trade deal, the market opened gap-up but failed to sustain at the top—signaling possible exhaustion of the bull run

📉 With this setup, we may be witnessing completion of the 5th wave, opening the door for a drawdown towards 55,000 levels in BankNifty.

NIFTY : Trading Plan and levels for 05-Feb-2026📘 NIFTY Trading Plan – 5 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,171 – Higher Timeframe Resistance

🟢 25,985 – 25,950 – Last Intraday Resistance Zone

🟠 25,569 – 25,696 – Opening Support / Resistance (Consolidation Zone)

🟢 25,452 – 25,309 – Last Intraday Support Zone

🟢 25,702 – 25,737 – Current Reference Price Area

🧠 Market Structure & Price Psychology

NIFTY has seen a sharp recovery followed by sideways consolidation near upper levels.

This behavior suggests short-covering exhaustion, where fresh buyers and sellers are waiting for confirmation.

👉 Tomorrow’s direction depends on acceptance or rejection at the consolidation zones, not on bias.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,850)

🧠 Psychology

Gap up after consolidation usually reflects breakout anticipation, but smart money often waits to sell near prior supply zones.

🟢 Bullish Plan

🔵 If price sustains above 25,985 on a 15-min closing basis

🔵 Expect continuation towards 26,171

🔵 Suitable for momentum trades only after confirmation

🔴 Rejection Plan

🔴 Rejection near 25,985 – 26,171

🔴 Expect pullback towards 25,696 – 25,569

📌 Why this works

True breakouts show acceptance above resistance, not just opening spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,650 – 25,780)

🧠 Psychology

Flat opening near resistance indicates balance and indecision. Market usually expands after testing boundaries.

🟢 Upside Plan

🔵 Sustaining above 25,696

🔵 Gradual move towards 25,985

🔴 Downside Plan

🔴 Failure to hold 25,569

🔴 Drift towards 25,452 – 25,309

📌 Important Note

🟠 25,569 – 25,696 is a consolidation zone

🟠 Expect whipsaws — trade only after clean break

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,452)

🧠 Psychology

Gap down after consolidation indicates profit booking or fresh short positions.

🟢 Bounce Setup

🔵 If 25,452 – 25,309 holds on 15-min basis

🔵 Expect technical bounce towards 25,569 – 25,696

🔴 Breakdown Setup

🔴 Clean break below 25,309

🔴 Downside momentum may accelerate sharply

📌 Why this works

Strong demand zones either give quick bounces or fast breakdowns—confirmation is critical.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads near resistance

🟢 Avoid aggressive buying in gap-up opens ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in high-level consolidation after sharp recovery

📌 25,696 & 25,452 are the key intraday decision levels

📌 Break above 25,985 needed for bullish continuation

📌 Trade price reaction, not emotions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Visualization of a Inverted Head and Shoulders ( Reality ) In this video I talk about general trends of the markets only - no bias - no directional indication - nothing - simply sharing how to create a setup / strategy building and concepts that I learned while becoming a full time trader - Giving back my experience .

NIFTY KEY LEVELS FOR 04.02.2026NIFTY KEY LEVELS FOR 04.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Trading levels and Plan for 04-Feb-2026📘 NIFTY Trading Plan – 4 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 25,985 – 26,020 – Last Intraday Resistance Zone

🟠 25,569 – 25,696 – Opening Support / Resistance (Consolidation Zone)

🟢 25,472 – Last Intraday Support

🟢 25,221 – Lower Support / Breakdown Level

🟢 25,714 – 25,745 – Current Reference Price Area

🧠 Market Structure & Price Psychology

NIFTY witnessed a strong vertical recovery from lower levels, indicating aggressive short covering and panic exit of sellers.

However, price is now approaching important supply zones, where profit booking and fresh selling pressure can emerge.

👉 Tomorrow’s direction will depend on acceptance or rejection near the opening zones, not on emotional bias.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,850)

🧠 Psychology

Gap up after a sharp rally often reflects euphoria and short covering, but institutions usually sell into higher resistance zones.

🟢 Bullish Plan

🔵 If price sustains above 25,985 on a 15-min closing basis

🔵 Expect upside extension towards 26,020 and above

🔵 Momentum trades only after clean acceptance

🔴 Rejection Plan

🔴 Rejection near 25,985 – 26,020

🔴 Expect pullback towards 25,696 – 25,569

📌 Why this works

Breakout works only when buyers accept higher prices, not when price spikes emotionally.

➖ Scenario 2: FLAT Opening

(Opening between 25,650 – 25,780)

🧠 Psychology

Flat open after a sharp rally shows temporary balance. Market usually consolidates before next expansion.

🟢 Upside Plan

🔵 Sustaining above 25,696

🔵 Gradual move towards 25,985

🔴 Downside Plan

🔴 Failure to hold 25,569

🔴 Drift towards 25,472

📌 Important Note

🟠 25,569 – 25,696 is a consolidation zone

🟠 Expect whipsaws — trade only after confirmation

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,472)

🧠 Psychology

Gap down after a sharp up-move signals profit booking or fresh short positions.

🟢 Bounce Setup

🔵 If 25,472 holds on 15-min basis

🔵 Expect technical bounce towards 25,569 – 25,696

🔴 Breakdown Setup

🔴 Clean break below 25,472

🔴 Downside opens till 25,221

📌 Why this works

Strong supports either create fast bounces or accelerated breakdowns — confirmation is critical.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer option spreads near resistance zones

🟢 Avoid aggressive buying in gap-up opens ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in post-short-covering consolidation

📌 25,696 & 25,472 are the most important intraday decision levels

📌 Break above 25,985 needed for bullish continuation

📌 Trade price reaction, not market excitement 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 03.02.2026NIFTY KEY LEVELS FOR 03.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Trading levels and plan for 03-Feb-2026📘 NIFTY Trading Plan – 3 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Use Only)

🔑 Key Intraday Levels (From Chart)

🟢 25,985 – Higher Timeframe Resistance

🟢 25,569 – 25,696 – Last Intraday Resistance / Consolidation Zone

🟢 25,266 – Opening Resistance (Flat Opening Case)

🟢 24,901 – Opening Support (Gap-Down Opening Case)

🟢 25,081 – Current Reference Price Area

🧠 Market Structure & Price Psychology

NIFTY witnessed a sharp intraday breakdown followed by a recovery bounce, indicating short-covering from lower levels.

However, price is still trading below major resistance zones, meaning trend reversal is not confirmed yet.

👉 Tomorrow’s direction depends on acceptance or rejection near opening levels, not assumptions.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,180–25,220)

🧠 Psychology

A gap up after a sharp fall is usually driven by short covering, but higher zones still carry strong selling pressure.

🟢 Bullish Plan

🔵 If price sustains above 25,266 on a 15-min closing basis

🔵 Expect upside towards 25,569 – 25,696

🔵 Break & acceptance above this zone can open path towards 25,985

🔴 Rejection Plan

🔴 Failure near 25,569 – 25,696

🔴 Expect consolidation or pullback towards 25,266

📌 Why this works

Only acceptance above resistance confirms fresh buying, not emotional gap-up trades.

➖ Scenario 2: FLAT Opening

(Opening between 25,050 – 25,150)

🧠 Psychology

Flat openings indicate balance between buyers and sellers. Market usually expands after testing resistance.

🟢 Upside Plan

🔵 Hold above 25,266

🔵 Targets: 25,569 → 25,696

🔴 Downside Plan

🔴 Failure to cross 25,266

🔴 Price may retest 24,901

📌 Key Note

🟠 Expect range-bound moves until breakout confirmation.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 24,901)

🧠 Psychology

Gap down reflects renewed fear, but strong supports often trigger short covering rallies.

🟢 Bounce Setup

🔵 If 24,901 holds on 15-min basis

🔵 Expect pullback towards 25,081 → 25,266

🔴 Breakdown Setup

🔴 Clean break below 24,901

🔴 Downside momentum can extend rapidly (no nearby support)

📌 Why this works

Supports either produce fast bounces or accelerated breakdowns—confirmation is critical.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer option spreads near resistance zones

🟢 Avoid aggressive buying in gap-up opens ❌

🟢 Risk maximum 1–2% of capital per trade

🟢 Book partial profits at pre-defined levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 Market remains volatile and reactive

📌 25,266 & 24,901 are the most important intraday levels

📌 Break above 25,696 needed for bullish continuation

📌 Trade price reaction, not market noise 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 02.02.2026NIFTY KEY LEVELS FOR 02.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Nifty Slides on Budget Shockwave: What’s Ahead for Markets?Indian equity markets faced sharp volatility following the Union Budget 2026, as the increase in Securities Transaction Tax (STT) on F&O trading weighed heavily on market sentiment.

In the special Sunday session, Nifty declined 495 points (-1.96%), closing at 24,825. Market uncertainty rose sharply, with India VIX climbing to 15.10, marking an 8-month high.

◉ Technical Setup

Nifty has broken below its rising channel, confirming that this isn’t just a healthy correction.

The structure now points toward a positional downtrend, with sellers firmly in control.

◉ Key Levels to Watch

Support Levels

24,500 – 24,400: Immediate support zone

24,000 – 23,900: Strong demand area with significant put writer positioning

Resistance Levels

25,000 – 25,100: Near-term resistance

25,500 – 25,600: Major supply zone

◉ Key Triggers for the Week

RBI Monetary Policy Meeting (Feb 4–6)

The RBI is widely expected to pause rates, after cutting 125 bps since Feb 2025, bringing the repo rate to 5.25%.

Q3 FY26 Corporate Earnings

A busy earnings calendar may influence index movement. Key companies reporting include State Bank of India NSE:SBIN , Bharti Airtel NSE:BHARTIARTL , LIC NSE:LICI , Adani Enterprises NSE:ADANIENT , and RVNL $NSE:RVNL.

Institutional Flows

After turning net sellers on Budget day, FII-DII activity will be closely watched.

◉ Weekly Outlook

The near-term outlook remains cautiously bearish with elevated volatility.

Nifty is expected to consolidate in the 24,500–25,100 range.

A sustained move above 25,200 is required to improve the technical outlook. Until then, upside attempts may face selling pressure.

◉ Trading Perspective

The market currently favours a sell-on-rise approach.

Aggressive long positions should be avoided unless Nifty closes above 25,200 on a daily basis.

#BANKNIFTY PE & CE Levels(02/02/2026)Bank Nifty is expected to open with a slightly positive gap, but the overall structure still reflects weakness after the sharp sell-off seen in the previous session. The index has decisively broken below the important 59050–58950 support zone, which earlier acted as a strong demand area. This breakdown has shifted the short-term trend clearly on the bearish side, and the gap-up opening should be treated more as a pullback rather than a trend reversal unless key levels are reclaimed.

From a technical perspective, the fall from the 59550–59600 region confirms strong supply at higher levels. The current price action is forming lower highs and lower lows on the 15-minute timeframe, indicating sustained selling pressure. Any bounce toward 58950–59050 is likely to face resistance, as this zone now turns into a supply area. If Bank Nifty fails to hold above this range after the opening, fresh selling pressure can re-emerge quickly.

On the downside, the immediate support lies near 58550–58450. A break below 58450 can accelerate the bearish momentum further, opening the gates for deeper targets around 58250, 58150, and potentially 58050. These levels are critical intraday and positional supports, and increased volatility can be expected if they are tested. As long as the index remains below 59000, bears will continue to have an upper hand.

On the upside, only a strong and sustained move above 59050 can provide some relief to the bulls. If Bank Nifty manages to reclaim and hold above 59050–59100, a short-covering bounce toward 59250, 59350, and 59450+ is possible. However, such a move should be confirmed with follow-through buying; otherwise, it may turn into a selling-on-rise opportunity.

Overall, despite the slightly gap-up opening, the market context remains cautious to bearish. Traders should avoid aggressive long positions near resistance zones and focus more on sell-on-rise or breakdown-based strategies. Strict risk management is essential, as volatility is expected to stay elevated after the recent sharp move. Patience during the opening minutes and confirmation of price action near key levels will be crucial for safer trades.

NIFTY : Trading levels and Plan for 02-Feb-2025Trend View : Sideways

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,000)

🧠 Psychology

A gap up after a sharp fall usually signals short covering, but higher levels still carry strong supply pressure.

🟢 Bullish Plan

🔵 If price sustains above 25,010 on a 15-min closing basis

🔵 Expect upside towards 25,252

🔵 Momentum continuation only if 25,252 is broken with volume

🔴 Rejection Plan

🔴 Failure to sustain above 25,010

🔴 Expect pullback towards 24,847 – 24,695 (No-Trade Zone)

📌 Why this works

Gap-up moves fail if buyers are weak. Sustaining above resistance confirms real demand.

➖ Scenario 2: FLAT Opening

(Opening between 24,750 – 24,900)

🧠 Psychology

Flat opens after a sell-off indicate confusion and balance. Market first tests both sides for liquidity.

🟢 Upside Plan

🔵 Acceptance above 25,010

🔵 Targets: 25,252

🔵 Suitable for low-risk call spreads

🔴 Downside Plan

🔴 Breakdown below 24,695

🔴 Price may drift towards 24,611 → 24,531

📌 Special Note

🟠 24,695 – 24,847 is a No-Trade Zone

🟠 Avoid trades here unless price breaks decisively

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 24,611)

🧠 Psychology

Gap down reflects fear-based selling. Smart money waits to see whether supports attract buyers or fail.

🟢 Bounce Setup

🔵 If 24,531 – 24,611 zone holds

🔵 Expect technical bounce towards 24,847 → 25,010

🔴 Breakdown Setup

🔴 Clean break below 24,531

🔴 Downside opens till 24,377

📌 Why this works

Strong supports either give sharp bounces or fast breakdowns—clarity comes with confirmation.

🛡️ Risk Management Tips for Options Traders

🟢 Trade only after first 15-min candle closes

🟢 Prefer defined-risk spreads in volatile markets

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits near next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 Market remains volatile and reactive

📌 25,010 & 24,611 are the most important intraday levels

📌 Avoid trades in 24,695 – 24,847 zone

📌 Let price confirm direction, not emotions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 01.02.2026 BUDJET DAY SPLNIFTY KEY LEVELS FOR 01.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

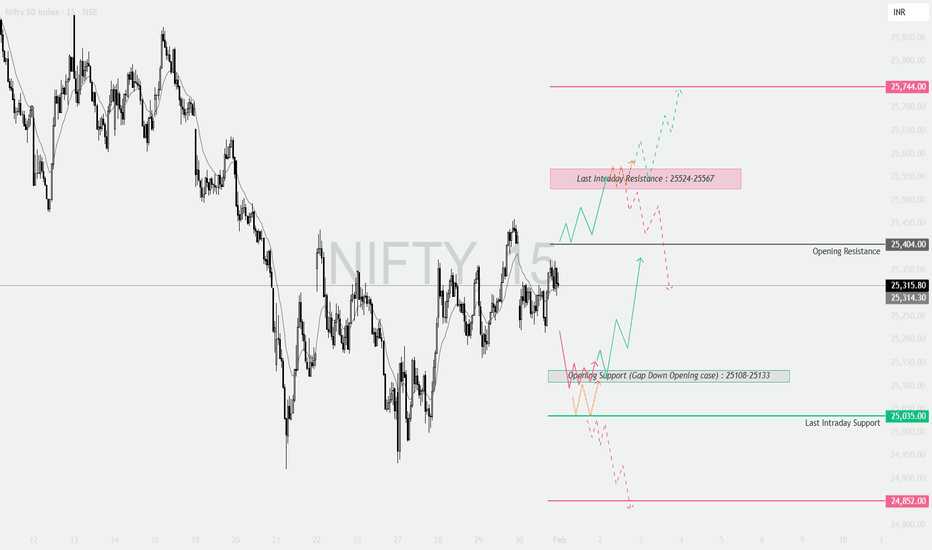

NIFTY : Detailed trading plan for 01-Feb-2026📘 NIFTY Trading Plan – 1 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | For Educational Purpose)

🔑 Key Levels to Track

🔹 25,744 – Higher Timeframe Resistance

🔹 25,524 – 25,567 – Last Intraday Resistance Zone

🔹 25,404 – Opening Resistance

🔹 25,108 – 25,133 – Opening Support (Gap-Down Case)

🔹 25,035 – Last Intraday Support

🔹 24,852 – Major Breakdown Support

🧠 Market Structure & Psychology

NIFTY is currently in a short-term recovery phase after a sharp sell-off, forming a base near lower supports.

However, price is now approaching important supply zones, where sellers may again become active.

👉 Direction for the day will depend on how price reacts near opening levels, not on predictions.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,420)

🧠 Psychology

A big gap up usually reflects short covering + overnight optimism, but higher zones still hold unfilled selling pressure.

🟢 Bullish Plan

🔵 If price sustains above 25,404 on a 15-min close

🔵 Expect move towards 25,524 – 25,567

🔵 Further strength can extend towards 25,744

🔴 Caution Zone

🔴 Rejection near 25,524 – 25,567

🔴 Indicates supply → Expect pullback or consolidation

📌 Why this works

Institutions sell into resistance. Acceptance above resistance confirms real demand, not emotional buying.

➖ Scenario 2: FLAT Opening

(Opening between 25,280 – 25,380)

🧠 Psychology

Flat opens show indecision. Market usually expands after liquidity grab on either side.

🟢 Upside Plan

🔵 Hold above 25,404 → Bias turns bullish

🔵 Targets: 25,524 → 25,567

🔴 Downside Plan

🔴 Breakdown below 25,315 – 25,300

🔴 Weakness towards 25,133 → 25,035

📌 Why this works

Flat opens reward patience. Direction becomes clear only after range expansion.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,133)

🧠 Psychology

Gap down creates panic selling, but strong supports attract smart money buyers.

🟢 Bounce Setup

🔵 If 25,108 – 25,133 zone holds

🔵 Expect pullback towards 25,315 → 25,404

🔴 Breakdown Setup

🔴 Clean break below 25,035

🔴 Downside opens till 24,852

📌 Why this works

Supports fail only when demand dries up. Breakdown confirms sellers are in full control.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer option spreads near resistance/support

🟢 Avoid aggressive buying in high IV zones

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next logical level

🟢 No revenge trades ❌ Discipline first

🧾 Summary & Conclusion

📌 Market is at a decision-making zone

📌 25,404 & 25,133 are the most important intraday levels

📌 Trade reaction at levels, not assumptions

📌 Confirmation + Risk control = consistency 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trade.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 30.01.2026NIFTY KEY LEVELS FOR 30.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.