Nifty - Intraday levels & Prediction for - 03 Jul 2025 (Expiry)Nifty Prediction for Tomorrow:

Trend : Sideways then BULLISH Reversal

Sentiment : Negative but will change to Positive

Expectation : Nifty almost tested 15m 200 EMA but still there is a gap to fill, once its done we can see good BULLISH reversal in Nifty for New high. Some sort of consolidation will take place in the first half then good move likely to come.

Look for Buy/Sell at Demand and Supply zone for profitable trades.

Demand and Supply Zones - When price breaks the zone, Demand zone will become Resistance and Supply zone will become Support.

Refer the chart for detailed Intraday Support and Resistance levels.

Niftylevels

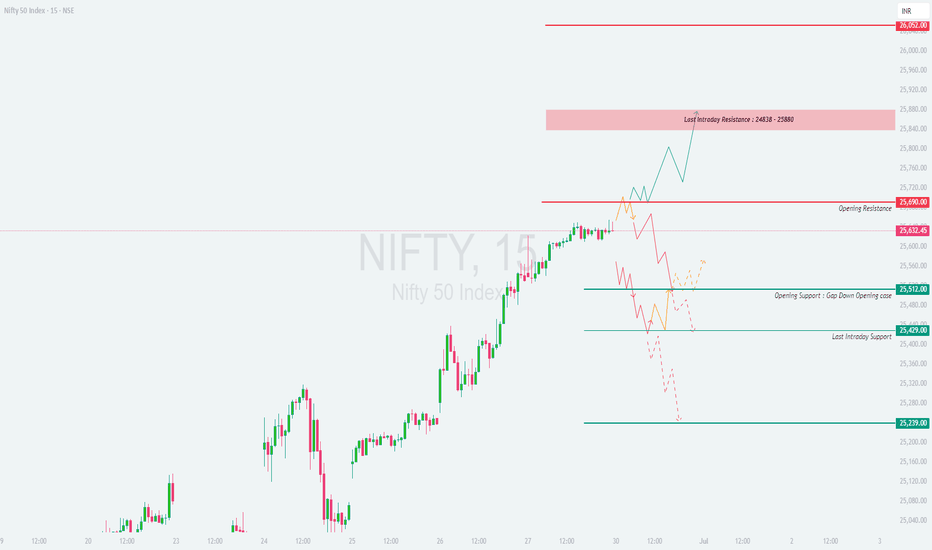

NIFTY : Trading levels and plan for 02-Jul-2025\ 📊 NIFTY TRADING PLAN – 2-Jul-2025\

📍 \ Previous Close:\ 25,533

📏 \ Gap Opening Consideration:\ ±100 points

🧭 \ Key Zones to Monitor:\

🔸 \ Opening Resistance:\ 25,581

🔸 \ Last Intraday Resistance:\ 25,628

🟥 \ Strong Resistance on Daily Chart:\ 25,690 – 25,760

🟦 \ Opening Support Zone:\ 25,429 – 25,450

🔻 \ Last Intraday Support:\ 25,330

🔻 \ Extreme Support:\ 25,239

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,628):\

If NIFTY opens above \ 25,628\ , it breaks the last intraday resistance and moves toward the daily resistance zone \ 25,690–25,760\ . Expect buyers to book partial profits here, which may cause a sideways movement or minor reversal.

✅ \ Plan of Action:\

• If price sustains above 25,690, expect further upside but beware of profit-booking near 25,760

• A pullback towards 25,628–25,581 may give a re-entry opportunity

• Avoid shorts unless a bearish reversal pattern forms at 25,760

🎯 \ Trade Setup:\

– Buy above 25,690 with SL below 25,640, Target: 25,760

– Sell only if price rejects 25,760 with confirmation

📘 \ Tip:\ Avoid chasing the move post-gap-up. Wait for 15–30 min of structure.

\ \ ⚖️ FLAT OPENING (Between 25,450 – 25,581):\

This opening keeps NIFTY inside the key action zone. Since the structure is tight, breakout from either side can offer directional moves.

✅ \ Plan of Action:\

• Wait for a clear breakout above 25,581 or breakdown below 25,450

• Avoid taking trades inside 25,450–25,581 unless directional bias builds up

• Watch for volume and price expansion beyond these levels

🎯 \ Trade Setup:\

– Buy above 25,581, SL: 25,533, Target: 25,628–25,690

– Sell below 25,450, SL: 25,490, Target: 25,330

📘 \ Tip:\ Consider deploying directional option spreads (e.g., debit spreads) post-breakout.

\ \ 📉 GAP-DOWN OPENING (Below 25,429):\

A gap-down below \ 25,429\ enters the opening support area, and if this breaks, the next target is the \ last intraday support at 25,330\ , followed by \ 25,239\ .

✅ \ Plan of Action:\

• If price holds 25,429–25,450, watch for intraday reversal setup

• If it breaks and sustains below 25,330, expect further weakness

• Trade light early, and scale in only if trend persists

🎯 \ Trade Setup:\

– Buy reversal at 25,430–25,450 with bullish confirmation; SL: 25,400, Target: 25,533

– Sell below 25,330, SL: 25,375, Target: 25,239

📘 \ Tip:\ Use OTM put options rather than naked futures for safer risk-defined entries.

---

\ 📌 SUMMARY & LEVELS TO WATCH:\

✅ \ Bullish Above:\ 25,581 → 25,628 → 25,690–25,760

🔽 \ Bearish Below:\ 25,450 → 25,330 → 25,239

📉 \ Tight Range Zone:\ 25,450–25,581 → Wait for a breakout

---

\ 💡 OPTIONS TRADING RISK MANAGEMENT TIPS:\

🧠 \ Smart Traders Should:\

• Prefer option spreads to limit risk and manage theta decay

• Set alerts at key levels and wait for confirmations

• Avoid weekly options if there's uncertainty around direction

🚫 \ Avoid These Traps:\

• Over-leveraging on directional bias

• Holding naked options during choppy consolidation

• Trading without SL or re-entry plan

📘 \ Pro Tip:\ Consider selling iron condors if volatility remains in check near expiry.

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is purely for educational purposes. Please consult your financial advisor before making any investment decisions. Trade with proper stop-loss and risk management at all times.

25,600 Resistance Holding Strong | Option Chain Signals Bearish For Intraday (5-Min Chart)

1. VWAP (Volume Weighted Average Price)

Use: Institutional buying/selling level

Watch:

Price above VWAP → bullish

Price below VWAP → bearish

Sideways around VWAP → consolidation

✅ Great for scalping & breakout trades.

For Swing Trading (3-Hour Chart)

1. MACD (12,26,9)

Use: Trend confirmation & momentum

Watch:

Bullish crossover (MACD line crosses above signal line) = possible up move

Bearish crossover = possible down move

MACD histogram momentum shows strength/weakness.

2. 200 EMA (Exponential Moving Average)

Use: Long-term trend

Above 200 EMA → bullish bias

Below → bearish

Acts as dynamic support/resistance.

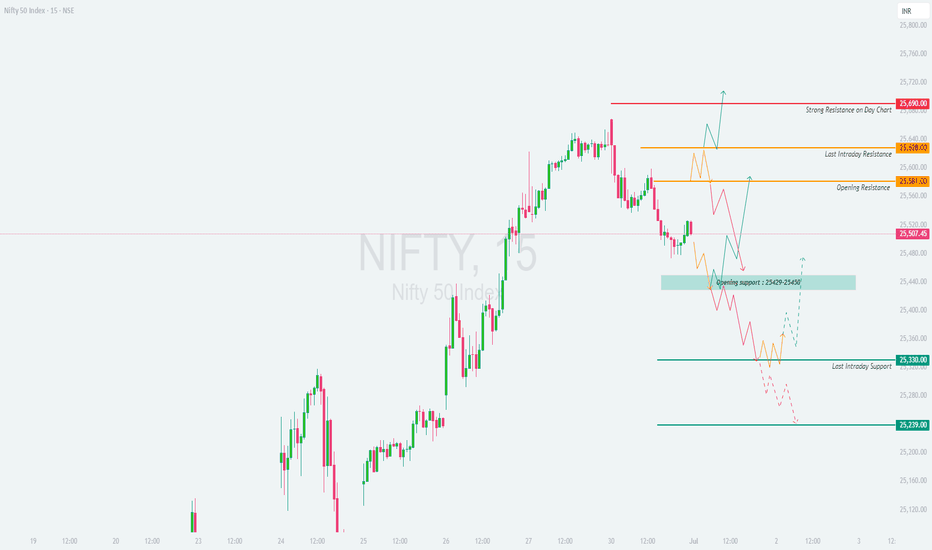

NIFTY - TRADING LEVELS AND PLAN FOR 01-JUL-2025

\ 📊 NIFTY TRADING PLAN – 1-Jul-2025\

📍 \ Previous Close:\ 25,507

📏 \ Gap Opening Consideration:\ ±100 points

🧭 \ Key Zones to Monitor:\

🔴 Strong Resistance on Day Chart: \ 25,690\

🟧 Last Intraday Resistance: \ 25,628 – 25,640\

🟨 Opening Resistance: \ 25,581\

🟦 Opening Support: \ 25,429 – 25,450\

🟩 Last Intraday Support: \ 25,330\

🟫 Final Support: \ 25,239\

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,640):\

A gap-up above \ 25,640\ pushes Nifty into the \ Strong Resistance zone\ visible on the daily chart. This area may trigger profit booking unless broken with strong volume and momentum.

✅ \ Plan of Action:\

• Wait for a 15-min candle close above 25,690 for confirmation of breakout

• If price stalls or forms reversal patterns, initiate short trade setups

• Only aggressive buyers may consider long trades above 25,690 if follow-up candles are strong

🎯 \ Trade Setup:\

– \ Buy above:\ 25,690, SL: 25,628, Target: Trailing towards 25,750+

– \ Sell near resistance:\ 25,675–25,690 zone if reversal confirmed, SL: 25,705, Target: 25,581

📘 \ Tip:\ Avoid buying directly into resistance. Wait for a breakout + retest for cleaner entries.

\ \ ⚖️ FLAT OPENING (Near 25,500 – 25,540):\

Flat openings near the \ Opening Resistance (25,581)\ can create indecisive sideways moves in early sessions.

✅ \ Plan of Action:\

• If price breaks above 25,581 with strength, look for long trades

• If price faces rejection near 25,581 or 25,628, wait for breakdown below 25,507 to confirm weakness

• Below 25,507, next support lies at the 25,429–25,450 zone

🎯 \ Trade Setup:\

– \ Buy above breakout of 25,581, SL: 25,500, Target: 25,628–25,690

– \ Sell below 25,507, SL: 25,581, Target: 25,450 or lower

📘 \ Tip:\ Flat opens are best traded on confirmation candles, not assumptions. Avoid overtrading.

\ \ 📉 GAP-DOWN OPENING (Below 25,400):\

A gap-down below 25,400 opens the day near the \ Opening Support zone of 25,429–25,450\ . This area is critical — a bounce or breakdown will define the day.

✅ \ Plan of Action:\

• If price shows bullish reversal signs near 25,429, consider a pullback trade

• Breakdown of 25,429 with volume may extend downside toward 25,330 and even 25,239

• Avoid chasing long trades unless price stabilizes above 25,450

🎯 \ Trade Setup:\

– \ Buy near support:\ 25,429 with SL below 25,390, Target: 25,507

– \ Sell on breakdown below 25,429, SL: 25,450, Target: 25,330 – 25,239

📘 \ Tip:\ Gap-down opens attract trap setups. Let the market settle before committing.

---

\ 🧭 KEY LEVELS – QUICK REFERENCE:\

🔺 \ Strong Resistance:\ 25,690

🟧 \ Last Resistance:\ 25,628 – 25,640

🟨 \ Opening Resistance:\ 25,581

🟦 \ Opening Support:\ 25,429 – 25,450

🟩 \ Intraday Support:\ 25,330

🟥 \ Final Support:\ 25,239

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ Stick to \ defined range breakouts\ before entering directional trades

✅ Don’t overleverage into gap-ups/downs; let premiums cool

✅ \ Avoid selling naked options\ without clear structure

✅ Protect capital with \ hedged strategies\ like debit spreads

✅ \ Exit when your reason is invalidated\ , not when SL hits randomly

🛡️ \ Always use stop-losses\ , especially in high-IV environments.

---

\ 📌 SUMMARY:\

• 📈 \ Bullish above:\ 25,581 → 25,640 → 25,690

• 📉 \ Bearish below:\ 25,507 → 25,429 → 25,330

• 🚫 \ No trade zone:\ 25,507–25,581 (if inside, wait for clarity)

🎯 \ Focus Zones:\

– Long breakout above 25,581

– Short breakdown below 25,429

– Reversal plays at 25,429 or 25,239 if structure supports

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This content is shared only for educational purposes. Please do your own analysis or consult a professional financial advisor before taking trades. Risk management is essential—never trade without a stop-loss and always protect your capital.

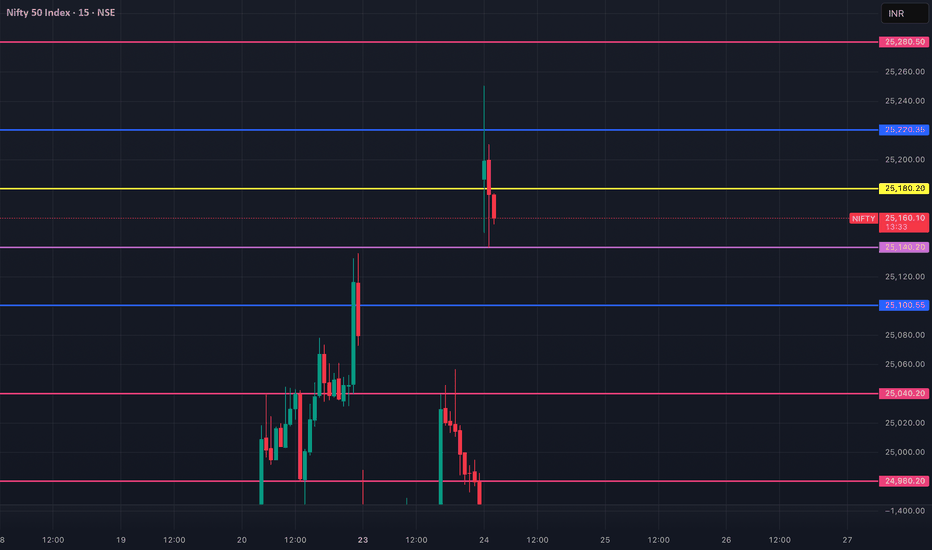

NIFTY INTRADAY LEVEL ( EDUCATIONAL PURPOSE) 01/07/2025🔷 Nifty Intraday Trade Plan – 1 July

📊 Analysis: 15-min TF | Execution: 1-min TF

🔸 GAP-UP Opening (Above 25,600)

📌 Plan: Avoid early longs. Wait for price rejection or reversal pattern.

🔁 Entry: Sell on breakdown below 5-min candle low

🛑 SL: 15–20 pts above day’s high

🎯 Target: 25,450 – 25,500

🔹 GAP-DOWN Opening (Below 25,400)

📌 Plan: Avoid panic selling. Wait for reclaim of early resistance

🔁 Entry: Buy if price reclaims 5-min opening high

🛑 SL: 15–20 pts below swing low

🎯 Target: 25,500 – 25,560

⚫ NORMAL Opening (Between 25,400–25,600)

📌 Range Play Setup

🔸 Sell Zone: Near 25,580–600 (resistance area)

🔹 Buy Zone: Near 25,420–440 (support area)

🛑 SL: 15–20 pts beyond trigger zone

🎯 Target: 30–40 pts

🔺 Breakout Trade Setup

🔁 Entry: Above 25,600 breakout candle (1-min TF)

🛑 SL: Below breakout bar

🎯 Target: 25,680 – 25,720

📌 Note: Respect price action & levels. Execute only if structure aligns with plan.

🧠 Discipline > Prediction

Nifty chart updates for this coming weekThis is a major resistance and possible price reversal zone. Keeping geopolitical news in mind, Nifty is set to break this for higher targets, as marked on the chart.

On the contrary, prices returning to this range will pull back the price to 25430 as major support for bullish sentiment.

All major levels for targets on both sides are mentioned on the chart. The Price trading in the blue colored range is a no-trade zone, which means it will be range-bound until it gives a breakout on either side.

NIFTY : Trading levels and Plan for 30-JUN-2025

\ 📊 NIFTY 50 TRADING PLAN – 30-Jun-2025\

📍 \ Previous Close:\ 25,632

📏 \ Gap Opening Consideration:\ ±100 points

📈 \ Chart Timeframe:\ 15-min

🧩 \ Key Zones:\ Resistance – 25,690 / Support – 25,429 / Last Resistance – 25,838–25,880

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,730):\

If NIFTY opens above \ 25,730\ , it will quickly enter the \ Last Intraday Resistance Zone (25,838 – 25,880)\ . This area is likely to act as a supply zone where profit booking may kick in. Traders should avoid aggressive longs near resistance unless a breakout is confirmed with strong momentum.

✅ \ Plan of Action:\

• Wait for price action to stabilize near 25,838

• Go long only if there's a breakout above 25,880 with strong volume

• Watch for bearish patterns like shooting stars or bearish engulfing near this zone

🎯 \ Trade Setup:\

– \ Buy above:\ 25,880

– \ Target:\ 26,000+

– \ SL:\ Below 25,730 or initial range low

📘 \ Tip:\ Avoid FOMO entries in first 15 minutes. Let the candle confirm breakout strength.

\ \ ⚖️ FLAT OPENING (Near 25,630 – 25,690):\

A flat opening near \ 25,632\ brings the market directly around the \ Opening Resistance of 25,690\ . This area could lead to sideways choppiness if there’s no directional conviction. Best strategy is to wait for a breakout or breakdown from this zone.

✅ \ Plan of Action:\

• Observe price behavior between 25,690 (resistance) and 25,512 (support)

• Go long if price breaks and sustains above 25,690 with strength

• Go short if breakdown below 25,512 is seen

🎯 \ Trade Setup Options:\

– \ Buy above:\ 25,690

– \ Sell below:\ 25,512

– \ Target:\ 25,838 or 25,429 depending on breakout/breakdown

– \ SL:\ Opposite zone or prior swing candle

📘 \ Tip:\ Wait for at least a 15-min candle close outside the range for confirmation.

\ \ 📉 GAP-DOWN OPENING (Below 25,512):\

If NIFTY opens below \ 25,512\ , it enters the \ Opening Support Zone for Gap-Down Cases\ . Immediate support lies at \ 25,429\ , which could act as a reversal point. However, if that breaks, NIFTY may fall towards \ 25,239\ .

✅ \ Plan of Action:\

• Watch for a bounce at 25,429 for possible reversal trades

• If price breaks below 25,429 and sustains, initiate short trades

• Look for bullish candles like hammers for reversal signals

🎯 \ Trade Setup:\

– \ Sell below:\ 25,429

– \ Target:\ 25,239

– \ SL:\ Above 25,512

📘 \ Tip:\ Avoid aggressive buying in early dip unless price holds and consolidates above support levels.

---

\ 🧭 KEY LEVELS TO WATCH:\

🔴 \ Opening Resistance:\ 25,690

🟥 \ Last Intraday Resistance:\ 25,838 – 25,880

🟩 \ Opening Support (Gap Down):\ 25,512

🟦 \ Last Intraday Support:\ 25,429

🟫 \ Major Support:\ 25,239

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ Trade near ATM options for quick deltas

✅ Don’t hold naked options if VIX is falling

✅ Always set stop-loss for option premiums

✅ Avoid averaging into losing trades

✅ For gap-ups, consider Bear Call Spreads

✅ For gap-downs, look into Bull Put Spreads

🛑 Never trade based on emotion; follow structure and levels only.

---

\ 📌 SUMMARY – ACTIONABLE ZONES:\

• ✅ \ Bullish above:\ 25,690 → Upside potential till 25,880+

• ⚠️ \ Choppy zone:\ 25,512 – 25,690 → Avoid forced trades

• ❌ \ Bearish below:\ 25,429 → Downside open till 25,239

🎯 \ Best Trades:\ Buy above 25,880 (momentum breakout), Sell below 25,429 (breakdown confirmation)

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This analysis is shared for educational purposes only. Please do your own research or consult a registered financial advisor before taking trades. Always use strict stop-loss and risk management protocols.

NIFTY INTRADAY LEVELS ( EDUCATIONAL PURPOSE ) 30/06/2025🔷 Nifty Intraday Trade Plan – 30 June

📊 Analysis: 15-min TF | Execution: 1-min TF

🔹 GAP-UP Opening (Above 25,700)

📍 Plan: Avoid chasing longs. Wait for rejection or reversal

🔁 Entry: Sell on breakdown below 5-min low

🛑 SL: 15–20 pts above high

🎯 Target: 25,500–25,540

🔹 GAP-DOWN Opening (Below 25,500)

📍 Plan: Avoid panic selling. Look for reversal candle

🔁 Entry: Buy if price reclaims 5-min opening high

🛑 SL: 15–20 pts below swing low

🎯 Target: 25,650–25,700

🔹 NORMAL OPEN (Between 25,500–25,700)

🔁 Range Play Setup

📍 Sell near 25,680–700 (resistance zone)

📍 Buy near 25,500–520 (support zone)

🛑 SL: 15–20 pts beyond trigger level

🎯 Target: 30–40 pts

🔺 Breakout Trade Setup

🔁 Entry: Above 25,700 breakout candle

🛑 SL: Below breakout bar

🎯 Target: 25,760–780

🔻 Breakdown Trade Setup

🔁 Entry: Below 25,500 breakdown

🛑 SL: Above breakdown bar

🎯 Target: 25,440–420

💡 KEY INTRADAY TIPS

✔ Avoid overtrading in opening 5 min

✔ Focus on clean 1-min structure

✔ Size small until confirmation

✔ Follow strict SL & trail profits

NIFTY Intraday Trade Setup For 30 Jun 2025NIFTY Intraday Trade Setup For 30 Jun 2025

Bullish-Above 25685

Invalid-Below 25635

T- 25885

Bearish-Below 25520

Invalid- Above 25570

T- 25340

NIFTY has closed on a bullish note last week. It gave a range breakout which was valid for more than a month. It is at a striking distance to ATH which may be taken out in the coming weeks. 25500 is a strong intraday support zone. We have planned a sell below the same (25520), but consider only in the second attempt. In case of a pullback breakout above 25685 we will long for the target of 25685. 25685-25930 will be a resistance zone in intraday.

In case of a big gap up/down, wait till 10 o'clock and mark the high and low of the trading range (5MIN). Trade on this range breakout.

==========

I am Not SEBI Registered

This is my personal analysis for my personal trading. Kindly consult your financial advisor before taking any actions based on this.

Nifty Continued to Rise, Bank Nifty Stands Tall at New Highs◉ Nifty Analysis NSE:NIFTY

Indian equity markets broke out of a five-week consolidation last week, powered by easing geopolitical tensions, which helped boost investor sentiment.

A Pole & Flag breakout on the charts signals a continuation of the uptrend, with strong bullish momentum building up.

Open Interest (OI) Snapshot

● 25,000 – Strong Base: Heavy put writing indicates strong support; bulls defending this level aggressively.

● 25,500 – Immediate Support: A secondary cushion with notable put buildup—short-term buyers watching this zone.

● 26,000 – Immediate Resistance Zone: Call writers active here; a breakout above this level could trigger a fresh leg up.

Outlook: The index looks set to maintain a bullish tone, with a possible move toward 26,000 in the coming sessions.

◉ Bank Nifty Analysis NSE:BANKNIFTY

The banking sector continues to lead the market’s strength, acting as a major driver behind the recent rally.

Fundamentally, optimism is being driven by lower funding costs, supported by banks cutting fixed deposit rates and the RBI’s recent cut in the Cash Reserve Ratio (CRR)—both of which have boosted liquidity and improved the outlook for lenders.

The index has confirmed a breakout from a Pole & Flag formation, aligning with Nifty’s bullish setup and further validating strength in the banking space.

Open Interest (OI) Snapshot

● 56,000 – Strong Support Zone: Significant put writing shows strong bullish conviction around this level.

● 57,000 – Immediate Support: Fresh positions being built; dip-buyers may step in here.

● 58,000 – Key Resistance Ahead: Call writers are holding the line—watch for breakout signals.

Outlook: As long as Bank Nifty holds above 57,000, the bullish momentum is expected to continue, with possible testing of 58,000 in the near term.

NIFTY LEVELS FOR INTRADAY ( EDUCATIONAL PURPOSE) 27/06/2025📊 Nifty Intraday Scalping Strategy – 27th June

📈 Chart Analysis: 15-min 📉 Execution: 1-min

🚀 Strong Momentum Above 25,550

🔼 If Gap-Up or Breakout Above 25,580:

✅ Buy above 25,580 on 1-min breakout

🎯 Target: 25,650 / 25,700

🛑 SL: 25,520

⚠️ Wait for retest if opening is volatile

📉 If Gap-Down Below 25,480:

✅ Sell below 25,470 on weakness

🎯 Target: 25,400 / 25,350

🛑 SL: 25,530

⚠️ No short if 25,450 holds with volume support

🔁 Sideways Note:

🔹 Don’t chase trades in first 5 mins

🔹 Use VWAP & 1-min candle structure for clean entries

NIFTY : Trading levels and plan for 27-Jun-2025📊 NIFTY TRADING PLAN – 27-Jun-2025

📍 Previous Close: 25,530

📏 Gap Opening Reference: ±100 points

🕓 Chart Timeframe: 15-Min

🧠 Approach: Actionable plan based on reaction zones + trend-following confirmation

🚀 GAP-UP OPENING (Above 25,690):

A 100+ point gap-up above 25,690 takes Nifty straight into the Opening and Last Resistance Zone — a zone marked for possible exhaustion, where further upside needs strong momentum or risk of rejection increases.

✅ Plan of Action:

• Watch early 15-min candle — strength above 25,690 = bullish extension

• A rejection with long upper wick may signal reversal

• If breakout sustains → New intraday high potential

🎯 Trade Setup:

– Long above 25,690 (on candle close)

– Target: 25,800+

– SL: Below 25,650

– Avoid shorting aggressively unless clean rejection observed

📘 Tip: Always wait for a breakout retest before jumping into longs in such extended zones. Avoid chasing in the first 5 mins.

⚖️ FLAT OPENING (Between 25,530 – 25,474):

A flat open will place Nifty just below the upper resistance. Volatility may expand in either direction from here, so patience is key.

✅ Plan of Action:

• First 15–30 mins are crucial for market direction

• If Nifty crosses 25,690 → breakout trade setup

• If it fails and comes back below 25,474 → shorting opportunity toward support zone

🎯 Trade Setup Options:

– Long above 25,690 (with volume)

– Short below 25,474 (weakness confirmation)

– Targets: 25,690 (upside) | 25,404 (downside)

– SL: Based on 15-min close above/below key level

📘 Tip: This zone demands trader discipline — don’t be early in either direction. Let the chart structure develop.

📉 GAP-DOWN OPENING (Below 25,404):

Nifty opening below 25,404 shifts the focus to the Opening Support Zone (25,404–25,356) and if broken, to the Major Support for Trend Reversal (25,239) . This creates a clean downside structure if sellers take control.

✅ Plan of Action:

• If Nifty holds within 25,356–25,404 zone and shows reversal signs → possible bounce

• Breakdown below 25,239 → could trigger trend reversal toward deeper supports

🎯 Trade Setup:

– Short below 25,356 with confirmation

– Target: 25,239 → 25,100

– Long only if bullish structure holds within support zone

– SL: Above 25,404 (for shorts)

📘 Tip: Avoid averaging down. If price bounces near 25,239, wait for reversal signal to confirm buyer interest.

📌 KEY ZONES TO TRACK:

🔴 Resistance Zone: 25,690 (Last Resistance — potential exhaustion)

🟧 Opening Support Zone: 25,404 – 25,356

🟩 Trend Reversal Support: 25,239

💡 OPTIONS TRADING & RISK MANAGEMENT TIPS:

✅ Use Vertical Spreads (Bull Call / Bear Put) in directional setups to reduce premium risk

✅ Avoid trading in overlapping zones unless a clear breakout occurs

✅ Don’t hold naked options near expiry without clear trend — use spreads

✅ Protect your capital : Never risk more than 1.5–2% of total capital per trade

✅ SL must always be respected based on candle close

✅ Keep tracking OI shifts and IV spikes — adjust strikes if momentum fades

🔍 SUMMARY:

• 🔼 Bullish Above: 25,690 → Scope for new high

• ⚠️ Flat Opening Zone: 25,530 – 25,474 → Wait and watch

• 🔽 Bearish Below: 25,404 → Breakdown may extend

• 🛑 Trend Shift Point: 25,239 — strong support, if breached = caution

⚠️ DISCLAIMER:

I am not a SEBI-registered advisor. This plan is purely for educational purposes. Please consult your financial advisor before acting on any trade ideas. Always use proper position sizing, stop-loss, and risk controls to protect your capital.

NIFTY MATHEMATICAL LEVELSThese Levels are based on purely mathematical calculations.

Validity of levels are upto expiry of current week.

How to use these levels :-

* Mark these levels on your chart.

* Safe players Can use 15 min Time Frame

* Risky Traders Can use 5 min. Time Frame

* When Candle give Breakout / Breakdown to any level we have to enter with High/Low of that breaking candle.

* Targets will be another level marked on chart

* Stop Loss will be Low/High of that Breaking Candle.

* Trail your SL with every candle.

* Avoid Big Candles as SL will be high then.

* This is one of the Best Risk Reward Setup.

For Educational purpose only

NIFTY Levels For Intraday (Educational Purpose) 29/06/2025📊 Nifty Intraday Plan (for 1-Min Chart Traders) – 26th June

🟢 Gap-Up Opening Strategy

✅ Buy above: 25,270

🎯 Targets: 25,320 / 25,380

🛑 SL: 25,210

⚠️ Avoid entry if no strong volume or if price gets rejected near 25,300.

🔴 Gap-Down Opening Strategy

✅ Sell below: 25,180

🎯 Targets: 25,120 / 25,050

🛑 SL: 25,240

⚠️ Avoid selling if Nifty holds above 25,200 after 15 mins.

📍 Use 1-min chart with candle + volume confirmation.

NIFTY : Trading levels and Plan for 26-Jun-2025\ 📈 NIFTY TRADING PLAN – 26-Jun-2025\

📍 \ Previous Close:\ 25,238

📏 \ Gap Opening Consideration:\ ±100 points

🕒 \ Chart Timeframe:\ 15-Minutes

🧩 \ Strategy Focus:\ Zone-based reaction + Breakout/Breakdown with confirmation

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,356):\

If Nifty opens 100+ points above and trades above \ 25,356\ , it will directly enter the \ Last Intraday Resistance Zone (25,356 – 25,404)\ . Sustained strength above this zone could trigger a move toward the upper resistance at \ 25,600\ .

✅ \ Plan of Action:\

• Observe price reaction near 25,404 — look for rejection or breakout

• If breakout sustains with volume, trend continuation possible

• A rejection here might signal intraday reversal or consolidation

🎯 \ Trade Setup:\

– Long above 25,404 with confirmation

– Target: 25,600

– SL: Below 25,356

– Short only if clear rejection occurs below 25,356 with volume

📘 \ Pro Tip:\ Don’t jump into trades immediately post open — let the first 15-minute candle confirm the bias.

\ \ ⚖️ FLAT OPENING (Between 25,158 – 25,250):\

This region is marked as \ NO TRADE ZONE\ , where indecision and false moves are more likely. Trapped buyers/sellers from previous sessions often create sideways or volatile price action here.

✅ \ Plan of Action:\

• Avoid trading within this zone

• Wait for a breakout above 25,250 or a breakdown below 25,158

• Entry only after 15–30 minutes of trend confirmation

🎯 \ Trade Setup:\

– Long above 25,250 → Target: 25,356

– Short below 25,158 → Target: 25,057

– SL: Outside of range boundary

📘 \ Pro Tip:\ Protect your capital — “no trade” is also a strategy. Trade only when structure forms outside the zone.

\ \ 📉 GAP-DOWN OPENING (Below 25,057):\

Opening below the \ Opening Support (25,057)\ brings the \ Buyer’s Support Zone (24,921 – 24,954)\ into focus. A reversal bounce or further breakdown will depend on early price action around this zone.

✅ \ Plan of Action:\

• Look for bullish candles or wicks from 24,921 zone for potential intraday reversal

• If breakdown below 24,921 occurs, expect move toward \ 24,703\

• Be cautious during volatile flushes in first 5–10 mins

🎯 \ Trade Setup:\

– Long only on strong reversal at 24,921–24,954

– Short below 24,921 with momentum

– Target: 24,703

– SL: Tight SL below support for longs or above resistance for shorts

📘 \ Pro Tip:\ Lower supports attract buying interest — ideal for low-risk reversals, but only with confirmation.

---

\ 📊 KEY LEVELS TO WATCH:\

🟧 \ NO TRADE ZONE:\ 25,158 – 25,250

🟥 \ Resistance Zone:\ 25,356 – 25,404

🟢 \ Opening Support:\ 25,057

🟦 \ Buyer’s Support Zone:\ 24,921 – 24,954

🔻 \ Breakdown Support:\ 24,703

---

\ 🛡️ OPTIONS TRADING & RISK MANAGEMENT TIPS:\

✅ Use \ Bull Call Spreads\ above resistance to reduce premium decay risk

✅ In sideways zones, prefer \ Iron Condors or Short Straddles\ (only if IV is high)

✅ Avoid naked OTM options inside no trade zone – theta kills premium

✅ Never chase after missed trades – wait for next setup

✅ SL should always be based on \ 15-min closing candles\

✅ Maintain risk per trade ≤ \ 2% of capital\

---

\ 📌 SUMMARY:\

• 🔼 \ Bullish Above:\ 25,404 → Next stop: 25,600

• ⛔ \ Avoid trading inside:\ 25,158 – 25,250

• 🔽 \ Bearish Below:\ 25,057 → Watch 24,921

• 🧲 \ Reversal or flush below:\ 24,921 → Can test 24,703

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered advisor. All trade setups shared are for educational purposes only. Always perform your own analysis or consult a financial expert before entering any trades. Use strict stop-loss and adhere to risk management at all times.

NIFTY Levels For Intraday ( Educational Purpose) 25/06/2025📊 Nifty Intraday Strategy – 25.06.2025

🔎 Structure: 15-min | Execution: 1-min

🔼 Buy Above: 25,110

🎯 Target: 25,180 / 25,240

🛑 SL: 25,060

🔽 Sell Below: 24,980

🎯 Target: 24,920 / 24,860

🛑 SL: 25,030

📈 Gap-Up Opening:

▪️ Wait near 25,180–25,240 zone

▪️ Avoid long entries until rejection or breakout confirmation (1-min + volume)

📉 Gap-Down Opening:

▪️ Watch 24,900–24,860 for reversal

▪️ Go long only after bullish engulfing / strong 1-min candle with volume

⚠️ Do’s & Don’ts:

✅ Use 1-min for trigger after breakout

❌ Don’t jump in first 5 mins

✅ Maintain 1:2 risk-reward

🚫 Avoid trading during news spike

NIFTY : Trading levels and Plan for 25-Jun-2025\ 📊 NIFTY TRADING PLAN – 25-Jun-2025\

📍 \ Previous Close:\ 25,071.55

📏 \ Gap Opening Consideration:\ ±100 Points

🕒 \ Time Frame Analyzed:\ 5-Min Chart

📦 \ Volume Check:\ 9.16M (aiding intraday trend confirmation)

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,148):\

If Nifty opens above the \ Opening Resistance Zone (25,128 – 25,158)\ , it immediately faces \ Last Intraday Resistance\ at \ 25,248\ . Sustained buying above this level may push prices toward the \ Profit Booking / Consolidation Zone (25,356 – 25,401)\ .

✅ \ Plan of Action:\

• Avoid jumping in at open — let first 15–30 minutes settle the tone

• Breakout above 25,248 = clear bullish structure

• Watch for profit booking at 25,356–25,401

🎯 \ Trade Setup:\

– Long above 25,248 with volume confirmation

– Target: 25,356 → 25,401

– SL: Below 25,158

– Short only if rejection seen near 25,248–25,356

📘 \ Pro Tip:\ Book partial profits at 1st target and trail rest.

\ \ ⚖️ FLAT OPENING (Between 25,012 – 25,128):\

This is a reaction zone where Nifty may oscillate inside the \ Opening Resistance/Support Band\ . Directional clarity may only come post breakout from this zone.

✅ \ Plan of Action:\

• Avoid early trades inside 25,012–25,128 zone

• Break above 25,128 = upside momentum

• Breakdown below 25,012 = weakness

🎯 \ Trade Setup:\

– Long above 25,128 (strong bullish candle)

– Short below 25,012 (bearish breakdown confirmation)

– SL: 30–40 pts from entry depending on volatility

– Prefer confirmation candle with decent volume

📘 \ Pro Tip:\ Stay flexible — it may be a sideways trap if no breakout happens in the first 45 mins.

\ \ 📉 GAP-DOWN OPENING (Below 24,912):\

Gap-downs below \ Opening Support (25,012)\ could test the critical \ Buyer’s Support for Sideways Zone – 24,852 to 24,905\ . This is a make-or-break area for the bulls.

✅ \ Plan of Action:\

• Observe price behavior near 24,852

• Reversal from here offers intraday long opportunity

• Breakdown confirms bearish pressure

🎯 \ Trade Setup:\

– Long near 24,852 (if bullish candle forms)

– Short below 24,852 (breakdown scenario)

– Target: 24,780 / 24,720

– SL: Above 25,012 for shorts, below 24,830 for longs

📘 \ Pro Tip:\ This is where "smart money" often plays — watch candle structure, not emotions.

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ \ 1. Avoid buying options near expiry without confirmation; theta will eat premiums fast.\

✅ \ 2. Use spreads (like bull call or bear put) in choppy markets.\

✅ \ 3. Always use Stop Loss based on structure — not emotions or PnL.\

✅ \ 4. Keep risk per trade below 2% of capital.\

✅ \ 5. Use 15-min chart candle closing to exit on SL breach.\

---

\ 📌 SUMMARY – LEVELS TO MONITOR:\

🟥 \ Last Intraday Resistance:\ 25,248

🟧 \ Opening Resistance/Support:\ 25,128 – 25,158

🟩 \ Opening Support:\ 25,012

🟦 \ Sideways Support Zone:\ 24,852 – 24,905

🟫 \ Breakdown Confirmation Target:\ Below 24,852 → 24,780

---

\ 🎯 CONCLUSION:\

• 🔼 \ Bullish Bias:\ Only above 25,248 with strength

• ⏸️ \ Sideways Bias:\ 25,012–25,128 — avoid unless breakout confirmed

• 🔽 \ Bearish Bias:\ Below 25,012 → Eyes on 24,852

\ ⚖️ Discipline + Risk Management > Prediction!\ Stay aligned with price structure and manage your capital smartly. 💰🧠📉

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This analysis is purely educational and intended to assist in structured thinking. Please consult your financial advisor before acting on any trading decisions. Always apply strict stop-loss and position sizing.

NIFTY : Trade plan and level for 24-Jun-25

\ 📈 NIFTY 50 TRADING PLAN – 24-Jun-2025\

📍 \ Previous Close:\ 24,958.20

📏 \ Gap Threshold:\ 100+ points

🕒 \ Chart Timeframe:\ 15-min

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,087):\

If Nifty opens above the \ Opening Resistance at 25,087\ , it would enter the red zone labeled \ Profit Booking / Consolidation Zone :: 25,204 – 25,243\ .

✅ \ Plan of Action:\

• Wait for 15–30 minutes to check if the price sustains above 25,087.

• If the price shows strength and crosses 25,204, it can trigger a short-term bullish move up to 25,243+.

• However, if the index shows a reversal in the red zone, profit booking may trigger a pullback to 25,087.

🎯 \ Trade Setup:\

– Buy on breakout + sustain above 25,204

– Target: 25,243–25,275

– SL: 25,080

– OR wait to short near 25,243 if reversal pattern forms

📘 \ Pro Tip:\ Avoid aggressive longs in the consolidation zone. Better to trade with breakout confirmations.

\ \ 📘 FLAT OPENING (Between 24,980 – 25,087):\

A flat opening puts Nifty in a narrow decision zone between \ Opening Resistance (25,087)\ and \ Opening Support/Resistance flip zone (24,980)\ .

✅ \ Plan of Action:\

• Avoid trading inside this range initially as volatility traps are common.

• A breakout above 25,087 = bullish continuation.

• Breakdown below 24,980 = early signs of weakness toward lower support levels.

🎯 \ Trade Setup:\

– Buy above 25,087 with volume

– Sell below 24,980 only if price sustains

– SL: 15–25 pts depending on entry type

📘 \ Pro Tip:\ Do not anticipate the breakout or breakdown—wait for confirmation and volume spikes to participate.

\ \ 📉 GAP-DOWN OPENING (Below 24,873):\

A gap-down below \ Opening Support (24,873)\ pushes Nifty into weaker terrain. The next reliable demand zone is the \ Last Important Intraday Support: 24,728–24,768\ .

✅ \ Plan of Action:\

• Look for price behavior near 24,728–24,768.

• If this zone holds, expect a bounce back toward 24,873

• If it breaks, downside may extend to \ Support for Consolidation / Sideways at 24,662\

🎯 \ Trade Setup:\

– Sell on breakdown below 24,728

– SL: 24,775

– Buy only if strong bullish reversal pattern forms around 24,728

📘 \ Pro Tip:\ Gap-down trades are riskier—patience pays. Avoid trading the first candle. Let sentiment unfold.

---

\ 💡 OPTIONS RISK MANAGEMENT TIPS:\

✅ \ 1. Avoid buying options inside tight ranges or sideways zones\

✅ \ 2. Use spreads (like Bull Call or Bear Put) when IV is high or near resistance zones\

✅ \ 3. Exit positions on major reversal signals or key levels break\

✅ \ 4. Always use stop-losses and pre-defined capital exposure per trade\

✅ \ 5. Don't overtrade on volatile days. Sit out if unclear!\

---

\ 📌 SUMMARY – KEY LEVELS FOR 24-Jun-2025:\

🔺 \ Profit Booking Zone:\ 25,204 – 25,243

🟥 \ Opening Resistance:\ 25,087

🟧 \ Opening Support/Resistance Flip:\ 24,980

🟨 \ Opening Support:\ 24,873

🟩 \ Key Intraday Support:\ 24,728 – 24,768

🟦 \ Lower Demand Zone:\ 24,662

---

\ 📚 CONCLUSION:\

• 🔼 \ Above 25,204:\ Bulls may extend to 25,243+

• ⏸ \ Between 24,980–25,087:\ Volatile – wait for clarity

• 🔽 \ Below 24,873:\ Bearish tone, support at 24,728

Patience and precision are more valuable than prediction. Wait for confirmation, and always protect your capital. 🎯📉📈

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is prepared purely for educational purposes. Please consult your financial advisor before taking any trades based on this information. Trade responsibly and with proper risk management.

NIFTY - range breakout possible nowThis breakout is possible because of ceasefire possibility & crude price fall.

25,230 if breaks we enter bullish territory.

As per 15 mins chart 25070 could have acted as resistance. Next is 25,222.

After 25070 crosses, as gapup (high probability) 25,222 is possible.

We need to see how candles are forming.

If each candle making only making only higher close than previous we need stay in trade.

Also today there is SENSEX expiry.

So.. need be aware of it.

Can NIFTY reach 26000? It's a question that requires careful thought, hitting that sweet spot between straightforward and complex.

The Indian equity market has been a story of resilience and growth, with the NIFTY 50 consistently scaling new peaks. The current buzz among investors and analysts is whether this upward trajectory can carry the benchmark index to the 26,000 mark.

While it's impossible to predict market movements with absolute certainty, a confluence of favorable factors suggests that NIFTY 26,000 is indeed a plausible, if not probable, milestone in the near to medium term.

Driving Forces Behind the Potential Rally:

S trong Economic Fundamentals : India continues to be a global bright spot, with various reports, including those from the OECD and World Bank, projecting it as the fastest-growing major economy in 2025 and 2026, with GDP growth rates estimated to be around 6.3-6.4%. This strong macroeconomic backdrop provides a fertile ground for corporate earnings growth.

Robust Corporate Earnings: Sustained earnings growth is the bedrock of any market rally. Analysts anticipate healthy earnings performance across various sectors, which will provide the fundamental validation for higher index levels. Sectors like financials, insurance, and telecom are showing resilience and are expected to contribute significantly.

Supportive Monetary Policy: The Reserve Bank of India (RBI) is expected to maintain an accommodative stance, with potential for further interest rate cuts. Lower borrowing costs can spur economic activity, boost consumption, and enhance corporate profitability, all of which are positive for the stock market.

Increasing Domestic Participation: The growing awareness and participation of Indian retail investors through Systematic Investment Plans (SIPs) have acted as a strong counter-balance to foreign institutional investor (FII) outflows. This sustained domestic liquidity provides a solid floor to the market and fuels its upward movement.

Government Initiatives and Capital Expenditure: Government focus on infrastructure development and structural reforms are expected to continue driving economic growth and creating opportunities for various industries, further boosting corporate performance.

Despite the optimistic outlook, the path to 26,000 may not be without its bumps. Global trade tensions, commodity price volatility, and any unexpected shifts in monetary policy globally could introduce short-term corrections. Furthermore, valuations, while considered reasonable by some, might still be elevated in certain segments, necessitating selective stock-picking.

In Conclusion:

The journey to NIFTY 26,000 appears to be driven by a powerful combination of India's resilient economic growth, improving corporate earnings, supportive domestic policies, and increasing investor confidence. While market volatility is an inherent part of investing, the fundamental strengths of the Indian economy make NIFTY 26,000 a very realistic and exciting prospect for investors looking at the Indian market horizon.