Nifty 50 Consolidation Zone – Ready to Explode?Here's a **brief high-level analysis** of the **Nifty 50 Index (15-min chart)**:

---

## 📊 **Nifty 50 – Consolidation & Breakout Setup**

* 🧱 **Structure**: Sideways consolidation in a **190-point range**

* 🔍 **Zones**:

* **Resistance**: ₹24,890

* **Support**: ₹24,700.00

* ⚡ **Breakout Watch**: Price approaching upper range

* 🕵️♂️ **Volume**: Spikes on breakout attempts hinting smart money interest

---

### 📌 **Scenarios to Track**

* ✅ **Bullish breakout above** ₹24,891 could lead to a **target of ₹25,070+**

* ❌ **Failure below** ₹24,700 may retest **₹24,488 support**

---

📌 *Ideal for intraday scalping or tight stop swing plays. Wait for volume confirmation on breakout.*

Niftylevels

NIFTY : Trading levels and Plan for 29-May-2025📘 NIFTY 50 – TRADING PLAN for 29-May-2025

📈 Based on 15-min structure and key zones

📍 Gap Opening Threshold: 100+ points from previous close of 24,757

🔼 GAP-UP OPENING (Above 24,857):

If Nifty opens above 24,857+, it will open above the current Opening Resistance Zone: 24,748 – 24,786 , creating early bullish momentum.

✅ Plan of Action:

• Let the price settle in the first 15–30 mins. Avoid chasing green candles in the first 5 mins.

• If Nifty sustains above 24,891 (Opening Resistance), bullish momentum is confirmed. You may initiate long trades (Call options or Futures) with targets at 24,997 (Last Intraday Resistance) and trail SL at 24,891 .

• Once price reaches 24,997, partial profit booking is advised, as it’s a strong resistance zone.

• In case of a sharp pullback toward the 24,748–24,786 zone, observe for bullish reversal patterns (hammer, engulfing) before considering re-entry.

• A failure to sustain above 24,891 followed by bearish price action may lead to a trap. Wait for confirmation before going short.

🧠 Educational Tip: A gap-up followed by sideways movement or rejection at resistance often leads to profit-booking. Be cautious if momentum fades quickly.

⚖️ FLAT OPENING (Between 24,748 – 24,786):

This is a tricky Opening Support-Resistance Zone , often referred to as the "No Trading Zone" due to choppy price action.

✅ Plan of Action:

• Stay out initially – wait for either a breakout above 24,786 or a breakdown below 24,748 to take a directional trade.

• A 15-min candle close above 24,786 with volume confirmation can lead to upward momentum targeting 24,891 → 24,997 .

• If Nifty breaks and sustains below 24,748 , consider short trades toward 24,702 → 24,667 .

• Avoid overtrading in this zone; wait for clean structure and direction. Sideways zones are premium killers in options.

🧠 Educational Tip: Price often consolidates near open when inside a resistance-support overlap. Don't anticipate the move — participate only when confirmation arrives.

🔽 GAP-DOWN OPENING (Below 24,657):

If Nifty opens more than 100 points lower (below 24,657), it opens near the Opening Support Zone: 24,667 – 24,702 or possibly close to Last Intraday Support: 24,592 .

✅ Plan of Action:

• Observe early reactions around 24,592 . If this level holds and bullish reversal patterns emerge, you can go long for an intraday bounce toward 24,702+ with a tight SL below 24,592.

• If Nifty breaks 24,592 and sustains below on 15-min candle close, you may initiate Put trades or shorts, targeting 24,391 → 24,326 (Important Buyer’s Support).

• Be cautious near 24,391–24,326 zone — sharp reversals often occur there as it’s a critical demand zone.

• Avoid emotional shorting just because of gap-down; confirm weakness through patterns like breakdown and retest.

🧠 Educational Tip: Many retail traders short gap-downs only to be trapped in V-shape recoveries. Patience and pattern confirmation matter more than the gap itself.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

📌 Always follow 15-min candle close SLs for directional confirmation.

📌 Use spread strategies like Bull Call/Bear Put spreads on high IV days to limit risk.

📌 Avoid trades inside overlapping zones like 24,748 – 24,786 unless a breakout/breakdown occurs.

📌 Stick to maximum 1–2 trades a day. Avoid overtrading due to boredom or FOMO.

📌 Define your Risk:Reward ≥ 1:2 before entering any trade.

📌 Don’t average losing positions. Respect your stop-loss.

📌 Protect profits using trailing SL once targets start hitting.

📊 SUMMARY & CONCLUSION:

• 🟢 Bullish Above: 24,891 → Targets: 24,997

• 🔴 Bearish Below: 24,592 → Targets: 24,391 / 24,326

• 🟧 Opening Support-Resistance Zone: 24,748 – 24,786

• 🟩 Support Zone: 24,667 – 24,702

• 🟥 Last Intraday Support: 24,592

• 💚 Strong Buyer's Zone: 24,391 – 24,326

✨ Key Rule: Follow the flow — don’t predict it. Let price tell you what it wants to do and then ride the wave.

📢 DISCLAIMER: I am not a SEBI-registered analyst. This plan is shared purely for educational purposes. Please consult a certified financial advisor before making any trading or investment decisions. Trade at your own risk. 💼📉📈

Nifty chart for 29th May 2025Looks like Nifty is forming a triangle pattern.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets.

NIFTY : Trading levels and Plan for 28-May-2025📘 NIFTY TRADING PLAN – 28 MAY 2025

🕰 Based on 15-min price structure & support/resistance zones

📍 Gap opening considered when price opens 100+ points above or below the previous close (24,837)

🔼 GAP-UP Opening (Above 24,937 – 100+ points):

If Nifty opens above 24,937+ , it enters the zone between Last Intraday Resistance (25,000) and moves toward the Profit Booking Zone (25,285 – 25,347) .

✅ Plan of Action:

• Avoid aggressive entries in the first 15–30 minutes. Let price action settle and confirm sustainability.

• A 15-min candle close above 25,165 with strong volume may signal a breakout toward the Profit Booking Zone at 25,285–25,347 .

• Pullbacks near 25,000–25,165 acting as a new support can offer good CE entries for continuation.

• However, if Nifty shows reversal signs (bearish engulfing or shooting star) near the Profit Booking Zone, traders may consider light PE positions for a possible retracement.

🧠 Educational Insight: Gap-ups into major resistance should never be chased blindly. Let the market confirm whether bulls have the strength to sustain or not.

⚖️ FLAT Opening (Between 24,701 – 24,937):

This zone is where Nifty opens near the Opening Resistance (24,837–24,861) or Opening Support Zone (24,666–24,701) .

✅ Plan of Action:

• Mark this range as the NO TRADE ZONE initially. Wait for a breakout above 24,937 or breakdown below 24,666 before taking directional trades.

• If Nifty sustains above 24,861 with strong green candles, you may initiate CE positions with targets of 25,000 – 25,165 .

• A breakdown below 24,666 with rejection at retest opens PE opportunities toward 24,594 and lower.

• If the market stays sideways between 24,701–24,861 , stay on the sidelines. Avoid theta decay traps in options.

🧠 Educational Insight: In sideways zones, wait for price confirmation instead of anticipation. Let price break levels and retest for high-probability trades.

🔽 GAP-DOWN Opening (Below 24,737 – 100+ points):

In this case, Nifty opens below Opening Support Zone (24,666–24,701) or even the Last Intraday Support (24,594) .

✅ Plan of Action:

• If price finds support near 24,594 and shows bullish reversal signs (hammer, bullish engulfing), a bounce toward 24,701+ is possible.

• Breakdown and a 15-min close below 24,594 will likely take Nifty toward the Buyer’s Important Support Zone (24,326 – 24,391) .

• Use PE options if 24,594 breaks decisively and price fails to reclaim it on a retest.

• For aggressive traders, any retest of 24,666–24,701 acting as resistance can provide a PE entry with tight SL.

🧠 Educational Insight: Gap-downs into support zones often trap sellers if support holds. Watch for exhaustion or follow-through before deciding direction.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

📌 Use 15-min candle close SL to avoid emotional exits.

📌 Avoid overtrading. Stick to 1–2 high-quality trades only.

📌 Avoid buying options right after the open – let premiums stabilize.

📌 Always calculate Risk:Reward Ratio before placing a trade.

📌 Don’t trade inside the noise zone (24,701–24,861); wait for levels to be breached.

📌 Use spreads (Bull Call / Bear Put) if volatility is high.

📊 SUMMARY & CONCLUSION:

• 🔼 Bullish Breakout Zone: Above 25,165 → Target: 25,285 / 25,347

• 🔽 Bearish Breakdown Zone: Below 24,594 → Target: 24,391 / 24,326

• 🟧 No Trade Zone: 24,701 – 24,861

• 🟩 Opening Support Zone: 24,666 – 24,701

• 🟥 Profit Booking Resistance Zone: 25,285 – 25,347

📌 Wait for price structure to confirm direction. Use patience and discipline – not emotions. Great setups reward prepared traders.

📢 DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is purely for educational purposes. Please consult your financial advisor before taking any investment decisions. Trade wisely and protect your capital. 💼📈📉

Nifty analysis for 28th May 2025Looks like Nifty is forming an inverse head and shoulders pattern.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets.

NIFTY : Trading levels and Plan for 27-May-2025📈 Nifty 50 Trading Plan – 27 May 2025

🔍 Chart Structure Analysis with Strategic Plan of Action

GAP-UP Opening (Above 25,076 – 100+ points):

If Nifty opens with a strong gap-up above 25,076 , we are stepping into the Opening Resistance zone , heading towards the Last Intraday Resistance at 25,195 and even towards 25,294 – Resistance for sideways price action .

✅ Plan of Action:

• Avoid early entries in the first 15-30 mins to let volatility settle.

• If price sustains above 25,195 on a 15-min candle close, potential momentum may push it to 25,294+ .

• Option buyers may consider buying CEs with tight SL below 25,076 on a retest for a favorable risk-reward.

• If price shows rejection from 25,195–25,294, watch for reversal patterns to scalp PEs with SL above 25,294 .

🧠 Education Tip: Gaps often trap retailers. Confirmation is key! Avoid aggressive trades at resistance without a proper base.

FLAT Opening (Between 25,007 – 25,076):

A flat start means price is within the NO TRADE ZONE (25,007–25,076). This zone offers low conviction as both bulls and bears wait for direction.

✅ Plan of Action:

• Wait and watch. Don’t force trades here.

• Trade only on clean breakout above 25,076 or breakdown below 25,007 with good volume .

• Avoid options buying here, theta decay will kill premiums.

• Look for directional breakouts post 10:00 AM for clarity.

🧠 Education Tip: No Trade Zone exists to protect your capital. Preserve energy for high-probability setups.

GAP-DOWN Opening (Below 24,877 – 100+ points):

A strong gap-down below 24,877 would take price into a decisive Buyer's Support Zone (24,877 – 24,791) or even to last intraday support at 24,790 .

✅ Plan of Action:

• If price holds above 24,790 – 24,877 zone , intraday pullback likely. Watch for reversal signals to scalp CEs with tight SL below 24,790 .

• Breakdown below 24,790 with volume may trigger further downside. Can aim for lower supports.

• Avoid chasing puts after a gap down—wait for a retest or consolidation before entry.

🧠 Education Tip: Buyer zones often act as magnets for smart money entries. Respect structure before shorting blindly.

💡 Options Trading Risk Management Tips:

• Use stop losses on candle-close basis and avoid mental SLs.

• Never buy options when premiums are inflated post-gap moves without confirmation.

• Use spreads (e.g., Bull Call or Bear Put spreads) on volatile days to reduce premium decay.

• Avoid over-leveraging—stick to 1–2 trades with proper planning.

• Hedge if you’re carrying positions overnight.

📊 Summary & Conclusion:

• 🔸 No Trade Zone: 25,007 – 25,076 (Avoid initiating fresh trades here).

• 🔼 Bullish breakout levels: Above 25,076 → Target 25,195 / 25,294

• 🔽 Bearish breakdown levels: Below 24,790 → Possible downside pressure.

• 💚 Buyer's Zone Support: 24,877 – 24,791

🔔 Remember: The market does not reward speed but precision and patience. Focus on execution based on structure and not emotions.

📌 Disclaimer: I am not a SEBI-registered analyst. The information provided is for educational purposes only. Please do your own analysis or consult your financial advisor before taking any trade. Trade safe and smart! 💼📉📈

Nifty analysis for 26th May 2025Looks like Nifty has formed an inverse head and shoulders pattern and it already broke the pattern moving upside.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets.

Nifty50 Intraday Setup – BO Above 24,905 or BD Below 24820Technical analysis of Nifty for 26th May - Summary with both breakout and breakdown scenarios

---

### 📊 **Nifty 50 (15-Min Chart) – Flag & Pole Pattern Analysis**

**Pattern**: Bullish Flag & Pole

**Pole Height**: \~442 pts

**Flag Range**: ₹24,820 – ₹24,905

---

### ✅ **Scenario 1: Breakout**

* **Breakout Above**: ₹24,905

* **Target**: ₹24,991

* **Stop Loss**: ₹24,905

* **Comment**: Valid **flag & pole continuation** only if price sustains above ₹24,905 with volume.

---

### ❌ **Scenario 2: Breakdown**

* **Breakdown Below**: ₹24,820

* **Target**: ₹24,735

* **Stop Loss**: ₹24,820

* **Comment**: Failure to hold the flag’s lower range can trigger a short-term **bearish move**.

---

📌 **Note**: Wait for **a decisive candle close** and **volume confirmation** above or below key levels before taking a position.

---

Nifty 50 Technical Analysis - May 23, 2025Nifty 50 Technical Analysis - May 23, 2025

Current Market Overview:

Closing Price: The Nifty 50 closed at 24,637, Down 203 points.

Day Range: Low: 24,500.00 | High: 25,000.00

Market Sentiment: The market exhibited strong bullish momentum, driven by positive global cues, including a ceasefire between India and Pakistan and optimism around US-China trade negotiations

Chart for your reference

NIFTY : Trading levels and plan for 23-May-2025📊 Nifty Trading Plan – 23-May-2025

Chart Timeframe: 15 Min | Reference Spot Price: 24,637

Gap Opening Threshold: 100+ Points

🚀 Gap-Up Opening (100+ Points Above Previous Close)

If Nifty opens above 24,737 (i.e., 100+ points higher), it will directly enter the critical Opening Resistance Zone: 24,761 – 24,790 .

🟥 This zone has historically shown supply pressure, and a direct gap-up into it might lead to either a quick rejection or consolidation.

✅ Plan of Action:

– Avoid immediate long trades at open if price opens inside this zone.

– Wait for a 15-min candle to close above 24,790 to confirm bullish strength. If successful, Nifty could aim for 24,974, the last intraday resistance.

– If a bearish rejection pattern forms (like an inverted hammer or bearish engulfing) in this zone, consider a sell-on-rise setup targeting a retest of 24,648 and possibly down to 24,577.

– Ideal stop loss for shorts: Above 24,800–24,810.

🎓 Educational Insight: Gap-ups into resistance zones often trap breakout traders. Patience is key—let price confirm before acting.

📈 Flat Opening (within ±100 Points from Previous Close)

If Nifty opens between 24,537 – 24,737, it will be inside the indecisive zone between support and resistance.

🟧 This is often a low-conviction zone where both buyers and sellers test each other, causing choppy price action in the initial 30 minutes.

✅ Plan of Action:

– Avoid trading in the very first 15–30 minutes; let the market provide direction.

– If price holds above 24,648 and breaks out of 24,761, it can extend toward 24,790, and possibly test 24,974.

– If price fails to hold 24,577 and slips below 24,521, expect downside toward 24,196, the major support zone.

– Inside this range, prefer to trade only on confirmed breakouts or breakdowns with volume support.

🎓 Educational Insight: In flat openings, fakeouts are common. Let breakout candles be confirmed with size and volume.

📉 Gap-Down Opening (100+ Points Below Previous Close)

If Nifty opens below 24,537 (i.e., near 24,500 or lower), it will be close to the strong Opening Support Zone: 24,521 – 24,577 .

🟩 This zone has previously acted as a demand area and could attract buyers trying to play a reversal.

✅ Plan of Action:

– Observe price behavior near 24,521.

– If bullish reversal patterns emerge (e.g., hammer, bullish engulfing), and Nifty holds above this zone, consider long trade setups targeting a move back to 24,648 and potentially 24,761.

– If Nifty breaks down with a 15-min close below 24,521, sellers may gain control. Look for a further decline to 24,196, the last strong support.

– Ideal stop loss for longs: Below 24,500.

– Ideal stop loss for breakdown shorts: Above 24,540.

🎓 Educational Insight: Don't blindly buy into support zones—watch for confirmation candles to avoid catching a falling knife.

🛡️ Options Trading – Risk Management Tips

✅ Trade with a predefined stop-loss based on spot levels, not just option premiums.

✅ Use ATM or slightly ITM options to minimize time decay and benefit from delta movement.

✅ Avoid buying OTM options at open, especially on flat or range-bound days .

✅ Don’t trade in No Trade Zones (24,577 – 24,648) unless a clear breakout/breakdown happens.

✅ Book partial profits and trail SL once your trade starts working.

✅ Never overleverage —risk only 1–2% of your capital per trade.

✅ Take a break after 2 stop-losses ; overtrading reduces clarity and increases risk.

📌 Summary & Conclusion

🔹 Opening Resistance Zone: 24,761 – 24,790

🔹 Last Resistance: 24,974

🔹 Opening Support / Resistance Mid-Zone: 24,648

🔹 Support Zone: 24,577 – 24,521

🔹 Last Support: 24,196

🕒 First 15–30 mins are crucial . Let price action unfold before executing any trade.

🎯 Only enter trades after confirmation candles near key zones .

⚖️ Risk-to-reward setups are best near edges of the support/resistance levels , not in the middle zone.

📈 Trend confirmation + volume + candlestick patterns = High Probability Setup .

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is shared for educational and informational purposes only. Always consult with a registered financial advisor before taking any investment or trading decisions.

Breakout Building Up from Falling Wedge PatternIndex: Nifty 50

Timeframe: 15-minute

Date: 21st May 2025

Price Action Insight

After a strong sell-off, NIFTY 50 formed a solid V-shaped recovery, followed by a series of higher lows, indicating a shift in momentum from sellers to buyers. Price is now consolidating near a key resistance level at 24,839.35, suggesting a potential breakout or rejection setup.

Chart Patterns in Focus

Falling Wedge (Bullish Reversal)

Breakout occurred after price compressed into the wedge.

A textbook reversal pattern signaling buying interest returning.

Bullish Flag / Pennant Formation

Post-wedge breakout, price is consolidating in a narrow range (flag).

Typically seen as a continuation pattern before another bullish leg.

Trendline Support

Price is holding above an ascending trendline, forming higher lows, reinforcing bullish bias.

Volume Analysis

Volume spiked during the wedge breakout – confirming buyer participation.

Current consolidation shows declining volume, indicating a possible volume expansion ahead.

Watch for a volume surge during breakout or breakdown for trade confirmation.

Educational Insight: How to Read This Setup

Why this matters for traders:

A falling wedge + bullish flag is a high-conviction combo.

Volume contraction during consolidation is healthy and often precedes explosive moves.

Price rejecting or sustaining above resistance gives traders directional edge.

Always wait for confirmation with price action + volume to avoid fakeouts.

Trade Scenarios

✅ Bullish Scenario (Long Trade)

Entry: Above 24,839.35

Target Zones: 24,900 / 24,950

Stop-Loss: Below 24,740.80 (below consolidation and trendline support)

Confirmation: Breakout candle with above-average volume

❌ Bearish Scenario (Short Trade)

Entry: Below 24,740.80

Target Zones: 24,650 / 24,580

Stop-Loss: Above 24,839.35

Confirmation: Breakdown from trendline support + rise in selling volume

NIFTY : Trading levels and Plan for 22-May-2025📊 Nifty Trading Plan – 22-May-2025

Chart Timeframe: 15 Min | Reference Price: 24,800

Gap Opening Threshold: 100+ points

🚀 Gap-Up Opening (100+ Points Above Previous Close)

If Nifty opens above 24,900+, the price is likely to open directly inside or just below the Opening Resistance Zone: 24,889 – 24,904 .

🟥 This is a supply area and could trigger initial selling if price shows signs of rejection (wicked candles, indecision). Traders must avoid chasing longs on open and instead wait for either a breakout or rejection.

✅ If price sustains above 24,904 with a strong bullish candle close (preferably 15min or 1hr), you can initiate long trades targeting the Intraday Resistance Zone: 24,974 – 25,021 . If momentum continues, watch for a potential rally toward 25,136.

🔄 On the flip side, if the opening is followed by sharp rejection at 24,904 and the price falls back below 24,860, it may signal a failed breakout and can be a shorting opportunity back toward 24,800 and even the support zone at 24,738–24,718.

🎯 Plan of Action:

– Avoid impulsive longs at open.

– Long only on candle close above 24,904.

– Short if strong rejection appears and price falls below 24,860.

📈 Flat Opening (within ±100 Points)

If Nifty opens around 24,750 – 24,850, the price will be stuck between a crucial resistance (24,889–24,904) and support (24,738–24,718).

🟨 The initial price action will be range-bound. Let the market settle in the first 15–30 minutes and observe whether it breaks the upper resistance or support zones .

🟢 If price climbs and breaks 24,904 with a bullish confirmation candle, it opens the path to move higher toward 24,974 – 25,021, and eventually 25,136.

🟠 Conversely, if the price starts slipping below 24,718, and especially below 24,670.90 (last intraday support), sellers could gain control and drag the price toward the major demand zone 24,475 – 24,521 (Buyer's Support Zone).

🎯 Plan of Action:

– Wait for breakout from either 24,904 or breakdown below 24,718.

– Long trade setup above 24,904 with SL below breakout candle.

– Short setup below 24,718 with SL above breakdown candle.

📉 Gap-Down Opening (100+ Points Below Previous Close)

If Nifty opens around 24,650 or lower, it is opening directly near the Last Intraday Support: 24,670.90 .

🟦 This support can trigger a bounce if defended, and could present a quick long trade back toward 24,718 – 24,738 , possibly even 24,800 if momentum sustains.

🔻 However, if the price fails to hold this support and breaks below 24,670.90 early in the session, bears could take it down to the Buyer's Support Zone: 24,475 – 24,521 .

📌 Watch this green zone for possible bottom-fishing or reversal setups, especially if there’s a bullish reversal candle with volume. Otherwise, a clean breakdown below 24,475 could extend selling pressure further.

🎯 Plan of Action:

– If support holds → Buy on bullish reversal with tight SL.

– If breakdown below 24,670 → Short with target 24,475 zone.

– Below 24,475 → Avoid bottom fishing unless confirmed reversal.

🛡️ Risk Management Tips for Options Traders

✅ Avoid buying deep OTM options at the open; they lose premium fast if the move doesn't come immediately.

✅ Position sizing is key —never risk more than 1–2% of your capital on a single trade.

✅ Use Stop Loss based on spot level breakout/failure , not on premium value.

✅ Don't average losing trades. Wait for structure re-entry if SL hits.

✅ Trail your profits if in the green—book partials or move SL to cost to protect gains.

✅ Avoid trading first 15 minutes unless you're experienced in handling volatility.

📌 Summary & Conclusion

– Opening Resistance: 24,889 – 24,904

– Intraday Resistance: 24,974 – 25,021 | Final Target: 25,136

– Opening Support: 24,718 – 24,738 | Last Intraday Support: 24,670.90

– Major Buyer’s Support: 24,475 – 24,521

🎯 Key Idea: Trade the reaction at zones, not the prediction. Let the price action confirm your bias. Don’t rush into positions at the open—wait for confirmation to improve your risk-reward ratio.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is shared for educational and informational purposes only. Please consult your financial advisor before making any investment or trading decisions.

NIFTY : Trading Levels and Plan for 21-May-2025📅 NIFTY Trading Plan – 21st May 2025

🕘 Timeframe: 15-Minute | 🧠 Approach: Structure + Reaction Zones + Momentum Psychology

📊 Key Price Zones to Watch:

🔴 Last Intraday Resistance: 24,911

🔺 Breakout Resistance: 25,019

🟠 Opening Resistance: 24,818

🟢 Opening Support: 24,627

🟩 Buyer’s Demand Zone: 24,415 – 24,432

🧱 Critical Demand Base: 24,323

📈 Scenario 1: GAP UP Opening (🔼 100+ points) – Opening Above 24,818

If Nifty opens directly above the Opening Resistance of 24,818 due to a bullish gap-up, it enters a low-volume zone that could push prices toward 24,911 and even 25,019 .

Do NOT chase long entries blindly post gap-up. First 15–30 minutes will decide the strength of bulls.

If a strong 15-minute candle closes above 24,911 , a potential breakout to 25,019 may play out.

Only enter long trades if price holds above 24,911 with good volume.

If price faces rejection at 24,911 , short-term reversal trades back to 24,818 → 24,750 are possible.

Avoid overtrading above 25,019 ; it’s uncharted territory and momentum may fade quickly.

📌 Educational Note: Gap-ups often trap emotional buyers. Look for signs of sustainability before entering. If candles show exhaustion or long upper wicks, it's a red flag.

⚖️ Scenario 2: FLAT Opening (±100 points) – Between 24,627 to 24,818

A flat opening gives both bulls and bears room to maneuver, making it the most flexible condition to work with structure-based plans.

If price sustains above 24,750–24,760 (the pivot area), buyers may push toward 24,818 → 24,911 .

Clear bullish strength beyond 24,911 can target 25,019 , but only after volume confirmation.

On the flip side, if price breaks below 24,627 , short trades toward the Demand Zone: 24,415–24,432 become active.

Wait for bearish structure (e.g., breakdown + retest rejection) to confirm shorts.

Use the opening 15-minute candle high/low as your first trigger range for bias.

📌 Educational Note: Flat opens are all about who dominates first. Let the market decide. Don’t be early; price action is your teacher — not your ego.

📉 Scenario 3: GAP DOWN Opening (🔽 100+ points) – Opening Below 24,627

A gap-down opens doors to panic-selling but also offers opportunity if the demand zone absorbs pressure.

If price opens around 24,550–24,600 and forms a base, a bounce toward 24,627 → 24,750 is highly probable.

However, if price immediately slides into 24,415–24,432 (buyer zone), watch for reversal patterns like hammer, bullish engulfing, or double bottom.

If breakdown occurs below 24,415 , then 24,323 becomes the final lifeline. A close below this may trigger sharp intraday sell-offs.

Only short if 15-min candle closes below 24,415 and fails retest.

📌 Educational Note: Panic gaps test emotional discipline. Don't assume rebounds—wait for confirmation. It's okay to miss the first move and catch the trend later.

🛡️ Options Trading – Risk Management Tips:

✅ Avoid Far OTM Buying: Unless you see trending moves, far OTM options will decay quickly.

✅ Use Defined-Risk Spreads: Prefer Bull Call or Bear Put Spreads on breakout/breakdown confirmations.

✅ Keep SL Fixed in % Terms: Suggested: 30–40% SL of premium for option buyers.

✅ Use the Opening Candle High/Low: As SL reference for naked option positions.

✅ Avoid Overnight Carry: Especially for naked options—risk can be unlimited.

✅ Reassess After 2 Failed Trades: Market might be rangebound or volatile beyond logic.

📌 Summary & Conclusion:

🔼 Above 24,911: Momentum bullish → Target 25,019

🔄 Between 24,627 – 24,818: Neutral zone → Let structure form

🔽 Below 24,627: Weakness → Test of 24,432 → 24,323 possible

📌 Core Principle: Let the market confirm your bias. Be a sniper, not a machine gunner. Clear structure = clear edge.

📢 Disclaimer:

I am not a SEBI-registered analyst . This content is purely for educational and informational purposes [/b

NIFTY : Trading levels and Plan for 20-May-2025📅 NIFTY Trading Plan – 20th May 2025

🕒 Timeframe: 15-Minute | 🎯 Strategy Focus: Price Reaction Zones + Structure-Based Trading + Psychological Triggers

📌 Key Zones to Watch:

🔴 Resistance Zone: 25,081 – 25,101

🟠 Opening Pivot Zone: 24,960 – 24,980

🟦 Initial Support/Resistance: 24,862 – 24,878

🟢 Last Intraday Support: 24,732

🟢 Final Breakdown Support: 24,623

🔺 Last Intraday Resistance: 25,239

📈 Scenario 1: GAP UP Opening (🔺 100+ points) – Opening Above 25,050

If Nifty opens with a strong gap-up directly into or above the resistance zone 25,081 – 25,101 , it enters a supply zone from where reversals have occurred in the past.

Avoid rushing into long trades immediately after a gap-up.

Wait for a 15-minute candle close above 25,101 with strong follow-up buying volume to confirm breakout strength.

On confirmation, expect targets toward 25,180 → 25,239 (last intraday resistance) .

However, if price gets rejected from the resistance zone with upper wicks or bearish engulfing candles, then short trades toward 24,980 → 24,960 become favorable.

A failed breakout from this level often leads to a short-trap liquidation move.

📌 Educational Note: A gap-up into resistance is a liquidity magnet. Always seek candle confirmation before acting. Momentum traders should only participate if the breakout sustains with strength.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 24,860 – 24,980

This scenario offers the most balanced opportunity to trade both sides, depending on where price moves post-opening.

If price sustains above 24,980 for 15–30 minutes, a breakout attempt toward 25,081 → 25,101 is likely.

A clear break and close above 25,101 may trigger long trades aiming for 25,180 → 25,239 .

On the downside, if price fails to hold above 24,960 and breaks below 24,878 , a slide toward 24,732 → 24,623 can unfold.

For rangebound movement, you may consider deploying neutral strategies like Iron Fly or ATM straddle with tight SLs.

📌 Educational Note: Flat opens are where the market seeks direction. Don’t trade the first candle — observe whether buyers or sellers dominate before committing capital.

📉 Scenario 3: GAP DOWN Opening (🔻 100+ points) – Opening Below 24,860

A gap-down below the initial support zone 24,862–24,878 sets a bearish tone, but it can trap emotional sellers if not confirmed.

If the price opens near 24,840–24,860 and shows early signs of holding, a short-covering move back to 24,960 is possible.

However, if price breaches below 24,732 (last intraday support) , the index could slide further toward 24,623 .

Avoid buying blindly just because it's a gap-down — instead, wait for a reversal confirmation (hammer, morning star).

Momentum traders can go short below 24,732 with SL above 24,780, targeting 24,650 – 24,623 .

📌 Educational Note: Gap-downs often trigger panic. Smart traders stay calm and react only when price gives clean structure — don’t bottom fish unless a reversal structure appears.

🛡️ Options Trading – Risk Management Tips:

✅ Respect the Premium Decay: Avoid buying far OTM options on Tuesday unless there's strong momentum confirmation.

✅ Set SL as a % of Premium: Use a 30–40% SL of premium for long option positions.

✅ Hedge Naked Options: If selling options, always hedge using defined-risk spreads.

✅ Use Time-Decaying Strategies: Calendar spreads or neutral plays work better in choppy zones.

✅ Position Sizing is Key: Don’t risk more than 1–2% of capital per trade — it protects your mental capital too.

✅ Avoid Holding Naked Positions Overnight: Carry only if hedged or directional clarity is backed by event data.

📊 Summary & Conclusion:

🔼 Above 25,101: Bullish momentum likely → Target 25,180 – 25,239

🔄 Between 24,862 – 24,980: Neutral zone → Wait for breakout or breakdown

🔽 Below 24,862: Bearish tone → Target 24,732 – 24,623 on confirmation

📌 Key Lesson: Let price confirm the move. React, don’t predict. Level-based action always wins over emotions.

📢 Disclaimer:

I am not a SEBI-registered analyst . The above content is shared purely for educational and informational purposes. Please consult your financial advisor or do your own research before taking any trades.

NIFTY : Trading levels and Plan for 19-May-2025📅 NIFTY 50 Trading Plan – 19th May 2025

⏰ Timeframe: 15-Minute | 🧠 Approach: Actionable, Risk-Reward Based, Psychological Zones

📍 Chart Key Levels:

🔸 No Trade Zone: 25,080 – 24,970

🟥 Opening Resistance: 25,081

🟧 Opening Support / Resistance: 24,970

🟩 Strong Support Zone: 24,862 – 24,805

🟥 Last Intraday Resistance: 25,136

🔺 Target/ATH Zone: 25,240 → 25,365

🟥 Breakdown Zone: Below 24,862 leads to weakness with next support at 24,629

📈 Scenario 1: GAP UP Opening (100+ Points Up) – Above 25,136 🚀

If Nifty opens with a gap-up above 25,136 , prices will already be near or inside the resistance zone. Avoid chasing trades at open.

Wait for a 15-min candle to close above 25,240 . This confirms strength and opens the way toward the ATH zone of 25,365+ .

Book profits gradually near ATH zone, and expect possible selling pressure here.

If price fails to sustain above 25,240 , avoid fresh longs and look for rejection patterns (like bearish engulfing) for quick intraday shorts back to 25,136 .

📌 Educational Note: When the market opens in a resistance zone, let it settle for the first 15–30 minutes to avoid false breakouts.

📉 Scenario 2: FLAT Opening (within 50 pts of previous close) – Inside No Trade Zone (24,970–25,080) 🔄

Opening in this range creates confusion. This zone is best avoided for fresh trades unless a breakout/breakdown is confirmed.

If price breaks above 25,081 with strong bullish momentum, you may consider a long entry targeting 25,136 → 25,240 .

If price breaks down below 24,970 , you can initiate short positions with target toward 24,862 → 24,805 .

Avoid any position inside the orange zone until one side is clearly broken.

📌 Educational Note: No Trade Zones often result in whipsaw moves – stay disciplined and wait for clean direction.

📉 Scenario 3: GAP DOWN Opening (100+ Points Down) – Below 24,862 ⚠️

If the market opens below the key support zone of 24,862 , sentiment turns bearish.

Look for follow-through selling below 24,805 to target 24,629 .

However, any bounce-back from 24,805 – 24,862 zone with volume confirmation can be used for intraday reversal trades back to 24,970 .

Wait for a proper rejection candle or bullish engulfing pattern before taking reversal long trades.

📌 Educational Note: Strong support zones can lead to high risk-reward reversal trades if combined with proper price action.

💡 Options Trading – Risk Management Tips:

🛡️ Always hedge directional positions when holding beyond intraday.

⏳ Avoid buying options when IV is high, especially after gap-ups.

💰 Use defined SLs like hourly candle closes to avoid panic exits.

📉 If trading breakout with options, consider buying near the money for better delta impact.

📊 Summary:

✅ Above 25,240 = bullish continuation zone

⚠️ 25,081 – 24,970 = No Trade Zone

🔻 Below 24,862 = Trend reversal or fresh weakness

Wait for first 15–30 min candle to confirm trade direction. Avoid emotional entries and focus on clean breakout or reversal confirmation patterns.

📢 Disclaimer:

I am not a SEBI-registered analyst . All views shared are for educational purposes only. Please do your own research or consult with a financial advisor before taking any trades.

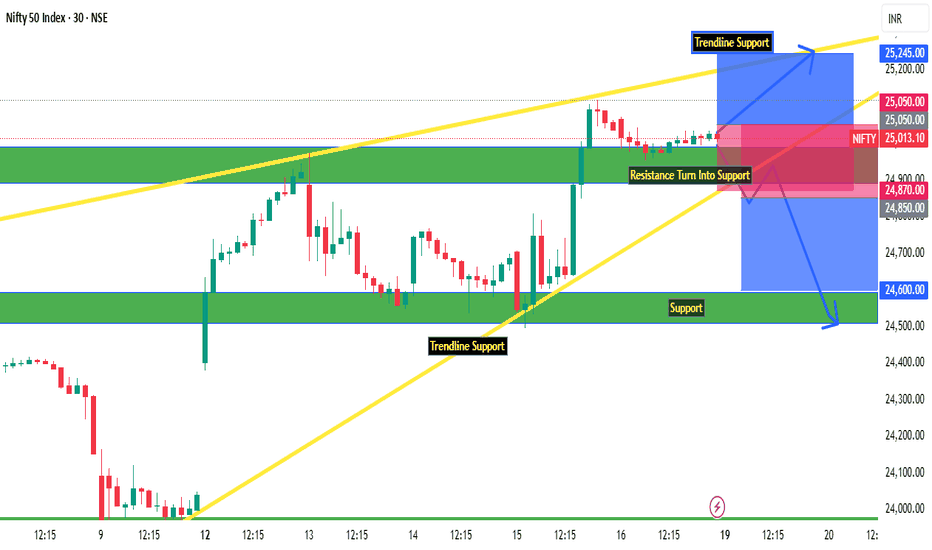

Nifty Intraday Levels : 19-May-25

Nifty Break Resistance and closed above of 25000,

Also above Trendline Support on 30 Min Timeframe.

Important zones mentioned on chart

Bearish < 25850

Bullish > 25050

Wait for Proper Rejection/Pattern :

@Support : Bullish

@Resistance : Bearish

*All views for educational purpose only

Nifty 50 Analysis and Dow theory LevelNifty 50 Analysis:

Points discussed in the video-

How we should observe structure when there is a big gap.

Importance of current gap up on major resistance.

Importance of today's closing.

Dow Theory Level:

As per Dow theory, we are heading towards trend change and uptrend will be there.

Once we are in uptrend we will be more confident while trade in "Long" side.

NIFTY : Trading levels and Plan for 16-May-2025📘 NIFTY TRADING PLAN – 16th May 2025 (15-Min Structure Based)

📍 Nifty closed at 25,035.30 on 15-May-2025. Price is currently hovering around the Opening Resistance/Support Zone (25,030 – 25,134) , which has been marked as a No Trade Zone due to potential whipsaws and lack of clear direction.

As per your rule, a Gap Opening is considered ±100 points or more from the previous close.

Let’s break down the strategy into three possible opening scenarios:

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,135)

(Gap-up of 100+ points)

If Nifty opens above 25,135 , it will start trading near the Last Intraday Resistance zone at 25,243 . This zone may act as a strong supply area initially.

Price action near 25,243 must be closely watched. If there’s rejection or failure to sustain, a quick pullback toward 25,134 – 25,030 is possible.

However, if Nifty shows strength and sustains above 25,243 on 15-min closing basis with bullish structure, fresh long entries can be considered.

Upside targets will be 25,504 and potentially 25,609 , which is the Profit Booking / Last Resistance zone for a New All-Time High .

Risk increases if you chase long trades right at open without confirmation candles.

👉 📚 Tip: Prefer a breakout-retest strategy above 25,243 for cleaner long trades. Avoid buying at peak unless there’s strong momentum confirmation.

📊 SCENARIO 2: FLAT OPENING (Between 25,030 – 25,134)

(Flat to minor gap opening)

This zone is marked as the Opening Resistance/Support Zone (25,030 – 25,134) and is a NO TRADE ZONE due to the likelihood of choppy moves and indecision.

Wait for a directional break — either above 25,243 for bullish trades or below 25,030 to consider bearish setups.

If price consolidates within this zone during the first 30 minutes, it’s best to stay patient and avoid noise trades.

A 15-min candle closing below 25,030 could trigger shorting opportunities with targets at 24,803 and then 24,625 .

Above 25,134 , longs should only be taken after a 15-min close above 25,243 to avoid being trapped.

👉 📚 Tip: This zone is not ideal for option buying as theta decay will hurt both sides. Let the direction become clear before entering.

🔻 SCENARIO 3: GAP-DOWN OPENING (Below 24,935)

(Gap-down of 100+ points)

A gap-down below 24,935 pushes Nifty closer to Opening Support zone at 24,803 , which has the potential to act as a bounce area.

If price bounces from 24,803 with a bullish 15-min candle, a quick recovery toward 25,030 can be expected.

However, if Nifty breaks below 24,803 decisively with volume and a follow-up 15-min candle close, further downside may continue toward 24,625 (Last Intraday Support).

This zone may provide scalping opportunities on both sides but demands high discipline and tight SLs.

Aggressive traders may also look for PE buying or bear put spreads below 24,803 , targeting 24,625 and potentially further if global cues support weakness.

👉 📚 Tip: Watch for volume and structure at 24,803 — it's a decision point. If it cracks, ride the trend but be cautious near 24,625 as it may trigger a short-covering bounce.

🛡️ RISK MANAGEMENT & OPTIONS TRADING TIPS:

⏰ Avoid trading within the first 15 minutes post-market open unless a clean breakout/breakdown is visible.

⚖️ Never trade both sides at once — choose the direction based on price structure and stick with it.

💼 Use ATM or ITM options to minimize theta impact during intraday trades.

📉 If the market consolidates, avoid buying options. Use spreads (Bull Call / Bear Put) or wait for V-shaped moves.

🔄 Exit OTM options by 2:45 PM unless holding momentum trades.

📊 Keep SL on candle close basis (15-min preferred) and don’t average your loss-making trades.

👉 💡 Bonus Tip: For momentum confirmation, look for confluence of volume spike + candle body closing beyond marked zone.

📌 SUMMARY & CONCLUSION:

🔸 Bullish Breakout Trigger: 25,243 → Targets: 25,504 / 25,609

🔸 Bearish Breakdown Trigger: Below 25,030 → Targets: 24,803 / 24,625

🔸 Flat Zone: 25,030 – 25,134 → Avoid trading until a clear breakout or breakdown

🔸 Critical Supports: 24,803 (Gap-down cushion), 24,625 (last support zone)

🔸 Risk Focus: Wait for structure confirmation, don’t get trapped in emotional trades

📈 Nifty is currently poised near a decision zone. A clean breakout or breakdown can set the tone for the day, but avoid premature entries in the No Trade Zone. Let price confirm its intent, and then follow with disciplined execution.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst . This trading plan is shared strictly for educational and informational purposes only . Please conduct your own analysis or consult a registered advisor before initiating any trade. Trading carries risks – protect your capital at all times.

NIFTY : Trading Levels and Plan for 15-May-2025📊 NIFTY TRADING PLAN – 15th May 2025 (15-Min Chart Structure Analysis)

Nifty closed at 24,685.75 on 14-May-2025. Based on the chart setup, price is attempting to break out from consolidation but still trades below the crucial resistance level of 24,752 . Support remains around 24,468–24,490 , and below that, a key demand zone lies at 24,313–24,356 .

We will consider a Gap Opening to be 100+ points as per standard practice.

🟢 SCENARIO 1: GAP-UP OPENING (Above 24,785)

(Gap up of 100+ points above last close)

If Nifty opens above 24,785 , it enters the Last Intraday Resistance Zone of 24,878–25,026 .

A direct open into resistance could invite profit booking or a reversal unless bulls show strength.

Wait for the first 15–30 minutes — if Nifty forms a strong bullish candle and sustains above 25,026 , it confirms a continuation rally. You can consider a long entry with a target of 25,100+ and stop-loss below 24,950 .

However, if price struggles to cross or shows rejection candles around 24,878–25,000 , then look for shorting opportunities with downside targets of 24,752 and 24,690 .

Do not chase a gap-up at open. Let structure confirm strength before acting.

👉 Educational Insight: Gaps into resistance zones often get filled if early momentum fails. Price needs strong follow-through to avoid being faded.

🟨 SCENARIO 2: FLAT OPENING (Between 24,600 – 24,750)

(Minor move from previous close)

If Nifty opens between 24,600 and 24,750 , it remains within the previous range — suggesting possible sideways action or a breakout setup.

The upside breakout level is 24,752 . A candle close above this with volume can trigger bullish momentum towards 24,878 and 25,026 .

On the downside, support lies near 24,468–24,490 . If that zone breaks, Nifty may slip to 24,313–24,356 .

Ideal strategy: Wait for price to break above 24,752 or below 24,468 and then trade with the trend.

Inside this zone, avoid aggressive trades — let market establish a clear direction.

👉 Educational Insight: Flat openings after consolidation days can lead to strong trending moves once breakout levels are breached. Don’t preempt; react to structure.

🔻 SCENARIO 3: GAP-DOWN OPENING (Below 24,590)

(Gap-down of 100+ points)

A gap-down below 24,590 brings Nifty closer to the key support zone of 24,468–24,490 .

If price opens and sustains below 24,468 , it confirms a breakdown and can extend losses toward 24,313–24,356 (Buyer’s Support Zone) .

Look for breakdown + retest structure. A bearish candle rejection near 24,468–24,490 post-open offers a high-probability shorting setup.

On the contrary, if price reverses from 24,468 or 24,313 with strong bullish candles (like hammer or engulfing), you can consider long trades for intraday pullbacks with targets back to 24,600–24,685 .

Avoid bottom fishing blindly. Let structure confirm reversal or continuation.

👉 Educational Insight: Gap-downs near support zones can trap both bulls and bears. Always let confirmation come through – don’t force entries on emotion.

💡 RISK MANAGEMENT & OPTIONS TRADING TIPS:

⚠️ Don’t chase premiums in first 5–10 mins — let volatility settle.

📌 Prefer ATM or slightly ITM options for intraday directional trades.

📊 Use spreads (e.g., Bull Call or Bear Put) to limit risk in breakout/breakdown setups.

⏳ Don’t hold out-of-the-money options too long — theta decay can erode value quickly.

📉 Always have a stop-loss or defined risk — either on candle structure or option premium basis.

💰 Risk only 1–2% of your trading capital per trade.

👉 Pro Tip: Treat option premiums like a stock — don’t average losers, and use trailing SL to lock profits when trades move in your favor.

📌 SUMMARY & CONCLUSION:

🔹 Immediate Resistance Zone: 24,752 – 25,026

🔹 Immediate Support Zone: 24,468 – 24,490

🔹 Trend Reversal Support: 24,313 – 24,356

🔹 Breakout Confirmation: Above 25,026

🔹 Breakdown Confirmation: Below 24,468

🔹 No Trade Zone: Between 24,600 – 24,750 unless breakout confirmed

The market structure suggests a possible breakout or reversal in play depending on opening action. A patient trader should let the first few candles guide the direction. Stay disciplined, don’t predict — prepare, react, and protect capital.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst . This trading plan is shared for educational purposes only . Please consult with your financial advisor or do your own analysis before taking any trades. Markets are uncertain — trade responsibly.

NIFTY : Weekly Analysis (07-Apr to 11-Apr)📊 NIFTY 50 Weekly Analysis – Elliott Wave & Retracement Outlook (April Week 2)

As per the latest Elliott Wave analysis and Fibonacci retracement zones plotted on the chart, NIFTY is currently at a critical juncture . Price action from here will define whether the market resumes upward correction or heads for a deeper fall.

🧠 Technical Structure Overview

The red-labelled impulse wave series 1 to 5 has completed, indicating a completed correction wave structure .

A corrective bounce has been observed post-Wave 5 in the form of Wave A .

Price is now moving in a Wave B correction and has entered a key Fibonacci retracement zone.

📍 Important Zones to Watch

🔶 Yellow Zone – Wave 4 Correction Resistance:

Range: 22,908 – 23,275

This was a previous bounce zone (Wave 4), now acting as a resistance range.

Price faced strong rejection here and reversed down into retracement territory.

🟩 Golden Fibonacci Retracement Zone for Wave B:

Range: 22,906 – 22,368

Price has entered this critical retracement zone.

This range corresponds to:

50% retracement = 22,906 (upper band)

61.8% retracement = 22,368 (lower band)

Implication: If NIFTY sustains within this zone and forms a base, it may initiate a move towards Wave C.

🧭 Scenarios for Coming Week

✅ Bullish Scenario:

If price sustains above 22,368 and reclaims 22,906, it can bounce back towards:

🎯 Target 1: 23,839

🎯 Target 2: 24,241 (Wave C projection)

Confluence: Wave A-B-C projection fits well within this move.

❌ Bearish Scenario:

If price breaks below 22,368 and fails to hold the golden zone:

Expect a sharp decline towards support zone: 21,444 – 21,632

This move would confirm the formation of another impulsive Wave 5 down .

🔍 Key Support and Resistance Levels

Resistance:

22,908

23,275

23,839

24,241

Support:

22,906 (Upper Golden Zone)

22,368 (Lower Golden Zone)

21,632 – 21,444 (Major Support Zone)

📌 Conclusion:

NIFTY is in a decisive zone. Whether we go for Wave C up or another Wave 5 down depends on price action within the 22,906 – 22,368 zone .

Traders should:

Watch for confirmation candles and volumes.

Use demand zone reactions to position accordingly.

Maintain strict risk management.

💬 Share your views in the comments – do you expect a bounce from here or a breakdown?

#NIFTY50 #ElliottWave #TechnicalAnalysis #TradingView #NIFTYAnalysis #Fibonacci #SwingTrading #PriceAction

NIFTY : Trading Levels and Plan for 14-May-2025📊 NIFTY TRADING PLAN – 14th May 2025 (15-Min Chart Analysis)

Nifty closed at 24,592.25 on 13-May-2025. As per the structure, the index is consolidating near its immediate support zone of 24,432–24,489 , while facing resistance from 24,759–24,881 . The opening on 14-May-2025 will play a crucial role in deciding the next directional move.

Gap threshold considered = 100 points+ (as per your preference).

🟢 SCENARIO 1: GAP-UP OPENING (Above 24,692)

(100+ points gap-up from previous close)

If Nifty opens above 24,692 , price enters the Opening Resistance Zone of 24,759–24,881 , where sellers have been active previously.

Wait for the first 15–30 minutes to observe whether bulls are able to sustain above 24,881 (Last Intraday Resistance) .

If a strong bullish candle closes above 24,881 , you may consider going long with targets towards 25,000–25,234 and a stop-loss below 24,830.

However, if price faces rejection around 24,759–24,881 (e.g., long upper wicks or bearish engulfing), shorting opportunity opens up with target near 24,600 and 24,489 .

Avoid buying calls at open unless structure confirms breakout. Let the momentum build and structure get established.

👉 Educational Tip: Gaps near resistance zones often get filled. Waiting for a retest or breakout confirmation improves win probability.

🟨 SCENARIO 2: FLAT OPENING (Between 24,492 – 24,692)

(Minor change from previous close)

A flat opening between Opening Resistance (24,759) and Opening Support (24,432–24,489) suggests sideways bias.

Price action will likely chop between support and resistance unless a clean breakout or breakdown occurs.

Upside move will be considered only on a break above 24,759 , where one can go long with target near 24,881 . Stop-loss can be placed below 24,700.

If the price fails to hold 24,432 and closes below it, this breakdown may push Nifty towards 24,345 or even 24,166 (Last Intraday Support) .

Avoid trading in no-clear-structure zones. Let price establish a direction after opening range.

👉 Educational Tip: Flat opens after prior range-bound days often resolve into trending moves later in the session. Trade breakouts with volume confirmation.

🔻 SCENARIO 3: GAP-DOWN OPENING (Below 24,492)

(100+ points gap-down from previous close)

A gap-down below the Opening Support zone b implies bearish control at open.

If Nifty opens below 24,432 and sustains, shorting opportunities arise with targets at 24,345 and 24,166 .

Do not short aggressively at open. Let the first 5–10 mins settle, and look for confirmation candles (e.g., breakdown + retest).

In case of a bounce back toward 24,430–24,460 , if price fails to break above this zone, it may act as a fresh supply area. Use this level to reinitiate short trades.

If price reverses from 24,345 or 24,166 with strong bullish structure, counter-trend buying is allowed with defined SL.

👉 Educational Tip: A breakdown of a key level on a gap-down day often accelerates momentum. Don’t chase – wait for pullbacks.

💡 OPTIONS TRADING & RISK MANAGEMENT TIPS:

📌 Trade near-the-money (ATM) or slightly ITM options for better delta exposure.

📌 Avoid deep OTM option buying unless breakout or breakdown is confirmed.

📌 Use multi-leg strategies (like spreads) to reduce risk in volatile conditions.

📌 Place SL based on structure (previous candle low/high or support/resistance).

📌 Never risk more than 1–2% of capital per trade.

📌 Do not hold losing options hoping for recovery. Theta decay is unforgiving.

👉 Pro Tip: In flat or slow sessions, switch to stock-specific option plays rather than forcing trades on Nifty.

📌 SUMMARY & CONCLUSION:

🔸 Opening Resistance Zone: 24,759–24,881

🔸 Opening Support Zone: 24,432–24,489

🔸 Breakout Confirmation: Above 24,881

🔸 Breakdown Confirmation: Below 24,432

🔸 Major Targets: 25,234 on upside, 24,166 on downside

🔸 No Trade Zone: Inside 24,489–24,759 unless price breaks out or down with volume

Nifty remains at a decisive support area. A trending move is possible if price breaks out of the current compression zone. Let the market lead — follow the levels, not the emotions. Focus on structure, manage risk, and stay alert for trap candles at open.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst . The above analysis is for educational purposes only . Please do your own research or consult a SEBI-registered advisor before taking any trades. Trade at your own risk.