Nifty near all time highSee trading any instrument during all time high or all time low is extremely hard.

You require experience and knowledge of the instrument to trade such conditions.

Nifty is usually very quick to retrace or fall from the top, especially all time high, if it wants to reverse the trend.

Currently we are witnessing Nifty in accumulation phase, so we can say Nifty is trying to go even higher.

Got confirmation we need a close above our demand zone, otherwise any more fall in prices will only create confusion about position, in that scenario avoid trading and wait for clarity.

Niftysetup

Nifty Intraday Analysis, Key Levels & Trade Plan for 14 Aug 2025Good Morning Traders,

Yesterday, Nifty maintained a bullish tone throughout the session, respecting the upward support trendline and closing near the higher levels. Price action stayed above key psychological support zones, hinting at buying interest on dips. Resistance near the 24,660 area acted as a hurdle, and today’s session will decide whether bulls can take control for higher targets or sellers will step in at resistance.

Important Levels for Nifty (15-Minutes Timeframe):

Intraday Support Zone: 24,583 – 24,536

Intraday Resistance Zone: 24,659 – 24,735

Buy Setup:

Buy above 24,659 if the level sustains for at least 15 minutes .

Targets: 24,735 / 24,794

Stop Loss: 24,612

Sell Setup:

Sell below 24,583 if the level sustains for at least 15 minutes .

Targets: 24,536 / 24,485

Stop Loss: 24,650

Trend Bias: Neutral-to-bullish above 200 EMA; bearish bias if price sustains below it .

Note: Levels are for reference. When a trade setup forms, I will update it in the live market, stay tuned .

Disclaimer: This analysis is for educational purposes only. Please do your own research or consult a financial advisor before trading .

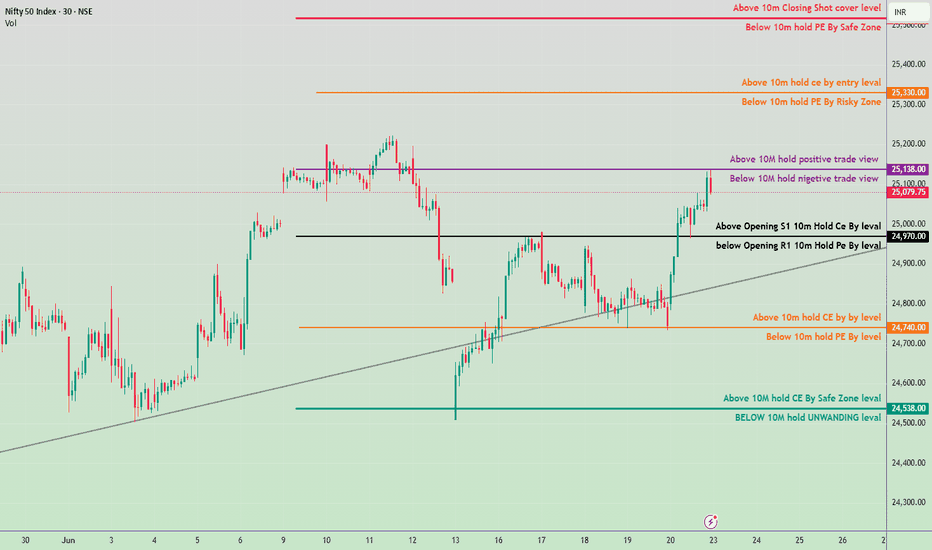

Monday,June 24 Nifty 50 Intraday Trade Plan & kye leves

🔴 Resistance Zones:

25,138 – Crucial Resistance (Above 10M hold = Positive Trade View)

Break & sustain above = bullish continuation

25,330 – Above 10M hold CE by entry level

25,390+ – Closing short-cover zone

🟡 Neutral Zone:

25,100 to 24,970

Sideways/volatility zone between positive and negative trade views

🔵 Support Zones:

24,970 – Opening S1 Hold CE By Level (Important support)

24,740 – 10M hold CE By Level (Demand zone)

24,538 – Safe Zone for CE holding

📌 Trade Plan:

🔼 Bullish Scenario:

If sustains above 25,138 → expect rally towards 25,330 and 25,390+

Entry near 25,110–25,138 zone (on retest) with SL below 25,070

🔽 Bearish Scenario:

If price breaks below 24,970 → watch for decline towards 24,740 and then 24,538

Entry on breakdown with SL above 25,000

🧠 Sentiment Strategy:

Above 25,138 = bullish bias (Buy on dips)

Below 25,100 = neutral

Below 24,970 = bearish sentiment builds up

6th May 2025 Nifty 50 Prediction #Nifty50 #option trading

🚀 If you like my trading plan and levels, don't forget to boost the post

99% working trading plan (Opning Possibility Flat )

👉Gap up open 24518 above & 15m hold after positive trade target 24628, 24880+

👉Gap up open 24518 below 15 m not break upside after nigetive trade target 24360,

👉Gap down open 24360 above 15m hold after positive trade target 24518, 24880

👉Gap down open 24360 below 15 m not break upside after nigetive trade target 24238,

👉 Gap down open Trade NIFTY NIFTY 08 MAY 24400 CALL 82 @

👉 Gap up open Trade NIFTY 08 MAY 24500 PUT 78@

💫big gapdown open 24238 above 1st positive trade view

💫big Gapup opening 24628 below 1st nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education follow social media and boost my idea

📌 koi bhi trade leval se 20 point ke sl ke bhina karan nahi hi

📌 koi trade app activate tabhi karana hota hi level pe 2 candle uper ya niche closing aati hai to

📌 leval par Ane pe turant trade plan na kare ...

📌 Full risk apaki hi hi meri na

Asian Session High-Low+India Market Opening Reaction–Must Know!

Hello Traders!

Most traders focus only on the Indian market’s open without realizing the hidden power of the Asian session highs and lows . The reaction around these levels during our market opening can provide a fantastic intraday setup! Today, I’ll show you how to use Asian session levels combined with Indian market open to catch clean trades .

Why Asian High-Low Levels Matter

Pre-Defined Support/Resistance:

Asian session high and low create important reference points even before India opens.

Liquidity Pools:

Big players often place orders around these zones — making them natural traps or breakout points.

Clear Bias for the Day:

Price reaction at these levels can hint whether the day will trend or stay sideways.

The Setup – Step-by-Step Guide

Step 1 – Mark Asian Session High & Low

→ Asian session = from 5:00 AM to 9:15 AM IST

→ Plot horizontal lines at the highest and lowest points.

Step 2 – Observe Price Behavior Near These Levels After India Opens

→ Rejection = Reverse (trade against breakout)

→ Break + Retest = Trend Continuation

Step 3 – Entry, Stop Loss & Target

→ Entry: After confirmation candle (like engulfing, pin bar) at Asian High-Low

→ SL: Few points beyond the high/low

→ Target: 1:2 or next major support/resistance zone

When to Avoid This Setup

Major Gap Up or Gap Down Days:

If the market opens far away from Asian levels, ignore.

High Volatility News Days:

Big news flow (RBI policy, US inflation data) can invalidate early session reactions.

Rahul’s Tip

“First 15-30 minutes after open are critical.” Patience is key — let the market show you if Asian High/Low will hold or break!

Conclusion

By combining Asian session highs and lows with opening reactions , you can trade with a plan instead of guessing. This setup works beautifully for Nifty, BankNifty, and major stocks with decent liquidity.

Have you ever tried tracking Asian session levels? Let’s discuss in the comments below!

If you found this post valuable, don't forget to LIKE and FOLLOW !

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience, not theory. Stay connected if you're serious about growing as a trader!

Straddle Selling in Sideways Market – Full Risk-Reward Strategy!Hello Traders!

Sideways market eating your premiums? Don’t worry — this is where option sellers shine the brightest. One of the most reliable setups in a consolidating market is the Short Straddle Strategy . Today, I’ll break down exactly how to deploy a straddle in a range-bound market , along with proper risk-reward planning, adjustments, and exit rules .

What is a Short Straddle?

You sell both a Call (CE) and a Put (PE) at the same strike price (ATM) .

Ideal for low volatility , range-bound days where you expect limited movement in either direction.

The maximum profit is earned when the index or stock stays near the strike price till expiry or exit.

When to Use This Strategy

CPR Narrow + Inside Previous Day Range → Indicates consolidation

VIX Falling or Low (Below 13–14): → Lower volatility supports premium decay

No Major Events or News Expected: → Avoid directional shocks

OI Buildup at ATM Strike: → Signals strong range expectation

Risk-Reward Setup & Management

Entry Time: Ideal between 9:45–10:15 AM after range is confirmed.

Stop Loss: Set a combined premium SL of 25–30% or exit on sharp one-sided breakout.

Adjustments: If breakout starts, shift legs (convert into strangle) or buy hedge OTM options.

Exit Time: Usually 1:1.5 RR is achievable by 12:30–2:30 PM on calm days.

Rahul’s Tip

“Straddle selling is not about predicting direction — it’s about predicting no direction.” Respect the structure. If price stays inside the trap, you win by default.

Conclusion

The Short Straddle Setup is perfect for range-bound conditions, especially in Bank Nifty or Nifty. With clear entry, SL, and adjustment rules , you can earn steady returns from time decay — but only if you stay disciplined.

Do you use straddles? What’s your favorite expiry day setup? Drop it in the comments below!

Nifty Long 24500 | Hourly View | Elliott waves Nifty now in wave C as shown in chart.

Right now wave 3 of c which should go min 24447 then with some halt final move towards 24551 min as of now.

Expecting some pullback and halt near 24500 before giving next move direction. Final destination is 24900-25000 for this move.

Nifty View Hourly | Next movesNifty 50 as we expected rotated between 24000-24500. Today it went to 24000.

Case 1: abc of B in progress and b completed near demand zone. As shown in red. Now reversal of c can come.

Reversal candles with RSI signals can confirm.

Case 2: abc of B completed already at a and Now C in progress. As shown in blue lines B to C.

Below 23900 can confirm further drop towards 23500 and maybe to 22900.

Disclaimer: Not a buy, sell recommendation. Only for educational/ entertainment purpose.

Nifty Analysis for 21-22 Nov Based on elliott wave forecasting on hourly chart we are in either wave iv or v of y of wxy correction. Which gives two possible scenarios as given in chart

Green : we are wave iv with a and b completed and c can continue in future. Possible trade given in green box.

Red: we are wave iii of iv and go like red arrow, trade given in red box.

This is for educational purpose and not an advice/recommendation to buy or sell. Do your research before trading. Happy Trading.

Long Setup in Choice InternationalAn On Neck Chart Pattern Breakout happened on the Weekly Time frame of NSE:CHOICEIN

Price Action is well supported by the volume.

The stock is currently in uptrend making higher highs and higher lows.

One can add this stock into their stocks to buy list.

Initiate the long trade only according to the levels mentioned.

Stop loss will be on a Weekly closing basis.

Trend Analysis :- UP Trend

Chart Pattern :- Bullish On-Neck Chart Pattern

Technical Indicator :- Positive MACD Crossover

Simple Trade Setup | NIFTY | 18-04-2023 [INTRADAY]NSE:NIFTY

Flip zone: : This zone is such a zone which will work as resistance if price is below it. And it will work as support if price is trading above it.

Resistance zone: This zone will mainly work as resistance. Once price sustain above it then it is considered as breakout.

Support zone: This zone will mainly work as support. Once price sustain below it then it is considered as breakdown.

All other levels between zones are such a level that you can scalp from it , book partial/full profit and also use it as trailing SL.

Good trade setup with good Risk reward will be only if we enter from any of zone.

-------------------------------------

Trade Setup for 18-04-2023

Most of all the levels and zones remains same as per previous.

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.

NIFTY ANALYSIS FOR 19/JAN/2023

As on today 18/Jan - Nifty was trading within 45 points range 18180 - 18137 lvl from 11.20 to 3.30.

Dow is -391.76 (-1.14%) as of 3.30pm. Dow is falling & Nifty is going up, we can expect some big moves in Nifty in the coming days.

Kindly trade with less quantities with strict SL in the current market condition.

This is just my view of NIFTY. Do your own analysis and trade!.

Nifty-23/09/2022-LevelsHello Traders,

Welcome to SriTrader5121

Nifty-23/09/2022-Levels

If market open as a GAP-UP and moves to UP-Side then BUY with the

Support of PDH and SELL with the Rejection of S@1.

(or)

If market open as a GAP-UP and moves to DOWN-Side then BUY with the

Support of PDL and SELL with the Rejection of PDL.