Nifty 28 Oct StrangleSell Nifty 26150 CE at 28 and 25800 Pe at 22. Combined premium 48 Target Zero

Hedge by buying CE worth 11 and PE worth 8

Looking at the current congestion and psychological resistance at 26000 I feel both will go to zero however the chances of downside are strong and a whiplash is often seen on the day of the expiry, so best to hedge with option buying

Niftystrategy

Bullish Iron Condor on Nifty (30th September 2025 expiry)Hello Traders!

Just like we shared the August Iron Condor setup, here comes the fresh plan for September expiry.

Nifty is trading around 24,840 and we are witnessing a defined range between 23,750 – 25,500.

Such ranges are perfect for premium eating strategies like the Iron Condor, where time decay works in our favour as long as the index stays inside the zone.

So here’s the September plan:

Position Details

Sell 2 lots 24,700 PE @ 140.30

Buy 2 lots 24,400 PE @ 71.60

Sell 2 lots 25,500 CE @ 53.95

Buy 2 lots 25,750 CE @ 22.95

We expect Nifty to consolidate between 23,750 – 25,500 as per our technical chart analysis .

200-DEMA is acting as dynamic support

Strong resistance capped near 25,500 – 26,270

Until a breakout happens on either side, premium sellers can stay in control

This Iron Condor gives us a balanced risk-reward setup and benefits from time decay while keeping risk well-defined.

Why I Like This Setup:

Limited loss , defined by hedge positions

High probability of success as long as Nifty remains in the range

Best suited for traders focusing on consistent income from option writing

Rahul’s Tip 👉 Discipline in trade management is always more important than the setup itself.

For income-based option strategies, always check for:

Key events and news (policy, RBI, FED, budgets, etc.)

Breakout signals beyond short strikes

Quick exit or adjustment if market moves out of range

Disclaimer This post is for educational purposes only . Please manage your risk and position sizing wisely.

Avoid large quantities at once – it’s always better to scale in gradually once the range confirms.

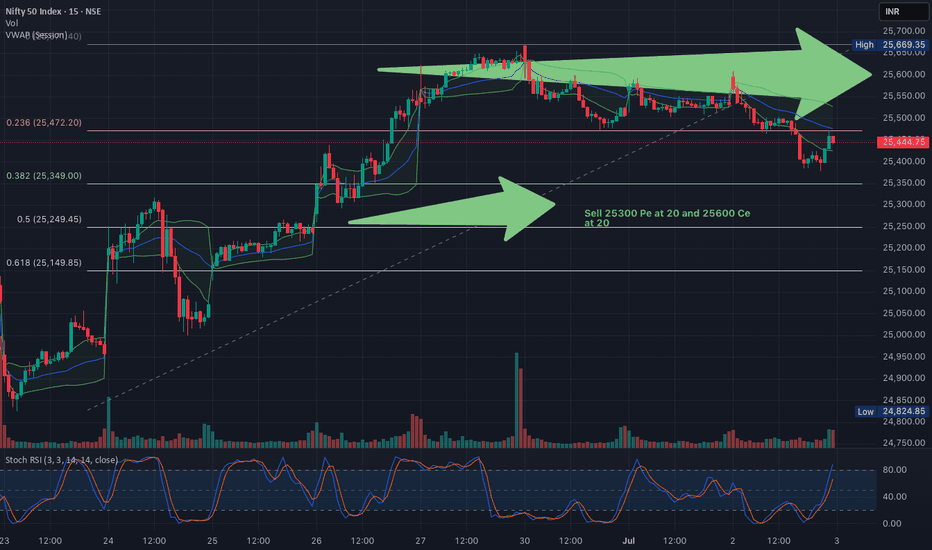

Nifty strangle 3 July[/b Sell 25300 PE and 25600 CE at 20 each

Combined premium 40 Rs per set. SL 40 each side, target Zero.

Looking at todays consolidation, taking this expiry trade to get max decay at opening bell. Will book or / and adjust at opening looking at the price.

Disclaimer : Naked option writing can have unlimited loss, profit however is limited. Hedge using buy for respective lower / higher strikes or next weeks options of same strike or any other strategy

Ind–Pak Tension Sparks Panic! Gift Nifty Crashes 436 Points Now!Tension across the India–Pakistan border isn’t just making headlines — it’s shaking the markets too.

As per recent reports, there’s been a rise in military activity and geopolitical instability, which triggered a massive reaction in Gift Nifty.

Overnight, Gift Nifty tanked 436 points (~1.8%), with back-to-back red candles and volume spikes confirming a fear-driven move.

Sharp fall on the 30-min chart with increased volume — signs of panic selling.

Geo-political fear is real — institutions hate uncertainty, and this newsflow rattled sentiment.

Key support zones are broken — intraday structure now shifts toward the bearish side.

Volatility likely to spike in today’s opening — option premiums can go wild.

Premium sellers need to stay cautious — blindly deploying short straddles/condors can backfire.

This isn’t just a technical breakdown — it’s a sentiment-driven move.

When fear enters the market, logic takes a back seat — so best is to wait and watch the price behavior post opening.

Watch List: Nifty, Bank Nifty, and Defence sector stocks like HAL, BEL, BDL — expect heightened volatility.

Rahul’s View:

Don’t try to be a hero when headlines are hot. Smart traders protect capital and adapt to risk. Let price stabilize, then take calculated trades — not emotional ones.

NIFTY 8TH MAY STRANGLE24550 CE at 55

24300 PE at 55

NIFTY 8 May strangle, Safe range is between 24656 and 24144, to check the same one can put this trade on any Options analyser like Opstra or sensibull.

This is a high risk trade, if one wants to hedge can buy CE and PE of the same expiry at 50% price.

I am expecting this to go to zero or at-least 50% decay. Sufficient margin to make adjustments are kept.

11:30 AM Secret: Intraday Reversal Strategy That Actually Works!Post 11:30 AM Reversal Strategy for Intraday Traders

Hello Traders!

If you’ve been trading intraday for a while, you’ll know one thing — after the initial morning volatility, the market often slows down… and then suddenly, around 11:30 AM to 12:30 PM, something shifts. This is when many smart traders enter the game using the Post 11:30 AM Reversal Strategy . Today, let’s decode this powerful and often overlooked setup that can help you catch trend changes with great timing!

Why the 11:30 AM Time Slot Matters

Volume Stabilizes: By 11:30 AM, the morning rush has faded, and smart money starts positioning.

Morning Trend Exhaustion: Early trends often reverse around this time, especially if driven by emotion or news.

Institutional Activity Begins: FII and DII orders start reflecting in price action from late morning onward.

How to Trade the Post 11:30 AM Reversal

Step 1 – Identify Overextended Morning Move

→ Look for a strong trend from market open that seems to be losing steam by 11:15–11:30 AM.

Step 2 – Look for Reversal Candlestick Pattern

→ Watch for doji, hammer, inverted hammer, or engulfing candle around key support/resistance zones.

Step 3 – Confirm with Volume or RSI Divergence

→ Volume drying + divergence in RSI/MACD = extra confirmation of possible reversal.

Step 4 – Plan Entry, SL, and Target

→ Entry after confirmation candle close

→ Stop Loss: Just below/above the reversal candle

→ Target: VWAP, previous day high/low, or risk-reward 1:2

Live Chart Example

In the attached Nifty chart, look how: On multiple days, the 11:30 AM candle marked major reversal points.

RSI divergence (bearish & bullish) around that time added confirmation.

Each reversal led to 80–230+ point moves post 11:30 AM, making this a high-probability window to watch.

When This Setup Works Best

On Trend Days with Sharp Morning Moves

→ Works well when the market stretches too far, too fast by 11:30 AM.

On News or Event-Driven Opens

→ If early move was driven by gap-up/down or news, reversals often happen in late morning.

Rahul’s Tip

“Don’t chase early volatility — observe the market structure till 11:30 AM, then trade with clarity and precision.”

This one habit can change your intraday game forever.

Conclusion

The Post 11:30 AM Reversal Strategy is a timing-based edge that allows you to trade like a sniper, not a machine gun. Add it to your intraday toolbox and use it with discipline and confirmation — you'll be surprised how often it works!

Have you ever noticed this timing-based shift in trend? Let’s discuss your experience in the comments!

If you found this post valuable, don't forget to LIKE and FOLLOW !

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience, not theory. Stay connected if you're serious about growing as a trader!

Trade Only 1 Setup a Day – Here’s the One I Use!Hello Traders!

Ever heard the phrase: “Less is more” ? That applies perfectly to intraday trading. Chasing multiple setups often leads to overtrading, emotional decisions, and avoidable losses . Today, I’ll share why I prefer trading just one high-quality setup a day — and the exact one I personally use to stay consistent and stress-free.

Why Just One Setup a Day Works Wonders

Focus = Better Execution: When you wait for your setup, you don’t get distracted by noise.

Avoids Overtrading: No revenge trades, no chasing — just clean, planned execution.

Improves Risk Management: With one trade, you manage position sizing, SL, and RR with more clarity.

The Setup I Personally Use (VWAP + CPR Rejection Strategy)

Step 1 – Mark CPR + VWAP Zones

→ CPR gives range reference, VWAP shows volume-weighted fair value.

Step 2 – Wait for Rejection or Reversal from Zone

→ Look for price rejecting CPR or VWAP with a strong reversal candle (e.g., engulfing, pin bar, etc.)

Step 3 – Entry with Confirmation + SL

→ Enter only after breakout candle closes beyond the rejection level

→ SL = just above/below the zone

→ Target = 1:2 or nearest support/resistance

Why I Stick to This Setup

It Works Across Indices: Bank Nifty, Nifty, and even stocks.

Clear Risk-Reward Ratio: I know my exit before I enter.

Less Screen Time, More Peace: Once the trade is done, I’m done.

Rahul’s Tip

The market gives hundreds of signals, but only a few are clean. Trade one that fits your rulebook and let the rest go. Discipline > Drama.

Conclusion

You don’t need 10 trades a day to be profitable. You just need one trade with logic, structure, and discipline . Master one setup, build confidence, and let consistency build your capital.

What’s your favorite intraday setup? Drop it in the comments and let’s share ideas!

Nifty Intraday Levels | 15-JULY-2024#Optionbuyers

#Niftyoptionscalping

1️⃣ Zones you always Like:-

👉Green zone- Institutional support

👉Red zone - Institutional resistance

👉Gap between institutional zones is always of 100 points

👉Zone is created with the help of pivot points and Fibonacci

👉Advance version of price action

👉Trades based on Nifty future chart

2️⃣ Trade Execution:-

👉Trade based on order flow data

👉Timeframe - 1 min and 5 min

👉Risk Reward Ratio always 1:2

👉Strike price always ATM & slightly ITM

👉Maintain Position sizing according to your own method

3️⃣ House Rules in trading:-

👉Sharp at 9:15 AM

👉Priority to risk management

👉Fast execution (morning breakfast)

👉Stop-loss 10 points (strictly)

#ThankU For Checking Out Our IDEA , We Hope U Liked IT 📌

🙏FOLLOW for more !

👍LIKE if useful !

✍️COMMENT Below your view !

Go Short on Nifty50.Rising channel breakdown or resistance formation in 1 hr time frame, both conclude to the direction that upcoming expiry might witness 17500 levels, strong momentum is calming its horses and facing few strings of pushed down. Future Contracts of Weightage stocks have been shorted with huge volume today, another indication of shift in momentum and this rally could be proven another retracement merely.

NIFTY 29 AUGUST 2022Guys today onwards i will be posting charts of SPOT instead of FUTURES. As maximum of my followers are demanding it to plot the zones and levels on SPOT, which makes them easy to trade all instruments, as due to Cost of Carry difference between SPOT & FUTURES, they are unable to follow the level on charts.

NIFTY FUTURES 21 JULY 2022Nifty today started from my zone 16510-16494 and ended at the same zone.

Power of Zones and Levels

Tomottow i am expecting a corrective move, but global markets are positive by now, lets see how it plays out.

Even if its a profit booking corrective move tomorrow, uptrend has not yet completed, kindly note it..

NIFTY FUTURES 14 JULY 2022NIFTY TODAY 13.07.2022

Started just below my zone of 16112, moved slowly to the upper border and finally fell from the zone upper border of 16139

Stopped at mid channel and consolidated for 2 hours, then gave a good breakdown crossing the lower zone of 16032-16013, but the zone acted as a magnet brought the price back to 16013 again.

Then finall ended at 15992 not very far from the zone 16032-16013

NIFTY TOMORROW 14-07-2022

Please follow the levels and zones and trade with price confirmation.

NIFTY FUTURES 07 JULY 2022NIFTY TODAY 06-07-22

Hovered around my zone 15827-15853 for first 45 minutes due to indecision of bulls & bears but then accumlated on the same zone and hit the zone of 15994-16014 directly.

Got some resistance from there and dropped but ultimately ended in the zone at day end.

Power of ZONES

NIFTY TOMORROW 07-07-22

As Nifty has tested 16000 thrice in two days, its now high time for Nifty to travel to 16200 levels, to fill the gap of 10-13 June 2022

Tomorrow due to expiry it may remain highly volatile but it will surely reach 16200 in a day or two.

If u are a strangle lover, keep your monthly strangles above 16500 on call side and below 15200 put side.

16800 CE and 15000 PE in monthly are the safest adjustment free strangles as of now.

NIFTY FUTURES 06 JULY 2022NIFTY TODAY 05-07-22

Did you see mates how Nifty reacted to my levels even in highly volatile panic situatuion.

Started Gap up, took support from my 15876-15859 zone went up rapidly and stopped at trendline exactly at 16014 and reversed.

Reversal was so fast that it didnot respect the trendline at 15901, broke the 15859 zone and retraced to the same zone took resistance and further fell to zone below of 15756-15727 zone, ended around it.

NIFTY TOMORROW 06-07-22

The more and more Nifty is getting volatile, the more zones are coming closer, which will make it move in range and increase volatility.

Best of Luck for Tomorrow, kindly trade around zones and levels with price action confirmation.

NIFTY FUTURES 27 JUNE 2022YESTERDAY NIFTY 24-06-22

First of all guys sorry for drawing two zones late and updating in live market. any ways market remained between my levels 15608-15743 to be precise, and kept consolidating.

Nifty on Monday 27-06-22

Just observe the blue lines and curves, it is an inverted head and shoulder and break out of the same has been confirmed on Friday 24th June itself.

i expect a strong gap up on Monday, above my zone of 15820-15865.

We have 15948 & 16062 as strong reversal points, let's see how it works out. Also mind well that 15865-15820 will work as strong support.

NIFTY FUTURES 24 JUNE 2022NIFTY TODAY 23 JUNE 2022

Even after a wild volatility Nifty respected my levels as a charm, started from above the zone of 15391-15357,

went to my zone of 15558-15625, consolidated for 1.45 hours and fell from there to my demand zone 15391-15357,

took a sharp bounce again from there directly to the above zone 15558-15625 and closed there it self.

Over all it was a clear display of pure tech analysis. Hope you earned from my levels.

NIFTY TOMORROW 24 JUNE 2022

Best of Luck for tomorrow, respect the levels and take careful entries as market is unbelievably volatile.

NIFTY FUTURES 22 JUNE 2022NIFTY TODAY 21-JUNE-2022

Bear flag didn't work, Nifty opened above mid channel and kept moving up till my zone at 15711, crossing the upper bound descending channel, failed to cross the zone and retuned back to the upper bound descending channel, closed just below it.

NIFTY 22-JUNE-2022

Nifty has too many resistances while moving up, it is purely sell on rise.