#NIFTY Intraday Support and Resistance Levels - 28/01/2026A gap-up opening in Nifty 50 reflects a positive overnight sentiment, likely driven by global cues or short-covering from lower levels. However, even after the gap-up, the index is still trading within a well-defined range, which means today’s move will be highly level-based rather than a straight trending day unless a strong breakout is seen.

Market Structure & Key Zones

The 25200–25250 zone is acting as a crucial pivot area for the session. This zone has repeatedly worked as both support and resistance in the recent past, making it a decisive region for intraday direction.

If Nifty holds above 25250, it signals strength and confirms that buyers are willing to defend higher levels.

Failure to sustain above this zone may drag the index back into the lower support band.

Bullish Scenario (Above 25250)

If price sustains above 25250, long positions can be considered with a bullish bias.

Upside targets are placed at:

25350 – first resistance and intraday booking zone

25400 – minor supply area

25450+ – strong resistance and previous rejection zone

A clean break and sustain above 25450 can further strengthen bullish momentum, but near these levels, profit booking is expected. Hence, partial exits and trailing stop-loss are advised.

Bearish Scenario (Below 25200)

If the index rejects the 25250–25200 zone and slips below 25200, bearish momentum can build up quickly. In such a case, short positions become favorable with downside targets at:

25100 – first support

25050 – intraday demand zone

25000 – major psychological and technical support

A decisive breakdown below 25000 would weaken the structure further and may invite panic selling, though bounce attempts can also emerge from this level due to its psychological importance.

Trading Approach for the Day

Despite the gap-up opening, Nifty is still not in a clear trend. The index needs price acceptance above resistance to continue upward. Until then, expect volatile, two-way moves around key levels.

Best approach for today:

Avoid chasing the gap

Trade only after confirmation near support/resistance

Book partial profits at each target

Keep strict stop-losses due to whipsaw risk

Overall, the bias remains cautiously positive above 25250, while below 25200 the tone turns weak. Discipline and level-based execution will be the key to navigating today’s session successfully.

Niftytrend

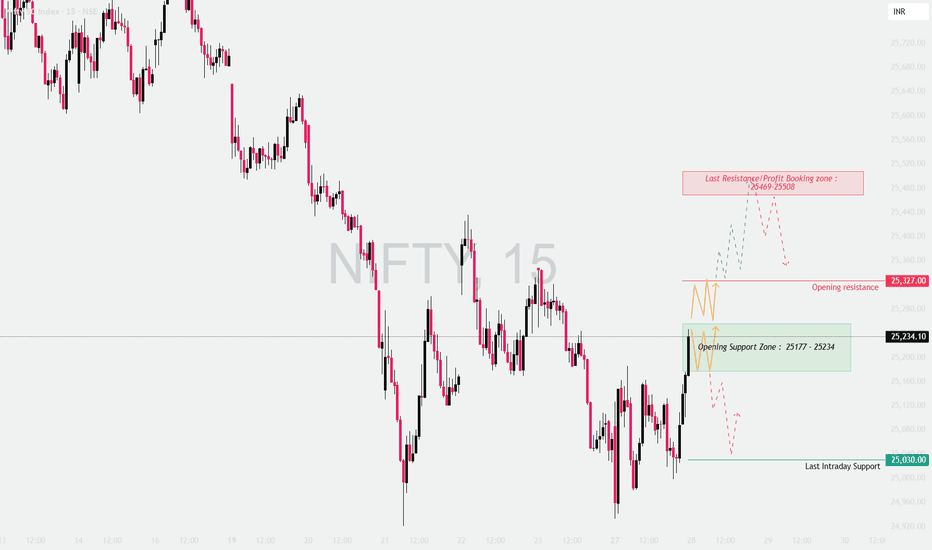

NIFTY – Detailed Intraday Trading Plan | 28 JAN 2026📊

Timeframe: 15-Min

Instrument: NIFTY (Index)

Gap Considered: 100+ Points

🔍 MARKET CONTEXT & STRUCTURE

NIFTY has shown volatile price action with sharp intraday swings, indicating active participation from both buyers and sellers.

The current structure suggests the market is transitioning from panic selling to selective buying, making key levels extremely important for the next session.

This plan is reaction-based, not prediction-based — we trade how price behaves at levels, not assumptions.

📌 IMPORTANT LEVELS FOR THE DAY

Opening Support Zone: 25,177 – 25,234

Opening Resistance: 25,327

Major Resistance / Profit Booking Zone: 25,469 – 25,508

Last Intraday Support: 25,030

🔼 SCENARIO 1: GAP UP OPENING (100+ POINTS) 🚀

A gap-up open signals short-covering or global support, but sustainability is key.

🟢 Bullish Continuation Plan

Price opens above 25,327

15-min candle closes above resistance

Retest of 25,327 holds as support

Upside targets: 25,469 → 25,508

🔴 Gap-Fill / Rejection Plan

Failure to sustain above 25,327

Long upper wicks / weak follow-through

Expect pullback towards 25,234

🧠 Trading Psychology:

Gap-up moves often trap late buyers near resistance. Acceptance above resistance confirms institutional participation.

➡️ SCENARIO 2: FLAT / NEUTRAL OPENING ⚖️

A flat open usually indicates indecision, leading to range-bound price action initially.

🟢 Upside Breakout Plan

Sustained price above 25,327

Volume expansion on breakout

Targets: 25,400 → 25,469

🔴 Downside Breakdown Plan

Breakdown below 25,177

Strong bearish 15-min candle

Targets: 25,100 → 25,030

🧠 Trading Psychology:

Flat opens create fake moves. Waiting for a 15-min confirmation avoids emotional entries and whipsaws.

🔽 SCENARIO 3: GAP DOWN OPENING (100+ POINTS) 📉

A gap-down open tests buyer strength immediately.

🟢 Support Hold / Pullback Buy

Price reacts positively from 25,177 – 25,234

Long lower wicks / higher-low structure

Bounce targets: 25,300 → 25,327

🔴 Breakdown Continuation

Acceptance below 25,177

Selling pressure increases

Targets: 25,030 → 24,950

🧠 Trading Psychology:

If key demand zones fail, sellers gain confidence and momentum accelerates.

🧠 OPTIONS TRADING STRATEGY (EDUCATIONAL)

Near resistance → Prefer Bull Call Spread, avoid naked CE buying

Inside range → Iron Condor / Short Strangle (low momentum)

Breakdown confirmed → Bear Put Spread

🛡 RISK MANAGEMENT RULES 🔐

Trade only after confirmation

Risk maximum 1–2% capital per trade

Avoid overtrading inside no-trade zones

Book partial profits near key levels

One setup = one trade

🧾 SUMMARY & CONCLUSION ✍️

25,177 – 25,234 is the most critical decision zone

Above 25,327 → buyers regain control

Below 25,177 → sellers dominate

Let price confirm direction — patience is the edge

Trade what you see, not what you feel 📊

⚠️ DISCLAIMER

This analysis is for educational purposes only.

I am not a SEBI registered analyst.

Markets involve risk — trade responsibly.

NIFTY KEY LEVELS FOR 28.01.2026NIFTY KEY LEVELS FOR 28.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 29/01/2026Nifty is expected to open on a flat to mildly positive note, indicating stability after the recent recovery from lower levels. The index is currently trading around the 25340–25350 zone, which is an important intraday pivot. A flat opening near this level suggests that the market is waiting for fresh cues before committing to a directional move. Volatility may remain moderate in the initial phase, with price action largely driven by how Nifty behaves around key support and resistance zones.

From a technical structure point of view, Nifty has shown a decent pullback from the 25000 support area, where strong buying interest was seen earlier. This bounce indicates that buyers are still active at lower levels. However, the upside is capped near the 25450–25500 resistance zone, which has repeatedly acted as a supply area. Until this zone is decisively broken, the index may continue to trade in a defined range, offering selective intraday opportunities rather than trending moves.

On the bullish side, if Nifty manages to sustain above 25250 on a 15-minute closing basis, it would indicate strength and continuation of the short-term upmove. In this scenario, long positions can be considered above 25250 with an initial target of 25350. If momentum builds further, the index can move toward 25400 and then 25450+, where partial profit booking is advisable due to expected selling pressure. A strong close above 25450 would further improve the bullish outlook for the coming sessions.

On the downside, failure to hold above 25200 would weaken the immediate structure. If Nifty breaks and sustains below 25200, it may trigger a short-term correction. In such a case, downside targets of 25100 and 25050 come into play, followed by the psychological 25000 level. The 25000–25050 zone remains a crucial support area, where fresh buying or a reversal attempt can be expected. A clean breakdown below 25000 would increase bearish momentum and may lead to deeper correction, though that seems less likely without strong negative cues.

For intraday traders, the zone between 25200 and 25250 should be treated as a wait-and-watch area, as price action here can be choppy and directionless. The best trades are expected only after a clear breakout above resistance or a confirmed breakdown below support. Strict stop-loss, partial profit booking, and disciplined position sizing are essential, as the market is still in a consolidation-to-reversal phase rather than a strong trend.

Overall, Nifty is positioned at a crucial juncture. Holding above 25250 keeps the bias mildly positive, while a break below 25200 shifts the bias toward a short-term corrective move. The session is likely to reward traders who focus on levels, confirmation, and risk management rather than aggressive directional bets.

NIFTY - Trading levels and Plan for 29-Jan-2026📊 NIFTY Trading Plan for 29-Jan-2026

(Educational & Level-Based | For Index Options Traders)

Market Principle to Remember:

Price reacts at zones where maximum traders are trapped, hedged, or emotionally committed.

Our job is not prediction — it is structured reaction 🧠📈

🟢 Scenario 1: GAP UP Opening (100+ Points) 🚀

Market Psychology:

A big gap-up often comes from overnight short covering or positive global cues. Retail traders chase breakouts emotionally, while smart money waits to sell premium or buy only after acceptance.

📌 Trading Plan:

🔹 Avoid buying immediately at market open

🔹 Let the first 15–30 minutes define direction

🔹 Mark opening range high & VWAP

🔹 Bullish bias only if price sustains above VWAP

🔹 Look for pullback + hold before Call buying

🔹 Prefer Bull Call Spread if IV is elevated

🔹 If price shows rejection near resistance, expect gap-fill or consolidation

🔹 Consider Bear Call Spread near strong resistance

🔍 Educational Insight:

Gap-up buyers are usually emotional. If price fails to sustain, institutions sell into strength, leading to sharp reversals.

🟡 Scenario 2: FLAT / RANGE Opening 😐

Market Psychology:

A flat open signals indecision. Big players wait for retail participation before initiating the real move.

📌 Trading Plan:

🔹 Mark Previous Day High (PDH) & Low (PDL)

🔹 First 30 minutes define the battle zone

🔹 Breakout with volume suggests directional move

🔹 Weak breakout often turns into a false trap

🔹 Use Straddle / Strangle near range boundaries

🔹 Deploy Iron Condor if price stays range-bound

🔹 Enter directional trade only after close + retest

🔍 Educational Insight:

Markets punish impatience. Flat opens reward traders who wait for confirmation, not anticipation.

🔴 Scenario 3: GAP DOWN Opening (100+ Points) 📉

Market Psychology:

Gap-down opens trigger panic selling. Weak hands exit early, while smart money waits for selling exhaustion.

📌 Trading Plan:

🔹 Do not sell Puts immediately at open

🔹 Observe opening candle size and volume spike

🔹 Watch how price behaves near key support zones

🔹 If support holds, expect a pullback or bounce

🔹 Buy Calls only after higher-low formation

🔹 If support breaks with volume, expect trend day down

🔹 Buy Puts on pullback toward resistance

🔹 Prefer Bear Put Spread for controlled risk

🔹 Use Call Credit Spread near resistance

🔍 Educational Insight:

Most gap-down moves start with fear but continue only when institutional selling confirms.

⚠️ Risk Management Tips for Options Traders 🛡️

🔹 Risk only 1–2% of total capital per trade

🔹 Avoid revenge trading after stop-loss hits

🔹 No fresh trades after 2:30 PM

🔹 Avoid naked option selling on event-driven days

🔹 Always check IV, Theta decay, and liquidity

🔹 Maintain minimum risk–reward of 1:2

🔹 Journal every trade — process > profits

🧠 Summary & Conclusion ✨

🔹 Gap openings offer opportunity but demand discipline

🔹 Structured trading beats emotional decisions

🔹 Price acceptance matters more than candle color

🔹 Options trading is a probability game, not prediction

🔹 Consistency comes from process, patience, and risk control

Trade like a risk manager first, trader second 💼📊

📜 Disclaimer ⚠️

This trading plan is shared strictly for educational purposes only.

I am not a SEBI registered analyst.

Trading in the stock market involves risk.

Please consult a certified financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 29.01.2026NIFTY KEY LEVELS FOR 29.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Vedl ltd 2nd Entry price 529 tgt 750 positionalVedanta Ltd (VEDL) – Technical View

VEDL has given a strong breakout above the ₹500 resistance zone, confirming bullish momentum on the charts. The breakout is supported by improved price structure and volume expansion, indicating further upside potential.

The medium-term target is ₹750, based on the breakout range and higher-timeframe resistance projections.

For positional investors, ₹529–₹535 is a favorable buy-on-dips zone, provided the stock sustains above the ₹500 breakout level.

Fresh entries should be considered only on retracements or consolidation above support, while maintaining strict risk management.

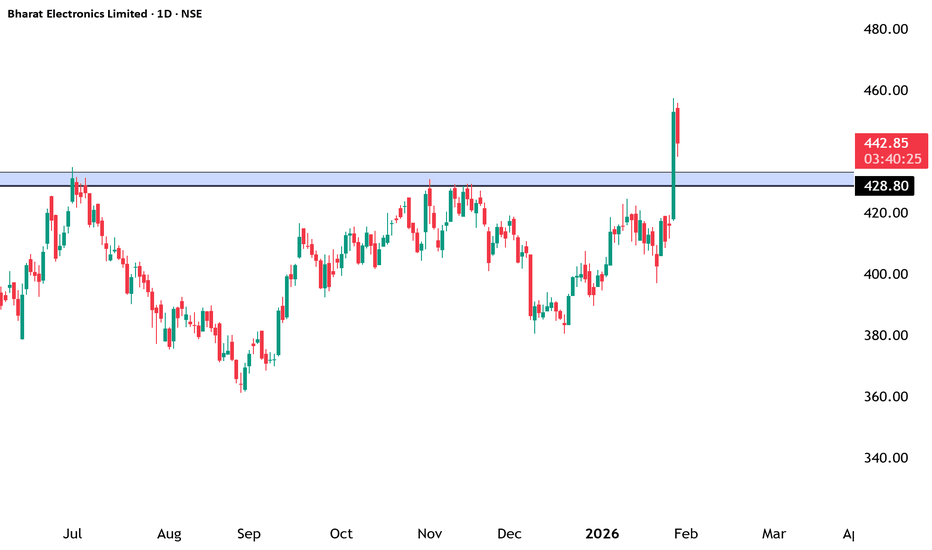

Bharat Electronics Ltd (BEL) – Bullish Structure BreakoutNSE:BEL

🔹 Technical View

Price has decisively broken above a major supply / resistance zone (~₹428–432) after multiple rejections in the past.

Strong bullish momentum candle indicates institutional participation and demand dominance.

Previous resistance now likely to act as strong support on any pullback.

Structure shows higher highs & higher lows, confirming an ongoing uptrend.

Immediate levels to watch:

Support: ₹428–420

Upside potential: ₹460 → ₹480 (positional)

🔹 Volume & Price Action

Breakout supported by healthy volume expansion, validating the move.

No major selling pressure visible near breakout zone so far.

🔹 Fundamental View

BEL is a Navratna PSU and a key player in defence electronics.

Strong order book driven by:

Defence modernization

Indigenous manufacturing (Make in India / Atmanirbhar Bharat)

Consistent revenue visibility, healthy margins, and improving ROE.

Virtually debt-free balance sheet adds financial stability.

🔹 Future Growth Prospects

Long-term beneficiary of India’s rising defence spending.

Increasing focus on:

Radar systems

Electronic warfare

Missile & naval electronics

Export opportunities and private-defence collaboration act as additional growth triggers.

Well-positioned for sustainable compounding over the next few years.

🔹 Conclusion

Technically strong breakout + fundamentally robust business.

Suitable for positional & long-term investors on dips near support.

Trend remains bullish as long as price sustains above ₹420–428 zone.

==============

⚠️ Disclaimer:

==============

This content is shared strictly for educational and informational purposes.

We are not SEBI-registered investment advisors or analysts.

The views expressed are personal opinions, based on publicly available data and market observations.

Please consult a SEBI-registered investment advisor before taking any investment or trading decisions.

Any actions taken based on this content are entirely at your own risk and responsibility.

========================

Trade Secrets By Pratik

========================

NIFTY KEY LEVELS FOR 27.01.2026NIFTY KEY LEVELS FOR 27.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 27/01/2026A gap-up opening near the 25200 zone in Nifty indicates an attempt by the market to stabilize after recent selling pressure, but the broader structure still suggests a range-bound to weak undertone unless key resistance levels are decisively crossed. The gap-up itself is not a confirmation of trend reversal; instead, it places the index right at an important decision-making area, where both buyers and sellers are active. The initial 30 minutes of trade will be critical to judge whether the gap sustains or starts filling.

From a technical perspective, the 25250–25300 region is acting as a major intraday resistance. This zone has previously seen supply and rejection, which means any upside move without volume support may struggle here. A reversal long setup becomes valid only if Nifty sustains above 25250, with follow-through buying. In such a case, upside targets can be projected towards 25350, 25400, and 25450+, where partial profit booking is advisable due to overhead supply and previous breakdown levels.

On the downside, 25200–25150 is the immediate support band. Failure to hold above this level, especially if the gap starts getting filled, can invite fresh selling pressure. A breakdown below 25200 opens up a short-selling opportunity, with downside targets around 25100, 25050, and 25000. These levels are psychologically and technically important, and price reactions here should be watched closely for potential intraday bounces.

If selling momentum intensifies and Nifty breaks below 24950, it would signal continuation of the broader bearish structure. Below this level, the index may slide towards 24850, 24800, and 24750, where stronger demand zones are placed. These lower levels can act as temporary support, but trend reversal should only be considered after clear price confirmation and structure change.

Overall, the market is showing a gap-up within a corrective or consolidation phase, not a confirmed bullish trend yet. Traders should remain level-driven, avoid chasing the opening move, and wait for price acceptance above resistance or breakdown below support. Tight stop-losses, partial profit booking, and disciplined risk management are essential, as volatility and false breakouts are likely around the current zone.

#BANKNIFTY PE & CE Levels(27/01/2026)A gap-up opening is expected in Bank Nifty, indicating a positive start to the session after recent consolidation near lower support zones. However, despite the gap-up, the broader structure still suggests cautious bullishness rather than a strong trending move, as price remains below major higher-timeframe resistance levels. Early volatility can be expected as the market reacts to the gap, and the first 15–30 minutes will be crucial to understand whether the gap sustains or gets filled.

From a technical perspective, the 59050–59100 zone is acting as a key intraday resistance-cum-decision area. If Bank Nifty manages to sustain above 59050, it can trigger a short-term bullish continuation. In such a scenario, CE positions can be considered, with upside targets placed near 59250, followed by 59350 and 59450+. These levels coincide with previous breakdown areas and supply zones, so partial profit booking is advised as price approaches each target.

On the downside, 58950–58900 remains an important intraday support. Any failure to hold above this zone, especially if the gap starts filling, may invite fresh selling pressure. A rejection from resistance or sustained trading below 58950 can open the path for PE trades, with downside targets around 58750, 58650, and 58550. This makes the current zone a classic sell-on-rise area unless buyers show strong follow-through.

If Bank Nifty breaks below 58450, the structure will weaken further, indicating continuation of the broader downtrend. Below this level, bearish momentum may accelerate towards 58250, 58150, and 58050, where stronger demand is expected. These lower levels could act as temporary bounce zones, but trend reversal should only be considered after confirmation.

Overall, the market setup suggests a gap-up within a range-bound to mildly bearish structure. Traders should avoid aggressive positions at the open and instead wait for price confirmation above resistance or below support. Focus on level-based trading, disciplined stop losses, and partial profit booking, as intraday whipsaws are likely. A clear directional move will emerge only after Bank Nifty decisively breaks out of the current consolidation range.

NIFTY : Trading levels and Plan for 27-Jan-2026📘 NIFTY TRADING PLAN – 27 JAN 2026

⏱ Timeframe: 15-Min

📊 Gap Considered: 100+ Points

🎯 Approach: Trade only after price acceptance / rejection

🔼 GAP UP OPENING SCENARIO 🚀

If NIFTY opens with a strong gap-up, avoid emotional buying in the first few candles.

📍 Key Resistance Zone: 25,177 – 25,230

• This zone acted as supply earlier

• High probability of consolidation or rejection

🟢 Bullish Continuation Plan:

15-min candle closes above 25,230

Follow-up candle shows higher low

Targets → 25,300 → 25,347

🔴 Rejection / Pullback Plan:

Failure to sustain above 25,177

Expect retracement towards 25,081

🧠 Options Strategy:

• Bull Call Spread (ATM CE Buy + OTM CE Sell)

• Avoid naked CE buying near resistance

➡️ FLAT / RANGE OPENING SCENARIO ⚖️

Flat open indicates indecision and option decay opportunity.

🚧 NO TRADE ZONE: 25,109 – 25,177

• Whipsaw probability is high

• Directional trades only after breakout

🟢 Upside Plan:

Acceptance above 25,177

Targets → 25,230 → 25,300

🔴 Downside Plan:

Breakdown below 25,109

Drift towards 25,081

🧠 Options Strategy:

• Short Strangle / Iron Condor

• Only with strict SL on breakout

🔽 GAP DOWN OPENING SCENARIO 📉

Gap-down open tests buyer strength early.

🟢 Opening Support Zone: 25,029 – 25,081

• Buyers may attempt initial bounce

🟢 Bounce Confirmation:

Rejection wicks near support

Higher low on 15-min chart

Upside target → 25,109 → 25,177

🔴 Breakdown Scenario:

Sustained trade below 25,029

Next downside zone → 24,854 – 24,781

🧠 Options Strategy:

• Bear Put Spread if breakdown confirms

• Avoid panic selling near support

🛡 OPTIONS RISK MANAGEMENT TIPS

Never trade inside NO-TRADE ZONE

Prefer spreads over naked options

Risk max 1–2% capital per trade

Book partial profits near levels

One trade = one idea (no revenge trading)

📌 SUMMARY & CONCLUSION

• 25,109 – 25,177 is the key decision zone

• Directional move only after acceptance

• Gap days reward patience, not speed

• Let price confirm → then execute 📊

⚠️ DISCLAIMER

This analysis is for educational purposes only.

I am not a SEBI registered analyst.

Markets involve risk—trade responsibly.

NIFTY 50 – Weekly Outlook (Key Levels & Structure)

NIFTY has decisively broken below the rising trendline that was supporting the index for the past few months. This trendline had multiple confirmations, and the breakdown signals a shift from bullish to corrective / sideways-to-bearish structure in the near term.

The index is currently testing a crucial horizontal support zone around 25,000–25,050. This level will be very important for next week’s price action.

⸻

Key Levels to Watch

Support Zones:

• 25,000 – 25,050 → Immediate and psychological support

• 24,600 – 24,650 → Major demand zone (next downside support)

• 24,350 – 24,400 → Strong long-term support if selling accelerates

Resistance Zones:

• 25,350 – 25,450 → Minor pullback resistance

• 25,750 – 25,850 → Breakdown retest zone

• 26,200 – 26,350 → Strong supply / rejection zone

⸻

Market Structure View

• As long as price remains below the broken trendline, rallies may face selling pressure.

• A sustained hold above 25,450 can lead to short-term relief bounce.

• Break and hold below 25,000 may open gates for 24,600 levels in coming sessions.

• Expect volatile moves, especially around weekly expiry and global cues.

⸻

Trading Approach

• Prefer wait & watch near support levels

• Avoid aggressive trades in the middle of the range

• Let price confirm direction before taking positional bias

⸻

Disclaimer

I am not a SEBI registered analyst/advisor.

This analysis is only for educational and informational purposes.

This is NOT a buy or sell recommendation.

Trading in the stock market involves risk. Please consult your financial advisor before taking any trade.

I am not responsible for any profit or loss arising from this analysis.

NIFTY Update Last Support 24500NSE:NIFTY

previously i posted nifty analysis but that became trap

nifty is stand near to support clusters.

there are no pullback in current down trend so pullback can also possibly and that pullback become breakout rally but this is possibility. pullback also continue the down rally that also possibility.

last support is 24500

this is not a any types of advice.

this is a just chart analysis and that can be wrong.

do your own research.

Eternal Zomato shows strong weakness NSE:ETERNAL

Zomato Near to end his up trend

major support is break near 300 and retested that level and gave another strong down move in daliy time frame. that retest also brakes another support with volume and big move.

chart picture explain all things.

next major support is gap is 230 and that whole zone till 200.

this is not any types of advice.

this is just chart analysis.

do your own research

NIFTY Faces Pressure: Can 24,300 Hold?NIFTY has turned weak after falling around 2.5% on the weekly chart. The index has made a double top near 26,250, which usually means the market is finding it hard to move higher from that area.

On the weekly chart, the candles look bearish. NIFTY is currently holding near an important support around 25,000 (50 EMA). If this level breaks, the market may move lower towards 24,300 and even 23,900.

On the daily chart, NIFTY is trading below all major moving averages (20, 50, 100 & 200 EMA). In the past, whenever NIFTY stayed below these averages, it usually corrected further. Right now, there is no strong support before 24,600.

On the monthly chart, a double top is visible again, showing weakness at higher levels. However, there is decent support near 24,300–24,240, which is also close to the monthly 20 EMA.

Momentum is also weakening. RSI is showing bearish divergence on weekly and monthly charts, which suggests upside strength is fading.

Resistance Levels :- 25,200 – 25,300, 25,500, 26,250

Support Levels :- 24,987, 24,600, 24,300 – 24,240, 23,900

Overall View

As long as NIFTY stays below 25,500, the trend remains weak. Market direction will become clearer near the 24,300 support zone.

Advanced Intraday Institution Option TradingAdvanced Intraday Institutional Option Trading

Institutional intraday option trading focuses on order flow, volatility expansion, and hedging behavior, not prediction. Institutions deploy capital where liquidity, gamma, and vega sensitivity allow fast risk adjustment—usually in near-expiry (0DTE–3DTE) index options.

Institutional Interpretation

Max Call OI at 21,500 → Heavy call writing → Resistance

Rising Put OI at 21,400 → Strong downside hedge → Support

IV spike on Calls above 21,500 → Short covering risk → Breakout fuel

Balanced IV at ATM → Volatility expansion likely

High-Probability Intraday Trades

Gamma Scalping: Buy ATM options when IV expands + price holds VWAP

Directional Break: Long calls above call-writer resistance with OI unwinding

Volatility Fade: Sell options after IV spikes near key levels

Key Rule

Institutions trade structure, not direction.

Retail trades candles. Smart money trades the option chain.

NIFTY – Intraday Structure | Breakout from Bullish ConsolidationOn 5m, 15m and 1H timeframes, NIFTY formed a bearish trendline breakout around 2 PM, followed by a pullback and formation of a bullish intraday consolidation channel.

Price is currently consolidating inside this bullish channel, and a decisive break on either side can define the next intraday move.

🔹 Intraday Plan

Upside Scenario:

Break above bullish channel

Targets:

T1: 25,500

T2: 25,550

T3: 25,650

Stop Loss: 25,300 – 25,280

Downside Scenario:

Break below bullish channel

Targets:

T1: 25,150

T2: 25,000

T3: 24,900 – 24,920

Stop Loss: 25,360 – 25,380

This is a pure intraday range-break setup based on post-breakout bullish consolidation.

⚠️ Disclaimer

I am not a SEBI registered advisor or trader.

This analysis is shared only for educational purposes.

Please consult a registered financial advisor before taking any trading decisions.

Understanding Long-Term Breakouts: Lessons from JINDALSTEL📈 Understanding Long-Term Breakouts: Lessons from JINDALSTEL

1. Long-Term Breakout: Why It Matters

A long-term breakout occurs when a stock surpasses a major resistance level that has held for years.

In JINDALSTEL’s case, the August 2010 high of ₹796 was finally breached in March 2024, after nearly 14 years.

Such breakouts are significant because they often mark a shift in market perception—investors are willing to pay higher prices than ever before, signaling confidence in the company’s future.

Key Insight: The longer the resistance holds, the more powerful the breakout tends to be, as it represents years of accumulated supply being absorbed.

2. Resistance Turned Support: The Golden Rule

Once a resistance level is broken, it often becomes a new support level.

JINDALSTEL pulled back to this zone (around ₹796–₹800), tested it, and then reversed upward.

This behavior shows that buyers defended the level, confirming its importance.

Why It Matters:

Respecting resistance-turned-support validates the breakout.

It reassures traders that the move wasn’t a false breakout but a genuine shift in demand.

3. Latest High Breakout: Continuation of Buying Interest

After the pullback, the stock began breaching its latest weekly highs.

This indicates follow-up buying—new participants are entering, and existing holders are adding positions.

A breakout after a successful retest of support is often seen as a high-probability continuation pattern.

Takeaway:

Breakouts after pullbacks are stronger than straight-line moves because they show healthy consolidation and renewed demand.

4. Risk Management: The Unsung Hero

Even the strongest chart setups require disciplined risk management:

Stop-loss placement: Below the new support (₹796–₹800 zone in this case).

Position sizing: Avoid overexposure; allocate capital wisely.

Trend awareness: Long-term breakouts can be powerful, but corrections are inevitable.

Avoid chasing: Enter near support or on confirmed breakouts, not in the middle of volatile moves.

5. Investor & Trader Takeaways

For Investors:

Long-term breakouts often signal a new growth phase.

Sustaining above old highs shows structural strength in the company.

For Traders:

Respect resistance-turned-support zones—they are ideal entry points.

Breakouts after pullbacks are high conviction trades.

Always pair technical setups with risk management discipline.

✨ Final Thoughts

JINDALSTEL’s chart is a textbook example of how markets reward patience.

A 14-year breakout signals a major shift.

The pullback to support and reversal confirms strength.

The latest high breakout shows continued buying interest.

For both investors and traders, this case highlights the importance of respecting technical levels, waiting for confirmation, and managing risk effectively.

NIFTY KEY LEVELS FOR 23.01.2026NIFTY KEY LEVELS FOR 23.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.