NIFTY KEY LEVELS FOR 06.02.2026NIFTY KEY LEVELS FOR 06.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Niftytrendanalysis

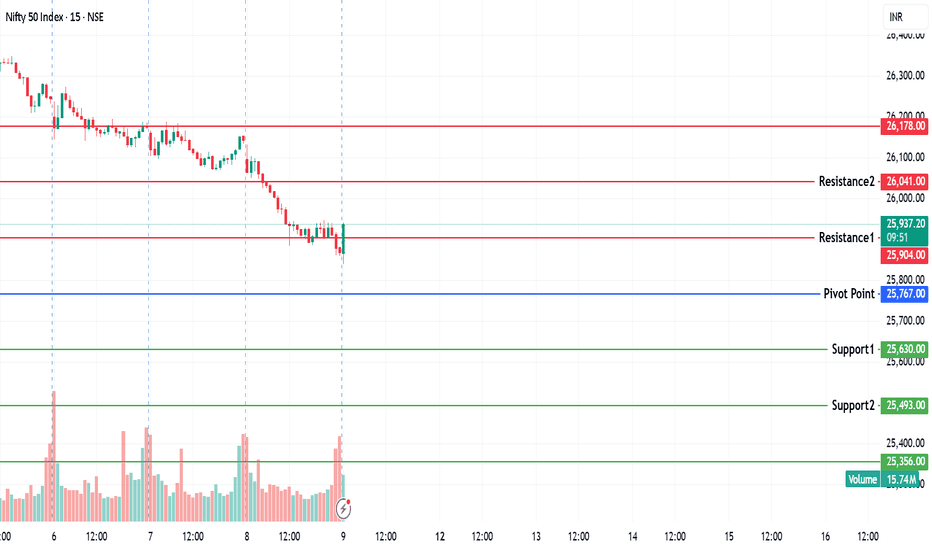

NIFTY KEY LEVELS FOR 05.02.2026NIFTY KEY LEVELS FOR 05.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 04.02.2026NIFTY KEY LEVELS FOR 04.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 02.02.2026NIFTY KEY LEVELS FOR 02.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Decoding Today’s Price Action on a Major Event Day(Union Budget)Is today’s market fall because of a negative budget surprise? Maybe yes, maybe no. That debate doesn’t help much.

But what does help is understanding that price action had already started preparing for this move nearly 10 days ago.

Candlesticks do speak — But only to those who have the patience to listen . Here's what they announced in advance:

Event days might trigger big moves — but structure prepares them in advance to facilitate big price movements

NIFTY KEY LEVELS FOR 01.02.2026 BUDJET DAY SPLNIFTY KEY LEVELS FOR 01.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 30.01.2026NIFTY KEY LEVELS FOR 30.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 29.01.2026NIFTY KEY LEVELS FOR 29.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY - Trading levels and Plan for 29-Jan-2026📊 NIFTY Trading Plan for 29-Jan-2026

(Educational & Level-Based | For Index Options Traders)

Market Principle to Remember:

Price reacts at zones where maximum traders are trapped, hedged, or emotionally committed.

Our job is not prediction — it is structured reaction 🧠📈

🟢 Scenario 1: GAP UP Opening (100+ Points) 🚀

Market Psychology:

A big gap-up often comes from overnight short covering or positive global cues. Retail traders chase breakouts emotionally, while smart money waits to sell premium or buy only after acceptance.

📌 Trading Plan:

🔹 Avoid buying immediately at market open

🔹 Let the first 15–30 minutes define direction

🔹 Mark opening range high & VWAP

🔹 Bullish bias only if price sustains above VWAP

🔹 Look for pullback + hold before Call buying

🔹 Prefer Bull Call Spread if IV is elevated

🔹 If price shows rejection near resistance, expect gap-fill or consolidation

🔹 Consider Bear Call Spread near strong resistance

🔍 Educational Insight:

Gap-up buyers are usually emotional. If price fails to sustain, institutions sell into strength, leading to sharp reversals.

🟡 Scenario 2: FLAT / RANGE Opening 😐

Market Psychology:

A flat open signals indecision. Big players wait for retail participation before initiating the real move.

📌 Trading Plan:

🔹 Mark Previous Day High (PDH) & Low (PDL)

🔹 First 30 minutes define the battle zone

🔹 Breakout with volume suggests directional move

🔹 Weak breakout often turns into a false trap

🔹 Use Straddle / Strangle near range boundaries

🔹 Deploy Iron Condor if price stays range-bound

🔹 Enter directional trade only after close + retest

🔍 Educational Insight:

Markets punish impatience. Flat opens reward traders who wait for confirmation, not anticipation.

🔴 Scenario 3: GAP DOWN Opening (100+ Points) 📉

Market Psychology:

Gap-down opens trigger panic selling. Weak hands exit early, while smart money waits for selling exhaustion.

📌 Trading Plan:

🔹 Do not sell Puts immediately at open

🔹 Observe opening candle size and volume spike

🔹 Watch how price behaves near key support zones

🔹 If support holds, expect a pullback or bounce

🔹 Buy Calls only after higher-low formation

🔹 If support breaks with volume, expect trend day down

🔹 Buy Puts on pullback toward resistance

🔹 Prefer Bear Put Spread for controlled risk

🔹 Use Call Credit Spread near resistance

🔍 Educational Insight:

Most gap-down moves start with fear but continue only when institutional selling confirms.

⚠️ Risk Management Tips for Options Traders 🛡️

🔹 Risk only 1–2% of total capital per trade

🔹 Avoid revenge trading after stop-loss hits

🔹 No fresh trades after 2:30 PM

🔹 Avoid naked option selling on event-driven days

🔹 Always check IV, Theta decay, and liquidity

🔹 Maintain minimum risk–reward of 1:2

🔹 Journal every trade — process > profits

🧠 Summary & Conclusion ✨

🔹 Gap openings offer opportunity but demand discipline

🔹 Structured trading beats emotional decisions

🔹 Price acceptance matters more than candle color

🔹 Options trading is a probability game, not prediction

🔹 Consistency comes from process, patience, and risk control

Trade like a risk manager first, trader second 💼📊

📜 Disclaimer ⚠️

This trading plan is shared strictly for educational purposes only.

I am not a SEBI registered analyst.

Trading in the stock market involves risk.

Please consult a certified financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 28.01.2026NIFTY KEY LEVELS FOR 28.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 27.01.2026NIFTY KEY LEVELS FOR 27.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 23.01.2026NIFTY KEY LEVELS FOR 23.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 21.01.2026NIFTY KEY LEVELS FOR 21.01.2026

Timeframe: 3 Minutes

Unable to post on time due to a technical glitch. Sorry for the delayed post.

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 20.01.2026NIFTY KEY LEVELS FOR 20.01.2026

Timeframe: 3 Minutes

Sorry for the Delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Nifty: Fear is there, but price is still fightingToday’s daily candle is clearly saying one thing. The market is not in surrender mode yet.

Yes, the index closed in red, but the structure is still intact.

The daily candle has a small body.

Selling came on the downside, but the close was not near the lows.

That tells us there is pressure, not panic.

Sentiment is weak, confidence is low, and retail participants are cautious.

Usually, in such conditions, prices fall fast.

But that is not happening here.

This is the most important clue.

Look at the price structure.

NSE:NIFTY has been pulling back from higher levels for the last few sessions,

but it has not given a clear breakdown yet.

Demand is repeatedly showing up near the 25500–25480 zone.

Intraday charts confirm this.

Down moves are not impulsive.

After every sell-off, price goes flat and gets absorbed.

So fear exists, but supply is not aggressive.

Sector behaviour supports the same story.

The broader market is weak, high beta stocks are under pressure.

But capital is not fully exiting the market.

FMCG and Pharma are showing relatively better strength.

This is a classic defensive rotation.

The market is not running away from risk, it is just shifting risk.

This does not mean a rally is about to start.

It simply means the market has not entered panic distribution.

For tomorrow, the structure-based scenarios are simple.

If the index holds above the 25500 zone

and selling remains shallow,

this is likely a time correction, not a crash.

If another dip comes due to fear

and that dip is again quickly absorbed,

it will point toward stronger base formation.

Real risk starts only if

price sustains below 25450 with heavy volume.

That behaviour is not visible yet.

Retailers are afraid.

Price is neutral to defensive.

Sector rotation is defensive.

All three signals are aligned.

The market is scared, but not broken.

In such phases, there is no need to be a hero.

Just stay disciplined and observe.

The market is speaking, not shouting.

Only those who listen survive.

That’s all for today.

Keep reading structure, stay away from emotions.

Tomorrow, the market will again show the next move on its own.

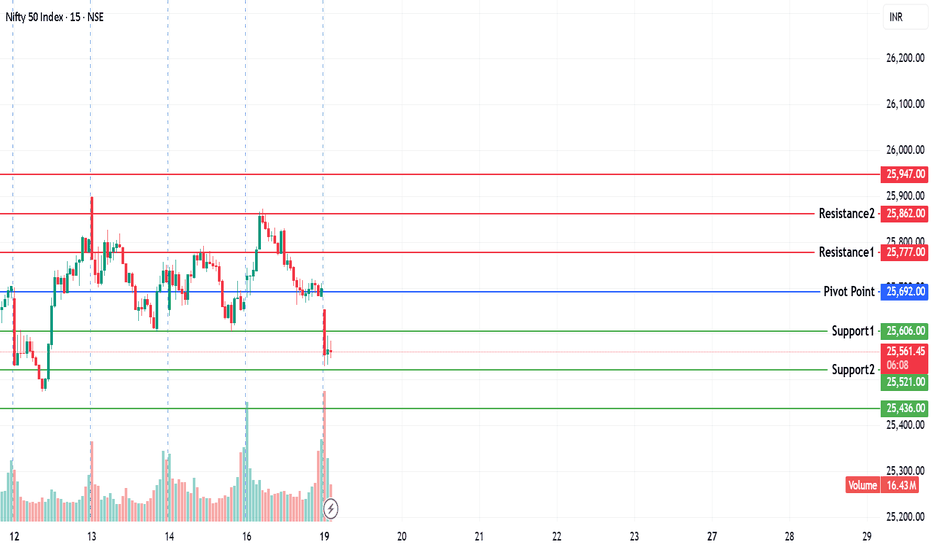

NIFTY KEY LEVELS FOR 19.01.2026NIFTY KEY LEVELS FOR 19.01.2026

Timeframe: 3 Minutes

Sorry for the Delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

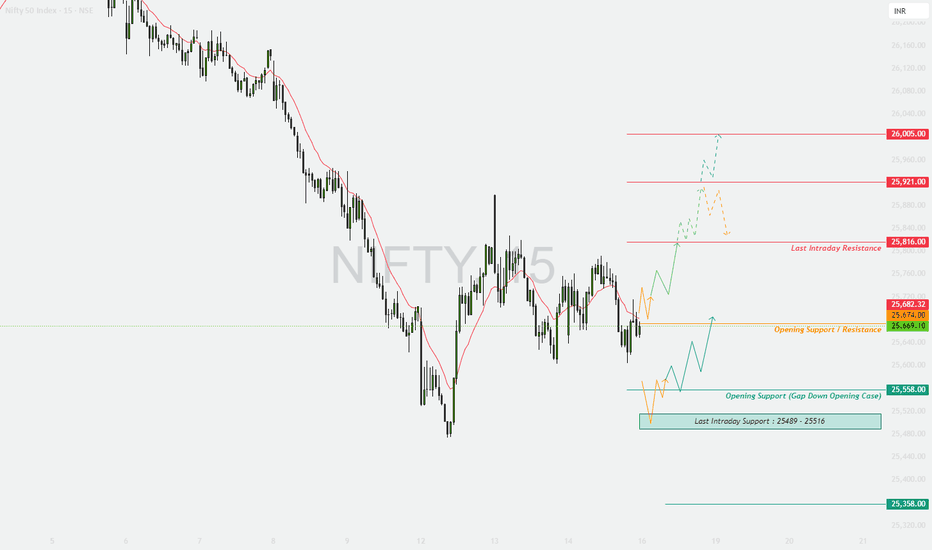

NIFTY : TRADING LEVELS AND PLAN FOR 16-JAN-2025Timeframe: 15-minute ⏱️

Gap Criteria: 100+ points ⚡

Market Structure: Pullback after a sharp sell-off, with price testing an important intraday equilibrium zone ⚖️

Scenario 1: Gap-Up Opening (100+ points) 🚀

If NIFTY opens above the 25,740–25,780 zone, it would indicate continuation of the recovery along with short covering activity 📈.

The first price reaction is expected near 25,816 (last intraday resistance). Sustained trading above 25,816 can open upside potential towards 25,921 and further towards 26,005, which is a major supply zone 🧱. Given the prevailing broader downtrend, profit booking is likely near higher levels 💼. Aggressive long positions should only be considered after a strong 15-minute candle close above the resistance area ✅.

Options Strategy for Gap-Up 🧾:

A bull call spread is preferred by buying an ATM call and selling an OTM call 🟢. Avoid taking naked call positions near 25,921 and above ⚠️. Trail stop losses aggressively to protect gains 🔒📈.

Scenario 2: Flat or Range-Bound Opening ⚖️

If NIFTY opens between 25,660 and 25,740, the market is expected to remain range-bound with higher chances of option premium decay ⏳.

This zone will act as an opening support and resistance area 🧭. The index may consolidate before revealing a clear direction 🔄. Long trades should only be initiated if price sustains above 25,816 with confirmation 🟢. A short bias can be considered only if there is a decisive breakdown below 25,558 🔴.

Options Strategy for Flat Market 🧾:

Experienced traders may consider short strangle or iron fly strategies 🕸️. Focus should remain on quick theta capture ⏳, and profits should be booked early rather than waiting until end of the day ⌛.

Scenario 3: Gap-Down Opening (100+ points) 📉

If NIFTY opens below 25,558, selling pressure is likely to resume 🔻.

Immediate support is placed in the 25,516–25,489 zone, which is the last intraday support area 🛑. A bounce from this region may offer only a short-term pullback opportunity 🔄. If the index breaks below 25,489, further downside towards 25,358 becomes possible ⬇️. Bottom-fishing should be strictly avoided without strong confirmation 🚫🎣.

Options Strategy for Gap-Down 🧾:

A bear put spread is preferred instead of naked put buying 🔴. Avoid selling put options in trending markets ⚠️. Quick profit booking is recommended due to higher volatility 💨.

Risk Management Tips for Options Trading 🛡️:

Risk only 1–2% of total capital per trade 🎯. During expiry week, price movements are faster, so exits should also be quicker ⚡. Spread strategies are preferred to manage theta decay and implied volatility risk 📉📊. Avoid revenge trading after a stop loss 🚫😤. Always wait for the first 15-minute market structure to form before initiating any position ⏱️.

Summary and Conclusion ✨:

NIFTY is currently positioned at a critical equilibrium zone after a sharp correction ⚖️. The 25,740–25,816 range remains the key bullish trigger 🟢, while 25,558 is the crucial make-or-break support 🔴. Trades should be executed strictly on confirmation, allowing the market to clearly indicate direction 👀📈.

Disclaimer ⚠️:

This analysis is shared strictly for educational purposes only 📚. I am not a SEBI-registered analyst. Markets are uncertain, and there is a possibility of being wrong 🤝. Please consult your financial advisor before taking any trade 🧑💼📑.

NIFTY KEY LEVELS FOR 14.01.2026NIFTY KEY LEVELS FOR 14.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Trading levels and Plan for 14-Jan-2026📊 NIFTY Trading Plan – 14 Jan 2026

Timeframe: 15-min

Gap Consideration: 100+ points

Market Context: Short-term corrective structure with defined intraday support & resistance

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If NIFTY opens above 25,816, it indicates bullish intent toward the previous supply area.

Immediate focus will be on 25,816 (Opening Resistance).

Sustained price action above 25,816 with volume can trigger short-covering.

Upside targets:

• 25,921 (Last Intraday Resistance)

• Partial profit booking recommended near resistance.

Rejection near 25,816–25,921 zone may lead to intraday pullback.

📌 Options Strategy (Gap-Up):

• Bull Call Spread (Buy ATM CE, Sell OTM CE)

• Avoid aggressive naked CE buying near resistance

• Trail stop once premium doubles 📈

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

If NIFTY opens between 25,672 – 25,816, expect consolidation and option decay.

This zone acts as Opening Support/Resistance (No Trade Zone).

Directional trades only after clear breakout or breakdown.

Above 25,816 → bias shifts bullish.

Below 25,672 → selling pressure likely.

📌 Options Strategy (Flat Market):

• Short Strangle / Iron Fly (experienced traders only)

• Focus on theta decay ⏳

• Book profits early, avoid late-day overconfidence

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

If NIFTY opens below 25,672, initial sentiment remains weak.

First support to watch: 25,559 (Last Intraday Support).

A bounce from 25,559 can offer a quick pullback trade.

Breakdown below 25,559 opens downside targets:

• 25,483

Avoid counter-trend longs without confirmation.

📌 Options Strategy (Gap-Down):

• Bear Put Spread or ATM PE with strict SL

• Avoid selling PE in trending weakness

• Trail profits aggressively 📉

🧠 Risk Management Tips for Options Traders 🛡️

Risk only 1–2% of capital per trade.

Expiry-week trades demand faster exits.

Prefer spreads over naked options to manage theta & IV risk.

Wait for first 15-min candle structure before committing.

One clean trade > multiple emotional trades.

📌 Summary & Conclusion ✨

NIFTY is trading within a defined intraday range.

📍 25,672–25,816 remains the key decision zone.

Directional clarity will emerge only after acceptance outside this range.

Trade what the market confirms — not what you assume.

⚠️ Disclaimer

This analysis is shared strictly for educational purposes only.

I am not a SEBI-registered analyst.

Markets are uncertain, and I may be wrong.

Please consult your financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 13.01.2026NIFTY KEY LEVELS FOR 13.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Trading levels and Plan for 13-Jan-2025

Timeframe: 15-min

Gap Consideration: 100+ points

Market Structure: Pullback after sharp recovery, now approaching key supply zone

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If NIFTY opens above 25,923, it indicates a continuation attempt into the previous intraday supply zone.

Initial reaction near 25,923–26,005 is crucial (previous resistance).

Sustainability above 25,923 with volume = bullish acceptance.

Upside targets:

• 26,005 (last intraday resistance)

• 26,075 (upper resistance / supply zone)

Failure to hold above 25,923 may lead to pullback toward the opening range.

📌 Options Strategy (Gap-Up):

• Bull Call Spread (e.g., Buy ATM CE & Sell OTM CE)

• Avoid naked CE buying near resistance

• Partial profit booking recommended near 26,005+

➡️ SCENARIO 2: FLAT / RANGE-BOUND OPENING ⚖️

If NIFTY opens between 25,743 – 25,816, expect range behaviour and option decay.

This zone acts as Opening Support/Resistance + No-Trade Area.

Wait for a clear breakout or breakdown before initiating trades.

Above 25,816 with hold → bullish continuation possible.

Below 25,743 → weakness resumes toward lower supports.

📌 Options Strategy (Flat Market):

• Short Strangle / Iron Fly (only for experienced traders)

• Focus on theta decay, tight SL mandatory

• Book profits early; do not hold till late expiry hours

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

If NIFTY opens below 25,743, selling pressure may dominate initially.

First support to watch: 25,640 (last intraday support).

A bounce from 25,640 can give a pullback trade.

Breakdown below 25,640 opens downside targets:

• 25,545

• Further weakness if momentum accelerates

Avoid aggressive longs unless strong reversal confirmation appears.

📌 Options Strategy (Gap-Down):

• Bear Put Spread or ATM PE buy with strict SL

• Avoid selling PE in trending breakdown

• Trail profits aggressively on downside moves

🧠 Risk Management Tips for Options Traders 🛡️

Never risk more than 1–2% of capital per trade.

Expiry trades require faster exits — do not expect positional moves.

Prefer spreads over naked options to control theta & volatility risk.

Trade only after first 15-min structure is clear.

One good trade is enough — overtrading kills edge.

📌 Summary & Conclusion ✨

NIFTY is currently at a decision zone after a sharp pullback recovery.

📍 25,743–25,816 remains the key battle area.

Directional bias will only be clear after acceptance outside this range.

Let price confirm — react, don’t predict.

⚠️ Disclaimer

This analysis is shared strictly for educational purposes only.

I am not a SEBI-registered analyst.

Markets are uncertain, and I may be wrong.

Please consult your financial advisor before taking any trades.

NIFTY : Trading levels and Plan for 12-Jan-2026(Timeframe: 15-min | Gap criteria considered: 100+ points)

🔑 Key Levels (from chart)

Last Intraday Resistance: 25,998

Opening Resistance Zone: 25,742 – 25,816

Spot / Pivot Area: 25,700

Opening Support Zone: 25,592 – 25,647

Last Intraday Support: 25,353

🧠 Market structure note: NIFTY is in a short-term downtrend, but currently showing a relief bounce from demand. Price is approaching an important supply zone, where rejection risk remains high unless acceptance improves.

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 25,742, it will be a pullback rally into resistance.

🎓 Educational Insight

Gap-ups in a corrective downtrend often face selling near supply zones. Strength is confirmed only when price holds above resistance, not just spikes.

Plan of Action

Avoid aggressive longs in the first 15 minutes ⏳

Sustain above 25,816 → move toward 25,998

Rejection from 25,742 – 25,816 → pullback toward 25,700

Fresh longs only after retest + higher low

Options idea: Bull Call Spread (ATM buy + OTM sell)

🟡 2. FLAT OPENING

If NIFTY opens near 25,680 – 25,720, expect range-bound and volatile price action.

🎓 Educational Insight

Flat opens near VWAP / pivot after a sell-off usually result in false breakouts. Direction emerges only after range expansion with volume.

Plan of Action

Above 25,742 → upside toward 25,816

Failure above 25,742 → sideways to weak bias

Break below 25,592 → selling toward 25,353

Avoid trades inside the middle range 🚫

Options idea: Iron Fly / Short Strangle with hedge

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,592, bears remain firmly in control.

🎓 Educational Insight

Gap-downs into demand can cause short covering bounces, but continuation happens if price fails to reclaim the opening range.

Plan of Action

First support to watch: 25,592 – 25,647

Weak bounce + rejection → downside toward 25,353

Sustain below 25,353 → further trend continuation

Avoid fresh shorts exactly at support

Options idea: Bear Put Spread / Put Debit Spread

🛡️ Risk Management Tips (Options Trading)

Risk only 1–2% capital per trade 💰

Prefer spreads over naked buying in volatile zones

Book partial profits at resistance/support levels

No averaging against the trend 🚫

Stop trading after 2 consecutive losses 🧠

🧾 Summary & Conclusion

Above 25,816: Relief rally toward 25,998

25,742 – 25,816: Selling / supply zone

Below 25,592: Weakness toward 25,353

Focus on price acceptance, not prediction 🎯

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Markets are risky, and I may be wrong. Please consult a qualified financial advisor before taking trades.

NIFTY KEY LEVELS FOR 09.01.2026NIFTY KEY LEVELS FOR 09.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research