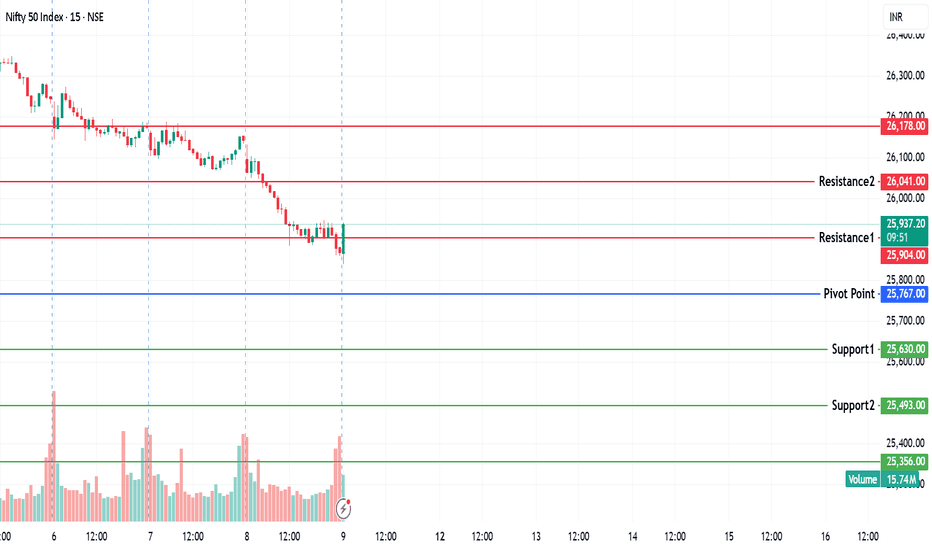

NIFTY KEY LEVELS FOR 09.01.2026NIFTY KEY LEVELS FOR 09.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

Niftytrendanalysis

NIFTY : Trading levels and Plan for 09-Jan-2026

(Timeframe: 15-min | Gap criteria considered: 100+ points)

🔑 Key Levels from Chart

Major Upside Resistance: 26,115

Last Intraday Resistance: 26,032

No-Trade / Supply Zone: 25,839 – 25,932

Opening Support / Pivot: 25,839

Last Intraday Support: 25,741

Lower Support Extension: 25,587

🧠 Market context: NIFTY is in a short-term corrective structure after a strong sell-off. Price is consolidating inside a well-defined no-trade zone, indicating balance before the next directional move.

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 25,932, it signals short-covering but into a supply zone.

🎓 Educational Insight

Gap-ups after a decline often face selling pressure near VWAP/supply zones. Sustainable upside requires acceptance above resistance, not just an opening spike.

Plan of Action

Avoid chasing longs in first 15 minutes ⏳

Sustain above 26,032 → upside toward 26,115

Rejection near 26,032 → pullback to 25,932 – 25,839

Fresh longs only on retest + higher low formation

Options idea: Bull Call Spread (ATM buy + OTM sell)

🟡 2. FLAT OPENING

If NIFTY opens inside 25,839 – 25,932, expect range-bound & whipsaw action.

🎓 Educational Insight

Flat opens within supply-demand overlap zones usually lead to false breakouts. Direction emerges only after range expansion with volume.

Plan of Action

Above 25,932 with hold → move toward 26,032

Failure above 25,932 → sideways to negative bias

Break below 25,839 → weakness toward 25,741

Avoid trades in mid-range 🚫

Options idea: Iron Fly / Hedged Short Strangle if volatility drops

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,839, bears remain in control.

🎓 Educational Insight

Gap-downs into prior supports can trigger panic selling, but sharp bounces are also common. Always wait for price confirmation.

Plan of Action

First demand zone: 25,741

Strong rejection from 25,741 → intraday bounce possible

Break & sustain below 25,741 → slide toward 25,587

Avoid fresh shorts exactly at support

Options idea: Bear Put Spread or Put Debit Spread

🛡️ Risk Management Tips (Options Trading)

Risk only 1–2% capital per trade 💰

Prefer spreads over naked buying in volatile zones

Book partial profits near resistance/support

No averaging against trend 🚫

Stop trading after 2 consecutive losses 🧠

🧾 Summary & Conclusion

Above 26,032: Short-term bullish toward 26,115

25,839 – 25,932: No-Trade / Chop Zone

Below 25,839: Weakness toward 25,741 → 25,587

Focus on price acceptance, not prediction 🎯

⚠️ Disclaimer

I am not a SEBI-registered analyst. This analysis is strictly for educational purposes only. Markets involve risk—please consult a certified financial advisor before trading.

NIFTY KEY LEVELS FOR 08.01.2026NIFTY KEY LEVELS FOR 08.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY KEY LEVELS FOR 07.01.2026NIFTY KEY LEVELS FOR 07.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY KEY LEVELS FOR 06.01.2026NIFTY KEY LEVELS FOR 06.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY KEY LEVELS FOR 02.01.2026NIFTY KEY LEVELS FOR 02.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

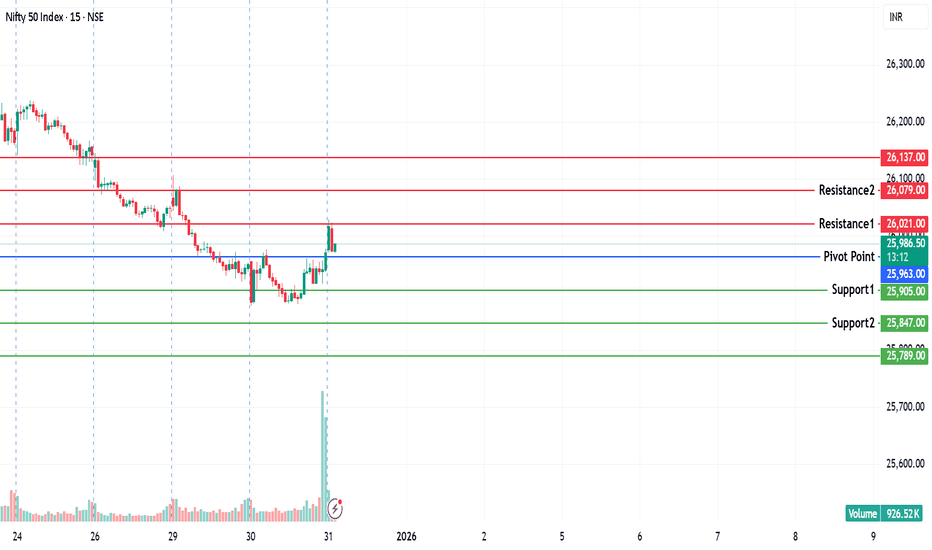

NIFTY KEY LEVELS FOR 31.12.2025NIFTY KEY LEVELS FOR 31.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY KEY LEVELS FOR 30.12.2025NIFTY KEY LEVELS FOR 30.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY : Trading levels and Plan for 30-Dec-2025NIFTY Trading Plan for 30-Dec-2025

(Timeframe: 15-min | Gap criteria considered: 100+ points)

Key Levels to Track (from chart)

Last Intraday Resistance: 26,168.00

Opening Support / Resistance (Pivot): 25,950.00

Opening Support Zone: 25,852 – 25,974

Last Intraday Support: 25,805.00

Lower Support (Extreme): 25,662.45

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 25,950, price starts the session near the pivot with scope for a relief bounce.

🎓 Educational Explanation:

Gap-up openings after a decline often invite short-covering first, followed by a test of overhead resistance. Sustainable upside needs acceptance above the pivot; chasing the opening spike usually gives poor R:R.

Plan of Action:

Wait 10–15 minutes to see acceptance above 25,950.

If price holds above 25,950, look for pullback-based long entries.

Upside targets: 26,050 → 26,168 (watch price behaviour near resistance).

Rejection near 26,168 may lead to a pullback toward 25,950.

Options: Prefer ATM / ITM Calls after confirmation; avoid far OTM CE at the open.

🟡 2. FLAT OPENING

A flat open near 25,900–25,980 keeps NIFTY inside the Opening Support / Pivot zone.

🎓 Educational Explanation:

Flat opens indicate balance. Direction generally emerges after a clear break of the opening range. Trading inside the zone without confirmation often results in whipsaws and theta decay.

Plan of Action:

Sustaining above 25,950 keeps bullish bias alive toward 26,050 → 26,168.

Failure to cross 25,950 keeps price range-bound.

Breakdown below 25,852 increases downside risk toward 25,805.

Watch for bullish rejection within 25,852–25,974 for bounce trades.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,852, early sentiment turns weak.

🎓 Educational Explanation:

Gap-downs are often emotional. Strong demand zones attract short-covering and value buying, so selling blindly into support increases reversal risk.

Plan of Action:

First support to watch is 25,805 — observe candle structure and volume.

Breakdown and acceptance below 25,805 opens downside toward 25,662.45.

Strong bullish reversal signals near 25,662.45 can trigger a sharp intraday bounce.

Any pullback toward 25,852 after breakdown can be used as a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Trading 🛡️

Avoid trading the first 5–10 minutes on gap days.

Don’t buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support levels.

🧾 Summary & Conclusion

Above 25,950: Bulls attempt recovery; targets 26,050 → 26,168.

Between 25,852–25,950: Market remains balanced; patience required.

Below 25,852: Sellers gain control unless buyers defend 25,805 / 25,662.

Trade price behaviour at levels, not predictions or emotions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 29.12.2025NIFTY KEY LEVELS FOR 29.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY : Trading levels and Plan for 29-Dec-2025📘 NIFTY Trading Plan for 29-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 100+ points)

Key Levels to Track (from chart)

Major Upside Resistance: 26,265.35

Last Intraday Resistance: 26,186.00

Opening Resistance: 26,099.00

Opening Support Zone: 25,979 – 26,040

Last Intraday Support: 25,920.00

Lower Support (Extreme): 25,834.00

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 26,099, price will start the session close to a short-term supply area.

🎓 Educational Explanation:

Gap-up openings reflect overnight bullish sentiment, but early profit booking near resistance is common. Strong continuation usually requires acceptance above resistance or a pullback-and-hold. Chasing the opening candle often results in poor risk-reward.

Plan of Action:

Wait for 10–15 minutes to check acceptance above 26,099.

If price sustains above 26,099, look for pullback-based long entries.

Upside targets remain 26,186, followed by 26,265.35 on strong acceptance.

Rejection near 26,186–26,265 may trigger a pullback toward 26,099.

Option buyers should prefer ATM / ITM Calls only after confirmation; avoid chasing far OTM CE.

🟡 2. FLAT OPENING

A flat open near 26,020–26,060 places NIFTY inside the Opening Support Zone (25,979–26,040).

🎓 Educational Explanation:

Flat openings indicate balance between buyers and sellers. Direction usually emerges only after a clear break of the opening range. Trading inside this zone without confirmation often leads to whipsaws and option premium decay.

Plan of Action:

Sustaining above 26,099 shifts bias bullish toward 26,186.

Failure to cross 26,099 keeps the market range-bound or weak.

Breakdown below 25,979 signals weakness toward 25,920.

Watch for bullish rejection candles near 25,979–26,040 for bounce trades.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,979, early sentiment turns cautious to bearish.

🎓 Educational Explanation:

Gap-down openings are often emotion-driven. However, strong demand zones attract short-covering and value buying. Selling blindly into support increases the probability of getting trapped.

Plan of Action:

First support to watch is 25,920 — observe price behaviour and candle structure.

Breakdown and acceptance below 25,920 opens the downside toward 25,834.

Strong bullish reversal signals near 25,834 may lead to a sharp intraday bounce.

Any pullback toward 25,979 after breakdown can be used as a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Trading 🛡️

Avoid trading the first 5–10 minutes during gap openings.

Do not buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support zones.

🧾 Summary & Conclusion

Above 26,099: Bulls stay active; targets 26,186 → 26,265.

Between 25,979–26,099: Market remains balanced; patience required.

Below 25,979: Sellers gain control unless buyers defend 25,920 / 25,834.

Focus on price behaviour at predefined levels, not predictions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

Nifty: Sideways Trend — Bounce Likely, Sustainability DoubtfulYou can clearly see from the NSE:NIFTY chart that the trend has turned sideways.

Momentum is positive, but the candles are overlapping. That is the main reason why many stocks, despite having good price action, are either not moving or failing to sustain their moves.

Another important point to note is that the index has again moved back inside the Pivot range, yet the volume is green even on red candles.

This combination indicates that a bounce may come, but it is unlikely to sustain.

More importantly, if you look at GIFT NIFTY, both trend and momentum are negative there. That adds caution to the overall view.

Because of this, my strategy for tomorrow remains Sell-on-Rise.

Resistance is near 26098 and support is at 25950.

If 26100 breaks decisively on the intraday chart, the Sell-on-Rise plan will be considered invalid.

For short-term accumulation, a strong support lies at 25777.

Looking ahead to next week, the market is likely to behave in a way where:

– Intraday traders can continue with Sell-on-Rise

– Short-term traders can accumulate trending theme stocks on dips

Next week will be more about building positions in high relative strength stocks, not chasing breakouts.

Plan your short-term portfolio carefully with stocks from strong sectors.

Defence is looking good. Stocks like NSE:BEL and NSE:HAL can be studied on dips or on clean breakouts.

📊 Levels at a glance:

Resistance: 26098

Support: 25950

Key intraday invalidation: 26100

Short-term accumulation support: 25777

Bias: Sell-on-Rise

Focus: High relative strength stocks, Defence sector

That’s all for now.

Take care.

Have a profitable tomorrow.

NIFTY KEY LEVELS FOR 26.12.2025NIFTY KEY LEVELS FOR 26.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY : Trading levels and Plan for 26-Dec-2025📘 NIFTY Trading Plan for 26-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 100+ points)

Key Levels to Track (from chart)

Major Upside Resistance: 26,341.10

Last Intraday Resistance: 26,265.00

Opening Resistance: 26,212.00

Opening Support / Resistance (Pivot Zone): 26,099 – 26,141

Last Intraday Support: 26,040.50

Lower Support: 25,920.85

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 26,212, price starts the session in a bullish zone but close to overhead supply.

🎓 Educational Explanation:

Gap-up opens indicate positive overnight sentiment. However, when price opens near resistance, early profit-booking is common. Strong trends usually continue only after acceptance above resistance or a clean retest, not on impulsive spikes.

Plan of Action:

If price sustains above 26,212 for 10–15 minutes, look for pullback-based long entries.

First upside hurdle is 26,265 (last intraday resistance).

Acceptance above 26,265 can extend the move toward 26,341.10.

Rejection or exhaustion near 26,265–26,341 may lead to a pullback toward 26,212.

Option buyers should avoid chasing CE at the open; confirmation improves R:R.

🟡 2. FLAT OPENING

A flat open around 26,120–26,160 keeps NIFTY inside the opening pivot zone (26,099–26,141).

🎓 Educational Explanation:

Flat opens reflect balance between buyers and sellers. Direction typically emerges after the opening range breaks. Trading inside this zone without confirmation often leads to whipsaws and theta decay.

Plan of Action:

Sustaining above 26,141 keeps bullish bias intact, targeting 26,212 → 26,265.

Failure to hold 26,099 increases downside risk toward 26,040.50.

Bullish rejection near 26,099–26,141 offers a low-risk bounce back to 26,212.

Breakdown and acceptance below 26,099 shifts momentum toward 26,040.50.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 26,099, early sentiment turns cautious to bearish.

🎓 Educational Explanation:

Gap-downs are often emotion-driven. Strong demand zones can attract short-covering and value buying, leading to sharp reversals. Selling blindly into support increases risk.

Plan of Action:

First support to watch is 26,040.50 — observe candle structure and volume.

Breakdown below 26,040.50 opens the downside toward 25,920.85.

Strong bullish reversal signals near 25,920.85 may lead to a sharp intraday bounce.

Any pullback toward 26,099 after breakdown can be used as a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Traders 🛡️

Avoid trading the first 5–10 minutes during gap openings.

Don’t buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support levels.

🧾 Summary & Conclusion

Above 26,212: Bulls remain active; targets 26,265 → 26,341.

Between 26,099–26,212: Market stays balanced; patience is key.

Below 26,099: Sellers gain control unless buyers defend 26,040.50 / 25,920.85.

Trade price behaviour at levels, not predictions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

Nifty Trend Turns Green — Buy-on-Dip Strategy Active As you can see on the chart, both Trend and Momentum in NSE:NIFTY have turned Green.

There is also a Pivot Low on the daily chart, and even though the candle is red, the volume is green — a clear sign of accumulation.

On top of that, the Macro Index has turned upward for the short term, which supports the bullish case.

However, the Pivot has shifted slightly lower to 26167. Because of this, a dip towards 26057 is possible, and that dip should be bought.

So the strategy now is Buy-on-Dip, as long as the trend structure remains intact.

The final support for the trend is 26000.

If Nifty gives a daily close below this level, then a deeper cut can happen and this view will fail.

Tomorrow is a weekly closing day, so instead of playing intraday, I’ll focus on planning positions for the coming week.

Resistance is at 26234.

A weekly close above this level can trigger a sharp move towards 26570, especially because PP has stayed tight for the last two days without releasing the expected move. When it comes, it is likely to be fast.

Overall, tomorrow’s close is very important.

Equities should continue to perform well into next week.

Sectors showing strong momentum are Defence, Metals, and Finance. Swing traders should keep these spaces on their radar.

📊 Levels at a glance:

Pivot: 26167

Support 1 (Buy Zone): 26057

Trend Support: 26000

Resistance: 26234

Upside on weekly close above resistance: 26570

Bias: Buy-on-Dip

Sector focus: Defence, Metals, Finance

That’s all for now.

Take care. Have a profitable tomorrow.

NIFTY KEY LEVELS FOR 23.12.2025NIFTY KEY LEVELS FOR 23.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY KEY LEVELS FOR 22.12.2025NIFTY KEY LEVELS FOR 22.12.2025

Timeframe: 3 Minutes

Sorry for the delayed post.

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY : Trading levels and Plan for 22-Dec-2025NIFTY Trading Plan for 22-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 100+ points)

Key Levels from Chart

Opening Pivot (Support / Resistance): 25,985

Opening Support Zone: 25,858 – 25,891

Last Intraday Support: 25,808

Buyer’s Support Zone: 25,640 – 25,672

Last Intraday Resistance: 26,100 – 26,137

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 25,985, price enters a positive momentum structure but near overhead supply.

🎓 Educational Explanation:

A gap-up above a key pivot reflects bullish overnight sentiment. However, markets often pause near prior resistance zones as early longs book profits. A sustained move above resistance is healthier than a straight vertical rally.

Plan of Action:

If price sustains above 25,985 for 10–15 minutes, look for pullback-based long entries.

Upside momentum can extend toward 26,100 – 26,137, a strong supply zone.

Acceptance above 26,137 may trigger trend continuation; manage trades with trailing SL.

Rejection from 26,100 – 26,137 can lead to a pullback toward 25,985.

Option buyers should avoid chasing CE at the open; enter only after retest confirmation.

🟡 2. FLAT OPENING

A flat open near 25,940 – 25,980 keeps NIFTY inside the balance zone.

🎓 Educational Explanation:

Flat opens indicate equilibrium between buyers and sellers. Direction emerges only after a breakout or breakdown of the opening range. Trading without confirmation in such conditions often leads to whipsaws.

Plan of Action:

Sustaining above 25,985 turns sentiment bullish, targeting 26,100 – 26,137.

Failure to hold 25,985 keeps price vulnerable to a decline toward 25,891 – 25,858.

Strong bullish rejection near 25,858 – 25,891 offers low-risk bounce trades.

Breakdown below 25,858 shifts control to sellers for a move toward 25,808.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,858, early sentiment turns weak.

🎓 Educational Explanation:

Gap-down openings often trigger emotional selling. However, strong demand zones frequently attract buyers and short-covering. Selling blindly into support increases risk.

Plan of Action:

First support to watch is 25,808 — observe price behaviour closely.

A breakdown below 25,808 exposes the Buyer’s Support Zone: 25,640 – 25,672.

Bullish reversal patterns in 25,640 – 25,672 can lead to a recovery toward 25,858.

Any pullback toward 25,858 after breakdown becomes a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Traders 🛡️

Avoid trading the first 5–10 minutes during gap days.

Do not buy options near resistance or sell near support without confirmation.

Use time-based stop loss (15–20 minutes) if the premium doesn’t move.

Risk only 1–2% of capital per trade.

Prefer ATM options or spreads to reduce theta decay.

Book partial profits near marked resistance/support zones.

🧾 Summary & Conclusion

Above 25,985: Bulls stay active; targets 26,100 – 26,137.

Between 25,858 – 25,985: Market remains range-bound; patience is key.

Below 25,858: Sellers gain control unless buyers defend 25,808 / 25,640–25,672.

Focus on price behaviour at levels, not prediction.

Consistency comes from discipline, not over-trading.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

NIFTY 50 Weekly — A Repeating ATH Expansion CycleAfter studying the NIFTY 50 weekly chart, I’ve identified a clearly repeating structural pattern around All-Time Highs (ATH).

This is not random price action — it’s a market expansion–consolidation–expansion cycle that has already played out multiple times.

Let’s break it down step by step so it’s easy to understand.

🔁 The Repeating ATH Pattern (Market Behavior)

Step 1: ATH – A (First All-Time High)

NIFTY makes a fresh All-Time High (ATH-A).

This marks the start of a new bullish expansion phase.

Step 2: Breakout of ATH – A → New ATH – B

Price breaks above ATH-A.

Momentum continues and NIFTY forms a New ATH (ATH-B).

This phase is usually strong and fast.

Step 3: Retest of ATH – A (Very Important)

After making ATH-B, NIFTY pulls back.

Price retests the previous ATH-A (old resistance becomes support).

This confirms structural strength, not weakness.

Step 4: Failed Attempt to Break ATH – B

After the retest, NIFTY tries to break ATH-B again.

The first attempt fails.

This is where many traders get confused, but structurally this is healthy.

Step 5: Consolidation Zone

Price moves sideways between:

Support = ATH-A

Resistance = ATH-B

This is accumulation, not distribution.

Time correction > price correction.

Step 6: Final Breakout of ATH – B

After consolidation, NIFTY successfully breaks ATH-B.

This breakout is clean and sustained.

The result: New ATH – A (Next Cycle Begins)

🧠 Pattern History on the Chart

Pattern – I (Previous Cycle)

ATH-A → Breakout → ATH-B

Retest ATH-A

Failed breakout at ATH-B

Consolidation

Strong breakout → New ATH

Same Pattern Repeating (Current Cycle)

Jan 2024: New ATH – A

Jun 2024: Breakout of ATH-A

Sep 2024: New ATH – B

Feb 2025: Retest of ATH-A

Dec 2025: Failed breakout at ATH-B

Now: Ongoing consolidation zone

➡️ Structurally, this is exactly the same pattern as before.

🔮 What This Suggests (If Pattern Holds)

NIFTY is not bearish.

It is in a time-based consolidation.

If history repeats:

Consolidation continues

ATH-B breaks decisively

New ATH-A is likely in 2026

📌 Key Takeaway

Markets don’t move randomly at higher timeframes.

They expand, pause, absorb liquidity, and expand again.

This weekly ATH structure has already repeated multiple times, and the current price action fits perfectly into the same framework.

⚠️ This is a structural market study, not a prediction or financial advice.

📈 Weekly timeframe focus — patience is key.

NIFTY KEY LEVELS FOR 19.12.2025NIFTY KEY LEVELS FOR 19.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

NIFTY : Trading levels and Plan for 19-Dec-2025📘 NIFTY Trading Plan for 19-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 100+ points)

Important Levels from Chart

Opening Resistance: 25,848

Last Intraday Resistance: 25,923 – 25,951

Upper Target / Supply: 25,985

Opening Support (No-Trade Zone): 25,763 – 25,814

Last Intraday Support: 25,677 – 25,703

Extreme Support: 25,594

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 25,848, it directly enters the overhead resistance structure.

🎓 Educational Explanation:

A gap-up opening indicates overnight positive sentiment, but price often reacts near prior supply zones due to profit booking. Professional traders avoid chasing and instead wait for acceptance above resistance or a healthy retest.

Plan of Action:

Sustaining above 25,848 for 10–15 minutes can allow pullback-based long entries.

First upside hurdle is 25,923–25,951 (last intraday resistance zone).

Acceptance above 25,951 may extend the move toward 25,985.

Rejection or exhaustion near 25,923–25,951 can trigger a pullback toward 25,848.

Option buyers should prefer ATM/ITM Calls only after confirmation; avoid buying at the opening spike.

🟡 2. FLAT OPENING

A flat open near 25,800–25,830 places NIFTY inside the Opening Support / No-Trade Zone.

🎓 Educational Explanation:

Flat opens represent market indecision. During such phases, price tends to trap early buyers and sellers. Direction becomes clear only after a range breakout or breakdown, making patience crucial.

Plan of Action:

Break and sustain above 25,848 shifts momentum toward 25,923–25,951.

Failure to cross 25,848 keeps price vulnerable to a downside test.

Breakdown below 25,763 opens downside toward 25,703–25,677.

Watch for bullish reversal patterns near 25,763–25,814 for bounce trades.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,763, selling pressure may dominate early.

🎓 Educational Explanation:

Gap-down openings are often driven by fear. However, strong historical demand zones usually attract buyers looking for value, leading to short-covering bounces. Selling blindly at support increases risk.

Plan of Action:

First demand zone to observe is 25,703–25,677; look for rejection or base formation.

A bounce from this zone can retrace toward 25,763–25,814.

Sustained breakdown below 25,677 exposes the 25,594 level.

Any pullback toward 25,763 after breakdown becomes a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Traders 🛡️

Avoid trading in the first 5–10 minutes during gap days.

Do not buy options near resistance or sell near support—wait for confirmation.

Use time-based stop-loss (15–20 minutes) if the premium fails to move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or vertical spreads to manage theta decay.

Book partial profits near marked resistance/support zones.

🧾 Summary & Conclusion

Above 25,848: Bulls stay active with targets 25,951 → 25,985.

Between 25,763–25,848: Market remains range-bound; patience is key.

Below 25,763: Sellers gain control unless buyers defend 25,703–25,677.

Focus on price behaviour at levels, not prediction.

Consistency comes from discipline, not frequent trades.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 18.12.2025NIFTY KEY LEVELS FOR 18.12.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research