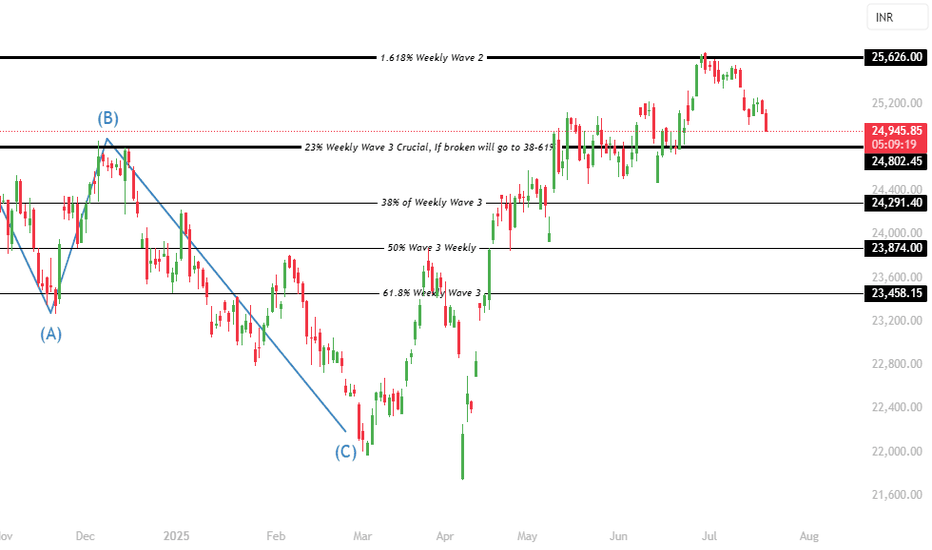

Nifty 50 Trend Analysis A detailed wave analysis in larger times frames indicates that nifty is beginning to trigger a sharp or moderate momentum deep correction. The correction & downtrend can last upto 23874 & 23458 potentially. In a downtrend, institutions will sell on every rise, hence its not the right time to make new investments directly in the stocks. Currently nifty is trading at 25073 and this swing momentum can go upto 24802 without reversals, and 24802 will play a crucial role but since the wave 3 has completed its maximum levels we need to brace for 23874 & 23458.

Niftytrendanalysis

NIFTY - Trading levels and plan for 18-July-2025📊 NIFTY INTRADAY TRADING PLAN – 18-Jul-2025

Gap Opening Consideration: 100+ points from previous close

📍 KEY LEVELS TO MONITOR

🟥 Last Resistance: 25,340 – 25,365

🟥 Major Resistance: 25,430

🟧 Opening Resistance: 25,265

🟨 No Trade Zone: 25,055 – 25,127

🟩 Last Intraday Support Zone: 24,932 – 24,970

🟢 Major Support: 24,832

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,365) 📈

(Gap-up considered as 100+ points above previous close)

If Nifty opens above 25,365 , it indicates bullish strength. Wait for a pullback near 25,340–25,365 for potential long entries.

If price sustains, expect a possible rally toward 25,430+ , which is the next resistance zone.

Avoid chasing entries; use 15–30 min candle confirmation to avoid false breakouts.

Options Strategy: Focus on ATM or slightly OTM Call Options or try a Bull Call Spread for limited risk.

⚖️ SCENARIO 2: FLAT OPENING (Between 25,055 – 25,127) 🟠

(Flat range aligns with the No Trade Zone )

This is a tricky zone with indecision between bulls and bears. Avoid initiating any trade immediately.

If Nifty breaks and sustains above 25,127 , bullish bias may emerge toward 25,265 – 25,340 .

On breakdown below 25,055 , a short trade setup opens targeting 24,932 – 24,970 zone .

Wait for clear hourly close before taking action in either direction.

Options Strategy: Consider Strangle or Iron Fly strategies for range-based volatility exploitation.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 24,932) 🚨

(Gap-down considered below previous close by 100+ points)

If Nifty opens below 24,932 , monitor price action near the 24,832 major support .

If the support fails and prices break down below 24,832 , expect further downside pressure.

However, if price finds buying interest at 24,832 and bounces, you may consider scalping long with tight stop loss.

Options Strategy: Deploy ATM or ITM Put Options or Bear Put Spreads to play downside with defined risk.

💡 RISK MANAGEMENT & OPTIONS TRADING TIPS

🛑 Never risk more than 1–2% of your capital on any single trade.

⏳ Avoid entering trades during the first 15–30 minutes ; let volatility settle.

📉 Use Hourly candle close to determine validity of breakouts/breakdowns.

⚖️ Prefer spread strategies like Bull Call or Bear Put to cap your risk.

🧠 Avoid revenge trading after losses—stick to your trading plan.

📌 SUMMARY & CONCLUSION

Bullish View: Above 25,365, look for long opportunities up to 25,430 with stop-loss below 25,340.

Range-Bound View: Between 25,055–25,127 (No Trade Zone) – wait for breakout/breakdown confirmation.

Bearish View: Below 24,932 – focus on support at 24,832; breach can accelerate fall.

Action Plan: Wait for price behavior near key levels before committing capital.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational and informational purposes only. Please consult your financial advisor before taking any trade or investment decisions.

NIFTY : Trading plan and levels for 17-July-2025📊 NIFTY INTRADAY TRADING PLAN – 17-Jul-2025

200+ Points Gap Opening Considered Significant | Educational Structured Trading Plan

📍 KEY ZONES & LEVELS TO MONITOR

🟥 Opening Resistance Zone: 25,376 – 25,340

🔴 Last Intraday Resistance: 25,430

🟧 Opening Support Zone: 25,083 – 25,102

🟩 Last Intraday Support Zone: 24,932 – 24,970

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,376) 📈

If NIFTY opens above 25,376 with 100+ points gap-up, expect buyers to dominate initially, pushing towards 25,430 (Last Intraday Resistance) .

Avoid aggressive longs exactly at the open. Let the first 15-minute candle settle to confirm strength.

If price sustains above 25,430 with volume, look for further upside, but be mindful of exhaustion near round numbers.

Options Tip: Prefer ATM Call Options with tight stop-loss or Bull Call Spread to manage risk better.

📊 SCENARIO 2: FLAT OPENING (Between 25,102 – 25,376) ⚖️

This range marks the consolidation area between Opening Support and Opening Resistance Zone .

Price behavior here is crucial for intraday direction bias.

If price holds above 25,224.40 post-open, bias is slightly bullish towards the Resistance Zone.

If price breaks below 25,102 , sellers may drag it towards Last Intraday Support 24,932 – 24,970 .

Options Tip: Consider Iron Fly or Strangle setups if premiums are attractive. Be patient for breakouts.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,083) ⚠️

If NIFTY opens below 25,083 with 100+ points gap-down, expect weakness to persist.

Primary downside target becomes Last Intraday Support Zone: 24,932 – 24,970 .

Sell-on-rise strategy is preferred after 15-minute candle confirmation below 25,083 .

Options Tip: Focus on ATM or ITM Put Options or use Bear Put Spreads for safer execution.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📏 Always risk only 1–2% of total capital per trade.

⏳ Avoid trades during the first 15–30 minutes to let volatility settle.

🔐 Respect Hourly Candle Close stops rather than reacting to wicks.

⚖️ Prefer Spreads and Hedged Strategies in highly volatile or uncertain conditions.

🚫 Avoid over-leveraging especially in expiry week or event-heavy days.

📌 SUMMARY & CONCLUSION

Bullish Bias: Gap-up above 25,376 → Target 25,430

Neutral Range: Between 25,102 – 25,376 → Wait for breakout confirmation

Bearish Bias: Gap-down below 25,083 → Target 24,932 – 24,970

Trade with a calm mindset, respecting the levels and waiting for candle confirmations to reduce false entries.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This plan is purely for educational and informational purposes. Always consult your financial advisor before making any investment decisions.

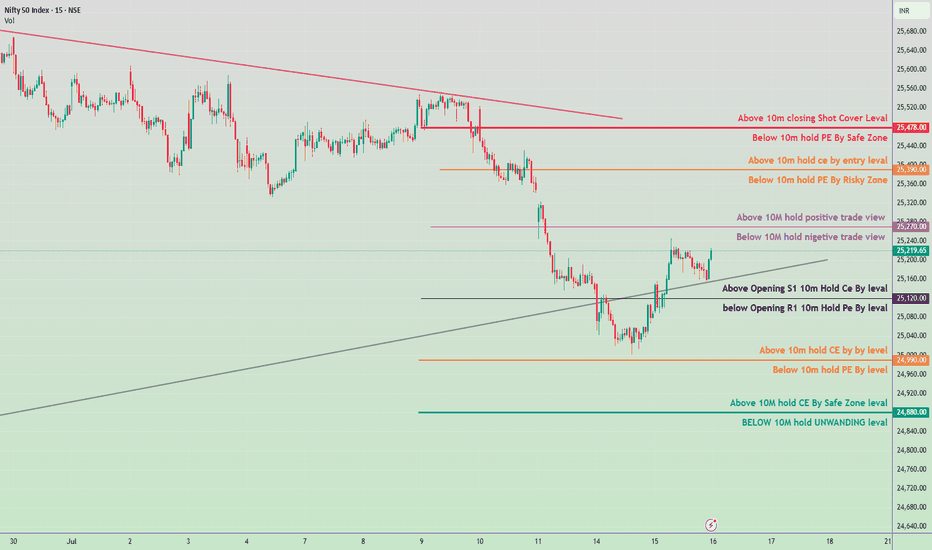

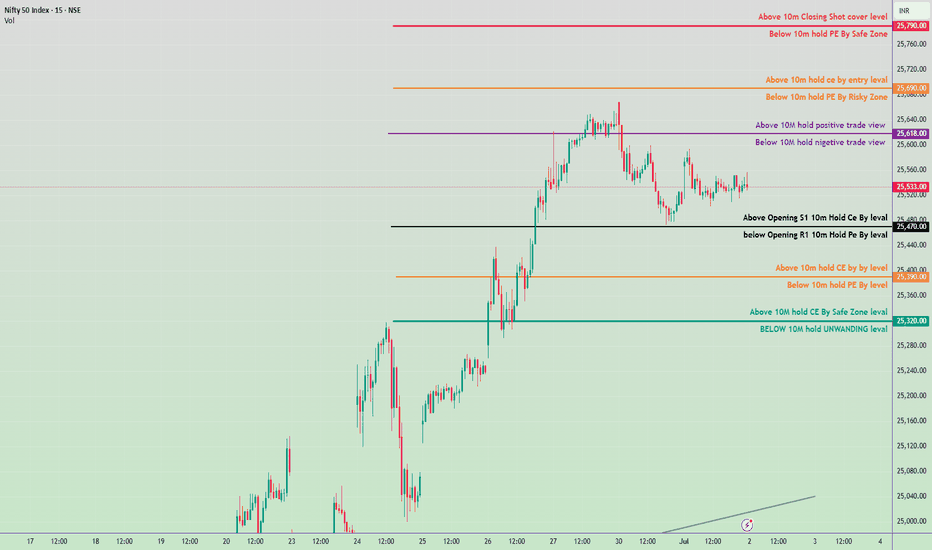

Nifty 50 Intraday Trade Plan - 17 July 2025🔴 Bullish Scenario (CE Buy Zones):

Above 25,480 → Shot Cover Level

→ CE BUY with strong momentum.

Above 25,338 → Entry Level for CE

→ CE BUY possible; moderate conviction.

Above 25,270 → Positive Trade View Starts

→ Start building CE positions cautiously.

Above 25,198.55 (Opening S1 Level)

→ Intraday CE HOLD if already bought.

Above 25,080 → CE by Buy Level

→ Entry-level for CE if market recovers.

Above 24,978 → CE Buy Safe Zone

→ Safer entry for CE, if bounce observed.

🔵 Bearish Scenario (PE Buy Zones):

Below 25,480 → PE by Safe Zone

→ PE can be added gradually.

Below 25,338 → Risky Zone for PE

→ PE buy with risk, SL tight.

Below 25,270 → Negative View Begins

→ Confidence increases in PE position.

Below 25,172 (Opening R1 Level)

→ If breaks this, PE HOLD.

Below 25,080 → PE by Buy Level

Below 24,978 → UNWINDING Level

→ Expect strong selling; PE aggressive buy zone.

🎯 Key Zones to Watch:

Range Bound Zone: Between 25,172 – 25,270

Trend Decider Zone:

Break above 25,270: Bullish Bias

Break below 25,172: Bearish Bias

NIFTY : Trading plan for 16-Jul-2025📊 NIFTY 50 INTRADAY TRADING PLAN – 16-Jul-2025

Strategy prepared with 15-Min chart observation. Gap openings 100+ points considered significant for intraday volatility.

📍 IMPORTANT LEVELS TO WATCH

🟥 Opening / Last Intraday Resistance: 25,340

🟧 Opening Resistance / Support Zone: 25,225

🟧 Opening Support: 25,132 – 25,150

🟩 Last Intraday Support: 25,053

🟩 Buyer’s Support Zone: 24,950 – 24,981

🟥 Profit Booking Zone: 25,408 – 25,430

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,340) 📈

If NIFTY opens above 25,340 , it indicates a strong bullish sentiment. However, watch for immediate profit booking around the Profit Booking Zone 25,408 – 25,430 .

Do not rush into trades immediately. Wait for a 15-minute candle close above 25,340 to confirm continuation.

If it fails to hold 25,340, there can be a quick dip toward 25,225 again.

Options Tip: Prefer ATM or Slightly ITM CE for momentum continuation. Avoid far OTM options due to theta risk on gap-up days.

📊 SCENARIO 2: FLAT OPENING (Between 25,132 – 25,225) 🔄

A flat opening suggests an indecisive mood. Watch how prices behave around Opening Resistance 25,225 and Opening Support 25,132 – 25,150 .

If price sustains above 25,225 with good volume, expect a bullish move toward 25,340 .

If price breaks and sustains below 25,132 , expect weakness toward 25,053 or even 24,950 – 24,981 .

Options Tip: Use ATM Straddles/Strangles if market consolidates between 25,132 – 25,225 for premium decay setups.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,053) ⚠️

A gap-down opening below 25,053 creates immediate bearish pressure. First downside support to monitor is 24,950 – 24,981 (Buyer’s Support Zone) .

If this zone holds, expect reversal buying with a stop-loss below 24,950 .

If 24,950 breaks, avoid fresh longs. Downtrend extension possible below this zone.

Options Tip: On gap-down days, prefer Bear Put Spreads or ATM Put Options for controlled risk instead of buying far OTM PEs.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

Risk only 1–2% of your capital per trade.

Avoid chasing prices in the first 15 minutes after the opening bell.

Prefer ATM/ITM options for directional trades.

Always mark Stop Loss and Stick to it strictly.

Control position sizing—don’t over-leverage on gap opening days.

📌 SUMMARY & CONCLUSION

Bullish Scenario: Above 25,340 → Target 25,408–25,430.

Range-Bound Scenario: Between 25,132 – 25,225 → Watch consolidation before acting.

Bearish Scenario: Below 25,053 → Target 24,950–24,981.

Always stay disciplined with entries and exits. Risk control should be your primary focus as an options trader.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared purely for educational purposes. Please do your own analysis or consult a certified financial advisor before acting on this information.

Nifty 50 – Intraday Plan for July 16, 2025📊 Intraday Key Levels & Strategy:

🔺 Upside Zones (CE Bias):

25,270 – Above 10M hold = Positive Trade View

25,390 – Above 10m hold CE by entry level

25,478 – Above 10m closing = Shot Cover Level

⚠️ Neutral to Mixed Zones:

25,120 – Above Opening S1: 10m Hold CE Buy Level

25,100 – Below Opening R1: 10m Hold PE Buy Level

25,070 – Below 10M = Negative Trade View

🔻 Downside Zones (PE Bias):

24,990 – Below 10m hold PE by level

24,920 – Below 10m hold PE = Risky Zone

24,880 – Above 10M = CE Safe Zone

24,860 – BELOW 10M = UNWINDING zone.

✅ Suggested Intraday Plan:

Bullish Scenario (CE Trades):

Buy CE above 25,120 (Only if 10 min candle holds).

Add on breakout & hold above 25,270.

Target zone: 25,390–25,478.

SL: Below 25,070.

Bearish Scenario (PE Trades):

Sell/Buy PE below 25,100 (Only if 10 min candle sustains).

Confirm further weakness if below 24,990 or 24,920.

Target zone: 24,880–24,860.

SL: Above 25,120.

NIFT : INTRADAY TRADING PLAN – 15-Jul-2025📊 NIFTY 50 INTRADAY TRADING PLAN – 15-Jul-2025

Planned according to the provided chart, focusing on Gap Opening 100+ points scenarios

💡 Previous Close: 25,067.10

⏱️ Timeframe: 15-Min Chart

⚙️ Gap Opening Threshold: 100+ Points considered significant

📍 IMPORTANT LEVELS

🟥 Last Intraday Resistance: 25,340

🟥 Opening Resistance: 25,210

🟧 Opening Support Zone: 24,949 – 25,020

🟩 Last Intraday Support: 24,949

🟩 Buyer's Support: 24,774

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,210) 📈

If Nifty opens above 25,210 , it directly enters the resistance zone. Caution: Do not buy blindly on a gap-up as there is a risk of profit booking.

Wait for a 15-minute candle to close above 25,210 for confirmation. Post-confirmation, upside targets are 25,340 and possibly higher.

Failure to hold above 25,210 can lead to a quick reversal towards the Opening Support Zone 24,949 – 25,020 .

Options Tip: Prefer ITM CE options for momentum continuation. Avoid far OTM on gap-ups to manage theta decay risk.

📊 SCENARIO 2: FLAT OPENING (Between 25,020 – 25,210) 🔄

Flat openings near these levels suggest a balance between bulls and bears. Observe price behavior carefully in the first 15–30 minutes.

A sustained move above 25,210 opens room for bullish continuation up to 25,340 .

Failure to hold Opening Support 24,949 indicates weakness. Below this, prices can drift toward the Buyer's Support 24,774 .

Options Tip: Avoid buying options immediately after a flat open. Monitor structure. Focus on ATM Straddles/Strangles for premium selling if prices remain range-bound.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 24,949) ⚠️

Gap-down below 24,949 brings immediate focus on Buyer's Support 24,774 .

If this zone holds, look for reversal buying opportunities with stop-loss below 24,774 .

A breakdown below 24,774 may trigger a larger downside. Be conservative in this scenario; wait for retest/rejection candles.

Options Tip: IV spike expected. Prefer Bear Put Spreads instead of naked PEs to manage risk and avoid premium erosion on rebounds.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

Stick to maximum 1–2% risk of total capital per trade.

Always observe the first 15–30 minutes before trading aggressively.

Use ATM/ITM strikes to control theta decay.

Respect key support/resistance zones. Do not overtrade.

Avoid chasing prices; let the market confirm direction post-gap.

📌 SUMMARY & CONCLUSION

Bullish Zone: Above 25,210 → Target 25,340.

Range Zone: 25,020 – 25,210 → Watch for structure clarity.

Bearish Zone: Below 24,949 → Target 24,774.

Trade mindfully and focus on capital preservation before chasing profits.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared for educational purposes only. Please do your own research or consult a qualified financial advisor before trading.

Nifty 50 Intraday Trade Plan July 15, 2025🔴 Upper Resistance Levels:

25,430.00

🔺 Above 10m closing: Short Cover Level

🔻 Below 10m: Hold PE (Safe Zone)

25,280.00

🔺 Above 10m: Hold CE (Entry Level)

25,240.00

🔻 Below 10m: Hold PE (Risky Zone)

25,160.00

🔺 Above 10M: Hold Positive Trade View

🔻 Below 10M: Hold Negative Trade View

🟢 Current Zone:

Market is trading near 25,087.10

Watch levels:

25,030.00 – Above Opening S1: Hold CE by level

25,000.00 – Below Opening R1: Hold PE by level

🟠 Lower Support Levels:

24,960.00

🔺 Above 10m: Hold CE by level

24,920.00

🔻 Below 10m: Hold PE by level

24,800.00

🔺 Above 10M: Hold CE by Safe Zone

24,760.00

🔻 Below 10M: UNWINDING Level

🔍 Strategy Suggestions:

✅ Bullish Bias:

If price sustains above 25,160, consider Call Option Buy (CE) or bullish trades.

❌ Bearish Bias:

If price fails below 25,030 or 24,920, consider Put Option Buy (PE) or short positions.

NIFTY : Trading levels and Plan for 14-Jul-2025b]📊 NIFTY 50 INTRADAY PLAN – 14 JULY 2025 (15-Min Chart Study)

Educational insights for all opening scenarios: Gap-Up, Flat, and Gap-Down.

📍 Previous Close: 25,140.55

📌 Gap opening threshold considered: 100+ points

⏱️ Tip: Let the first 15–30 minutes settle before entering trades based on levels.

📌 KEY LEVELS TO MONITOR

Resistance Zone: 25,460

Last Intraday Resistance: 25,318

Opening Support / Resistance Zone: 25,247

Opening Support / Resistance Zone: 25,152 – 25,123

Last Intraday Support Zone: 25,088 – 25,050

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,247) 📈

Bias: Bullish continuation possible

If Nifty opens above 25,247 , watch for continuation towards 25,318 (Last Intraday Resistance) .

Sustainable strength above 25,318 can lead to 25,460 . That’s the upper profit booking zone.

If price shows exhaustion candles near 25,460, avoid fresh longs. Instead, look for selling opportunities with tight stop-loss.

Options Traders: Prefer ATM or slightly ITM calls; avoid chasing far OTM CE after gap-up. Time decay will be sharp in such cases.

📊 SCENARIO 2: FLAT OPENING (Near 25,140 – 25,152) 🔄

Bias: Neutral-to-bearish bias

If the market opens around 25,140 – 25,152 , focus on whether the 25,152 – 25,123 zone holds as support or flips as resistance.

If price holds above 25,152, there’s potential for a bounce towards 25,247.

If price breaks and sustains below 25,123, expect a gradual drift towards the Last Intraday Support: 25,088 – 25,050 .

Avoid quick trades here — observe the first 30 minutes’ range before committing capital.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,050) ⚠️

Bias: Bearish with bounce attempt from lower supports

If Nifty opens below 25,050 , immediate attention should be given to Last Intraday Support: 25,088 – 25,050 .

If that zone breaks, next major support becomes psychological round numbers or extreme supports which may form intraday.

Aggressive selling should only be considered if prices show no reaction around this zone. Watch for hammer or reversal patterns before taking contra long trades.

Options Traders: Avoid buying deep OTM puts after a large gap-down as premiums often get inflated due to IV spikes.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

Focus on ATM or ITM strikes to reduce theta impact on both CE and PE buying.

Apply Stop-Loss based on 15-minute candle closes instead of absolute price ticks to avoid noise.

If VIX is high, hedge with vertical spreads instead of naked options buying.

Strictly maintain a 1–2% max risk of your capital per trade.

Avoid over-trading after 2:45 PM as theta erosion accelerates in options.

Keep tracking Bank Nifty as well for broader market cues.

📌 SUMMARY & CONCLUSION

Bullish Trigger: Above 25,247 → Target 25,318 – 25,460

Neutral Zone: 25,140 – 25,152 → Wait and watch zone

Bearish Trigger: Below 25,123 → Watch 25,088 – 25,050 for bounce

Keep your discipline intact and avoid emotional trades.

Options premium decay is real — always respect time and structure.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please do your own analysis or consult with a financial advisor before making trading decisions.

Nifty 50 spot 25149.85 by the Daily Chart view - Weekly updateNifty 50 spot 25149.85 by the Daily Chart view - Weekly update

- Support Zone 24900 to 25100 Price Band, yet sustained

- Next Support Zone seen at 24325 to 24500 of the Nifty Index

- Resistance Zone 25860 to 26035 then ATH 26277.35 of Nifty Index levels

- Rising Price Channel Breakdown indicates probable weakness to see following

- Falling Resistance Trendline test might be seen coming up, by decent probability

- Nifty Index keeping within self drawn limits and shying away at each attempt towards 26000

NIFTY INDEX INTRADAY LEVELS ( EDUCATIONAL PURPOSE ) 11/07/2025📈 Nifty 50 Index Intraday Trade Plan – 11 July

🕒 Analysis on 15-min | Trades on 1-min TF

🔍 Market Context:

Nifty is approaching key support zone near 25,340–25,350

If broken, downside momentum expected

If it holds, intraday bounce possible

🟢 BUY Setup (Bounce from Support Zone)

✅ BUY above 25,365

🎯 Target 1: 25,410

🎯 Target 2: 25,450

🛑 Stop Loss: 25,330

🔎 Entry Trigger: Bullish engulfing or strong 1-min green candle after bounce

🔴 SELL Setup (Breakdown of Support)

✅ SELL below 25,330

🎯 Target 1: 25,280

🎯 Target 2: 25,240

🛑 Stop Loss: 25,365

🔎 Entry Trigger: Volume spike on breakdown; avoid first red candle trap

⚠️ Flat Opening (Between 25,340–25,365)

🔄 Range Play until breakout

🔁 Buy dips at 25,340 with SL: 25,320

🔁 Sell rallies near 25,400–25,420 with SL: 25,440

⚙️ 1-Min Scalping Tips

🕔 Wait 5 mins post market open

🚫 Avoid trading in first 1–2 candles unless breakout/breakdown confirmed

🔍 Volume + structure-based confirmation needed

📊 Follow strict 1:2 risk-reward ratio

NIFTY: Trading levels and plan for 11-Jul-2025📈 NIFTY INTRADAY PLAN – 11 JULY 2025 (15-min TF)

A level-based, educational breakdown to help traders plan trades across opening scenarios.

📍 Previous Close: 25,348.25

📊 Consider 100+ points for Gap classification

⏱️ Pro Tip: Allow first 15–30 mins of price action to settle and confirm direction before entering trades.

📌 KEY ZONES TO MONITOR

Resistance for Sideways: 25,574 – 25,605

Last Intraday Resistance: 25,506

Opening Resistance for Sideways: 25,439

Opening Resistance/Support Zone: 25,377

Opening Support Zone: 25,288 – 25,311

Buyer's Support Zone (Must Try Zone): 25,221 – 25,246

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,439)

Bias: Bullish but expect sideways to resistance at higher zones

If Nifty opens above 25,439 , it may retest the Last Intraday Resistance: 25,506 quickly.

Sustainable strength above this level can lead to the upper resistance zone between 25,574 – 25,605 , where profit booking is expected.

Avoid fresh CE buying if prices reach the top resistance zone too quickly after open – wait for price cooling or consolidation.

On sharp gap-up days, wait for a pullback to 25,439 to see if it acts as support before continuing higher.

📊 SCENARIO 2: FLAT OPENING (Near 25,348 – 25,377)

Bias: Neutral-to-bearish depending on early structure

If Nifty opens flat between 25,348 – 25,377 , it may face immediate selling pressure.

Support lies around 25,288 – 25,311 ; bulls will try to defend this zone.

Breakdown below this zone can trigger a drift toward Buyer’s Support Zone: 25,221 – 25,246 , which is ideal for reversal trades.

Look for strong reversal candles like hammer or engulfing patterns at buyer's zone to take call side trades.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,288)

Bias: Bearish with potential buy-on-dip opportunities

If Nifty opens below 25,288 , initial support comes in the Buyer’s Support Zone: 25,221 – 25,246 .

Watch for price reaction here – if bulls defend this zone, expect a sharp bounce-back move.

If this zone is breached with volume, don’t force counter-trades – wait for re-entry signals above 25,246 again.

On the bounce, target toward 25,311 – 25,377, but trail stop as we approach resistance.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

Use ATM or ITM options to reduce the impact of time decay, especially in sideways zones.

Avoid trading aggressively in the first 5-minute candle — let price structure settle.

Stick to 15-min candle SL closing logic to reduce false stop-outs.

Avoid buying both CE & PE (straddle) blindly on volatile days — pick a side with confirmation.

If VIX is high, consider hedged strategies like spreads.

Secure profits early after 2:30 PM – avoid fresh entries late unless very high conviction.

📌 SUMMARY & CONCLUSION

Bullish Pathway: Above 25,439 with target toward 25,605

Neutral Zone: 25,348 – 25,377 (watch for confirmation)

Bearish Trigger: Below 25,288, eyes on reversal from 25,221 – 25,246

Observe volume, candle structure, and overall market tone to validate bias

Discipline and execution with risk control are more important than direction

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please consult your financial advisor before taking trades.

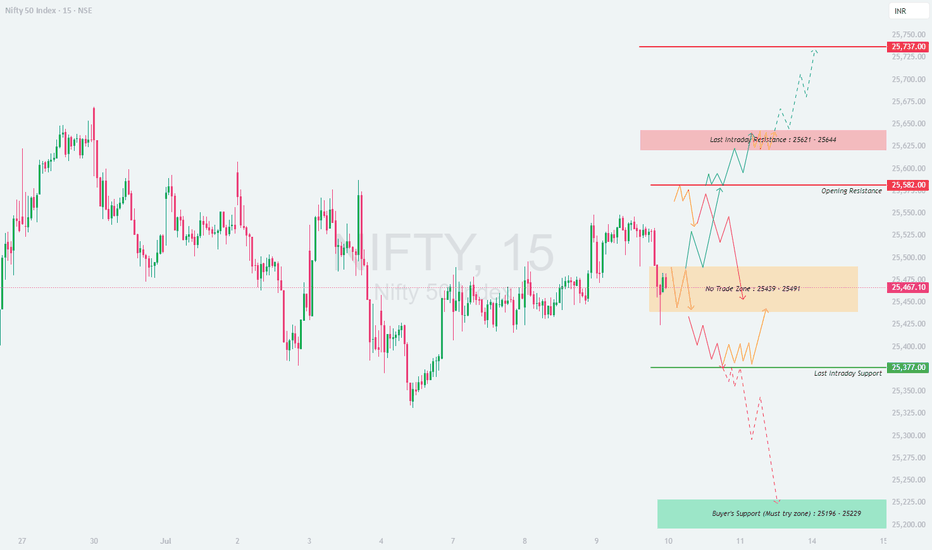

NIFTY : Trading levels and plan for 10-Jul-2025📊 NIFTY INTRADAY PLAN – 10 JULY 2025 (15min TF)

Educational setup with key intraday levels and directional bias – Based on price behavior and reaction zones

📍 Reference Close: 25,467.10

📈 Consider Gap-up or Gap-down if the opening is 100+ points away from this close.

⏱️ Allow the first 15–30 minutes for volatility to settle before taking directional trades.

🔍 KEY LEVELS TO MONITOR

Opening Resistance: 25,582

Last Intraday Resistance: 25,621 – 25,644

No Trade Zone: 25,439 – 25,491

Last Intraday Support: 25,377

Buyer’s Support (Must Try Zone): 25,196 – 25,229

Major Resistance (Profit Booking Zone): 25,737

📈 SCENARIO 1: GAP-UP OPENING (Above 25,582)

Bias: Bullish to Consolidation at upper resistance

If Nifty opens 100+ points higher and sustains above 25,582 , upside may extend to 25,621–25,644 zone.

Watch for rejection candles or indecision near 25,644 – this is a potential supply zone.

If bullish momentum is strong, price may hit 25,737 , but caution near that level for profit booking.

Shorts only if strong reversal seen at resistance with volume and price failing to hold above 25,621.

📊 SCENARIO 2: FLAT OPENING (Within 25,439 – 25,491 – the No Trade Zone)

Bias: Wait & Watch – Let the market show its hand

Flat openings inside the No Trade Zone (25,439–25,491) often lead to whipsaws and indecisive moves.

Avoid taking trades inside this zone unless price breaks out or breaks down with strength.

Upside breakout above 25,491 should retest 25,582; downside breakdown below 25,439 may lead to support testing at 25,377.

Best strategy is to wait for directional clarity before entering trades.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,377)

Bias: Bearish to Neutral – Watch for demand reaction

A 100+ point gap-down opening below 25,377 will take price closer to Buyer’s Support Zone (25,196–25,229) .

Observe buyer activity in this green zone – a bullish engulfing or hammer can provide bounce trades.

Avoid fresh shorts in this area unless there’s a breakdown below 25,195 with volume.

Any recovery from this support can revisit 25,377 or even test No Trade Zone.

💡 OPTIONS RISK MANAGEMENT TIPS:

Avoid directional trades in the first 15 minutes of the market

Don’t trade blindly inside No Trade Zones – wait for breakout confirmation

Use spreads (Bull Call/Bear Put) instead of naked options in choppy markets

Avoid overleveraging, especially around volatile zones like 25,582 and 25,196

Respect time decay – avoid buying weekly options post 2 PM unless clear momentum

Use strict SL (based on 15min candle close) to control emotional trades

📌 SUMMARY – KEY TAKEAWAYS

Bullish above 25,582 – but resistance ahead at 25,644–25,737

Sideways in 25,439–25,491 – best to stay out

Bearish or bounce watch below 25,377 – strong support at 25,196–25,229

Plan the trade, and trade the plan. React, don’t predict.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. All views shared here are for educational purposes only. Please consult your financial advisor before making any trading decisions.

Nifty 50 Intraday Trade Plan 10 july 2025🟣 1. Trend Confirmation Zone (Level: 25,562.00)

Above 25,562.00 → Positive View Active

If Nifty sustains above this level for more than 10 minutes, it indicates bullish momentum. Call Option (CE) traders can stay in the trade or consider new entries.

Below 25,562.00 → Negative View Active

If Nifty stays below this level, bearish momentum is likely. Put Option (PE) trades are favorable.

⚫ 2. Opening Range Levels

Above 25,467.10 (Opening S1) → Hold CE (Call Option)

If the market holds above this after the opening 10-minute candle, you can go long (buy CE).

Below 25,418.00 (Opening R1) → Hold PE (Put Option)

If Nifty breaks this level on the downside, and sustains for 10 mins, it suggests weakness – PE trade is favorable.

🟠 3. Entry-Level Zone

Above 25,682.00 → Entry for CE (Call Option)

Bullish breakout level – good for fresh buying positions if sustained above.

Below 25,682.00 → Risky PE (Put Option) Zone

Aggressive traders may consider short trades, but this is a risky area.

🔴 4. Safe Zone for Positional Traders

Above 25,782.00 → Closing Shot / Cover Level

Indicates overbought or strong bullish continuation – exit PE positions if short.

Below 25,760.00 → Safe Zone for PE

A good place to hold PE (put) positions, as the market is weak below this.

🟠 5. Support Resistance Flip Zone

Above 25,280.00 → CE Hold Level

Support for intraday buyers. A bounce from here can give a CE opportunity.

Below 25,280.00 → PE Hold Level

Breaking this means more downside is likely – favorable for PE.

🟢 6. Strong Support / Breakdown Level

Above 25,158.00 → CE Safe Zone Level

Indicates strong buying support. If held, expect intraday recovery.

Below 25,158.00 → Unwinding Level

Panic selling or unwinding of long positions may start. Avoid CE, prefer PE.

SENSEX INTRADAY LEVELS ( EDUCATIONAL PURPOSE ) 09/07/2025🔹 SENSEX Intraday Trade Plan – 9 July

📊 Analysis: 15-min TF | Execution: 1-min TF

🔵 GAP-UP Opening (Above 83,750)

📌 Plan: Avoid chasing the gap. Look for reversal or a retest

🔁 Entry: Sell below 5-min breakdown or rejection from 83,750–83,800

🛑 SL: 25–30 pts above high

🎯 Target: 83,580 – 83,500

🔻 GAP-DOWN Opening (Below 83,400)

📌 Plan: Avoid panic selling. Wait for price to reclaim or reversal

🔁 Entry: Buy above 5-min high after reclaim or strong bullish candle

🛑 SL: 25–30 pts below low

🎯 Target: 83,600 – 83,750

📏 NORMAL OPEN (Between 83,400–83,750)

🔁 Range Play Setup:

Buy near 83,400–450 (support zone)

Sell near 83,700–750 (resistance zone)

🛑 SL: 20–30 pts beyond level

🎯 Target: 50–70 pts

🚀 Breakout Trade Setup

🔁 Entry: Above 83,800 breakout candle

🛑 SL: Below breakout bar

🎯 Target: 83,900 – 84,000

🔁 Breakdown Trade Setup

🔁 Entry: Below 83,350 breakdown candle

🛑 SL: Above breakdown bar

🎯 Target: 83,200 – 83,100

📌 Note: Stick to risk management. Avoid overtrading in sideways zone. Use confirmation on 1-min candle before entry.

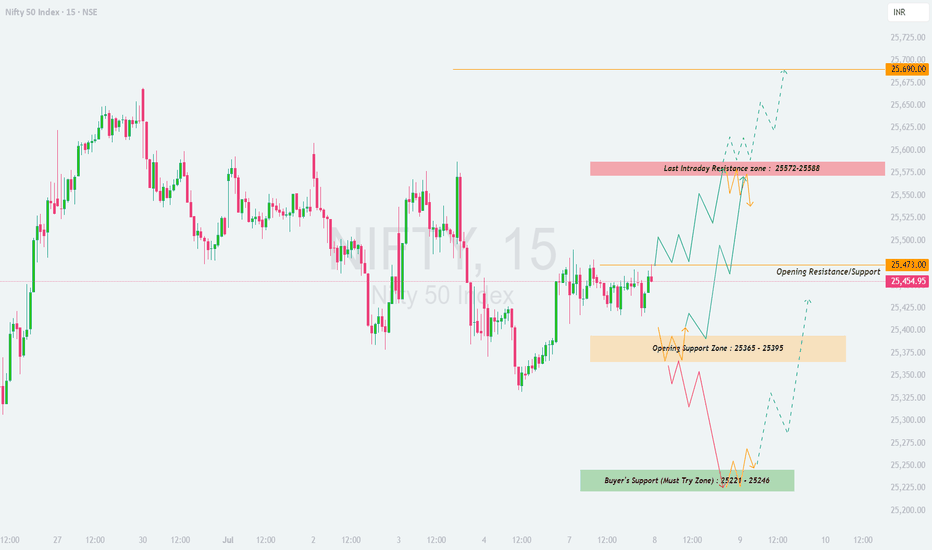

NIFTY : Trading levels and plan for 08-July-2025📊 NIFTY TRADING PLAN – 08 July 2025

(Based on 15-min chart structure – For educational purposes only)

Gap Opening Reference: 100+ pts

Structure favors breakout or reversal play from key zones.

Let price settle in first 15–30 mins before executing any plan.

🔍 Key Zones to Watch:

Opening Resistance/Support: 25,473

Opening Support Zone: 25,365 – 25,395

Buyer’s Must-Hold Zone: 25,221 – 25,246

Last Intraday Resistance: 25,572 – 25,588

Major Resistance (Profit Booking): 25,690

📈 SCENARIO 1: GAP-UP OPENING (100+ pts above 25,473)

If NIFTY opens above 25,572 and sustains, expect price to test the 25,690 zone.

Look for signs of reversal near 25,690 to book longs or consider a short with SL above the zone.

If price fails to hold above 25,572, it may fall back toward 25,473.

📉 SCENARIO 2: FLAT OPENING (within 25,454 – 25,473 range)

Avoid early trades — let the price action confirm direction.

Break above 25,473 can take NIFTY toward 25,572–25,588.

Break below 25,395 may open downside toward 25,246.

📉 SCENARIO 3: GAP-DOWN OPENING (100+ pts below 25,365)

Watch for support near 25,221–25,246 zone — a strong demand area.

If price bounces with bullish structure, a reversal trade can be taken with defined SL.

Break and sustain below 25,221 could invite further selling toward 25,080.

💡 OPTIONS RISK MANAGEMENT TIPS:

Trade only near defined levels with confirmation.

Use spreads (e.g., bull call/bear put) during high volatility to reduce risk.

Avoid buying deep OTM options unless there's a strong trending move.

Always define SL and adhere to position sizing rules.

📌 SUMMARY:

Above 25,473 = Bullish bias

Below 25,365 = Bearish bias

25,221–25,246 = Strong reversal zone

Wait for price action to confirm before taking positions

⚠️ DISCLAIMER: I am not a SEBI-registered advisor. This plan is for educational purposes only. Please do your own research or consult a financial advisor before trading.

NIFTY : Trading levels and plan for 07-July-2025📘 NIFTY INTRADAY TRADING PLAN – 07-Jul-2025

🕒 Chart Timeframe: 15-Min | 🧭 Approach: Zone-Based Price Action | 🎯 Focus: Scalping to Positional Intraday

📍 Important Levels:

🔸 Opening Support Zone: 25,391 – 25,353

🔹 Opening Resistance Zone: 25,491

🔸 Last Intraday Resistance: 25,581

🔺 Major Resistance for Consolidation: 25,690 – 25,736

🔻 Last Intraday Support: 25,222

🟩 1. GAP-UP Opening (100+ points above 25,491)

If Nifty opens near or above 25,600, it will enter the last Intraday Resistance Zone and approach the Consolidation Resistance Zone (25,690–25,736).

📈 Action: Wait for a candle close above 25,581, then buy on strength toward 25,690–25,736.

🔄 Partial Booking: Consider profit booking in the upper consolidation zone.

📉 Rejection Trade: If strong reversal appears near 25,736, aggressive traders may short for a pullback to 25,491 with tight SL above the highs.

🛑 Stop Loss: Below 15-min candle low (for long) or above rejection high (for short).

🟨 2. Flat Opening (between 25,417 – 25,491)

This is the Opening Resistance Band—expect sideways price behavior in the first 15–30 mins.

📊 Wait for price to either break above 25,491 or fall below 25,417 with strength.

📈 Long Setup: If price crosses 25,491, ride it toward 25,581. Book partial at this resistance.

📉 Short Setup: Breakdown below 25,417 opens up support test at 25,391 – 25,353.

🧠 Tip: Avoid trades within the orange range (25,417–25,491) unless breakout is clear.

🟥 3. GAP-DOWN Opening (100+ points below 25,353)

This brings price closer to Opening Support and possibly into Breakdown Territory.

📉 Breakdown Trade: If price opens below 25,353 and fails to recover in first 15–30 mins, consider shorting toward 25,222 (Last Support).

📈 Reversal Trade: If price rebounds sharply and crosses back above 25,417, initiate reversal long with targets at 25,491.

🛑 SL Management: Use 15-min candle close basis – especially near support/resistance edges.

⚠️ Avoid shorts near 25,222 unless clean breakdown occurs.

💡 Risk Management Tips for Options Traders:

✅ Use ATM or slightly ITM options for directional trades; avoid deep OTM in the morning.

✅ Avoid trading aggressively in the first 15 mins—allow price to settle.

✅ For rangebound markets, prefer option selling strategies like Iron Condor or Strangle.

✅ Set a maximum loss limit for the day (1–2% of capital) and stick to it.

✅ Avoid emotional averaging—follow the plan or stay out.

📝 Summary & Conclusion:

📌 Above 25,581, Nifty could push into a high-consolidation resistance near 25,736

📌 Failure to sustain above 25,491 may result in a pullback to the support zone

📌 Break below 25,353 brings the 25,222 zone into play

📌 Wait for the first 15–30 mins to reduce fakeouts—zone-based trading will offer best R:R setups.

⚠️ Disclaimer:

I am not a SEBI-registered analyst . This plan is shared purely for educational purposes. Please consult a registered financial advisor or conduct your own analysis before making any trades.

Nifty 50 spot 25461 by Daily Chart view - Weekly updateNifty 50 spot 25461 by Daily Chart view - Weekly update

- Support Zone 24900 to 25100 of Nifty Index

- Next Support Zone 24325 to 24500 of Nifty Index

- Resistance Zone 25860 to 26035 then ATH 26277.35 of Nifty Index levels

- Nifty Index retraced by unwarranted events and to a good extent by profit booking

- Nifty Index is shying away to sustain any upside towards 26000 and falling down flat face

NIFTY : Trading levels and plan for 02-Jul-2025\ 📊 NIFTY TRADING PLAN – 2-Jul-2025\

📍 \ Previous Close:\ 25,533

📏 \ Gap Opening Consideration:\ ±100 points

🧭 \ Key Zones to Monitor:\

🔸 \ Opening Resistance:\ 25,581

🔸 \ Last Intraday Resistance:\ 25,628

🟥 \ Strong Resistance on Daily Chart:\ 25,690 – 25,760

🟦 \ Opening Support Zone:\ 25,429 – 25,450

🔻 \ Last Intraday Support:\ 25,330

🔻 \ Extreme Support:\ 25,239

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,628):\

If NIFTY opens above \ 25,628\ , it breaks the last intraday resistance and moves toward the daily resistance zone \ 25,690–25,760\ . Expect buyers to book partial profits here, which may cause a sideways movement or minor reversal.

✅ \ Plan of Action:\

• If price sustains above 25,690, expect further upside but beware of profit-booking near 25,760

• A pullback towards 25,628–25,581 may give a re-entry opportunity

• Avoid shorts unless a bearish reversal pattern forms at 25,760

🎯 \ Trade Setup:\

– Buy above 25,690 with SL below 25,640, Target: 25,760

– Sell only if price rejects 25,760 with confirmation

📘 \ Tip:\ Avoid chasing the move post-gap-up. Wait for 15–30 min of structure.

\ \ ⚖️ FLAT OPENING (Between 25,450 – 25,581):\

This opening keeps NIFTY inside the key action zone. Since the structure is tight, breakout from either side can offer directional moves.

✅ \ Plan of Action:\

• Wait for a clear breakout above 25,581 or breakdown below 25,450

• Avoid taking trades inside 25,450–25,581 unless directional bias builds up

• Watch for volume and price expansion beyond these levels

🎯 \ Trade Setup:\

– Buy above 25,581, SL: 25,533, Target: 25,628–25,690

– Sell below 25,450, SL: 25,490, Target: 25,330

📘 \ Tip:\ Consider deploying directional option spreads (e.g., debit spreads) post-breakout.

\ \ 📉 GAP-DOWN OPENING (Below 25,429):\

A gap-down below \ 25,429\ enters the opening support area, and if this breaks, the next target is the \ last intraday support at 25,330\ , followed by \ 25,239\ .

✅ \ Plan of Action:\

• If price holds 25,429–25,450, watch for intraday reversal setup

• If it breaks and sustains below 25,330, expect further weakness

• Trade light early, and scale in only if trend persists

🎯 \ Trade Setup:\

– Buy reversal at 25,430–25,450 with bullish confirmation; SL: 25,400, Target: 25,533

– Sell below 25,330, SL: 25,375, Target: 25,239

📘 \ Tip:\ Use OTM put options rather than naked futures for safer risk-defined entries.

---

\ 📌 SUMMARY & LEVELS TO WATCH:\

✅ \ Bullish Above:\ 25,581 → 25,628 → 25,690–25,760

🔽 \ Bearish Below:\ 25,450 → 25,330 → 25,239

📉 \ Tight Range Zone:\ 25,450–25,581 → Wait for a breakout

---

\ 💡 OPTIONS TRADING RISK MANAGEMENT TIPS:\

🧠 \ Smart Traders Should:\

• Prefer option spreads to limit risk and manage theta decay

• Set alerts at key levels and wait for confirmations

• Avoid weekly options if there's uncertainty around direction

🚫 \ Avoid These Traps:\

• Over-leveraging on directional bias

• Holding naked options during choppy consolidation

• Trading without SL or re-entry plan

📘 \ Pro Tip:\ Consider selling iron condors if volatility remains in check near expiry.

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is purely for educational purposes. Please consult your financial advisor before making any investment decisions. Trade with proper stop-loss and risk management at all times.

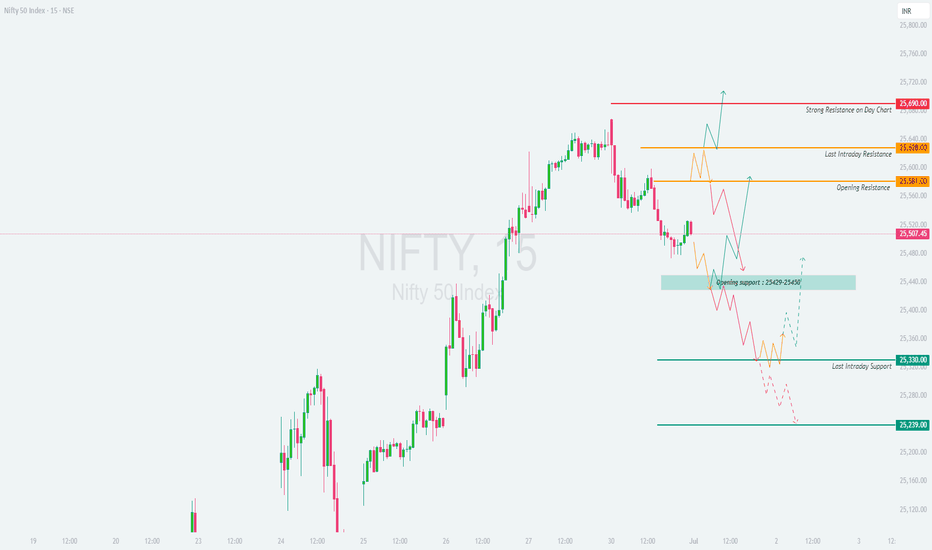

Nifty 50 Intraday Trade Plan 2nd july 2025🔼 Bullish Zones (Calls/CE preferable)

Above ₹25,790 → Closing Shot cover level

Above ₹25,760 → Hold PE by Safe Zone ends

Above ₹25,690 → Entry level for CE (Calls)

Above ₹25,618 → 10M hold positive trade view

Above ₹25,470 → Opening S1 | 10M Hold CE by level

Above ₹25,390 → 10M hold CE by Buy level

Above ₹25,320 → 10M hold CE by Safe Zone level

🔽 Bearish Zones (Puts/PE preferable)

Below ₹25,760 → Hold PE by Safe Zone starts

Below ₹25,690 → Risky Zone for PE

Below ₹25,618 → 10M hold negative trade view

Below ₹25,470 → Opening R1 | 10M Hold PE by level

Below ₹25,390 → 10M hold PE by level

Below ₹25,320 → UNWINDING level (Strong support loss)

📌 Trade Plan Guidelines

🔹 Above ₹25,618 with volume: Favor CE (calls), look for targets up to ₹25,690–₹25,790.

🔹 Below ₹25,470 with confirmation: Favor PE (puts) toward ₹25,390–₹25,320.

🔹 Avoid trading between ₹25,470–₹25,618 if price is consolidating — this is a neutral “no trade zone”.

📉 Below ₹25,320, expect strong unwinding.

NIFTY - TRADING LEVELS AND PLAN FOR 01-JUL-2025

\ 📊 NIFTY TRADING PLAN – 1-Jul-2025\

📍 \ Previous Close:\ 25,507

📏 \ Gap Opening Consideration:\ ±100 points

🧭 \ Key Zones to Monitor:\

🔴 Strong Resistance on Day Chart: \ 25,690\

🟧 Last Intraday Resistance: \ 25,628 – 25,640\

🟨 Opening Resistance: \ 25,581\

🟦 Opening Support: \ 25,429 – 25,450\

🟩 Last Intraday Support: \ 25,330\

🟫 Final Support: \ 25,239\

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,640):\

A gap-up above \ 25,640\ pushes Nifty into the \ Strong Resistance zone\ visible on the daily chart. This area may trigger profit booking unless broken with strong volume and momentum.

✅ \ Plan of Action:\

• Wait for a 15-min candle close above 25,690 for confirmation of breakout

• If price stalls or forms reversal patterns, initiate short trade setups

• Only aggressive buyers may consider long trades above 25,690 if follow-up candles are strong

🎯 \ Trade Setup:\

– \ Buy above:\ 25,690, SL: 25,628, Target: Trailing towards 25,750+

– \ Sell near resistance:\ 25,675–25,690 zone if reversal confirmed, SL: 25,705, Target: 25,581

📘 \ Tip:\ Avoid buying directly into resistance. Wait for a breakout + retest for cleaner entries.

\ \ ⚖️ FLAT OPENING (Near 25,500 – 25,540):\

Flat openings near the \ Opening Resistance (25,581)\ can create indecisive sideways moves in early sessions.

✅ \ Plan of Action:\

• If price breaks above 25,581 with strength, look for long trades

• If price faces rejection near 25,581 or 25,628, wait for breakdown below 25,507 to confirm weakness

• Below 25,507, next support lies at the 25,429–25,450 zone

🎯 \ Trade Setup:\

– \ Buy above breakout of 25,581, SL: 25,500, Target: 25,628–25,690

– \ Sell below 25,507, SL: 25,581, Target: 25,450 or lower

📘 \ Tip:\ Flat opens are best traded on confirmation candles, not assumptions. Avoid overtrading.

\ \ 📉 GAP-DOWN OPENING (Below 25,400):\

A gap-down below 25,400 opens the day near the \ Opening Support zone of 25,429–25,450\ . This area is critical — a bounce or breakdown will define the day.

✅ \ Plan of Action:\

• If price shows bullish reversal signs near 25,429, consider a pullback trade

• Breakdown of 25,429 with volume may extend downside toward 25,330 and even 25,239

• Avoid chasing long trades unless price stabilizes above 25,450

🎯 \ Trade Setup:\

– \ Buy near support:\ 25,429 with SL below 25,390, Target: 25,507

– \ Sell on breakdown below 25,429, SL: 25,450, Target: 25,330 – 25,239

📘 \ Tip:\ Gap-down opens attract trap setups. Let the market settle before committing.

---

\ 🧭 KEY LEVELS – QUICK REFERENCE:\

🔺 \ Strong Resistance:\ 25,690

🟧 \ Last Resistance:\ 25,628 – 25,640

🟨 \ Opening Resistance:\ 25,581

🟦 \ Opening Support:\ 25,429 – 25,450

🟩 \ Intraday Support:\ 25,330

🟥 \ Final Support:\ 25,239

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ Stick to \ defined range breakouts\ before entering directional trades

✅ Don’t overleverage into gap-ups/downs; let premiums cool

✅ \ Avoid selling naked options\ without clear structure

✅ Protect capital with \ hedged strategies\ like debit spreads

✅ \ Exit when your reason is invalidated\ , not when SL hits randomly

🛡️ \ Always use stop-losses\ , especially in high-IV environments.

---

\ 📌 SUMMARY:\

• 📈 \ Bullish above:\ 25,581 → 25,640 → 25,690

• 📉 \ Bearish below:\ 25,507 → 25,429 → 25,330

• 🚫 \ No trade zone:\ 25,507–25,581 (if inside, wait for clarity)

🎯 \ Focus Zones:\

– Long breakout above 25,581

– Short breakdown below 25,429

– Reversal plays at 25,429 or 25,239 if structure supports

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This content is shared only for educational purposes. Please do your own analysis or consult a professional financial advisor before taking trades. Risk management is essential—never trade without a stop-loss and always protect your capital.

NIFTY INTRADAY LEVEL ( EDUCATIONAL PURPOSE) 01/07/2025🔷 Nifty Intraday Trade Plan – 1 July

📊 Analysis: 15-min TF | Execution: 1-min TF

🔸 GAP-UP Opening (Above 25,600)

📌 Plan: Avoid early longs. Wait for price rejection or reversal pattern.

🔁 Entry: Sell on breakdown below 5-min candle low

🛑 SL: 15–20 pts above day’s high

🎯 Target: 25,450 – 25,500

🔹 GAP-DOWN Opening (Below 25,400)

📌 Plan: Avoid panic selling. Wait for reclaim of early resistance

🔁 Entry: Buy if price reclaims 5-min opening high

🛑 SL: 15–20 pts below swing low

🎯 Target: 25,500 – 25,560

⚫ NORMAL Opening (Between 25,400–25,600)

📌 Range Play Setup

🔸 Sell Zone: Near 25,580–600 (resistance area)

🔹 Buy Zone: Near 25,420–440 (support area)

🛑 SL: 15–20 pts beyond trigger zone

🎯 Target: 30–40 pts

🔺 Breakout Trade Setup

🔁 Entry: Above 25,600 breakout candle (1-min TF)

🛑 SL: Below breakout bar

🎯 Target: 25,680 – 25,720

📌 Note: Respect price action & levels. Execute only if structure aligns with plan.

🧠 Discipline > Prediction