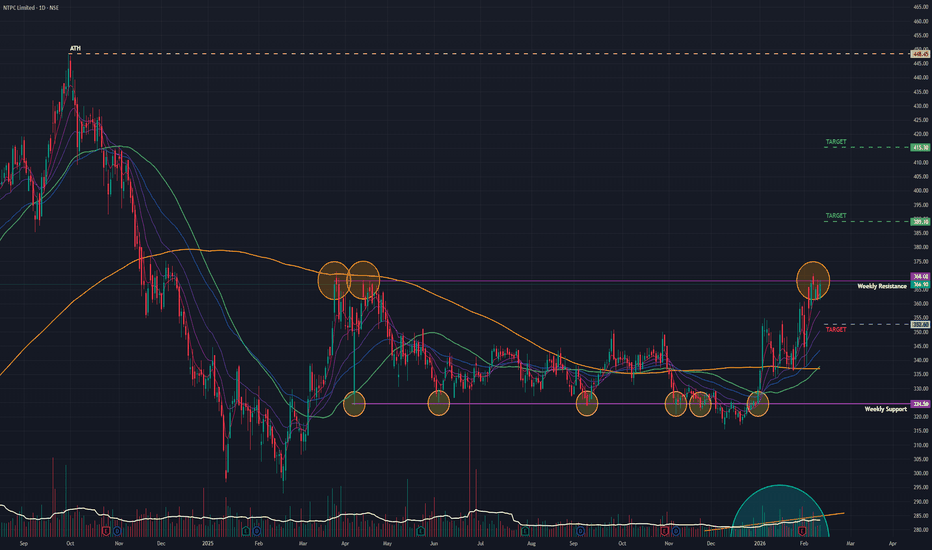

NTPC (D): Bullish (Golden Crossover + Base Breakout)(Timeframe: Daily | Scale: Linear)

The stock is on the verge of a major structural breakout from a 10-month consolidation base. The occurrence of a Golden Crossover (50 SMA > 200 SMA) confirms that the long-term trend has officially shifted from "Correction" to "Uptrend."

🚀 1. The Fundamental Catalyst (The "Why")

The technical strength is supported by solid numbers:

> Q3 Earnings Support: The recent Q3 FY26 results (Jan 30) showed stable operational performance with an 8% profit jump. This removed the "Event Risk," allowing institutions to re-enter.

> Valuation Comfort: Trading at a P/E of ~14.5x, NTPC remains attractive compared to private power peers. The dividend of ₹2.75 (Record Date: Feb 6) has also kept the stock supported.

> Monitorable (NGEL): Note that its subsidiary, NTPC Green Energy (NGEL) , is currently trading weak (around ₹89-90). A reversal in NGEL would act as an additional booster for NTPC.

📈 2. The Chart Structure (The Box)

> The Base: ₹315 – ₹370 range. The stock spent nearly a year in this zone.

> The Resistance: The ₹370 – ₹372 level is the "Lid." (This also aligns with the recent 52-week high in Mar 2025).

- Current Status: The stock is knocking on this door. A close above ₹372 will trigger a "Box Breakout."

📊 3. Volume & Indicators

> Golden Crossover: The 50-Day SMA crossing the 200-Day SMA is the headline signal. Historically, for PSU stocks, this signal often precedes a 15-20% rally over the next 3-6 months.

> RSI: Rising in all timeframes. It has room to run before hitting "Extreme Overbought" levels (80+).

🎯 4. Future Scenarios & Key Levels

The stock is primed for a new leg up.

🐂 Bullish Targets (The Breakout):

- Trigger: A decisive Daily Close above ₹372.

- Target 1: ₹390.

- Target 2: ₹415.

🛡️ Support (The "Must Hold"):

- Immediate Support: ₹352. this is a strong swing low.

- Stop Loss: A close below ₹345 (200-Day SMA) would invalidate the Golden Cross and signal a "Bull Trap."

Conclusion

This is a High-Reliability Setup.

> Refinement: The Golden Cross makes this a "Portfolio Grade" buy signal, not just a swing trade.

NTPC

NTPC - Long• Price has moved above the middle Bollinger Band on the weekly chart. This shows the stock is shifting from sideways to bullish.

• The recent weekly candle is strong and moving toward the upper Bollinger Band. This tells us volatility is expanding on the upside, which usually supports further upside movement.

• RSI on the weekly chart is above 60. When RSI stays above 60, it shows strong momentum and confirms that buyers are in control.

• Earlier, when RSI was below 60, the stock remained in a range. The move above 60 indicates a clear momentum shift in favour of bulls.

• Volume has increased during this move. Rising volume along with price moving toward the upper Bollinger Band confirms that the breakout is supported by real buying interest.

• When price is above the middle Bollinger Band, RSI is above 60, and volume is expanding together, it signals a healthy and sustainable uptrend.

Weekly trade plan

• Trend remains positive as long as price stays above the middle Bollinger Band and RSI remains above 60.

• Buying on small weekly pullbacks or near the middle Bollinger Band can be considered.

• Stop loss can be kept below the recent weekly swing low or below the lower Bollinger Band.

• Upside can be trailed toward the upper Bollinger Band as long as momentum stays strong.

Powergrid inside Perfect Descending Parallel Channel PatternPowergrid seen travelling perfectly inside the descending channel pattern, taking perfect resistance and support at the channel (from April 2025 till now)

Now seen at the perfect crucial point where it can either move bullish or bearish in the upcoming days

Bearish view gets cancelled on getting past the red dotted line...till that we can't be bullish on Powergrid!!!

Just add to the watchlist and let's watch how its going to move!!!!

will update once the decider move occurs!!!!

Just Sharing my view ...not a tip nor Advice!!!

Thank you!!!

ITC 1D Time frameCurrent Price: ₹405.60

52-Week High: ₹524.35

52-Week Low: ₹390.15

Trend: Downward — trading below 5, 20, 50, 100, 200-day moving averages

Daily Chart Insights

Price below moving averages → bearish trend.

RSI & MACD → weak momentum, signaling short-term selling pressure.

Support zone at ₹390–₹400 → critical; a break below can push price down to ₹370–₹380.

Resistance at ₹420–₹430 → a strong close above may signal trend reversal.

Strategy / Outlook

Bearish Bias: Short-term trend is downward.

Buying Opportunity: Near support zones (₹390–₹400) if it holds.

Bullish Trigger: Close above ₹430 with strong volume indicates potential reversal.

Risk Management: Use stop-loss below critical support zones.

BRITANNIA 1D Time frameCurrent Price: ~₹5,953.50

Day’s Range: ₹5,939.50 – ₹6,036.00

52-Week Range: ₹4,506.00 – ₹6,469.90

📏 Key Levels

Immediate Resistance: ~₹6,300

Next Resistance: ~₹6,470 (52-week high)

Immediate Support: ~₹5,800

Next Supports: ~₹5,600 and ₹5,300

🧠 Insights

If Britannia breaks above ₹6,300 with volume, it may push toward ₹6,470+ (new highs).

If it fails to break resistance, expect sideways movement or a pullback toward ₹5,800.

A break below ₹5,800 would signal weakness and can drag it down toward ₹5,600–₹5,300 levels.

HCLTECH 1D Time frameOpening Price: ₹1,387.40

Closing Price: ₹1,387.40

Day Range: ₹1,383.10 – ₹1,395.00

Previous Close: ₹1,387.40

📉 Trend Analysis

Short-Term Trend: Bearish — The stock is trading below key moving averages, confirming the bearish trend.

Medium-Term Trend: Neutral — The stock is in a consolidation phase, characterized by lower highs and lower lows.

Long-Term Trend: Neutral — No significant trend identified; the stock is trading within a range.

HINDZINC 1D Time frameDay Range: ₹478.35 – ₹488.40

52-Week Range: ₹378.15 – ₹575.40

Volume: 284,459 shares traded

📉 Trend Analysis

The stock is in a downtrend, characterized by:

Lower highs and lower lows.

Failure to break above resistance levels.

The short-term trend remains bearish.

🔮 Conclusion

Hindustan Zinc is in a downtrend with weak momentum.

Break below ₹470.00 could lead to further decline toward ₹460.00.

Break above ₹495.00 would indicate a potential trend reversal.

HEROMOTOCO 1D Time frame📌 Current Status

Closing Price: ₹5,410

Day Change: –35 points (–0.64%)

Day’s High: ₹5,470

Day’s Low: ₹5,380

52-Week Range: ₹4,800 – ₹6,050

🔍 Chart & Price Action Insights

Price is moving sideways, bouncing between support and resistance.

Bulls are defending ₹5,380

Sellers resist above ₹5,470

Watch for a break above ₹5,470 for potential upward momentum

Break below ₹5,380 may trigger a short-term decline toward ₹5,330

ASIANPAINT 1D Time frameCurrent Price Snapshot

Current Price: ₹2,345.50

Day’s Range: ₹2,342.00 – ₹2,388.80

52-Week Range: ₹2,124.75 – ₹3,358.00

Technical Indicators

RSI (14-day): 44.19 — indicates a neutral to slightly bearish momentum.

MACD: -4.010 — suggests bearish momentum.

Moving Averages:

5-day: ₹2,396.00 — indicates a Sell signal.

50-day: ₹2,389.00 — indicates a Sell signal.

200-day: ₹2,350.00 — indicates a Neutral signal.

Technical Summary: Predominantly Sell signals across various indicators.

Summary

Above ₹2,388.80: Potential rise toward ₹2,400 – ₹2,420.

Below ₹2,342.00: Potential fall toward ₹2,320 – ₹2,300.

Between ₹2,300 – ₹2,380: Likely range-bound movement.

ICICIBANK 1D Time frame₹1,345.80 (NSE)

Day’s Range: ₹1,342.60 – ₹1,356.60

52-Week Range: ₹1,186.00 – ₹1,500.00

📉 Technical Overview

Trend: The stock is trading below its 200-day moving average, indicating a mildly bearish trend.

RSI: Currently at 26.6, suggesting the stock is in the oversold zone.

MACD: At -10.01, reinforcing the bearish momentum.

Moving Averages: A strong sell signal is indicated, with 0 buy signals and 12 sell signals across various timeframes.

🔼 Potential Upside (Rise)

Immediate Resistance: ₹1,355 – ₹1,365

Breakout Target: Above ₹1,365, the next resistance is around ₹1,380 – ₹1,390.

Bullish Confirmation: A close above ₹1,390 could signal a reversal or consolidation.

🔽 Potential Downside (Fall)

Immediate Support: ₹1,340 – ₹1,330

Breakdown Target: Below ₹1,330, the stock may test ₹1,310 – ₹1,300.

Bearish Confirmation: A close below ₹1,300 would strengthen the bearish outlook.

✅ Summary

Above ₹1,365: Potential rise toward ₹1,380 – ₹1,390.

Below ₹1,330: Potential fall toward ₹1,310 – ₹1,300.

Between ₹1,330 – ₹1,365: Likely range-bound movement.

TATAMOTORS 1D Time frameCurrent Market Snapshot

Current Price: ₹675.60

Opening Price: ₹684.00

Day’s Range: ₹673.00 – ₹685.00

Previous Close: ₹672.90

🔑 Technical Indicators

Relative Strength Index (RSI): 48.5 – indicating a neutral condition.

Moving Average Convergence Divergence (MACD): -3.20 – suggesting bearish momentum.

Moving Averages: Trading below the 50-day and 200-day moving averages, indicating a bearish trend.

📈 Key Support & Resistance Levels

Immediate Support: ₹673

Immediate Resistance: ₹685

Pivot Point: ₹679

📉 Market Sentiment

Trend: The stock is trading below its 50-day and 200-day moving averages, indicating a bearish trend.

Volume: Trading volume is higher than average, suggesting increased investor activity.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹685

Stop-Loss: ₹673

Target: ₹690 → ₹695

2. Bearish Scenario

Entry: Below ₹673

Stop-Loss: ₹685

Target: ₹665 → ₹660

⚠️ Risk Management

Limit risk to 1% of capital per trade.

Always use stop-loss to protect against unexpected market movements.

Monitor broader market trends and sector-specific news that may impact stock performance.

NIFTY 1D Time frameOpening Level: ₹24,691.10

Current Level: ₹24,765

Day's Range: ₹24,500 – ₹24,900 (approximate)

🔑 Key Support & Resistance Levels

Immediate Support: ₹24,500

Immediate Resistance: ₹24,900

Pivot Point: ₹24,765

📊 Market Sentiment

Trend: The NIFTY 50 has experienced a six-day losing streak, indicating bearish momentum.

NDTV Profit

Volume: Trading volume is higher than average, suggesting increased investor activity.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹24,900

Stop-Loss: ₹24,500

Target: ₹25,100 → ₹25,300

2. Bearish Scenario

Entry: Below ₹24,500

Stop-Loss: ₹24,900

Target: ₹24,300 → ₹24,100

⚠️ Risk Management

Limit risk to 1% of capital per trade.

Always use stop-loss to protect against unexpected market movements.

Monitor broader market trends and sector-specific news that may impact index performance.

MOTHERSON 1D Time frameStock Snapshot

Closing Price: ₹105.66

Day's Range: ₹103.26 – ₹106.01

52-Week Range: ₹71.50 – ₹144.66

Market Cap: ₹1,11,518 crore

P/E Ratio (TTM): 33.54

P/B Ratio: 3.20

Dividend Yield: 0.80%

Book Value: ₹33.05

Beta: 1.64

Volume: 24,534,407 shares traded

VWAP: ₹104.93

Face Value: ₹1.00

📈 Performance Overview

1-Week Return: -3.14%

1-Month Return: +13.27%

YTD Return: +22.73%

1-Year Return: -11.16%

3-Year Return: +28.45%

5-Year Return: 0.00%

🧾 Financial Highlights

TTM EPS: ₹3.15

Net Sales (Latest Four Quarters): ₹9,271.58 crore

Net Profit (Latest Four Quarters): ₹605.86 crore

Shareholder's Funds: ₹1,676.80 crore

Total Assets: ₹3,089.00 crore

🔍 Technical Insights

Trend: Currently in a downtrend; price below VWAP indicates bearish momentum.

Support Levels: ₹103.26, ₹100.00

Resistance Levels: ₹106.01, ₹110.00

📌 Key Takeaways

Dividend: 50% (₹0.50 per share)

Bonus Issue: 1:2 ratio

Market Position: Strong over 3 years despite short-term volatility

Analyst Sentiment: Positive overall, short-term corrections possible

SENSEX 1D Time frameCurrent Snapshot

Closing / Current Level: ~ ₹ 80,426.46

Day’s Range: High ~ ₹ 81,033, Low ~ ₹ 80,332

Open: ~ ₹ 80,956

⚡ Strategy Thoughts

Bullish approach:

If it recovers above ~80,700 and holds, targets can be 81,000 → 81,300.

Bearish / defensive view:

If Sensex fails near 80,700–81,000, or breaks below ~80,300, downside toward 79,800 and lower comes into play.

Range play:

Between 80,300 and 80,700, you can trade both sides — buy near the bottom of the range, short near resistance — but use tight stops.

TATAMOTORS 1D Time frameCurrent Price: ₹673.00

Day's Range: ₹662.35 – ₹680.35

Previous Close: ₹664.30

Volume: 15,780,434 shares traded

Market Cap: ₹247,780 crore

52-Week High: ₹1,000.40

52-Week Low: ₹535.75

Face Value: ₹2.00

Beta: 1.30

🧾 Financial Highlights

P/E Ratio (TTM): 11.69

P/B Ratio: 0.00

EPS (TTM): ₹57.54

Dividend Yield: 0.89%

ROE: 28.1%

Book Value: ₹315

📈 Technical Insights

Trend: The stock has shown resilience with strong long-term performance over three years, despite recent challenges compared to the Sensex.

Support Levels: ₹662.35, ₹650.00

Resistance Levels: ₹680.35, ₹700.00

📌 Key Takeaways

Recent Performance: Tata Motors' shares rose over 2% today, snapping a two-day decline, following the announcement that Jaguar Land Rover (JLR) had commenced a phased restart of its operations after a cyberattack.

Analyst Sentiment: Despite recent volatility, Tata Motors remains a top pick among analysts for long-term investment.

INFY 1D Time frame📊 Daily Snapshot

Closing Price: ₹1,484.65

Day’s Range: ₹1,476.50 – ₹1,502.70

Previous Close: ₹1,494.60

Change: Down –0.64%

52-Week Range: ₹1,307.00 – ₹2,006.45

Market Cap: ₹6.17 lakh crore

P/E Ratio (TTM): 22.62

Dividend Yield: 2.90%

EPS (TTM): ₹65.63

Beta: 1.09 (indicating moderate volatility)

🔑 Key Technical Levels

Support Zone: ₹1,469 – ₹1,473

Resistance Zone: ₹1,485 – ₹1,490

Pivot Point: ₹1,480.97 (Fibonacci)

All-Time High: ₹2,006.45

📈 Technical Indicators

RSI (14-day): 44.45 – approaching oversold territory, suggesting potential for a rebound.

MACD: Negative at –6.34, indicating bearish momentum.

Moving Averages: Trading below the 50-day (₹1,511.06) and 200-day (₹1,495.15) moving averages, indicating a bearish trend.

Stochastic RSI: Between 45 and 55, indicating a neutral condition.

CCI (20): Between –50 and 50, implying a neutral condition.

📉 Market Sentiment

Recent Performance: Infosys experienced a decline of 0.64% on September 25, 2025, underperforming the broader market.

Volume: Trading volume was significantly higher than its 20-day average, indicating increased investor activity.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹1,485

Stop-Loss: ₹1,469

Target: ₹1,490 → ₹1,500

2. Bearish Scenario

Entry: Below ₹1,469

Stop-Loss: ₹1,485

Target: ₹1,460 → ₹1,450

NTPC 1D Time frame📊 Today's Performance

Closing Price: ₹347.55

Day’s Range: ₹342.25 – ₹350.40

Previous Close: ₹343.00

Change: Up +1.33%

52‑Week Range: ₹292.80 – ₹448.45

Market Cap: ₹3.37 lakh crore

P/E Ratio: 14.07

Dividend Yield: 2.40%

EPS (TTM): ₹24.71

Beta: 1.06 (moderate volatility)

🔑 Key Technical Levels

Support Zone: ₹335.00 – ₹336.00

Resistance Zone: ₹350.00 – ₹355.00

All-Time High: ₹448.45

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹350.00

Stop-Loss: ₹342.00

Target: ₹355.00 → ₹360.00

2. Bearish Scenario

Entry: Below ₹335.00

Stop-Loss: ₹342.00

Target: ₹325.00 → ₹320.00

ASHOKLEY 1D Time frame📊 Today's Performance

Closing Price: ₹142.26

Day’s Range: ₹139.60 – ₹143.99

Previous Close: ₹144.04

Change: Down ~ –1.24%

52-Week Range: ₹95.93 – ₹144.50

Volume: ~36.96 million shares

Market Cap: ₹83,556 crore

P/E Ratio: 26.05

Dividend Yield: 4.39%

EPS (TTM): ₹5.46

🔍 Key Technical Levels

Support Zone: ₹139.60 – ₹140.00

Resistance Zone: ₹143.50 – ₹144.50

All-Time High: ₹144.50

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹143.50

Stop-Loss: ₹141.50

Target: ₹146.00 – ₹148.00

2. Bearish Scenario

Entry: Below ₹139.60

Stop-Loss: ₹141.50

Target: ₹136.00 – ₹134.00

HDFCBANK 1D Time frame📍 Current Price & Range

Current price: ₹964.20

Day’s High / Low: ₹968.20 / ₹955.50

52-week High / Low: ₹1,018.85 / ₹806.50

🔍 Key Levels (with current context)

Immediate support: ₹955-₹958

Stronger support: ₹945-₹950

Immediate resistance: ₹970-₹975

Next resistance: ₹980-₹985

Major psychological resistance: ₹1,000+

📊 Indicators & Momentum

Price is near resistance zone (₹964-₹967), showing hesitation.

Holding above ₹955 is important for stability.

Price is below the 50-day moving average → short-term weakness.

Still above the 200-day moving average → long-term structure remains intact.

RSI around 40-45 → momentum is neutral to slightly weak.

🔮 Possible Scenarios

Bullish breakout: Above ₹975-₹980 with volume → upside toward ₹1,000–₹1,018.

Sideways: Between ₹955–₹975 until a decisive breakout.

Bearish pullback: Below ₹955 → could slide toward ₹945-₹950 or even ₹940.

👉 Outlook: At the current level (₹964), the stock is sitting close to resistance. It needs strength above ₹975 to turn bullish; otherwise, it risks drifting back toward ₹955 support.

SENSEX 1D Time frame🔍 Current Market Snapshot

Current Level: 82,439.48

Day’s Range: 82,151.07 – 82,583.16

Previous Close: 82,626.23

Market Sentiment: Neutral to mildly bearish

📊 Technical Indicators

Moving Averages: The Sensex is trading slightly below its short-term moving averages, indicating potential resistance.

RSI (14): Approximately 50, suggesting a neutral stance with no clear overbought or oversold conditions.

MACD: Neutral, with the MACD line and signal line close together, indicating indecision in market momentum.

🧮 Strategy / Trade Ideas

Long Setup:

Entry: Consider entering near support levels (~82,200) if bullish reversal signals appear.

Stop Loss: Place below 82,000 to manage risk.

Target: First resistance around 82,600, then 82,900.

Short Setup:

Entry: If price fails to break above resistance (~82,600) and shows signs of reversal.

Stop Loss: Above 82,900.

Target: Downside toward 82,200, then 81,800

HDFCBANK 1D Time frame📊 Current Snapshot

Current Price: Around ₹967

Day Range: ₹962 – ₹976

52‑Week Range: High ~ ₹1,018, Low ~ ₹805

Volume: Slightly above recent average, showing decent trading interest

🔍 Support & Resistance

Immediate Resistance: ₹975 – ₹983

Higher Resistance: ₹989 – ₹990

Immediate Support: ₹960 – ₹954

Lower Support: ₹946

⚙️ Indicators & Trend

RSI / Stochastic: Neutral to slightly bearish, indicating mild selling pressure

Pivot Level: Around ₹968 – ₹969, meaning price is near equilibrium

Moving Averages: Mixed signals; short-term MAs under slight pressure, long-term trend still intact

🎯 Possible Scenarios

Bullish Case: Break and sustain above ₹980 → next target ₹990+

Bearish Case: Fail at resistance → pullback toward ₹960‑₹954; below ₹954 → possible drop to ₹946

⚠️ Key Points

Resistance zones are tight and need strong volume for a breakout

Price near pivot levels may lead to short-term sideways movement or volatility

Confirmation from trading volume is important for trend sustainability

TCS 1D Time frameCurrent Price: Around 3,174

Current Trend: Stock is in a sideways to slightly bullish phase after consolidation.

Support Zone: Strong support at 3,140 – 3,150. Buyers may defend this level.

Resistance Zone: Key resistance at 3,200 – 3,220. A breakout above 3,220 can trigger fresh upside.

Indicators: Daily candles indicate mild buying interest; volume is stable.

Outlook:

Above 3,220 → bullish momentum may extend toward 3,250+.

Below 3,140 → weakness may push toward 3,100–3,120.

👉 In short:

Range: 3,140 – 3,220.

Neutral to slightly bullish; breakout will determine next move.

TATAMOTORS 1D Time frameCurrent Price: 707

Current Trend: Strong bullish momentum; stock is trading near recent highs.

Support Zone: Immediate support at 695 – 700. If this holds, uptrend remains intact.

Resistance Zone: Next resistance at 720 – 730. A breakout above this can push toward 750+.

Indicators: Daily candles are bullish, showing higher highs and strong buying interest.

Outlook:

Above 720 → continuation of bullish rally likely.

Below 695 → minor correction possible toward 680–685.

👉 In short (with 707 current price):

Bullish tone.

Range to watch: 695 – 730.