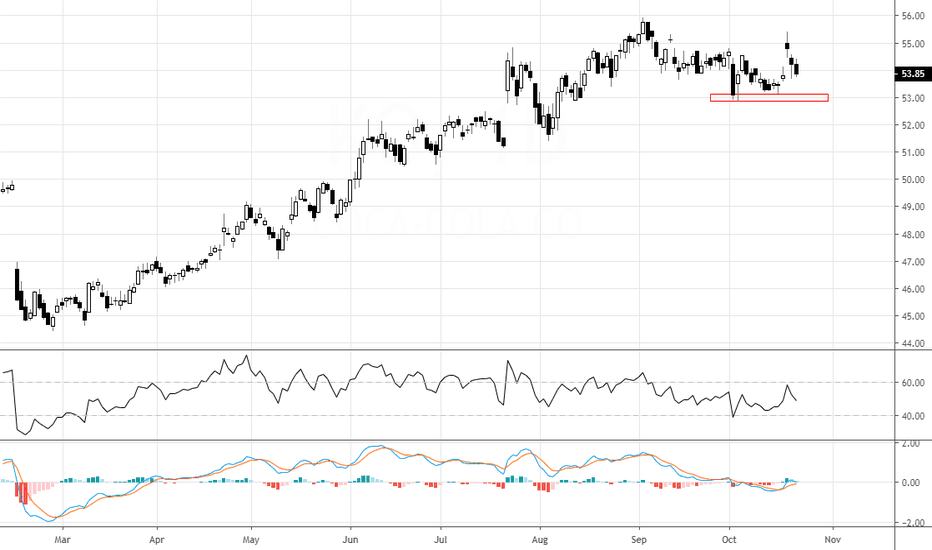

Southern copper Corporation NYSE:SCCO

1)monthly chart.

2)Long term investment .

3)flag and pole .

4)last metal cycle gave return of 3279%

5)Very long consolidation period

6)BO and retest done.

7) Below 54 exit and wait for re-entry

8) long term target pole length

9)Reason - metal , shortage , EV will change demand once its rolled out fully.

10) Its just for learning purpose. do ur own analysis b4 investment.

Nyse

Live Challenging NYSE Stock Market Analysis SGFY Buy @ 26.70Market Analysis

Live Challenging NYSE Stock Market Analysis SGFY Buy @ 26.70

Target @ 30.88

#sharemarket #SGFY #NYSE #Nse #stockmarket

Our Unique Features:

—————————————————————

1. Follow our 15 signals ….10% equity will increase in your account for sure.

2. We are not Trailing stop! or average the trades.

3. 2% Risk Management Per trade.

4. Risk vs Reward up to 1:7.

Note:

Trade signals would usually have a risk to reward ratio of 1:2.

It means that even 2 out of 4 signals hits their SL marks, the other two would have closed with profit.

This allows you to be good in overall pips profit.

Signals are usually inter-day (Based on the daily candle) therefore, trades would usually have a holding time of an average minimum of 24 hours.

Note: Everything works with Best money management.

Note: Please leave comments for any query.

Disclaimer: This is my trading experience, it is not an invite or recommendation to trade.

Best Wishes

Tradingwithtamil

S

Live Challenging NYSE Stock Market Analysis SOL Buy @ 9.15Market Analysis

Live Challenging NYSE Stock Market Analysis SOL Buy @ 9.15

Target @ 16.84

#sharemarket #sol #Nse #stockmarket #NYSE

Our Unique Features:

—————————————————————

1. Follow our 15 signals ….10% equity will increase in your account for sure.

2. We are not Trailing stop! or average the trades.

3. 2% Risk Management Per trade.

4. Risk vs Reward up to 1:7.

Note:

Trade signals would usually have a risk to reward ratio of 1:2.

It means that even 2 out of 4 signals hits their SL marks, the other two would have closed with profit.

This allows you to be good in overall pips profit.

Signals are usually inter-day (Based on the daily candle) therefore, trades would usually have a holding time of an average minimum of 24 hours.

Note: Everything works with Best money management.

Note: Please leave comments for any query.

Disclaimer: This is my trading experience, it is not an invite or recommendation to trade.

Best Wishes

Tradingwithtamil

S

sell side spxHello guys i had find this setup in 1h timeframe which is on double top and broken structure we will wait for channel breakout and retest and will open position and will put our sl at swing high with target near trendline and plzz before opening any position do your won analysis if you like my analysis do like share and follow thank you

Live Challenging NYSE Stock Market Analysis Buy GME @ 185.00

Live Challenging NYSE Stock Market Analysis Buy GME @ 185.00

Target @ 349.75

Our Unique Features:

—————————————————————

1. Follow our 15 signals ….10% equity will increase in your account for sure.

2. We are not Trailing stop! or average the trades.

3. 2% Risk Management Per trade.

4. Risk vs Reward up to 1:7.

Note:

Trade signals would usually have a risk to reward ratio of 1:2.

It means that even 2 out of 4 signals hits their SL marks, the other two would have closed with profit.

This allows you to be good in overall pips profit.

Signals are usually inter-day (Based on the daily candle) therefore, trades would usually have a holding time of an average minimum of 24 hours.

Note: Everything works with Best money management.

Note: Please leave comments for any query.

Disclaimer: This is my trading experience, it is not an invite or recommendation to trade.

Best Wishes

Forex Tamil

QQQ KEY LEVELS SUPPORT AND RESISTANCE 04/06/2020Key Levels for QQQ INVESCO for INTRADAY TRADING are :

Upper Breakout~184.80

First Target~186.10

Interim Resistance~187.70

Final Resistance~189.50

**Lower Levels**

Lower Breakout~182.25

First Target~181.30

Interim Support~179.95

Final Support~178.90

Please trade with caution and consult your financial adviser before trading.

BAC KEY LEVELS SUPPORT AND RESISTANCE 04/06/2020Key Levels for BAC(BANK OF AMERICA CORPORATION) for INTRADAY TRADING are :

Upper Breakout~20.85

First Target~21.55

Interim Resistance~22.60

Final Resistance~23.55

**Lower Levels**

Lower Breakout~19.40

First Target~18.85

Interim Support~18.35

Final Support~17.55

Please trade with caution and consult your financial adviser before trading.

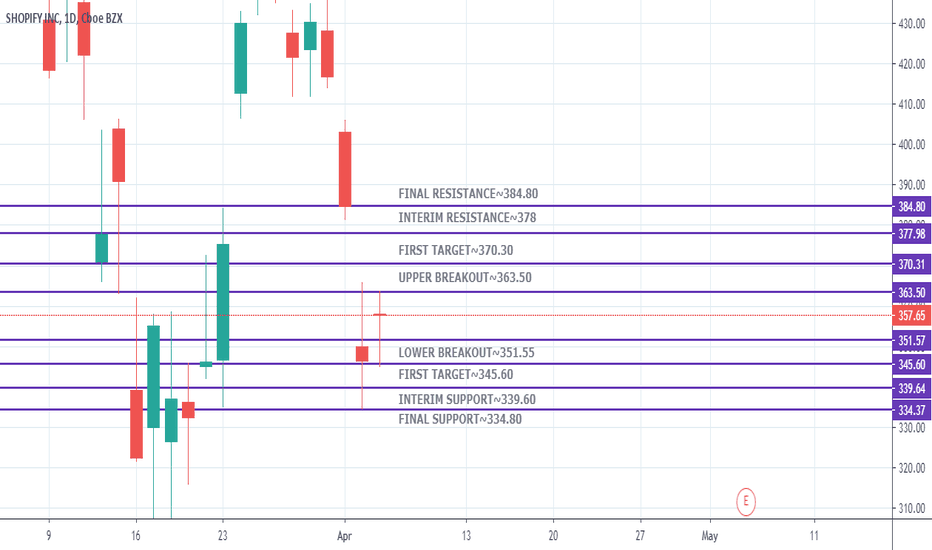

SHOPIFY KEY LEVELS SUPPORT AND RESISTANCE 04/06/2020Key Levels for SHOPIFY INC NYSE for INTRADAY TRADING are :

Upper Breakout~363.50

First Target~370.30

Interim Resistance~378

Final Resistance~384.80

**Lower Levels**

Lower Breakout~351.55

First Target~345.60

Interim Support~339.60

Final Support~334.80

Please trade with caution and consult your financial adviser before trading.

S

Chevron recent rally may be just a corrective pullback.Chevron Corporation: The move up in the last couple of sessions seems to be a corrective pullback. The RSI is now at the bearish extreme zone, the candles are forming bearish patterns. The prices have also closed below the KS & TS lines. The trend down is expected to continue. A close below 115.5 will confirm the trend.

Coca Cola may get bitter here!The stock is in a dominant trend up. Recently a lower high and lower low price pattern has been noticed on the daily charts. The RSI also seems to have shifted the range from bullish 80-40 zones to neutral 60-40 zones in the past few weeks. Important support levels are marked on the charts. Breaking them may result into corrections. The degree of the corrections are still not predictable, but the RSI forewarns. To get more insights into RSI visit www.prorsi.com

GE is at a very important juncture! The stock is trading at a very crucial juncture. The RSI is indicating a sideways trend, important support pivot level is 8.75, below this point the stock may falter and selling may set in as the stock may start to move down in A-B-C pattern. On the flip side a good close above 9.30 may change the course of the trend GE may start trending up. For greater insight on RSI do visit www.prorsi.com

Boeing cautious view for the next week!!!Yellow box: M formation is done. The last candle is a spinning top which indicates indecision in this counter. A break below 340 pinpoint may show us 330 levels. Another support is there at 324 where consolidation can be seen. If any bad news in BA other downside levels will open. This is my cautious view for the coming week.

SLong

ImmunoPrecise Antibodies Stock AnalysisQuote: #IPA/#IPATF

Buy Target:$0.80/$0.60 (don’t bet the house here looking for a quick scalp)

Sell Target: $1.00

Description: ImmunoPrecise Antibodies Ltd. engages in antibody production and related services in the United States, Canada, and Europe. It also provides human antibody development, hybridoma development, genetic immunization, rabbit monoclonal antibody development, recombinant protein expression and production, cryostorage, hybridoma sequencing, antibody generation, antibody purification, polyclonal development, and peptide production services. The company has a collaboration agreement with TetraGenetics, Inc. The company was founded in 1989 and is based in Victoria, Canada.

Please follow us on our facebook and twitter. Subscribe to our newsletter to get analysis directly to your mail.

Facebook - @SFYBUofficial

Twitter - @SFYBUoffical

ILong

IMAX Stock analysis long termCompany: Imax

Quote: #IMAX

Buy Target: TBD pending on price action and tapes into earnings

Sell Target: $28-$30

Next Earnings date: April 26th

This Is a 20% gainer we missed last Q from being to conservative we will be looking for an entry ether before or after earnings all pending on the tape such a small float it will be a good read reading the tapes into Friday to see which way this name is going to trade.

Description: IMAX Corporation, together with its subsidiaries, operates as an entertainment technology company that specializes in motion picture technologies and presentations worldwide. It offers cinematic solution comprising proprietary software, theater architecture, and equipment. The company engages in Digital Re-Mastering (DMR) of films into the IMAX format for exhibition in the IMAX theater network; the provision of IMAX premium theater systems to exhibitor customers through sales, long-term leases, and joint revenue sharing arrangements; the distribution of documentary films; the provision of production technical support and film post-production services; the ownership and operation of IMAX theaters; and the provision of camera and other miscellaneous items rental services. It also designs, manufactures, installs, sells, and leases IMAX theater projection system equipment; maintains IMAX theater projection system equipment in the IMAX theater network; distributes and licenses original content investment, IMAX home entertainment, and others; and sells or leases its theater systems to theme parks, private home theaters, tourist destination sites, fairs, and expositions, as well as engages in the after-market sale of projection system parts and 3D glasses. The company markets its theater systems through a direct sales force and marketing staff. It owns or otherwise has rights to trademarks and trade names, which include IMAX, IMAX Dome, IMAX 3D, IMAX 3D Dome, Experience It in IMAX, The IMAX Experience, An IMAX Experience, An IMAX 3DExperience, IMAX DMR, DMR, IMAX nXos, IMAX think big, think big, and IMAX Is Believing, as well as the service mark IMAX THEATRE. As of December 31, 2018, the company had a network of 1,505 IMAX theater systems comprising 1,409 commercial multiplexes, 14 commercial destinations, and 82 institutional facilities operating in 80 countries. IMAX Corporation was founded in 1967 and is headquartered in Mississauga, Canada.

Short Interest:

Short Percent of Float 5.86%

Short percent of increase or Decrease -4%

Analysis Ratings : Stock price Target #IMAX

High : $34

Median : $27

Low : $21.50

Average : $27.04

Current Price : $25.33

Feb 25 - 19 Downgrade Canaccord Genuity Buy - Hold $23

Apr 25 - 19 Upgrade The Benchmark Company Hold - Buy $28

Feb 28 - 18 Reiterated B. Riley FBR, INC. Buy $35-$37.75

Tapes last week: 3/5 wouldve gotten a one however the last two days were very bullish

Please our Facebook and Twitter for more updates.Please subscribe to our Newsletter for more information

Facebook - @SFYBUofficial

Twitter - @SFYBUofficial