Gold Faces Strong Selling PressureGold came under heavy selling pressure after failing to break above the 5,100 USD level overnight and subsequently falling below 4,900 USD during today’s trading session.

The US dollar climbed to its highest level in two weeks and appears to be extending its recent solid recovery from a four-year low, which is adding notable downside pressure to the precious metal.

In addition, the current corrective move is still struggling, as price remains below the trendline. As long as this trendline—and more importantly the recent high at 5,100 USD—is not convincingly broken, the path of least resistance remains to the downside.

What’s your view? How do you see the next move for OANDA:XAUUSD ?

P-signal

OCTOBER 18: I CALLED $107K CRASH. TODAY: BITCOIN -44% AT $60K.OCTOBER 18: I CALLED $107K CRASH. TODAY: BITCOIN -44% AT $60K. RECEIPTS INSIDE.

They Called Me "FUD Spreader" When I Warned You On October 18, 2025.

Bitcoin Was At $107K.

Everyone Screamed "BUY THE DIP"

I Showed You The Bearish Divergence And Said: "Protect Your Capital."

THE NUMBERS DON'T LIE:

Bitcoin: $107,000 → $60,000

Total Drop: -44%

Short Profit: $47,000 Per BTC

IF YOU FOLLOWED THIS ANALYSIS:

✅ You Saved Your Portfolio From -44% Destruction

✅ You Made Massive Profits On The Short

✅ You're Now Positioned To Buy At 44% Discount

✅ You Ignored The Noise And Followed The Chart

WHAT HAPPENED:

Weekly Bearish Divergence ✓ CONFIRMED

$104K Support Breakdown ✓ BROKE

$73K Support Level ✓ SMASHED

$66K Zone ✓ CRUSHED

Now At $60K Testing Critical Support

WHAT'S NEXT:

$48K-$49K Zone Still In Play If $60K Breaks.

This Is NOT About Being Bearish.

This Is About PROTECTING CAPITAL And Buying Smart.

Bull Market Will Continue.

But Corrections Are PART Of The Journey.

Now You Can Start Accumulation Bitcoin From $60K Level Slowly

THE DIFFERENCE:

❌ Moonboys: "Buy At $107K, HODL Forever"

✅ Real Analysis: Save 44%, Re-Enter Lower

This Is Why Technical Analysis Matters.

This Is Why You Don't Follow Blind Hopium.

Drop Comment If You Followed This Call.

More Updates Coming. The Opportunity Isn't Over.

The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction⚠️ The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction Nobody Talks About (The $1M Bitcoin Trap Exposed)

Cathie Wood Just Predicted $1.5M Bitcoin By 2030. Before You Get Excited, Let Me Show You Something Important.

Her Prediction Track Record:

1️⃣ November 2020: Target: $400K-$500K

2️⃣ May 2021: Target: $500K By 2026

3️⃣ September 2021: Target: $500K by 2026

4️⃣ January 2022: Target: $1M+ by 2030

5️⃣ February 2023: Target: $1M-$1.48M by 2030

6️⃣ January 2024: Target: $1.5M by 2030 (Raised 50%)

6️⃣ November 2024: Target: Base $650K, Bull $1.5M by 2030

7️⃣ February 2025: Target: Bull $1.5M, Base $710K, Bear $300K

8️⃣ April 2025: Target: Up to $2.4M by 2030

9️⃣ November 2025: Target: $1.2M by 2030 (Reduced from $1.5M)

Notice The Pattern? The Target Year Keeps Shifting But The Big Numbers Stay In Headlines.

🔰 Ask Yourself This:

If Institutions Truly Believed Bitcoin Will 15x From Here, Why Would They Tell You?

Why Reveal Their “Secret” To Millions Of Retail Investors?

Think About It. When They Announce Massive Targets, Retail Holds Expecting $1M While Institutions Quietly Take Profits. Then They Buy Back Cheaper When You Panic Sell The Dip.

This Is How Exit Liquidity Works.

🔰 The Reality Check:

I Am Not Against Bitcoin Reaching $1M. It Absolutely Can Happen.

But Here Is What Nobody Tells You: Bitcoin Is Not Magic. It Does Not 10x Overnight Because Someone On TV Said So.

$1M Bitcoin Is Possible But Realistic Timeframe Is 5–10 Years Of Holding Through Multiple Cycles, Crashes And Recoveries.

🔰 My Honest Take:

➡️ Institutions Are Not Your Friends. They Are Not Sharing Alpha, They Are Creating Liquidity.

➡️ When ARK Says Buy, Ask Yourself: Who Are They Selling To?

➡️ Big Targets Make Great Headlines But Terrible Trading Strategies.

🔰 What You Should Do Instead:

👉 Never Make Financial Decisions Based On Influencer Predictions.

👉 Do Your Own Research With Proper Calculations.

👉 Have Your Own Entry And Exit Strategy.

👉 Understand That Wealth Building Takes Time Not Tweets.

CryptoPatel Summary:

🔹 Yes Bitcoin Can Reach $1M. I Support That Long Term Vision.

🔹 But It Will Take Years Of Patience, Not Months Of Hopium.

🔹 The Difference Between Retail And Institutions? They Have A Plan. Do You?

🔹 Stop Being Exit Liquidity. Start Being Strategic.

Save This Post. Your Future Self Will Thank You.

Follow @CryptoPatel For Real Talk, Not Hype.

NFA & DYOR

Gold: Correction or a Pause Before Continuation?Hello everyone, what’s your view on gold at the moment?

Yesterday, gold posted a strong intraday rally followed by a sharp reversal lower, clearly highlighting the intense battle between short-term capital flows. It was a highly volatile session, but from a professional perspective, there is still insufficient evidence to conclude that the medium-term trend has been broken.

From a news and market-context standpoint, the initial upside move was driven by renewed safe-haven demand as cautious sentiment returned. However, as price reached higher levels, large-scale profit-taking, combined with liquidation pressure from risk assets, quickly pushed gcapital reacted faster than.

On the techn, tkey support zone below acting as the equilibrium area between supply and demand. Price behavior around this area will determine whether gold is consolidating for another leg higher or transitioning into a deeper correction.

At this stage, my preferred approach is to monitor price reaction at the support zone rather than act impulsively. If buying interest returns and structure stabilizes, gold still has room to recover. Conversely, if support is decisively broken, staying on the sidelines becomes the most prudent choice.

What’s your take on XAUUSD?

GOLD - Breakout Continues, Bullish Momentum Remains StrongGold prices have attracted fresh buying interest for a second consecutive session, reaching a new all-time high and currently trading around $4,710.

The key driver behind gold’s strength is the ongoing global geopolitical and trade uncertainty. Hawkish statements regarding U.S. tariffs and foreign policy, along with the risk of escalating tensions among major economies, have significantly boosted safe-haven demand. In this environment, gold continues to reaffirm its role as a store of value, drawing strong attention from investors worldwide.

Beyond political factors, investment flows into precious metals are clearly increasing. Global gold ETF holdings have risen steadily over recent weeks, signaling long-term market confidence. Notably, strong buying demand from Asia—especially China—is viewed as a major pillar supporting gold’s sustained upward momentum.

🔎 Key Economic Events to Watch This Week

Wednesday: U.S. President Donald Trump speaks at the WEF; U.S. Pending Home Sale

Thursday: U.S. Q3 GDP (final reading), PCE Price Index, Weekly Jobless Claims

Friday: U.S. S&P Preliminary Manufacturing and Services PMI

$TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATELCRYPTOCAP:TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

#TRX Is Quietly Building A Massive Multi-Year Base On The 2W Chart.

Price Has Respected The Same Rising HTF Trendline Since 2020 — A Clear Sign Of Long-Term Strength.

Technical Highlights:

✅ Clean Higher Highs & Higher Lows

✅ Multi-Year Ascending HTF Trendline Holding

✅ Strong HTF Demand Zone Holding At ~$0.25

✅ Extended Consolidation → Expansion Setup

✅ Macro Trend Bias Remains Bullish

CryptoPatel Targets: $1 → $2 → $5+

Invalidation: ❌ Weekly Close Below ~$0.20

As Long As TRX/USDT Holds Above $0.25, The Bullish Structure Remains Intact.

A Loss Of This Level Would Break The Macro Thesis.

Cycle Outlook:

2025 = Compression Phase

2026–2027 = Potential Parabolic Expansion

TA Only | DYOR | Not Financial Advice

ETHEREUM 2026 ATH Price Forecast | Bitcoin Halving Cycle AnalysiThis study observes Ethereum’s historical behavior relative to Bitcoin halving events. The purpose is to highlight recurring market structure patterns, not to provide financial or investment advice.

Observed Historical Cycles

2016 Bitcoin Halving

~70% drawdown in ETH

~546 days of sideways accumulation

Followed by a multi-year expansion phase (~22,800% peak move)

2020 Bitcoin Halving

~75% drawdown in ETH

~546 days of consolidation

Subsequent expansion to ~$4,693 (+2,600% approx.)

2024 Bitcoin Halving (Current Cycle)

~66% drawdown observed

~609 days of consolidation (ongoing)

Market structure remains comparable to prior accumulation phases

Key Observation

ETH trading within the $2,600–$3,000 range aligns with previous long-term accumulation zones seen before historical expansion phases.

Forward-Looking Scenario (Cycle-Based Projection)

If historical rhythm continues, the next expansion window may extend into 2026, with hypothetical price zones often discussed by market participants between:

$10,000

$15,000

$18,500+

These levels represent cycle-based projections, not price guarantees.

Conclusion

Ethereum has historically followed a pattern of deep drawdowns, prolonged consolidation, and later expansion after Bitcoin halving events. Whether this cycle continues to rhyme remains to be confirmed by future market behavior.

This analysis is for educational and informational purposes only. Always conduct independent research and risk assessment.

XAUUSD (Gold) Intraday Outlook - 23/12/2025XAU/USD Trend: Strong Bullish

Current Price: $4,491.99

Key Levels:

Support: $4,486 / $4,479

Resistance: $4,497 / $4,501 / $4,508

Pivot: $4,490

Strategy:

Buy on dips: $4,486–$4,479 → Target $4,497–$4,501

Breakout buy: Above $4,497 → Target $4,501–$4,508

Sell only if below $4,486

Gold remains bullish; prefer buying on dips or breakouts, keep stops tight near support.

Disclaimer: Trading involves risk. This analysis is for educational purposes only and is not financial advice. Trade responsibly.

$ONDO Could Be the Next 20x Gem: Are You Ready?LSE:ONDO Could Be the Next 20x Gem: Are You Ready?

Currently in bearish breakdown, but if price falls below $0.50, IMO best accumulation zone starts.

Strong Support Zones:

Support 1: $0.53–$0.46

Support 2: $0.24–$0.20

Targets (Long Term): $5 / $10 (~20x from entry if filled)

Manage risk & DYOR, huge upside if supports hold!

Bitcoin LTF Analysis & Market OutlookBitcoin LTF Analysis & Market Outlook

#Bitcoin still doesn’t look strong on LTF, and I’m expecting some more downside movement in the coming days. So if you’re holding high leverage longs, manage them carefully and always use strict stop loss.

Here’s the key structure to watch:

Resistance 1: $116,000

If CRYPTOCAP:BTC fails to break and hold above this level, momentum stays weak and we could revisit the $100,000 zone again.

Resistance 2: $122,500

Only a confirmed breakout above this level can trigger the next leg toward a new ATH around $150,000.

Until then, play defense. Avoid emotional trades, don’t gamble with your hard-earned money, and only take entries backed by clear confluence, strategy, and discipline.

Remember: The market always rewards patience, not greed. Stay alert, follow structure, and let the setup come to you.

Gold Prices Continue to Rise Amid Rate Cuts and Geopolitical RisGold prices today are being strongly supported by growing expectations that the Federal Reserve (FED) will continue to cut interest rates and the increasing demand for safe-haven assets amid rising geopolitical instability.

Last week, the FED made its first rate cut of 0.25% since December, causing gold prices to surge. While some investors took profits, most experts believe the uptrend is not over yet.

This week, investor focus will be on the U.S. Personal Consumption Expenditures (PCE) data for August, the FED's preferred inflation measure, which may provide further clues about future rate cuts. Many forecasts predict a slowdown in core PCE, reinforcing the case for continued rate cuts by the FED.

Additionally, safe-haven flows are further supported by prolonged geopolitical risks, including the Russia-Ukraine conflict and concerns over economic impacts from U.S. tariffs.

Furthermore, strong gold buying activity from global central banks plays a crucial role in strengthening the bullish outlook for the precious metal.

Ethereum sell sign in 15 min as per indicator To identify potential short-selling opportunities in the stock market, technical indicators can signal a stock is overbought, losing momentum, or entering a downtrend. Short-selling is a high-risk strategy, and these indicators are most effective when used together to confirm signals.

EURUSD TankThis looks like a very good spot to SELL the EURUSD. Economic factors are showing slightly weak US dollar, but COT reports indicate Commercials still have a lot of LONG contracts. This gives a very nice confluence with a 61.8% retracement of last week's bearish move, also paired with an attractive $1.70 price tag along with it.

Gold Surges on Weak NFPHello everyone, what’s your take on XAUUSD?

Gold prices soared at the end of the last session and are now trading around $3,380. This sharp rise followed a weaker-than-expected U.S. Non-Farm Payrolls (NFP) report, which shifted market sentiment toward expectations that the Fed may delay interest rate cuts. As a result, the U.S. dollar weakened and demand for gold as a safe haven surged.

Technically, gold appears to be forming a cup and handle pattern, with the first resistance target at $3,400, followed by $3,435.

What do you think? Could this rally continue? Let us know in the comments!

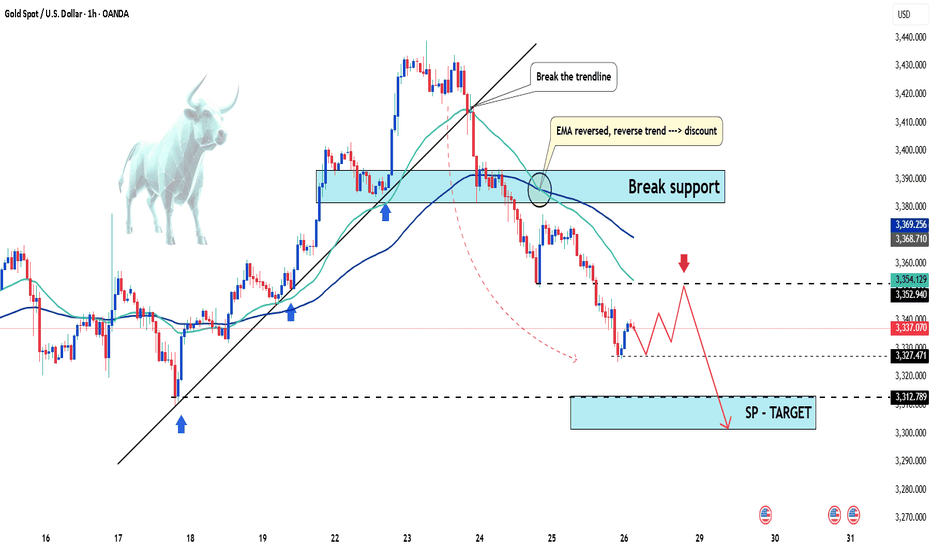

Gold weakens further – is 3250 next?Hello traders, take a look at the chart — what do you see?

Here’s my perspective:

Recently, gold has shown signs of weakness as the U.S. dollar strengthens amid expectations that the Fed will delay interest rate cuts. In response to this, gold continues to trend lower and is currently hovering around the 3,289 USD mark.

The previous ascending trendline has been broken, and both the EMA 34 and EMA 89 have turned downward, fueling bearish momentum. The 3,320 support level has also failed, and the latest bullish correction was rejected — reinforcing the downtrend.

Given these clear fundamentals and technical confirmations, I expect the bearish momentum to accelerate, at least in the short term.

My immediate target for this move is 3,250 USD.

What about you — where’s your target?

Gold dips again – is the bounce just a trap?Hello traders!

After a quiet start to the day, gold has turned lower and is now hovering around the $3,300 mark. The decline in OANDA:XAUUSD came as U.S. Treasury yields rose in response to strong U.S. economic data. The Fed is widely expected to maintain its current monetary policy stance during today’s session.

From a technical perspective, XAUUSD continues to form bearish structures and breakdowns. While a short-term bullish correction is currently underway, the bears still hold the upper hand — and selling opportunities remain the preferred strategy.

I’ll be focusing on two key entry zones marked on the chart, with a short-term bias favoring sell setups.

Do you agree with this approach?

⚠️ Please remember: This is just a trading idea — make sure to manage your risk properly with defined TP and SL levels.

Good luck and happy trading!

EURUSD at risk of reversal: will sellers take control?Hello everyone! What are your thoughts on EURUSD?

Lately, the euro has been under pressure due to growing weakness in the Eurozone economy. The European Central Bank (ECB) has sent out more cautious signals in response to rising recession risks and cooling inflation. This increases the likelihood that the ECB may wrap up its tightening cycle earlier than the Fed – a shift that could weigh heavily on EURUSD.

From a technical standpoint, EURUSD recently hit a peak around 1.1766 after several attempts, and a CHOCH (Change of Character) reversal pattern may be forming. If the pair fails to reclaim the 1.1766 zone, a deeper downside scenario is likely to unfold.

As for me, I’m currently favoring short setups, especially around supply zones or after failed retests. Discipline and solid risk management remain my top priorities.

How about you? What’s your take on this pair?

Gold dives toward 3,320 as Fed decision loomsHello everyone, what are your thoughts on gold prices?

Gold's decline is accelerating, dragging the precious metal down toward the 3,320 USD mark. A stronger U.S. dollar and further developments on the trade front following the U.S.-EU agreement have significantly impacted demand for safe-haven assets.

From a technical perspective, the break below the rising price channel could mark the beginning of a deeper correction. Oscillators on the chart have just started turning negative, suggesting that the path of least resistance for gold is now downward.

Looking ahead, Wednesday’s key FOMC decision—along with the accompanying policy statement and Powell’s press conference—will be closely scrutinized for clues on the Fed’s interest rate cut roadmap.

Additionally, investors will face several important U.S. macroeconomic data releases this week, which will play a vital role in shaping the USD’s trajectory and provide new momentum for XAUUSD.

What do you think about the precious metal? Share your thoughts below!

EUR/USD Under Pressure : Sell or Buy ? The EUR/USD pair remains under mild bearish pressure, hovering around the 1.1700 mark and extending its Thursday downtrend. Meanwhile, the US Dollar (USD) stays firm despite growing optimism over improving US-China relations. However, the ongoing tension between Trump and Powell continues to capture market attention.

In response to these developments, EUR/USD has stalled its previous rally. On the chart, the pair is forming a series of lower highs, moving within a narrowing wedge pattern. The 1.1600 level now emerges as the critical battleground between bulls and bears.

Do you think EUR/USD can successfully defend this support zone? Let us know your thoughts!

Latest Gold Price Update TodayIn the most recent trading session, global gold prices dropped over 31 USD per ounce, closing at 3,337 USD. This sharp decline follows a three-day rally and reflects profit-taking by investors and a shift in capital flow.

Newly released economic indicators show that the U.S. labor market remains strong, with jobless claims falling for the sixth consecutive week — the longest streak since 2022. This helped the U.S. dollar rebound slightly, putting pressure on gold, a non-yielding asset.

At the same time, investor sentiment has tilted toward riskier assets like equities, as trade talks between the U.S., EU, and Japan show positive progress. Stock markets in the U.S. and Europe surged, drawing capital away from gold.

Although expectations remain for a potential Fed rate cut in September, gold faces short-term headwinds. The 3,300 USD zone is now a key level to watch. Traders should look for reversal signals and volume confirmation before considering long entries.

Personal view: USD strength, rising stock markets, and profit-taking are creating a short-term correction for gold. However, in the longer term, there is still upside potential if the Fed signals a policy shift in the coming months.

And you — what’s your take on gold prices today?

EURUSD: Bearish Breakdown in SightEURUSD is currently holding above the 1.173 support zone, but the bearish structure is becoming more evident. The downward trendline and nearby resistance have repeatedly rejected price rebounds.

If the support at 1.173 breaks, a sharp move toward the 1.168 target is likely — a key previous low.

Trend: Prefer SELL if a breakdown confirms – low risk, high potential.

Gold holds steady—Is a breakout above $3,400 next?Gold prices have corrected exactly as we anticipated yesterday. At the time of writing, gold is hovering around $3,370 USD, showing little volatility since the start of the session.

Although the market is undergoing a short-term pullback, I still believe gold remains in a medium- to long-term uptrend. One key reason is the global shift away from the US dollar, with many countries increasing their gold reserves. Meanwhile, the USD is projected to weaken further in the long run. On top of that, if the Federal Reserve indeed begins to ease monetary policy, gold could break above the $3,400 level and potentially set a new record.

In addition, trendline support remains intact—if momentum picks up from here, the bullish trend may soon resume.