BSE-Likely Cup &Handle Break outBSE:

Trading at 2881 and above all its critical Moving averages Viz10/20/50/10 DEMA

In daily chart has formed C&H Pattern,

Based on the pattern and price volume suggests -breaking the Neckline resistance at 2880-2900 likely to test 2950/3000+ shortly(For educational purpose only)

Community ideas

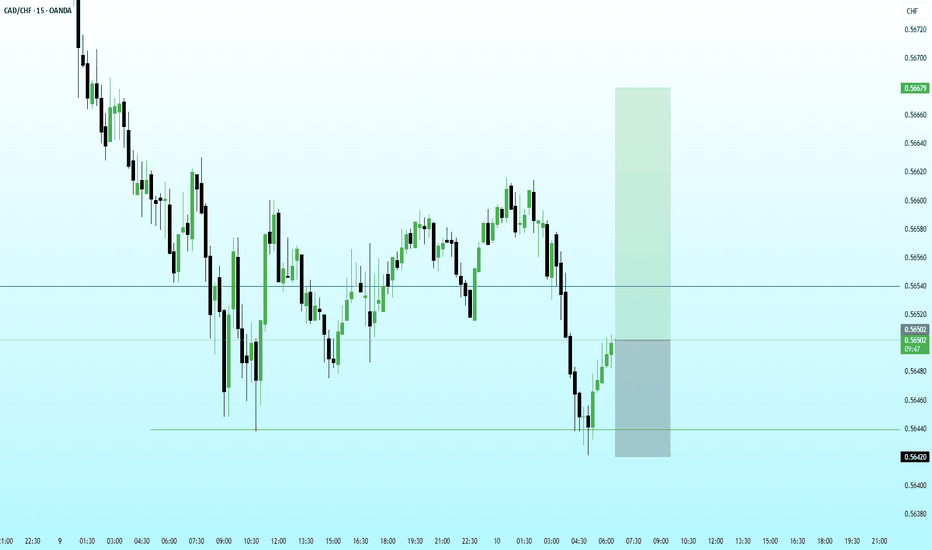

CADCHF-M15CAD/CHF has delivered a textbook sell-side liquidity raid beneath the Asian range, purging weak longs before staging an aggressive displacement higher. The reaction from the discount array suggests deliberate smart money activity, with price repricing toward equilibrium after leaving a clear imbalance in the wake of the impulsive markdown.

The current dealing range is defined by the recent swing high and the freshly engineered liquidity low near 0.56420. With price now trading back above the mean threshold, the narrative shifts toward a draw on liquidity resting at the buyside pools overhead.

Orderflow observations indicate:

• **Liquidity Event:** External range liquidity was efficiently harvested, followed by immediate rejection, signaling absorption rather than continuation.

• **Displacement:** The impulsive rally establishes a short-term market structure shift, increasing the probability of continuation toward premium.

• **Fair Value Gap (FVG):** Price is actively rebalancing the inefficiency, reinforcing the case for algorithmic delivery toward opposing liquidity.

• **PD Array Alignment:** Current pricing favors rotation from discount to premium within the active dealing range.

**Execution Framework:**

Tactical longs remain favorable on shallow retracements into imbalance or consequent encroachment, provided price maintains acceptance above 0.56420. Failure to hold this level would imply incomplete sell-side objectives, exposing the pair to deeper liquidity magnets.

**Liquidity Targets:**

Primary draw rests at 0.56540, with resting buyside liquidity projected near 0.56680. A clean expansion through this zone could trigger a momentum cascade toward 0.56790.

Until proven otherwise, expect algorithmic delivery to favor premium pricing as the market seeks balance after the engineered liquidity event.

TORNTPHARM - Consolidation Is Not Boring Read the chart slowly.

This stock doesn’t move randomly — it prepares.

• Nearly 2 years of consolidation → breakout → ~13% rally

• Again 3 months of tight consolidation → breakout → ~12% rally

• And now?

Price is back to consolidation with strong buying interest,

structure is clean, volatility is compressed,

and an IHNS (Inverse Head & Shoulders) is quietly forming.

This is how trends are built — not in excitement,

but in patience, absorption, and disbelief.

The market rewards those who wait when others get bored.

XAGUSD - Parallel ChannelThe price of silver has already borken out from this parallel channel that it was trading inside for the past few days. If the Bullish momentum continues, expect to have quick pullback to approx $74-$75 before continuing the next leg up. Also the RSI has now returned to neutral territoriy, which would be a good sign for the bullish trend to continue. But if we do see a breakdwon in the momentum, expect the prices to retest $50-$54 before turning bullish again.

NIFTY KEY LEVELS FOR 11.02.2026NIFTY KEY LEVELS FOR 11.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

IRCTC - Markets Don’t Speak Loudly — They Whisper FirstI’m not complicating price action.

I’m just listening to what price is quietly telling us.

This rounded bottom shows one thing clearly —

selling pressure is fading and buyers are slowly stepping in.

No excitement. No indicators. No noise.

Just patience, structure, and early footprints.

Trends don’t change in one candle.

They change when most people stop paying attention.

Bitcoin Bybit chart analysis FEBURARY 10Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicators will be released shortly at 10:30 AM.

The 4-hour chart is undergoing a MACD dead cross.

I've created today's strategy.

*When the light blue finger moves,

Short->Long switching or holding a long position.

This is a two-way neutral strategy.

1. The light blue finger at the top is the entry point for a short position at $70,032.7.

/ Stop-loss price if the orange resistance line is broken.

2. Switch to a long position at $67,889. / Stop-loss price if the purple support line is broken.

3. The first target for a long position at $70,848.3. Target prices are Top, Good, and so on.

If the light blue finger at the top falls immediately without touching 70K,

Long position holding at the first area at the bottom is the final defensive line. / Stop-loss price if the green support line is broken.

Below that is the bottom area.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

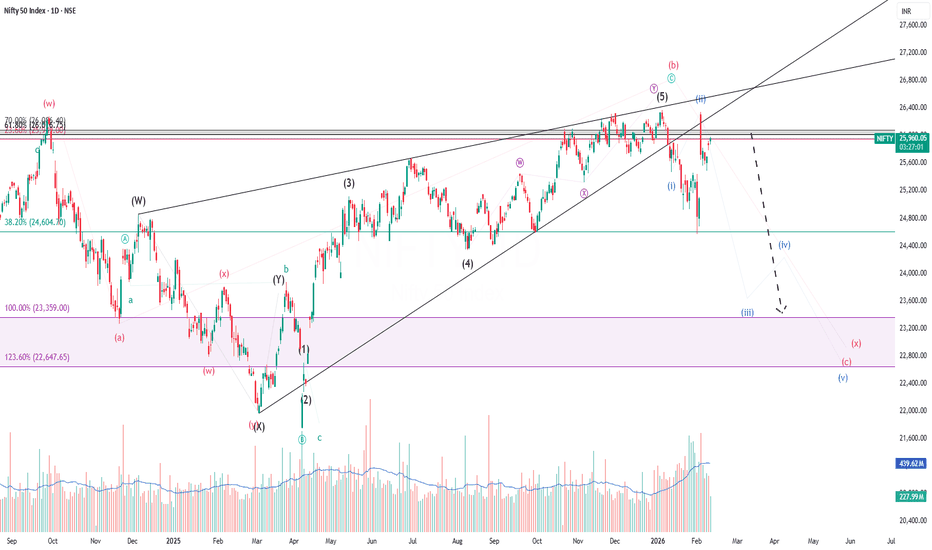

Very Short Term View for Nifty (Till April, 2026)Wrap up:-

Nifty has made breakdown below the rising wedge on 09.01.2026 and thereafter, it is retesting the breakout.

Further, Nifty has made breakdown below 24604 which is 38.6% of total rise i.e. from 21743 to 26373. Thereafter, it is assumed/weightaged that wave 5 has been completed. Now, wave Cis running for a min. target of 23359.

In wave c, wave 1 is completed at 25473, wave 2 at 26341and wave 3 is currently in progress.

What I’m Watching for Till April, 2026 🔍

Nifty is now facing a resistance in the zone 25949 to 26086. Low Risk Entry Range is 25949-26086 with a stoploss of 26373 for a probable target of 23359-22647.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

Part 1 Institutional Trading VS. Technical Analysis What Is Premium?

The premium is the price of the option contract. It is influenced by several factors:

Current price of the underlying

Strike price

Time remaining till expiry

Volatility

Interest rates

Dividends

Premiums are higher when:

Market is volatile

Expiry is far away

Stock price is near the strike price

Cipla - Positional LongCMP 1342 on 11.02.26

All important levels are marked on the chart.

The range between 1280 and 1330 appears to be a support level. The price is sustaining and consolidating here. If it goes up. may go to the levels of 1425/1480/1550.

The setup fails if the price sustains below 1280-1270.

The above illustration is only for learning and sharing purposes, not a buy or sell recommendation.

All the best.

Weekly Analysis with buy/Sell scenarios in BTCAnother selling week. Price made low of 59977 and closed above ~70K. Overall BTC is still bearish and we may see further downfall after some pullback. ~74500 is critical level for pullback. ~55K is critical next level. We may witness a consolidation and reversals on 50K – 55K zone.

Price will remain bearish till delivery changes at 4-hour time frame. Currently price has formed double top in 4H time frame which is a good signal for further downside move.

Weeks back we analyzed down fall toward 65K and further ~50K and price made the low of 60K so far. So our overall analysis is still stands good.

Critical Points

1. Price has created double top in 4H TF and targeting further low.

2. Price may hit the zone of 50K-55K and show the delivery change.

3. Next POI is second quadrant of weekly time frame.

4. Price may consolidate at this level and form MSS at this POI and possibly reverse for further highs.

5. Most probably price will take liquidity of FVG/RDRB level and create MSS/CISD/TS/iFVG in LTF.

6. Price should show rejection/reversal in respective LTF (4H/1H) at Key Level/FVG zone.

7. Take the trade only once clear entry model i.e. turtle soup. iFVG break, CDS or MSS happens on LTF.

All these combinations are signalling a high probability and high reward trade scenario.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.

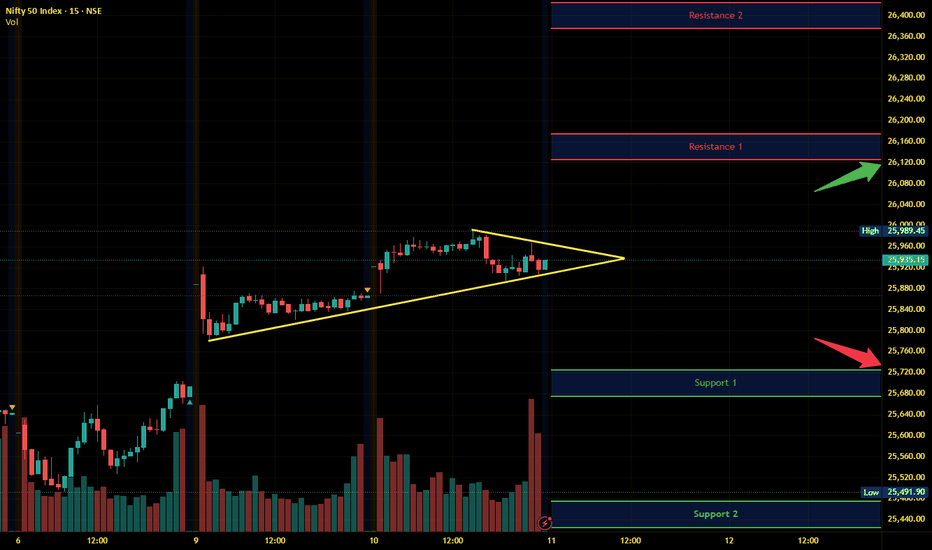

Nifty Intraday Analysis for 11th February 2026NSE:NIFTY

Index has resistance near 26125 – 26175 range and if index crosses and sustains above this level then may reach near 26375 – 26425 range.

Nifty has immediate support near 25725 – 25675 range and if this support is broken then index may tank near 25475 – 25425 range.

The market is expected to be range bound with positive momentum and rejection near the resistance zone.

NDLVENTURE | Long-term Investment IdeaStock Name: NDLVENTURE

📊 Breakout Context: Weekly trendline breakout confirmed with strong volume today, adding conviction.

TRADE PLAN

💰 Buy near CMP: 100

🎯 Target: 180 (+80.0%)

🛑 Stop Loss: 84 (-16.0%)

⚖️ Risk/Reward Ratio: ~1 : 5.0

🔑 Key Notes

📌 Strong volume breakout suggests genuine momentum; monitor for retests.

📍 Healthy retest zone: 95–100 (as long as price holds above stop loss).

🔒 Trail stop loss upward as price advances to secure gains.

Cup & Handle Pattern: GMDC’s Breakout Opportunity ExplainedGMDC Ltd, currently trading near ₹624 on the daily chart, has formed a cup & handle pattern with a neckline breakout. This is a classic bullish formation in technical analysis, and understanding it can help traders and investors make informed decisions.

☕ What is a Cup & Handle Pattern?

The cup resembles a rounded bottom, showing a period of consolidation after a prior uptrend.

The handle forms as a short pullback or sideways movement, representing the final shakeout of weak hands.

Once the price breaks above the neckline (the resistance level at the rim of the cup), the pattern is considered complete.

📈 Importance in an Uptrend

The cup & handle is a continuation pattern, meaning it usually appears in an existing uptrend.

It signals that after a healthy consolidation, buyers are regaining control.

The breakout often leads to a fresh leg higher, supported by renewed momentum.

🔑 Breakout Significance

A breakout above the neckline confirms the pattern’s completion.

It suggests that demand has overcome supply at that resistance level.

Traders often view this as a high-probability entry point, especially if accompanied by strong volume.

⚖️ Risk Management Principles

Even with a strong pattern, risk management is essential:

Stop-loss placement: Typically below the handle’s low or neckline support.

Position sizing: Avoid over-leveraging; allocate capital wisely.

Confirmation: Enter only after sustained breakout, not on the first tick above resistance.

Diversification: Don’t rely solely on one stock or one pattern.

💡 Opportunity in GMDC

With the neckline breakout confirmed, GMDC’s chart suggests potential for trend continuation.

The breakout aligns with bullish technicals, offering traders an opportunity to ride momentum.

Investors may see this as a sign of strength and accumulation, reinforcing confidence in the stock’s trajectory.

✨ Key Takeaway for Traders & Investors

The cup & handle pattern in GMDC highlights how technical setups can reveal market psychology. A breakout above the neckline signals renewed buying strength and continuation of the uptrend. However, disciplined risk management remains the cornerstone of successful trading.

TORRENT POWER:Likely Tri-Angle Breakout -Huge Target is on cardsTORRENT POWER

-Formed a Triangle Pattern in weekly chart

-Trading at 1429 and above Tri-Angle Pattern Trend line

-trading above all its critical Moving averages Viz 10/20/50/100 in Daily Charts

-Stochastic RSI -Positive divergence at cross over 40 suggests trend reversal and possible upside

-Combination of the Tri-angle pattern break out,Stochastic RSI Positive divergence and cross over,increase in volume suggests a possible move towards TGT :1500 TGT 2:1600+(For educational purpose only)

BHEL: Bear Flag on Weekly, Fundamentals Don’t Help EitherBig Picture (Weekly)

BHEL formed a bearish pole and flag on the weekly chart. After a sharp fall, price moved into a rising, overlapping channel — typical corrective behaviour.

Wave X looks completed near 305.9 . As long as price stays below this level, the structure favours another leg down.

Zoom In (1H)

From 305.9 — 240.5 , price unfolded in a clean ABC zigzag , marking (a) of Y .

The current rise is overlapping, slow, and wedge-shaped , suggesting a corrective (b) of Y , not a new trend.

Confluence to note:

Rising wedge formation

0.618 retracement of the entire fall near ~280

Momentum losing steam near resistance

A break below the lower wedge trendline is the trigger for the final (c) of Y decline.

Fundamentals Check

Fundamentals are not supporting upside here:

P/E ~118 — wildly stretched for a PSU with low returns

ROCE ~2–3% — weak capital efficiency

Operating margins ~5.5% — thin and fragile

Free cash flow = inconsistent — spikes, then collapses; not durable

Debt increased sharply in the latest year

In short: price optimism > business reality.

Trade View

Bias: Bearish below 305.9

Entry:

On a 1H breakdown below the rising wedge

Targets:

165 (primary)

150 (extended, if momentum expands)

Invalidation:

Weekly close above 305.9 — bearish view fails

Bottom Line

This is a classic case where structure, lower-timeframe signals, and fundamentals are aligned .

Until proven otherwise, rallies look corrective — not the start of a new bull run.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

SENSEX Spot level Analysis 11th Feb 2026 & Onwards SENSEX Spot level Analysis 11th Feb 2026 &

Onwards IntraSwing & Positional.

PCR Data Analysis:

Weekly (12 Feb 2026) EXP basis PCR:

Put OI: 11,81,709, Call OI: 10,15,668, PCR: 1.16. Trend Strength=> Bullish

Intraday Change Basis:

Put OI Chg: 5,31,883, Call OI Chg: 3,98,204, Change OI PCR: 1.34. Trend Strength=> BULLISH

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹: ━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

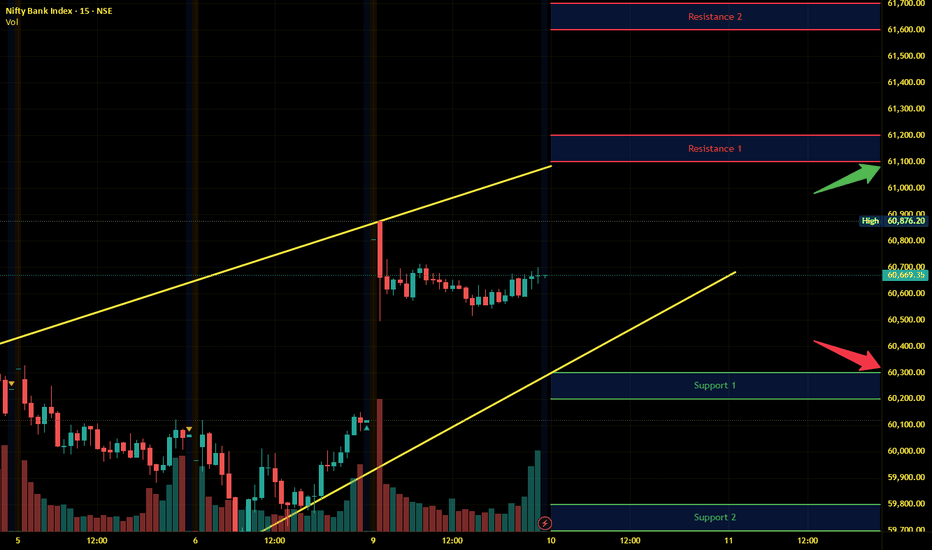

Banknifty Intraday Analysis for 10th February 2026NSE:BANKNIFTY

Index has resistance near 61100 – 61200 range and if index crosses and sustains above this level then may reach near 61600 – 61700 range.

Banknifty has immediate support near 60300 - 60200 range and if this support is broken then index may tank near 59800 - 59700 range.

Expect a range-bound market as we monitor whether the small gap from 9th February gets filled or holds as support.