Community ideas

Gold (XAU/USD) Bullish Breakout: Aiming for the $5,120 MilestoneGold is currently exhibiting strong bullish momentum on the hourly timeframe, supported by a well-defined ascending trendline. After a period of consolidation, the price has successfully breached a key resistance zone around the $4,950 - $4,970 level.

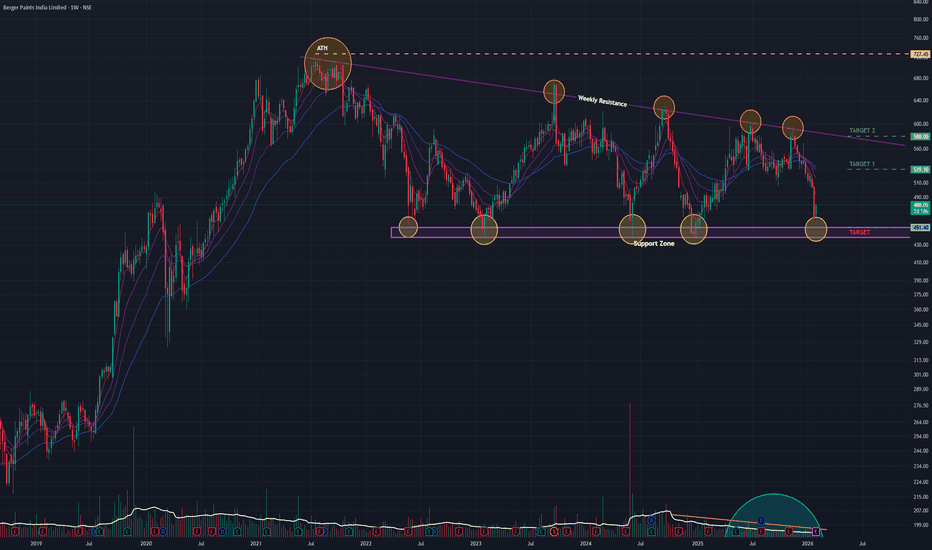

Berger Paints (W): Neutral-Bullish, Support Defense Pre-Earnings(Timeframe: Weekly | Scale: Logarithmic)

The stock is defending a 3-year critical support zone (₹440–₹450) just days before its Q3 results. While the technical reversal signal (Hammer) is present, the immediate direction will be dictated by the earnings reaction on Feb 5.

🚀 1. The Fundamental Catalyst (The "Why")

The technical bounce is tentative due to the upcoming event:

> Q3 FY26 Earnings (Feb 5): The market is cautious. If Berger manages to show volume growth (which has been a struggle for peers like Asian Paints), this support will act as a "Springboard."

> Valuation vs. Growth: The stock has corrected significantly from its ATH, compressing its P/E multiple. The market is looking for signs that the "Paint Wars" (competition from Grasim/Birla Opus) impact is priced in.

📈 2. The Chart Structure (Descending Triangle)

> The Floor (Support): ₹440 – ₹450 , this zone has bounced the stock in May 2022, Feb 2023, Jun 2024, Dec 2024 and now Jan 2026.

- Significance: A break below this would open a trapdoor to ₹380. The fact that it held last week is a positive sign for bulls.

> The Ceiling (Resistance): The angular trendline connecting the Lower Highs is currently coming down near ₹560 – ₹580.

📊 3. Volume & Indicators

> Volume: Volume is low. This "drying up" near the apex of a triangle is normal. It indicates that sellers are exhausted, but buyers are hesitant until the news (Earnings) is out.

> RSI: Rising from oversold zone in all timeframes.

🎯 4. Future Scenarios & Key Levels

The trade hinges on the Feb 5 Earnings reaction.

🐂 Bullish Reversal (The Bounce):

- Trigger: A weekly close above ₹480 (Post-Earnings).

- Target 1: ₹530.

- Target 2: ₹580.

🛡️ Support (The "Line in the Sand"):

- Immediate Support: ₹450.

- Stop Loss: A weekly close below ₹440 would invalidate the 3-year support and trigger a capitulation fall.

Conclusion

This is a "High Stakes" Setup .

> Refinement: The "Hammer" is a buy signal, but the Earnings Event (Feb 5) adds binary risk.

> Strategy:

- Safe Play: Wait for the earnings reaction.

Analysis of 5th wave in NiftyWrap up:-

After today fall in Nifty and break of 25318 (low of November, 2025). Whole of the Pattern of wave 5 in Nifty has been changed. Now, Nifty forming a Ending Diagonal pattern in wave 5.

In wave 5, wave 1 is completed at 25448, wave 2 at 25587, wave 3 at 26104 and wave 4 is expected to be completed at 25171 once nifty breaks and sustains above 25630. In Ending diagonal pattern wave 5 must be extended as wave 3 is not extended. Thereafter, wave 5 is expected to be completed in the range of 26374-26938.

What I’m Watching for 🔍

Buy Nifty @25171 or on safer side Buy Nifty when it breaks and sustains above 25630 sl 25171 for a target of 26374-26938.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

#XAUUSD📊 Gold (XAU/USD) Elliott Wave Analysis

Gold is unfolding a corrective structure that highlights the power of Elliott Wave theory:

- Wave A: The decline began with a 5-wave fall. Wave 1 retraced more than 61.8% by Wave 2, forming a zigzag.

- Wave 3: The strongest and largest bearish leg, confirming downside momentum.

- Wave 4: Price is now rising in a corrective move. This rise is part of the ABC pattern within Wave 4, where the current rally represents Wave C.

- Wave 5 (ahead): Once this corrective rise completes, the next bearish leg is expected.

📈 Key Levels to Watch:

- Corrective rise could extend toward 5030 – each rally remains an opportunity to sell.

- Downside target: Price is projected to revisit the 4200 zone as Wave 5 unfolds.

💡 Trading Insight:

Every corrective rally is a chance to align with the larger trend. Staying patient and disciplined in identifying these setups is crucial for risk-managed entries.

ATH Breakout Pullback: Smart Money Reloading at Demand Zone?Price has corrected from an all-time high and is now revisiting a high-quality demand zone that played a key role in breaking previous highs. This is not a random pullback — this is a structurally important retest. Let’s decode what the chart is really saying using pure Supply & Demand and Price Action.

📊 Higher Timeframe & Intermediate Trend Context

The weekly structure remains firmly bullish. Price has already achieved something critical: it broke and closed above the previous all-time high. This single fact changes the entire narrative.

When a market makes a fresh all-time high, it confirms:

• Strong institutional participation

• Absence of historical supply overhead

• A higher probability of continuation over deep reversal

The current move is best understood as a corrective pullback within a dominant higher-timeframe uptrend, not trend reversal.

📦 Demand Zone Logic: Why This Area Matters 🧠

The demand zone currently in play is not just any zone — it is the origin of the rally that led to the all-time high breakout. That gives this zone exceptional importance.

Key observations:

• This zone generated a powerful follow-through move

• It successfully absorbed supply and pushed price into price discovery

• Previous all-time high was broken after leaving this zone

Such zones often act as institutional reload zones, where large players look to re-enter positions during corrections.

🧩 Zone Structure & Strength

• The base is clean and well-defined

• The leg-out was explosive, signaling urgency from buyers

• Very limited basing candles, which increases imbalance

• First meaningful return after the breakout, enhancing freshness

This combination significantly improves the credibility of the zone.

🧠 Market Psychology Behind the Pullback

After an all-time high, weaker hands tend to book profits aggressively, mistaking correction for reversal. Meanwhile, stronger hands wait patiently for price to return to value.

📐 Trade Logic & Risk–Reward Perspective 🎯

The trade idea on the chart is structured around a 1:3 risk-to-reward ratio, which aligns well with:

• Higher timeframe Uptrend

• Strong demand location

• Favourable asymmetry between risk and potential reward

⚠️ Risk Awareness & Execution Discipline ⚖️

Even the best demand zones can fail. No setup is 100% reliable. Always define risk first, respect invalidation, and avoid emotional decision-making. Capital protection is more important than being right.

📌 Final Takeaway 🧭

higher-timeframe uptrend, all-time high breakout, and a controlled pullback into a good demand zone. Now, price action inside this area will decide the next move — reaction matters more than anticipation.

“Big trends are built on deep patience and precise execution.” 🔥📊

Thank you for your support, your likes & comments. Feel free to ask if you have questions.

This analysis is for educational purposes only and not intended as a trading or investment recommendation. I am not a SEBI registered analyst.

Brinks company analysisI am going to buy this stock because of following reason.

1. Stock has given good move

2. stock is created good based of 3 weeks long.

3. Stock has broken out with good volumn.

4. Stock has seen consistent growth in last 8 quarters.

5. high financial strength, mid valuation, good momentum score

6. quarterly profit has increased & revenue has decreased, both are up YoY.

7. EPS is stable.

8. company has low debt.

9.company has seen consistence profit growth in last 8 quarters.

I am managing my my risk with 4.5% of Stop loss with profit between 15-20%

GBP/AUD Analysis: Bearish Momentum Accelerates on Hawkish RBAFresh Selling Level_ At CMP

The GBP/AUD currency pair is experiencing significant selling pressure on the 1-hour timeframe as the Australian Dollar strengthens following a hawkish interest rate decision. The pair is currently trading at 1.95423, down approximately 0.58% from the daily open.

USDCHF – M15 | Sell-Side Purge → Mitigation Rally → ContinuationPrice completed a textbook sell-side liquidity sweep, flushing weak longs below the range. The impulsive push down was real displacement. What followed is a forced bounce, driven by short covering and mitigation, not fresh demand.

Current price is retracing into a discounted supply / imbalance zone, where previous bearish orderflow originated. Structure remains bearish unless proven otherwise.

Market Narrative

Range highs → distribution

Sharp sell-side run = intent revealed

Bounce = mitigation into prior inefficiency

Execution Bias

Shorts favored into the marked retracement zone

Ideal entries on signs of rejection / bearish shift

Invalidation only on clean M15 acceptance above the green level

Targets

Recent sell-side lows

External liquidity below the range

Deeper discount expansion if momentum accelerates

US100 (Nasdaq) – Structure & BiasPrice is currently trading inside a well-defined consolidation range, capped by a major resistance zone near 25,850–25,900 and supported around 25,230–25,250, which has acted as a strong demand flip multiple times.

The recent price action shows:

A liquidity sweep to the downside, followed by a sharp bullish reaction, indicating smart money absorption.

Price reclaiming the mid-range level, suggesting buyers are regaining short-term control.

Compression near support, often a precursor to expansion.

The projected path indicates a minor pullback or sideways consolidation, followed by a bullish continuation toward the upper resistance band. Structure favors upside as long as price holds above the marked support zone.

Key Levels

Support: 25,230 – 25,250

Mid-range equilibrium: ~25,300

Target / Resistance: 25,850 – 25,900

Bias

🟢 Bullish continuation, provided price maintains above the demand zone.

A clean breakout above consolidation could trigger momentum-driven expansion toward the highs.

SILVER – How Greed and Fear Build Every Market MoveThis chart shows the complete market cycle in real time — not indicators, not theory, but pure price action and human behavior.

First, smart money slowly accumulates in the stealth phase while price moves quietly.

Then institutions step in and price starts trending higher during the awareness phase.

After that, the public joins with excitement and greed, pushing price sharply into the mania phase.

This is where most people buy thinking price will go up forever.

The blow-off phase comes next — fast moves, big candles, and emotional buying.

Soon after, reality hits. Price starts returning back toward normal levels as fear replaces greed.

Every major market moves like this again and again.

Different assets, same psychology.

This is why understanding price action and structure is more important than any indicator.

Markets are driven by emotions — accumulation, excitement, greed, delusion, and fear.

Sharing this to help the community see the real story behind every chart.

Feel free to share your thoughts in the comments.

$RIVER: A Complete Market Cycle in One ChartMarkets don’t move randomly.

They move like nature.

And among all charts, CRYPTOCAP:RIVER behaves closest to a real river — not just in name, but in cycles, violence, calm, overflow, and destruction.

This is not imagination.

This is price history.

Phase 1: The Dry Season (September — $1.5 to $3)

In September, CRYPTOCAP:RIVER barely moved.

Price stayed between $1.5 and $3, unnoticed, ignored.

Just like a river during dry season:

• Water exists

• Flow is thin

• Surface looks lifeless

• Most people assume it’s dead

But rivers don’t die in dry seasons.

They retreat underground.

Liquidity remained.

Structure remained.

Only attention was missing.

Phase 2: The First Rains (October — $5 to $10)

October brought the first rainfall.

CRYPTOCAP:RIVER slowly expanded from $5 to $10.

This wasn’t a flood.

It was a signal.

Early rains always look harmless:

• Farmers notice

• Travelers still ignore

• Only observers understand

Price began carving a path again.

Most people said: “It already moved.”

But rivers don’t stop flowing because they started.

They stop only when rain disappears.

Phase 3: The False Calm (Mid-Nov to Dec — $3 to $6)

Then came silence.

Rain paused.

Flow weakened.

Between mid-November and December, price slipped back to $3–$6.

To the impatient: “The river dried again.”

But in reality:

The riverbed was now wider

Soil was saturated

Pressure was stored beneath

This phase wasn’t weakness.

It was absorption.

> When rain pauses, rivers don’t vanish —

they move quietly underground.

Weak hands left.

Patient watchers stayed.

Phase 4: The Monsoon (Dec–Jan — $1.6 to $86)

Then the season changed.

Rain returned — heavy, nonstop, uncontrollable.

From around $1.6, CRYPTOCAP:RIVER didn’t rise…

It overflowed.

Within roughly 40 days, price surged to $86.

This was flood stage.

What happens during floods?

• Boundaries break

• Fields submerge

• Land gets reshaped forever

That’s exactly what happened:

• Liquidity rushed in

• Resistance lost meaning

• Price discovery exploded

• Logic disappeared

Floods don’t ask questions.

They follow pressure.

Phase 5: 26 Jan 2026 — When the Rain Suddenly Stopped

Nature is brutal when seasons change.

On 26-01-2026, rainfall stopped suddenly.

But worse —

the river started leaking heavily.

Cracks appeared in the riverbanks.

And once leakage begins during flood stage,

collapse is inevitable.

Phase 6: The Crash — When the River Destroyed Itself

What followed was not a pullback.

It was structural collapse.

The river didn’t flow backward gently —

it crashed violently.

Here’s what happened next:

27 Jan: -18%

28 Jan: -20%

Followed by:

-12%

-18%

-27%

-39%

This wasn’t profit-booking.

This was:

Leverage unwinding

Panic exits

Liquidity vacuum

Floodwaters escaping through broken banks

> Floods don’t recede politely.

They tear everything on the way down.

Why This Crash Was Inevitable

Every flood carries a hidden truth:

> The higher the overflow, the weaker the banks.

During the monsoon phase:

Price moved too fast

Structure couldn’t stabilize

Participation became emotional, not strategic

When rain stopped, there was nothing holding the water.

Markets behave the same way:

Fast moves without base = fragile

Vertical rallies = unstable terrain

Liquidity exits faster than it enters

This wasn’t manipulation.

It was nature completing its cycle.

The Lesson Traders Must Learn

Most traders only study how rivers rise.

Very few study how they fall.

But survival comes from understanding both.

❌ Expecting floods forever is delusion

❌ Calling crashes “unexpected” is ignorance

❌ Blaming the river after ignoring seasons is denial

Nature gave signals.

Markets always do.

Final Thought

CRYPTOCAP:RIVER didn’t betray anyone.

It behaved exactly like a river should:

It waited

It flowed

It flooded

And when rain stopped…

it destroyed everything unstable

If you only watch rivers during floods,

you’ll think crashes are unfair.

But if you respect seasons,

you’ll understand:

Every flood carries the seed of its own collapse.

And every dry season…

carries the promise of another river 🌊