#NIFTY Intraday Support and Resistance Levels - 02/02/2026Nifty is expected to open with a slightly positive gap, but the broader structure remains weak after the sharp breakdown seen in the previous session. The index has fallen decisively from the 25250–25300 resistance zone and slipped below multiple intraday supports, indicating that selling pressure is still dominant. This small gap-up opening should be seen as a technical pause or minor pullback rather than a clear sign of strength unless price action improves significantly after the open.

From a technical point of view, the zone around 25000 is a crucial psychological and technical level. This area is acting as a make-or-break zone for today’s session. If Nifty manages to reclaim and sustain above 25000 on a closing basis, a short-term reversal bounce can be expected. In such a scenario, the index may gradually move towards 25150, then 25200, and extend up to 25250+. This move would mainly be driven by short covering, so follow-through buying and stability above 25000 will be very important to confirm any bullish reversal.

On the downside, the price structure is still bearish as Nifty is trading below its recent support band of 24950–24900. Any failure to hold above this zone, or rejection near 24950, can invite fresh selling pressure. Below 24900, the index may slide towards 24850, followed by 24800 and 24750. These levels are important intraday supports, and a break below them can further accelerate the downside momentum.

If the selling pressure intensifies and Nifty breaks below 24700, the bearish trend can deepen further. In that case, the next downside targets come in near 24600, 24550, and 24500. Such a move would indicate panic selling or continuation of the broader weakness seen in recent sessions. Volatility is likely to remain high, so traders should be prepared for sharp and fast moves on both sides.

Overall, despite the slightly gap-up opening, the trend remains cautious to bearish. Bulls need a strong hold above 25000 to regain control, while bears will continue to dominate below 24950. Traders should wait for clear confirmation near these key levels before taking positions, keep position sizes light, and follow strict risk management, as whipsaws are highly possible in the current market environment.

Pricemovement

#BANKNIFTY PE & CE Levels(02/02/2026)Bank Nifty is expected to open with a slightly positive gap, but the overall structure still reflects weakness after the sharp sell-off seen in the previous session. The index has decisively broken below the important 59050–58950 support zone, which earlier acted as a strong demand area. This breakdown has shifted the short-term trend clearly on the bearish side, and the gap-up opening should be treated more as a pullback rather than a trend reversal unless key levels are reclaimed.

From a technical perspective, the fall from the 59550–59600 region confirms strong supply at higher levels. The current price action is forming lower highs and lower lows on the 15-minute timeframe, indicating sustained selling pressure. Any bounce toward 58950–59050 is likely to face resistance, as this zone now turns into a supply area. If Bank Nifty fails to hold above this range after the opening, fresh selling pressure can re-emerge quickly.

On the downside, the immediate support lies near 58550–58450. A break below 58450 can accelerate the bearish momentum further, opening the gates for deeper targets around 58250, 58150, and potentially 58050. These levels are critical intraday and positional supports, and increased volatility can be expected if they are tested. As long as the index remains below 59000, bears will continue to have an upper hand.

On the upside, only a strong and sustained move above 59050 can provide some relief to the bulls. If Bank Nifty manages to reclaim and hold above 59050–59100, a short-covering bounce toward 59250, 59350, and 59450+ is possible. However, such a move should be confirmed with follow-through buying; otherwise, it may turn into a selling-on-rise opportunity.

Overall, despite the slightly gap-up opening, the market context remains cautious to bearish. Traders should avoid aggressive long positions near resistance zones and focus more on sell-on-rise or breakdown-based strategies. Strict risk management is essential, as volatility is expected to stay elevated after the recent sharp move. Patience during the opening minutes and confirmation of price action near key levels will be crucial for safer trades.

Silver Weekly Outlook: Post-Exhaustion PhaseSilver has entered a high-volatility post-exhaustion phase after a sharp parabolic rise followed by an equally aggressive correction. The weekly chart clearly shows that price moved too far, too fast, and the recent sell-off is a classic example of mean reversion after euphoric buying. Such phases rarely resolve in a straight line and typically evolve into consolidation, base-building, or deeper corrective structures.

At current levels, Silver is hovering near an immediate demand zone around the 80–85 region, which now acts as a crucial decision area. This zone represents the first major area where buyers are expected to defend aggressively. The way price behaves here will define the next medium-term trend.

Scenario A – Range / Base Formation (High Probability):

The most probable outcome at this stage is sideways consolidation. After a vertical fall, markets often need time to absorb supply and rebuild demand. If Silver manages to hold above the immediate demand zone and starts forming higher lows on lower timeframes, it would indicate base formation rather than trend failure. This scenario favors range traders and patient positional participants, as price may oscillate between support and overhead resistance for several weeks or months.

Scenario B – Breakdown Continuation (Moderate Probability):

If the current support zone fails decisively with strong weekly closes below it, Silver could enter a deeper corrective phase. In such a case, price may gravitate toward the next major demand zone near 73–75, which aligns with prior consolidation and breakout structure. This move would likely be driven by broader risk-off sentiment or macro pressure rather than technical weakness alone. Traders should avoid aggressive longs if this breakdown structure develops.

Scenario C – Bullish Reclaim and Bounce (Low Probability, Needs Confirmation):

A less likely but still possible outcome is a bullish reclaim, where Silver holds current levels, absorbs selling pressure, and reclaims the 90+ zone with strong weekly confirmation. For this scenario to gain credibility, price must show acceptance above resistance with volume and structure. Until then, any bounce should be treated as reactive and corrective, not a confirmed trend reversal.

From a structural perspective, the major resistance remains far above near the 115–120 zone, which was the distribution area before the sharp reversal. This level will act as a long-term supply cap unless Silver builds a strong base over time.

In summary, Silver is no longer in a trending phase but in a transition zone. Patience is critical here. Traders should focus less on prediction and more on reaction to price behavior at key demand levels. Let structure, confirmation, and risk management guide decisions, as this phase can easily trap both early bulls and aggressive bears if approached without discipline.

#BANKNIFTY PE & CE Levels(29/01/2026)Bank Nifty is expected to open flat, indicating a pause in momentum after the recent sharp recovery from lower levels. Such flat openings generally signal indecision in the market, especially when the index is trading close to an important resistance zone. At present, Bank Nifty is hovering near the 59550–59600 area, which has acted as a strong supply zone in recent sessions. This makes today’s trade more level-driven, with higher chances of range-bound movement and sudden volatility around key levels.

From a broader structure perspective, the index has bounced strongly from the sub-58500 region, mainly due to short covering. However, as price approaches higher resistance zones, fresh buying strength needs confirmation. Until that happens, the market may either consolidate in a narrow range or show false breakouts followed by quick reversals. Traders should avoid anticipating moves and instead react to confirmed price action.

On the bullish side, if Bank Nifty manages to sustain above 59550 on a 15-minute closing basis, it would indicate that buyers are gaining control despite the overhead supply. In such a scenario, call options can be considered above 59550. The first upside target would be around 59750, which is a minor resistance and a good zone for partial profit booking. If momentum continues, the next levels to watch are 59850 and then 59950 or higher. Near the 60000 psychological level, strong profit booking is expected, so trailing stop-loss becomes crucial for long positions.

On the bearish side, failure to hold above 59550 followed by a breakdown below the 59450–59400 zone would indicate rejection from higher levels. This would open the door for a corrective move. In that case, put options can be considered around 59450–59400. The immediate downside targets would be 59250 and then 59150. If selling pressure increases, the index could drift toward the 59050–59000 support zone. A clear break below 59050 would weaken the structure further, though such a move would likely require negative global cues or heavy institutional selling.

For intraday traders, the zone between 59450 and 59550 should be treated as a no-trade area, as price action here can be choppy and misleading. The best trades are expected only after the market shows clear acceptance above resistance or below support. Partial profit booking at every target and strict risk management are essential due to the possibility of sudden spikes on either side.

Overall, Bank Nifty is at a crucial decision point. Sustained trade above 59550 favors bullish continuation, while rejection and breakdown below 59400 may lead to a pullback. The session is likely to be volatile but structured, rewarding traders who stick to levels, wait for confirmation, and avoid emotional or over-leveraged positions.

#BANKNIFTY PE & CE Levels(28/01/2026)A gap-up opening in Bank Nifty indicates a positive start to the session, supported by short-covering and fresh buying interest from lower levels. The index has opened above the immediate intraday support zone, which suggests that bulls are attempting to regain control after recent consolidation. However, despite the gap-up, the market is still trading within a broader range, so confirmation through price sustain is crucial before assuming a strong trending move.

From a technical structure point of view, the 59050–59100 zone is acting as a major demand and decision area. Holding above this region keeps the bullish bias intact for the intraday session. If Bank Nifty sustains above 59050, buying Call options becomes favorable, with upside targets placed near 59250, followed by 59350, and then 59450+. These levels correspond to previous supply zones and minor swing highs, where profit booking or partial exit should be considered due to potential resistance.

A stronger bullish continuation will only be confirmed if the index manages to break and sustain above 59550. Above this level, momentum buying can accelerate, opening the path towards 59750, 59850, and eventually 59950+, which is a major resistance area marked by previous rejections. This zone is critical, as failure to cross it decisively may again push the index back into consolidation or minor correction.

On the downside, 59450–59400 is the first intraday support. A breakdown below this zone may trigger short-term weakness, making Put options attractive with targets around 59250, 59150, and 59050. If selling pressure increases and Bank Nifty slips below 58950, the structure turns weaker, and further downside targets open up towards 58750, 58650, and 58550, which are stronger demand zones from where bounce-back attempts can emerge.

Overall, the gap-up opening reflects positive sentiment, but the market is still trading near crucial resistance bands. Traders should avoid chasing the gap and instead focus on price acceptance above key levels. A sustained move above resistance confirms bullish strength, while rejection from higher zones can quickly lead to a pullback. Maintaining strict stop-losses, booking partial profits near targets, and trading strictly based on levels will be essential due to expected volatility around these zones.

#BANKNIFTY PE & CE Levels(23/01/2026)A flat opening is expected in Bank Nifty, indicating a pause after the recent volatile swings and suggesting that the market is entering a short-term consolidation phase. Price action over the last few sessions clearly shows sharp intraday moves on both sides, followed by quick pullbacks, which reflects indecision and lack of strong directional conviction among participants. This kind of structure usually favors level-based trading rather than aggressive trend-following trades, especially during the first half of the session.

From a technical perspective, the 59050–59100 zone is acting as a crucial intraday pivot and demand area. As long as Bank Nifty holds above this region, the bias remains mildly positive with scope for a gradual upside move. Sustained trading above 59100 can trigger fresh long interest and short covering, which may push the index towards 59250, followed by 59350 and 59450+. However, this upside is likely to be slow and grindy, not impulsive, unless there is a strong breakout candle with volume confirmation above the higher resistance.

On the flip side, the 59450–59400 zone continues to behave as a strong supply and selling area. Any rejection from this region, especially if the price forms long upper wicks or fails to sustain above it, can invite renewed selling pressure. In such a scenario, PE buying near 59450–59400 becomes valid, with downside targets towards 59250, then 59150, and 59050. This makes the 59400–59500 band a critical area where traders should be extremely cautious and avoid chasing breakouts without confirmation.

If selling pressure intensifies and Bank Nifty breaks decisively below 59050, the structure may again turn weak. A breakdown below this support can open the gates for a deeper correction towards 58950–58900, and further down to 58750, 58650, and 58550. These lower levels are strong higher-timeframe supports, so any sharp fall into these zones could again attract bounce-based buying, keeping volatility elevated.

Overall, the broader trend still leans sideways to mildly bearish, with repeated failures near resistance and limited follow-through on rallies. Traders should focus on support-resistance reactions, avoid overtrading during choppy moves, and wait for clear confirmation before committing to large positions. A disciplined approach with strict risk management will be crucial, as Bank Nifty is likely to remain range-bound with sudden spikes on either side during the session.

#NIFTY Intraday Support and Resistance Levels - 21/01/2026A flat opening is expected in Nifty, indicating continued consolidation after the recent sharp decline and volatile price action near lower demand zones. The index has shown strong selling pressure from higher levels and is now hovering close to a critical support area, suggesting that the market is at an important decision point. Early trade is likely to remain range-bound with heightened volatility, as both buyers and sellers assess whether the recent support will hold or break further.

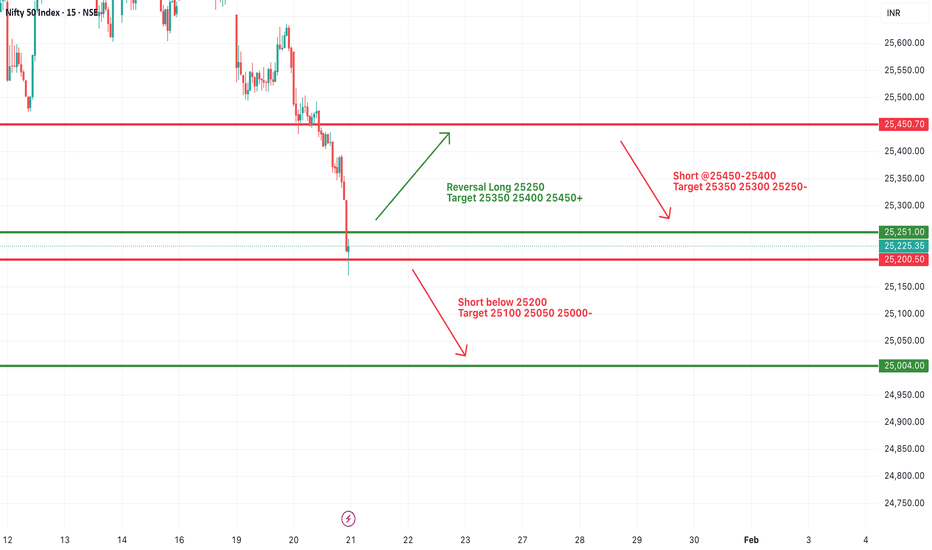

On the support side, the immediate demand zone is placed around 25,250–25,200. This area has already witnessed a sharp reaction, indicating short-term buying interest and the possibility of a technical bounce. If Nifty manages to hold above 25,250, a reversal long setup may come into play with upside targets of 25,350, 25,400, and 25,450+. Any pullback followed by strong bullish candles or higher low formation near this zone can be used as a confirmation for intraday or short-term long trades, keeping strict stop-losses below the support.

On the upside, the immediate resistance lies near 25,450–25,400, which is a previous breakdown zone. Sustaining above this level is crucial for bulls to regain control. Failure to cross this resistance may again attract selling pressure, keeping the index trapped in a sideways-to-bearish structure. Hence, profit booking is advised near resistance levels for long positions, and fresh longs should be considered only on a decisive breakout with volume confirmation.

On the downside, a clear break below 25,200 would weaken the structure further and open the door for fresh short trades. In such a scenario, downside targets are placed at 25,100, 25,050, and 25,000, which are the next major psychological and technical support levels. Below 25,000, the selling momentum can accelerate, so traders should be cautious and trail profits aggressively in short positions.

Overall, the broader trend remains bearish with short-term consolidation, and today’s flat opening suggests a wait-and-watch approach during the initial phase of the session. Traders should focus on level-based trading, avoid chasing moves, and strictly follow risk management. Directional clarity is expected only after a confirmed breakout above resistance or a breakdown below the key support zone.

[INTRADAY] #BANKNIFTY PE & CE Levels(21/01/2026)A flat opening is expected in Bank Nifty, indicating indecision after the recent sell-off and rejection from higher levels. The index is currently trading below its immediate resistance zone, reflecting weak momentum and cautious sentiment among market participants. Early trade is likely to remain volatile but range-bound, as both buyers and sellers wait for confirmation near the marked support and resistance levels before committing to fresh positions.

On the upside, the key resistance zone is placed near 59,550–59,600. If Bank Nifty manages to sustain above 59,550, it can trigger a buy-on-breakout setup with upside targets of 59,750, 59,850, and 59,950+. A move above this zone would indicate short-covering and fresh buying interest, potentially leading to a recovery rally towards the upper resistance band near 59,950. Long trades should be considered only after clear acceptance above resistance with stable price action.

On the downside, the immediate support is seen around 59,450–59,400. Failure to hold this level can invite fresh selling pressure, making buy PE options favorable for downside moves. In such a case, targets are placed at 59,250, 59,150, and 59,050, where partial profit booking is advisable. A stronger breakdown below 58,950–58,900 would further weaken the structure and open deeper downside targets near 58,750, 58,650, and 58,550, which are major demand zones and potential bounce areas.

Overall, the broader structure suggests a sell-on-rise and range-trading strategy unless a decisive breakout above resistance occurs. Traders should avoid aggressive positions during the initial flat phase and instead focus on level-based trades with strict stop-loss management. Scalpers and intraday traders can capitalize on moves near support and resistance, while positional traders should wait for a confirmed directional breakout before taking larger exposure.

#NIFTY Intraday Support and Resistance Levels - 20/01/2026A flat opening is expected in Nifty, indicating continued consolidation after the recent corrective move. The index is currently trading below the previous resistance zone, suggesting that the overall bias remains cautious in the near term. Early price action is likely to remain range-bound, with volatility expected around the marked support and resistance levels. Traders should be patient during the opening minutes and wait for price confirmation near key levels before initiating positions.

On the upside, the immediate resistance zone is placed around 25,750–25,800. A sustained move and acceptance above 25,750 can trigger a reversal long setup, indicating that buyers are regaining control. If this breakout holds, Nifty may gradually move towards 25,850, followed by 25,900 and 25,950+, where fresh supply and profit booking can be expected. Long trades should only be considered if the index shows strong price acceptance above this zone with supportive volume.

On the downside, the 25,700–25,650 region remains a crucial intraday support. Any rejection from the resistance zone or failure to hold above 25,700 can lead to a reversal short setup. In such a scenario, downside targets are seen at 25,650, 25,550, and 25,500, which are important demand areas. A decisive breakdown below 25,450 will further weaken the structure and can open the gates for deeper downside towards 25,350, 25,300, and 25,250, where buyers may attempt a defensive bounce.

Overall, the market structure suggests a sell-on-rise or range-trading environment unless a strong breakout above resistance occurs. Traders should focus on level-based trading with strict stop-loss discipline and avoid overtrading during sideways moves. Scalping and short-term trades near support and resistance will be more effective than positional trades until Nifty shows a clear directional breakout.

RBL Bank Shows a Powerful Cup Pattern Breakout on Weekly ChartRBL Bank has completed a textbook Cup & Handle pattern on the weekly timeframe, signaling a meaningful shift from a long consolidation phase into a fresh bullish trend. The rounded base formation highlights a gradual transition from distribution to accumulation, indicating growing confidence among long-term market participants.

The most critical development is the decisive breakout above the handle resistance zone, which had previously acted as a strong supply area. This breakout is supported by strong price expansion and follow-through candles, confirming that buyers are in control. Such breakouts from multi-month bases often lead to sustained trending moves rather than short-lived rallies.

From a price projection standpoint, the measured move of the cup suggests an initial upside target around 380+, followed by an extended projected target near 440+ if momentum continues to build. The current structure also shows healthy consolidation above the breakout level, which is a positive sign and often acts as a base for the next leg higher.

Risk management remains clearly defined in this setup. As long as the price holds above the breakout support zone near 280–290, the bullish structure stays intact. Any sustained breakdown below this area would invalidate the pattern and shift the outlook back to neutral or corrective.

Overall, RBL Bank appears to be transitioning into a new medium-to-long-term uptrend, backed by a strong chart structure and favorable risk–reward dynamics. This makes it a compelling setup for positional traders and investors who prefer structurally confirmed breakouts with clear targets and controlled downside risk.

#NIFTY Intraday Support and Resistance Levels - 16/01/2026Based on the current price structure and the levels marked on the chart, the market is expected to open flat with no major deviation from the previous session’s range. Nifty is currently trading near a well-defined demand–supply zone, indicating indecision and consolidation rather than a strong directional bias. As long as the index holds above the 25,750–25,800 support area, there is a possibility of a technical pullback or reversal on the upside. A sustained move above this zone can attract fresh buying interest, with upside targets placed around 25,850, followed by 25,900 and 25,950 levels. This zone will act as an important intraday trigger, and confirmation should ideally come with strong price acceptance and volume.

On the downside, the 25,700 level remains a critical breakdown point. If Nifty fails to sustain above this level and slips below 25,700, selling pressure may intensify, opening the path for a decline towards 25,650, 25,550, and potentially 25,500. This makes the lower support band extremely important for intraday traders, as a breakdown below it can quickly change the market sentiment to bearish. Until a clear breakout or breakdown is seen, the overall structure suggests range-bound movement, and traders are advised to be patient and wait for confirmation near key levels rather than taking aggressive positions at market open.

Overall, the market context remains neutral to mildly cautious, with flat opening expectations and stock-specific or level-based opportunities likely to dominate the session. Strict risk management is recommended, along with partial profit booking near targets, as volatility may increase once the index moves decisively out of the current consolidation range.

[INTRADAY] #BANKNIFTY PE & CE Levels(16/01/2026)A flat opening is expected in Bank Nifty, with the index trading near the 59,550–59,600 zone, which continues to act as a key intraday balance area. Price action shows consolidation within yesterday’s range, indicating that the market is still indecisive and waiting for a directional trigger. No major changes are observed in the overall structure compared to the previous session.

On the upside, a sustained move above 59,550–59,600 will be important for bullish continuation. If Bank Nifty holds above this zone, long trades (CE positions) can be considered with upside targets at 59,750, 59,850, and 59,950+. A breakout above 59,950 may further strengthen bullish momentum toward higher resistance levels.

On the downside, failure to hold the 59,450–59,400 support zone may invite fresh selling pressure. In such a scenario, short trades (PE positions) can be considered with downside targets at 59,250, 59,150, and 59,050, where strong demand is expected. Until a clear breakout or breakdown occurs, traders should continue with range-based strategies, maintain strict stop-loss discipline, and avoid aggressive positions in the early part of the session.

#NIFTY Intraday Support and Resistance Levels - 14/01/2026A flat opening is expected in Nifty, with the index trading near the 25,700–25,750 zone, which continues to act as an important intraday pivot area. The broader structure remains weak after the recent sharp decline, and price action suggests consolidation rather than immediate trend reversal.

On the upside, a reversal long can be considered only if Nifty sustains above 25,750–25,800. A confirmed hold above this zone may trigger short covering and pull the index towards 25,850, 25,900, and 25,950+. However, upside momentum is likely to remain limited unless price decisively reclaims the 25,950 resistance.

On the downside, 25,700 remains a crucial breakdown level. If the index slips below 25,700, fresh selling pressure may emerge with downside targets at 25,650, 25,550, and 25,500. The 25,500 area is a strong support, and any sustained break below it can extend weakness further.

Overall, the market remains range-bound with a bearish bias. Traders should wait for a clear breakout above resistance or breakdown below support, follow strict risk management, and avoid aggressive positions during the initial phase of the session.

[INTRADAY] #BANKNIFTY PE & CE Levels(14/01/2026)A flat opening is expected in Bank Nifty, with price hovering around the 59,500–59,600 zone, which is acting as an intraday equilibrium area. Recent price action shows range-bound behavior with sharp intraday swings, indicating indecision and a lack of fresh directional cues.

On the upside, a sustained move above 59,550 will be important to trigger bullish momentum. If the index holds above this level, CE buying can be considered with upside targets at 59,750, 59,850, and 59,950+. A decisive breakout above 59,950 may open the door for a stronger recovery move.

On the downside, rejection near current levels and a break below 59,450–59,400 can invite selling pressure. In that case, PE positions may work for targets at 59,250, 59,150, and 59,050, where strong support is placed near 59,050. A breakdown below this support could accelerate downside momentum.

Overall, the structure remains range-bound. It is advisable to trade only after a clear level breakout or breakdown, maintain strict stop-losses, and avoid overtrading until a decisive move emerges.

#NIFTY Intraday Support and Resistance Levels - 13/01/2026A flat opening is expected in Nifty 50, with the index trading near the 25,800–25,820 zone, which is acting as a short-term balance area after the recent sharp recovery from lower levels. The bounce from the 25,500–25,550 support zone indicates short-covering and selective buying, but overall price action still reflects a cautious and range-bound environment. The market is currently waiting for a clear directional trigger before committing to a stronger move.

On the upside, a sustained hold above 25,850–25,900 will be crucial to confirm bullish continuation. If this zone is reclaimed and held, long positions can be considered with upside targets at 25,950, 26,000, and 26,050+. A decisive breakout above 25,950 may invite fresh buying momentum and improve short-term sentiment.

On the downside, failure to sustain above 25,750 may weaken the recovery attempt. A break below 25,700 can reintroduce selling pressure, opening downside targets at 25,650, 25,550, and 25,500-, where strong demand is expected again. Until a clear breakout or breakdown occurs, traders should continue to focus on range-based trades, keep strict stop-losses, and avoid aggressive directional bets.

#NIFTY Intraday Support and Resistance Levels - 12/01/2026A flat opening is expected in Nifty 50, with the index currently trading near the 25,700 zone after a sharp corrective move in the previous sessions. The overall structure remains weak, but some short-term stabilization and minor pullback attempts are visible near intraday support levels. Market participants should remain cautious and focus strictly on level-based trades.

On the upside, the 25,750–25,800 zone is a crucial support-cum-reversal area. If Nifty manages to hold and show strength above this zone, a reversal long can be considered with upside targets at 25,850, 25,900, and 25,950+. A sustained move above 25,950 would indicate short-covering and may lead to further recovery.

On the downside, failure to hold 25,700 will keep selling pressure intact. A break below 25,700 may trigger fresh shorts with targets at 25,650, 25,550, and 25,500-. Additionally, any pullback toward 25,950–25,900 that shows rejection can be used for short positions, targeting 25,850, 25,800, and 25,750. Until a clear directional breakout occurs, traders are advised to trade with strict stop-losses and avoid overexposure in a volatile environment.

[INTRADAY] #BANKNIFTY PE & CE Levels(12/01/2026)A flat opening is expected in Bank Nifty, with the index continuing to trade within the same downward structure seen over the last few sessions. Price is currently hovering around the 59,250–59,300 zone, which is acting as an intraday equilibrium area where minor pullbacks and short-covering are visible, but no strong buying conviction has emerged yet. Overall sentiment remains cautious unless a clear breakout occurs.

On the upside, a sustained move above 59,550 will be the key trigger for bullish momentum. If Bank Nifty manages to hold above this level, long trades / CE positions can be considered with upside targets at 59,750, 59,850, and 59,950+. A clean breakout above 59,950 may further open the gates toward higher resistance zones.

On the downside, if the index fails to hold 59,250–59,200, selling pressure may intensify. In such a scenario, PE positions can be considered with downside targets at 59,050, 58,950, and 58,750. A decisive breakdown below 58,950 could extend the move toward 58,650 and 58,550-. Until a clear directional move is confirmed, traders are advised to stick to level-based trades with strict risk management and avoid aggressive positions.

#NIFTY Intraday Support and Resistance Levels - 09/01/2026A flat opening is expected in Nifty 50, with the index continuing to trade under pressure after the recent sharp decline. Price is currently hovering around the 25,850–25,900 zone, which is acting as a short-term decision area. This zone is crucial, as it marks the balance point where buyers are attempting a pullback while sellers still maintain overall control.

On the upside, a sustained move above 26,050 will be the first sign of strength. If the index manages to reclaim and hold this level, long positions can be considered with upside targets at 26,150, 26,200, and 26,250+. A further breakout above 26,250 may shift sentiment toward a stronger recovery phase.

On the downside, if Nifty fails to hold 25,900–25,850, selling pressure may resume. In such a scenario, short positions can be considered with downside targets at 25,800, 25,750, and 25,700. A decisive break below 25,700 could accelerate the fall toward 25,650, 25,550, and 25,500-. Until a clear directional breakout occurs, traders should stay cautious, focus on level-based trades, and follow strict risk management.

[INTRADAY] #BANKNIFTY PE & CE Levels(09/01/2026)A flat to slightly gap-down opening is expected in Bank Nifty, with price continuing to trade under selling pressure after the recent decline. The index is currently hovering around the 59,650–59,700 zone, which is acting as a short-term consolidation area. This zone remains critical, as buyers are attempting to defend lower levels while overall sentiment stays cautious.

On the upside, a sustained move above 59,950–60,050 will be the first sign of recovery. If Bank Nifty manages to hold above this zone, long (CE) positions can be considered with upside targets at 59,750, 59,850, and 59,950+ initially. A stronger breakout above 60,050 may further extend the rally toward 60,250, 60,350, and 60,450+, confirming bullish continuation.

On the downside, failure to hold the 59,550 support may invite fresh selling pressure. In such a case, short (PE) positions can be considered, with downside targets at 59,450, 59,250, and 59,150, followed by 59,050- if weakness persists. Until a clear breakout or breakdown is seen, traders should remain range-bound, trade with confirmation, and strictly manage risk in this volatile zone.

Gold (XAUUSD) Shows Head & Shoulders BreakdownGold on the 1-hour timeframe has formed a clear Head and Shoulders reversal pattern, signaling a potential shift from bullish momentum to a corrective or bearish phase. The structure is well-defined, with a visible left shoulder, a higher head, and a lower right shoulder, indicating weakening buying strength after the recent rally.

The neckline zone, highlighted around the 4,440–4,445 area, acted as a crucial support and demand region earlier. Price has now broken below this neckline and is struggling to reclaim it, which confirms the breakdown of the pattern. This behavior suggests that sellers are gaining control, and any pullback toward the neckline is likely to face selling pressure rather than fresh buying.

As long as Gold remains below the neckline, the bias stays bearish. The projected move, based on the height of the head-to-neckline, points toward a downside target near the 4,380–4,385 zone. Minor pullbacks or consolidations may occur in between, but unless price reclaims and sustains above the neckline, the risk remains tilted toward further downside.

From a trading perspective, this is a classic example of trend exhaustion after a strong upside move. Bulls should be cautious at current levels, while bears can look for continuation setups on weak pullbacks, keeping risk tightly managed. The overall structure clearly indicates that Gold is no longer in a strong bullish phase on the intraday chart and is now transitioning into a corrective move.

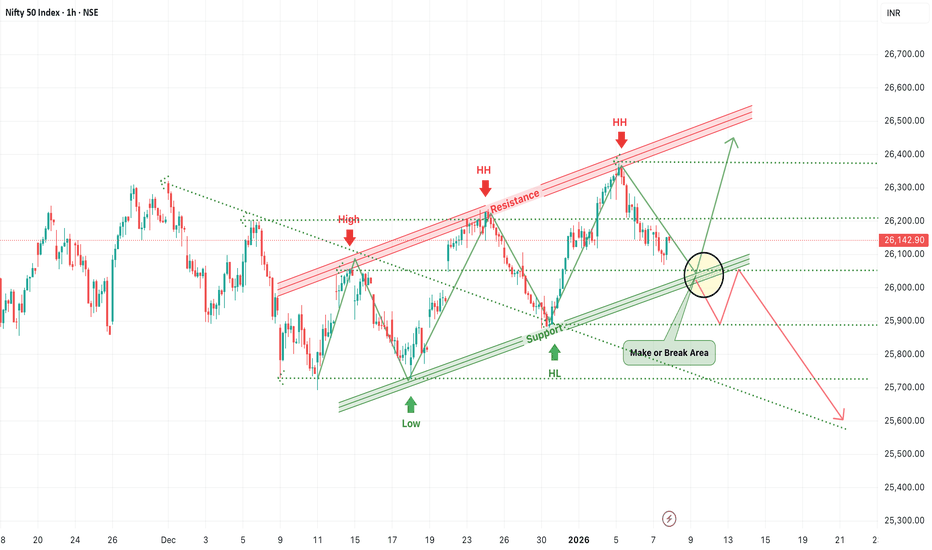

Nifty Near at Make-or-Break ZoneNifty is currently trading near a highly sensitive decision area on the 1-hour timeframe, where a rising support trendline is intersecting with a short-term corrective structure. Price has already formed a sequence of higher highs and higher lows in the recent swing, indicating that the broader intraday trend is still bullish. However, repeated rejection from the rising resistance zone near the recent highs suggests that buyers are losing momentum at higher levels.

The marked “make-or-break” zone around the 26,000–26,050 area is extremely important. This region is acting as a dynamic support, backed by the rising trendline and previous demand. As long as Nifty holds above this support and shows a bullish reaction, a bounce toward the 26,300–26,450 resistance zone remains possible. A sustained move above this resistance would confirm trend continuation and open the path for further upside in the short term.

On the flip side, if Nifty fails to hold this support zone and breaks decisively below it, the structure will weaken significantly. Such a breakdown would invalidate the higher-low formation and could trigger a sharper corrective move toward the 25,700–25,600 area, as indicated by the projected downside path. This would signal a shift from trend continuation to a deeper pullback or short-term trend reversal.

Overall, Nifty is at a point where patience is crucial. Directional clarity will emerge only after price either holds and bounces from the current support or breaks down convincingly below it. Traders should avoid anticipation and wait for confirmation, as this zone is likely to decide the next meaningful intraday move.

[INTRADAY] #BANKNIFTY PE & CE Levels(08/01/2026)A flat opening is expected in Bank Nifty, with price action continuing to respect the same range and structure observed in the previous session. The index is currently trading around the 60,000–60,050 zone, which is acting as a short-term equilibrium area where buying and selling pressure remain balanced. As there are no major changes in key levels, the market sentiment stays neutral, indicating consolidation rather than a trending move.

On the upside, a sustained move above 60,050–60,100 will be the key trigger for bullish momentum. If Bank Nifty holds above this zone, long/CE positions can be considered with upside targets at 60,250, 60,350, and 60,450+. A decisive breakout above this resistance may attract fresh buying and extend the upside.

On the downside, if the index fails to hold 59,950–59,900, selling pressure may increase. In such a scenario, short/PE positions can be considered with downside targets at 59,750, 59,650, and 59,550-, where strong support is expected. Until a clear breakout or breakdown occurs, traders should continue to focus on range-bound trades, keep strict stop losses, and avoid aggressive directional positions.

#NIFTY Intraday Support and Resistance Levels - 07/01/2026A flat opening is expected in Nifty 50, with the index continuing to trade within the same price structure seen in the previous session. The market is hovering around the 26,170–26,200 zone, which is acting as an immediate balance area where buyers and sellers are evenly placed. Since there are no major changes in yesterday’s key levels, the overall tone remains range-bound, and the index is waiting for a clear directional trigger.

On the upside, a sustained move above 26,250 will be crucial to revive bullish momentum. If Nifty holds above this level, long positions can be considered with upside targets at 26,350, 26,400, and 26,450+. A clean breakout above this resistance may lead to follow-through buying and expansion of the current range.

On the downside, failure to hold 26,200 can increase selling pressure. A decisive break below this level may open the downside toward 26,150, 26,100, and 26,000, where strong support is placed. Until the index breaks out of this range, traders should focus on range-based setups, avoid over-leveraging, and strictly follow risk management in intraday trades.