BSE Limited, signs of revival?On the daily charts a clear sign of range shift is visible on RSI. Right now the stock is at immediate resistance of trend line, above which the stock can further scale higher. On the weekly charts we notice RSI taking support on 40 levels, hence yet another signal of strength. The macd on the daily charts is above zero line. Overall the stock is painting a bullish picture.

Prorsi

Looks confusing but have a story to say...The weekly charts displays inv head & shoulder marked in green, while the daily charts displays a topping h&s marked in red. Any one pattern needs to be negated. While RSI is into bullish zone, any retracement can be utilized for getting into position in the stock. While the MACD is bullish on daily as well as weekly time frames. It will be a good watch in the coming weeks.

GAIL closed over important pivot levelGAIL has closed above an important pivot level, net resistance is placed at 138 - 140 levels, above which a good and strong move may be seen to 170 levels.

RSI is now spending time in bullish zone while MACD has moved above zero line. Accumulate on dips suggested.

. The stock has to maintain itself above 55 levels, if it holds The stock has been trading with strength since last few sessions. It has been above to maintain above the support levels. An inverse head & shoulder pattern is visible on the daily chart. The breakout took place in the last session. The stock has to maintain itself above 55 levels, if it holds the levels then we may witness emergence of a fresh bull run in it. A minor resistance is placed at 60-62 levels, above which the sky is open for the stock till 76 levels. Below 55 levels it may resume downtrend ok keep trading sideways. The RSI is maintain well above 50 levels from last few weeks and MACD has moved into bullish zone as well. Buying at dips till 55 is suggested.

. A sustenance above 12290 may push up the prices to .....The index pulled back in a great way after the Middle East tensions. The prices halted at the previous highs. The momentum (RSI) is into a sideways zone and still diverging with the price. A sustenance above 12290 may push up the prices to 12360 – 12500 levels, however any failure to sustain above the levels may push nifty to 11930 where it may find support. The MACD is above zero line (bullish) while RSI has slided between 60-40.

31450 levels will serve as a strong support to the index....Finally a eventful week ends. This week made trading the most difficult task. Price actions were impacted by the tensions between Middle East and US. In the end the indices did manage to sustain most of the losses that were made by the attack news. The last candle on bank nifty was undeceive though the weekly close resulted into a hammer.31450 levels will serve as a strong support to the index, if bank nifty sustains above this then 32460 – 32860 seems to be eminent targets. A move above 32200 will assure the above levels. However a failure to keep up above this level may result into a pullback to 31450. The MACD is into the bullish zone while RSI is neutral with bullish bias.

CNX SMALL CAPS displaying strength, capable of 10% move here!CNX Small Cap Index registered a decent close above all major pivots. Also RSI is now displaying bullish momentum with MACD comfortable into bullish zone. Small Caps stocks are expected to outperform the overall Nifty index in the coming quarter.

Cummins displaying strength, may face resistance near...Cumminsind stayed strong and managed to register a close above an important pivot level. 600 will serve as another resistance in the coming week above which the stock can rally hard "bohot hard" Also noticing an inverse H&S in the stock. The swing of right shoulder can be kept as a stop loss. The RSI has started moving into the 60's and MACD is above the zero line. The momentum is painting a positive picture.

RSI is facing resistance at the extreme levels.The RSI is facing resistance at the bearish extreme levels. We can notice the price action hasn't been too supportive for longs. A not so prominent H&S is noticed. Breaking below the neckline may result into deep corrections.

The RSI and MACD are displaying divergence, if the formation is The weekly banknifty chart has closed negative this week, back to back two bearish candles also indicates momentum suppression in the index. 31800 will provide immideate support to the index, giving away this may push the index to 31300 levels. However the trend is still up and any bounce from the support will push banknifty up 32600, 32800 & 33300 finally. The RSI and MACD are displaying divergence, if the formation is not negated in coming sessions then correction is quite probable.

This 12200 levels will serve as minor supportThe index has been consolidating in a sideways range since last two weeks. A triangle pattern is visible on the daily charts, the breakout is yet to occur. The prices are holding the TS line support tightly. This 12200 levels will serve as minor support while 12070 the KS line is an important support. Any redound should take place from these supports. Nifty is set to move to 12310, 12380 & 12500 levels. But when we look at the RSI, the momentum seems to lose its strength, I would really like the RSI to break up from the 60 levels which it is tested a multiple number of times.

Banknifty may attempt to correct. But......Banknifty is losing momentum gradually, we can notice a divergence on RSI with doji formation though divergence is not indication of trend change, a detour may not be ruled out. The MACD also displays divergence. Probable support at TK & KS confluence placed close to 31800. However there is no point in pre attempting correction, rather wait for price confirmation. Also to bring to notice there is a volatility divergence as well.

Berger paint is spending too much time on ....Berger paints is spending too much time on extremes zones on RSI. The momentum hasn't been impressive and strong to break above the 60 levels. If the prices aren't able to break through it in a session or too it will result into a "momentum puncture" which will lead to corrections in the stock.

Nifty may find support at 11980! Trend still upNifty corrected today and closed negative. The most probable and strong support area now seems to be at 11980. This level is breeding many support levels of different parabola. We are expecting prices to rest here and move up again to create a new highs, any failure to hold it will result into deep corrections.

Bajaj Auto enjoying a momentum time out.The stock is taking its time out at the 60 levels on RSI. After a unstoppable rally from August it has moved sideways and have consolidated. As of now he prices are resting on KS/TS support line, if a breakout is not registered within a session or two then some serious momentum loss may be grip up thereby pushing the stock into some sharp corrections.

The tri start doji story in INFYInfy is plaing hide & seek with traders, in the last 3 sessions it formed 3 dojis (tri star doji) these formations comes close to a very high intensity supply zone. While all other IT stocks were faltering infy kept itself tightly clinged to the range, if the range is not taken out buy the buyers in a session or two, it will result into some fast corrections. The RSI is into neutral zone with MACD into bearish territory.

Bank Nifty close to 31000. It's a important support level.In my last Friday’s update I mentioned that we may see banknifty trading at 31000 levels. The index registered a close at 31160 today. Now it’s trading close to a support level the KS line. A major support is at 30600. Most of the time KS acts as a very good support for prices, so a bounce from it is not ruled out. 31600 will be the decider level for coming sessions, a strong close above it will only result in trend resumption. The RSI is pointing down while MACD lags upside momentum.

Nifty breaks below an important pivot support. 11700 may supportNifty left behind an important support level. After giving away 12000 levels which was a physiological support level this will act as an important pivot in the coming sessions. Next support can be seen at 11700 (Lead 1) on the charts, expecting some bounce from these levels. Major area of demand is 11420 (hopefully we may visit it). RSI is moving towards 40 levels & MACD as turned neutral with positive bias.

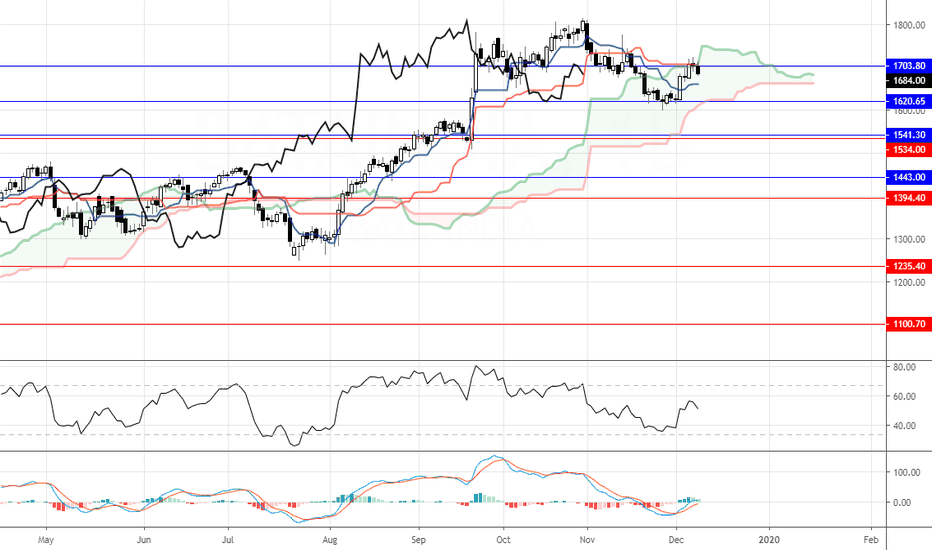

Bata India: Has the trend bent?The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support. Above 1735 the bearish analysis is negated.

Maruti's break failed at 7000! MARUTI SUZUKI: The stock was holding support levels for last few sessions, in today’s move it broke down from an important pivot and negated the bullish view. Now the stock is expected to remain sideways to down for a couple of weeks. The RSI is close to 40, which may result into some bounce, till 7000 levels. This level will now serve as a resistance instead of a support. The stock may head to 6600 levels in the coming weeks.

If bulls don't come to rescue then 29500 is quite evident. BANKNIFTY: Selloff was dominant on the last two sessions on daily charts. After the RBI policy, weakness took over resulting in a sell off. Prices closed below the TS line almost after 45 days of holding it. A minor support has been given away. The next key support zone is close to 30790 levels, the index is expected to take support here, breaking this key level will push the banknifty into deeper corrections and it may drag itself towards 29500 levels. Giving such deep targets is not feasible as of now, the important thing to consider is the key levels mentioned above. On the weekly charts RSI is just at 60, the price action in the coming week will be decide the final fate of the index.

Tri Star Doji! Will it allow nifty to make a new high? 11800 ...The movement of Nifty was directionless this week. From last three weeks Nifty has kept traders on the edge and has been teasing both buyers and sellers. We can see a tri star doji formation on the weekly charts at resistance, tough doji does not mean outright sell, it depicts chaos and confusion. We should not discount the fact that the trend is up and yet no confirmation of any selling pressure is seen on the charts. 11800 will be acting as a strong support breaking it may lead to correction to 11570 – 11370 levels. The RSI is flat on the weekly charts, though on the daily charts we notice RSI taking a hit at the 60 levels.