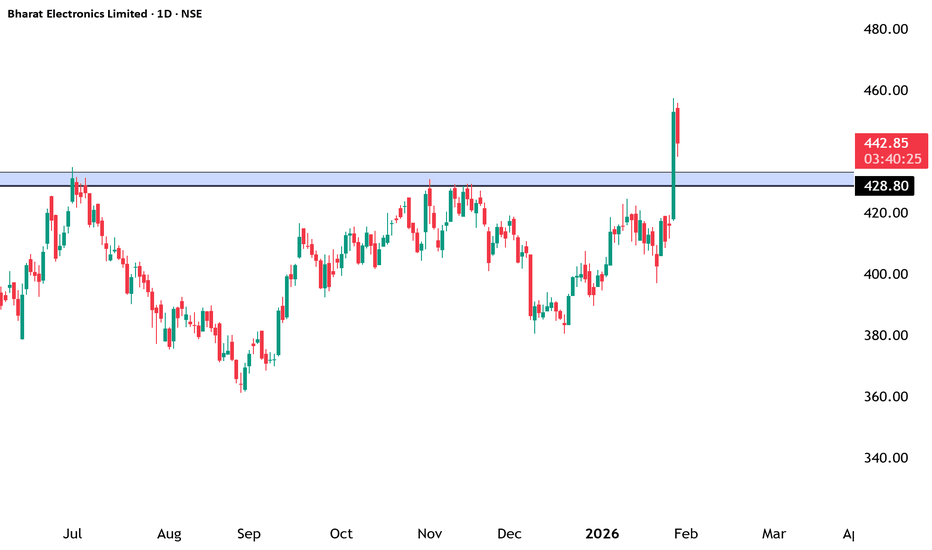

Bharat Electronics Ltd (BEL) – Bullish Structure BreakoutNSE:BEL

🔹 Technical View

Price has decisively broken above a major supply / resistance zone (~₹428–432) after multiple rejections in the past.

Strong bullish momentum candle indicates institutional participation and demand dominance.

Previous resistance now likely to act as strong support on any pullback.

Structure shows higher highs & higher lows, confirming an ongoing uptrend.

Immediate levels to watch:

Support: ₹428–420

Upside potential: ₹460 → ₹480 (positional)

🔹 Volume & Price Action

Breakout supported by healthy volume expansion, validating the move.

No major selling pressure visible near breakout zone so far.

🔹 Fundamental View

BEL is a Navratna PSU and a key player in defence electronics.

Strong order book driven by:

Defence modernization

Indigenous manufacturing (Make in India / Atmanirbhar Bharat)

Consistent revenue visibility, healthy margins, and improving ROE.

Virtually debt-free balance sheet adds financial stability.

🔹 Future Growth Prospects

Long-term beneficiary of India’s rising defence spending.

Increasing focus on:

Radar systems

Electronic warfare

Missile & naval electronics

Export opportunities and private-defence collaboration act as additional growth triggers.

Well-positioned for sustainable compounding over the next few years.

🔹 Conclusion

Technically strong breakout + fundamentally robust business.

Suitable for positional & long-term investors on dips near support.

Trend remains bullish as long as price sustains above ₹420–428 zone.

==============

⚠️ Disclaimer:

==============

This content is shared strictly for educational and informational purposes.

We are not SEBI-registered investment advisors or analysts.

The views expressed are personal opinions, based on publicly available data and market observations.

Please consult a SEBI-registered investment advisor before taking any investment or trading decisions.

Any actions taken based on this content are entirely at your own risk and responsibility.

========================

Trade Secrets By Pratik

========================

Pse

BHEL Picture Abhi Baki Hai (The Show is not Over Yet)BHEL has been in impulse wave since 2020 & is completing Wave 3 of lager wave (3) so 1 more wave looks pending a close above 280 would be first sign of correction has ended & the recent low was wave 4 which ended in ABC in a irregular flat or we might make a new low but should end between 234-224 right now shorts are not a good idea in current wave structure.

NBCC : A NAVARATNA CPSE Sector#NBCC (India) Ltd

Positive sentiments in media after it bagged multiple new orders worth ₹541cr

Now at 37.60

For swing trading Taken position @ 36.30

SL Just Below the 50 EMA

R:R favourable

#stocks #StocksToBuy #StockMarket #investing #investment #SwingTrading

Disclaimer - All information on this page is for

educationaland learning purpose only.

Not SEBI registered financial advisor.

RCF - The Boring CompounderIf you want to make money in stocks chose boring if you want excitement travel to a casino

RCF has broken out of decade long triangle & rise from Covid bottom is a clear impulse & this stock has already started Wave 3 so a 10% risk from here gives us a target of 300% rise a good RR trade.

I am not a SEBI Registered analyst charts shared for education purpose.

Swing Trading Opportunities for the week beginning 13-12-21SWING TRADING WATCHLIST FOR THE WEEK BEGINNING 13-12-21

INTENT

I will only be sharing the time frame and the scrip name. I will leave the trade basis aside as the intent is to engage the reader in learning the basics of finding good scrips. You can have a look at the charts and place your favorite indicators and check out if any of these fit your trade plan.

Some readers feel that I am simply listing down several scrips so that if they go up I can claim so. This is not the case - I am not here to score any points. I am sharing my weekly analysis and if you like it, read it and if you do not agree, I am fine with that.

ON MY WATCHLIST FOR THE COMING WEEK

This week, I have changed the format to some extent and I request you to let me know if you like this approach to finding Swing Trading Opportunities or the one that I was following till last weekend.

This is a weekly review of the available opportunities so my time frame for analysis moves from Daily to Weekly and from Hourly to Daily. I have also filtered the sectors based on Monthly candles. Here are the likely candidates for the week -

SECTORS LOOKING GOOD FOR LONG POSITIONS-

Considering the Monthly Charts, the following sectors look good:

Nifty 100 Liquid

Auto

Bank Nifty

Fin Service

Media

PSE

Considering the Weekly Charts, the following sectors look good:

Energy

Infra

IT

Midcap 100 Free

Midcap 50

MNC

Realty

If you look at the sectoral indices on the daily charts, all of them look beaten down and you would not like to trade them. This is precisely the message for a short term trader - these could be good short sell candidates, but not for Swing or Positional candidates.

WEEKLY TIME FRAME- FOR LONG POSITIONS - Nifty Spot at 17511

Bandhan Bank

Federal Bank

ICICI Bank

PNB

Bajaj Finance

Britannia

Dr Reddy

Infosys

Reliance

TCS

IRCTC

MCX

Arvind Fashion

Bank Baroda

BHEL

Car Trade

Chola Fin

Hind Petro

IndiGo

Indo Solar

Kitex

Mangalam Cement

Mphasis

Tata Coffee

Tata Comm

UBL

There are several opportunities that are available even as the tradable indices are at crucial levels. There were many more opportunities that I could sight but I have restrained myself and chosen what I believe are good or may end up as a good risk reward bets.

I may / may not take these trades as not every opportunity should / can be traded.

I believe that it is better to help someone learn the technique of selecting good scrips than giving tips - in any case, I am not SEBI regd so I do not have the authority as well to do so.

In case you are able to spot the setup and the trade basis, please do share so that together we can learn.

Here is the Video Link:

Thank you for your time and Happy Learning,

12-12--21

Disclaimer -- This post is shared for learning and educational purposes only and in no way acts as a recommendation. I am not a SEBI regd trader so please either decide your trades/investments on your own or consult your financial advisor before making any trades.

CONTAINER CORPORATION OF INDIA. PRICE ACTION ANALYSISCCI stock's price had a breakout above the trendline but for confirmation, we need the price to sustain above 748. This will be the confirmation for the uptrend.

Place the stop loss below the demand zone, because this demand zone is expected to support the price.

The ultimate profit booking target is given by the XABCD bearish crab pattern's 1.618 fib extension i.e, 914.

This is a monthly timeframe analysis, so give time for the price to adjust in case of fall and trail your profits.

Happy trading :)

This is just for educational purposes.

NIFTY PSE PRICE ACTION ANALYSIS. A MULTIYEAR BREAKOUT?Nifty PSE is currently trading at the multiyear strong supply zone which has been tested 3 times since June 2018 but PSE failed to break.

We can see a breakout in the daily timeframe's trendline as pointed on the chart. Currently, NIfty PSE is 2.6% away from the top of the supply zone. If this supply zone is broken, we can see momentum in PSE stocks.

XABCD bearish crab pattern terminal bar price is placed at 4388, where we could book profits and exit.

This process can take months but we will be ready to buy PSE stocks on breakouts.

This is just for educational purposes.

Is Nifty PSE set to be in Uptrend for next 2years ????Hi

Just an observation and analysis based on charts and other technical factors

Looks like we are going to see an uptrend on NIFTY PSE i.e. >51% outstanding shares owned by Central / State govt

The list of all the PSE mentioned in the below link and individual charts are also indicating a bull run for PSE

in.investing.com