AVAX/USDT Is super Potential as per chart analysis CRYPTOCAP:AVAX Ready for $270 in Bull Run?

1⃣ #AVAX Forming Bull Flag in HTF

2⃣ Breaking out Flag resistance

3⃣ As per Bull Flag Pattern target will be $269

4⃣ For Bull Zone Weekly Candle must hold above $32

5⃣ If 1,2,3 Fractals works then AVAX/USDT will be Super Bullish

6⃣ #Avalanche is a layer-1 blockchain

#cryptomarket

Search in ideas for "CRYPTO"

ETH/BTC Chart Overview in monthlyETH/BTC Ascending Triangle Chart Analysis

1️⃣ Forming Strong Ascending Tringle in Monthly Chart

2️⃣ Price holding Strong Support at 0.045 BTC Level

3️⃣ Not Expecting Much Move but Expect Max will hit 0.150 BTC

4️⃣ If hit ETH = 0.150 BTC then CRYPTOCAP:ETH

Price will be FWB:12K -$15k

5️⃣ Supper Bullish Spot Ethereum ETF News in Q2

PEPEcoin now 1000% up from our Entry Level.. cheers#PEPE 1000% Profit Update:

1⃣ Finally, I booked My Profit from CRYPTOCAP:PEPE Coin.

2⃣ My Entry was $0.000000710 on Oct 2023

3⃣ Today I Sold all PEPE at $0.0000079 price

4⃣ My Investment was $9000

5⃣ My Total Realized Profit is $92,380 ( Almost 10x )

6⃣ My PEPE Holding Period is only 5 Months

7⃣ Still 700% up from My Initial PEPE Entry Setup

8⃣ My Honest View = Now is Not Good time to Fresh entry into PepeCoin

Hope you also enjoyed my Long-term GEM analysis.

Thank you for your Trust and love with the CryptoPatel Family.

NFA

BITCOIN 2025 ROADMAP for BULL RUN#BITCOIN SUPER BULLISH ROADMAP

1⃣ CRYPTOCAP:BTC Forming Inverse H&S ( IMO )

2⃣ Strong NECK LINE Resistance at $69,000

3⃣ If Rejected from NECK LINE Resistance then We can see Right Shoulder in Play

4⃣ If Right Sholder play then Buying Range will be $35000-$30,000 = Strong Support

5⃣ If #BTCUSDT Play Inverse H&S Pattern Then Target for Bull Market will be $2,50,000

Like and Share if you Want Bitcoin at $250k

ADA/USDT 1500% Potental as per Fractal AnalysisCRYPTOCAP:ADA Super bullish 1500% Potential Analysis

1⃣ Congrats #ADA up 70% from our Initial Entry

2⃣ Long Term I am Expecting $5-$10

3⃣ Best Entry: $0.4-$0.5 (Less chances but Placed bid)

4⃣ As per Fractal #Cardano is $15 Potential

5⃣ Big Red Box = Accumulation Zone

6⃣ Strong Support = $0.40 Level

NFA & DYOR

LITECOIN BULL MARKET CHART ANALYSIS#LITECOIN BULL MARKET CHART ANALYSIS

1⃣ CRYPTOCAP:LTC Stong Bounced From Support $60 Level

2⃣ Next Major Resistance is $115-$120 Level

3⃣ Bull Market Targets: $219/$388/$500/$700/$1000

4⃣ Entry: Buying Dip is good Opportunities

5⃣ Profit: Almost 50% Up from Our Last #LTC Setup

6⃣ Long Term: I am Super Bullish in the Long Run

RT/Like if you agree with my setup.

Thank you

#Cryptocurrencies #Altcoins

HBAR/USDT 180% up from our Entry and Still 10x Potential #HBAR Ready for $1 in Bull Market?

1000% Potential as per Chart.

CRYPTOCAP:HBAR is currently 180% up from our entry and the most important thing we bought at the actual Bottom.

Our Entry was: $0.037 ✅

You booked a huge Opportunity to buy at Dips in the Green Box ✅

New Re-Entry Zone: $0.07-$0.08 ( If Price dump )

Targets:-

TP1: $0.083 ✅ ( 180% up )

TP2: $0.17

TP3: $0.25

TP4: $0.5

Long Term Target: $1

Still Potential 1000% gains in this bull run from our Re-entry zone.

Supports: $0.07

If you are happy with my analysis please Rt/Like

#cryptocurrency

Bitcoin Inverted Head & Shoulder Pattern #Bitcoin Inverse H&S Spotted

▪️ CRYPTOCAP:BTC Inverted H&S potential building

▪️ Clear breakout level to watch

▪️ Attractive upside targets if triggered

▪️ No confirmation yet, so caution is still advised

While traders are buzzing about a potential inverted head and shoulders forming on the BTC charts, caution is still warranted until we get CONFIRMATION.

The breakout point to watch is $43,700 - only a decisive 4 Hour CLOSE above that level would trigger the bullish pattern targeting:

▫️ 1st Target: $47,090

▫️ 2nd Target: $49,225

CRUCIAL: Below the neckline at $43700 Bitcoin remains Bearish territory.

Disciplined traders will await a confirmed breakout before getting too bullish here!

Patience pays with chart patterns.

Bitcoin Bearish Divergence Target $30,000 ?#Bitcoin Bearish Divergence Into Play

CRYPTOCAP:BTC showing concerning signs, but I remain long-term bullish despite short-term uncertainties.

Bearish divergence + RSI below resistance could spur pullback if $44k fails.

If so, watch $43.5k-$44k level.

Lose that and we may see $30k

But hold> $44k = rally to $51k.

Weigh scenarios carefully friends.

➡️ Bearish divergence forming

➡️ RSI struggling below resistance

➡️ $44k Critical Resistance

➡️ Below that could hit $30k

➡️ But over $44k keeps $51k+

VITE printing higher targetsVITE showing upcoming Bullish perseverance and could go easily gain by using Weekly Support. Above this Support it will remain on bullish path, below this support it will be bearish . Targets are mapped via red lines ...always buy in parts for max profit.. ..Always trade with stop loss and OCO ...do your research ..Like and Comment our ideas..Trade Safe Play Safe:))

Major Cycle in Crypto Market (Attention Hedge Funds)Cycle-1: Bitcoin’s First Major Boom–Bust Structure (2013–2015)

(Screenshot-1 Breakdown)

Understanding Bitcoin’s historical behaviour is essential for forecasting macro-cycles in the crypto market. This post is the first of a 4-part series, where each screenshot highlights a repeating structural pattern in BTC’s long-term market psychology. After all four cycles are explained, I will present the combined Buy, Sell or Hold conclusion for long-term investors and institutional desks.

🟦 Cycle-1 Overview (April 2013 – January 2015)

In the first major structural cycle of Bitcoin, a very clear macro behaviour emerged — a pattern that continues to repeat across all future cycles.

🔵 Step 1 — ATH (A) Formed (April 2013)

Bitcoin printed a strong All-Time High (A) in April 2013, marking the top of its first major momentum wave.

🟢 Step 2 — Breakout Above ATH (A) → New ATH (B) (Nov 2013)

Once BTC broke above Point A, it entered an aggressive parabolic rally, setting a new ATH (B) in November 2013.

This breakout phase triggered:

FOMO-driven retail participation

Sharp acceleration in volatility

Rapid expansion in price multiples

🔴 Step 3 — Post-Breakout Collapse: -75% to -80% Drawdown

After forming ATH (B), Bitcoin failed to sustain the parabolic breakout.

A deep correction followed:

–75% to –80% decline

Capitulation phase

Panic selling and liquidity contraction

This phase marks the beginning of the macro mean-reversion cycle, a consistent signature in BTC’s long-term structure.

🟣 Step 4 — Price Returns to Previous ATH (A)

The most important element of Cycle-1:

After making a new ATH (B), Bitcoin retraced back to the previous ATH (A)

Time taken: 15–17 months

This behaviour is extremely rare in traditional markets but has repeated consistently in Bitcoin’s long-term structure.

📌 Why This Cycle Matters

Cycle-1 establishes the foundation for a powerful historical pattern:

BTC tends to fall back to its previous ATH after forming a new ATH.

This phenomenon repeats due to:

Leverage washouts

Liquidity resets

Miner capitulation

Long-term holder profit-taking

Macro monetary tightening phases

This is Cycle-1.

In the next screenshots, we will see how Cycle-2, Cycle-3, and Cycle-4 follow the same structural behaviour.

⏭️ Coming Next (Screenshot-2):

“Post-2017 Cycle — New ATH → 83% Crash → Return to Previous ATH.”

Cycle-2: 2017 Parabolic Expansion → 2018–2019 Reset (Screenshot-2 Breakdown)

This is the second chart in the ongoing 4-part series highlighting Bitcoin’s macro boom-and-bust rhythm—a structural pattern that repeats regardless of market participants, liquidity cycles, or macroeconomic conditions.

Cycle-2 again confirms that Bitcoin follows a highly predictable long-term retracement behaviour after every breakout to a new All-Time High.

🟦 Cycle-2 Overview (2017–2019)

This cycle mirrors the exact structure of Cycle-1:

Break previous ATH

Establish new ATH

Drop –75% to –80%

Return to previous cycle’s ATH

Time duration: 15–17 months

Let’s break down the chart step-by-step.

🔵 Step 1 — BTC Breaks Previous ATH on May–June 2017 (Point E)

In early 2017, Bitcoin broke the previous cycle’s ATH (from 2013–2014).

This breakout point is marked as:

Point E (May–June 2017)

Acts as the new cycle support

Represents the start of the parabolic expansion leg

This breakout confirms institutional liquidity entry and the beginning of a classic crypto macro-cycle.

🟢 Step 2 — Massive Rally to New ATH (Point F) — Dec 2017

After the breakout at E, Bitcoin entered its most aggressive historical rally:

BTC exploded into a full parabolic top

New ATH formed at Point F (Dec 2017)

Extreme retail inflow and speculative leverage

ICO mania peak

This is similar to the 2013 pattern—breakout → acceleration → parabolic top.

🔴 Step 3 — Reversal and Deep Crash: –75% to –82%

Post-ATH, Bitcoin collapsed sharply:

Total Drawdown: –75% to –82%

Duration: 455 days (≈15 months)

Angle of correction: Steep capitulation slope (as shown in your chart)

ICO bubble burst + liquidity draining

Dominance reset + long-term distribution

The depth and duration match Cycle-1 almost exactly.

🟣 Step 4 — Price Re-tests Previous ATH Zone (Point G — Mar 2019)

Just like Cycle-1, Bitcoin returned precisely to the previous breakout area:

Cycle Support (E) → Retest at G

Time Duration: ≈15–17 months

Price forms a demand zone around the previous ATH

Bottoming structure completes at G (March 2019)

This confirms again:

Bitcoin always re-tests its previous ATH after forming a new ATH — within a fixed time band of ~15–17 months.

Cycle-2 perfectly aligns with the behavioural signature of Cycle-1.

📌 Why Cycle-2 Matters to Institutions

This cycle reveals Bitcoin’s predictable macro liquidity reset pattern:

Break previous ATH → Excess speculation → Parabolic top

Systemic deleveraging → –80% correction

Return to previous cycle’s ATH support

Fresh long-term accumulation

This behaviour is structurally identical across multiple halving cycles.

Cycle-3: 2020 Breakout → 2021 Mania → 2022–2023 Reset (Screenshot-3 Analysis)

This third chart demonstrates the strongest confirmation of Bitcoin’s repeating macro-cycle structure.

Despite greater institutional involvement, derivatives expansion, and global liquidity changes, Bitcoin still respected the same 75–80% retracement and 15–17-month correction window.

Cycle-3 proves the pattern is structural, not accidental.

🟦 Cycle-3 Overview (2020–2023)

Like previous cycles:

BTC breaks previous ATH

Creates a new ATH

Drops –75% to –80%

Comes back to retest the previous ATH

Same time duration: ~15–17 months

Let’s decode the chart.

🔵 Step 1 — BTC Breaks Previous ATH in Nov–Dec 2020 (Point H)

Bitcoin broke the 2017 ATH during late 2020:

Breakout Point H (Nov 2020)

This previous ATH (Point F = Point H) becomes the new major cycle support zone

Triggered institutional FOMO: MicroStrategy, Tesla, hedge funds

This breakout ignited the strongest bull run in Bitcoin’s history.

🟢 Step 2 — Bitcoin Forms a New ATH in Nov 2021 (Point I)

Following the breakout at H:

BTC surged to a macro ATH at Point I (Nov 2021)

Fueled by:

Unlimited liquidity (pandemic QE)

Institutional buyers

ETF expectations

Retail mania & leverage

This top perfectly mirrors the parabolic peaks from 2013 and 2017.

🔴 Step 3 — Deep Macro Crash: –75% to –80%

After the November 2021 top:

BTC entered a systemic deleveraging phase

Complete 2022 crypto meltdown:

Luna collapse

Celsius, Voyager, BlockFi

FTX implosion

Price fell 77% from the ATH

Duration: 485 days (~16 months)

Exactly the same timing window as the previous two cycles.

🟣 Step 4 — Retest of Previous ATH Support (Point J — Mar 2023)

Just like Cycle-1 (2013 → 2015)

and Cycle-2 (2017 → 2019):

Bitcoin again returned exactly to its previous ATH zone:

Support Retest Point J (Mar 2023)

Perfect touch of the 2020 breakout zone

Massive demand entered the market

Cycle bottom completed right on schedule

This completes the third full repeat of BTC’s long-term structural cycle.

📌 Institutional Takeaway

Cycle-3 confirms:

Bitcoin’s macro behaviour is identical across 2013, 2017, and 2021 cycles — regardless of market maturity.

Every time Bitcoin breaks its previous ATH:

It creates a new parabolic peak

Then crashes 75–80%

Then returns to retest the previous ATH level

All within a consistent 15–17 month window

This makes Bitcoin the most predictable high-beta asset on the planet at a macro timescale.

Cycle-4: Oct-2024 Breakout → Oct-2025 ATH → Mar-2027 Retest of Legacy Support

After analyzing the previous three Bitcoin macro cycles (2013–2015, 2017–2019, 2021–2023), the new chart strongly suggests that Bitcoin is following the exact same structural behaviour for the 4th time.

This idea explains why BTC may enter a 15–17 month decline starting from the Oct-2025 macro top, and why the next major demand zone sits around 30,000 USD in Mar-2027.

🟥 1. Break of Previous ATH (I = K) — Oct 2024

Bitcoin broke above its previous ATH zone in Oct 2024, exactly like in all earlier cycles:

2013 ATH break → 2013 bull run

2017 ATH break → 2020–2021 bull run

2021 ATH break → 2024 surge

2024 ATH break → current cycle

This breakout (I = K level) becomes the new structural support for the cycle bottom later.

🟩 2. BTC Forms New Macro ATH (Point L) — Oct 2025

One year later, Bitcoin printed a new ATH around Oct 2025, marking the peak of Cycle-4.

Previous cycles also peaked approx. 11–14 months after breaking the last ATH, which strengthens this model.

🔻 3. Post-ATH Crash Begins — Same Pattern, Same Angle, Same Duration

All 3 previous cycles share:

• 75%–80% decline

• Duration: 15–17 months

• Final target: previous ATH or the ATH-1 level

Your chart highlights the same decline angle and same time window (Oct-2025 → Mar-2027).

This is exactly what Bitcoin has done before:

Cycle ATH → Bottom Duration Drop Retest Level

2013 → 2015 15 months –86% Previous ATH

2017 → 2019 17 months –84% Previous ATH

2021 → 2023 16 months –77% Previous ATH

2025 → 2027 (Prediction) 15–17 months –75% to –80% Previous ATH

Nothing in the 2024–2025 structure breaks this long-term behaviour.

🟦 4. Current Price Near “N” = Retesting Breakout Support

BTC is currently trading back near the Oct-2024 breakout level, marked as:

N = Previous ATH Support Zone

Historically, this level is not the final bottom.

It is only the first macro support touch before the full 75–80% correction completes.

Because the full 15–17 month window has not yet played out, a deeper decline remains statistically likely.

🟡 5. Final Prediction — BTC Bottom Around 30,000 USD (Mar-2027)

Following cycle symmetry:

Top: Oct-2025

Drop duration: 15–17 months

Bottom: Mar-2027 (same month as previous major bottom in Mar-2023)

Target zone: $30,000 ≈ last-to-last ATH (2020 level)

This fits perfectly with all 4 historical cycles.

This means BTC may revisit the deep demand zone before the next major bull cycle begins.

📌 Final Outlook (Important for Long-Term Investors)

If Bitcoin truly repeats its macro cycle:

The best long-term buying opportunity would occur in Mar 2027

Price reading: $28K–$32K

After that, BTC begins Cycle-5 (likely targeting $180K–$250K)

This idea is not short-term trading advice; it is a macro-cycle pattern that has consistently repeated for 12+ years.

🟡 BUY / SELL / HOLD — Clear Conclusion

SELL / REDUCE RISK

If you are a trader or short-term investor, Bitcoin is in the post-ATH declining phase, which historically produces 15–17 months of lower prices.

HOLD (Long-Term Only)

Long-term holders can remain calm but should expect deep volatility, not straight-up movement.

BUY (Smart Accumulation Window)

The next high-conviction buying zone will be:

🔥 $28K–$32K

🔥 Timeline: Mar 2027

That will be the start of the next Bitcoin mega cycle (Cycle-5).

📢 Final Message

This research is not about fear or hype—it is about Bitcoin’s consistent repeating macro behaviour.

Every single major crash and rally of the last decade followed the same timing, structure, and depth.

Bitcoin is not random.

Bitcoin is cyclical.

And the cycle says:

**The real bottom is not here yet.

The real opportunity comes in 2027.**

$XPL ALERT: Bearish Now, Massive Accumulation Ahead?AMEX:XPL ALERT: Bearish Now, Massive Accumulation Ahead?

Current Chart View:

AMEX:XPL (Plasma) is showing bearish momentum at current levels. Expect a potential 30%-50% downside, which could create a high-probability accumulation zone for strategic investors.

Key Resistance: $0.32 (blue trendline)

Only a close above $0.32 on higher timeframes (HTF) will trigger a bullish trend reversal. Until then, bears are in control.

Targets if Bullish Breakout Occurs:

Short-term: Price clears $0.32 → bullish momentum resumes

Long-term: $2 possible if price sustains above $0.32

Trading Strategy:

Accumulate in the lower support zone for maximum risk-reward

Wait for HTF confirmation above $0.32 for safer long positions

Watch volume & momentum for breakout validation

Market Insight:

AMEX:XPL offers strategic accumulation potential now, but patience is key. The next bullish move depends entirely on HTF breakout confirmation.

NFA & DYOR

Retail Panic Meets ETF Outflows: $1B Bitcoin Sell-Off Hits MarkeRetail Panic Meets ETF Outflows: $1B Bitcoin Sell-Off Hits Markets

Bitcoin saw renewed selling pressure on Oct 30, as Binance retail traders dumped over 9,200 BTC (~$1B) around $107.7K, just days after another 12,000 BTC sell wave near $108.3K.

Technical View:

Retail traders are aggressively selling into weakness, while long-term holders remain largely inactive.

Historically, these sharp sell-offs from short-term players often form local bottoms, liquidity events where smart money quietly accumulates.

Fundamental Side:

Spot Bitcoin ETFs added more weight to the downside:

🔹 BlackRock: -$2.6B

🔹 Fidelity: -$790M

🔹 Grayscale: -$500M

These ETF outflows likely shifted capital to spot exchanges, amplifying short-term selling pressure.

Key Insight:

▶️ Retail capitulation + ETF outflows = short-term volatility

▶️ But remember, markets often bottom when retail panic peaks.

Note: NFA & DYOR

Will SUI/USDT hit $20 in current bull market or future?SUI Testing Final Demand Zone: Reversal Imminent?

SUI is currently testing a major re-accumulation zone around $2.1 – $1.8, which previously acted as a strong demand area.

A liquidity grab below this level could trigger a sharp reversal, similar to the last time price swept lows before a massive rally.

The structure remains valid as long as this zone holds.

Once price reclaims the $2.7–$3.0 resistance, momentum could shift strongly bullish, targeting the $4.8 zone, and eventually the $20 macro target if the trend continues.

Support: $2.1 – $1.8

Resistance: $2.7 / $4.8

Macro Target: $20

Of course, NFA & Always DYOR

This $4 Token Could Hit $20 And Nobody's Talking About ItThis $4 Token Could Hit $20 And Nobody's Talking About It

Support: $3.70-$4.00 (holding)

HTF Target: $20 (5x potential)

Why it matters:

✅ Exchange tokens outperform in bull cycles

✅ Clear support zone + bullish structure

✅ 500% upside if base holds

While everyone chases pumps, smart money accumulates at support with 5:1 risk-reward.

IF this holds $4 Support, NYSE:BGB could be the millionaire-maker nobody saw coming.

DYOR. Not financial advice.

$TRUMP MEMECOIN: -98% DRAWDOWN ANALYSIS$TRUMP MEMECOIN: -98% DRAWDOWN ANALYSIS

TECHNICAL BREAKDOWN:

▶️ ATH Distribution: $70 (Exit signal executed)

▶️v Current Price Action: 98% retracement from peak

▶️ Market Structure: Parabolic blow-off → capitulation phase complete

▶️ Performance validates early exit thesis.

CURRENT MARKET STRUCTURE:

▶️ Bias: Bearish continuation

▶️ Key Resistance: $8.00 (structural pivot)

▶️ Invalidation Level: Sustained break above $8 with volume

▶️ Breakout scenario → $50 measured move target

▶️ Probability: Low (requires liquidity catalyst)

SPECULATIVE OPPORTUNITY (HIGH RISK):

▶️ Asset Class: Extreme volatility / lottery ticket

▶️ Entry Thesis: 92% discount from ATH = asymmetric R/R

▶️ Position Allocation: 1-2% max portfolio weight

▶️ Time Horizon: 12-24 month hold

▶️ Stop Loss: Total loss acceptable

▶️ This is binary outcome speculation, not investing.

INSTITUTIONAL PERSPECTIVE:

▶️ Celebrity token = coordinated distribution to retail

▶️ Tokenomics favor insiders

▶️ Liquidity profile indicates exit event completed

▶️ Capital preservation >> speculative moonshots

Risk Disclosure: Speculative asset. Trade accordingly.

⚠️ NOTE: Never invest hard-earned money in celebrity/influencer tokens. These are engineered liquidity extraction schemes, not legitimate projects.

Capital preservation > moonshot gambling.

NFa & DYOR

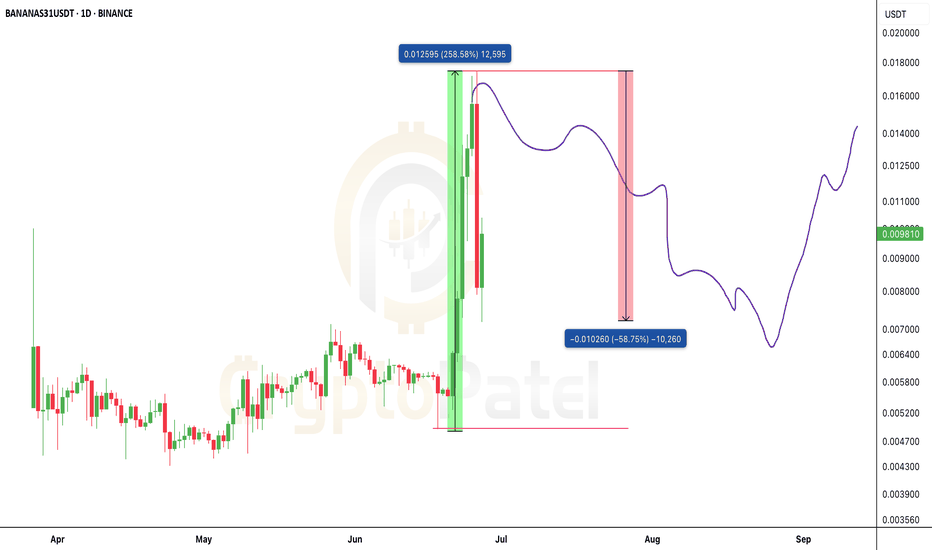

$BANANAS31 Dumped 58% — Hope You Took Profits, Not Pain.$BANANAS31 Dumped 58% — Hope You Took Profits, Not Pain.

It just dumped 58% within hours. Brutal.

Yesterday: $0.016–$0.018

Now: $0.0071 and still sliding…

Hope you enjoyed huge profit with $BANANAS31 short trade —

and not by buying the top.

This is why I always say:

Never chase green candles.

Don’t be exit liquidity.

Learn the game or pay the price. What’s your biggest FOMO trade?👇