Divergence: A Retrospective Divergence Trading is lucrative as the price movement following a divergence is with high momentum, hence rewarding with decent Risk:Reward.

The common way is to add conventional RSI and check for divergence . However we often found that many of the vanilla RSI divergence signals are conveniently ignored by the following price action.

Then the question is: Does RSI divergence fakes out? OR with the confluence of something other stuff we can more accurately identify these sorts of divergence and hop into it happily with lucrative Risk:Reward.

Potentially the Volume Profile (more specifically: The Fixed Range Volume Profile) identified high liquidity zones (classical term: Point of Control , PoC ) are the area where one should look out for a potential RSI divergence.

We have picked up the FX_IDC:USDINR last 5 months Daily chart and followed this analysis tecnique:

Analysis Methodology:

Use Daily (or something like hourly/4-hour etc.) normal candlestick.

Identify the swings in the chart (high, lows).

For each swing, apply Fixed Range Volume Profile free TradingView indicator (available under Technicals > Profile, 2nd from top)

The PoC (Point of control) is visible in the chart. You may mark it in the chart with a horizontal line (or a rectangle). That's the liquid-most zone .

If you see some other areas other than PoC area (technically called Value Area ) are showing decent liquidity (comparable to PoC, say within 60% of PoC), then mark that area also with a horizontal line.

Add a RSI. Cleanout everything other than just the RSI line chart.

Change the main price chart from normal candle to line chart.

Once you see the price is in the high liquidity zone, check the price and the RSI together. See if there is a divergence.

Positive/Bullish Divergence : Price is making a lower-low, but corresponding RSI levels are not making lower-low (either same or making higher low).

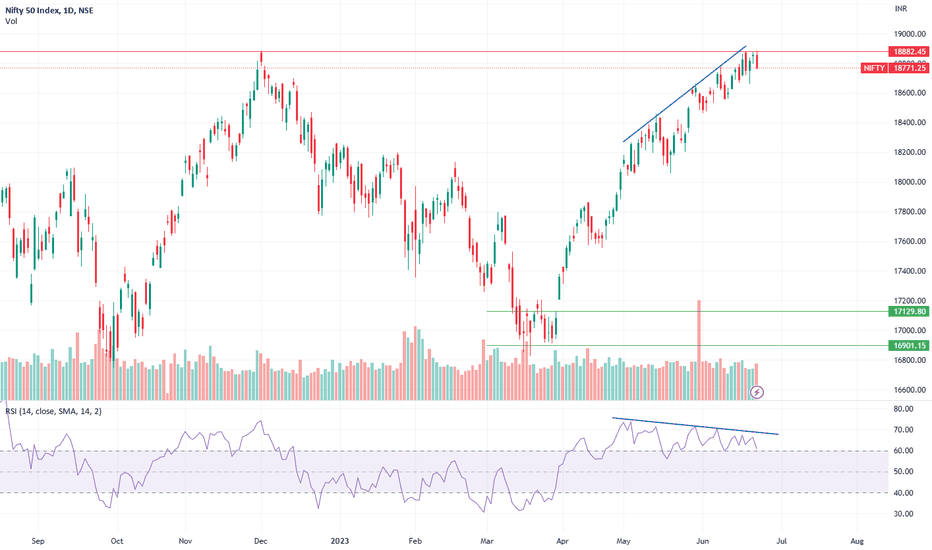

Negative/Bearis Divergence : Price is making higher-high, but corresponding RSI levels are not making higher-high (either same or making lower high).

Hidden Divergence : No need to consider too much. Spotting a normal RSI divergence is good enough.

That's it. Once you find out the divergence, take a Positional Trade in the opposite direction of trend. (means +ve divergence Long / -ve divergence Short). Hold it with the SL of the Highest Point of the high liquidity zone (which you have marked earlier) and ride the reversal movement with trailing the stop loss.

In last 5 months USDINR, we can see it happened at least thrice. So it's powerful. Lesser number of quality trades.

Search in ideas for "divergence"

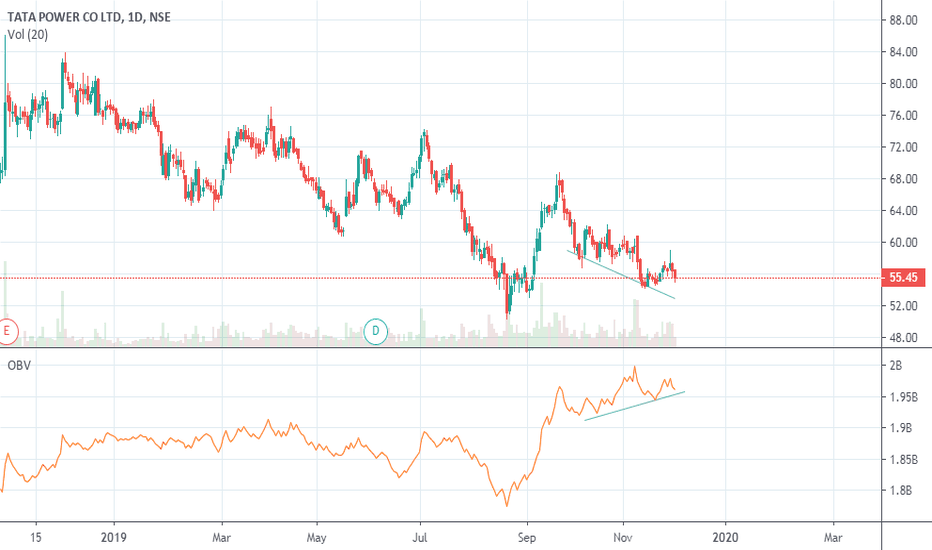

Divergence reversal LongIndicators are telling that price may try to reverse at this level, specially the RSI divergence when appears in oversold area. I will go long with small stop loss just some ticks below the low made today. IF it works it can give decent return so one can take chance by risking small amount. Good Luck

Example of positive and negative divergence Divergence occurs when the RSI is increasing and the price movement is either flat or decreasing. Conversely, divergence occurs when the RSI is decreasing and price movement is either flat or increasing.

A bearish(Negative) divergence occurs when the price makes a higher high and RSI makes a lower high. As in the first case. we can see a significant price fall after that.

A bullish(Positive) divergence occurs when price makes lower low or maybe at the same level in some cases and RSI makes a higher low. We can see a price rise after it.

Divergence of MACD silent reversal signal BHARTOARTL longThe stock is in downtrend making lower lows. IT has given first reversal signal forming double bottom and also divergence at this level in MACD/RSI. One can enter the long trade now as the risk is low. How far it would go only time would tell but 325 seems quite reasonable expectation.

RSI Divergence: Apollo TyresIn NSE:APOLLOTYRE the stock was making Higher highs whereas RSI was making lower highs creating the divergence. The stock yesterday closed below the trendline and so did the Rsi. The target for the same will be the immediate support that is also the channel line of the stock.

* It is my analysis and not a buy or sell recommendation.

RSI DIVERGENCE - RADICO KHAITANNSE:RADICO - DAILY CHART ANALYSIS

The price was heading down, making lower lows.

Initially, the RSI indicator was following the price too.

on daily chart its seen that the RSI starts making higher lows while the price is still heading down.

That’s when divergence pattern appears.

After a bullish divergence, the price will tend to change from a downtrend to an uptrend.

PLEASE NOTE THAT:

This chart analysis is only for reference purpose.

This is not buying or selling recommendations.

I am not SEBI registered.

Please consult your financial advisor before taking any trade.