Shorttermtrading

BPCL Breaks Structure, Big Targets Ahead: Long-Term Chart TurnsBPCL is currently positioned at a highly important zone on the higher-timeframe chart where price is attempting to shift from a prolonged consolidation into a potential expansion phase. The stock has respected a long-term structure and is now trading near a critical breakout region, making it an interesting candidate for positional and long-term traders. However, the setup is still in the developing stage and requires confirmation before any aggressive long exposure.

From a structure perspective, BPCL has formed a broad base after a long corrective phase. Price action is compressing near the upper boundary of this range, suggesting that volatility expansion could occur in the coming sessions. A sustained move above the key resistance zone, accompanied by strong volume and follow-through candles, would indicate strength and increase the probability of an upside continuation toward higher targets.

In the bullish scenario, a confirmed breakout and successful retest could open the path for a gradual move toward the next resistance cluster. If momentum sustains, the stock may attempt a trend continuation move in phases rather than a straight rally. Positional traders should focus on price holding above the breakout level on closing basis, as this will be the primary sign of trend acceptance by the market.

On the other hand, if BPCL fails to break and hold above the resistance zone, the stock may slip back into its previous consolidation range. In such a case, sideways or corrective movement cannot be ruled out, and premature long positions may face drawdowns. A deeper rejection from resistance would indicate that buyers are not yet in control.

Risk management remains crucial in this setup. Since the breakout is not yet confirmed, any long exposure should be planned only after clear confirmation, with a strict stop loss below the invalidation zone. This approach helps protect capital while allowing participation in the upside if the breakout sustains.

Overall, BPCL is at a decisive technical juncture. The chart structure favors a bullish bias in the medium to long term, but confirmation is key. Traders and investors should remain patient, track price behavior around the breakout zone, and act only when the market clearly validates the move.

Angel One on the Edge: Long-Term Chart Points to 4800+The monthly chart of Angel One shows a well-defined broadening wedge pattern, where price has been repeatedly oscillating between a rising support line and a widening resistance zone. The structure has been forming for almost two years, indicating a long consolidation phase after a strong uptrend. Currently, the price is trading near the lower trendline support, which aligns with the long-term uptrend support. This zone is marked as the Buying Zone, suggesting that the risk-reward ratio is favourable for long-term buyers as long as the support remains intact.

A potential breakout above the upper wedge resistance may trigger a strong upside rally. The first major level on the upside is the Reversal Target around 3050, which is the initial confirmation level. If price sustains above this, the momentum may carry it towards the Breakout Target near 3500, which represents the first official breakout swing. Once this level is surpassed, the trend may accelerate towards Target 2 around 3900, indicating continuation of the long-term bullish structure. The complete projected move from the pattern height signals a Final Projected Target around 4840, which is the long-term positional upside expectation.

On the downside, the setup remains valid only while the price trades above the lower trendline region. A sustained close below the marked failure level would invalidate the pattern, signalling potential weakness and a breakdown of the long-term bullish structure. However, until that failure zone is breached, the pattern continues to favour a bullish breakout scenario with upward projections as highlighted.

SchaefflerInd - Technical Analysis#Schaeffler India - Technical Analysis Report

Current Price: 4,141.10 / Prev ATH @4951.

Trade Setup Overview

Basic Dow Theory : Stock is making Higher High - Higher Low by Breaking previous ATH decisively and stock is down to strong Demand Zone for retracement.

Stock is in consolidation before breaking previous ATH & currently forming Flag & Pole Pattern.

Entry on breakout above resistance 4,200-4,300

Conservative Stop Loss at 3,800 | Tight SL near 4,000

Tgt 1: 4,602

Tgt 2: 4,776

Tgt 3: 5,026

Grand Flag & Pole Target: 5,495.

Technical Highlights:

- Trend Reversal confirmed by breaking previous High on May 2025 around 2,800

- Price consolidating after strong recovery rally

- Trading above key moving averages

- Breakout above 4,300 resistance could trigger momentum toward 4,600 / 5495

Risk-Reward:

Favorable R:R with potential 11-33% upside vs 3-8% downside to stop loss levels.

"NAVA" A Pole & Flag pattern breakout on 1day chart Stock name:- Nava on 1day chart price formed a pole and flag pattern and on 29-aug-2025 price breakout and sustained above and closed which simply means price is ready to move up but there's a immediate resistance at "696" once price breaks it then 710 is our next resistance and there's possibility of 3 scenarios 1.price breaking high and going up till 740-765 level. 2.price breaking high and then take resistance and fall below 700 level & stay in a range then decide the move. 3.price taking resistance at 710 then fall till 660.

for Monday i.e. 1-sep-2025 if price opens gap up wait till 10:15am then on hourly chart see candle then take trade, if flat opens then wait for price to cross 696 level then trade but with less quantity as 700 is psychological round level and 710 a previous high so price can form a big candle & break previous high then fall & retest then go up, so be cautious a little and once price goes up we can add quantity, if gap up price take resistance from 710 and closes below 675 then a fall till 660 can be seen.

for investment/swing trade once price goes above 710 then add up quantity as price can go up till 740-765 in 1st level then to 780 in next tgt level.

Disclaimer:- i'm not a sebi registered analyst and idea shared here is my personal view point which includes various technical indicators and i don't have any investment in this scrip nor do i have any contact with employees of the company the idea shared is for educational purpose so before taking any trade or investment pls consult with your financial advisor.

JSW-INFRA : Powering India’s Port Revolution – A Deep Dive into NSE:JSWINFRA

JSW Infrastructure Ltd.

🧾 Company Overview

Role: JSW Infrastructure is India's second-largest commercial port operator (after Adani Ports), and forms a core part of the JSW Group.

Operations: The company manages and operates major ports across both the east and west coastlines of India.

Revenue Streams: Primarily driven by port operations (handling bulk, breakbulk, containerized cargo), as well as integrated logistics services.

📊 FY24 Financial Snapshot

Revenue ₹3,200+Cr

EBITDA Margin 55–60%

Net Profit ₹750+Cr

Debt to Equity ~0.6x

ROCE ~15%

ROE ~13%

Positive aspects:

Asset Turnover Strong

Double-digit revenue CAGR (>20%) over the past three years.

High EBITDA margins consistent with best-in-class infra businesses.

Well-diversified cargo and customer profile, with increasing non-JSW business.

Stable long-term contracts & beneficiary of India’s logistics and trade reforms.

Risks / Weaknesses:

~70% revenue is from group companies, though diversification is underway.

Aggressive capex plans elevate financial risk.

Susceptible to regulatory, tariff, and environmental compliance changes.

📈 Technical Analysis (July 2025)

• Share Price: Trading in the ₹260–₹280 range. IPO was at ₹119 (Sep 2023); strong price appreciation since listing.

• Trend: Intact uptrend; recently consolidated between ₹240–₹260.

• Support/Resistance: Key support at ₹230–₹235; resistance at ₹285–₹300.

• Moving Averages: Stock remains above both its 50-EMA and 200-EMA — a structurally bullish indicator.

• Momentum:

o RSI: 60–65 (bullish, but approaching overbought)

o MACD: Fresh bullish crossover; volume shows accumulation near breakout.

• Outlook: Breakout above ₹285 could trigger medium-term upside toward ₹320–₹340. Buy-on-dips is favored, with strong accumulation likely in the ₹230–₹240 zone.

🚀 Growth Prospects & Strategic Moves

• Capacity Expansion: Plans to nearly double port capacity by FY30 (from ~160 MTPA to ~300 MTPA).

• Cargo Diversification: Targeting major reduction of group dependency (from ~70% to ~50%) by growing third-party cargo traffic.

• New Projects: Investment pipeline includes both greenfield and brownfield projects in Odisha, Maharashtra, and other states.

• Integrated Logistics: Deeper backward integration into rail connectivity and warehousing to capture higher value from logistics value chain.

• Macro Tailwinds

o Major government initiatives (e.g., Sagarmala) catalyzing sector growth.

o India’s trade/exports rising; strong outlook for cargo and container volumes.

o Shifts in supply chains to coastal shipping and blended logistics.

o Demand uptrend in containerization and warehousing services.

⚠️ Key Risks & Limitations

• High Capex Cycle: Expansion could elevate debt and financial leverage.

• Macro Sensitivity: Lower industrial/output growth would hit cargo volumes.

• Regulatory Overhang: Tariff and ESG regulations present chronic uncertainty.

• Group Concentration: Third-party cargo growth remains an execution challenge.

• Rivalry: Competitive intensity from Adani, DP World, and others is ramping up.

📌 Conclusion & Investment Verdict

Parameter Verdict

Fundamentals Strong, superior margins, efficient operations

Valuation Fair to premium (due to uptrend and growth)

Technical Trend Bullish, ready for potential breakout

Growth Outlook High (supported by sector tailwinds)

Risk Profile Moderate (driven by capex & regulatory factors)

For long-term investors:

JSW Infra presents a compelling case for portfolio inclusion, offering robust growth visibility, sectoral leadership, and operating excellence. Accumulation is best near ₹230–₹240 on dips.

Short-term view:

Stocks in strong uptrends may see minor corrections but are well-placed for fresh breakouts above ₹285, targeting ₹320–₹340.

The stock is ideal for investors seeking infrastructure-sector exposure with high growth potential, but one must remain mindful of execution and regulatory risks.

==============================

==============================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

Update idea

Add note

Trade_Secrets_By_Pratik

Also on:

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

English (India)

Select market data provided by ICE Data services.

Select reference data provided by FactSet. Copyright © 2025 FactSet Research Systems Inc.

© 2025 TradingView, Inc.

More than a product

Supercharts

Screeners

Stocks

ETFs

Bonds

Crypto coins

CEX pairs

DEX pairs

Pine

Heatmaps

Stocks

ETFs

Crypto

Calendars

Economic

Earnings

Dividends

More products

Yield Curves

Options

News Flow

Pine Script®

Apps

Mobile

Desktop

Tools & subscriptions

Features

Pricing

Market data

Trading

Overview

Brokers

Special offers

CME Group futures

Eurex futures

US stocks bundle

About company

Who we are

Athletes

Blog

Careers

Media kit

Merch

TradingView store

Tarot cards for traders

The C63 TradeTime

Policies & security

Terms of Use

Disclaimer

Privacy Policy

Cookies Policy

Accessibility Statement

Security tips

Bug Bounty program

Status page

Community

Social network

Wall of Love

Refer a friend

House Rules

Moderators

Ideas

Trading

Education

Editors' picks

Pine Script

Indicators & strategies

Wizards

Freelancers

Business solutions

Widgets

Charting libraries

Lightweight Charts™

Advanced Charts

Trading Platform

Growth opportunities

Advertising

Brokerage integration

Partner program

Education program

Look First

HDFC BANK LTD

NSE•Real-time•Market closed

Edit Idea

Minimize

Close

JSW INFRA : Powering India’s Port Revolution – A Deep Dive into

NSE:JSWINFRA

JSW Infrastructure Ltd.

🧾 Company Overview

Role: JSW Infrastructure is India's second-largest commercial port operator (after Adani Ports), and forms a core part of the JSW Group.

Operations: The company manages and operates major ports across both the east and west coastlines of India.

Revenue Streams: Primarily driven by port operations (handling bulk, breakbulk, containerized cargo), as well as integrated logistics services.

📊 FY24 Financial Snapshot

Revenue ₹3,200+Cr

EBITDA Margin 55–60%

Net Profit ₹750+Cr

Debt to Equity ~0.6x

ROCE ~15%

ROE ~13%

Positive aspects:

Asset Turnover Strong

Double-digit revenue CAGR (>20%) over the past three years.

High EBITDA margins consistent with best-in-class infra businesses.

Well-diversified cargo and customer profile, with increasing non-JSW business.

Stable long-term contracts & beneficiary of India’s logistics and trade reforms.

Risks / Weaknesses:

~70% revenue is from group companies, though diversification is underway.

Aggressive capex plans elevate financial risk.

Susceptible to regulatory, tariff, and environmental compliance changes.

📈 Technical Analysis (July 2025)

• Share Price: Trading in the ₹260–₹280 range. IPO was at ₹119 (Sep 2023); strong price appreciation since listing.

• Trend: Intact uptrend; recently consolidated between ₹240–₹260.

• Support/Resistance: Key support at ₹230–₹235; resistance at ₹285–₹300.

• Moving Averages: Stock remains above both its 50-EMA and 200-EMA — a structurally bullish indicator.

• Momentum:

o RSI: 60–65 (bullish, but approaching overbought)

o MACD: Fresh bullish crossover; volume shows accumulation near breakout.

• Outlook: Breakout above ₹285 could trigger medium-term upside toward ₹320–₹340. Buy-on-dips is favored, with strong accumulation likely in the ₹230–₹240 zone.

🚀 Growth Prospects & Strategic Moves

• Capacity Expansion: Plans to nearly double port capacity by FY30 (from ~160 MTPA to ~300 MTPA).

• Cargo Diversification: Targeting major reduction of group dependency (from ~70% to ~50%) by growing third-party cargo traffic.

• New Projects: Investment pipeline includes both greenfield and brownfield projects in Odisha, Maharashtra, and other states.

• Integrated Logistics: Deeper backward integration into rail connectivity and warehousing to capture higher value from logistics value chain.

• Macro Tailwinds

o Major government initiatives (e.g., Sagarmala) catalyzing sector growth.

o India’s trade/exports rising; strong outlook for cargo and container volumes.

o Shifts in supply chains to coastal shipping and blended logistics.

o Demand uptrend in containerization and warehousing services.

⚠️ Key Risks & Limitations

• High Capex Cycle: Expansion could elevate debt and financial leverage.

• Macro Sensitivity: Lower industrial/output growth would hit cargo volumes.

• Regulatory Overhang: Tariff and ESG regulations present chronic uncertainty.

• Group Concentration: Third-party cargo growth remains an execution challenge.

• Rivalry: Competitive intensity from Adani, DP World, and others is ramping up.

📌 Conclusion & Investment Verdict

Parameter Verdict

Fundamentals Strong, superior margins, efficient operations

Valuation Fair to premium (due to uptrend and growth)

Technical Trend Bullish, ready for potential breakout

Growth Outlook High (supported by sector tailwinds)

Risk Profile Moderate (driven by capex & regulatory factors)

For long-term investors:

JSW Infra presents a compelling case for portfolio inclusion, offering robust growth visibility, sectoral leadership, and operating excellence. Accumulation is best near ₹230–₹240 on dips.

Short-term view:

Stocks in strong uptrends may see minor corrections but are well-placed for fresh breakouts above ₹285, targeting ₹320–₹340.

The stock is ideal for investors seeking infrastructure-sector exposure with high growth potential, but one must remain mindful of execution and regulatory risks.

==============================

==============================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS________________________________________________________________________________

📈 BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range(Resistance): 1324.50

🟢 Bottom Range(Support): ₹1270

⚪ No Trade Zone: Mid-range, no clear directional bias

________________________________________________________________________________

🧩 Chart Pattern: No

There is no visible or marked chart pattern (e.g., flag, triangle, head and shoulders) on the chart.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No visible reversal candle pattern at the supply zone on this chart snapshot, but the area has been marked for potential rejection.

🟢 Bottom Range: No textbook reversal candlestick (like pin bar, hammer, or engulfing) is clearly visible at ₹1270. However, the price bounced strongly from this level, indicating possible short-term support or buyer interest.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: If price retests ₹1270 and forms a bullish structure (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹1269

Risk-Reward: 1:1 | 1:2+

Logic: you need to give an actual logic to this

________________________________________________________________________________

🔽 Bearish Trade:

Idea: If price rejects 1324.50 and forms a bearish structure (strong bearish candle, reversal candles, volume support, long wick)

Stop Loss: ₹1325

Risk-Reward: 1:1 | 1:2+

Logic: Historically rejected area as marked on chart.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone Trade:

Zone: ₹1293.30 – ₹1299.90

SL: ₹1301.45

Plan: Trade the Supply Zone (only on rejection confirmation)

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: No defined demand zone.

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Bharat Forge?

Will it reject from the supply zone or hold the bottom range?

Share your charts or thoughts below 👇

________________________________________________________________________________

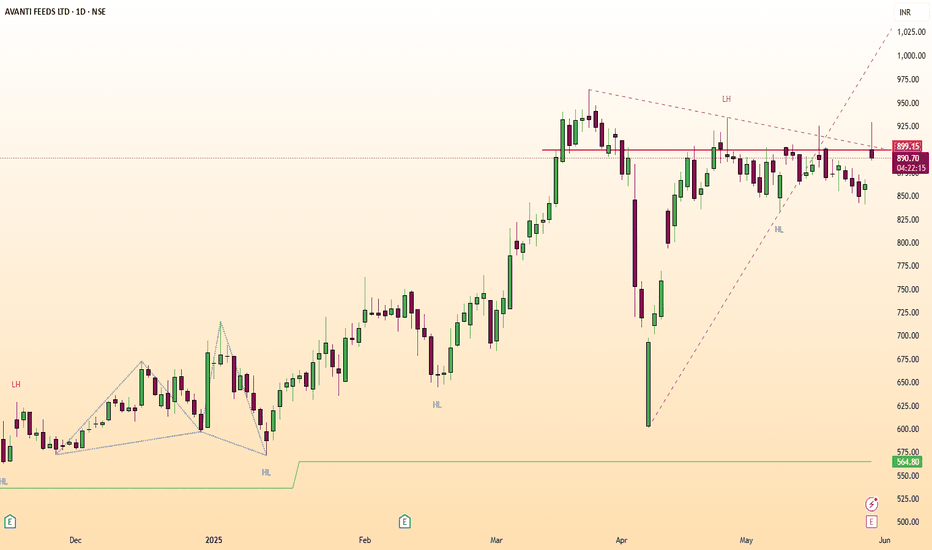

AVANTIFEED Breakout StockGood Above 900 on Closing Basis.

For Educational Purpose only.

Rationale:-

Volume:

Volume is greater than previous session by 848.49%.

Volume is greater than last 10 sessions average volume.

Volume is greater than last 10 sessions volume. That is a high volume.

Highest volume marked in last 20 sessions. That is a volume spurt.

Volatility:

ATR% of the stock is 3.96%

Average of last 20-day is 4.33%

Moving Average Observations:

Price remains above 200-day Moving average.

Price went above 50-day Moving average in the current session, it is a bullish crossover.

Price above 50-day, 100-day and 200-day Moving average.

Moving average alignment is bullish. It is an uptrend & a bullish setup.

RSI Observations:

The Daily RSI indicator has crossed above 50 in the current session. Current Daily RSI reading is 56.32.

The Weekly RSI indicator has remained above 50. This is a bullish zone. Current Weekly RSI reading is 60.34.

The Monthly RSI indicator has remained above 70. Current Monthly RSI reading is 72.59.

ADX Observations:

The Daily DMI position turned bullish. Its a bullish crossover.

The Daily ADX went up by 4.34%. Current ADX reading is 10.76.

The Daily distance between DMI lines is 28.43%.

The Weekly DMI position remains bullish.

The Monthly DMI position remains bullish.

Donchian Channel Observations:

Price is above middle Donchian channel (Bullish).

Price is at Upper Donchian channel band.

Upper band is rising. 20-day new high marked.

Difference between bands is 11.53%.

Ichimoku Observations:

Price above Ichimoku clouds.

Clouds are bullish.

Tenkan line went above Kinjun line in current session. Bullish crossover.

Tenkan line is above Kijun line. Ichimoku setup is bullish.

Current cloud range is 1.25% and Future cloud range is 11.34%.

Bollinger Band Observations:

Price is above middle Bollinger band (Bullish).

Price is above Upper Bollinger band.

Bands are expanding.

Difference between bands is 6.05%.

SWIGGYSWIGGY is showing highest ever volume after listing day. Forming a base pattern with volume. Now if if doesn't break today's low then this may be considered as a short term bottom. So no 297 is a key support are. Though for a momentum play its closing above 330 is v crucial. But if above all conditions satisfied then definitely is may prove to be a good trade in coming days.

SANDUMA-Positional Long trade-Swing tradeStock has rejected trendline multiple times. In next 1-2 session if it holds above 450 and breakout the trendline with bullish candle. Good opportunity to go long.

If it falls below 450, avoid.

Please don't forget click on follow button so you won't miss any upcoming ideas.

Any confusion, feel free to drop msg. Happy to help :)

This is only for educational purpose, please manage your risk accordingly.