SHREECEM

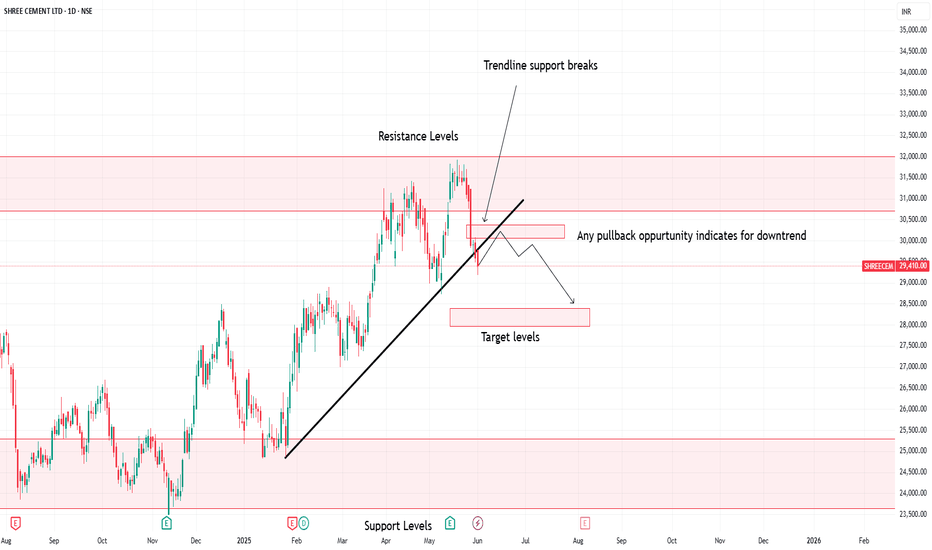

SHREECEM Analysis & Prediction in DTFThis is the analysis of SHREECEM in Daily Time Frame. Watch carefully. The chart explains itself.

There are some prediction levels. These Levels act as Support and Resistance according to position of price. You have to trade according to level breakout or breakdown.

Always maintain your risk management.

Book your profit according to your “STOMACH”.

Disclaimer:

This is not investment advice. I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

Happy trading.

About SHREECEM :

Shree Cement Ltd. engages in the manufacturing of cement and cement-related products. The company's brand names include Shree Ultra, Bangur, and Rock Strong. The firm's products include: Ordinary Portland Cement, Portland Pozzolona Cement, Portland Slag Cement, and Composite Cement. The company was founded on October 25, 1979 and is headquartered in Kolkata, India.

Shree Cement looking slight bearish on weekly charts.Shree cement has been in a bearish move and a retest to 38.2% fib levels is also there on the weekly charts.

The stock is trading around 25500 levels and the price action formation is looking bearish.

Bearish engulfing candle and rejection from 20 ema adds on to the confluence. Though the markets are trading at ATH and chances are there of a profit booking.

If the stock start trading below the support zone around 24400 levels, a shorting opportunity may be captured in the stock.

The stock is trading near a high volume area. It is showing some selling happening around 26000 level.

Entry can be made once the price start trading below 25400 with proper SL.

Another entry for new trades can be made below the support zone.

Targets are marked and can be achieved in 1-2 weeks after the entry triggers.

Wait for the price action near the levels before entering the trade.

Shree Cement forming bear flag pattern.Shree Cement has been consolidating in a narrow range for around 4 weeks.

The stock has formed a bull trap on the daily time frame, giving a break out and getting back to the consolidation zone.

It has been facing a rejection from 20 DMA and a bear flag is there.

Moving averages on the hourly time frame are close and the stock can give either side break out/down.

3 point confirmation.

1. Bull trap on daily time frame.

2. Trading below 20 ema (on weekly time frame).

3. Rejection from 20 DMA.

An intraday or swing trade can be initiated once the stock break out/down form the box.

For option traders next month option can be traded as tomorrow is monthly expiry.

Target (upside) :- 22000, 200 DMA

Target (downside):- 20200, 19500

The stock has been trading in a range of 3.5% from end of september. A nice movement can be captured in this stock once is closes outside the box and sustains the levels.

Wait for the price action near the levels before entering the trade.

Shree Cement Chart Analysis !!📈 SHREE Cement 📉

My Findings :-

1. Breakout of Downtrending Trendline Zone.

2. Breakout from a swing high.

3. Close above Feb and March high.

4. Higher High and Higher Low formation.

Bias- Long

Target- 27528, 29533 and 31059

SL- 24565

RR- 1: 4

All Important Supports and Resistances are drawn in chart. All levels are on closing basis.

Please have a look and revert back if you need some more study on it.

Disclaimer : Consult Your Financial Advisor Before Taking Any Decision On This Analysis.

SHREECEM Buy signal , price at support I will buy SHREECEM because :

It has been taking support .

It has touched the support 3 times and has not been able to break it.

So will be looking at buying opportunities.

If it breaks the support look at shorting

Entry : 26548

Target : 29527/31792

Stop loss : 26021

Shree Cement Trade ReasonBreak out with Good volume - Confidence

Next candle with big WICK with heavy volume - Shows the Buying is still absorbing selling

Next two candles Profit booking Because there are big candles but no Volume - Sellers are not Aggressive

So that's the reason for the entry now also is a good one

#SHREECEM .. 25% upside in next 2 monthsAll details of analysis are on the chart..

MACD and RSI are at great levels too for both daily and weekly timeframes..

the superimposition method is just a way to estimate the timeframe of price movement and is not indicative of how the actual price movement may happen.. Be Aware of that..Also, timeframe of trade will be less or more than my estimate.. I don't know the future, it is an educated guess

#STARCEMENT CMP114.60 #Target 126.75 #Cement #Industrial #NiftyDaily Chart

#STARCEMENT

NSE: STARCEMENT

Short Term Quick Profit

CMP 114.60

Target : 126.75

SL : 109

Timeframe < 30 Days

Can hold for longer time

ITS A BULL MARKET RALLY. Bullish on whole INDIA!

Corrections and then higher highs again.

Factors:

Inverted Head & Shoulder Pattern Forming

Trend Following

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Retest Successful.

Higher Highs & Higher Lows.

Broken above RESISTANCE levels

Trading at SUPPORT levels

Earnings are strong.

Bullish Wedge Breakout

Risk Return Ratio is healthy.

And

Rising from Double Bottom Pattern to Flag Pattern forming.

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia

#RAMCOIND 13% $return #RAMCOCEM #ULTRACEMCO #ACC #SHREECEM #STAR#RAMCOIND

NSE:RAMCOIND

CMP: 282.50

Target: 320

Stop Loss: 254

Time Frame: Approximately 2 months.

Factors:

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Higher Highs & Higher Lows.

Breakout above RESISTANCE levels

Trading at SUPPORT levels

Fundamental are strong.

Earnings report & quality strong

EPS Positive

Risk Return Ratio is healthy.

And

Rising from the Bottom to V Shaped Pattern to Flag Pattern forming

The stock might cross its all time high.

Compare with peers

NSE: ULTRACEMCO

NSE: RAMCOCEM

NSE: ACC

NSE: SHREECEM

NSE: INDIACEM

NSE: JKCEMENT

NSE: JKLAKSHMI

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia

SHREECEM Buy signal at 23397 , Forming a Channel patternI will go LONG on SHREECEM because:

The price is forming a Chanel or Rectangle Pattern .

The price is also under Support/Resistance zone.

It has touched the support (lower end of rectangle ) and may reach the resistance zone (upper end of rectangle ) .

Target would be the Resistance area . Book profit when it reaches the resistance zone .

Entry - 23397

Target - 26144

Stop loss - 22408