Gold flipped structure — real reversal or liquidity trap?Gold has just delivered a clear structural shift after weeks of heavy downside pressure — but this is not the time to chase.

Market Structure (M30)

Price printed a bullish CHoCH, ending the prior bearish sequence.

Followed by a BOS to the upside, confirming short-term bullish control.

Momentum is strong, but price is now approaching a key reaction zone.

Key Zones to Watch

FVG Support: ~4,950 – 4,980

→ Ideal area for pullback continuation if bullish structure holds.

Mid Resistance / Reaction: ~5,100 – 5,150

→ Expect volatility and possible shakeout.

Upper Target Zone: 5,270 – 5,450

→ Fibonacci 0.5 → 0.786 retracement of the prior sell-off.

Trading Scenarios

Bullish continuation:

Wait for pullback into FVG + higher low → continuation toward 5,27x → 5,45x.

Failure scenario:

Loss of FVG + M30 close back below ~4,95x → bullish structure invalid, range or reversal risk.

🧠 Trading Mind

This is a reaction market, not a prediction market.

After a structure flip, pullbacks pay — breakouts trap.

SMC

GOLD BULLISH OR BEARISH?Gold is bouncing — but context matters.

After a strong selloff, price is now retracing into a key resistance zone, not breaking structure. This is where many traders get trapped chasing a “bottom” while smart money distributes.

Market Structure

Clear downtrend: Lower Highs & Lower Lows remain intact

Current move = retracement, not impulsive bullish continuation

Price is reacting below the descending trendline

Key Technical Zone

FVG / Supply zone around 5.26x → high-probability reaction area

This zone aligns with retracement levels and prior imbalance

If–Then Scenarios

If price rejects 5.26x:

→ Downtrend continuation toward 4.63x → 4.51x → 4.40x

If price breaks and holds above 5.26x (H1 close):

→ Bearish bias weakens, wait for new structure before trading

Trading Mindset

This is distribution after a selloff, not accumulation.

Don’t confuse a bounce with a trend change.

📌 Strong trends don’t reverse quietly — they test patience first.

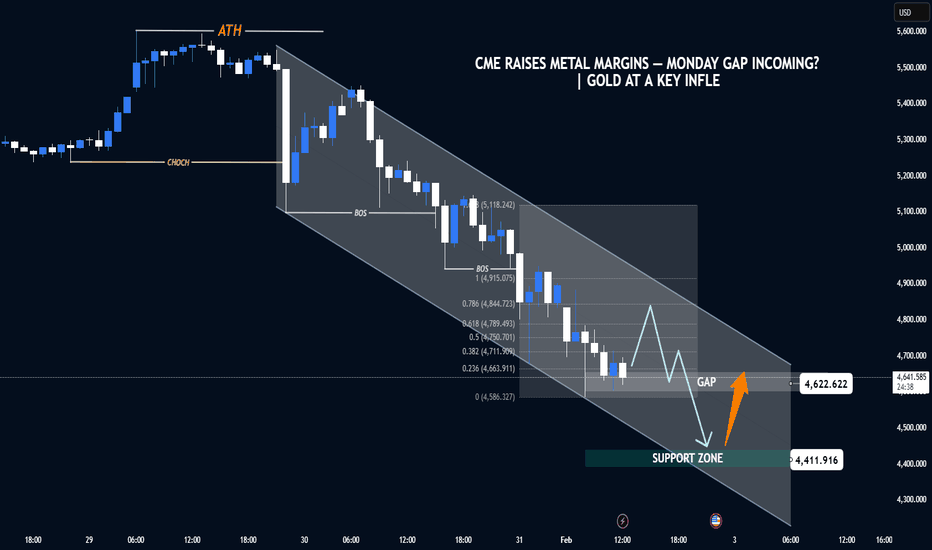

CME raises metal margins, Monday gap risk? Gold key influence.Gold is no longer trending freely — it’s correcting with structure.

After printing ATH, XAUUSD delivered a clear CHoCH, followed by a sequence of bearish BOS, confirming a controlled pullback, not panic selling. Price is now respecting a descending corrective channel, which typically appears before the market decides its next major leg.

🧠 Fundamental Context (Flow > Headlines)

CME raised margin requirements for metals

Higher margins = forced position reduction for leveraged traders

This often creates liquidity-driven gaps at the weekly open

Important: this is mechanical pressure, not a macro trend flip

➡️ Expect volatility first, clarity later.

📊 Technical Structure (HTF → LTF)

ATH rejection + CHOCH = bullish momentum paused

Multiple BOS inside the channel = distribution phase

Price is compressing toward key liquidity zones

🔑 Key Levels to Watch

5,090 – 5,120: Upper channel / sell-side reaction zone

4,620 GAP area: High-probability liquidity magnet if Monday gaps

4,410 Support zone: HTF demand & channel base (critical level)

🎯 Scenarios (If – Then)

If Monday gaps into 4,620

→ Expect sharp moves and fake breaks

→ Wait for acceptance / absorption before any long bias

If price loses 4,620 cleanly

→ Next draw = 4,410 support

If price reclaims 4,900+ quickly

→ Gap likely becomes a trap → squeeze back into range

XAUUSD (H3) – Liam Weekly Trading PlanStructure has shifted | Early-week focus stays SELL on rallies

Quick summary

Gold has completed a sharp downside expansion after a prolonged bullish run, breaking the prior structure decisively. The current price action shows weak recovery attempts, suggesting the move lower is corrective-to-distributive rather than a completed reversal.

For the start of the week, the bias remains clear: sell the structure, not chase bounces.

Market structure

The previous uptrend has been fully disrupted by an impulsive sell-off.

Price is now trading below former support, which has flipped into resistance.

Current rebounds lack momentum and show characteristics of corrective pullbacks, not accumulation.

This keeps the market in a sell-on-rallies environment until proven otherwise.

Key technical zones

Primary sell FVG / resistance: 4970 – 5000

This zone aligns with imbalance and prior liquidity and is the preferred area for sell reactions.

Secondary sell FVG: 4795 – 4820

A lower reaction zone where price may stall before continuing lower.

Deeper liquidity target: 4340 – 4350

This remains the main downside objective if the structure continues to unwind.

Upper invalidation zone: 5300+

Acceptance above this area would force a reassessment of the bearish bias.

Early-week scenarios

Primary scenario – SELL rallies

As long as price remains capped below the 4970–5000 zone, any rebound should be treated as corrective. The expectation is for further downside continuation toward lower liquidity.

Secondary scenario – Deeper pullback

If price fails to reclaim the first sell zone cleanly, a slow grind lower into the 4795–4820 area may occur before continuation.

Reassessment condition

Only a strong reclaim and acceptance above 5300 would invalidate the current sell structure.

Key notes

Early-week price action often clears residual liquidity.

Avoid counter-trend longs inside resistance.

Let price come to the level, then execute.

Structure > opinion.

Weekly focus:

selling corrective rallies into FVG and resistance, or waiting for price to show a clear structural shift before changing bias.

— Liam

Trump speaks tonight — Gold at decision point.Market Context (H1–H4)

Gold remains in a broader bullish structure, but short-term price action has shifted into a decision phase after rejecting ATH. The sharp drop created a displacement leg, followed by a corrective bounce — typical post-event behavior.

Structurally:

HTF trend is still upward (ascending channel intact)

No confirmed HTF bearish reversal yet

Current move looks like rebalancing, not trend failure

Fundamental Context

Trump’s speech tonight is the key volatility trigger

Any geopolitical / USD-impacting rhetoric can cause:

A liquidity sweep before direction

Or a direct continuation if risk-off sentiment returns

Market is likely positioning → expect fake moves before clarity

Technical Breakdown

ATH: recent distribution, not yet reclaimed

FVG (upper): potential reaction zone for sellers if price rallies

Mid Zone (~5090–5120): short-term decision / balance area

Strong Demand (~4980–5000): HTF buy zone, aligns with trendline & prior BOS base

Trading Scenarios (If–Then)

If price holds above 5090–5120 → look for continuation into FVG, then ATH test

If price sweeps below 5090 but reclaims → classic liquidity grab → BUY continuation

If price breaks and holds below 5000 (H1 close) → deeper pullback, bullish bias pauses (not flips yet)

Key Takeaway

This is not the place to chase.

Trade reactions, not headlines.

Let Trump speak → let liquidity show → then follow structure.

Bias: Bullish continuation unless strong demand fails.

XAUUSD – M30 Technical AnalysisMild Pullback Before the Next High | Lana ✨

Gold has extended sharply and is now trading into a high-resistance zone, where price often needs a light correction or consolidation to rebuild liquidity before attempting higher levels again. The broader trend remains bullish, but the next clean opportunity is more likely to come from a pullback into structure, not from chasing the highs.

📈 Market Structure & Trend Context

Price is still respecting the broader bullish structure, but the current leg is stretched after a strong impulsive run. The market is now reacting under the highest resistance zone, which typically creates short-term profit-taking and liquidity reactions before continuation.

As long as price holds above key structural support, the bullish trend remains intact.

🔍 Key Technical Zones

Highest resistance zone: 5585 – 5600 This is a premium area where price may hesitate or reject in the short term.

First support zone: 5508 A key decision level where price can rebalance before choosing direction.

Buy liquidity zone: 5446 – 5450 A strong liquidity pocket where buyers are more likely to step back in.

Long-term support zone: 5265 – 5285 A deeper base area if volatility expands into a broader correction.

🎯 Trading Scenarios

Gold may correct modestly from resistance and retest structure before pushing higher.

Buy Entry: 5446 – 5450 Stop Loss: 5438 – 5440

Take Profit targets:

TP1: 5508

TP2: 5538 – 5545

TP3: 5585 – 5600

TP4: 5650+

A shallower pullback toward 5508 could also be enough to reset momentum before another attempt higher, but repeated rejection at the top would increase the risk of deeper consolidation.

🧠 Lana’s View

Gold remains bullish, but the market is now at a level where patience matters more than speed. Rather than chasing price near resistance, the focus should stay on how price reacts during pullbacks into key structural zones.

✨ Respect the structure, manage risk, and let price come to your level.

XAUUSD – Brian | M45 Technical Analysis— Buyers Still in Control Above 5,200

Gold continues to trade firmly above the 5,000 milestone, with price action confirming strong bullish acceptance at higher levels. On the M45 timeframe, the market remains in an expansion phase, supported by aggressive buying volume and well-defended value areas.

Current conditions suggest that buyers are still in control, with pullbacks being absorbed rather than sold into. This behavior typically characterizes a strong trending environment rather than a distribution phase.

Macro Context (Brief Overview)

From a fundamental perspective, institutional positioning remains stable, with no signs of defensive de-risking despite gold trading at record highs. At the same time, the market remains sensitive to upcoming macro events, which may introduce short-term volatility but have not altered the broader bullish bias so far.

As long as uncertainty persists and risk appetite fluctuates, gold continues to benefit from its role as a strategic hedge.

Market Structure & Volume Context (M45)

The current structure on M45 remains constructive:

Price is holding above the rising trendline.

Buying volume remains elevated, indicating strong demand and reduced willingness to sell.

Pullbacks continue to develop in a corrective manner rather than impulsive declines.

In strong trends, high volume combined with shallow retracements often signals continuation rather than exhaustion.

Key Technical Zones to Watch

Based on the chart structure and volume profile, several zones stand out:

Upside Reaction Zone

5,385: A major resistance and extension area where price may pause, consolidate, or react before deciding the next directional leg.

Primary Value Support

POC + VAH: 5,243 – 5,347

This is the most critical zone for continuation. Acceptance and holding within this range would reinforce the bullish structure.

Secondary Support

VAL: 5,163 – 5,168

A deeper pullback into this zone would still be considered corrective as long as price stabilizes and reclaims value.

Deeper Structural Support

POC: 5,086 – 5,091

This level represents broader value and would likely come into play only during heightened volatility.

Forward Expectations & Bias

Primary bias: Bullish continuation while price holds above value zones

Pullbacks are currently viewed as opportunities for re-accumulation rather than trend reversal.

Short-term volatility is expected, but structure remains the key reference point rather than individual candles.

Strong trends rarely move in straight lines. The ability of gold to hold value during pauses continues to support the case for further upside.

Refer to the accompanying chart for a detailed view of value areas, trend structure, and projected paths.

Follow the TradingView channel to get early structure updates and join the discussion on key market levels.

Gold in Decision Zone – GAP Reaction Defines Next MoveMarket Context (Fundamentals → Flow)

Recent sessions continue to be driven by elevated geopolitical and macro uncertainty. Risk sentiment remains fragile as markets reassess global political tensions and their implications for trade, energy routes, and monetary stability.

As a result:

USD remains under pressure, lacking strong follow-through buying.

Equities show signs of fatigue near highs.

Gold continues to attract defensive flows, keeping the broader bullish structure intact.

This environment supports trend continuation, but not without technical pullbacks.

Technical Structure (H1–H4)

Gold is trading within a well-defined ascending channel.

Multiple BOS (Break of Structure) confirm the bullish trend.

The recent impulsive leg created a bullish GAP / imbalance.

Price is now reacting near the mid-channel decision zone, where continuation vs. deeper retrace is decided.

➡️ Trend is bullish, but location matters.

Key Levels to Watch

Current resistance: 5,080 – 5,100

GAP / reaction zone: 5,020 – 5,000

Major demand (FVG): 4,960 – 4,940

Invalidation: H1 close below 4,940

Scenarios (If – Then)

Scenario 1 – GAP Holds (Primary Bias)

If price holds above 5,000

Buyers defend the imbalance

→ Continuation toward 5,120 – 5,180 within the channel.

Scenario 2 – Deeper Pullback (Healthy Correction)

If price loses 5,000

Expect a retrace into 4,960 – 4,940 FVG.

Bullish reaction here keeps the higher-timeframe trend intact.

Only a clean break and acceptance below 4,940 would weaken the bullish structure.

Summary

Gold is not topping — it is pausing at a decision zone. In a risk-sensitive environment, pullbacks are opportunities, not threats.

XAUUSD – Brian | H3 Technical AnalysisGold has officially broken above the 5,000 level for the first time, confirming a major structural shift on higher timeframes. The breakout reinforces the broader bullish narrative, with price now trading firmly in expansion mode rather than consolidation.

The move above 5,000 reflects sustained safe-haven demand amid elevated global uncertainty. While short-term volatility remains possible, the broader environment continues to favour gold as a defensive asset, supporting upside continuation scenarios.

Market Structure & Trend Context (H3)

On the H3 timeframe, XAUUSD remains well-contained within a rising price channel, with structure defined by higher highs and higher lows. The recent impulsive leg confirms continuation within the dominant trend rather than a terminal move.

Key structural observations from the chart:

Price is holding above the ascending trendline, which has acted as dynamic support throughout the advance.

A clean impulsive push above 5,000 followed by shallow pullbacks suggests strong buyer acceptance at higher prices.

The broader Elliott structure remains constructive, with price progressing through higher-wave extensions rather than showing signs of distribution.

Key Technical Zones to Monitor

Several important technical areas stand out:

5,000 – trendline retest zone: A potential area for price to stabilise if a technical pullback develops.

Strong liquidity zone around 4,787: A deeper support area where buy-side liquidity is concentrated, aligned with prior structure.

FVG zone below current price: Represents unfinished business in case volatility increases.

Upper resistance / extension zone near 5,315 (Fibonacci 1.618): A key upside reaction area where price may pause or consolidate before further expansion.

As long as price remains above the trendline and key liquidity supports, the bullish structure remains intact.

Liquidity & Forward Outlook

The breakout above 5,000 opens a new liquidity regime. With limited historical resistance overhead, price is now driven more by liquidity expansion and momentum than by traditional supply zones.

Short-term pullbacks should be viewed in the context of trend continuation rather than reversal, unless there is a clear breakdown in structure. Acceptance above 5,000 would further strengthen the case for continued upside toward higher Fibonacci extensions.

Trading Bias

Primary bias: Bullish continuation while structure holds

Key areas of interest:

Trendline / 5,000 retest zone

4,787 liquidity support

5,315 extension resistance

Preferred timeframe for confirmation: H1–H4

Strong trends rarely move in a straight line. Patience and alignment with structure remain critical in this phase of the market.

Refer to the accompanying chart for a detailed view of trend structure, liquidity zones, and Fibonacci extensions.

Follow the TradingView channel to get early access to structural updates and join the discussion.

XAUUSD – Brian | H3 Technical AnalysisGold continues to trade within a well-defined bullish structure on the H3 timeframe, supported by strong technical momentum. Price action remains orderly, with impulsive advances followed by controlled pullbacks — a characteristic of a healthy trending market.

From a macro standpoint, geopolitical uncertainty remains elevated after recent comments from President Trump regarding increased U.S. control over strategic military areas in Greenland. While not implying direct occupation, the development adds to broader risk sensitivity and continues to support gold’s role as a defensive asset.

Market Structure & Technical Context (H3)

On the H3 chart, XAUUSD remains firmly above its rising trendline, with market structure defined by higher highs and higher lows. A prior break of structure (BOS) confirmed bullish continuation and opened the door for further expansion.

Key technical areas highlighted on the chart:

A strong impulsive leg followed by corrective pullbacks, consistent with trend continuation.

Fibonacci expansion with the 2.618 extension near the 5005 zone, acting as a major reaction area.

A liquidity pullback zone around 4825, aligned with trendline support and suitable for continuation scenarios.

A lower POC / value area acting as deeper support if volatility increases.

As long as price holds above these demand zones, the broader bullish structure remains intact.

Liquidity & Forward Expectations

Upside liquidity remains available above recent highs, while short-term pullbacks are likely driven by profit-taking rather than structural weakness. The 5000–5005 area represents a key decision zone where price may pause or consolidate before the next directional move.

Trading Bias

Primary bias: Bullish continuation while structure holds

Key zones to monitor:

4825 – liquidity pullback / trend continuation

5000–5005 – major extension & reaction zone

Preferred timeframe: H1–H4

Risk management remains essential, particularly in a market sensitive to sudden news flows.

Refer to the accompanying chart for a detailed view of market structure, liquidity zones, and Fibonacci extensions.

Follow the TradingView channel to receive early updates and join the discussion on market structure and price action.

XAUUSD – H2 Technical AnalysisLiquidity Pullback Within a Strong Bullish Structure | Lana ✨

Gold continues to trade within a well-defined bullish structure on the H2 timeframe. The recent surge was impulsive, followed by a healthy retracement that appears to be rebalancing liquidity rather than signaling a trend reversal.

Price action remains constructive as long as the market respects key structural levels and the ascending trendline.

📈 Market Structure & Trend Context

The overall trend remains bullish, with higher highs and higher lows still intact.

Price continues to respect the ascending trendline, which has acted as reliable dynamic support throughout the uptrend.

The recent pullback occurred after an aggressive upside expansion, fitting the classic sequence:

Impulse → Pullback → Continuation

No clear distribution pattern is visible at this stage. As long as structural support holds, the bias remains BUY on pullbacks, not selling strength.

🔍 Key Technical Zones & Value Areas

Primary Buy POC Zone: 4764 – 4770

This area represents a high-volume node (POC) and aligns closely with the rising trendline.

It is a natural zone where price may rebalance before resuming the bullish trend.

Secondary Value Area (VAL–VAH): 4714 – 4718

A deeper liquidity zone that could act as support if sell pressure temporarily increases.

Near-term resistance: 4843

Acceptance above this level strengthens the continuation scenario.

Psychological reaction zone: 4900

Likely to generate short-term hesitation or profit-taking.

Higher-timeframe expansion targets:

5000 (psychological level)

2.618 Fibonacci extension, where major liquidity may be resting.

🎯 Trading Plan – H2 Structure-Based

✅ Primary Scenario: BUY the Pullback

Buy Entry:

👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, strong rejection of lower prices, or bullish follow-through).

Stop Loss:

👉 4756 – 4758

(Placed ~8–10 points below entry, beneath the POC zone and the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843

First resistance zone — partial profit-taking recommended.

TP2: 4900

Psychological level with potential short-term reactions.

TP3: 5000

Major psychological milestone and upside expansion target.

TP4 (extension): 5050 – 5080

Area aligned with the 2.618 Fibonacci extension and higher-timeframe liquidity.

The preferred approach is to scale out gradually and protect the position, adjusting risk as price confirms continuation.

🌍 Macro Context (Brief)

According to Goldman Sachs, central banks in emerging markets are expected to continue diversifying reserves away from traditional assets and into gold.

Average annual central bank gold purchases are projected to reach around 60 tons by 2026, reinforcing structural demand for gold.

This ongoing accumulation supports the idea that pullbacks are more likely driven by positioning and profit-taking, rather than a shift in long-term fundamentals.

🧠 Lana’s View

This remains a pullback within a bullish trend, not a bearish reversal.

The focus stays on buying value at key liquidity zones, not chasing price at highs.

Patience, structure, and disciplined execution remain the edge.

✨ Respect the trend, trade the structure, and let price come to your zone.

XAUUSD - Brian | H2 Technical AnalysisGold remains constructive and continues to hold a bullish structure despite last night’s sharp cross-market volatility. The main driver behind the larger moves was heavy selling pressure in U.S. equities, which briefly accelerated safe-haven demand and helped support gold.

On the macro side, tensions linked to Greenland and renewed tariff rhetoric have increased uncertainty across markets. The USD weakened in the short term, while the EUR appears more exposed to medium-term geopolitical and policy risks. This backdrop generally remains supportive for gold, especially on pullbacks into key support.

Technical Structure & Key Zones (H2)

On the H2 timeframe, XAUUSD is still trading within a clear uptrend: price respects the rising trendline and continues to print higher highs and higher lows, confirming buyers remain in control of the primary structure.

The latest impulse leg has left several important technical areas:

A Fair Value Gap (FVG) below current price, which may be revisited if a technical retracement develops.

The 0.618 Fibonacci retracement zone at 4750–4755, aligned with the rising trendline — a strong confluence support for a deeper pullback scenario.

A higher, near-term demand area around 4812, suitable for shallow pullbacks during strong momentum conditions.

As long as price holds above these demand zones, the medium-term bullish structure remains intact.

Liquidity & Forward Expectations

To the upside, the market still has room to expand toward prior highs and the ATH liquidity area. Any short-term pullback, if it occurs, may simply act as a reset before continuation — especially while macro volatility remains elevated.

Reminder: strong trends rarely move in a straight line. Pauses and retracements are normal and often offer better participation than chasing price at the highs.

Trading Bias

Primary bias: Buy pullbacks in line with the trend; avoid FOMO entries near the top.

Key zones to watch:

4812: shallow pullback / momentum continuation zone

4750–4755: deeper pullback into 0.618 + trendline confluence

Preferred monitoring timeframe: H1–H4 to reduce noise

Risk management remains critical given the market’s sensitivity to news flow and cross-asset swings.

Refer to the accompanying chart for a detailed view of the structure, FVG, and key pullback zones.

Follow the TradingView channel to get early updates and join the discussion on market structure and trade ideas.

XAUUSD (H4) – Liam PlanMacro tailwinds remain, but price is extended | Trade reactions, not emotions

Quick summary

Gold remains supported by a strong macro backdrop:

📌 Fed hold probability in January: 95% → USD/yields capped.

📌 Geopolitical tension (Kremlin praising Trump over Greenland, NATO cracks) adds safe-haven demand.

Technically, price has pushed aggressively into upper expansion territory. At this stage, the edge is reaction trading at key levels, not chasing strength.

Macro context (why volatility stays elevated)

With the Fed very likely holding rates in January, markets are highly sensitive to USD and yield shifts.

Rising geopolitical noise keeps gold bid, but also increases the risk of headline-driven spikes and liquidity sweeps.

➡️ Conclusion: directional bias is secondary to execution quality. Trade levels + confirmation only.

Technical view (H4 – based on the chart)

Gold is trading inside a rising channel, currently extended toward the upper Fibonacci expansion.

Key levels to focus on:

✅ Major sell Fibonacci / wave top: 4950 – 4960

✅ Sell wave B / reaction zone: 4825 – 4835

✅ Buy entry / structure support: 4730 – 4740

✅ Sell-side liquidity: 4520 – 4550 (below structure)

Price is stretched above the mid-channel — conditions where pullbacks and rotations are statistically more likely than clean continuation.

Trading scenarios (Liam style: trade the level) 1️⃣ SELL scenarios (priority – reaction trading)

A. SELL at Fibonacci extension (primary idea) ✅ Sell zone: 4950 – 4960 SL: above the high / fib extension TP1: 4830 TP2: 4740 TP3: 4550 (if momentum accelerates)

Logic: This is an exhaustion area aligned with wave completion and fib extension — ideal for profit-taking and mean rotation, not trend chasing.

B. SELL wave B reaction ✅ Sell: 4825 – 4835 Condition: clear rejection / bearish structure on M15–H1 TP: 4740 → 4550

Logic: Classic corrective wave zone. Good for tactical shorts within a broader volatile structure.

2️⃣ BUY scenario (secondary – only on reaction)

BUY at structural support ✅ Buy zone: 4730 – 4740 Condition: hold + bullish reaction (HL / rejection / MSS on lower TF) TP: 4825 → 4950 (scale out)

Logic: This is a key flip zone inside the rising channel. BUY only if price proves acceptance — no blind dip buying.

Key notes (risk control)

Market is extended → expect fake breaks and sharp pullbacks.

Avoid mid-range entries between levels.

Reduce size during geopolitical headlines.

Confirmation > prediction.

What’s your play: selling the 4950 fib extension, or waiting for a clean reaction at 4730–4740 before reassessing?

— Liam

Trump Davos Warning Keeps Gold in Strong Uptrend Market Context (News → Flow)

Comments from Trump at Davos, including renewed threats and pressure around Greenland, have escalated geopolitical uncertainty during the Asian session.

Markets reacted in classic risk-off mode:

USD weakens amid political uncertainty

Equities hesitate, risk appetite fades

Safe-haven flows rotate into Gold, driving momentum higher

Gold is not moving on speculation — it is reacting to capital seeking protection.

Technical Structure (H1 – SMC)

Overall structure remains bullish, confirmed by multiple BOS

Price is trending inside a well-defined ascending channel

Recent pullback respected the bullish FVG, showing strong demand

No bearish acceptance below structure at this stage

➡️ FVG respected → continuation remains in play

Key Decision Zones

Upper FVG: 4,765.425

Mid support: 4,727.188

Current impulse high: 4,883.900

These are reaction zones, not chase levels.

Scenarios (If – Then)

Primary Scenario – Trend Continuation

If price holds above 4,765.425

Bullish structure remains intact

Gold can continue advancing toward higher channel resistance

Alternative Scenario – Technical Pullback

If price loses 4,765.425

A pullback toward 4,727.188 is possible for rebalancing

Only a clear H1 close below 4,727.188 would weaken the bullish bias

Summary

Geopolitical rhetoric is accelerating volatility, but structure still leads the narrative.

Gold is not reacting emotionally —

it is pricing risk.

Gold Rotating After CHoCH – Liquidity Controls the FlowGold is currently trading in a post-impulse, post-breakout environment.

After the earlier expansion and BOS, price did not continue trending cleanly.

Instead, it transitioned into sideways consolidation, signaling Smart Money rebalancing rather than continuation.

This is not indecision — this is liquidity management.

Market Structure & Liquidity Context

• Higher-timeframe structure shows a breakout followed by hesitation, a classic sign of distribution and absorption.

• Price spent time ranging, engineering liquidity on both sides before expansion.

• A clear CHoCH formed after the sell-off, confirming the shift from expansion into controlled rotation.

• The 4610–4608 zone aligns with prior structure and demand, where Smart Money defended price aggressively.

• From this discount reaction, price expanded strongly, targeting upper liquidity.

This confirms that rotation → expansion was liquidity-driven, not emotional buying.

Key Trading Scenarios

🟢 Buy Reaction at Discount (Already Played)

The 4610–4608 demand zone acted as a protected discount area.

Strong rejection here confirmed Smart Money defense and initiated upside expansion.

🔴 Sell Reaction at Premium (Next Focus)

If price revisits 4742–4744, this premium zone aligns with:

• Prior expansion highs

• Buy-side liquidity resting above range

• Potential distribution area

Weak acceGold is currently trading in a post-impulse, post-breakout environment.

After the earlier expansion and BOS, price did not continue trending cleanly.

Instead, it transitioned into sideways consolidation, signaling Smart Money rebalancing rather than continuation.

This is not indecision — this is liquidity management.

Market Structure & Liquidity Context

• Higher-timeframe structure shows a breakout followed by hesitation, a classic sign of distribution and absorption.

• Price spent time ranging, engineering liquidity on both sides before expansion.

• A clear CHoCH formed after the sell-off, confirming the shift from expansion into controlled rotation.

• The 4610–4608 zone aligns with prior structure and demand, where Smart Money defended price aggressively.

• From this discount reaction, price expanded strongly, targeting upper liquidity.

This confirms that rotation → expansion was liquidity-driven, not emotional buying.

Key Trading Scenarios

🟢 Buy Reaction at Discount (Already Played)

The 4610–4608 demand zone acted as a protected discount area.

Strong rejection here confirmed Smart Money defense and initiated upside expansion.

🔴 Sell Reaction at Premium (Next Focus)

If price revisits 4742–4744, this premium zone aligns with:

• Prior expansion highs

• Buy-side liquidity resting above range

• Potential distribution area

Weak acceptance or rejection here would signal that buy-side liquidity has been delivered, opening room for rotation or consolidation.

Expectation & Bias

This is not a chase market.

• Expansion only follows liquidity delivery

• Continuation requires acceptance above premium

• Failure to accept favors rotation back toward equilibrium

Until then:

Liquidity > Indicators

Reaction > Prediction

Structure > Emotion

Let price confirm intent — Smart Money always shows its hand first.

💬 Do you expect acceptance above premium, or another rotation back to discount?ptance or rejection here would signal that buy-side liquidity has been delivered, opening room for rotation or consolidation.

Expectation & Bias

This is not a chase market.

• Expansion only follows liquidity delivery

• Continuation requires acceptance above premium

• Failure to accept favors rotation back toward equilibrium

Until then:

Liquidity > Indicators

Reaction > Prediction

Structure > Emotion

Let price confirm intent — Smart Money always shows its hand first.

💬 Do you expect acceptance above premium, or another rotation back to discount?

Gold weekly rotation between 4682 supply and 4420 demand🟡 XAUUSD – Weekly Smart Money Plan | by Ryan_TitanTrader (17/01)

📈 Market Context

Gold remains structurally bullish on the higher timeframe, but weekly price action has clearly transitioned into a controlled Smart Money rotation. After delivering buy-side liquidity into premium, continuation has stalled.

This week’s hot drivers — USD volatility, U.S. yield repricing, and renewed Fed rate-cut expectations amid sticky inflation data and geopolitical hedging flows — are creating ideal conditions for inducement and liquidity engineering rather than clean trend expansion.

With risk sentiment fragile and positioning crowded, Gold is behaving typically at extremes: sweeps, fake breaks, and mean reversion, not impulsive continuation.

🔎 Technical Framework – Smart Money Structure (H4–H1)

Current Phase:

HTF bullish bias remains valid, but internal structure shows distribution from premium after liquidity delivery.

Key Idea:

Sell reactions from premium supply, or wait patiently for a deeper pullback into HTF demand to reload longs.

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already taken above highs

• Clear rotation channel forming

• Liquidity shortage zone acting as magnet

• Discount demand aligns with prior OB + channel support

💧 Liquidity Zones & Key Levels

• 🔴 SELL GOLD 4680 – 4682 | SL 4690

• 🟢 OB BUY GOLD 4420 – 4418 | SL 4410

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB / FVG retest → expansion or deeper rotation

🎯 Execution Rules

🔴 SELL GOLD 4680 – 4682 | SL 4690

Rules:

✔ Price taps premium channel supply

✔ Buy-side liquidity taken above recent highs

✔ Bearish MSS / CHoCH on H1–M15

✔ Downside BOS confirms distribution

✔ Entry via bearish FVG or supply OB

Targets:

• 4620 — internal reaction

• 4560 — liquidity shortage

• 4480 — deeper weekly rotation

• Trail aggressively (distribution play)

🟢 OB BUY GOLD 4420 – 4418 | SL 4410

Rules:

✔ Sweep into weekly discount zone

✔ Strong confluence: HTF OB + channel support

✔ Bullish MSS / CHoCH on M15–H1

✔ Impulsive BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4560 — first reaction

• 4620 — mid-range liquidity

• 4680+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones = liquidity traps

• Expect false breaks during macro headlines

• No entry without MSS + BOS

• Reduce risk near HTF extremes

📍 Summary

Gold is bullish by structure, but this week is about precision execution, not prediction:

• Premium may deliver a Smart Money sell from 4680–4682, or

• Discount at 4420–4418 may reload longs for the next impulsive leg.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for weekly Smart Money gold breakdowns.

Gold fluctuates between 4672 resistance and 4560 support.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (16/01)

📈 Market Context

Gold remains structurally bullish on the higher timeframe, but intraday price action has shifted into controlled rotation. With today’s hot drivers — USD volatility, U.S. yield fluctuations, and ongoing Fed rate-cut speculation — Smart Money is no longer pushing continuation. Instead, liquidity is being engineered around premium and discount zones.

Ahead of U.S. macro headlines and inflation-linked expectations, Gold is behaving typically at extremes: inducement, stop-hunts, and mean reversion rather than impulsive trend extension.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias intact, while intraday structure shows corrective rotation after buy-side liquidity was taken.

Key Idea:

Look for distribution from premium supply or a deeper pullback into discount demand for buying/entry reloads.

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already delivered

• Price rotating, not expanding impulsively

• Internal FVG acting as downside magnet

• Discount demand aligns with prior OB support

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4670 – 4672 | SL 4680

• 🟢 BUY GOLD 4561 – 4559 | SL 4551

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4670 – 4672 | SL 4680

Rules:

✔ Price taps premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4620 — internal reaction

• 4585 — liquidity pool

• Trail aggressively (distribution play)

🟢 BUY GOLD 4561 – 4559 | SL 4551

Rules:

✔ Sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4620 — first reaction

• 4670 — internal liquidity

• 4700+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones = liquidity traps

• Expect fake breaks during news volatility

• No entry without MSS + BOS

• Reduce size near extremes

📍 Summary

Gold is bullish by structure, but today is about execution, not prediction:

• Premium may deliver a Smart Money sell from 4670–4672, or

• Discount at 4561–4559 may reload buying/entry for the next leg higher.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD H1 – Range Bound MarketSideways Consolidation, Waiting for a Range Break

Gold on the H1 timeframe is currently trading inside a clear sideways range near the ATH, showing signs of balance after the recent impulsive move. At this stage, the market is not trending — it is building liquidity and waiting for a breakout.

MARKET STRUCTURE

Price is consolidating inside a wide sideways box after failing to continue higher from the ATH.

Multiple rejections on both sides of the range confirm that neither buyers nor sellers have full control yet.

This behaviour typically appears before a volatility expansion.

KEY ZONES & LIQUIDITY

Upper range – Resistance / Breakout trigger:

~4620 – 4640

Acceptance above this zone would signal renewed bullish strength and open the path toward new highs.

Mid-range equilibrium:

Current price is hovering around the balance area, where false signals are common. Patience is required here.

Lower range – High liquidity support:

~4580 – 4590

This zone has absorbed selling pressure multiple times. A clean reaction here could support a bounce back into the range.

Deeper liquidity support:

~4515 – 4520

If the range breaks to the downside, this is where strong demand and liquidity are likely to sit.

SCENARIOS TO WATCH

Bullish breakout scenario:

Price holds above the lower range and breaks cleanly above 4620–4640.

Acceptance above the range confirms continuation toward new ATH levels.

Bearish liquidity sweep scenario:

Price sweeps below 4580–4590, tapping deeper liquidity.

A failure to reclaim the range would shift short-term bias to the downside.

SUMMARY

Current state: Sideways / consolidation

Market is compressing and building liquidity

Best trades come after the range breaks, not inside it

Let price show direction before committing

In this environment, discipline matters more than activity — wait for the breakout, and trade the reaction, not the noise.

Gold oscillates between 4690 supply and 4576 demand.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (14/01)

📈 Market Context

Gold remains structurally bullish after printing fresh ATH territory, but price action has clearly slowed into rotation. With markets reacting to today’s hot drivers — U.S. inflation expectations, USD volatility, and shifting Treasury yields — Smart Money is no longer chasing upside. Instead, liquidity is being engineered around premium and discount zones.

Ahead of key U.S. data and rate-cut speculation, Gold is behaving exactly as expected at extremes: stop hunts, inducement, and controlled rebalancing rather than clean continuation.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias intact, while intraday structure shows corrective rotation after buy-side liquidity was delivered near ATH.

Key Idea:

Expect distribution from premium supply near ATH, or a deeper pullback into discount demand to reload longs.

Structural Notes:

• HTF BOS confirms bullish dominance

• ATH zone has delivered buy-side liquidity

• Price rotating, not expanding impulsively

• Internal FVG acting as downside magnet

• Discount demand aligns with HTF EMA support

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4688 – 4690 | SL 4700

• 🟢 BUY GOLD 4578 – 4576 | SL 4568

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4688 – 4690 | SL 4700

Rules:

✔ Price taps premium ATH supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4635 — internal reaction

• 4600 — liquidity pool

• Trail aggressively (distribution play)

🟢 BUY GOLD 4578 – 4576 | SL 4568

Rules:

✔ Sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4620 — first reaction

• 4680 — internal liquidity

• 4720+ — ATH extension if expansion resumes

⚠️ Risk Notes

• ATH zones are liquidity traps

• Expect false breaks during news volatility

• No entry without MSS + BOS

• Reduce size near ATH — range expansion risk

📍 Summary

Gold is bullish by structure, but today is about execution, not prediction:

• Premium may deliver a Smart Money sell from 4688–4690, or

• Discount at 4578–4576 may reload longs for the next ATH push.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold reaches new ATH — Smart Money rotates.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (13/01)

📈 Market Context

Gold has officially printed a new All-Time High (ATH), confirming higher-timeframe bullish dominance. However, after delivering buy-side liquidity into premium, price action is no longer impulsive. Instead, Smart Money is transitioning into controlled distribution and rotation, engineering liquidity rather than chasing continuation.

With price stretched deep into premium and resting above prior structure, today’s environment favors liquidity sweeps, inducement, and mean reversion, not blind breakout trading. Execution must be precise, level-based, and confirmation-driven.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish structure intact, but intraday corrective rotation active from premium after ATH print.

Key Idea:

Expect Smart Money to distribute near ATH supply (4630–4632), or rebalance deeply into discount (4492–4490) before the next expansion leg.

Structural Notes:

• Clear HTF BOS confirms bullish dominance

• New ATH delivered buy-side liquidity

• Price reacting from premium with corrective characteristics

• Internal FVG + liquidity pocket acting as magnet below

• Discount OB zone aligns with higher-timeframe demand

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4630 – 4632 | SL 4640

• 🟢 BUY GOLD 4492 – 4490 | SL 4482

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4630 – 4632 | SL 4640

Rules:

✔ Price taps ATH premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4588 — internal reaction

• 4560 — FVG mitigation

• Trail aggressively (intraday distribution play)

🟢 BUY GOLD 4492 – 4490 | SL 4482

Rules:

✔ Liquidity sweep into discount demand

✔ Confluence with OB + FVG + strong liquidity pool

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4520 — first reaction

• 4580 — internal liquidity

• 4630+ — ATH retest if expansion resumes

⚠️ Risk Notes

• New ATH zones are liquidity traps by nature

• Expect false breakouts and aggressive stop hunts

• No trades without MSS + BOS confirmation

• Size down near ATH — volatility can expand rapidly

📍 Summary

Gold is bullish by structure, but today is about rotation, not continuation:

• A reaction at 4630–4632 may deliver a Smart Money sell back into liquidity, or

• A sweep into 4492–4490 may reload longs for the next ATH extension.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD (M30) – Trading slightly below resistance level⚡️ Weekly plan using Volume Profile + Liquidity (Liam)

Quick summary:

Gold has just delivered a strong impulsive push and is now consolidating right beneath the highs, which is classic “compression” behavior before the next expansion. With macro conditions still sensitive (USD, yields, Fed expectations + geopolitical headlines), the best approach this week is don’t chase — trade liquidity zones and value areas (POC/VAL) instead.

1) Macro context (why price behaves like this)

When headlines are heavy, gold often moves in two phases:

run to buy-side liquidity → pull back to value → then decide whether to trend or range.

That’s why this week I’m focused on:

selling reactions in premium, and

buying dips into value (POC/VAL)

rather than buying mid-range candles.

2) What Volume Profile is showing on your chart

Your M30 chart highlights the key “money zones” very clearly:

🔴 SELL Liquidity (premium reaction)

4577 – 4579: a sell-liquidity / reaction area (good for scalp or short swing if rejection prints).

🟢 BUY Liquidity (shallow pullback)

4552 – 4555: the clean pullback zone to stay aligned with the bullish structure.

🟦 POC zones (value – where the market does the most business)

Buy POC 4505 – 4508: a major value magnet; price often revisits this area.

Buy POC 4474 – 4477: deeper value / reset zone if we get a sharper liquidity sweep.

➡️ Simple VP logic: POC = price magnet. When price is in premium, the probability of a rotation back into value is always on the table.

3) Trading scenarios for the week (Liam style: trade the level)

✅ Scenario A (priority): BUY the pullback into 4552–4555

Buy: 4552 – 4555

SL: below 4546

TP1: 4577 – 4579

TP2: continuation towards the highs if we break and hold above 4580 cleanly

Best “trend-following” entry if the pullback stays shallow.

✅ Scenario B (best VP entry): BUY at POC 4505–4508

Buy: 4505 – 4508

SL: below 4495

TP: 4552 → 4577 → higher if momentum returns

If the market runs liquidity and drops back into value, this is the area I want most.

✅ Scenario C (deep sweep): BUY POC 4474–4477

Buy: 4474 – 4477

SL: below 4462

TP: 4505 → 4552 → 4577

This is the “panic wick” setup — not frequent, but high quality when it appears.

⚠️ Scenario D (scalp): SELL reaction at 4577–4579

Sell (scalp): 4577 – 4579 (only with a clear rejection/weak close)

SL: above 4586

TP: 4560 → 4552

This is a short-term reaction sell, not a long-term bearish call while structure remains supported.

4) Execution checklist (to avoid getting swept)

No entries in the middle of the range — only at the zones.

Wait for M15–M30 confirmation: rejection / engulf / MSS.

Scale out in layers — highs often deliver fast up-sweeps and sharp pullbacks.

If I had to pick one “clean” setup this week: BUY the 4552–4555 pullback, and if we get a deeper reset, I’ll be waiting at POC 4505–4508.

xauusd gold tradingplan volumeprofile poc liquidity priceaction marketstructure intraday swingtrading

XAUUSD (H1) – Following the bullish channelpatience before continuation ✨

Market structure

Gold remains in a well-defined ascending channel on the H1 timeframe. Despite recent intraday pullbacks, the overall structure is still bullish with higher highs and higher lows preserved. Current price action shows consolidation inside the channel rather than any sign of trend reversal.

Technical outlook (Lana’s view)

Price is rotating around the midline of the rising channel, indicating healthy digestion after the previous impulsive leg.

The recent pullback appears to be a controlled correction, likely aimed at collecting buy-side liquidity before the next expansion.

Market is still respecting structure and trendline support — no breakdown confirmed so far.

Key levels to watch

Buy-side focus

FVG Buy zone: 4434 – 4437

A clean reaction here could offer a good continuation entry within the trend.

Major buy zone: 4400 – 4404

This is the stronger demand area aligned with channel support and previous structure.

Sell-side reaction (short-term only)

4512 – 4515

This zone aligns with Fibonacci extension and channel resistance, where short-term profit-taking or reactions may appear.

Scenario outlook

As long as price holds above the lower channel boundary, bullish continuation remains the primary scenario.

A pullback into FVG or the lower buy zone followed by confirmation would favor another push toward channel highs and liquidity above.

Only a clean break and acceptance below 4400 would force a reassessment of the bullish bias.

Lana’s trading mindset 💛

No chasing price near resistance.

Let price come back into value zones inside the channel.

Trade reactions, not predictions.

Trend is your friend — until structure says otherwise.

This analysis reflects a personal technical perspective for educational purposes only. Always manage risk carefully.

XAUUSD H3 – Liquidity Dominates Near ATHGold is trading in a sensitive zone just below all-time highs, where liquidity, Fibonacci extensions, and trend structure are converging. Price action suggests a controlled rotation rather than a clean breakout, with clear reaction levels on both sides.

TECHNICAL STRUCTURE

Gold remains in a broader bullish structure, with higher lows supported by an ascending trendline.

The recent impulse confirmed bullish intent, but price is now stalling near premium liquidity, signaling potential short-term distribution.

Market behavior shows buy-the-dip dynamics, while upside extensions are being tested selectively.

KEY LEVELS FROM THE CHART

Upper liquidity / extension zone:

Fibonacci 2.618 extension near the top band

This area represents profit-taking and sell-side liquidity, especially if price reaches it with weak momentum.

Sell reaction zone:

4412 – 4415 (Fibonacci 1.618 + prior ATH reaction)

A classic area for short-term rejection if price fails to break and hold above.

Buy-side focus:

4480

This level acts as a buy-on-pullback zone, aligned with trendline support and prior bullish structure.

Expected flow:

Price holds above 4480 → attempts to push toward ATH → potential extension into the 2.618 zone.

Failure to hold 4480 → rotation back toward lower structure for liquidity rebalance.

MARKET BEHAVIOR & LIQUIDITY LOGIC

Current structure favors reaction-based trading, not chasing breakouts.

Liquidity above ATH is attractive, but the market may need multiple attempts or a deeper pullback before a sustained breakout.

As long as higher lows are respected, pullbacks remain corrective.

MACRO CONTEXT – DXY BACK ABOVE 99

The US Dollar Index (DXY) has climbed above 99 for the first time since December 10, gaining 0.14% on the day.

A firmer USD can slow gold’s upside momentum in the short term.

However, gold’s ability to hold structure despite a stronger dollar highlights underlying demand and strong positioning.

This divergence suggests gold is not purely trading off USD weakness, but also off liquidity, positioning, and risk hedging flows.

SUMMARY VIEW

Gold remains structurally bullish on H3

Short-term price action is driven by liquidity near ATH

4480 is the key level defining bullish continuation

Upside extensions may require consolidation or pullbacks before a clean break

In this environment, patience and level-based execution matter more than directional bias.