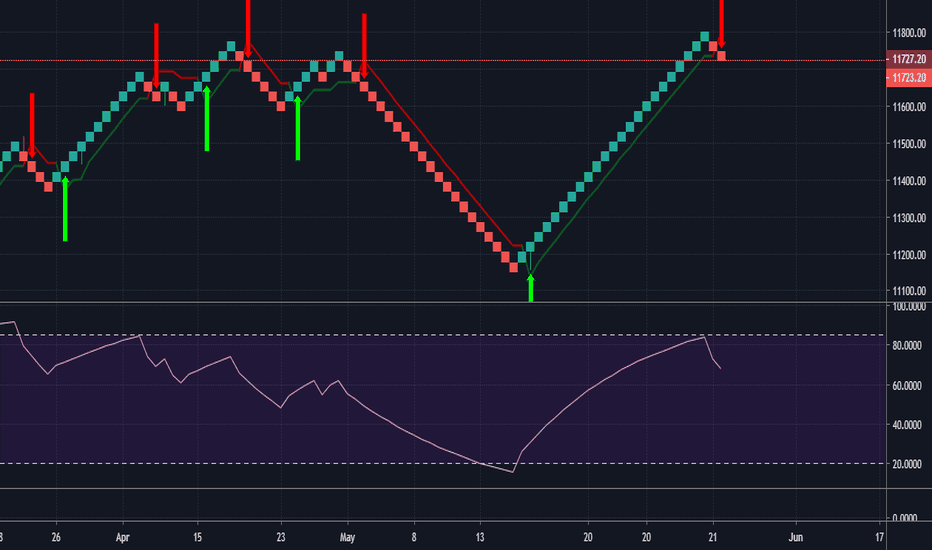

StableF-Main and stableF-AdxPLot StableF-Main By E-nifty and StableF-ADx BY Enifty and Recommended timeframe for intrady is 3min or 5 min

Other than trading view You can use stableF-main as supertrend and stablef-adx as adx and dmi with below settings

stableF-main==>Use defalt settings i.e atr=23 and factor=2.7 or use atr 35 and factor 2.5 (for other than trading view supertrend)

stableF-adx==> use setting adx 7 and Dmi 14 (for other than trading view Normal adx)

BUY==> When StableF-main or Supertrend Provide BUY signal and below conditions must meet

1 => adx above 25 and IT shown with label as strong Trend

2 => +Dmi is above -Dmi

3 => and +Dmi is above 25

stoploss=StableF-main or Supertrend dotted line which is below the price

target= 1:1 or Blue crosses

Sell==> When StableF-main or Supertrend Provides Sell signal and below condition must meet

1 => adx above 25 and IT shown with label as Strong Trend

2 => -Dmi is above +Dmi

3 => and -Dmi is above 25

stoploss= StableF-main or Supertrend dotted line which is above the price

Target= 1:1 or Blue crosses

Supertrend

triangle pattern readyAs uh are watching price action is ready to breakout either breakdown.

i m on bullish on this stock .

if its breakdown their it will go approx 640 which is 50% of retracement of trend, but this all after breakdown.

until its break 780 i m bullish.

keep learning and earning.

stay safe

happy trading.

tata

c yaaaa

Levels for - 23 Sep 2021EXPLANATION : This is a 15 min time frame chart of BANKNIFTY , It has taking resistance from trend line . We use Superternd strategy Buy signal activated , If BANKNIFTY break trendline with high volume I'm seeing very good opportunity in buying side .

If you like this analysis of Stock give a Thumbs up // Like , let me know in comments below :)

Super Cloud Momentum SetupStrategy consist of

RSI (21) Overbought 60 Oversold 40

Super trend (7,3)

Ichimoku Cloud - Only Kumo i.e Senkou Span A & Senkou Span B ( default )

Bullish Signal

When RSI closes above 60 and price closes above ichimoku cloud and super trend

Buy above the bullish candle and trail the trade with super trend

Bearish Signal

When RSI closes below 40 and price closes below ichimoku cloud and super trend

Buy below the bearish candle and trail the trade with super trend

Super consolidation breakout - KANSAINER👑 Drop a follow here: @Averoy_Apoorv_Analysis 👑 ----------------------- 🔥🔥 Target: 2000 Followers 🔥🔥

Self explained chart

⌛ Motivational and psychological area ⌛

✣Trade only if you are in the right mindset, if you have been emotionally weak for some time, take your time and don't trade, trade with a happy and + mindset only.

✣If you want to make money, firstly be prepared to lose it, only that much which you can afford and that much by which you can make a mistake again, learn from them and grow

✣Don't lose hope and keep grinding

✣I have seen my friends on youtube streaming games with watching 10, constantly they streamed for a year or two and now they are buzzing with 1k to 2k watching daily.

✣Focus on the process, you are here to make money not stupid decisions, and lose it all

✣No one will help you climb the mountain, few will tell the path, so follow good people, make good mentors and make good decisions and choices in the stock market.

✣Believe in yourself :)

🎓🎓 Some info about me :)

➼My name is Apoorv and I am a 2nd year Engineering student, I want to pursue trading as my career, and thus whatsoever setups or trades I potentially see on my charting platform, I post it here and share them with you all.

➼I hope you will love my simple analysis style.

➼Feel free to suggest your view on this as learning is earning here :)

➼I take my trades on my Zerodha account :)

➼I don't take all the trades I post

➼These charts are my and only my work, my thought process, just from an educational point of view and no calls.

☃☃☃☃ Thank You Have a Nice Trading Day ☃☃☃☃

Triveni - Breakout (Target - 225, SL 161, Buy zone 181.23)Triveni Enginering

Past stock goes from 80 to 180 in less than 2 months.

now again ready for big move

Above 21 MA, 55 MA, 100 MA.

Supertrend is positve

RSI is Good.

Buy zone - 181.23 (vwap of 8th june)(bullish candle with high vol.)

Stop loss - 161.20 or 161 (lower of High vol. candle) + match with Fibonacci

Target - 225 (using Fibonacci)

Risk to Reward Ratio - 1:2

correct me or Guide me, if i'm wrong at some point.

#MyFirstTrade

The long-term outlook of MCX CopperLook at the above weekly chart of MCX Copper. It has created an ascending channel pattern without breakout. This channel started in the previous year's April month. At present, it's falling after making a tail. But how much it can go down? Copper may fall more from here, and that can be up to 728 - 710.6 levels.

But overall, it's on an uptrend. So, soon it will start marching for the following levels:

760 - 780 - 800 - 820 - 840+

Breakout generated in LAXMIMACHDisclaimer :- This is not any buy or sell recommendation. This is just my personal view on this counter. Kindly consult with your financial or investment advisor before investing.

There is Breakout generated in LAXMIMACH on weekly chart. With rounding bottom pattern. Next levels as below :-

1st Resistance :- 7800

2nd Resistance :- 8440

3rd Resistance :- 9000

Support Level :- 7000 - 6400 is a support zone.

LLong

HOW TO TRADE NIFTY/BANKNIFTY USING SUPERTREND

Identify the underlying trend of the market on a higher time frame.

After identifying the underlying trend, you will have a bias . For example, In a Bullish market, always look for a long trade. Never short a Bullish market. Likewise, in a Bearish market, always look for a short trade.

For opening a trade, use an hourly time frame . Other time frames work too, but if you are an amateur, the hourly time frame will provide less noisy signals.

BUY on the signal(Blue arrow in this case).

Use 8-EMA as trailing stop loss.

Place Stop Loss just below the close of the previous candle . If the Previous candle is too small then, place the SL below the close of the Previous-to-Previous candle.

SELL(Close Longs) if >50% body of the candle closes below the 8-EMA .

You can also use a fixed Risk-Reward ratio if you do not want to use a trailing stop loss.

The same principles can be followed to open SHORTS. Hence, I am not writing them again.

This strategy can be applied to Banknifty or other equities/commodities etc.

You can backtest this strategy and paper trade for some time.

Always remember there is no holy grail in trading. It's a game of probability.

Let me know your views in the comments.

P.S: This is NOT investment advice. This chart is meant for learning purposes only. This is my personal journal. Invest your capital at your own risk.

Breakout generated in KARURVYSYADisclaimer :- This is not any buy or sell recommendation. This is just my personal view on this counter. Thank You !

KARURVYSYA is already gave us trend reversal signal. Currently this stock is in uptrend. On this Friday there is a fresh breakout generated on weekly chart above around 50 with good volume.

Next levels as below :-

1st Target :- 63.00

2nd Target :- 80.00

3rd Target :- 94.00

Stop Loss :- Below 42.00 on closing basis.

Hi Friends ! If you like my Ideas Please Like, Comment and Follow Me.