Vascon Engineers cmp 63.50 by Daily Chart viewVascon Engineers cmp 63.50 by Daily Chart view

- Support Zone 55 to 59 Price Band

- Resistance Zone 66 to 70 Price Band

- Heavy Volumes surge based breakout above Support Zone earlier Resistance Zone

- Multiple Bullish Patterns made around Support Zone with Head & Shoulders, Rounding Bottoms, Cup and Handle

Supportandresistancelevels

Bikaji Foods cmp 800.05 by Daily Chart viewBikaji Foods cmp 800.05 by Daily Chart view

- Support Zone 774 to 788 Price Band

- Resistance Zone 825 to 840 Price Band

- Pretty closely considerate Bullish Double Bottom formed

- Support Zone seems like going thru testing retesting mode

- Falling Resistance Trendline Breakout seems been attempted

- Price momentum seem respecting the Rising Support Trendlines

- Bullish Rounding Bottoms with Head & Shoulders below Support Zone

- Price Breakout will sustain after closure above Resistance Zone for few days

AGI - Breakout Alert – Strong Volume, Clear Trend, Smart Zones! ________________________________________________________________________________

📈 AGI GREENPAC LTD – AGI GREENPAC Breakout Alert – Strong Volume, Clear Trend, Smart Zones! Breakout

🕒 Chart Type: Daily Chart

📆 Date: July 22, 2025

________________________________________________________________________________

📌 Price Action:

AGI GREENPAC has staged a textbook breakout above its rising channel, with a massive +14.83% rally, closing the day at ₹972.35. The price not only cleared a medium-term resistance level but also broke above critical Fibonacci levels, reclaiming bullish control. This is not just a price breakout — it's a structure + volume + indicator alignment, offering a compelling bullish setup with potential for follow-through.

________________________________________________________________________________

📊 Chart Pattern:

✅ Rising Channel Breakout – A bullish continuation pattern formed over several months

✅ Breakout occurred near the channel’s upper boundary with explosive volume

✅ Price cleared 0.5 (₹950.50) and 0.618 (₹1037.15) Fibonacci retracement levels from the prior fall

✅ The structure was backed by a base formation, indicating accumulation beneath resistance. This pattern signals a potential transition from slow ascent to impulsive trend phase — a powerful sign when backed by volume and momentum indicators.

________________________________________________________________________________

🕯️ Candlestick Pattern:

✅ Wide-Range Bullish Candle

✅ Open = Low formation (strength from the first tick)

✅ Strong follow-through above consolidation

✅ Classic “Buy Today, Sell Tomorrow” price action

✅ Confirms structural breakout from channel top

________________________________________________________________________________

🔊 Volume Analysis:

AGI GREENPAC saw a big jump in trading volume, with over 8.7 million shares traded — that’s more than double the usual average of the past 20 days. This kind of volume shows that a lot more people were actively buying the stock, and it wasn’t just a one-time spike — the buying continued throughout the day. What makes this even more special is that it comes after many days of low activity, which often means big investors were slowly building their positions. When such quiet periods are followed by a big volume and price breakout, it usually signals the start of a strong uptrend. Also, this is the highest volume in the past 52 weeks, which gives even more strength to this breakout and shows serious buying interest.

________________________________________________________________________________

📈 Technical Indicators:

The technical indicators are showing strong signs of bullish momentum in AGI GREENPAC. The RSI is at 73, which means the stock is trending strongly and buyers are in control. The MACD, a popular momentum indicator, has given a bullish crossover both on the daily and weekly charts — this is a positive signal that the trend may continue. The CCI, which tracks the speed and strength of price moves, is at 274, indicating very strong upside pressure. The Stochastic is at 93, which means the stock is in the overbought zone, but still confirming the ongoing strength. The price is trading above the VWAP (Volume Weighted Average Price), showing that buyers are dominating the day. Lastly, the stock has broken out of a Bollinger Band squeeze — a setup where the price was moving in a tight range and has now burst out with momentum. When all these indicators point in the same direction, it gives us a high-confidence signal that the breakout is genuine and may continue.

________________________________________________________________________________

🧱 Support & Resistance:

🔻 Supports:

• ₹887.83 – Immediate support (breakout zone)

• ₹803.32 – Mid-structure base

• ₹752.93 – Last support before invalidation

• Bottom Range: ₹599.10 – Historical demand base

🔺 Resistance Zones:

• ₹1022.73 – First resistance (Fibonacci level)

• ₹1073.12 – Previous swing top

• ₹1157.62 – 0.786 Fib level and prior rejection area

• Top Range: ₹1307.90 – Final upside Fibonacci target

________________________________________________________________________________

👀 What’s Catching Our Eye:

What really makes this setup stand out is that everything is coming together at once — and that doesn’t happen often. The stock has broken out of a rising channel, which is a strong chart pattern. It also crossed important Fibonacci levels, showing strength in the move. The volume is more than double the average, which tells us that serious buyers are stepping in. Momentum indicators like RSI and CCI are showing strong upward energy. On top of that, the price has broken out of a tight Bollinger Band range and is staying above VWAP, which adds more strength to the trend. When so many signals align like this, it usually means the stock has a good chance of moving even higher — this is what we call a high-confidence breakout.

________________________________________________________________________________

🔍 What We’re Watching For:

The key thing now is whether the stock can stay above the ₹950–₹960 zone over the next few days. If it does, it will confirm that the breakout is strong and has the potential to move higher. However, if the price dips slightly into the ₹900–₹915 range with low volume, it could be a good opportunity for a safe re-entry. On the other hand, if the stock closes below ₹887, it may be a warning sign that the breakout is failing. This zone is very important — it’s the make-or-break level that will decide if the uptrend continues or fades away.

________________________________________________________________________________

✅ Best Buy Levels (Low Risk Idea):

🔹 Entry: On pullback to ₹861.7–₹864.9 zone with SL ₹848.54

🔹 Low Risk Entry: ₹851.12 with Stop Loss: ₹833.72 (closing basis)

🔹 Risk-Reward: 1:1 | 1:2 +

📌 Avoid chasing — let the price validate the breakout

________________________________________________________________________________

💼 Sector Tailwinds:

AGI GREENPAC is in a business that’s currently seeing strong demand — especially from sectors like real estate, pharmaceutical packaging, alcohol bottling, and FMCG (like food and household products). These industries need high-quality glass and packaging, which is exactly what AGI provides. With growth happening in these areas, the company stands to benefit. This means that the fundamentals are also supporting the chart breakout, making the overall setup even stronger.

________________________________________________________________________________

⚠️ Risks to Watch:

Even though the chart looks strong, there are a few things to be careful about.

First, indicators like RSI and Stochastic show that the stock is in the overbought zone, which means a small pullback or correction is possible. If the price closes below ₹887, it could mean the breakout has failed. Also, if you start seeing red candles with low volume, it might be an early sign that buying interest is fading. Most importantly — don’t invest all your money at once. It's always better to enter with proper risk management and a clear plan, especially after a sharp move.

________________________________________________________________________________

🔮 What to Expect Next:

If AGI GREENPAC stays above the ₹950–₹960 range, it can likely move up to ₹1022–₹1073 in the short term. If the momentum continues and the stock breaks above ₹1073, it could head even higher toward ₹1157–₹1300 in the coming weeks. But if the price drops below ₹887, it could mean the breakout has failed, and the upward trend might not continue. So, the next few days are very important to confirm whether the breakout is real and sustainable.

________________________________________________________________________________

🧠 How to Trade AGI GREENPAC (For Educational Use Only):

🔹 Breakout Plan

• Entry: ₹988.60 or Pullback Zone ₹903–₹915

• SL: ₹842 (Closing basis)

• Risk-Reward: 1:1 | 1:2 +

• Position Sizing: Never all-in — always size by risk

________________________________________________________________________________

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this Helpful?

How would you trade this — chase momentum or wait for pullback entry?

👇 Drop your thoughts or questions below

🔁 Share this post with your trading community – let them benefit from clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for charts, clean setups, and educational content based on price action, zones, and risk-managed trades.

🚀 Trade with patience, trust your charts, and stay clear-headed!

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊________________________________________

KAYNES TECHNOLOGY IND LTD – Technical Analysis________________________________________

🧠 KAYNES TECHNOLOGY IND LTD – Technical Analysis

Ticker: NSE:KAYNES | Sector: EMS & Semiconductors

Current Price: 6,172.00 ▲ (+9.5% on July 31, 2025)

Technical View: ⭐⭐⭐⭐ | Chart Pattern: Falling Wedge Breakout

________________________________________

📈 Technical Overview

🔹 Chart Pattern Formed: Falling Wedge Breakout with extremely high volume confirmation

🔹 Breakout Zone: 6,000–6,050

🔹 Momentum Signals:

— RSI breakout above 60

— Strong bullish candle with rising volume

— VWAP and SuperTrend aligned bullish

🔹 Support Trendline Held on multiple touchpoints

🔹 Breakout Candle marked by heavy institutional volume

________________________________________

📰 Key Fundamental Developments

✅ Q1 FY26 PAT up ~50% YoY to 74.6 Cr

✅ Gross margin expanded to 41%, EBITDA margin to 16.8%

✅ Strategic acquisitions from Fujitsu (85 Cr domestic + 118 Cr JV with L&T)

✅ Strong order book visibility (~7,400 Cr)

✅ Raised 1,600 Cr via QIP to fund growth

________________________________________

📊 Sentiment Analysis

Sentiment: ✅ Positive

— Strong earnings beat and margin expansion

— Global expansion through Fujitsu JV

— Bullish commentary from major brokerages

— Institutional confidence via QIP and upgrades

________________________________________

🔼 Resistance Levels

6,400 – Immediate breakout target

6,834 – Top of consolidation range

7,285 – Medium-term resistance (historic supply zone)

🔽 Support Levels

5,970 – Breakout retest zone

5,700 – Structure base

5,170 / 4,864 – Deep support for longer-term invalidation

________________________________________

📌 What’s Catching Our Eye

🔹 Volume spike confirms genuine breakout

🔹 RSI, SuperTrend, VWAP – all flashing bullish

🔹 Back-to-back bullish closes after a 10 day contraction breakout

🔹 Volume & price action aligned across multiple timeframes

________________________________________

👀 What We’re Watching For

🔸 Follow-through momentum toward 6,400+

🔸 Whether breakout holds above 5,970 in coming sessions

🔸 Semiconductor line execution progress

🔸 Margin trends in upcoming quarters

________________________________________

⚠️ Risks to Monitor

⚠️ Rich valuations (~130x P/E) – limited room for disappointment

⚠️ Execution risk on new lines and acquisitions

⚠️ Global slowdown in electronics & macro headwinds

⚠️ Any delay in semiconductor segment scale-up

________________________________________

🔮 What to Expect Next

🔹 Retest of breakout zone (~6,000–6,050) possible

🔹 If held, expect momentum toward 6,400–6,800

🔹 Sideways consolidation likely if volumes taper

🔹 Strong close above 6,400 could initiate fresh uptrend leg

________________________________________

📈 Strategy Insight (For Educational Purposes Only)

— Aggressive Traders: Watch level of 6284

— Momentum Traders: Watch 6,050 retest for low-risk entry

— Risk Management: Position sizing + Capital risk – as per individual preference

________________________________________

💬 Why It’s On Our Watchlist

Kaynes blends EMS scale with high-margin ODM design and semiconductor upside. Rare in India’s listed space. Strong revenue visibility, global expansions, and balance sheet strength make it a high-conviction long-term story.

________________________________________

📉 If Price Comes Down…

5,700–5,800 is a critical support zone. Breakdown below this with volume = trend weakness. 5,400 is final demand zone before structural damage.

________________________________________

🪙 Educational Insight for Learners

This chart is a real-world example of a falling wedge breakout confirmed by volume. The key takeaway: price alone is not enough—watch volume, RSI, and structure. Never chase momentum without a plan. Always pair conviction with discipline.

________________________________________

🚨 Reminder: No stock is a “sure thing.” Use proper risk management. Stay rational when others get emotional.

________________________________________

⚠️ Disclaimer (Please Read Carefully):

This content is shared strictly for educational and research purposes only.

I am not a SEBI-registered investment advisor, and no buy or sell recommendations are being made.

All views expressed are based on personal market analysis and experience. They are not intended as financial advice.

Trading — especially in derivatives like options — involves significant financial risk. Losses can exceed your initial investment.

👉 Always do your own research and consult a certified SEBI-registered advisor before making any investment or trading decisions.

👉 Use proper risk management and only trade with capital you can afford to lose.

The author assumes no responsibility or liability for any trading losses incurred from acting on this content.

By engaging with this material, you agree to these terms.

________________________________________

💬 Found this helpful?

Drop your thoughts, questions, or insights in the comments below ⬇️ — let’s learn together!

🔁 Share this post with your trading friends and community — help them discover clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for clear setups, educational content, and a no-nonsense approach to price action, supply-demand zones, and risk-managed trades.

🚀 Trade with patience. Trust your charts. Stay clear-headed.

Because the goal is not just to trade — it's to trade better.

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

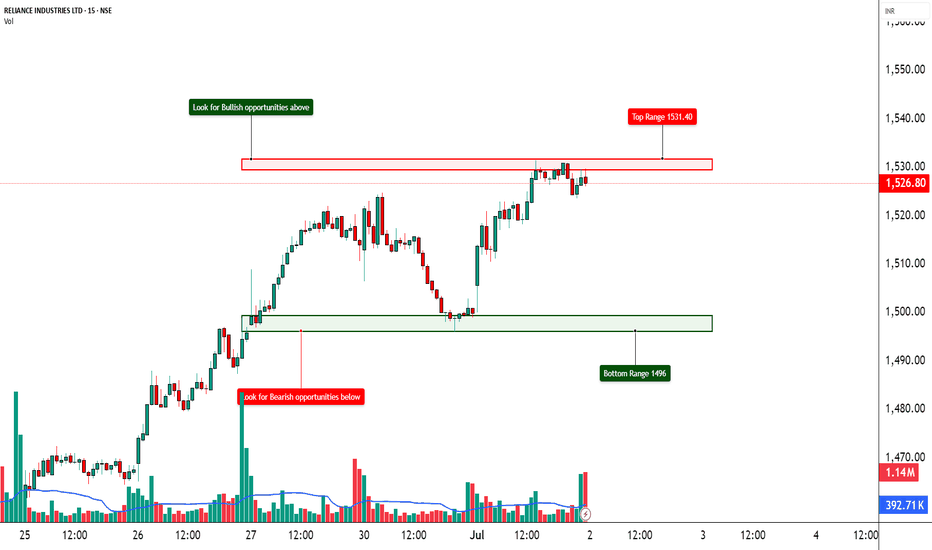

RELIANCE – Short Covering Fueling a Reversal?📈 RELIANCE – Short Covering Fueling a Reversal?

🔍 Heavy Action Across 1500–1570 CEs | Bullish Reversal on the Cards?

Chart Type: 15-min / 1H / Daily

Indicators: STWP Zones, Option Chain Activity, Volume Clusters, Demand-Supply

🔹 What’s Catching Our Eye?

✅ Aggressive Long Build-Up across multiple CEs (1550–1580)

✅ Massive Short Covering on 1500–1530 Calls – Bears exiting fast

✅ Huge OI Additions at 1550, 1560, 1570 CEs – Smart money positioning ahead?

✅ Put Writers Building Base at 1500–1520 PE → Strong support developing

✅ Spot Price at ₹1528.4 – Right at the heart of breakout zone

✅ IVs remain in control (~15.9–16.3%) = room for expansion

📊 What We’re Watching for:

📍 Breakout Zone: 1530–1540

📍 Targets: 1560 → 1580 → 1600

📍 Invalidation Below: 1490

📍 Momentum Confirmation: Price closing above 1540 with volume & OI spike

📍 Option Chain Support: 1500 PE (OI: 29.3L) + short build-up in multiple puts

📌 Trade Plan (Educational Purpose Only):

🔹 Bullish Idea: Buy above 1530–1540 with SL below 1490

🔹 Options Play: 1550 or 1560 CE suitable for short-term directional trades

🔹 Positional Angle: Momentum may sustain toward 1600 if 1540 holds

⚠️ Disclaimer:

This post is for educational and learning purposes only.

It does not constitute buy/sell advice or investment recommendation.

Always consult your financial advisor before taking any positions.

STWP is not liable for any financial decisions based on this content.

📚 “When bears cover in panic, bulls prepare their charge.”

💬 What’s your take on Reliance? Is 1600 on the radar, or is this just a squeeze?